2.

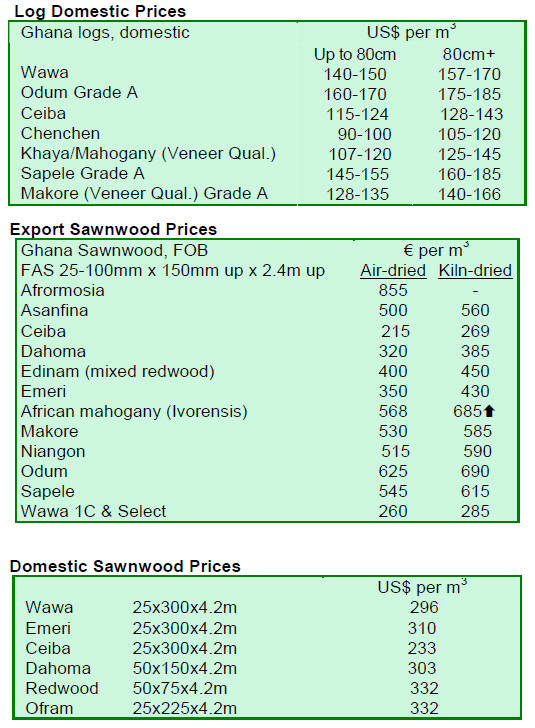

GHANA

Commercial bank interest rate investigation

A storm has been brewing in parliament over the official

inflation figures. The figures from the Ghana Statistical

Service put May inflation at around 8.% (down on the

previous month) but some prominent members of

parliament have questioned how inflation is reportedly

dropping while there is ample evidence of price inflation.

Part of the problem stems from the disparity between the

Bank of Ghana (BOG) base rate and the average interest

rate charged by commercial banks. The BOG¡¯s current

base rate is around 13 percent but the average interest rate

of commercial banks is said to be around 25 percent.

The country¡¯s lawmakers have decided to probe the issue

of the difference between the BOG¡¯s base rate and the

interest rates of the various commercial banks operating in

the country as it seems that high interest rates are

hindering development of small enterprises especially in

the agriculture and forestry sectors.

Highway construction discussed with Chinese banks

Officials from the Economic Community of West African

States (ECOWAS) have started talks with China seeking

investors for the agricultural and industrial sectors and for

investments in physical infrastructure.

The ECOWAS delegation is scheduled to hold talks with

representatives of the Export-Import Bank of China and

the China Development Bank on possible support for

infrastructure projects seen as supporting the economic

integration of West African states.

Media reports indicate that Ghana and Sierra Leone are

asking the Export-Import Bank of China for an investment

of US$320 million for the construction of a highway

network linking the countries.

Call to guard against forest Degradation.

The National Forestry Forum of Ghana (NFF) has stated

that the time has come for government, to curb forest

degradation by taking tough action to combat illegal

logging and illegal mining activities in the country¡¯s

forests.

In an address the vice president of the NFF, Mr. Kwame

Asamoah-Dwomoh, called on the government to tighten

procedures for the allocation of land for mining and also

put in place new strategies to curb illegal logging before

the situation gets out of hand.

The NFF advised government to do more to reverse the

loss of forest cover through sustainable forest management

and to prevent forest degradation.

3.

