Japan Wood Products

Prices

Dollar Exchange Rates of

25th January 2013

Japan Yen

90.87

Reports From Japan

Economy remains relatively weak

The Bank of Japan (BoJ) Monetary Policy Board held a meeting on January 21

and 22, and released its assessment of the Japanese economy. The following

two main points are emphasized in the BoJ press release.

Exports and industrial production have declined mainly due to the fact

that overseas economies remain in a deceleration

phase.

Business fixed investment in Japan has shown some weakness, but resilience

has been observed in the non-manufacturing sector.

In contrast, public investment has continued to increase and housing

investment has picked up. Private consumption has remained resilient and the

decline in car sales, due to the ending of some measures to stimulate

demand, has diminished.

Economic outlook from the Bank of Japan

Japan's economy is not expected to deteriorate any further. The economy is

expected to return to a moderate recovery path as domestic demand remains

resilient.

This will be achieved through government economic measures and through

recovery of overseas demand as the major economies gradually recover.

Exports are expected to continue to fall but at a reduced pace in the short

term. Eventually, says the BoJ, exports will pick up as overseas economies

gradually strengthen.

Public investment is expected to continue trending upward supported by the

effects of various economic measures and housing investment is expected to

continue to pick up. Some improvement in domestic demand is anticipated.

Private sector fixed investment is projected to remain relatively weak for

the time being, especially in the manufacturing sector, but to eventually

follow a moderately upward trend partly due to investment related to

disaster prevention and energy. Private consumption is expected to remain

resilient.

As a reflection of these developments in demand, both at home and abroad,

industrial output is projected to stop falling and then start recovering.

However, there remains a high degree of uncertainty about the pace at which

the global economy can improve.

For the BoJ statement see :

http://www.boj.or.jp/en/mopo/gp_2013/gp1301a.pdf

Consumers remain cautious

The Japanese consumer confidence index dropped in December as consumers

weigh the economic policies and proposals of the new government.

The consumer confidence survey shows the number of people who think prices

will rise over the next 12 months (59.6 percent of respondents) remained

unchanged from the previous month. The policies of the new Liberal

Democratic Party government are yet to have an impact on consumer price

expectations.

The survey also assessed sentiment on incomes and jobs, which fell to 39.2

in December 2012 only marginally changed for the 39.4 recorded in November

2012. A reading below 50 suggests consumer pessimism.

The quarterly survey by the Bank of Japan indicates that over 50% of those

polled expect prices to be higher a year ahead however, about 40 % indicated

that they expect prices to remain largely unchanged over the next 12 months.

Defending the weakening of the yen

As recent data is showing that Japan's exports fell more than expected,

there have been more demands from the private sector for the government to

take action to further weaken the yen.

Compared to the export performance in the same month a year earlier, Japan’s

exports fell almost 6 percent last month driving the trade deficit to a

record 7 trillion yen.

A weaker yen has the potential to boost exports but raises the cost of

imports and Japan needs to import more energy resources to ensure a stable

power supply since almost all the nuclear power plants in the country have

been shut down for safety checks.

Economists in many countries have voiced concern that the deliberate

weakening of the yen could spark a regional currency war. In response to

this the head of the BoJ said the bank was not targeting a competitive

devaluation but rather a devaluation to fight deflation.

Over the past 3 months the yen that has weakened about 8 percent against the

US dollar and on the 25th January crossed the 90 yen to the dollar level.

Some analysts expect the government and the BoJ to work together to push the

yen to 100 to the dollar.

From the Japan Lumber Reports:

1. Housing starts projection for 2013

2. South Sea (tropical) log trade

3. Trends in the plywood market

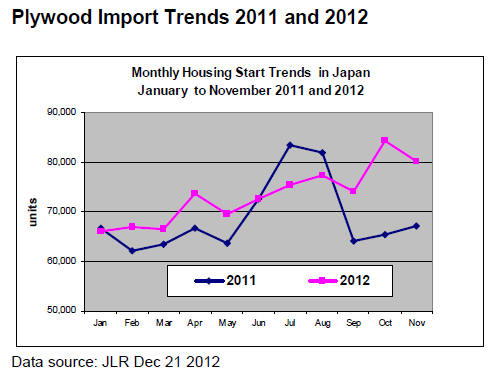

Housing starts projection for 2013

The Japan Forest Products Journal made a survey last December on this year’s

housing starts.

