2.

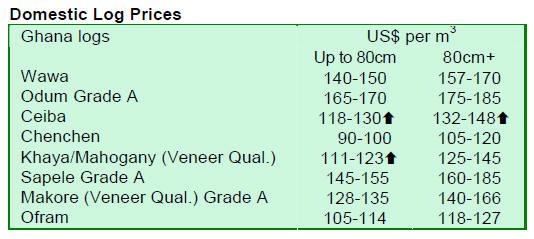

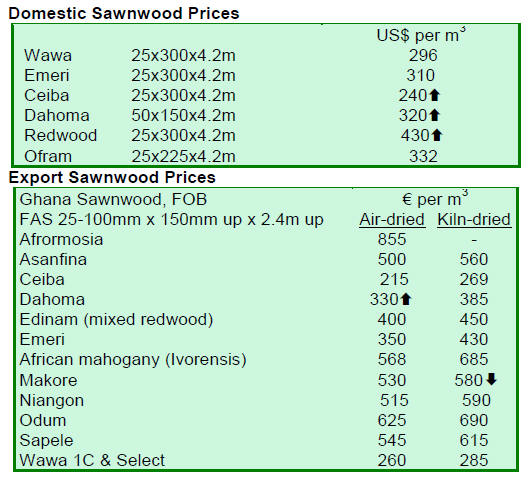

GHANA

Minister calls for shared effort to protect forest resources

The Minister of Lands and Natural Resources of Ghana

has called for a concerted and shared effort from civil

society and the private sector to help protect the remaining

forest resources from further depletion.

The minister said the challenging state of the nation¡¯s

forest resources needed a more pragmatic solution to

address the situation, stressing that the timber industry¡¯s

raw material requirement was currently in excess of 2.7

million tonnes annually out of which there was a supply

gap of 430,000 tonnes from domestic sources.

See:

http://www.ghananewsagency.org/details/Social/Minister-calls-forcollective-

responsibility-to-protect-nation-s-forest/?ci=4&ai=31916

Measures taken to halt illegal teak billet processing

As part of efforts to put an end to the theft of teak logs

from forest reserves, the Forestry Commission (FC) has

introduced strict measures to ensure that only legally harvested and

processed teak billets are shipped out of the country.

The plantations department of the FC has intensified its

monitoring to clamp down on illegal teak harvesting and

processing and is confiscating suspect teak billets.

The Brong Ahafo Regional Manager, Mr. Joe Ackah,

disclosed that his unit conducted an investigation into

operations of some mobile sawmills in and around

Berekum and Japekrom where the theft of teak was

reported.

A member of the investigative team, Mr. Clement Brown,

also the head of the Plantation Department of FC, hinted

that the Commission, as part of its measures to ensure only

legally harvested teak is shipped, had put teams on the

roads to inspect containers carrying teak from inland areas.

Marginal decline in inflation

In financial news, inflation for the month of July 2011

recorded another marginal decline, dropping to 8.3 percent

down from the June figure of 8.59 percent. This is the

lowest inflation rate since June 1992.

The slight decline is said to be the result of a drop in the

price of food items.

African manufactured product exports double

African exports of manufactured goods have doubled over

the last ten years with the rise in demand for goods by

emerging trade partners, says a new report.

According to the African Economic Report the share of

trade conducted by the continent with emerging partners

has grown from approximately 23 per cent to 39 per cent

in the last decade.

The report shows that in 2009 China replaced the US as

the main Africa's trading partner. Africa's top five

emerging trade partners include China (38 per cent), India

(14 per cent), Korea (7.2 per cent), Brazil (7.1 per cent)

and Turkey (6.5 per cent).

However, the European Union and the US remain the most

important sources of Foreign Direct Investment for

African countries, says the report.

Ghana/Togo cross-border trade boosted by new

Border Information Centres

In a press release the ECOWAS and UEMOA

Commissions announced that, in collaboration with the

Governments of Ghana and Togo, the World Bank¡¯s

Abidjan-Lagos Corridor Organization (ALCO), the

USAID West Africa Trade Hub and private sector partners

a major step has been taken toward improving crossborder

transport and trade with the launch of two Border

Information Centres (BIC) on the Ghana-Togo border.

