US demand for W. African Khaya (mahogany) appeared

to be improving mid-year but the anticipated continued

increase in demand did not materialised.

2.

GHANA

Ghana¡¯s timber export performance

According to Ghana Timber Industry Development

Division (TIDD) report, a total of Euro 8,439 million was

realised from a volume of 24,116 cu.m of wood products

exported in September this year. The corresponding

figures for September 2010 were Euro 12,618 million, and

36,000 cu.m indicating that 20011 exports fell by around

33% in value and in volume.

For the first nine months of 2011, wood product exports

fell by 18 percent in value and 16 percent in volume (Euro

85,923 million and 259,151 cu.m) when compared to the

same period in 2010.

The decline, says the TIDD, was mainly the result of an

inadequate supply of logs, coupled with operational

challenges faced by most sawmillers.

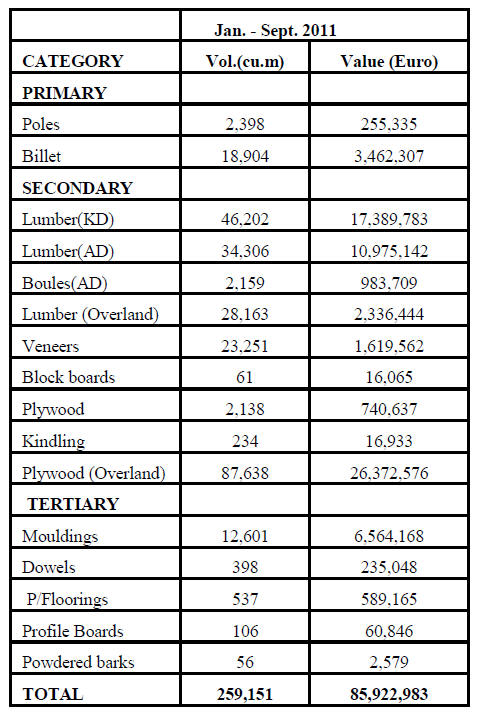

During the first three quarters exporters shipped about

sixteen different wood products as shown in the table

below.

Markets within Africa accounted for around 50 percent of

all wood product exports by Ghana in the first three

quarters of the year with Europe and four other markets

accounting for the balance. The main product exported to

regional markets was plywood and this went mainly to

Nigeria, Burkina Faso, Togo and Niger.

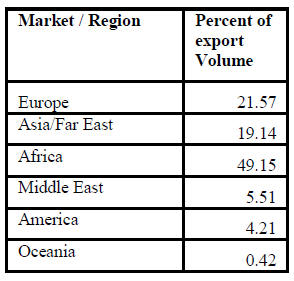

The table below shows the pattern of market distribution

from Ghana¡¯s wood products.

3.

MALAYSIA

2011 export target can be meet says Minister

The Malaysian Plantation and Commodities Ministry said

that the Malaysian timber industry is projected to meet its

export target of RM20 billion to RM21 billion, which is

close to the RM20.5 billion exports in 2010.

The Malaysian timber industry is still battling the effects

of the 2009 global financial crisis and weakness in the US

economy as well as the effects of the Euro debt crisis,

which have given rise to weak demand for Malaysian

timber products in affected markets.

In addition, unrest in some Middle East countries has

added to the toll on the Malaysian timber industry.

The Ministry added that local timber consumption stands

at about RM7 billion per year, with demand coming

mainly from the local building and construction sector.

Encouraging furniture export earnings as markets are diversified

Exports of Malaysian made furniture products are likely to

be between RM7 billion to RM7.5 billion this year

compared with RM7.95 billion last year says the

Malaysian Furniture Entrepreneurs Association (MFEA).

The association had projected a 15% drop in exports to

RM6.8 billion earlier this year.

From January to August this year, the value of furniture

exports from Malaysia stood at RM4.9 billion, a decline of

7.9% compared with RM5.3 billion for the same period

last year. However, demand in the second quarter

improved with exports to Japan, India, Russia and Saudi

Arabia picking up.

Exports to Japan increased to RM554 million during the

January-August period compared with RM433 million in

the same period last year. This performance elevated

Japan to the second largest market for MFEA members;

contributing about 8.9% or RM709 million out of a total of

RM7.9 5 billion export revenue in 2010.