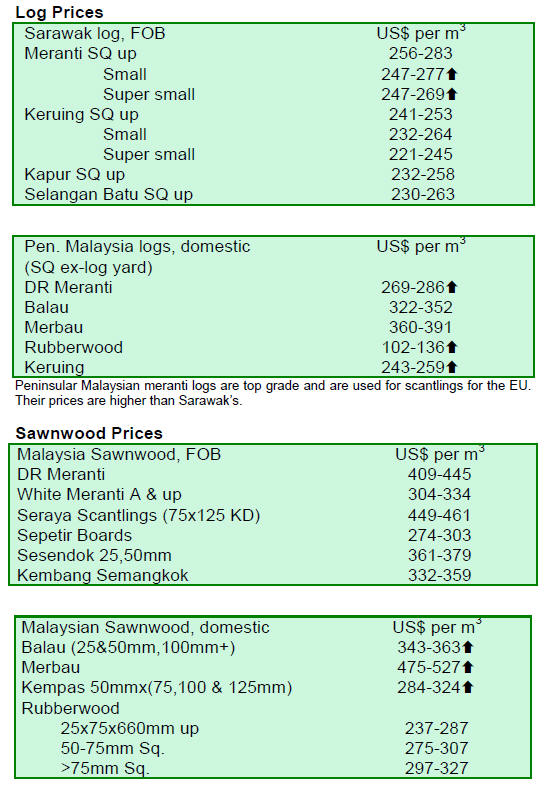

MALAYSIA

New homes out of reach for young workers

Prices of residential housing in Malaysia have increased to

a point where they are almost beyond the reach of many

young working adults, says an analyst.

Increased ferrous and non-ferrous commodity prices and

increases in the costs of other construction materials such

as cement and roofing tiles over recent years is one of the

main contributory factors. Estimates put the cost of

construction at around 70% of the total cost of a property

with land cost accounting for the balance 30%.

Construction grade sawn mixed hardwood prices have

risen and formboard plywood for poured concrete work

costs RM1,290 per cubic metre, up from the RM820 per

cubic metre seen in the recent past.

Steel bars could constitute up to 20% of construction cost,

while concrete account for 15% and other masonry works

account for 10% of the cost. The cost of construction

materials has increased by no less than 70% in the last 5 to

6 years in Malaysia.

Analysts suggest that the price difference between

domestic and export quality sawnwood and panel products

such as plywood will continue to narrow substantially over

the rest of the year.

ome timber traders are of the opinion that selling to the

local construction industry may now be more attractive

and profitable than exporting, especially as the EU debt

crisis and economic uncertainty in the US continues to

bear on the market.

Latex prices steady so no change in rubberwood prices

The price of rubberwood sawnwood is unchanged as the

prices of crude rubber latex remains stable so there is no

incentive for plantation owners to fell and replant rubber

plantations. The main market for latex is the automobile

and aircraft tyre industry. Both industries are still very

much in the doldrums due to weak global demand.

Clearing of redundant oil palm plantations underway

The current dry weather is providing oil palm plantation

owners the opportunity to replant. The clearing of

redundant and old oil palm trees is also creating much

needed raw material for panel product manufacturers.

Analysts report that the trade is not expecting export prices

of plywood and other panel products to vary much over

the next few months.

4.

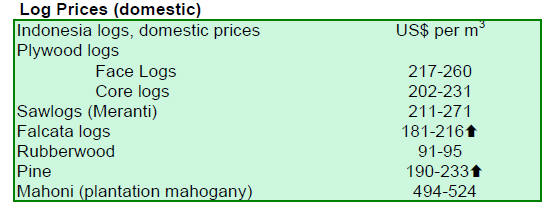

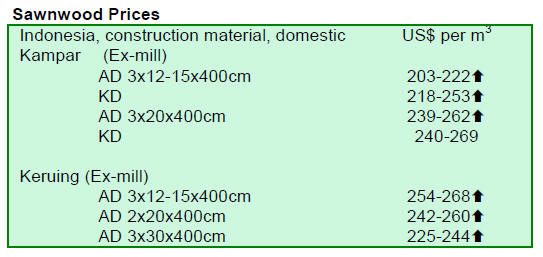

INDONESIA

Bali furniture exports edge up

The Indonesian province of Bali, better known for

tourism, reported that its furniture exports had edged up to

US$13.4 million for the first four months of 2011.

Furniture exports accounted for around 8% of Bali¡¯s

total

exports for the period. The export of furniture is one of the

14 major export products for the province.

Competition eating into Indonesia¡¯s market share

The Indonesian Chamber of Commerce has expressed

concern that Indonesia is losing market share in its trade

with the EU. It added that stiff competition from China,

India, Thailand and Vietnam is cutting into Indonesia¡¯s

market share in the EU market.

Meanwhile, on the same note, Indonesia and the EU have

agreed to commence negotiations that will lead to a free

trade agreement (FTA) between the two.