The BIC is an initiative of the USAID West Africa Trade

Hub to support effective implementation of the ECOWAS

Trade Liberalization Scheme (ETLS), a regional

mechanism for improving intra-Community trade in

locally produced goods towards boosting the regional

economy, stimulating employment and thereby

contributing to the overall development of the region.

Transport costs in West Africa are considered among the

highest in the world, constituting a serious constraint to

business across the region and a disincentive to local and

foreign investment.

The objective of the BIC is to reduce transport costs,

reduce, if not eliminate, delays in paperwork processing,

prevent duplicative processes/procedures, and improve

collaboration/coordination of enforcement agencies.

For more see:

http://news.ecowas.int/presseshow.php?nb=140&lang=en&annee

=2011

3.

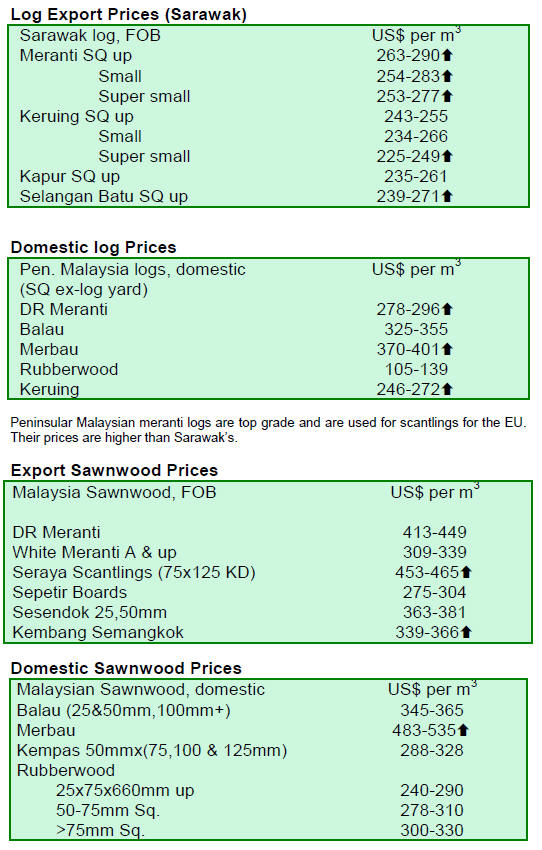

MALAYSIA

China the largest importer of Malaysian furniture

China is fast becoming a leading importer of Malaysian

furniture with imports valued at RM50.2 million in 2010,

an increase of 23% compared to the RM41 million in

2009. China has already replaced the US as the largest

importer of Malaysian furniture.

Analysts expect China to import more furniture from

Malaysia in the years to come as its population grows and

as income levels rise. Estimates put income per household

rising to around US$9,000 over a decade.

Council of Asian Furniture Associations Furniture

plans promotion in China

The Council of Asian Furniture Associations (CAFA) is

working closely with associations in its member countries

including the China National Furniture Association, the

Chamber of Commerce of LeCong Furniture Cities as well

as the owners of the LeCong International Exhibition

Centre to organise trade and market promotion activities

for greater market penetration in China.

LeCong is reportedly offering showroom space on a

permanent basis to members of CAFA to promote and

market Asian furniture in China. Five CAFA member

countries and Malaysia are committed to participate in this

new venture. They are Indonesia, the Philippines,

Singapore, Thailand and Vietnam.

The LeCong IEC is located within an hour¡¯s drive of

Guangzhou International Airport. The LeCong Furniture

Cities occupy 3 million square metres of space and are

home to many modern furniture malls.

STIA calls on government to review Sabah log export policy

The Sabah Timber Industries Association (STIA) has

called on the State government to implement export

policies that will aid the timber industries in the state to

overcome the persistent shortage of raw materials.

The STIA is of the opinion that the volume of logs

exported from Sabah should be reduced and that log

imports should be facilitated.

STIA said that this policy review is necessary to

encourage the development of downstream processing in

the State.

Some RM4.8 billion in revenue and RM1.0 billion in

foreign investment by the local timber industry were

recorded in 2009.

4.

