Japan Wood Products

Prices

Dollar Exchange Rates of

10th January 2013

Japan Yen 87.04

Reports From Japan

Business sentiment in Japan

Business sentiment among large manufacturers

remains extremely low as 2013 begins. The Japanese

Tankan survey released in mid December 2012 painted

a gloomy picture of business sentiment.

The various indices in the Bank of Japan survey of

business represent the views of companies seeing good

business conditions minus those feeling pessimistic.

The December data indicated a sharp drop from minus

3 in the July to September survey.

The data for the last quarter of 2012 recorded the first

double-digit minus figure since March 2010, the lowest

in almost 3 years.

The decline in Japanese business sentiment is

attributed to the global economic slowdown, the strong

yen, strained relations between Japan and China and

the end of most government subsidies for consumer

products, especially automobiles.

The forecast business sentiment does not anticipate any

further slowdown, rather expecting a slight

improvement. This is attributed to expectations that the

global economy will slowly pick up in early 2013

giving a boost to exports.

The new Japanese government has indicated that the

economy is a major priority and has introduced

emergency economic measures to try and stimulate the

stagnant economy.

The stimulus package aims to overcome deflation

through massive investments in public works. The

immediate effect of the new stimulus package,

financed largely through the issue of special

government bonds, has been to drive down the Yen in

the currency market.

The new economic package includes around US$115

billion in central government spending with around

half of this going to increased public works.

Direct support for businesses

In addition to the spending on public works the

government has allocated some 500 billion Yen to help

businesses acquire overseas companies.

The Liberal Democratic Party (LDP) spending

packages are causing concerns that Japan’s public debt

burden, already the highest in the developed world,

could become unmanageable. Many economists are of

the opinion that reforms of the economy would have a

more lasting impact than the stop-start growth that

Japan has experienced over the last decades.

Apparently, the Development Bank of Japan (DBJ), a

state-owned lender, will disburse around 100 billion

Yen to support firms developing new technologies

especially in the renewable energy field.

Japan’s economic stimulus package

The government is pressuring the Bank of Japan to

concentrate its efforts on reversing the current

deflationary cycle in the country by pumping more

money into the economy.

The Japanese government plans to spend most of the

new budget on public works and disaster preparedness

projects, subsidies for companies that invest in new

technology and financial aid to small businesses.

The moves by the new LDP government has already

driven the yen to a 24 month low against the US dollar,

a welcome relief to exporters whose international

competitiveness improves with a weaker currency.

Government targets deflation

In its December 2012 assessment of the current state of

the Japanese economy the government Cabinet Office

reaffirmed that the economy remains weak reflecting

the deceleration in the global economy. In summary:

Exports have fallen moderately recently

Industrial production has continued to decline

Corporate profits remain weak especially for

manufacturers

Business investment has not improved

Firms consider business conditions poor and

remain cautious

The earlier reported improvement in the

employment situation has not been maintained

and some severe negative aspects still remain

Private consumption is almost flat

Recent developments indicate that the

Japanese economy is in a deflationary phase

The Cabinet Office report suggests that the economic

weakness will remain until there is improvement in

overseas economies. However, there is much

uncertainty about recovery in overseas economies and

the downside risks to the Japanese economy remain.

Domestically, reconstruction efforts are propping up

demand.

Government and Bank of Japan to tackle deflation

The Government and the Bank of Japan are forging a

new relationship driven by the new government and

have pledged to make their utmost efforts to overcome

deflation as early as possible and to return to a

sustainable growth path. One aim of the new

government is to address the cycle of Yen appreciation

and deflation.

To address deflation the government has said it will

deploy a broad range of policy measures and it expects

the Bank of Japan to continue powerful monetary

easing. Recently the Bank of Japan decided to increase

its Asset Purchase Programme which had the effect of

driving the Yen lower against major currencies.

Yen weakens significantly

The Japanese Yen has now fallen to a two year low

against the U.S. dollar. The fall was triggered by

statements from the new finance minister who pledged

to weaken the Yen in an effort to boost exports and

therefore help the economy.

The Yen has been weakening against the dollar since

late 2012 due to threats from the LDP that, to end

Japan's recession, chronic deflation and Yen strength it

intended to push the Bank of Japan to ease monetary

measures further.

Japan's finance minister, Taro Aso, has said he is

determined that the new stimulus measures include

strong support for fighting the strength of the Yen

which, at current levels, is a drag on exports.

Unusually direct language during the Japanese general

election campaign and now the confirmation of the

massive government stimulus package has driven the

Yen lower.

Analysts point out however that these moves by the

new Japanese administration could complicate

relations with the US and regional trading partners.