The EU is currently undertaking similar negotiation

with

several other Asian countries, including Japan, Singapore

and has just concluded an FTA with South Korea.

The EU negotiating team has handed a list of

recommendations to Indonesia for the negotiation of a

Comprehensive Economic Partnership Agreement

(CEPA). The FTA is expected to cover up to 95% of tariff

lines and trade values over a period of nine years.

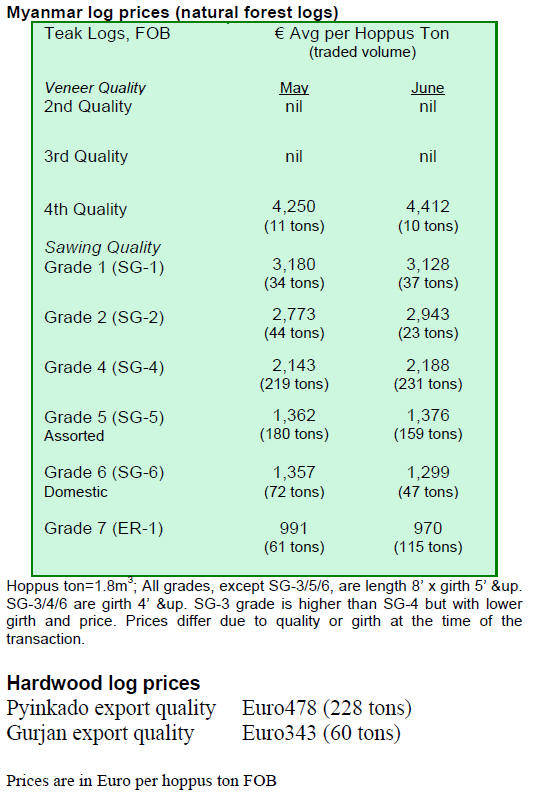

5. MYANMAR

Brisk trade in Gurjan

The demand for Pyinkado remains very subdued while, as

was the situation last month, demand for Gurjan (Kanyin)

is very brisk.

Trade analysts suggest this is, in part, due to

price factors.

Because of its popularity Pyinkado prices have been rising

steadily over the past months whereas prices for Gurjan

have not moved up at the same rate.

The Teak market remains generally stable despite the

past

price increases.

Strong Kyat not helpful to the timber industry

The timber industry, along with other sectors of the

economy, has had to adjust to the recent upsurge in the

value of the Myanmar Kyat against the US Dollar.

The highest and lowest Kyat values against the

Dollar are

as follows:

A strong Kyat is not helpful to the timber industry

in

exporting wood products however, as analysts point out,

this may not effect in the resale of teak logs in the export

markets as this is all effected in hard currencies.

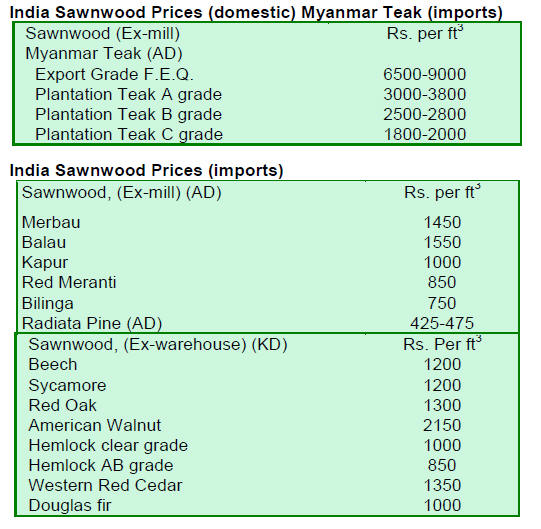

6. INDIA

Indian industry going for automation

In India, both wood raw materials and now labour are now

in short supply. Because labour was cheap in India the

timber industry developed using labour intensive

production processes.

Today however, the situation is different and

because low

cost labour is no longer readily available many factories

are running at around only 60% of their capacity.

To overcome this persistent problem the industry now

prefers to have as much automation as possible and is

retooling production plant accordingly. This change is

driving up demand for high tech wood processing

equipment.