Furniture exports to India also improved to RM171

million during the same eight months compared with

RM137 million previously. Exports to the US also

improved considerably.

Exports to Saudi Arabia grew to RM101 million in the

first eight months compared with RM88 million a year

earlier, while exports to Russia improved to RM51 million

up from RM43 million previously.

The weakening of the Malaysian currency against the US

dollar by 3 - 5% in the third quarter of this year

contributed to the increase in exports.

4.

INDONESIA

Indonesia expected to phase out raw rattan

exports

The Indonesian Industry Ministry is widely expected to

phase out the export of raw rattan over a three years period

commencing early 2012 in a bid to revive the local rattan

industry. A decision on this is expected in December 2011.

The Ministry had earlier submitted recommendations to

the Trade Ministry for a new rattan export regulation,

including a three-year export ban and a transition period.

The debate on a rattan export moratorium gained

momentum over the past few months as the 2009 Trade

Ministry regulations on rattan export quota expired in

August this year.

The previous regulations allowed for the export of a

total

of 35,000 tons of washed and sulphurised rattan of 4 to

16mm in diameter. It also stipulated that exports of semifinished

rattan such as sega and irit were permissible as

long as rattan producers produced a written commitment

that they have supplied rattan to the local industry.

Nevertheless, the rattan furniture industries and

associations regarded the regulations as ineffective in

assuring an adequate supply of raw rattan to meet the

demands of the local industry.

Rattan exporters counter-claimed that the local

industry

could not absorb the large volume of raw rattan produced

by Indonesian rattan producers.

The Industry Ministry estimated that local industry

could

absorb up to 63,000 tons of semi-finished rattan.

Indonesia is the world¡¯s largest rattan producer

accounting

for some 80% of worldwide production. Indonesia also

exported 33,033 tons of semi-finished rattan, valued at

US$32.32 million, while exporting 4,275 tons of rattan

furniture worth US$16.09 million in 2010, according to

data provided by the Industry Ministry.

Poor company results in Indonesia partly due to raw

material shortages

Indonesian publicly listed timber companies are citing

poor market conditions for Indonesian timber products as

the main reason for poor corporate performance in the

third quarter of this year.

In a consolidated financial report submitted to the

Indonesia Stock Exchange (IDX), PT Sumalindo Lestari

Jaya Tbk reported a nett loss of Rp.209.05 billion

(US$23.39 million) in the first nine months of 2011, after

reporting year-on-year profits of Rp.15.92 billion in 2010.

A sharp decline in export sales contributed to the

losses.

Sumalindo recorded sales of Rp278.08 billion up to the

end of the third quarter, a decline of about 43% from

Rp489.08 billion for the same period in 2010.

PT Sumalindo Lestari Jaya Tbk¡¯s activities comprise

mainly timber processing, logging activities and operation

of industrial timber plantations in addition to export,

import and local trading. It has a combined total

concession area of 448,986 ha. in East Kalimantan.

The group has six direct and indirect subsidiaries

engaged

in the logging business and operation of industrial timber

plantations.

It also has two subsidiaries that are engaged in the

power

generation and glue manufacturing industry. The company

and its subsidiaries have a combined total concession area

of up to 804,786 ha. in East Kalimantan.

Integrated timber product manufacturer PT Tirta

Mahakam Resources Tbk reported a better performance,

albeit with a nett loss of Rp1.03 billion up to the end of the

third quarter this year, after registering losses of Rp19.77

billion for the same period last year.

PT Tirta Mahakam Resources Tbk is involved in the

manufacturing and marketing of plywood and panelproducts.

It owns and operates an integrated wood

processing factory located in East Kalimantan. Its products

range from floor boards, general plywood, laminated

plywood, concrete panels, block boards, to wood

mouldings.

Its products are distributed and marketed locally in

Indonesia and are also exported to Japan, Taiwan, Korea,

Hong Kong, the US, Europe and India.

An analyst attributed the decline in profits of these

listed

companies to a shortage of raw material supply within

Indonesia which is said to be becoming acute.

5. MYANMAR

Myanmar and Malaysia cooperate on timber

production

The Myanmar Timber Merchants Association (MTMA)

and the Malaysian Timber Industry Board (MTIB) are

working on areas of collaboration and are drafting a

memorandum of understanding between the two bodies.

