Japan Wood Products

Prices

Dollar Exchange Rates of

28th August 2011

Japan Yen 76.83

Reports From Japan

Peak demand for plywood for emergency housing over

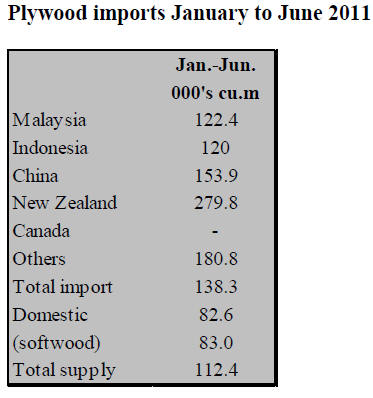

The Japan Lumber Reports (JLR) has indicated that the

total plywood supply (production plus imports) in Japan

for the first six months of 2011 was 3,113,700 cu.m, 9%

more than during the same period last year.

Domestic production in the same period dropped by 14%

due to the effect of the March earthquake and tsunami

while imports increased by 28%.

Imports of plywood in May were the largest for over four

years but then declined in June to 383,000 cu.m; however

this was still 38% more than in June last year.

Producers of tropical plywood in Malaysia increased

exports to assist with the quake recovery efforts so imports

of plywood from Malaysian increased. Indonesian

producers were unable to expand production for Japan due

to log availability problems.

Up until early May the plywood market was very active

says the JLR but this was largely the result of speculative

trading in anticipation of strong demand for reconstruction

efforts.

The basic demand drivers had not changed in Japan so

once the demand for plywood from the quake hit areas

was satisfied, the market weakened sharply and prices for

structural and concrete formboard panels softened.

Domestic plywood production on recovery track

Domestic plywood production in June was 198,900 cu.m,

17.4% less than June last year but 5.6% more than May

reports the JLR. Softwood production was 173,300 cu.m,

17% less than June last year. June domestic plywood

production was the largest since the March disaster. The

quake and tsunami damaged plywood mills were quickly

restored and production began in some during July.

The JLR anticipates that domestic supply will gradually

increase so the issue facing the sector is how to balance

supply and demand to maintain stability in the plywood

market.

Fake JAS stamped plywood detected

The JLR is reporting that immediately after the March

disaster some traders imported plywood samples from

China and that some of this was falsely JAS marked with a

certificate of origin from China. The samples provided

were 910x1,820 mm and of an uneven thickness of 12.1-

12.5 mm.

These panels had marking for both structural and standard

quality and were nine ply panels with a pintangor face and

back and poplar cores.

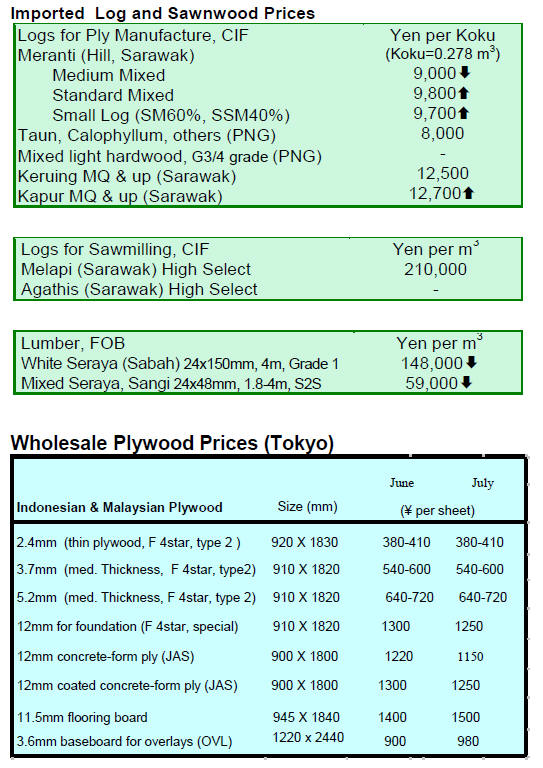

Tropical log FOB and wholesale prices ease

Prices for tropical logs in Japan peaked in July and this

was most noticeable for Sarawak Meranti says the JLR.

Since July wholesale log prices have eased as stock levels

have improved and because FOB prices have fallen

slightly.

Meranti log prices in Sarawak in early August were about

US$310 per cu.m FOB, US$20-30 lower than in early July

reports the JLR. Some log suppliers are asking peak

prices, claiming the logs are from virgin forest and are of

high quality. Other suppliers, who also export to China,

have been accepting slightly lower prices from Japanese

buyers.

Small Meranti prices are around US$280 per cu.m FOB

and super small Meranti prices are at US$265 per cu.m

FOB. Future price levels are difficult to predict says the

JLR as Indian importers have resumed active buying so a

continual downtrend in FOB prices seems unlikely, say the

JLR.

Sabah log prices are mixed but, in general, they are on the

high side. In Japan, July wholesale log prices for Sarawak

Meranti regular were Yen 10,000 per koku CIF but, as the

Yen has appreciated, prices recently eased to Yen 9,700

per koku CIF.

Demand for tropical hardwood structural plywood weakening

Domestic demand for imported tropical hardwood

structural plywood is weakening says the JLR. Prices

moved down in July then dropped further during August.

JAS structural panel (special type/F4star) prices are Yen

1,100 per sheet delivered. Prices for Type 1 panels are

Yen 30-50 lower than for structural panels. Concrete

formboard 3x6 (JAS) prices are Yen 1,100 per sheet

delivered while coated concrete formboard 3x6 panels are

priced at Yen 1,200 per sheet delivered.

The current stock replacement cost of imported coated

concrete formboard panels is around Yen1,280 per sheet

so the current wholesale price of Yen 1,200 per sheet is

too low for the importers.

Compared to structural panels and non-JAS panels, for

which inventories are rather high, inventories of concrete

formboard panels are not high says the JLR so prices for

this type of panel should not weaken as prices for other

panels types could.

Prices for thin and medium thin panels are reportedly flat.

Panels of 2.4 mm thickness (F4star/type two) are Yen 380-

400 per sheet delivered. Medium thick 3.7 mm panels

(type one) prices are Yen 540-570 while 5.2 mm panel

prices are Yen 640-670 per sheet. As the supply of thin

panels is limited and the demand is stable the market is

well balanced at present.

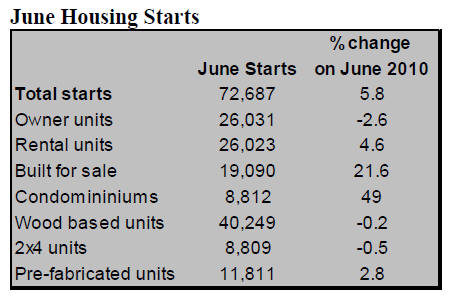

Only bright spot in June housing starts is units built for sale

June 2011 new housing starts, says the JLR, were 72,687

units, almost 6% more than in June last year. This

represented three months of consecutive increases.

However, for the month of June this was third lowest level

of housing starts.

Construction of units for owner occupiers in June was the

second lowest for a June month and continued the

downward trend which began two months ago. Units built

for rent increased for the first time in nine months but still

they were the third lowest for a June.

The only bright spot was in units built for sale. In

particular, condominium starts climbed almost by 50%.

Condominium starts in the Tokyo metropolitan area

increased by 92% and the considerable increase continues

the trend which began last September.

Related News:

|