¡¡

2. GHANA

Ghana Revises Forest and Wildlife Policy

Ghana¡¯s cabinet has recently approved the revised

Forest and Wildlife Policy which the focuses on the

non-consumptive values of the forest including

protection of water bodies, conservation of biological

diversity and ecotourism.

The revised Forest and Wildlife Policy is a shift from

the focus on timber production towards creating a

balance between timber production and realigning the

forestry sector to address poverty, contribute to

employment generation through plantations

development, promote good governance and forest

industry development as a means of wealth creation in

the rural areas and addressing rural-urban migration.

The new policy is therefore people centred providing

guidance on sustainable financing mechanisms that are

dependent on internally generated funds.

Timber sector operating well below capacity

The Chief Executive of the Ghana Timber Millers

Organisation, Dr Kwame Asamoah Adam, has made it

known that around 50-60 timber companies have

collapsed over the past decade. Companies that have

managed to survive the turbulence, mainly the result of

the financial and economic crisis and the stronger

monitoring and regulation of the forest resource, are

running well below their installed capacity due to raw

material shortage.

Estimates put the job losses from mill closures at

around 30,000.

While the current situation in the industry is serious

and exacerbated by high interest rates and electricity

tariffs as well as high fuel costs the Millers

Organisation said government policies to promote

value added products and curb illegal logging are

encouraging the industry.

The initiatives by the Forestry Commission and the

private sector to develop plantations are giving hope to

the Organisation for the future. The plantations being

developed will help solve the problem of raw material

shortages when ready for harvest.

The immediate problem is one of securing adequate

supplies of raw materials to keep mills running. The

government of Ghana is in consultations with the

government of Cameroon for the supply of logs to

firms in Ghana.

This arrangement is also expected to allow for

collaboration between the two countries in the

promotion of lesser used species from Cameroon.

Getting tough on illegal operators

The Ghana Forestry Commission (FC), is committed to

continuing the fight against illegal logging and

chainsaw operations in the country and has created a

special Rapid Response Unit (RRU) to tackle these

issues that challenge the sustainability of Ghana¡¯s

forests.

A five-member team from the FC RRU was deployed

to the Western, Ashanti and Brong Ahafo regions and

has been successful in carrying out a number of

operations to combat illegal activities in the forest and

wildlife sectors.

The Chief Executive Officer of the FC, Mr Samuel

Afari Dartey, stated that 54 illegally constructed

hamlets within the Sui River Forest Reserve catchment

in the Sefwi Wiawso District in the Western Region

had been demolished, while 31 hectares of illegal

farms had also been destroyed in the Krokosua Hills

and the Tano-Offin Forest reserves.

In addition, 18 chainsaw machines and some 11,000

pieces of assorted sawnwood were seized from illegal

operators. A further 51 illegally felled logs were

confiscated in the Nkawie and Goaso forest districts.

Ghana set to access climate investment fund

The Forestry Research Associates (FRA) website

carries a story on the approval of Ghana¡¯s investment

programme.

See:

http://www.forestry-research.com/forestryinvestment/

1692/fra-welcomes-news-of-ghana-forestryinvestment-

approval

FRA is a research and advisory consultancy that

focuses on forestry management, sustainability issues

and forestry investment.

The FRA site highlights, ¡°Ghana¡¯s Forest Investment

Programme has won approval from the World Bank in

a move welcomed by Forestry Research Associates

(FRA)¡±.

The approval means the African nation is one step

closer to gaining the $50 million in funding it needs to

help it implement climate change reduction strategies

through the safeguarding of its forests.

The cash will come from the Climate Investment Fund

and will be used to help engage the local community in

sustainable forestry management under the REDD+

reforestation scheme.¡±

Government bond sale oversubscribed

The government has successfully raised, a little over

GHc400million from its bond issue for 2013, an offer

which was oversubscribed by 450 percent.

Ghana accepted 402 million Cedis in bids for its threeyear

bonds at an oversubscribed auction last week,

with the average yield dipping to 16.7% from 21% at

the previous sale according to the Ghana Central Bank.

The Ministry of Finance and Economic Planning, on

whose behalf the Bank of Ghana issued the bond, said

the funds raised would be used to mainly to finance the

country¡¯s maturing debts.

According to the Ministry, about 99% of the bids came

from foreign investors, which is an indication of

investor confidence in the Ghana¡¯s economy.

Ghana¡¯s inflation dips

Ghana¡¯s annual consumer price inflation eased in

December but economic growth slowed in the third

quarter raising expectation of an interest rate cut.

Inflation dipped to 8.85 in December from 9.3% in

November. The economy grew by 1.7% year-on-year

in the third quarter of 2012.

