2.

GHANA

Ghana to introduce new rules on wood procurement

Ghana is soon to introduce a new Legislative Instrument

(LI) for the procurement of wood products by public

sector institutions for all government projects in the

country.

Analysts say that the new law will require the use of wood

products for public sector projects from verified legal

sources and will also redefine export procedures in

relation to verifying the legal source of wood products

destined for export markets.

The new LI is to ensure total protection of the country¡¯s

forest which the government says has been depleted over

the years as a result of activities of illegal chainsaw

operators.

This information was alluded to by the Deputy Minter of

Lands and Natural Resource, Mr. Henry Ford Kamel, at a

Forum on Natural Resources and Environmental

Governance in Ghana.

The Minister voiced concern over the continuing illegal

logging taking place in the country¡¯s scarce forest

resources.

Forestry Commission seeks independent monitor for

the VPA

The Forestry Commission of Ghana has called for

expressions of interest for the engagement of an

Independent Monitor under the Voluntary Partnership

Agreement (VPA).

This is in line with the VPA which requires the

establishment of a Joint Monitoring and Review

Mechanism (JMRM), a body that will conduct periodic

reviews to ensure the effective implementation of the

VPA.

The appointment of an Independent Monitor aims at

providing assurances to all interested parties, that the

Legality and Assurance System (LAS) of the agreement is

being observed.

Among the key responsibilities of the Independent

Monitor are;

• Assessing the implementation and effectiveness

of LAS,

• Conducting field investigations on the relevant

work of the forestry regulatory agencies,

• Identifying and documenting system failures, and

recommending corrective action,

• Assessing the adequacy of data management

systems supporting the LAS,

and

• Assessing the effectiveness of license verification

procedures on entry of wood products into the

EU,

The service of the Independent Monitor is expected to

cover a period of 4 years in the first instance. Ghana

became the first timber-producing country to sign a

Voluntary Partnership Agreement with the European

Union (EU) in Nov.2009.

VPA to support forestry sector reform

Officials of the Ministry of Lands and Natural Resources

and the European Union have concluded a 3-day meeting

in Accra to deliberate on the Voluntary Partnership

Agreement.

A report from the ministry indicated that the Government

of Ghana sees the VPA as a means to support forestry

sector reform and to strengthen its regulatory capacity in

order to reduce revenue loss and environmental

degradation that result from illegal logging.

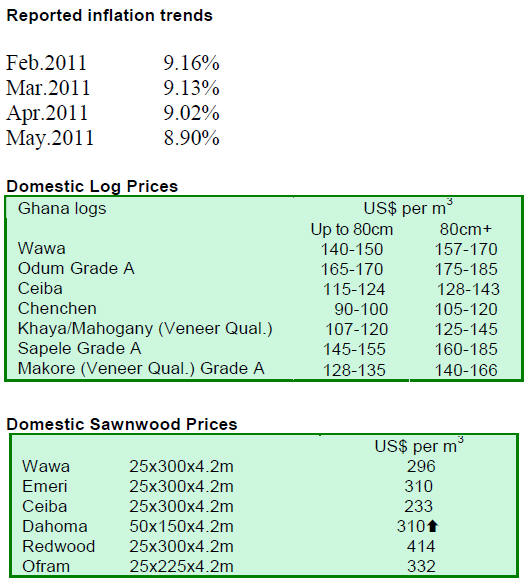

Bank of Ghana announces interest rate cut

The Monetary Policy Committee (MPC) of the Bank of

Ghana, has cut the policy rate by 0.5 percent to 12.5

percent from 13 percent, citing low inflation and an

improved economic environment.

The Governor of the Bank of Ghana, Mr. Amissah-Arthur,

said the MPC was committed to price stability to provide a

supportive environment for growth, adding the Bank was

confident that the annual inflation target of nine percent

was achievable.

3.

MALAYSIA

Industry urged to develop code of conduct

The Ministry of Plantation Industries and Commodities

said that Malaysian timber businesses should lend their

support to the introduction of a code of conduct for the

industry as global consumers are becoming more aware of

issues related to sustainability and the environment.

The minister added that the code of conduct for the timber

industry could draw upon the experiences of the local

palm oil and mining industries and those of foreign timber

associations which have successfully implemented their

own codes.

The ministry took cognizance of the importance of an

industry code of conduct as the timber industry continues

to address various concerns such as illegally harvested

timber, deforestation, forest conversion and native land

rights.