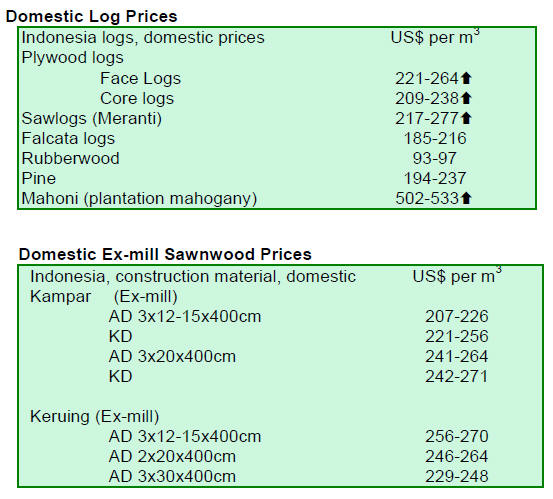

INDONESIA

Indonesian forestry continues to

attract investment

To-date, the Indonesian Ministry of Forestry has issued 12

licenses for commercial forest plantations (HTI) according

to reports. The revenue from these licenses which

amounted to Rp.23.95 trillion will be utilized to develop

around 373,300 ha. of forest plantations.

Data shows that there is still an inflow of investment

into

Indonesian forestry industry despite the signing of the 2

year moratorium on land clearing with Norway.

The Indonesian government is reportedly rehabilitating

developing 35 million ha. of degraded land. Of the total,

some 9 million ha. will become commercial forest

plantations (HTI), 13 million ha. will remain primary

forests, 7.5 million ha. will be allocated for ecosystem

restoration projects, and 5.5 million ha. will be for public

plantation forests (HTR).

Indonesia a safe haven for investment

The Indonesian Minister of Economics stated that

Indonesia stands to gain from the current negative global

outlook. He added that foreign funds are likely to flow to

Indonesia as the country is a low risk country with

minimal exposure to the crises besetting the US and

Europe.

However, he said that Indonesia needed to improve its

infrastructure if it wanted to see an even greater influx of

foreign funds and investments. Traffic congestion and

poor port facilities are a serious handicap to Indonesian

businesses.

Improved infrastructure could improve the export

competitiveness of Indonesian timber and timber products

and other building materials..