3. MALAYSIA

Weak global demand affects exports

The most recent export data shows that Malaysian

exports totalled RM 390.3 billion for the period

January to September 2012; this generated an average

monthly positive trade balance of around RM 10

billion.

By comparison, over the same period last year total

exports were slightly lower at RM 381.2 billion. The

marginal 2.4% increase year on year reflects the weak

global economy which is lowering expectations for

wood product exports.

Industry raises concerns on new minimum wage

Two major issues are of concern to the timber industry

at the moment; the changes in the statutory minimum

wage provision in Malaysia which came to force on 1st

January 2013 and the EU FLEGT which is due to enter

into force in March.

Analysts report that Malaysian furniture manufacturers

feel especially hard hit as they struggle to cope with the

changes in wage structures while preparing for

compliance with the EU FLEGT requirements.

The Malaysian government, trade bodies and

associations have been holding consultations for

stakeholders and have been disseminating information

to exporters. Throughout the industry there is

considerable apprehension on how the EUTR will

affect the wood product exporters and Malaysia¡¯s

exports to the EU.

By law, the Malaysian minimum monthly wage, by

law, is now RM 900 (approximately US$ 290) in

Peninsular Malaysia while in Sabah and Sarawak, the

new rate is RM 800 (approximately US$ 260).

The timber industry in Malaysia is trying to adjust to

this new wage structure which something of a problem

for those companies which include room and

occasionally food in their workers employment

contract.

Some companies are saying the new law does not

reflect the local living expenses, pointing out that it is

more expensive to live in the cities than in the rural

areas where logging and some timber companies

operate.

This point is particularly pertinent in the eastern

Malaysian states of Sabah and Sarawak.

Sabah timber association calls for government support

Recently, as reported in the Daily Express, 2 Jan 2013,

James Hwong, president of the Sabah Timber

Industries Association, called on the government to

help the downstream timber industries in the state.

Hwong said that stricter regulations on logging natural

forests could reduce the supply of raw materials to

manufacturers forcing them to import the raw materials

needed in their manufacturing processes. The report

says a call was made for government to not impose any

fees or restrictions on timber raw material imports.

Hwong noted that worldwide, the trend is towards

¡®green¡¯ products and said ¡°In order to survive, the only

way is plantation timber¡±.

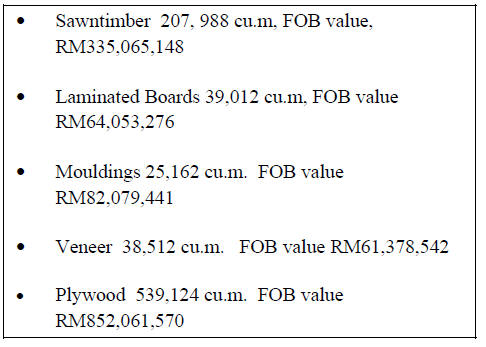

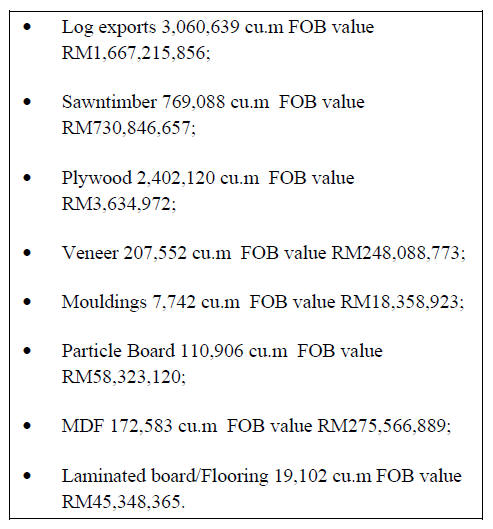

Sabah export statistics

Data on timber exports from Sabah were released

recently. For the period January to October 2012

exports were:

New minimum wage levels an issue for industry in

Sarawak

Comments on the new minimum wage structure for the

state have focussed on the impact the changes will

have on overall wage bills as, already, wages are

trending up due to the problem of labour supply.

The plantation sector in Sarawak is especially

dependent on foreign labour because of its low

domestic population.

The domestic labour force is not attracted to working

in the forestry and timber sectors, preferring to work in

an urban environment instead.

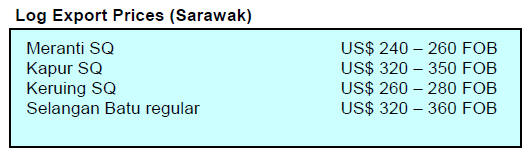

Sarawak log price indications

Sarawak log export prices are provided as a range to

take into account shipment size and variations in log

quality and diameter.