Malaysia is currently working to position itself as an

ethical and major producer of timber and timber products.

As such, 4.65 million ha. of natural forest has been

certified under the Malaysian Timber Certification

Scheme in collaboration with the Programme for

Endorsement of Forest Certification Scheme.

This is in addition to 173,000 ha. of natural forest and

31,000 ha. of forest plantations certified under the Forest

Stewardship Council scheme.

Of particular concern to Malaysian timber exporters is the

US Lacey Act amended in May 2008 to ban the import of

illegally harvested timber and timber products into the US.

Similar regulations have been adopted in the European

Union and will come into force in 2013 thus a code of

conduct for the local timber industry will be a catalyst to

help to address the myriads of issues faced by the industry

in the international marketplace.

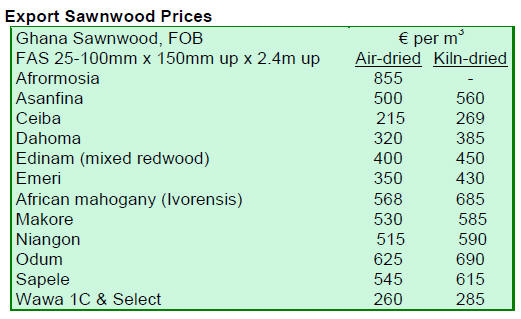

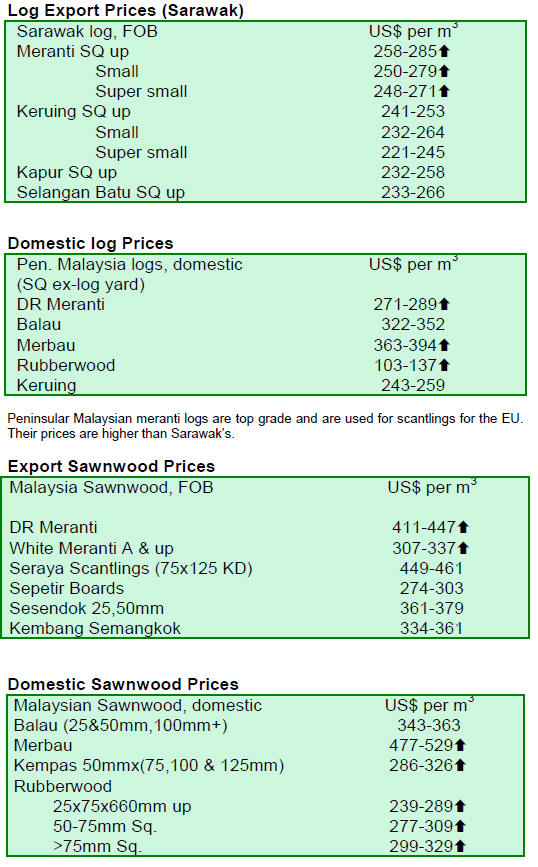

Producers cautious because of mixed market signals

Prices of Malaysian timber and timber products remain

stable. Sarawak based loggers are still trying to overcome

river transportation problems linked to the Bakun Dam.

However, this is beginning to have a marginal effect on

timber processors in Peninsular Malaysia who are

increasingly looking overseas for their raw material

supply, in particularly from Africa, Australia and New

Zealand.

While the plywood sector is enjoying an increase in orders

from Japan, the combination of the European debt crisis

and uncertainty in the US economy has brought about an

element of caution in the local timber market. Timber

processors are wary of being caught with excessive

inventory as at the beginning of the global economic

slowdown in 2009.

4.

INDONESIA

Increasing demand for verification and

certification

services creates business opportunities

California-based Scientific Certification Systems (SCS)

announced that they will be setting up an office in Jakarta

in direct response to an increasing demand for verification

and certification services from the Indonesian timber

industry.

PT Scientific Certification Systems Indonesia (PT-SCS),

as it will be known, will offer services in Forest

Stewardship Council (FSC) Chain of Custody

Certification and Forest Management Certification, in

Indonesia.

PT-SCS will also offer ¡®LegalHarvest¡¯ verification

services, and is in the process of becoming an accredited

SVLK (Timber Legality Assurance System) service

provider for the Indonesian mandatory national standard in

timber certification.

In addition, PT-SCS will offer forest carbon offset

verification services. It has already begun to verify

Indonesia's first REDD project to the Voluntary Carbon

Standard (VCS).