Many Asian countries have been trying to weaken their

currency which strengthened after the US Federal

Reserve and European Central Bank adopted very

loose monetary policies.

The recent moves by the Japanese government is

clearly aimed at helping domestic exporters who have

faced very tough trading conditions for the last two

years because of the strength of the Yen.

The weakened Yen will have an impact in Asia as

other countries will be tempted to follow the lead given

by Japan.

South Korea, Taiwan P.o.C and increasingly China rely

on exports of electronic, automotive and industrial

goods to drive the economy. Because these countries

will loose a competitive edge as the Yen weakens they

may move to weaken their own currencies.

JP Morgan Chase and Co. has recently revised the Yen

projections forecasting a fall to 90 Yen to the dollar in

the second quarter of this year. Nomura Holdings also

reduced its forecast to 90 Yen per dollar for the same

period.

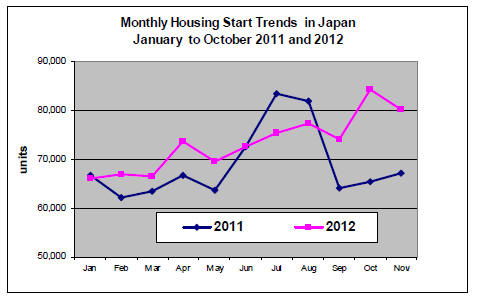

Consumer confidence slips

Consumer confidence in Japan fell in the last quarter of

2012 due mainly to the failure of the government to

come out with coherent policies to create more job

opportunities and bring the economy out of recession.

The latest data suggests that the new government in

Japan is being given credit for some of the bold, some

say reckless, plans it has for increasing public works

projects and the consumer confidence index halted its

downward slide.

Over the coming months consumers will be watching

to see if the Bank of Japan can deliver on its inflation

target, if it does this could possibly result in greater

consumer spending.

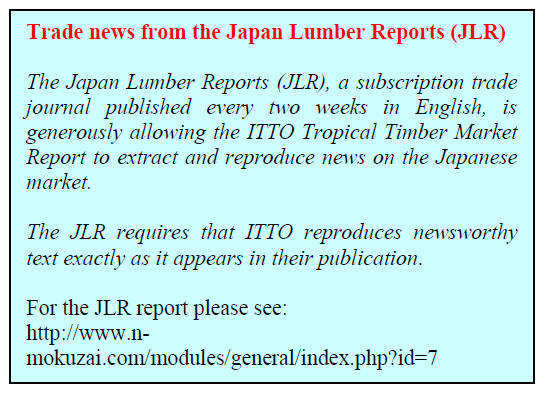

Housing starts in Japan

Data from the Japanese Ministry of Land,

Infrastructure, Transport and Tourism released in

December shows that November housing starts totalled

80,145 units up around 11% year on year and but the

pace of growth is lower than the 25% rise in October.

Owner-occupier units totalled 28,200 (+9%) while

homes built for rent were 30,100 in November (+23%).

Sales of condominiums and houses increased

marginally

The rate of growth in housing starts slowed after the

government's eco-reward programme expired as of

Oct. 31, 2012. Eco reward points were given to owners

of homes built to new energy saving standards.

Annualised housing starts totaled 907,000 calculated

on the basis of the year to November compared to

978,000 based on developments up to October.

The general consensus is for 2012 starts to reach

911,000. However it is reported that construction

orders received by the 50 largest contractors fell 2% in

November, following a steep decline in October.

Increase in wooden buildings

The number of new wooden buildings is growing in

Japan especially in the suburbs where fire resistant

standards are not as strict as in the built up areas.

Wooden structures are considered cost-competitive in

Japan especially in one-story construction. Wooden

buildings are now popular for care facilities,

convenience stores and educational facilities such as

schools, nursery schools, and preschools.

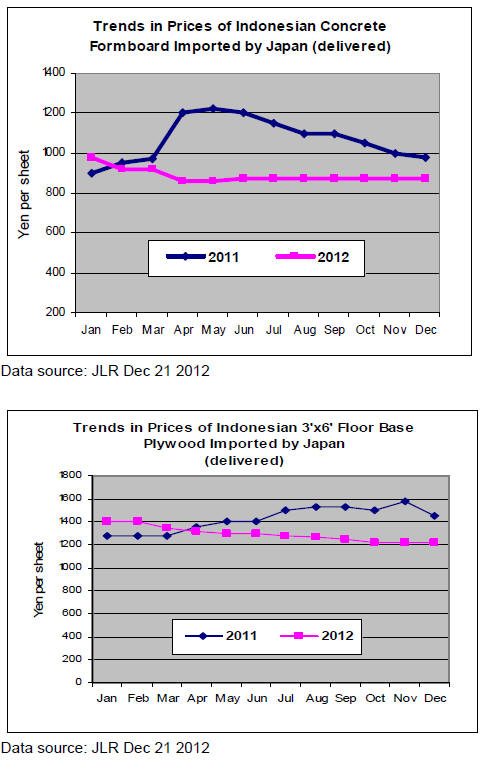

Restoration of Seihoku’s damaged plants

(source JLR Dec 21 2012)

Seihoku group’s plants on the North East coast of

Japan suffered considerable damages by the earthquake

and tsunami in March 2011. The plants recovered one

after another and the production is coming back.