FOB prices for Meranti SQ quality logs provides a

good indicator of overall market price trends for

Malaysia natural forest logs as prices for other species

usually follow the same general trends as Meranti

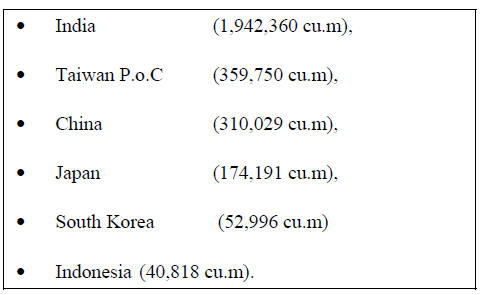

Sarawak export data

Sarawak export data for the period January to

November 2012 was recently released and is

summarised below:

For the period January to November the top buyers

of

logs from Sarawak were:

The top buyers of plywood from the state of Sarawak

were Japan (1,297,092 cu.m), South Korea (299,462

cu.m) and Taiwan P.o.C (214,406 cu.m).

¡¡

4. INDONESIA

Indonesian legality verification system enters

into

force

Indonesia and the European Union have finalised an

agreement aimed at ending trade in illegally-sourced

wood through the implementation of the Voluntary

Partnership Agreement (VPA).

Indonesia has introduced the mandatory Timber

Legality Assurance System (TLAS) or in Bahasa

Indonesia, Sistem Verifikasi Legalitas Kayu (SVLK),

which is defined in Forestry Regulation Number

P.38/Menhut-II/2009 (amended by P.68/Menhut-

II/2011).

Under the new arrangements Indonesian exports will

be covered by a V-Legal/FLEGT license which verifies

that the timber products conform with the timber

legality assurance system (TLAS).

The new Indonesian legality regulation, which is now

in effect, applies to 26 products defined by their HS

Codes with a further 14 products to be included in

January 2014.

These additional 14 categories of wood products are

mainly manufactured by small and medium enterprises

producing handicrafts and secondary wood products.

V-Legal test shipment concluded

Indonesia and EU have conducted a test shipment of

some products for which a V-Legal documents/

FLEGT-License is mandatory.

The test run will be conducted in two phases, the first

was during the period of October-December 2012 in

Indonesia and the second in some EU countries during

November-February 2013.

The first test shipment test from Indonesia was made

from PT Kayu Lapis Indonesia (KLI) a company in

Central Java .

The test run launch was attended by Deputy Minister

of Trade Mr. Bayu Krisnamurti who explained that

shipment tests of V-Legal products will be conducted

by 17 Indonesian registered exporters of industrial

forest products..

The Deputy Minister anticipated that this trial would

identify any deficiency in the system so that exports of

timber products from Indonesia will run smoothly and

comply with the EUTR as well as demands formproof

of legality from other countries.

The export shipment test was aimed at demonstrating

the readiness of Indonesia to supply verified legal

timber product to world timber markets.

Three certification schemes operate in Indonesia

Forest management certification plays a significant role

in sustaining Indonesian forest resources and three

schemes are currently operational in the country

namely; FSC, LEI, and PEFC.

The implementation of certification in Indonesia has

been supported by many agencies and organisations

such as The Borneo Initiative (TBI), WWF, Ford

Foundation, ITTO, Tropical Forest Foundation (TFF),

the Multi-stakeholder Forestry Programme (MFP) and

many local consultants.

The TBI has supported certification in 19 forest

management units (FMUs) covering some 1.2 mil.ha.

TFF has supported 7 FMUs and the FSC has certified

six FMUs in a period of 12 months.

The certified forest under LEI system amounts to

around 0.4 mil. ha. of natural forests;

0.97 mil. ha .of plantations and 26.7 thousand ha. of

community forests.

PEFC certification is new to Indonesia and PEFC

recently inaugurated a national governing body called

the Indonesian Forest Certification Cooperation

(IFCC).

This body is now developing, with stakeholders, a

consensus based standard and guidance for forest

certification.

5. MYANMAR

Change, the theme for 2012

In the words of a local analyst ¡®2012 was a very

eventful year for Myanmar as there were so many

changes¡¯. The newly elected civilian government now

includes the internationally known Daw Aung San Suu

Kyi who was recently elected to the legislative

assembly.

The political party which she leads participated in the

2012 by-elections and won 43 of the 45 seats

contested. In other developments, journals have been

given more freedom to report on issues affecting the

country and express more freely on matters which once

had to be avoided.

Myanmar plans log export ban

Taking advantage of the greater freedom in the press

many commentators have expressed their views on the

deteriorating situation in state-owned forests.