The MTIB commented that Malaysia, with its

experience

of the complex supply chain in the timber industry, will be

able to offer advice and training to the Myanmar timber

industry to enhance efficiency and productivity in the

sector.

Malaysia export RM3.2 million worth of timber and

timber products to Myanmar in 2010, an increase from

RM1.7 million in 2009.

Exports of Malaysian furniture to Myanmar in 2010

stood

at RM2.4 million, with particleboard at RM648, 000 and

fibreboard at RM80, 000 in the same year.

Likewise in 2010, Malaysia imported RM75.9 million

worth of timber and timber products from Myanmar, a

41% increase over 2009, of which RM48.5 million was for

sawnwood and RM211, 000 was for furniture.

6.

INDIA

Weakening rupee continues to

undermine imports

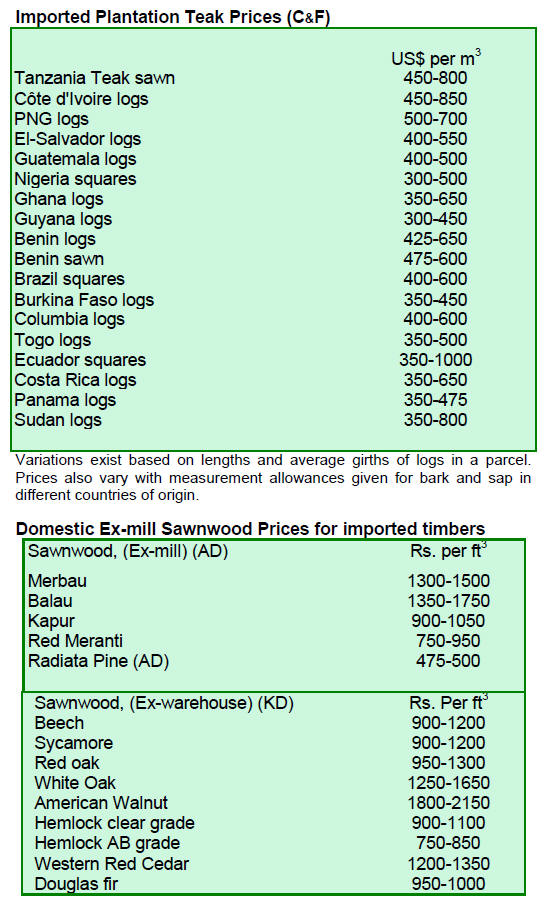

Fluctuations in the Rupee/US Dollar exchange rate have

affected timber imports and the current 10% rise in import

costs due to the weakening of the Rupee is difficult for the

industry to absorb.

Analysts say that while exporting countries have

satisfactory log inventories, currency movements are

creating a mood of uncertainty in the Indian industry and it

is expected that orders for teak could ease.

Alternative timbers such as Meranti, Kapur, Merbau,

and

Balau are in demand as price structures for these species

are more favorable at present.

Importers now seeking wider range of species

Indian importers have now widened the range of species

they are importing to include hardwoods from Latin

America like ipe, camaru, greenheart and purpleheart for

use in the manufacture of flooring and furniture.

Logs harvested prior to monsoon attracting good

prices

Approximately 2,500 cu.m of teak logs were sold in South

Gujarat depots this month. Even though these were logs

felled before the monsoon, prices remained firm and sales

were brisk.

The best quality logs were at prices around 20%

higher

than the average for sales of this type of log. Analysts

report that good quality fresh logs have been steadily

arriving in the depots. The prices for domestic teak logs at

the recent auction are shown below.

Depreciation of the Rupee and galloping inflation

of

concern to industry

Indian exports registered slower growth in September but

still surpassed levels in September last year (US$ 24.8

billion up from US$ 18.2 billion). Imports increased 17

percent in September reaching US$34.6 billion as against

US$29.5 billion in September last year.

European markets absorb about 20 % of India¡¯s

exports

and uncertainties in that market are likely to affect India¡¯s

export performance in the months to come.

On the domestic front, the depreciation of Indian

Rupee

against other major currencies and galloping inflation are

major worries for everyone running a business and the

government is revising downwards GDP growth estimates.

High interest rates and the economic uncertainties are

weighing heavily on the housing market.