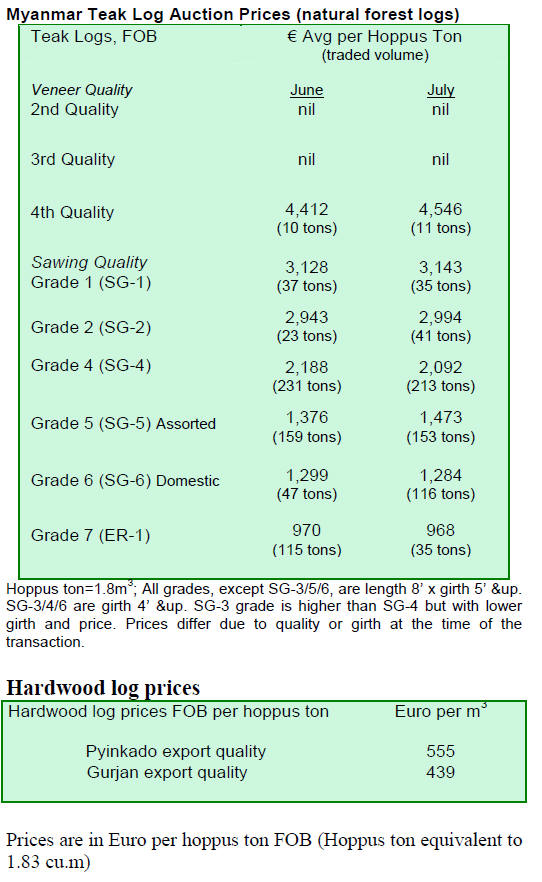

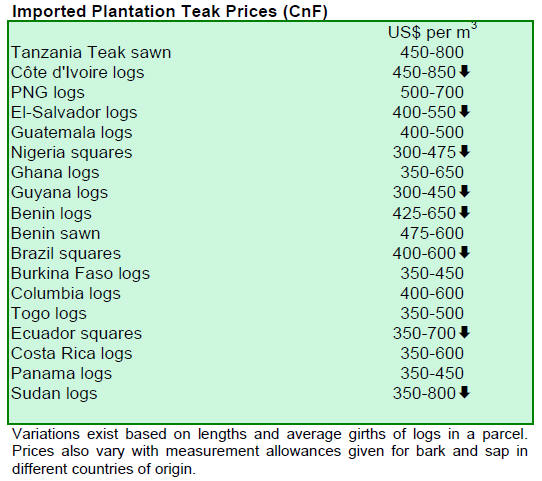

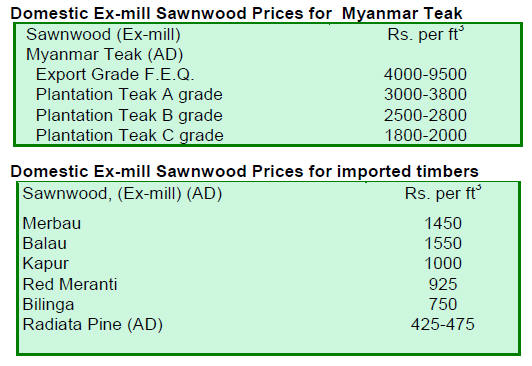

5. MYANMAR

Analysts see market weakness ahead

The market for Pyinkado logs is unchanged but the

demand for Gurjan (Kanyin) is very strong despite recent

price increases. Demand for Teak is stable but not

showing any real signs of improvement.

Analysts say that while the local teakwood industry

reports slightly rising demand for teak flooring blanks and

other sawnwood, the current pessimistic economic outlook

does not seem conducive to improved exports of value

added products.

Plantation forests as a future resource base

The Myanmar media is reporting that the country has over

500,000 hectares of forest plantations and that some of

these were established during theearly days of the national

plan which began in 2001 and will end in 2030.

Estimates by FREDA, a local NGO, suggest that by the

end of the plan period 25% of the nation¡¯s timber needs

could be harvested from the plantations.

FREDA, a very active NGO undertaking development of

the forest resources is very successful in promoting

environmental awareness all over the country.

Asian Clearing Union mechanism reduces burden of

international trade transactions

The Myanmar Central Bank has said that traders can

reduce the burden of complicated international

transactions to some countries by using the Asian Clearing

Union (ACU) mechanism.

This emerged during a meeting to explain the ACU

arranged by the Union of Myanmar Federation of

Chambers of Commerce and Industry (UMFCCI) and the

Central Bank.

The Asian Clearing Union (ACU) mechanism is promoted

as a convenient way to settle payments for intra-regional

transactions among the participating central banks.

The main objectives of a clearing union are to

facilitate

payments among member countries for eligible

transactions, thereby economizing on the use of foreign

exchange reserves and transfer costs, as well as promoting

trade among the participating countries.

A spokesperson from the Myanmar Foreign Trade Bank

(MFTB), said that using the ACU allowed traders to settle

accounts in either dollars or euros.

The ACU was established in 1974 and includes

Bangladesh, Bhutan, India, Iran, Myanmar, Nepal,

Pakistan, Sri Lanka and the Maldives. Myanmar¡¯s only

significant trading partners in the union are Bangladesh

and India.

For more see http://www.asianclearingunion.org/

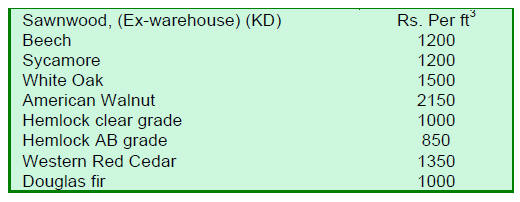

6. INDIA

Brisk log sales at Central India

auctions

Recent auction sales of Teak and other hardwoods at

depots in Central India were well attended. As these were

the last auctions before the depots close until the monsoon

season ends sale prices were up.

Good quality log lots fetched almost 100 Rupees per

cubic

foot more than in previous auctions.

Sawing grade A quality Teak prices at the auctions

averaged Rs.1500, while the average price for B grade was

around Rs.1200. Prices for C grade logs varied from

Rs.800~1000 per cubic foot.

Prices for Haldu ( Adina cordifolia ) ranged between

Rs.500~550 per cubic foot and those for long length

Laurel ( Terminalia tomentosa ) were Rs.550~600 per

cubic foot dropping to Rs.350 per cubic foot for average

sawing quality.

Growing market for wood-plastic composite

products

Domestically manufactured wood-plastic composite

products are appearing on the market in India.