Except for some plantations, almost all the forest land

in Myanmar is technically state-owned. Some writers

have called for a logging ban. Daw Aung San Suu Kyi

also spoke very strongly on the subject of the depleting

natural resources during her December 2012 visit to

Magwe in Central Myanmar.

The ¡®Myanmar Herald¡¯ has reported that the Minister

of Environmental Conversation and Forestry

(MOECAF), in an interview for the newspaper,

indicated that a total log export ban will be introduced

to take effect starting April 1st 2014.

It was apparently explained that some 15 months will

be needed to clear all current logging contracts. The

Herald also reported that the Minister has met with the

Chinese Ambassador on several occasions and that the

issue of the illegal transport of logs into China was

discussed.

News on steps to abolish log exports first came to light

during October 2012 and the teak market reacted

sharply.

At the moment reports suggest that there are

considerable volumes of unshipped logs from

outstanding contracts in Yangon and in upper

Myanmar and that owners are trying to move the logs

out of the country as soon as possible.

Merit of total log ban questioned

Some analysts are questioning the wisdom of a total

log export ban as Myanmar needs to build up its

industrial capacity to process the higher grades teak

logs internally.

As analysts point out, while there are specialist timber

processing companies in Myanmar which can process

high-end teak products there are too few for Myanmar

to become a potential natural teak export ¡®tiger¡¯.

Some really high grade teak logs fetch very high prices

in the tenders and auctions and analysts argue that the

domestic mills are not able to pay as much as foreign

competitors.

It is argued that the highest grades should be auctioned

in an open market where local and foreign buyers can

participate and that, upon winning the bidding, the

foreign buyers should be given permission to export

the logs. However the proponents of a total log export

ban remain adamant at present.

Current log export market erratic

The Myanmar timber market is erratic and unstable at

the moment and trends are difficult to discern. The

trade in non-teak hardwood logs is much the same as in

previous years; fresh logs being sold and shipped

quickly while logs which have been harvested some

time ago are slow to move.

The pressure is now on buyers to ship logs which have

been paid for as indications are that exports beyond the

proposed date of entry into force of the log ban will not

be entertained.

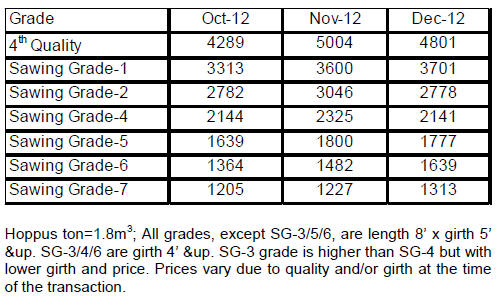

Myanmar Teak Log Auction Prices (natural forest logs)

Average prices during the Teak tender sales in the final

quarter of 2012 are shown below. Prices are Euro per

hoppus ton

¡¡

6.

INDIA

2013 begins on a confident note.

While the Indian economy could not avoid the impact

of the weak global economy and also had its share of

economic shocks, activity in wood based industry was

rather resilient and demonstrated continued expansion,

albeit more slowly than over the past few years.

Imports of logs and sawnwood in fiscal 2011 totaled

Rs.94 billion compared to the level of Rs.60 billion in

fiscal 2010.

Increased imports of plywood and veneers and other

panel products such as MDF and Particleboard were

recorded and imports of wooden furniture were higher

than in previous years.

In total, fiscal 2011 wood product imports came to

Rs.121 billion compared to Rs.81 billion in the

previous financial year.

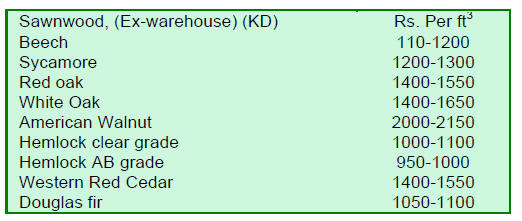

Domestic market buoyant

Weakness of the Indian Rupee resulted in a slowing of

some imports but still a negative trade balance was

recorded largely driven by imports of petro-products,

prices of which remained firm throughout the year.

Despite the fall in exports, because of weak overseas

demand, the colossal domestic market and continued

overall economic growth generated record breaking

foreign investments of some US$ 22 billion in 2012.

Forecast decline in India¡¯s GDP

Unfortunately, India¡¯s GDP slipped below 6% over the

past year. India's economy is forecast to grow by about

5.8% this year, the slowest rate for many years

according to official forecasts.

The Ministry of Finance is on record as saying it

anticipates India's growth rate to have accelerated

slightly in the second half of the financial year which

ends in March 2013 generating an annualized 5.8%

growth. However the burst in growth will not be

enough to improve GDP expansion to the forecast of

7.6%.

