|

Report

from

North America

Canadian imports of sawn tropical hardwood on the rise

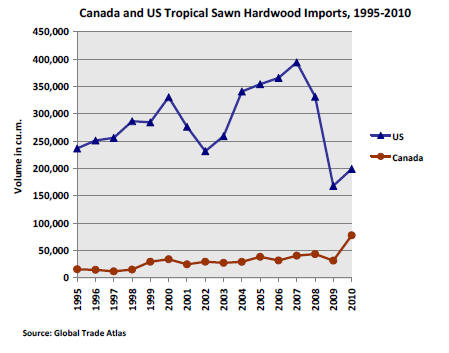

Canada is a much smaller market than the US, and

Canadian tropical sawnwood imports have historically

been less than 10% of the volumes imported by the US.

Over the last ten years, however, Canadian imports have

slowly gone up and in 2010 the highest import volume to

date was recorded.

Canada imported 77,736 cu.m. of sawn tropical hardwood

in 2010 according to Statistics Canada, this represents

almost 40% of (the unusually low) US imports in 2010.

The Canadian Housing and Mortgage Corporation

forecasts declining housing starts and construction

expenditures for the next two years, so Canadian tropical

sawnwood imports are likely to stabilize and not continue

the strong growth seen in 2010.

When looking at the value of the sawnwood imported,

trade figures show that the Canadian market bought more

lower-value species and grades in the last three years than

the US. The average unit price dropped to approximately

half of that paid by US importers.

Canada and the US are very similar markets when it

comes to wood product end uses, although a few

differences exist that affect demand for tropical timber.

Both countries import tropical wood mainly in the form of

plywood and finished products such as flooring, moulding

and furniture. Canada¡¯s hardwood flooring manufacturers,

located mainly in the province of Quebec, are the key

users of sawn tropical hardwood.

Demand for tropical wood in exterior applications such as

decking is lower in Canada than in the US. Canada¡¯s

decking market is overall much smaller because a

significant and growing share of Canadians lives in

apartment buildings, while the vast majority of housing in

the US are single-family homes.

Canada also uses predominantly treated softwood for

decking and boardwalks, and there is less demand for

tropical wood or other, non-wood materials. An exception

is marine applications where softwoods are not suitable.

Canada does not have Lacey Act-type mandatory

requirements for wood to be legal, but in practice most

tropical timber imports come to Canada via US ports and

from distributors who need to adhere to the Lacey Act.

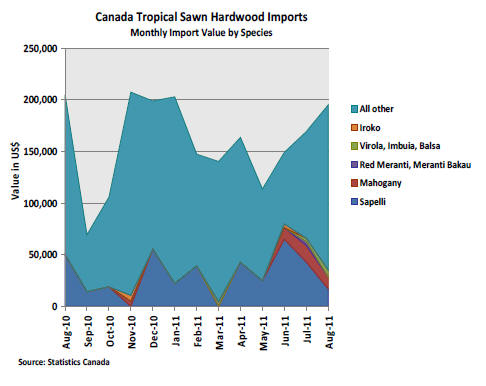

Statistics Canada distinguishes only few tropical species in

their sawnwood import data. Of the species shown, sapelli

accounts for the largest share in Canada¡¯s tropical

sawnwood imports.

Tropical timber demand in the US slow to recover

It looks increasingly likely that 2011 will not see a

significant improvement in tropical timber consumption in

the US compared to the previous year.

Imports of tropical sawn hardwood are also trailing nontropical

hardwood imports. In August, year-to-date import

volumes of tropical sawn hardwood were just 2% above

the previous year, while temperate sawn hardwood

imports saw a 30% increase.

It is difficult to say what role the Lacey Act amendment is

playing in this slow recovery of tropical sawn hardwood

demand.

Tropical hardwood imports are still doing better than sawn

softwood imports, which are 7% below 2010 volumes.

Sawn hardwood also accounts for only a small share of US

tropical timber consumption. Most tropical wood comes

into the US as semi-finished or finished products, such as

plywood, moulding, flooring and furniture.

While overall tropical timber imports are at similar levels

as in 2010, some products saw large gains this year up to

August.

On the sawn hardwood side, imports of most species were

up, especially keruing, sapelli, ipe and cedro, while balsa

imports declined. Significant increases were also seen in

hardwood moulding imports from Brazil and Malaysia and

in hardwood flooring from Indonesia, Malaysia and China.

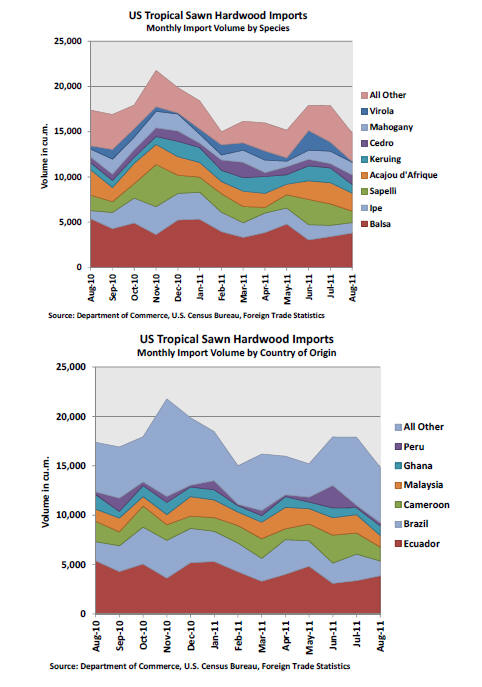

Imports of most sawn hardwood species down in August

In August, US tropical sawn hardwood imports dropped to

its lowest monthly level since February 2010. Total

imports were 14,843 cu.m., 17% down from July, but on a

year-to-date basis imports are still 3% above 2010.