Private consortium raises cash for carbon projects

A major Australian banking and financial services

provider - the Macquarie Group, the International Finance

Corporation (IFC), an affiliate of the World Bank and a

forest management firm said they had raised $25 million

for forest carbon projects in developing countries.

The Macquarie Group¡¯s firm, BioCarbon Group, said it

had agreed to the terms and conditions of the investment

plan, with fellow investors the IFC and U.S.-based Global

Forest Partners LP for total equity financing package of

$25 million.

The Macquarie Group is currently developing 3 REDD

projects in Indonesia in partnership with the global

conservation group Fauna & Flora International, and is

looking for room for expansion. BioCarbon will be the

financial vehicle for these upcoming projects.

The first recipient of the new investment funding is

set to

be a 40,000 ha. (100,000 acre) project in Kapuas Hulu in

West Kalimantan. Most of the project is on carbon-rich

peat swamp forest.

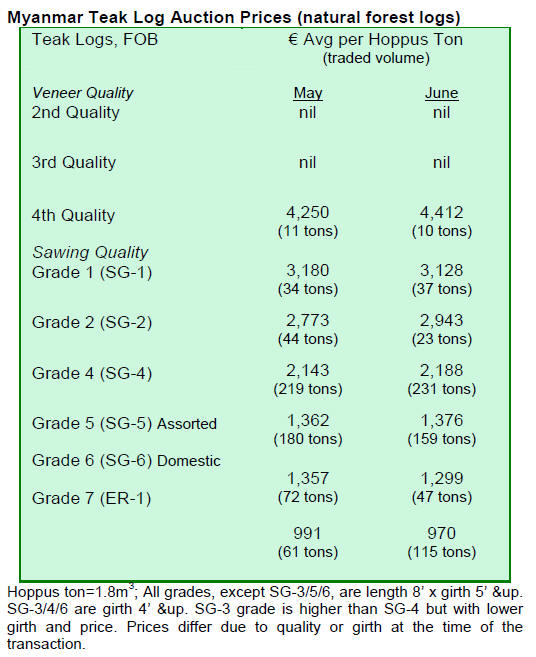

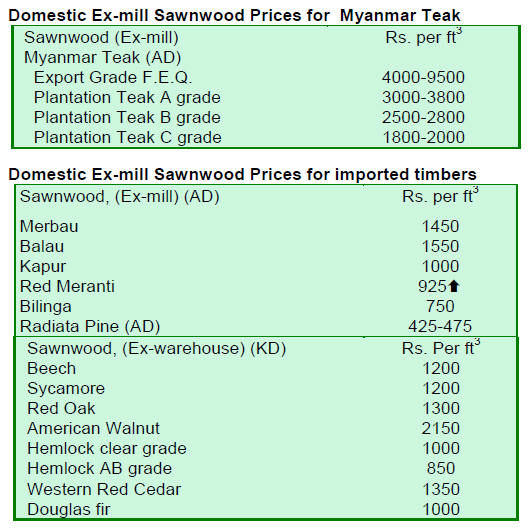

5. MYANMAR

Timber market lacking direction

The market situation during the first weeks of July was

similar to that of the previous month with a quiet Pyinkado

market, while Gurjan (Kanyin) continues to enjoy a brisk

trade.

New price structure for Gurjan

The Myanmar Timber Enterprise, the trading arm of the

Ministry of Forestry has announced new price structures

for Gurjan.

During the current financial year, 2010-11, prices

for

Gurjan (Kanyin) logs harvested from the Monywa-

Momeik-Mawlike-Mabein areas will now be priced at

US$ 440 per hoppus ton (the previous price was US$ 390).

Logs from all other areas will be priced at US$425

(previously US$ 375).

Environmental concerns driving end-users away

from

natural teak

Analysts in close contact with traders in Taiwan P.o.C and

Thailand say that furniture manufacturers and other highend

teak product producers are showing a gradual

preference for plantation teak over teak from natural

forests.

Environmental concerns, trade sanctions and certification

constraints are quoted as the reasons driving this change.

It appears that teak from Myanmar is now only being used

extensively for flooring production. This news is very

depressing for those manufacturers who have a marked

preference for natural teak.

Calls to limit teak log exports

Some analysts feel that reduction in harvested volumes

and a reduction in teak log exports should be considered

while the negative impressions in the market of the

management of natural teak forests in Myanmar are

addressed.

6. INDIA

Economists suggest export growth

could slow

During fiscal 2010/11 India made good progress in

international trade. During May 2011 imports grew by

54% to US$ 40.9 billion and exports by 57% to US$25.9

billion. Both imports and exports have recorded double

digit growth continuously for 13 months.