While India has recently introduced reforms to attract

foreign investment in the retail sector analysts doubt it

will be enough to generate the double-digit growth

rates achieved in the past.

Businesses expect 2015 turn-around in global

economy

Reports of a survey of over 250 executives of small,

medium and large companies by the Indian PHD

Chamber says most executives expect the domestic

economic climate to improve in coming fiscal year

despite continued weakness in the US and EU

economies.

Almost half of those surveyed expected the global

economy to begin a full revival no sooner than 2015

while most of the others surveyed were not so

optimistic pointing to a 2017 recovery.

Domestic investment was not expected to improve but

neither would it decline and there seemed to be more of

a tendency in the responses of executives to anticipate

that economic reform measures by government had the

potential to stimulate investment.

The survey identified that the high the cost of doing

business is a continuing burden and hampers industrial

production. In terms of commodity supplies most of

the executives expected raw material prices to continue

moving upwards.

Slowing housing sector impacts timber industries

Home buyers in India now face additional costs in the

form of stamp duty and VAT on transactions.

This is negatively affecting the housing market by

slowing investment and this in turn is negatively

affecting the timber industry.

The impact of the duty and VAT on housing demand

has been taken up by the relevant ministries and

analysts say the timber industry is hopeful that a

solution will be found and that housing growth will

expand.

The Indian timber industries are also being hard hit by

increased imports of low price plywood and other

panel products.

An anti-dumping duty is levied on some MDF

suppliers which is some relief but they still feel the

burden of rising raw material and labour costs.

There are reports of acute shortages of labour in many

sectors in India especially the timber industries.

Smuggling of rare woods continues

Sandlewood (Santalum alba) Agar wood (Aquillaria

agalocha) and Red sanders (Pterocarpus dalbergiodes)

are the target of illegal loggers, poachers and

smugglers in India and the pace of criminal thefts of

precious trees continued in 2012.

These timbers are used to satisfy demand for traditional

medicines and perfumes, a demand that it is difficult to

deflect. Analysts point out that to solve the problem of

illegal harvesting and theft consumer demand must be

met from sources other than the natural forests.

Some Sandalwood plantations are being established

and plantations for Agar wood are being created in

India and in Australia, Vietnam, Thailand and other

neighbouring countries. These plantations, when

mature, will augment supplies and help satisfy Indian

demand.

Analysts point out that there is a need to take up large

scale planting of red sanders by private and public

organizations to increase availability and thus limit

illegal felling.

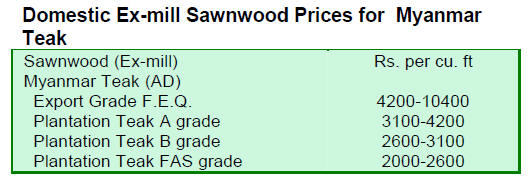

Sales of domestic teak and other hardwoods

Throughout 2012 demand for local hardwoods was

buoyant and sales were brisk at the auctions where

prices firmed throughout the year.

Indian teak is generally equivalent in terms of colour

and quality to Myanmar teak, say local analysts, and

this is one factor behind for the strong demand for

locally grown teak.

In 2012 the Indian rupee lost ground to major

currencies and thus imports became more expensive

and this was another factor for the firm demand for

local teak as opposed to imported Myanmar teak which

is priced in US dollars or euro.

Imported plantation teak is a viable and lower cost

alternative to natural teak however say analysts, while

the volume of imported plantation teak has been

increasing the quality continues to be poor.

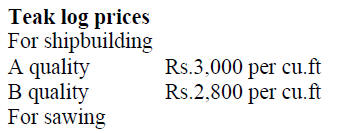

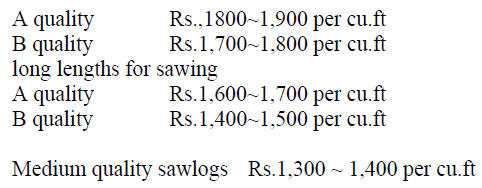

Average prices realised in sales held at government

teak depots in Western India are illustrated below.

Freshly harvested logs attracted active bidding. The

prices below are per cubic foot ex depot.

