|

Report

from

Europe

Diminished French influence on tropical timber trade

Traditionally France has played a central role in the

international tropical hardwood trade. Over recent year¡¯s

this influence has diminished as a greater proportion of

tropical hardwood is diverted away from Europe and into

markets in emerging countries, as tropical hardwood has

lost competitiveness in Europe, and as tropical producing

countries have restricted log exports and increased

domestic production.

Nevertheless France remains the leading European

importer of tropical wood, accounting for around 900,000

cu.m (roundwood equivalent volume) of the 4.5 million

cu.m of tropical wood products imported into the EU

during 2010. French companies retain large investments in

the tropical wood industry, notably in Central and West

Africa.

The French market is particularly relevant at the present

time because it is one the few European countries that

performed reasonably well during the recent economic

downturn. There are also on-going policy processes with

real potential to benefit wood consumption.

Following a downturn in GDP in 2009 (-2.6%), the French

economy recorded robust growth in 2010 (+1.6%) driven

by strong expansion in exports (+9.5%) and government

stimulus measures which boosted private consumption

(+1.5%).

The economy is expected to grow by a further 1.6% this

year despite progressive phasing out of government

stimulus measures. The French construction sector

continued to shrink by 4.2% in 2010 but at a slower pace

than in 2009 (-7%).

Removal of stimulus measures has little impact on construction activity

Confidence in the construction sector is now improving,

particularly in the new residential and civil engineering

components. Stimulus measures boosted new home sales

to pre-crisis levels by mid2010 and encouraged housing

starts during the second half of 2010.

The removal of stimulus measures was widely expected to

cool the new residential sector this year, but so far activity

has remained reasonable and is being partly offset by an

upturn in renovation and infrastructure projects. A chronic

shortage of housing in France combined with French

attachment to home ownership indicates good longer-term

prospects in the residential construction sector.

In order to reduce carbon emissions and boost the use of

French native forests, wood is now favoured in French

government policy. Government guidelines propose that a

minimum of 2dcm³ of wood should be used for every sq.m

of construction.

In May 2009, President Sarkozy not only reaffirmed this

commitment but indicated that the target should be raised

ten-fold to 20dcm³/m². There is a strong environmental

element in government measures designed to stimulate

residential construction.

Okoum¨¦ plywood consumption falls

While there is strong potential to increase overall wood

consumption, tropical hardwoods have not fared well in

France in recent years. Consumption of okoum¨¦ plywood,

a standard reference product on the French market for

decades, has been declining.

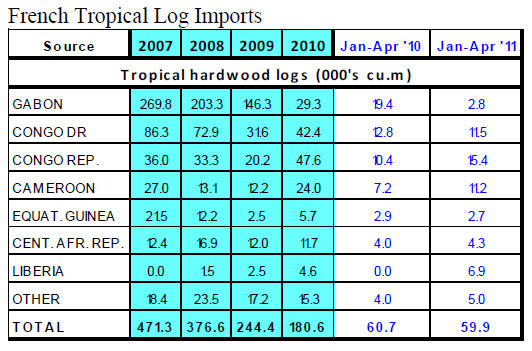

Imports of logs for manufacture of okoum¨¦ plywood in

France have fallen dramatically since 2007. The reduction

in availability in log supply from Gabon following that

country¡¯s log export ban in May 2010, has been only

partly offset by rising log imports from other countries in

the Congo basin.

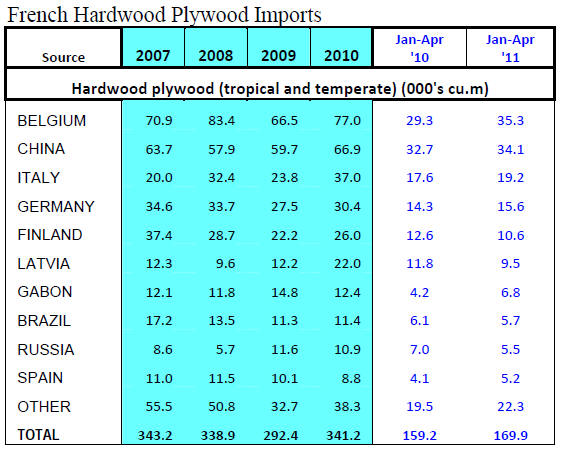

French imports of tropical hardwood veneer did increase

in 2010, but are still well below levels prevailing in 2007.

Declining production of tropical hardwood plywood in

France has not been offset by any significant increase in

imports of hardwood plywood from other countries. This

may be partly explained by the EU¡¯s imposition of antidumping

duties on okoum¨¦ plywood from China since

November 2004, a measure most recently extended in an

EU decision on 31 January 2011. The European

Commission¡¯s review of the okoum¨¦ plywood market as

background to this decision concluded that the European

industry remained ¡°fragile and vulnerable¡±.