However, despite the good May data some economists

are

suggesting that the level of India's exports may see a

period of decline because of rising inflation and interest

rates, both of which would undermine the competitive

edge Indian products currently have in world markets.

A recently concluded survey said that exporters are

becoming less optimistic about the future. The removal of

the interest rate subsidy for exporters in March this year

has affected export prices, even though the companies

have been trying hard to absorb the negative impact of the

subsidy removal.

With oil prices continuing to climb exporters

anticipate a

decline in demand in many Asian countries.

Exporters react to changes in tax refund system

The government's decision to only extend the tax refund

system for exporters for three months has angered many

exporters.

There is a plan to replace this tax refund scheme

with a

new tax structure but details of this have not yet been

finalised.

The current scheme, in operation until later this

year,

allows for the reimbursement of customs duty paid on an

imported input used in the export product. This scheme

has been in place for over a decade and covers around half

of the exports from India.

Ganhidham is home to many timber industries

Imports of timber through Kandla have been increasing as

the district of Kutch has good port facilities and wood

based industries have been permitted with Gandhidham as

the central point.

Estimates put the number of workers employed in the

sector in Ganhidham at around 25000 in approximately

500 wood based factories of which 65 are peeling, slicing

and plywood units.

Total quantity of timber imported here during

2010~11

Was37, 28,256 cubic metres consisting of hardwoods and

softwoods. But, in terms of quantity Kandla is the number

one port for imports of timber.

Demand from Europe, USA and Middle East for teak and

other hardwoods remains steady.

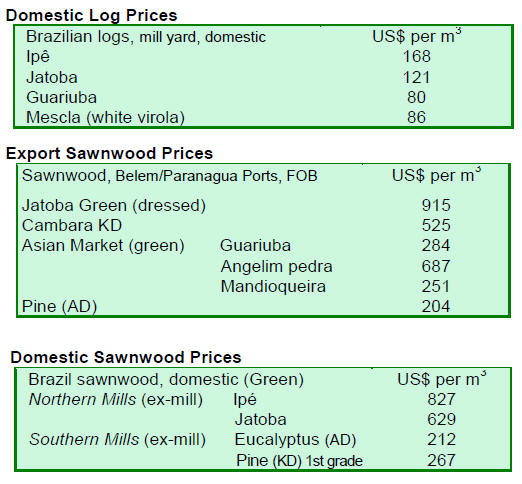

7. BRAZIL

Domestic consumer awareness

programme launched

Concerns have been raised on the level of wood waste

generated by the timber industry due to inefficient

harvesting and processing.

Brazil reportedly consumes around 17 million cu.m

of

wood per year and the highest consumption is in the state

of Sao Paulo.

Harvests of tropical timber from the Amazon are in

the

region of 2.5 mil. cu.m annually. It is estimated that only

around 1.5 mil. cu.m is used for construction, furniture

manufacturing and other uses, the balance is unaccounted

for and assumed to be mainly harvesting and processing

resides.

In Sao Paulo a consumer awareness programme has

been

launched called ¡°Wood is Legal¡±. This seeks to encourage

domestic consumers to purchase wood from proven legal

sources and to promote the use of legally sourced timber

in construction.

The Brazilian authorities recognize that, at

present, it is

difficult to separate wood that comes from forests

managed to approved standards and that from illegal

logging.

By encouraging timber companies to commit

themselves

to reduce waste and to adopting more efficient

technologies and at the same time encouraging consumers

to demand to know the origin of the timber they purchase,

the level of illegal harvesting can be reduced and the level

of processing efficiency can be improved.

Intensified action to combat illegal logging

Deforestation in the Amazon fell in May compared to

April 2011. According to the National Institute for Space

Research (INPE), deforested areas, captured by satellites

that monitor the bioma, recorded a decrease of more than

200 sq. km in the area deforested.

According to the Brazilian Ministry of Environment

this

recorded drop in the area deforested is a consequence of

tough measures adopted in March and April by the Crisis

Office formed by the Brazilian Institute of Environment

and Renewable Natural Resources (IBAMA), the Federal

Police, the Federal Highway Police, the National Security

Force and the Army.

The activities of this office resulted in an

intensification of

efforts to combat illegal logging and in patrolling the

highways to detect and stop the transport of illegal timber.