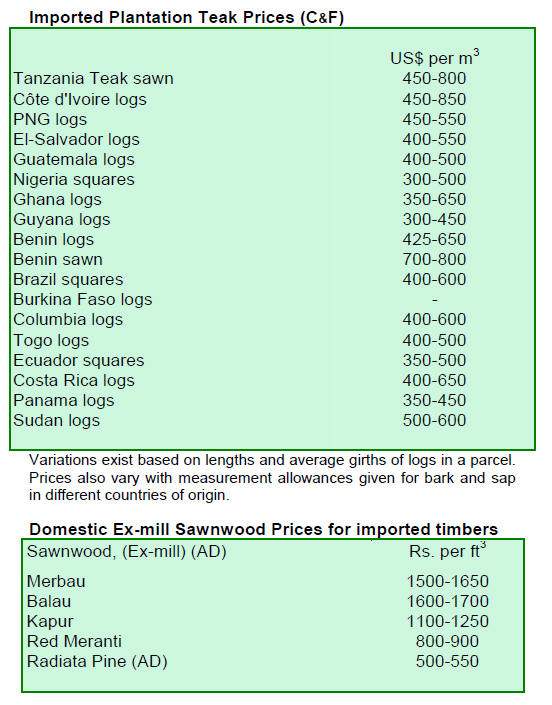

Calls to improve teak plantation stock

There has not been any appreciable rise in the C&F

prices even though the weaker Rupee has increased the

landed costs of plantation teak.

Some in the industry are complaining that the quality

of plantation teak logs from West Africa and also

Central and South America is deteriorating. Importers

say it is high time that teak plantation managers in

these regions take steps to improve the quality of the

growing stock and in future plant quality cloned

saplings.

Indian experts say that while such moves may increase

the cost of plantation establishment the investment will

earn excellent dividends by way of better prices for

harvested good quality logs.

¡¡

7.

BRAZIL

2012 export performance

Brazil¡¯s exports of wood products (except pulp and

paper) delined 1.4% in 2012 compared to 2011, from

US$ 2,396.2 billion to US$ 2,362.6 billion.

Pine sawnwood exports fell 7.4% in value in 2012

compared to 2011, from US$ 170.5 million to US$

157.9 million.

In terms of volume, exports of wood products dropped

3.0%, declining from 741,400 cu.m to 718,900 cu.m

over the period.

The volume of exports of tropical sawnwood declined

16.0% in 2012, from 451,900 cu.m in 2011 to 379,500

cu.m in 2012. The decline in export value was almost

19%, down from US$ 238.2 million to US$ 193.8

million, year on year.

On the other hand pine plywood exports increased

14.5% in value in 2012 compared to 2011, from US$

324.9 million to US$ 371.9 million.

The volume of pine plywood exports increased 13.7%

during the same period, from 865,600 cu.m to 983,900

cu.m.

However, exports of tropical plywood fell from

74,500cu.m in 2011 to 58,200cu.m in 2012,

representing a 21.9% decline.

In value terms, exports of tropical plywood fell 20.4%

in 2012, declining from US$ 45.5 million in 2011to

US$ 36.2 million last year.

The value of Brazilian export of wooden furniture

dropped from US$ 496.1 million in 2011 to US$ 474.9

million in 2012, representing a 4.3% decline.

Tropical Sawnwood Exports from Mato Grosso

Mato Grosso accounted for around two thirds of the

Brazilian trade balance surplus generated in 2012,

equivalent to US$ 12.89 billion of the total surplus

US$ 19.43 billion. Despite the ups and down in the

global economy the State of Mato Grosso achieved

positive overall export growth.

The Brazilian Ministry of Development, Industry and

Foreign Trade of Brazil (MIDIC) has data indicating

the contribution to the positive trade balance by various

products, with soybeans and tropical wood products,

especially sawnwood, featuring prominently.

Mato Grosso state exported 723,000 cu.m of tropical

sawnwood in 2011 and this increased by 12% in 2012,

to 812,000 cu.m.

On the other hand, there was a 4% drop in tropical

sawnwood export values from Mato Grosso with

revenues falling from US$ 45.4 million in 2011 to US$

43.7 million in 2012.

Par¨¢ State timber exports fell in 2012

Par¨¢ state is one of the principal exporters of tropical

sawnwood in Brazil, according to the Ministry of

Development, Industry and Foreign Trade of Brazil

(MDIC). In 2012 tropical sawnwood exports from the

state declined slightly in 2012 such that the state was

responsible for 40% of Brazilian tropical sawnwood

exports compared to 46% in 2011.

In 2012, Par¨¢ state exported 151,200 cu.m of tropical

sawnwood, while in 2011 the state exported 206,800

cu.m, representing a 27% decline in export volumes. In

value terms, the decline amounted to around 30%, from

US$ 119.5 million in 2011 to US$ 84.2 million in

2012.

A significant decline in tropical plywood exports from

Par¨¢ state has been reported. In 2012, the state

exported 4,900 cu.m of plywood, while exports in 2011

were 8,900 cu.m. This represents a 45% decline year

on year. In terms of value, the fall was 34%, from US$

6.2 million in 2011 to US$ 4.1 million in 2012.