Trade levels continue to surge

Exports from India surged over 50% during May reaching

as high as US$25.9 billion at the same time imports were

also up over 50% reaching US$ 40.9 billion compared to

the level in May last year.

Renewed licenses for closed sawmills

With a view to conserving and rationalising the

consumption of wood, the Supreme Court of India had

issued rules and guidelines on forest harvesting and the

State governments had strictly followed these. As a result,

many companies which did not meet the requirements of

the new rules had to close with the loss of many jobs.

The good news from Gujarat is that 265 mills

producing

lumber and veneers which had to cease operation because

of the State rules have been granted new operating

licenses.

Scheme to increase imports of timber through

Kochi

The supply and distribution of logs to processing mills is

satisfactory and this has supported the market demand in

Mumbai, Kandla, Mangalore and Tuticorin.

Efforts are being made to increase imports of timber

through Kochi and the Port Trust Authorities of Kochi

have introduced schemes offering discounts on timber in

storage.

Presently, Kochi is reported to be handling 60,000

tonnes

of timber as against 550,000 tonnes being handled by

Tuticorin.

The news that Kochi port will be further developed

is a

good for the timber industry and could increase the

handling of teak logs and other wood products at Kochi.

Satisfactory break of monsoon aids tree planting

programmes

The South West Monsoon is the major lifeline for Indian

agriculture and for re-forestation programmes undertaken

by all states in the country. The uniform end of this year¡¯s

monsoon across the country is seen as foretelling good

crops and steady prices.

Reports of massive tree planting pouring in.

Karnataka had

made ready 10 million saplings to be planted during this

season. Gujarat is next with roughly the same number of

saplings being made available.

All states and environmental and community

organizations

have ambitious programmes to plant trees on a large scale.

This is good news for the environment and large scale

plantations are needed by industry as there is a chronic

shortage of wood raw materials in the country.

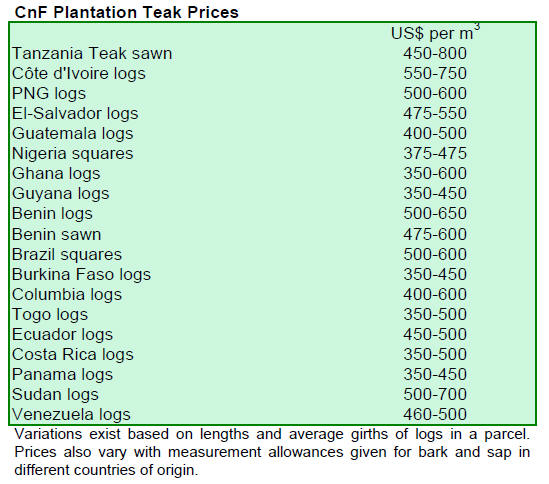

Plantation teak prices C&F Indian ports remain

unchanged.

Demand from Europe, USA and Middle East for teak and

other hardwoods remains steady.

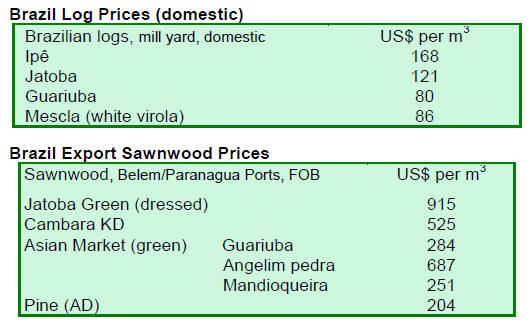

7. BRAZIL

Only pine sawnwood exports expand

In May 2011, exports of timber products (except pulp and

paper) fell 2.7% compared to values in May 2010, from

US$ 226 million to US$ 220 million.

Exports of tropical sawnwood declined both in

volume

and in value, from 44,400 cu.m in May 2010 to 33,100

cu.m in May 2011 and from US$ 21.2 million to US$ 17.5

million, respectively, over the same period. This

performance corresponds to a 17.5% decline in export

value and a decline of 25.5% in export volume.