According to the replies from 15 major house builders, an average starts are

920,000 units. Incidentally, the projection for last year was 870,000 units

so this year’s

starts would be 5.7% up from last year.

Regarding increase of consumption tax to 8% from current 5% from April next

year, which is the most impacting factor this year, it is hard to foresee

the impact because there are no definite measures yet of tax incentive for

house purchase at this stage although many forecast increase of housing

starts this year before the tax increase.

When the consumption tax was increased from 3% to 5% in April of 1997,

housing starts in 1998 dropped by 28% compared to the starts in 1996, which

were 1,630,000 units.

The general view of the housing industry is that orders would be up by 10%

then the drop off after the tax increase would be 20%.

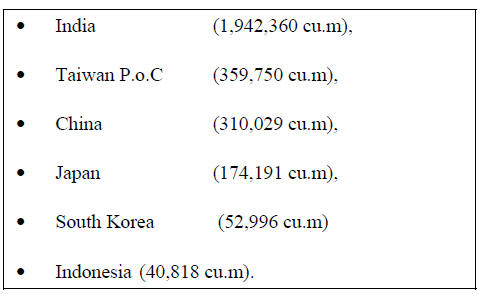

South Sea logs

Heavy rain continues in Malaysia, which hinders transportation of logs

together with log production. Local plywood mills struggle to secure enough

logs with declining inventories.

Export log prices have not climbed so sharply as India keeps log purchase

composedly but bullish mood continues.

Proposed prices on Sarawak meranti regular are about $260 per cbm FOB but

actual prices are about $255. Meranti small prices are $215-220 and super

small are $195-200.

Sabah also suffers foul weather and kapur prices are firm at about $363 and

firming due to log shortage.

Ocean freight rate is also up by $1 per cbm since January 1. All those

factors of higher FOB, increasing freight and weakening yen are cost push

factors.

Log prices in Japan are gradually climbing as the log importers need to

cover inflated cost by weak yen.

Meranti regular prices are 8,000 yen per koku CIF, 200-300 yen higher than

December. Kapur regular prices are 11,200 yen, 300-400 yen up. Even if FOB

prices remain unchanged, yen cost would be up by 400-500 yen.

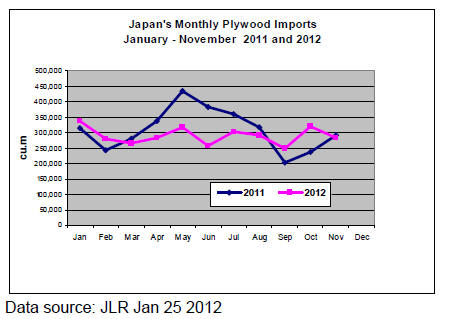

Plywood market

The market for both domestic and imported plywood is firm. Shipment of

domestic softwood plywood for precutting plants and major house builders was

active in January and the manufacturers give priority to such direct users

so that deliveries for wholesalers and retailers now take more than two

weeks.

The manufacturers carry orders through to mid February so they have started

allocating the volume for trading firms since mid January.

Secondary dealers buy from primary wholesalers at high prices in tight

supply.

Current market prices of 12 mm 3 x6 (special type/F 4 star) are 780 yen per

sheet delivered, 30 yen up from December. since January 21 the manufacturers

started taking orders at 800 yen.

Long panel of 9 mm 3x10 prices are 1,200 yen, 20-30 yen up and thick panel

of 24 mm 3x6 prices are 1,600-1,650 yen, 30-40 yen up.

Imported plywood market prices are rapidly climbing with weakening yen and

sizable price hike by the largest plywood supplier in Malaysia, Shenya for

January shipment.

Their proposal is 45,000 yen per cbm C&F on 3x6 JAS concrete forming panel,

which is 4,000 yen higher than December price. Considering rapid progressing

depreciation of the yen, yen based purchase may be safer.

Importers have started pushing the prices up in Japan market as future

arrivals would cost much higher.

Current prices are 920 yen on 3x6 JAS concrete forming panel, 30-40 yen up

from December. 1,070-1,100 yen on JAS 3x6 concrete forming for coating,

40-50 yen up. 970 yen on 12 mm structural panel, 50 yen up.

Trading firms say that those prices are not high enough to cover future

arrivals so they need to go higher yet but gradual hike is preferable as the

market may stall if the prices go up without supporting demand.

|