Brazilian furniture Sector set to expand 2013

The Brazilian furniture sector is expected to continue

to grow in 2013. According to consumer research by

the Institute of Industrial Studies and Marketing

(IEMI), some 90% of domestic consumers had, by the

ned of 2012, already planned their future furniture

purchases.

The recent research identified that bedroom furniture,

especially wardrobes, was the main feature for

consumers in 2012. In 2012, the number of items of

furniture sold increased 4.5% overlevels reported in

2011 while, in terms of value, sales revenue jumped

8.0%.

For 2013 an almost 7% increase in the number of items

sold is forecast and earnings are forecast to rise around

10%. The IEMI report foresees an overall 5.5% growth

in the furniture sector during 2013.

Investment in construction to drive domestic

furniture demand

The Association of Furniture Industries of the State of

Rio Grande do Sul has reported that the performance of

the furniture sector in 2012 was satisfactory and the

association is anticipating an increase of 3.5% in the

state¡¯s furniture production over levels in 2012.

The forecast growth in the sector is based on

expectations of continued expansion of civil

construction activity and the continued ease at which

consumers can access credit for house purchases and

purchases of durable goods such as furniture.

Further support for the IEMI forecasts derives from

expectations of increased exports to new markets,

establishment of specialized multi-brand shops,

detailed retail research to target promotion through the

internet and an expansion of e-commerce.

The growing purchasing power of the expanding

Brazilian middle class is good news for furniture

manufacturers as well as for importers of high end

furniture from around the world.

State of Par¨¢ plans more plantations

The Government of State of Par¨¢, in the Brazilian

Amazon, has launched a state plantation programme to

stimulate establishment of more forest and wood based

industries.

This programme will require combining the resources

of public institutions with technological development,

re-organization of the production chain, changes in the

law to provide guarantees for investors and the

nurturing of family agriculture.

One of the main challenges, say analysts, will be

regularising land registration issues in order to attract

investments and provide legal certainty for investors. A

further challenge will be to provide for swift state

government responses to the environmental licensing

processes required for plantation projects.

Some 70% of the State of Par¨¢ is covered by natural

forests and under various forms of protection. It is

reported that around 14 million hectares of degraded

land will be included in the new plantation programme.

Plantation forests in the state currently amount to about

300,000 hectares which is consider far too small to

meet the demand of the growing timber sector in the

state.

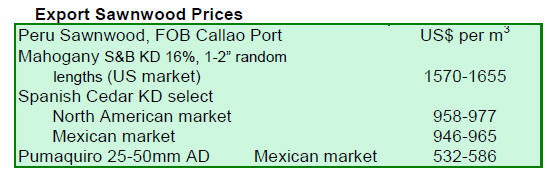

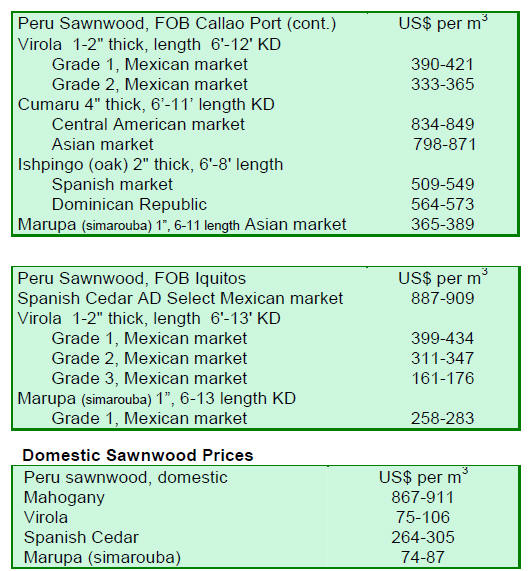

8. PERU

Concerns over forest concession

management

Peru¡¯s agriculture minister, Milton Von Hesse La

Serna has reportedly expressed deep concern about the

current forest concession system in the country. He

said that the forestry institutions are weak and that the

regional governments are not managing the forests to

the required standard.

To address these short comings the minister is calling

for improvements in the institutional framework for

forest concession allocation and management through

dialogue between stakeholders including OSINFOR,

the ministry of agriculture, regional governments, local

governments and civil society.

Currently, forest concessions are granted by regional

governments however, many of the regional

institutions are said to be lack of technical and

managerial capacity for this task and there are fears of

favouritism in the decision making process when

concessions are allocated.

Only 21% of concessions operational in Ucayali

Reports indicate that the forestry authorities in Ucayali

are facing a critical situation as only 21% of the

allocated forest concessions are operational. A round

table discussion has been held to try and identify the

reason for this and to offer solutions.

Among the proposals put forward was a new payment

structure moving away from an advanced payment

system for which a flat rate is calculated on the

assumption that the concessionaire will extract 65% of

the allocated standing volume.

Another proposal was to allow small logging operators

and sawmill owners to undertake harvesting in

allocated areas. Apparently current policies do not take

account of the needs and capacity of small operators.

The roundtable also proposed the creation of a Forest

Recovery Fund and the need to streamline procedures

for evaluating and approving environmental impact

studies in forest management plans.

¡¡

9.

GUYANA

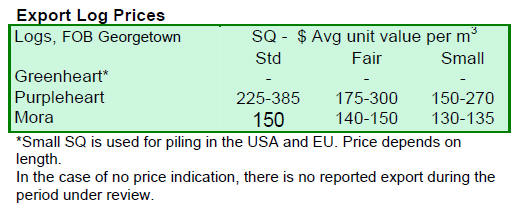

Export prices at satisfactory levels

For the period under review Guyana did not export any

Greenheart logs however, there were exports of

Purpleheart logs. Standard sawmill quality Purpleheart

logs for export were priced at US$ 385 per cubic metre

FOB.

Purpleheart fair and small sawmill quality logs were

also exported and satisfactory price levels were

recorded.

Export FOB prices for Mora logs of standard and fair

sawmill quality reached US$ 150 per cubic metre while

small sawmill quality logs achieved a price of US$ 135

per cubic metre.

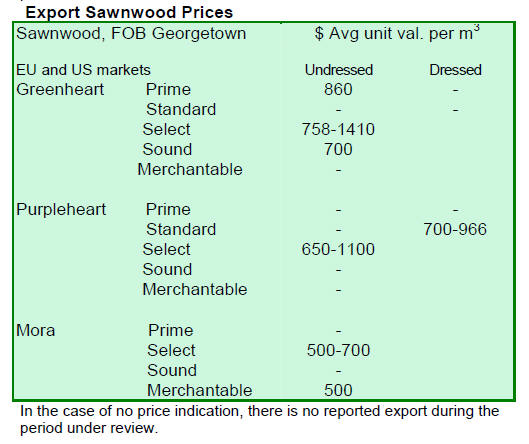

The demand for Guyana sawnwood was reportedly

firm for the period and attractive prices were achieved.

¡®Undressed¡¯ Greenheart sawnwood attracted the best

prices.

Undressed Greenheart (select) was priced at US$ 1,410

per cubic metre FOB. Only select Undressed sawn

Purpleheart was exported and the best price secured

was around US$ 1,100 per cubic metre FOB.

Undressed Mora (select quality) also made a notable

contribution to export earnings as the top end price was

US$ 700 per cubic metre FOB.

EU a major market for Guyana producers

Guyana¡¯s structural and durable timbers were marketed

in Asia and the Caribbean but most went to markets in

the EU. There were also buyers in the Middle East as

well as South and North American markets.

Dressed Greenheart sawnwood prices were firm in the

period reported at around US$ 1,534 per cubic metre

FOB. Exporters of sawn and dressed Purpleheart

lumber also managed to secure good prices in the

region of US$ 1,080 per cubic metre FOB.

Guyana¡¯s Washiba (Ipe) continues to attract firm

demand in N. America as reflected in prices as high as

US$ 2,300 per cubic metre FOB in this market.

Only BB/CC plywood was exported in the period

reviewed and the maximum price achieved was US$

584 per cubic metre FOB in the main market, the

Caribbean.

Guyana¡¯s Roundwood (Piles) secured maximum price

of US$ 616 per cubic metre FOB in the European

market, while Pole prices were US$ 354 per cubic

metre FOB for the North America market.

Caribbean market for shingles picks up amid slack

in US demand

Splitwood (Shingles) made a valuable contribution to

export earnings at prices of US$ 864 per cubic metre

with the Caribbean being the primary export as the

building industry in N. America is subdued at this time

of the year.

The export of doors and windows frames manufactured

from timbers such as Kabukalli (Cupiuba) and

Purpleheart (Amarante) continue to contribute to

export earnings.

LUS handbook for homeowners and builders

The Forest Products Development and Marketing

Council, the Guyana Forestry Commission and the

Forest Products Association have jointly produced a

handbook to encourage home owners and builders to

use lesser know timbers.

This initiative came in the wake of the housing boom

in Guyana which resulted in shortages of the popular

timbers and thus caused timber prices to rise in the

domestic market. It was recognised that the advantages

of using Lesser Used Species in building projects for

consumers and end users were both affordability and

availability.

The handbook is designed for end users of timber as it

provides information on the properties of the LUS

alternative species in terms of application compared to

the more commonly used timber species in Guyana.

The Guyana LUS e-handbook can be found on the

FPDMC website www.fpdmcguy.org.

¡¡