Exports of tropical plywood dropped from 9,300 cu.m

in

May 2010 to 6,500 cu.m in May 2011, representing a 30%

decline. In value terms a 20% decrease was registered as

exports fell from US$ 5 million to US$ 4 million.

In contrast pine sawnwood exports increased 22.4%

in

value in May 2011 compared to the same month in 2010,

from US$ 13.4 million to US$ 16.4 million. In volume

terms, exports increased 17.8%, from 59,500 cu.m to

70,100 cu.m over the period.

Pine plywood exports dropped 2.4% in value in May

2011

compared to the same month of 2010, from US$ 37.2

million to US$ 36.3 million. Export volumes fell 5.2%

during the same period, from 100,300 cu.m to 95,100

cu.m.

The value of exports of wooden furniture dropped

from

US$ 52.2 million in May 2010 to US$ 44.2 million in May

2011, representing a 15.3% drop.

Real continues to appreciate against dollar

The average exchange rate in May 2011 was BRL1.61 per

US dollar whereas it was BRL1.81 to the dollar in May

2010 illustrating the sharp appreciation of the Brazilian

currency against the US currency.

The Brazilian Consumer Price Index (IPCA) of May

fell

0.3% compared to the level in April and the accumulated

IPCA for the first five months of the year was 3.71%, a

0.62% increase compared to the same period in 2010

(3.09%).

Inflation risk drives up interest rates

Brazil¡¯s Central Bank increased the prime interest rate

(Selic) by 0.25% bringing the rate to an annualized

12.25%. This increase was anticipated as inflation has

been rising and could breach the inflation target of 4.5%

for if no action was taken.

However, forecasts suggest that inflation, as

measured by

the Consumer Price Index (IPCA) shows a yearly trend

close to 6. % plus.

Workshops to strengthen community forest

management

Natural forests can generate profits and based on this

premise the Brazilian Forest Service (SFB) has arranged a

capacity-building workshop (the first of the four

scheduled) for participants from civil society and

community leaders involved in community forestry in the

regions of Transamazonian and Xingu River.

The forest management practices of today are

adequate to

maintain the potential of the forest generating income for

local populations but, say the SFB, many are not aware of

this.

One of the biggest problems in the Amazon region is

that

of land tenure. Many of the social, environmental and

ownership conflicts that occur in the region stem from

problems relating to land titles.

The goal of the SFB workshops is to help

participants in

the evaluation of community organizations such as

cooperatives and associations to identify where they can

be improved.

The objective of SFB is to help strengthen the

region's

forest economy, valuing its resources and providing

technical capacity that these communities need to achieve

their goals.

According to the SFB, in case of the Altamira

region,

efforts have been concentrated on the forest valuation and

sustainable harvesting.

Timber movement control technology transfer to

other ountries

The Brazilian computerised system for data recording in

timber operations and trade called ¡°Document of Forest

Origin¡± (DOF) will be shared with other Latin American

countries and also with South Africa, China and Russia

according to the Brazilian Institute of Environment and

Natural Resources (IBAMA).

This technology has replaced the former Forest

Products

Transport Permits (ATPF) in Brazil which were frequently

falsified.

The Brazilian system is considered a world best and

if the

interest of various countries is confirmed, Brazil will

transfer the system through technical cooperation to those

interested.

According to IBAMA, the advantage of the DOF system

is

decentralised monitoring of the entire chain of custody of

timber from the forest to first processing.

The legal timber trade in Brazil amounts to around

BRL

15 billion annually with most production originating in

Para, Mato Grosso, Rondônia and Maranhão states.

The Amazon Cooperation Treaty Organization (ACTO)

is

encouraging its member states, such as Peru, Ecuador,

Colombia, Venezuela, Guyana and Suriname to adopt the

DOF system. Reports indicated that Bolivia has already

signed a cooperation agreement with Brazil for use of the

system.

Mechanisms to promote development of forestry

sector

The Heads of State and governments of tropical forest

basins of the world agreed on June 3 to continue

strengthening relationships to emphasize their common

interests in regional and multilateral fora on forests,

biodiversity and climate change.