Okoum¨¦ plywood prices benefited little from recent

highs for SE Asian plywood

The okoum¨¦ plywood sector in Europe so far seems to

have benefited little from recent tight plywood supplies in

the Far East and strong plywood demand for

reconstruction activity in Japan. This is despite

manufacturers having product to hand and being able to

offer buyers short lead times of only 2 to 4 weeks.

The reality is that okoum¨¦ plywood in France has come

under increasing competitive pressure from cheaper

substitutes. In the past, okoum¨¦ plywood was strongly

valued in France for its huge versatility. French joiners

would always have a stock of okoum¨¦ plywood at hand

and would use it for a huge range of applications, even

those for which such a high-performance product was not

necessary.

However, as the construction sector has become more

price competitive and as pre-fabrication has increased, the

demand for okoum¨¦ plywood as a utility joinery product

has diminished. It has been replaced in less demanding

applications by cheaper materials like softwood and

combi-plywood, veneered MDF and various composites.

Okoum¨¦ plywood has increasingly been confined to those

applications where it is specifically required, for example

external applications where durability is essential or

internal applications where the final visual aspect comes

first.

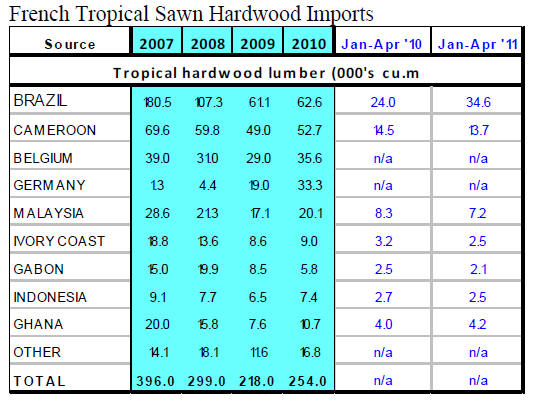

France remains a large and diverse market for tropical

hardwood lumber. The economic downturn led French

imports of this commodity to fall dramatically between

2007 and 2009, from 396,000 cu.m to 218,000 cu.m.

Imports rebounded to 254,000 cu.m in 2010 and have

continued to rise in 2011. Much of the increase this year

has been due to reviving imports from Brazil ¨C which

consist mainly of utility hardwoods used by large French

joinery manufacturers. However supply problems are

hampering more significant recovery in imports from other

tropical countries.

LCB Charter adapted to meet EU due diligence requirements

The French timber trade association Le Commerce du

Bois (LCB) is currently engaged in a process to adapt its

existing Charter for members to ensure it is fully

conformant to the EU Timber Regulation (EUTR).

From March 2013 all wood importers in the EU will be

required to implement due diligence systems which

minimise the risk of any timber from illegal sources being

placed on the internal market. LCB is expected to act as a

so-called ¡°Monitoring Organisation¡± (MO) under the

terms of the EUTR. MOs will be mandated to develop and

monitor a due diligence system on behalf of their

members.

LCB¡¯s Charter, which has been mandatory for members

since 2008, already commits French timber importers to

responsible purchasing of timber. A priority of the system

is to increase the supply of certified products year after

year.

Members must also provide their clients with proof of

legality for all non-certified products. Members are

required to clearly identify to their clients the commercial

name, country of origin and form of certification, if any,

for all products. Members are subject to a bi-annual

auditto assess conformance to the Charter.

While the Charter already covers many of the

requirements of the EUTR, a process is underway to

review and update the current documentation, to develop

monitoring capacity, and to cooperate with the French

authorities to develop compliance procedures and

sanctions. To further assist LCB members to conform to

the EUTR after March 2013, LCB is working with the

WWF to develop a database assessing the risk of illegal

wood being sourced from individual suppliers.

Cooperative wood marketing initiative in France

The various French trade organisations representing both

manufacturers of timber products and professional users of

timber have joined together to create a new trade

organization. The newly established FBIE will help raise

the image and visibility of wood as a material and create a

more powerful political lobby in support of wood.

The founding members of the FBIE include the UIB

(wood industry), l'UIPP (panel manufacturers), the FFPPC

(French federation of paper pulp producers), UNIFA

(furniture manufacturers), together with federations

representing joinery contractors. Other members who have

recently joined FBIE includeFNB (F¨¦d¨¦rationnationale du

bois), LCB (Le commerce du bois), l'IRB

(Interprofessionsr¨¦gionales bois).

Related News:

¡¡

|