The wood-plastic base material is being used to

produce

mouldings, boards, door and window frames, blocks for

pallets and flooring blocks. Analysts expect this will prove

to be a fast growing market in India as the wood polymer

composite utilises residues from wood working factories

and from agricultural product processors.

Rupee likely to weaken in the short-term

Reports suggest that the rupee is likely to weaken in the

short-term but that in the medium term the rupee could

gain against the US dollar as money begins to flow back

into emerging markets in Asia.

Just after the downgrade of US bonds the rupee fell

to a

low of 45.75 to the dollar.

If the rupee strengthens significantly then

exporters would

be negatively affected but, as analysts point out, at a time

of rising inflation a stronger rupee is the lesser of these

two evils.

India's exports would be affected in the event of a

slowdown in major economies around the world.

In a survey by the Federation of Indian Chambers of

Commerce and Industry immediately after the US

economic downgrade Indian industrialists were of the

opinion that it is unlikely that the current rate of export

growth will continue.

Statistical blip

India statisticians have been thrown a challenge to answer

questions on India's export statistics as it seems there are

large discrepancies between the value of exports reported

by India and the value of imports reported by some major

trading partners.

This apparently came to light in the data released

by the

IMF which shows, in some cases, India¡¯s export values in

FOB terms exceed that of the importing country which

reports the CIF value of trade.

For more on this see:

http://economictimes.indiatimes.com/news/economy/forei

gn-trade/foreign-investors-doubt-indias-exportnumbers/

articleshow/9522434.cms

Demand from Europe, USA and Middle East for teak and

other hardwoods remains steady.

7. BRAZIL

Booming furniture sector in

northeastern Brazil

In the state of Para¨ªba in northeastern Brazil, furniture

manufacturers are taking advantage of the current

domestic construction boom to expand production to meet

the growing demand for furniture.

Analysts say that the local furniture industry is

booming

and that manufacturers of all types of household furniture

are benefiting from increased sales. By way of example, a

company in the municipality of Bayeux has achieved

market growth of 30% to 40% every year for the past three

years.

The local housing market has grown almost 200% over

the

last three years which has boosted the furniture sector. The

state has around 500 furniture manufacturers, employing

some 7,000 workers.

Support to Bayeux furniture SMEs

Companies in the municipality of Bayeux have assistance

from the Brazilian Service for the Support to Micro and

Small Enterprises (SEBRAE).

This organization provides training, consulting and

marketing advice. In order to rationalise raw material

availability SEBRAE created a central business district

where raw materials are marketed to the furniture sector.

SEBRAE also helps the SMEs to visit furniture fairs in

other states such as Ceara, Sao Paulo and Rio Grande do

Sul so as to create new business opportunities.

Furniture park to improve sector competitiveness

In other news, the government of Paraiba has plans to

create an industrial park for furniture manufacturers which

they anticipate will improve revenues in the sector. The

state¡¯s goal is to make companies in the sector more

competitive so that they can reach out to new markets and

achieve brand recognition.

Demand for sustainable wood products leads to

advances in forest management

The Brazilian domestic market consumes about 80% of

the wood produced in the Amazon and consumers of the

wood products manufactured from timber from the

Amazon are now concerned that the wood in these

products is from legal sources.

This awareness by Brazilian consumers, along with

the

demands for proof of legality in the international markets,

is driving demand for legally harvested timber and is

influencing the management regimes adopted by

companies with concessions in the Amazon.

The impact of the market as well as the influence

of the

forest concession policy developed by the federal

government is changing the way forests are managed in

Brazil.

It has been estimated that currently there are

concession

bids pending for more than 1 million hectares of forest.

Reports indicated that the state of Par¨¢ will shortly

conclude concession procedures for an area of 150,000

hectares and two other states, Acre and Amap¨¢, are in the

process of concluding concession over a large area.

Mato Grosso main producer of Amazon timber

The municipalities of Alta Floresta, Sinop and Sorriso in

the northern part of the state of Mato Grosso are the main

producers of timber from the Amazon.

Exports from Alta Floresta in June 2011 totaled US$

2.7

million, a 52% increase over the level in June in 2010.

According to the Ministry of Development, Industry and

Foreign Trade, in the first quarter of 2011, export sales

were just over US$ 17 million, 122% up over the first

quarter in 2010.

Tropical timber is the main export product and

first quarter

exports amounted to US$ 8.1 million. Meat products are

ranked second with coniferous wood products coming in

third place.

The United States was the main buyer of wood

products

from Alta Floresta (US$ 6.3 mil.) followed by Hong Kong

(US$ 3.7 mil.) Egypt (US$ 2 mil.) and Iraq (US$ 1.2 mil.).

The remaining exports went to 17 other countries.

Congo adopts Brazilian technology for monitoring forests

The Democratic Republic of Congo (DRC) has adopted

the technology developed by the Brazilian National

Institute for Space Research (INPE), for a satellite-based

forest monitoring system. The goal of the government of

the DRC is to use the results monitoring to design and

implement national forest policies.

DRC has the second largest tropical forest resource

in the

world, after Brazil. The operation and utilization of the

Brazilian satellite monitoring system has been promoted in

several countries but the DRC is the first country to adopt

the Brazilian technology.

INPE is training technicians from various parts of

the

world and training courses are planned for representatives

from the Congo Basin countries, Latin America and Asia.

The system for monitoring the forests in the DRC

should

be launched at the United Nations Climate Change

Conference in South Africa at the end of this year.

8. PERU

Wooden furniture import business is

booming

During the first five months of 2011 imports of wooden

furniture into Peru rose 55% to US$ 23 million thanks to

the rapid expansion of the real estate sector and the greater

willingness of households to purchase household furniture.

Growth was recorded in imports and domestic sales

of

wooden furniture used in the kitchen (+130% growth),

used in offices (67%) and used in the bedroom (46 %).

The main importer in Peru was Saga Falabella

(approx.

25% of the total value of imports), followed by Sodimac

(18.5%) and Ripley (7%). Analysts expect that in 2011

and subsequent years the wood furniture import business

will deliver double-digit growth.

This, it is said, will be underpinned by demand for

household and office furniture for new apartments and

offices, a sector of the economy which still has much room

for growth.

In 2010 imports of wood furniture were US$ 52.3

million,

71% up on levels in 2009. The main origin of imports was

Brazil (37%), followed by China (18%) and Colombia

(10.0%).

First payment given for community forest

conservation

For the first time in the history of Peru the government has

provided direct financial support to indigenous

communities to conserve their forests.

The funds were provided to five native communities

in the

valley of the Apurimac and Ene rivers as part of the

Program for National Forest Conservation.

To participate in the programme communities were

required to delimit the extent of the forest preserve and

present an investment plan. The goal for this years¡¯

programme is to reach 300,000 hectares of preserved

primary forest.

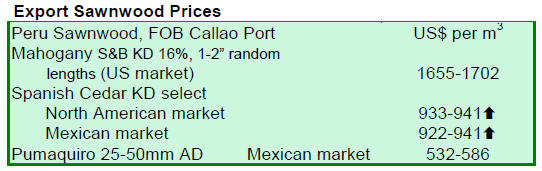

January to May export performance mixed

The Export Association of Peru (ADEX) has reported the

latest wood product trade data showing that from January

to May 2011 exports were valued at US$59.3 mil. FOB an

8% decline on the same period in 2010.

The three main wood exports markets were China,

Mexico

and United States accounting for 83% of the wood sector

exports.

There were reduced shipments recorded to China (

down

37%) and the Dominican Republic ( down 18%) while for

Mexico and the United States shipments rose 21% and

12% respectively over the same period in 2010.

Exports of semi-manufactured products from January

to

May 2011 accounted for 40% of the total value of exports

for the month and the accumulated value of exports of

these products was US$23.8 mil.

The main market for semi-manufactured products was

the

Chinese market which accounted for 64% of the trade.

The value exports of sawnwood from January to May

2011 were US$ FOB 18.5 million while for the same

period in 2010 the trade was worth US$23.1 mil. FOB.

The main market for sawnwood from Peru is Mexico

which accounted for 38% of the total sawnwood trade.

Exports of veneer and Plywood in the period January

to

May 2011 totaled US$7.9 mil. FOB while for the same

period in 2010 they were US$6.5 mil. FOB, an increase of

21%.

Mexico is the main market for veneer and plywood

from

Peru absorbing 80% of exports of these products. In recent

months the United States market has shown more interest

in veneer and plywood from Peru.

The export of furniture and parts is small and

export

earnings were only US$3.1 mil. FOB in the first 5 months

of the year but the level of trade has increased by 28%

compared to the same period in 2010.

9.

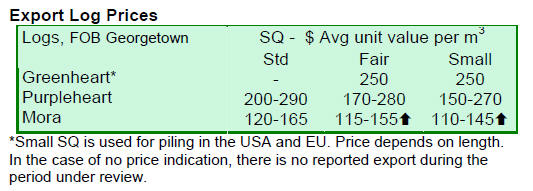

GUYANA

Log export prices holding

steady

During the period under review Greenheart logs were

exported and prices for Fair and Small sawmill qualities

were good. There were no exports of Standard sawmill

quality Greenheart logs.

Purpleheart log prices remain largely unchanged

from the

earlier period while Mora log prices rose for all sawmill

quality logs.

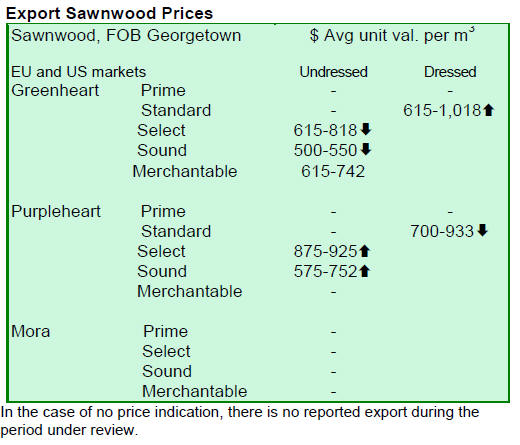

Undressed sawnwood prices weaken as demand stalls

Prices for sawnwood were mixed depending on the species

sold. For Undressed Greenheart (select, sound and

merchantable sawmill grade) prices dropped.

Prices for Undressed Greenheart (Select) fell at

the top end

of the range from US$1,018 to US$818 per cubic metre

but, despite this decline, price levels are still considered as

favourable.

Undressed Greenheart (Sound) prices fell at the top

of the

range from US$954 to US$550 per cubic metre. A similar

drop was recorded for Undressed Greenheart

(Merchantable) where the maximum price level fell from

US$806 to US$742 per cubic metre.

On the other hand, prices for Undressed Purpleheart

improved, increasing for two sawnwood categories.

Undressed Purpleheart (select) sawnwood was sold in the

range of US$650 to US$925 per cubic metre. Similarly

Undressed Purpleheart (sound) sawnwood also recorded a

price increase from US$600 to US$742 per cubic metre.

For the period under review there was no export of

Mora

sawnwood.

Dressed Greenheart sawnwood prices increase

Dressed Greenheart prices were very favourable,

increasing from US$890 to US$1,018 per cubic metre. On

the other hand Dressed Purpleheart sawnwood, while still

at the top of its price range, did experience some price

weakness dropping from US$1,060 to US$933 per cubic

metre.

Plywood, piles and post prices firm

For this fortnight period prices for BB/CC quality

plywood improved on the export market fetching a price

of US$ 600 per cubic metre.

Guyana¡¯s Roundwood exports (Greenheart Piles and

Wallaba Post) were in demand in export markets and

prices in the markets such as the Caribbean, Europe and

North America were good.

Guyana¡¯s Ipe (Washiba) continues to be in high

demand in

overseas market and is attracting prices of US$ 2,500 per

cubic metre.

Local company unveils prefab homes in Guyana

A local timber and roof shingle-maker has announced

plans to introduce pre-fabricated homes to the Guyanese

market with a complete structure erected in as little as 18

days.

Bulkan Timber Works Inc, which runs its main

operations

from its factory at Yarrowkabra, Soesdyke/Linden

Highway, has achieved significant production at its site

catering almost exclusively to the Caribbean market.

From decking, mouldings, wooden windows to doors,

and

shingles, the company is ready to now unveil prefabricated

homes as its latest product.

While management has indicated that the cost may be

a

little high for a low income family the advantage is the

speed at which the home can be constructed.

In the short term the company is targeting the

middle

income families but will look into the possibilities of

producing even cheaper prefabricated homes.

A 700-square foot home which is displayed at the

company¡¯s local office would cost as little as $7M Guyana

dollars.

Related News:

¡¡