The decision is part of the "Brazzaville

Declaration"

adopted at the end of the summit of member countries of

forest basins of the Congo (Africa), the Amazon (Central

America) and Borneo-Mekong (Southeast Asia) held in

the Republic of Congo.

Having analysed the relationship between

deforestation,

forest degradation and socio-economic problems the

participating countries recommend cooperation to

eliminate actions that encourage destructive exploitation

of the forest.

They agreed to establish mechanisms to promote

development of the forestry sector, encouraging the green

economy for development of low carbon and reducing

poverty in member countries. They also advocate

additional funding, sustainable and transparent to allow

countries to meet the challenges of sustainable forest

management and to respect their commitments on forests.

The creation of new public-private partnerships was

recommended to facilitate investment in the forestry sector

oriented towards development.

Brazil participated in the summit with other Latin

American parties such as Bolivia, Colombia, Ecuador,

French Guiana, Guyana, Peru, Surinam and Venezuela.

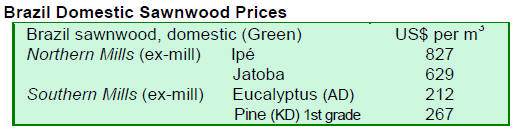

8. PERU

Approved Forestry and Wildlife law

The Congress of the Republic overwhelmingly approved

the new draft Forestry and Wildlife law which establishes

the legal framework for the conservation, protection and

sustainable use of forests in the country.

In emphasising the importance of this step for the

sustainable development of forest resources and wildlife in

the country, the president of the Agrarian Commission,

Anibal Huerta, said the new draft was prepared after

meetings and public consultations between the

government and rural and indigenous communities.

The latest ruling approved the creation of a new

the

authority called the Forest and Wildlife Service (Serfor),

which replaces the current Forest and Wildlife Department.

FTA with neighbours about to be concluded

Peru is currently negotiating free trade agreements with

Panama, Guatemala and Costa Rica, three of the five

Central American countries with which the country trades.

Reports suggest that it is possible that agreement

will be

reached soon but this depends on completing the work that

remains to be done in the DOHA round of negotiations.

The outstanding issue to be resolved to achieve the

completion of negotiations involve the exclusion of some

agricultural relief programmes amongst other issues.

Panama is currently the fourth largest importer of

wood

from Peru and the main importer of wooden furniture from

the country.

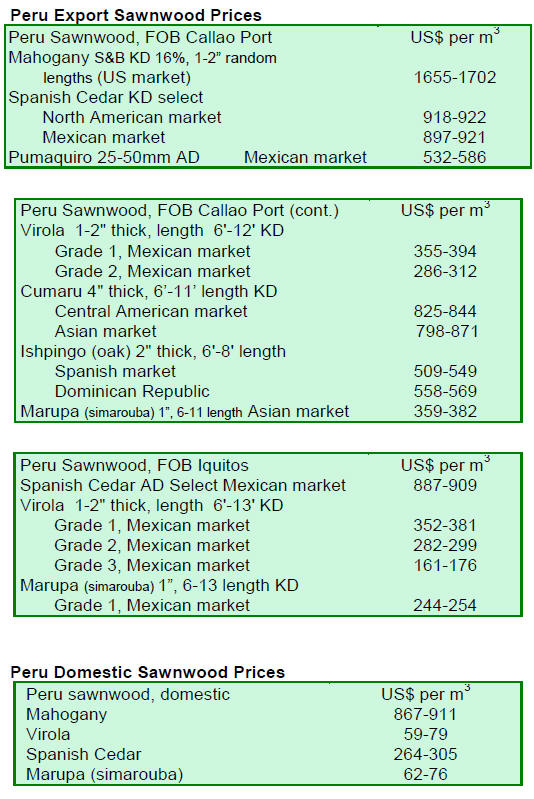

9. BOLIVIA

Forest product exports increase

Forest products exports comprising timber and non-timber

items from January to April increased by 8.4% compared

with the same period last year.

Export earnings rose from US$ 64 million in 2010 to

US$

69.7 million this year. Manufactured wood products and

Brazil nuts accounted for around 83% of the total exports

of forest products. The balance of exports was made up of

semi-finished wood products.