The Indian economy withstood most of the negative

effects of the global recession of 2008/9 for over two years

by working successfully with Far East, Middle East and

Latin American markets. However these markets have

now started to feel the effects of the latest round of

financial weakness and the result of this is seen in

performances of Indian industries for the second quarter of

2011-12.

Indian exporters hope that the slight improvements

seen in

the North America economy and in some of the European

countries will continue so that exports begin to expand at

rates seen earlier this year.

India granted MFN status by Pakistan

Pakistan has announced it will grant most favoured nation

(MFN) status to India. India had granted MFN status to

Pakistan in 1996. Over the past few years the relationship

between the two countries has improved and a draft

bilateral visa agreement soon to be ratified will make it

easier for businessmen to move between the two countries.

One of the first advantages of the MFN will be

better

recording of trade data, the current indirect trade would

now be recorded as direct trade between the two countries.

India International Furniture Fair just concluded

The India International Furniture Fair, arranged by MP

International and the International Furniture Fair,

Singapore, has just ended at the Bombay Convention and

Exhibition Centre.

The fair attracted around 100 companies and leading

furniture makers from around the world such as Singapore,

Malaysia, China, Spain, India and Indonesia.

Manufacturers from just these six countries occupied

about 70 percent of the show space.

The show also hosted Indian manufactures and

importers

such as Artasia, Burosys Furniture, Decora Innovations,

Maspar, Mehar Industries, Laxmi International Export,

SunCity and Sharda India.

The Indian furniture show website puts the value of

the

formal Indian furniture market at around US$8 billion but

notes that this accounts for only 15% of the whole market.

7. BRAZIL

Northeast investing in Arapiraca

furniture park

The Arapiraca municipality is the second largest city in the

State of Alagoas in terms of population and economic

importance, especially in the production and distribution

of furniture.

In order to strengthen the furniture sector the

Alagoas

State government is building a large industrial park in

Arapiraca specifically for wood products and furniture.

The furniture park is being built in S¨ªtio Capim, some 6

km from the city centre.

The goal is to restructure and strengthen the

furniture

sector and related-companies as well as to attract new

small, medium and large-sized companies to the region.

This, it is anticipated, will generate more jobs and boost

growth. The park project includes the building of a

warehouse and a showroom to exhibit furniture.

The construction of this industrial park is

expected to

boost the productivity of the furniture sector. The park will

provide for interaction among companies and allow for

further development of the furniture sector thus improving

the competitiveness of companies in the domestic furniture

market.

Furniture sector may loose tax exemption

The President of Brazil signed a set of regulations in

August 2011 to stimulate industrial growth. The new

industrial policy, called the ¡°Plano Brasil Maior¡± (Brazil

Major Plan), aims to help the private sector in the current

difficult trading conditions through reduced taxes.

There are several factors of concern to

manufacturers

including the difficulty in trading when the Real is so

strong, the rapid rise in imports and the risk of a new

global economic crisis.

The governments¡¯ plan includes measures to improve

access to financing through the Brazilian Development

Bank (BNDES), incentives for innovations, tax reductions,

export promotion and trade protection.

The government plan proposes to remove the

furniture

sector from the list of industries subject to the tax

reduction. However the proposed alternative tax of 1.5%

applied to the gross sales of the industry, which replaces

the 20% tax on employer social security, is considered a

setback by many entrepreneurs in the furniture industry.

This was taken up with the authorities by

manufacturers

but they failed to secure agreement for a reduction of the

tax rate from 1.5% to 0.75% as requested by the furniture

sector.

This prompted the furniture industry to request

withdrawal

of sector from the list of industries subject to tax

reductions so as to avoid a further burden on the sector.

Nevertheless, companies will keep the current export

benefits. The dialogue between the government and the

furniture sector continues.

Assistance by Brazil in forest monitoring

intensifies

Technology for monitoring forest cover developed by the

National Institute for Space Research (INPE) and used to

detect deforestation is being transferred to other countries.

The pressure on countries to increase control and

monitoring over their tropical forest areas grows as

climate negotiations advance. INPE developed a

monitoring system for tracking deforestation and the

technique has proven effective domestically and found to

be applicable in other countries.

The Brazilian Government, in partnership with the

United

Nations Food and Agriculture Organization, the Amazon

Cooperation Treaty Organization and the Japan

International Cooperation Agency, has established training

programmes in countries such as Mexico, Gabon, Guyana,

Congo, Papua New Guinea and Vietnam, many of which

intend to utilise this monitoring system.