The number of satellite deforestation alerts issued doubled

as the sky was clear and the satellites were able to more

accurately capture the images of deforestation in the

Amazon.

IBAMA allocated 400 inspectors in Mato Grosso alone

where the severe deforestation was recorded by the

monitoring system. This state continues to account for the

highest rates of deforestation.

In May, 94 sq. km. were deforested in Mato Grosso

equivalent to 35% of the total Amazon deforestation the

second worst level was recorded in the state of Rondônia

where the rate was around 67 sq. km. INPE reported that

in May 2011 the rate of deforestation in the Amazon

exceeded the levels in May in 2009 and 2010.

Uruguay emerges as the main market for Brazilian

furniture

Data for furniture exports for the first 5 months of the year

reveal that Uruguay became the main destination of

furniture exports from the state of Rio Grande do Sul, in

Southern Brazil, surpassing the level of exports to the

United Kingdom and Argentina.

During the same period in 2010, exports to the UK

and

Argentina reached US$ 12.6 million and US$ 8.3 million,

respectively, while exports to Uruguay were just US$ 8.0

million. But in January to May 2011, exports to the United

Kingdom and Argentina dropped 27.4% and 22.3%,

respectively, while exports to Uruguay grew 17.4%.

Furniture export performance slips

The Ministry of Development Industry and Foreign Trade

has reported that furniture exports from Rio Grande do

Sul, in the first 5 months of the year fell almost 6%

compared to the same period last year.

Nevertheless, Rio Grande do Sul maintains its

second

place in the ranking of Brazilian furniture exporting states

just behind the state of Santa Catarina.

Overall, Brazilian furniture exports fell almost 1%

in the

period January to May 2011 compared to the same period

last year. While the furniture export performance to-date is

disappointing, it is expected to grow 4% this year and in

2012 according to projections from the Center for

Industrial Studies.

Brazil currently accounts for 2% of the world furniture

production, occupying 13th position in the ranking of

largest furniture producers and 30th in the ranking of

exporters. The four largest furniture exporters in the world

continue to be China, Italy, Germany and Poland.

Inward looking furniture sector about to change

The Brazilian furniture industry has traditionally been

dependant on the domestic market and the level of

furniture imports has generally been low.

For furniture exporters around the world it has

been an

uphill struggle to penetrate the Brazilian market for

furniture but, as Brazil will host both the 2014 FIFA

World Cup and the 2016 Olympics, domestic furniture

manufacturers and traders see a bright future for the

sector. Demand for furniture especially for the hospitality

sector for hotel refurbishment is expected to grow.

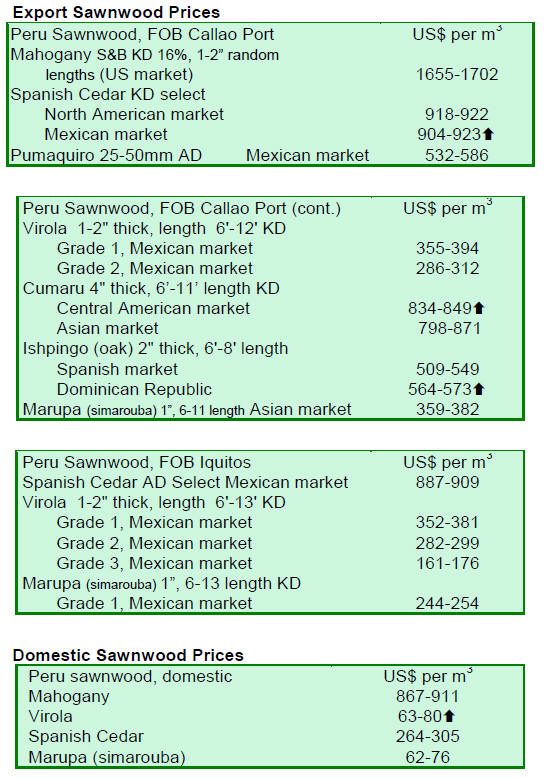

8. PERU

Targetting US$5 billion investment

for the Amazon

Peru is to establish an Investment Promotion Agency for

the Amazon. This agency will seek and oversee

investments in the Amazon regions of Loreto, Ucayali,

Amazonas, San Martin and Madre de Dios and aims to

secure investment commitments from the private sector

and has targeted investments of US$ 5 billion over 12

months.

It is anticipated that much of the investment will

be in the

forestry and timber processing sectors.

The agency will also aim to integrate commercial

investments with projects to support local economies and

communities.