The U.S. market remains the main buyer of Bolivian

wood

products accounting for US$ 19 million or almost 30% of

the total. The United Kingdom followed with trade

amounting to US$ 8.9 million (14% share) and the

Netherlands with US$ 4.8 million (7.5%). Other major

markets were Argentina and China.

10.

GUYANA

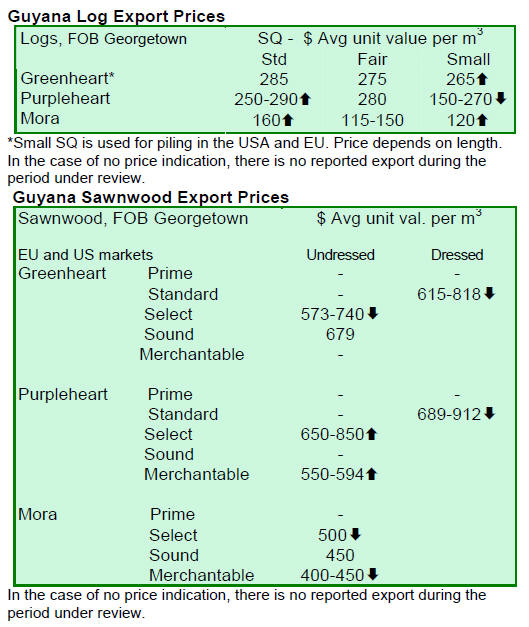

Greenheart log prices reverse direction

For the period under review log prices were very

favourable. Greenheart logs of all sawmill qualities

secured price increases during the past two weeks, in sharp

contrast to the situation some weeks ago.

Purpleheart log prices were stable except for small

sawmill quality logs which saw a rise in price as against

prices in the previous fortnight.

Mora log prices also improved slightly over the two

week

period under review.

Sawnwood prices slip marginally

Sawn lumber prices were mixed. Some items, including

undressed Greenheart (select) quality recorded a marginal

decline in its top-end price from US$ 848 to US$ 740 per

cubic metre and undressed Mora (merchantable) quality

also saw a decline in prices for this fortnight period.

On the other hand, prices for undressed Purpleheart

(select) rose from US$ 750 to US$ 875 per cubic metre.

Dressed Greenheart prices fell slightly from US$

890 to

US$ 818 per cubic metre; similarly dressed Purpleheart

also recorded a marginal decrease in price from US$ 975

to US$ 912.

Splitwood prices remain firm and reached as high as

US$976 per cubic metre on the export market for this

fortnight period.

Roundwood piles attracted buyers in Europe and

North

America and fetched good prices.

Prices for Guyana¡¯s Ipe (Washiba) continue to hold

firm at

around US$ 2,350 per cubic metre on the export market.

Plywood exports resume

Plywood was exported during the period under review

with BB/CC grades fetching as much as US$640 per cubic

metre. The main destination for this plywood was

neighbouring countries in South America.

Guyana and Republic of Congo to cooperate on

forestry

Guyana has signed an agreement with the Republic of

Congo to increase cooperation between the two countries

in the fields of forestry and wood industries.

The Memorandum of Understanding, covering a five

year

period, was signed by Guyana¡¯s Agriculture Minister

Robert Persaud and Congolese Minister of Forestry and

Sustainable Development Henri Djombo.

This agreement will see the two countries

establishing and

developing cooperation to address sustainable forest

management, REDD+ initiatives and the enhancement and

development of processed wood and wood-based

construction industries.

Recognising the importance of sustainable

utilisation of

forest resources for the economic and social development

of the two countries which boast large areas of pristine

rainforest, bilateral cooperation in technical, industrial and

managerial aspect of the forest industry will significantly

enhance the development of the two countries.

Other initiatives will include exchange visits by

delegations from the two countries and exchange of

information on science and technology relating to forest,

tree seedlings, genetic material and other forest resources.

It will also see other group studies and human

resource

training and collaboration in research and production and

joint surveys. The two countries will also explore trading

in timber and other forest products and the training of

technicians and other experts in forestry related

disciplines.

Related News:

¡¡