|

Report

from

North America

US lowers anti-dumping duties on wood flooring from

China

The US Department of Commerce has lowered the antidumping

duties for 74 engineered wood flooring

manufacturers in China from 10.88% to 0.29%. The

Department had apparently miscalculated the freight and

overhead cost of one of the largest wood flooring suppliers

to the US.

The anti-dumping rate of 82.65% for over 100 other

manufacturers in China was also reduced, to 27.12%.

The preliminary countervailing duties of 27.01% for most

Chinese manufacturers remain unchanged. The final

countervailing and anti-dumping rates will be released

later this year.

US economic growth forecast reduced

The US Federal Reserve Board reduced its growth forecast

for the US economy to less than 3% for 2011 after GDP

growth slowed to 1.9% during the first quarter of the year.

Of the four factors needed to turn around the US economy,

only the inventory cycle has recovered as companies have

rebuilt inventories that they reduced to a minimum during

the recession.

Consumer spending has improved, but most Americans

are still concentrating on paying down mortgages and

other debt. There has been no recovery in the other two

important factors, the housing market and unemployment.

The housing market fuelled consumer spending until the

housing bubble burst. Housing prices fell on average 30%

and Americans lost US$7.38 trillion in the value of their

homes. This accounts for the slow economic recovery in

the US since many households have no extra money to

spend or they are holding back on spending.

Manufacturing strong, but not wood products sector

Manufacturing activity accelerated in June according to

the Institute of Supply Management, but wood product

manufacturing contracted after reporting the highest

growth of all industries in April.

Manufacturing for export markets created an additional

500,000 jobs in 2010, according to a recent report by the

US Department of Commerce. President Obama launched

the National Export Initiative earlier this year with the

goal of doubling US exports by 2015.

US unemployment worsens

Unemployment worsened again to 9.2% in June 2011

according to the US Department of Labor. The normal rate

of unemployment before the recession was around 6%.

The number of private sector jobs grew, but all levels of

government cut positions.

The resulting net gain in jobs in June did not keep up with

population growth. It is estimated that the US economy

would need to grow by 5% for a year to reduce

unemployment.

No improvement in the US housing market

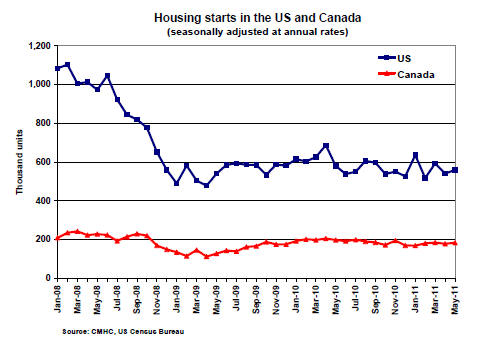

Since our last housing market update the number of US

housing starts has declined again. In May 2011, 560,000

(seasonally adjusted annual rate) were registered

according to the US Department of Commerce. This is

3.4% below the starts in May last year.

There has been no improvement in the conditions for new

home construction as the number of foreclosed homes on

the market is still high; home prices are low and credit is

tight. Lenders have foreclosed on 3.5 million homes since

2007.

One condition that has improved is the inventory of new

homes for sale, which fell to a new record low in May.

Housing starts are at the bottom of historic lows and

according to the National Association of Home Builders

(NAHB), the current level of starts accounts for just the

replacement of destroyed or dilapidated homes.

Single-family starts went up by 3.7% from April to

419,000, while multi-family starts reached 141,000 in

May. Starts increased in the US South and West, which

had previously seen the strongest declines, but starts

declined in the Northeast and Midwest.

Permits for new homes improved by 8.7% to a seasonally

adjusted annual rate of 612,000 units in May. The number

of permits issued can be an indicator of future building

activity. Sales of new single-family homes declined by

2.1% in May, after a large gain in April.

The NAHB reports that the builders¡¯ confidence in the

market for new single-family homes dropped in June 2011

after holding steady for six months.

Prices of existing homes are still very low while material

costs for new homes have risen. The weak economy and

low consumer confidence add to the difficult

circumstances for home builders.

Increasing housing affordability reflects the decline in

home prices. Affordability rose to its highest level since

measurements started more than twenty years ago,

according to the NAHB. 75% of all homes sold in the first

quarter of 2011 were affordable to families earning the

national median income.

Downturn in business for non-residential buildings

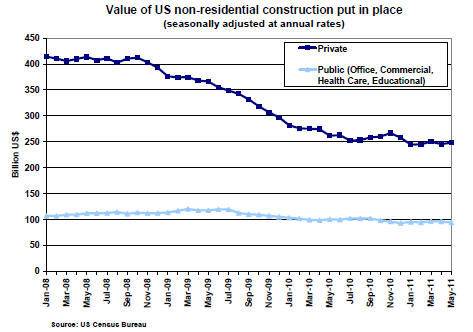

There was little change in the value of non-residential

construction in May 2011. Private construction increased

by 1.2% while public expenditures declined 1.9%.

Business conditions in non-residential construction have

worsened according to the American Institute of

Architects. Design firms in both commercial/industrial and

institutional sectors have seen a decline in activity after

seeing improving conditions last fall and winter.

Construction costs have been rising relatively fast, mainly

because of an increase in the cost of energy and metals.

The cost of material inputs in construction increased 7.5%

between May 2010 and May 2011. Tight credit remains an

issue for many non-residential projects.

Canadian housing market steady

Canadian housing starts increased to 183,600 in May

(seasonally adjusted annual rate), up 2.7% from April.

Multi-family starts drove the growth while construction of

single-family homes in urban areas declined from April.

House construction is expected to decline in the second

half of 2011 according to Conference Board of Canada

forecasts. The Canadian Housing and Mortgage

Corporation forecast a total of 177,600 housing starts for

2011, which is slightly less than in 2010.

The value of building permits in the residential sector

increased 5.3% in May, but this is largely due to rising

prices of multi-family housing in Ontario and Quebec.

The value of building permits for single-family homes

decreased by 2.9%, following two consecutive monthly

gains.

The value of permits for commercial building construction

reached the highest level in two years in May.

Construction intentions rose across Canada for retail

stores, office buildings, hotels and restaurants.

Canada¡¯s unemployment rate was unchanged in June at

7.4%, and the central bank has left its key interest rate

unchanged at 1% since September 2010.

Related News:

|