Production of coated concrete forming plywood made

by local softwood and particleboard is back on right

track.

Seihoku’s plywood mills have been adjusting

production to maintain supply and demand so that the

mill inventories are less than one month.

Seihoku Plywood mill has started producing coated

concrete forming panel with local softwood since last

July and the production moved up to 50,000 sheets for

October and November. Also five plied 100% cedar 15

mm panel is now tested. There is some concern that

softwood concrete forming panel may cause cracks in

concrete but the mill says there is no such worry.

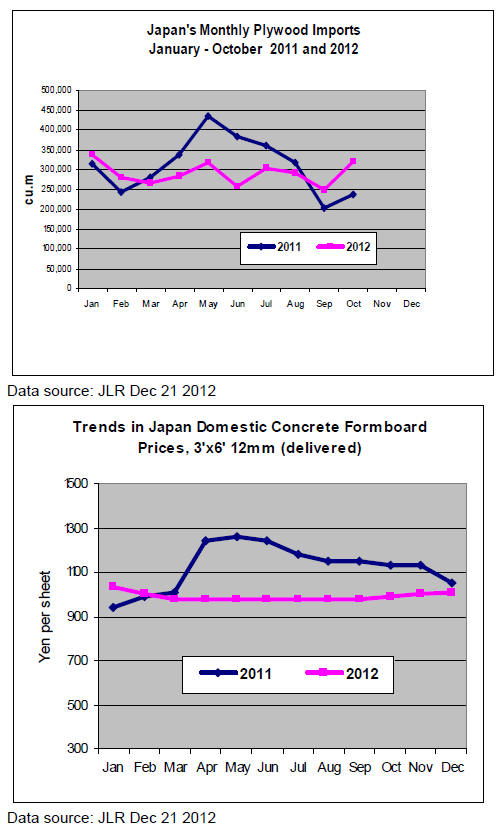

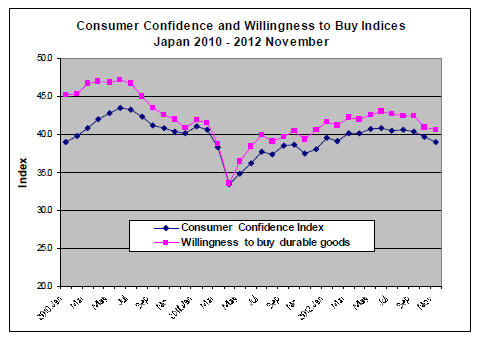

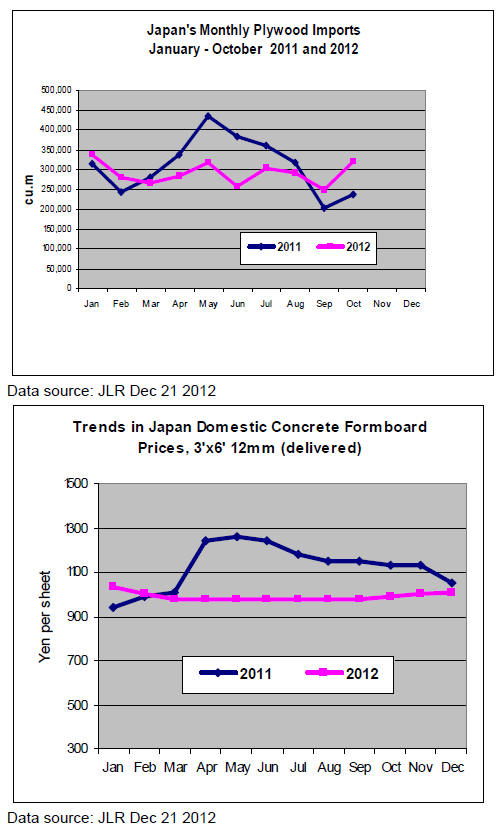

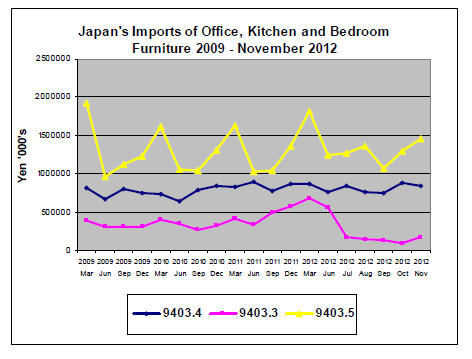

Plywood

(source JLR Dec 21 2012)

Domestic softwood plywood production in October

was 213,900 cbms and the shipment was 219,500

cbms. Both are the highest monthly record this year.