Imports of balsa were 3,811 cu.m. (-22% year-to-date), ipe

1,147 cu.m.(+34% year-to-date) and mahogany 1,384

cu.m.(-19% year-to-date), while imports of cedro bounced

back up to 1,072 cu.m. (+30% year-to-date).

Virola imports were just 104 cu.m. in August (+58% yearto-

date). The two main African species imported also

declined in August; acajou d¡¯Afrique imports were 1,984

cu.m.(-18% year-to-date) and sapelli 1,271 cu.m. (+48%

year-to-date). Keruing imports declined to 954 cu.m. in

August (+86% year-to-date).

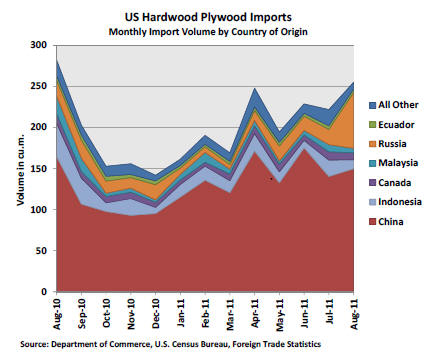

Plywood imports from China continue to rise

The US imported 255,187 cu.m. of hardwood plywood in

August, up from July but just 1% above 2010 on a year-todate

basis. 68% of all hardwood plywood imports this year

come from China, a significant increase from China¡¯s 59%

market share in 2010.

Shipments from Indonesia declined again after a brief

upswing in July. August imports from Indonsia were

10,713 cu.m. (-36% year-to-date). Malaysia shipped 5,435

cu.m. (-59% year-to-date) and Ecuador 3,868 cu.m. (-16%

year-to-date).

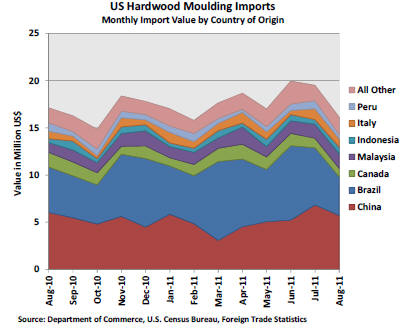

Brazil remains largest hardwood moulding supplier

Hardwood moulding imports declined to US$16.1 million

in August, but the import value remained 16% above 2010

on a year-to-date basis. Imports from China were US$5.7

million in August followed by Brazil with US$4.1 million.

More than a third of the US¡¯ total hardwood moulding

imports this year came from Brazil, while imports from

China account for 29%. Imports from Malaysia remained

at relatively high levels in August at US$1.5 million

(+44% year-to-date).

Strong growth in hardwood flooring imports

Hardwood flooring imports continued to increase despite

the slow US housing market and economic uncertainty.

US hardwood flooring imports were US$ 2.6 million in

August, a 60% year-to-date increase over 2010. There was

a shift in the sources of supply, however, with China

seemingly gaining market share from Malaysia in August.

China exported US$650,000 worth of hardwood flooring

in August, compared to Malaysia¡¯s US$234,000.

China¡¯s exports to the US remain far below pre-recession

levels, however, while Malaysia and Indonesia increased

shipments over the last two years. Malaysia doubled its

flooring exports to the US on a year-to-date basis from

2010, while Indonesia¡¯s almost tripled.

US Department proposes final anti-dumping duties on

engineered wood flooring from China

The US Department of Commerce has proposed antidumping

duties of up to 58.84% on multi-layer

(engineered) wood flooring from China.

A final ruling is expected in November. The anti-dumping

duties would replace the current preliminary

countervailing and anti-dumping duties on engineered

wood flooring from China.

The proposed duties are 58.84%, except for 74

manufacturers who would pay 3.31% and three other

exporters who were assessed duties of 3.98%, 3.31% and

0%, respectively. A coalition of US flooring importers and

retailers opposes the introduction of antidumping and

countervailing duties, stating that the duties would

threaten their businesses and American jobs.

Lacey Act Amendment ¨Cbipartisan legislation introduced

Congressman Jim Cooper and Marsha Blackburn, both of

Tennessee, have introduced a bill to amend the Lacey

Act. The bill received initial support from a wide range of

industries and groups such as the Audubon Society and a

variety of trade associations.

The International Wood Products Association (IWPA) has

signed on to a letter to Congressman Cooper say, ¡°IWPA

expresses its appreciation for the correct identification of

the issues the business community is facing as a result of

the Lacey Act.

The process is only beginning but we see this as an

excellent start in alleviating some of the unnecessary

burdens of Lacey Act while maintaining the spirit of the

Act.¡±

http://cooper.house.gov/index.php?option=com_content&task=vi

ew&id=537&Itemid=73

Related News:

|