Six international groups from Venezuela, Bolivia,

Colombia, Peru and Ecuador are currently receiving

training in Bel¨¦m, Par¨¢ state, in the Amazon region in

Brazil. African countries also are also interested in the

system. The Congo, which has the world¡¯s second largest

rainforest, Mozambique and Angola have sent personnel

to be trained in Brazil.

The satellite monitoring of the Amazon rainforest

has

gained momentum with the creation of software called

¡°Terra Amazon¡±. The system collects images from the

U.S. Landsat satellite and transforms them into maps

defining various ecosystems and allows an evaluation of

forest degradation at different stages.

Furniture industry calls for an end to Argentine

customs delays

The ongoing customs clearance delays in Argentina on

imported Brazilian products, including furniture from the

industries in Rio Grande do Sul, has led the Association of

Furniture Industries to ask the Federal Government to take

action.

The State of Rio Grande do Sul has suffered a

drastic

decline in their exports of furniture to Argentina since the

delays in clearance began in 2009.

Brazilian exporters complain that customs

authorities in

Argentina do not respect the internationally adopted norm

of a period of 60 days for issuing import licenses.

It has been estimated that over R$ 7 million in

furniture

produced in the State of Rio Grande are being delayed

because licenses take an average of 136 days to be issued.

8. PERU

State urged to invest more

to prevent illegal logging

A representative of the Environment, Public Services and

Indigenous Peoples Ombudsman office has urged the State

to invest more to strengthen the management of the natural

forests to ensure the sustainable use of resources, to

combat illegal logging and prevent the loss of the

country¡¯s natural heritage.

Journalists update understanding on forest

resource management

The Ministry of Agriculture (MINAG), and the College of

Journalists of Peru (CPP), issued guidelines and arranged a

workshop for journalists and social communicators in

order to broaden their understanding of management of

forest resources and wildlife.

It was reported that the workshop was given by

specialists

from the Directorate General of Forestry and Wildlife

(DGFFS) and the Technical Administration of Forestry

and Wildlife (ATFF) and the Peruvian Society of

environmental (SPDA).

The workshop objective was to provide new and

useful

environmental information, enabling professionals to

inform the media of the facts relating to the care of the

environment and sustainable management of natural

resources.

Latin American Forestry Congress concluded in

Lima

The Latin American Forestry Congress (V CONFLAT)

with the theme "The Future of the World Depends on

Forests" has just concluded. The aim of the congress was

to promote the development of forestry on the continent.

Some 700 participants from various countries in Latin

America attended the congress. ITTO was represented by

Peruvian engineer, John Leigh.

This international event was sponsored by the

Ministry of

Agriculture (MINAG) along with public and private sector

entities.

Minister calls for protection of 50 million

hectares of natural areas

The Environment Minister, Ricardo Giesecke, said

recently that at least 50 million hectares of Peru¡¯s natural

areas need to be protected in collaboration with

communities. This was stated during a training workshop

for 73 heads of natural areas protected by the state,

organized by the National Natural Protected Areas by the

State, SERNAMP, a public body under the Ministry of

Environment.

¡®Green¡¯ credits awarded to Peru to preserve the

environment

The Inter-American Development Bank, will reportedly

award two 'green' credits to Peru worth a total of US$50

million to promote environmental sustainability in Peru.

Activities to be financed include intervention in water

management, sustainable agriculture, energy, climate

change, natural disaster preparedness and solid waste

management.

9.

