Japan Wood Products

Prices

Dollar Exchange Rates of

10th June 2011

Japan Yen 80.37

Reports From Japan

Damaged plywood mills to restart soon

The Japan Federation of Plywood Manufacturers

Association is quoted as saying that six plywood mills

which sustained considerable damage as a result of the

recent earthquake and tsunami will restart partial

production, probably in July.

In Ishinomaki the power supply was restored late May but

in other areas, such as Miyako and Ofunato, it will be

some time before power supplies are resumed and this will

delay the resumption of production of mills in these areas.

The Association reported that April plywood production

was almost the same as in April last year. Mills that were

not damaged increased production to meet the emergency

demand for temporary housing in the quake and tsunami

stricken areas.

Many mills in Japan had been running below capacity due

to weak demand so it was relatively easy for them to

increase output.

Demand for plywood for emergency housing will soon

begin to slow say the Japan Lumber Reports (JLR). The

concern in the trade is now focused on prices rather than

on the supply.

Despite rising production costs domestic plywood mills

are trying not to increase panel prices any further in order

to stabilise the market.

Modest 2010 recovery in housing starts lifts log consumption

Statistics from the Ministry of Agriculture, Forestry and

Fisheries show that log consumption in 2010 was

23,724,000 cu.m, 4% up from 2009. Of this, domestic log

consumption was 17,193,000 cu.m, 3.5% up and

consumption of imported logs was 6,531,000 cu.m, 5.6%

higher than a year earlier.

The increase in log consumption is said by the JLR to be

due to the modest recovery in housing starts in 2010.

Notably, the consumption of domestic logs for plywood

was 2,490,000 cu.m, the highest on record.

The use of imported logs for plywood production

increased in 2010 by 17% while the utilization of domestic

logs for plywood manufacture grew by almost 26%.

Japanese grown cedar for off-shore plywood production

According to the JLR, Noda Corporation is considering

manufacturing plywood in Malaysia after its subsidiary

Ishinomaki Plywood suffered heavy damage during the

recent earthquake and tsunami.

The idea is to send cedar logs from Japanese forests to

Malaysia for processing and to then ship the plywood back

to Japan.

Noda has a subsidiary plywood plant in Sarawak, Sanyan

Wood Industries (SWI), with a monthly production

capacity of around 15,000 cu.m of concrete formboards

from tropical logs. Noda has been shipping all the

production from this mill to Japan.

Combination of factors pushing up tropical log prices

Hardwood log prices in Malaysia were firming for the past

12 months and began to rise sharply in the third quarter of

last year after log supply declined due to poor weather

which hampered logging operations in Sarawak and due to

strong demand from Indian importers.

In addition, in March this year, demand for logs in Japan

jumped as mills rushed to increase production to meet the

needs for construction of emergency housing for victims

of the earthquake and tsunami and thereby pushing up log

prices.

The weather in Sarawak has now improved and it has been

possible to resume normal logging although rafting is still

a problem. Demand from India has slowed as importers

there could no-longer bear the spiralling log prices.

The JLR reports that because of these changes FOB export

log prices are levelling off. However, plywood mills in

Sarawak need to replenish log stocks and secure logs to

meet current orders for plywood.

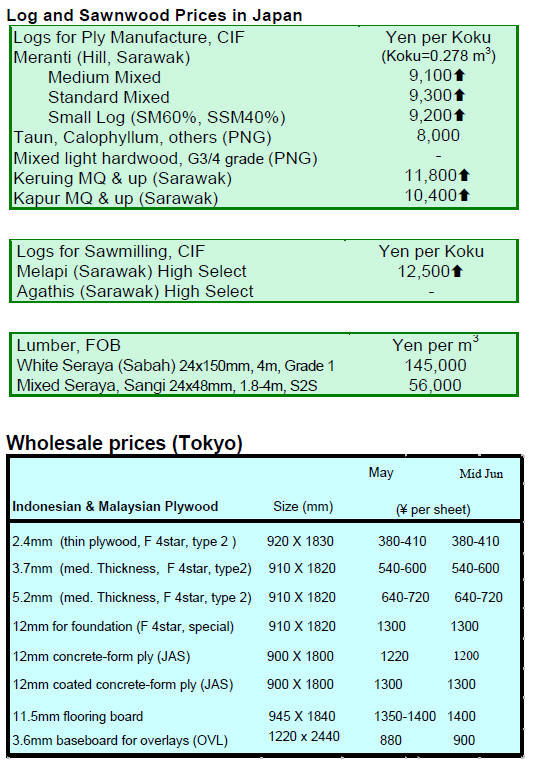

FOB log prices for Sarawak meranti regular in late May

were around US$360 per cu.m, unchanged from late April

prices. Small meranti prices are currently about US$330

and super small prices are US$310 per cu.m.

The JLR is reporting that in order to secure a full log cargo

some Japanese buyers have paid up to US$380 for meranti

regular. There are reports that some suppliers in Sarawk

are proposing higher prices having been encouraged by the

firm demand from Taiwan P.o.C.

Because of the high FOB prices, wholesale log prices in

Japan will exceed Yen 10,000 per koku CIF, which is the

highest level since the summer of 1993, says the JLR.

The JLR suggests that log FOB prices are unlikely to drop

in the near future which means that the mills in Japan will

eventually need to pass on the high log cost to consumers.

Level of plywood imports keeps rising

Export prices for Malaysian plywood are leveling off

despite the fact that suppliers still need to push the prices

up due to high log cost.

Malaysian 3x6 concrete formboard prices are currently

Yen 55,000 per cu.m C&F. Coated concrete formboard

panels are priced at Yen 62,000 per cu.m C&F. Structural

12mm panels are selling at Yen 56,000 per cu.m C&F,

both unchanged from levels in May.

Over the past weeks the wholesale price range in Japan

has been narrowing and the range between the high and

low price is now less than 100 yen per sheet. Concrete

formboard JAS 3x6 panel prices are Yen 1,200 per sheet

delivered, Yen 50 lower than in May.

Coated concrete formboard 3x6 panel prices are about Yen

1,300 delivered while structural 12mm 3x6 panel prices

are unchanged at around Yen 1,300 per sheet delivered.

Arrivals of imported plywood in April were 337,100 cu.m,

21% more than March and the level of imports seems to

keep increasing.

Seasonally adjusted housing starts at a record low

Total housing starts in April were 66,757 units, 0.3% more

than April last year. Private owner units and units built for

sale both increased by 0.2% and 12.4% respectively but

units built for rent declined by 9.3%.

Despite the overall increase, seasonally adjusted annual

starts in April were just 798,000 units, the first time these

dropped below 800,000 units in nine months. The JLR

notes that there has been an immediate impact on starts

because of the earthquake in eastern Japan.

Housing starts in the three disaster hit prefectures of Iwate,

Miyagi and Fukushima, which suffered severe damage

caused by the earthquake and tsunami, were down by 33%

in April after a 19% decline in March.

In the three major populated regions of Tokyo, Nagoya

and Osaka, Tokyo starts fell by 3.0%, Osaka starts

dropped by 7.9% and starts in Nagoya were down by

4.9%.

Related News:

|