Mexican industry seeks early approval of FTA

with Peru

Fifteen Mexican business associations, including some

timber industry associations, have asked the Mexican

Senate to endorse the Free Trade Agreement between Peru

and Mexico as soon as possible.

According to Peru¡¯s deputy Minister of Foreign

Trade this

FTA will be ratified by Congress and could take effect as

early as late July.

The FTA signed between Peru and Mexico, which

deepens

the Economic Complementation Agreement No. 8 (ACE

8), will open the way for improved trade of some 12,000

Peruvian products, almost twice the number under the

ACE8.

Indutrial sectors in Peru that will benefit include

Peruvian

textiles and wood products. Mexico is a market consisting

of more than 112 million people and in 2010 Peru's

exports to Mexico totalled US$ 286 million.

9.

GUYANA

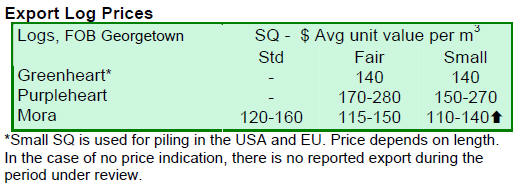

Greenheart log prices give

up recent gains

During the period under review Greenheart log prices both

for the fair and small sawmill qualities gave up some of

the gains made earlier, there was no export of standard

sawmill quality for Greenheart logs.

Purpleheart log prices for fair and small sawmill

qualities

remains firm, while there was no export of the standard

sawmill quality of Purpleheart logs.

Mora log prices remained unchanged with the

exception of

small sawmill quality logs prices of which increased.

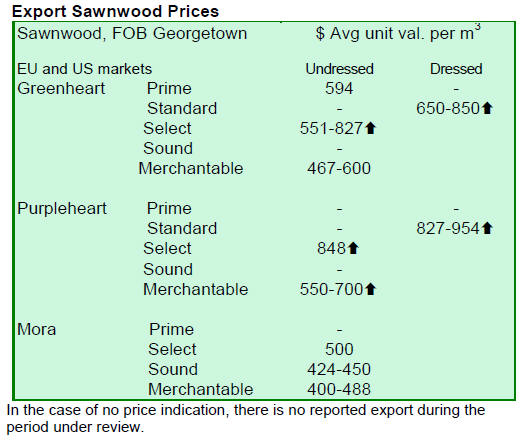

Demand in N. America and Caribbean sustaining

sawnwood prices

Sawnwood prices were encouraging and contributed

positively to total export earnings. Undressed Greenheart

(Prime) was exported earning improved price levels to

US$ 594 per cubic metre.

Undressed Greenheart (select) saw an increase in

prices at

the top of the range from US$ 740 to US$ 827 per cubic

metre. Undressed Greenheart (merchantable quality) also

achieved good price levels reaching as much as US$ 600

per cubic metre.

Undressed Purpleheart sawnwood saw price changes

for

both the select and merchantable qualities with Undressed

Purpleheart (merchantable) showing a notable increase in

its top-end price from US$ 594 to US$ 700 per cubic.

Undressed merchantable quality Mora secured an

increase

in price while prices for the other qualities (select and

sound) remain unchanged.

Dressed Greenheart prices were good on the export

market

for this fortnight, moving from US$ 818 to US$ 850 per

cubic metre. Similarly Dressed Purpleheart sawnwood

experienced an encouraging upward trend in price from

US$ 912 to US$ 954 per cubic metre.

Piles and posts were in demand and prices improved

with

post prices reaching as high as US$ 700 per cubic metre.

The main destination for these products was North

America and the Caribbean.

Welcome news as local plywood mill resumes production

Barama Company Limited has restarted plywood

production with the aim of getting output up to 2,400

cubic metres per month.

The Company has also committed itself to working

closely

with the government to ensure that they maintain

compliance with all forest sector policies and to the

objective of value-adding processing.

When the company announced the restart of

production

company representatives indicated that they had been

working hard to restore plywood production so as to be

able to re-employ the over 200 workers who had been

without work. The restart of this plywood factory will

have a positive impact on the country¡¯s housing drive and

for many businesses involved in house building.

Prior to the temporary closure, Barama was

producing

around 1,600 cubic metres per month but with the new

operation this should increase to 2,400 cubic metres per

month.

The resumption of plywood exports came at a time

when

demand was firm and good prices were secured with

BB/CC quality plywood prices having increased from US$

640 to US$ 690 per cubic metre.

Related News:

¡¡