GUYANA

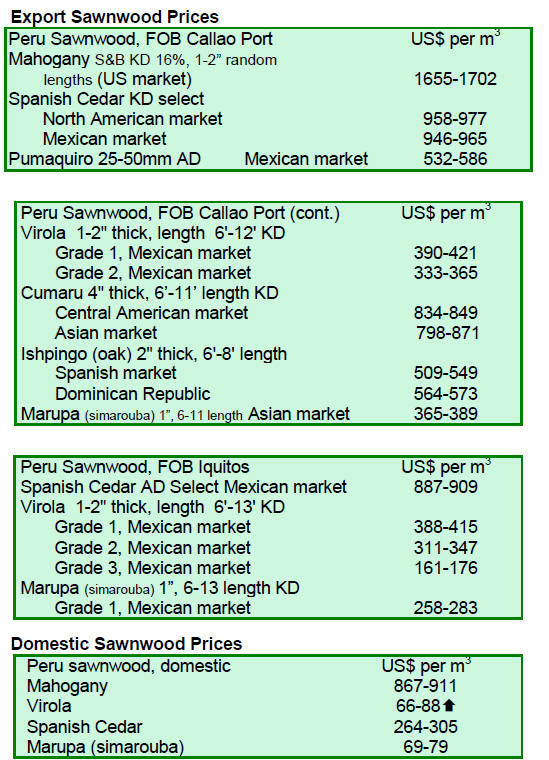

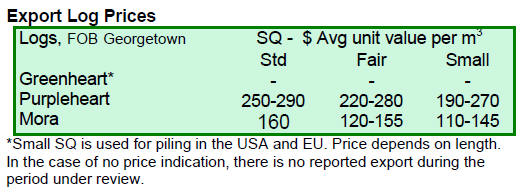

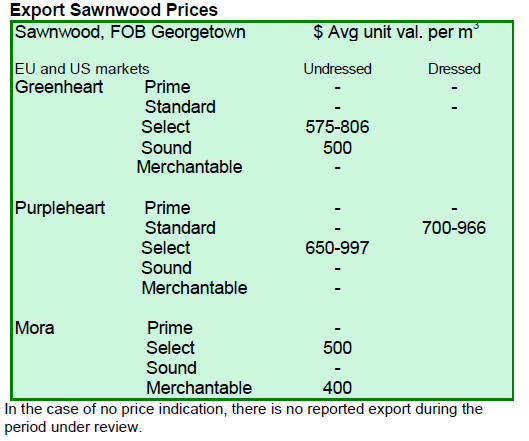

Guyana log prices remain

firm

While there were no exports of Greenheart logs in the

period under review, Purpleheart logs were traded and

prices remain firm for all categories. On the other hand,

Mora log prices showed considerable variation depending

on the specifications and prices for only two categories

increased compared to levels seen in the previous period.

Mora sawnwood prices firm on export market

Greenheart (select) sawnwood recorded a decline in the

top end prices from US$975 to US$806 per cubic metre

for this period. Undressed Greenheart (sound) prices

remained stable for this fortnight period.

In contrast, undressed Purpleheart (select)

sawnwood

secured better prices rising from US$912 to US$997 per

cubic metre for this period.

Undressed Mora sawnwood prices continue firm on the

export market for this fortnight. Undressed sawnwood was

shipped to various destinations including the Caribbean,

Europe, Middle East and North America.

Dressed Greenheart sawnwood was in demand and

prices

firmed from US$848 to US$1,350 per cubic metre, while

dressed Purpleheart sawnwood prices remain unchanged.

Plywood, poles and shingles in demand in export

markets

Baromalli plywood prices fell from US$708 to US$500

per cubic metre for this fortnight period in comparison to a

price of around US$700 about a month ago.

Exports of roundwood, mainly posts and piles, made

a

notable contribution towards to total export earnings. Piles

attracted favourable prices as much as US$703 per cubic

metre with a significant portion of exports going to North

America.

Splitwood (Shingles) also attracted good prices on

the

export market reaching as high as US$1,200 per cubic

metre. This product has always captured the attention of

the endusers in the Caribbean due to its durability and

ability to withstand weathering.

Barama celebrates 20 years in Guyana

Barama¡¯s Chief Executive Mr. Clement Ooi has revealed

that after being granted 1.6 million hectares of forests, the

Malaysian-based Company has invested some GYD$25

bil. in Guyana over the past 20 years.

Barama is the largest foreign investor in Guyana¡¯s

timber

sector and is involved in sawmilling and processing

operations. The Barama complex includes two sawmills, a

veneer plant and a large shipping facility. Barama

stimulated a transformation in the forestry sector

especially with the introduction of new and modern

processing technologies.

The Guyana Forestry Commission has said that this

company has expanded to be the largest interior road

developer and a pioneer of a sustainable management

model under the guidance of the Edinburgh Centre for

Tropical Forest. The Government of Guyana has over the

years, created the necessary investment climate to attract

foreign investors.

Related News: