Japan Wood Products

Prices

Dollar Exchange Rates of

29th July 2011

Japan Yen 76.77

Reports From Japan

Seihoku plywood production recovering

Seihoku's Ishinomaki plywood plants sustained

considerable damage during the March earthquake and

tsunami but clearing of debris and repairs to the machinery

is progressing well say the Japan Lumber Reports (JLR).

Seihoku plans to dispatch the first structural softwood

plywood this month end and the other Seihoku plant will

begin production in late August. By late October, both

plants will be producing one million sheets a month

reports the JLR.

The rotary lathe in the third plant was not badly damaged

so veneer production is underway. Drying is carried out in

the third plant and gluing, pressing and finish are done at

the number one plant.

The company reportedly plans to produce 150,000 sheets

this month and the target is to make 400,000 sheets in

August and 600,000 sheets in September.

Flood of import disrupts plywood market

In Osaka inventories of imported 12 mm plywood have

grown dramatically due to the arrival of imports, orders

for which were rushed to suppliers imediately after the

March earthquake.

In the port of Senboku, south of Osaka, more than five

ships had to wait off-shore as they could not unload. Some

of these vessels had been re-directed from the original port

of destination as they could not unload as planned due to a

lack of warehouse capacity.

Traders are reporting that the plywood market continues to

be depressed and that wholesalers and retailers are

carrying considerable inventories.

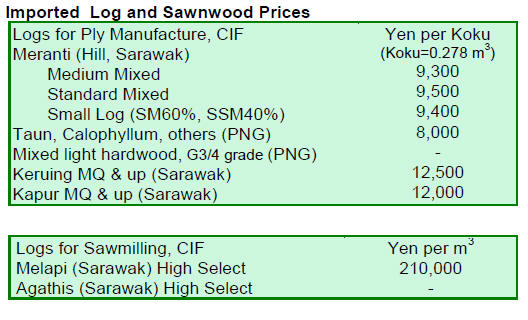

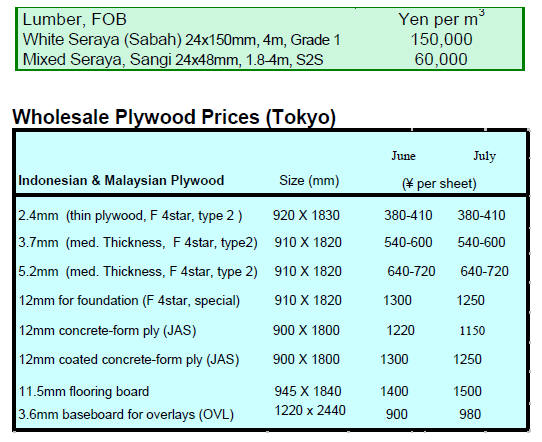

The price of 12mm structural panels dropped by Yen 350

per sheet from the peak of Yen 1,550 to about Yen 1,200

delivered.

Concrete formboard panels (JAS/F4star) prices are Yen

1,150 and coated concrete formboard prices are at Yen

1,250 yen per sheet. Both are down by more than Yen 100

per sheet from levels in June.

June orders for houses builders remain flat

Major house builders are reporting that June demand was

about the same as June last year.

Sekisui House, the largest builder in Japan, reported that

orders for detached units in June were 15% down from

June last year, the first decline in 22 months. However,

orders for apartments were up by 22 %, but orders for

units built for sale dropped by 8%. Overall, the housing

sector business, including renovation works, was 6% up.

Daiwa House reported a modest increase of custom

ordered detached units, the first increase in four months

but at only plus 1% the figures are barely changed from

one year ago. Orders for units built for sale were up by

1% while the overall sales of properties were up by 4%.

Sarawak log producers maintain firm stand on prices

When the rain season arrived in Sarawak logging was

curtailed and log prices increased. Further increases were

caused but a surge in demand after the March earthquake

in Japan.

The news in June this year was that log buyers in both

India and China had begun to slow purchases of logs as

prices were seen spiralling beyond their capacity to absorb

the increases. At the same time plywood mills in Sarawak

also reduced purchases of logs after the surge in demand

from plywood importers in Japan eased.

The JLR is saying that Japanese log buyers continue to

request a reduction in log prices but that the suppliers are

ignoring these requests. In particular, prices for regular

quality logs remain at peak levels.

The latest indications for the JLR is that Sarawak meranti

regular prices are US$330-350 per cu.m FOB, just US$5

lower than late June. Small meranti prices are US$300-

315 and Super small prices are US$290-305, US$10

down.

In the Sarawak domestic market prices for mixed light

hardwoods began to weaken but the plywood mills started

to actively purchase these logs to support the prices

fearing there would be pressure to reduce plywood prices

if log cost were seen to drop.

Prices for Sabah mixed serayah are reportedly steady at

about US$350 per cu.m FOB with active local demand.

In Japan, importers are asking 10,000 yen per koku CIF

for meranti regular logs but plywood mills are strongly

resisting because of depressed plywood market.

Rains in PNG hinder log deliveries to China

The weather in PNG and the Solomon Island is reportedly

very bad at present with heavy rain affecting harvesting.

The main buyer of logs, especially calophyllum, from

these two suppliers is China and importers there have been

placing more orders after they decided prices for logs from

Sarawak were too high.

New berths at Iwakuni port

Muronoki wharf at the port of Iwakuni (Yamaguchi

prefecture), west of Hiroshima, is one of the major log

discharge ports in western Japan. Until recently the port

had one berth of draft of 10 metres and two berths with a

draft of 5.5 metres.

In order to attract larger vessels to the port work was

undertaken to extend the length of the wharf and to dredge

the port to provide a deeper draft.

One new berth has a 12 metre draft and a wharf of 240

metres and two others have a 7.5 metre draft and a wharf

length of 260 meters.

With 12 metres of draft, 30,000 ton class vessel can now

be handled. The cargo handling yard has also been

expanded to 37,740 square metres.

Related News:

|