|

Report

from

North America

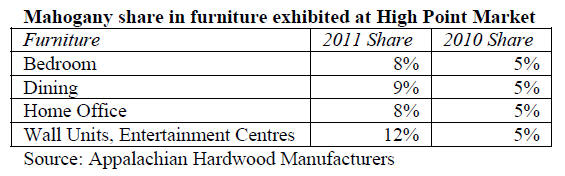

Strong mahogany use in furniture at High Point Market

More than 90% of the bedroom and dining room furniture

exhibited at the High Point Market used solid wood or

veneer according to the trade association Appalachian

Hardwood Manufacturers. The High Point Market is North

America¡¯s largest furnishing industry trade show, where

the annual Furniture Styles and Material Use Survey was

carried out.

American cherry is the leading species used in bedrooms,

dining rooms, home offices and in entertainment cabinets,

followed by American walnut and red oak. Mahogany was

in fourth place with high levels of use in all types of

furniture surveyed.

The survey results do not show what species were

included in the ¡°mahogany¡± category, but the relatively

high use percentages indicate that it includes species such

as khaya.

Other tropical and subtropical species did not see much

use at the show, with the exception of plantation species

such as rubberwood and acacia, as well as wenge. The use

of materials other than wood, including painted and

overlayed wood, decreased from 12-14% in 2010 to less

than 10% this year.

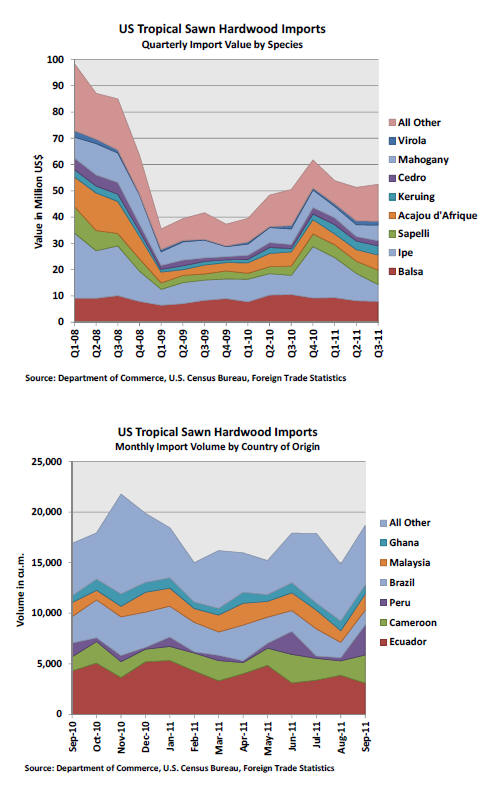

Third quarter increase in sawn tropical hardwood

imports

In the third quarter of 2011 the value of US imports of

sawn tropical hardwood increased by 2% from the

previous quarter. Imports did not reach the high levels

seen in the last quarter of 2010, but the value of year-todate

imports is still 13% above 2010. This compares to a

gain in year-to-date import volume of just 3%.

The US imported US$50.9 million of sawn tropical

hardwood in the third quarter of 2011, up from US$49.8

million in the second quarter. Among the species that

gained the most year-to-date are keruing (+110%), sapelli

(+80%), virola (+61%) and ipe (+34%).

On a monthly basis, the volume of sawn tropical

hardwood imports increased from August by 26% to

18,666 cu.m. in September. Imports of balsa were 3,063

cu.m. (-23% year-to-date), virola 2,370 cu.m. (+70% yearto-

date), acajou d¡¯Afrique 2,267 cu.m. (-13% year-todate),

mahogany 1,284 cu.m. (-14% year-to-date), keruing

1,243 cu.m. (+83% year-to-date), and ipe 1,051 cu.m. (-

8% year-to-date).

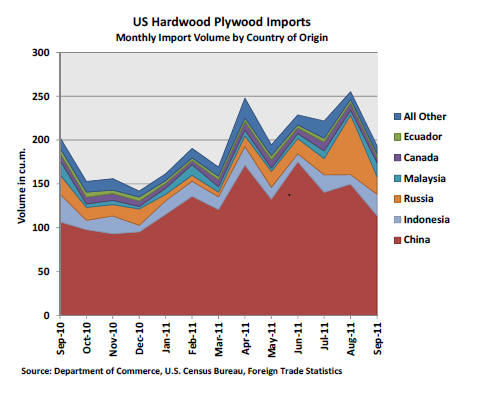

China¡¯s share in plywood imports declined in

September

US hardwood plywood imports declined by 24% to

193,548 cu.m. in September. Year-to-date plywood

imports were unchanged from the previous year. Imports

from China were at 113,862 cu.m. (+16% year-to-date),

accounting for just 59% of total US hardwood plywood

imports in September. Imports from Indonesia were

24,296 cu.m. (-34% year-to-date), from Malaysia 16,140

cu.m. (-53% year-to-date) and from Ecuador 3,577 cu.m.

(-19%).

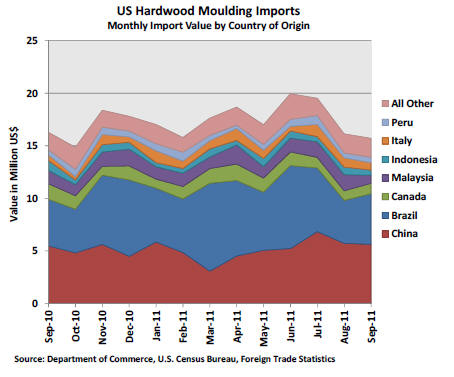

Moulding imports from China surpassed Brazil¡¯s in

September

US imports of hardwood moulding weakened again in

September. The value of imports was US$15.7 million in

September, down 3% from the previous month. Brazilian

shipments accounted for 34% of year-to-date imports

compared to 30% from China. In September, Brazil

shipped US$4.8 million worth of hardwood moulding

(+38% year-to-date), compared to US$5.6 million from

China. Imports from Malaysia declined to US$771,000 in

September, but on a year-to-date basis Malaysian

shipments are 32% above 2010.

¡¡

More hardwood flooring imported from Indonesia

Hardwood flooring imports increased by 4% to US$2.7

million in September, up 53% compared to year-to-date

2010. China regained its position as leading supplier from

Malaysia in August, but at US$851,000 imports from

Malaysia remained high nonetheless (+81% year-to-date).

China exported US$982,000 (+66% year-to-date).

Together China and Malaysia account for half of the US¡¯

total hardwood flooring imports. Indonesia shipped

US$346,000 (+280% year-to-date), while imports from

Brazil declined to US$86,000 (-15% year-to-date).

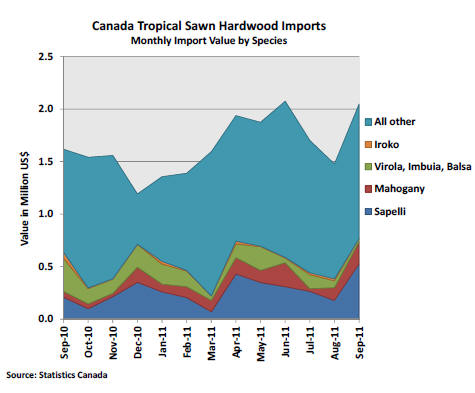

Canadian imports of sawn tropical hardwood up in

September

Canada imported US$2 million worth of sawn tropical

hardwood in September, up 38% from August. This brings

Canadian imports back to the high levels seen in spring

and early summer.

The strong increase in imports was mainly due to higher

sapelli shipments, which reached the highest level seen so

far this year at US$526,378. Demand for mahogany was

also strong and imports reached US$208,333 in

September, up 72% from August.

Statistic Canada revised the monthly import value data

since they were reported in the TTM report number 20.

The revised import data is shown in the graph below.

Statistics Canada distinguishes only few tropical species in

their sawnwood import data. Of the species shown, sapelli

accounts for the largest share in Canada¡¯s tropical

sawnwood imports.

Related News:

|