The inventories have been below 200 M cbms for three

straight months. October’s inventory was 193 M cbms.

Dealers say that November shipment seems higher than

October. The market is very firm.

Current market prices are 730-750 yen per sheet

delivered on 12 mm 3x6 (special type/ 4 star), 10 yen

up from November. 1,550-1,580 yen on JAS 24 mm

3x6. 1,150-1,180 yen on 9 mm 3x10. Both are holding

steady.

Market of imported plywood is also firm. Port

inventories are down while shipment continues busy.

Some warehouse recorded that the November shipment

was the highest since last April.

There are more than 13 ships waiting for unloading at

the port of Yokohama, which may not be unloaded in

this month.

Bullish suppliers’ attitude of Malaysia and Indonesia is

impacting the market in Japan so that the prices

continue edging up.

The market prices for 3x6 JAS concrete forming for

coating are 1,030 yen per sheet delivered, 20 yen up

from November. Concrete forming is 870-890 yen, 10

yen up. 12 mm structural panel is 920-930 yen, 10 yen

up.

Japan-China Wood Use Promotion Seminar

The Japan Wood-Products Export Promotion Council

and the Japan External Trade Organization (JETRO)

co-organized a seminar titled “Japan-China Wood Use

Promotion Seminar 2012” in Tokyo in this fall. Four

lecturers from Chinese enterprises visited Japan to

introduce completed buildings.

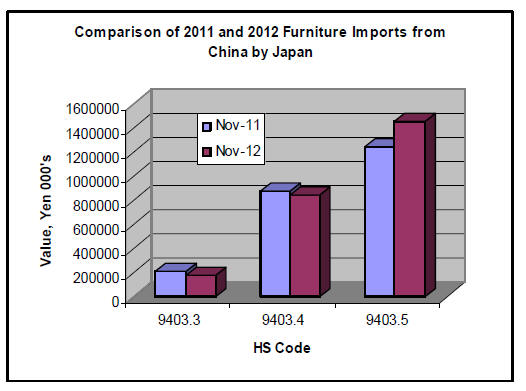

Japan’s furniture imports

Japan’s imports of Office Furniture (HS 9403.30) in

November 2012 totalled Yen 179,896,000, marginally

lower than the Yen 209,187,000 imported in the same

month in 2011 but higher than the Yen 90,695,000

imported in October 2012.

Of imports of office furniture in November 2012

Chinese manufacturers provided Yen 81,909,000 or

around 45% followed by Indonesia with 8%. China’s

exports of office furniture to Japan in November 2012

were almost double that in October 2012.

Japan’s imports of Kitchen Furniture (HS 9403.40) in

November 2012 amounted to Yen 845,786,000,

marginally down on levels in October (Yen

876,267,000). China’s contribution to Japan’s imports

of Kitchen Furniture amounted to Yen 140,098,000

once again placing China third in the rank of supply

countries behind Vietnam (Yen 316,968,000 and

Philippines (Yen 171,083,000).) Both countries

managed to increase exports to Japan.

Indonesian exports of Kitchen Furniture continued but

it appears Indonesian exporters lost ground to exporters

in Vietnam and Philippines.

China’s exports of Kitchen Furniture valued at Yen

140,098,000 in November 2012 were below levels

recorded in November 2011.

Japan’s imports of Bedroom furniture (9403.50) in

November 2012 at Yen 1,452,561,000 were, once

again, higher than levels recorded in November 2011.

China’s contribution to Japan’s imports of Bedroom

furniture in November was Yen 826,005,000, a marked

improvement on levels in October 2012 and higher

than levels in November 2011.

In November 2012, apart from China, the other major

suppliers of Bedroom furniture to Japan were Vietnam

(Yen 317,582,000) and Malaysia (Yen 141,841,000).

The figure below illustrates the changes in Japan’s

imports of Office, Kitchen and Bedroom furniture in

November 2011 and 2012.

It will be seen that Japan’s imports of Bedroom

furniture from China increased in 2012 compared to

levels in 2011 but for the other products illustrated

declines were recorded.

|