Japan Wood Products

Prices

Dollar Exchange Rates of

28th Apr 2011

Japan Yen 81.54

Reports From Japan

Timber industry in crisis

Many domestic wood processing mills in coastal areas in

eastern Japan suffered extensive damage caused by the

March 11 earthquake and tsunami. It is estimated that a

capacity of 60,000 cu.m of plywood per month has been

lost.

Damaged infrastructure and a shortage of fuel brought all

businesses in the region to a halt. As a result, the supply of

plywood in the major markets of Tokyo and Osaka was

badly affected. Other unaffected sawnwood and plywood

mills have plans to increase production to supply wood

materials for restoration work, but they are also suffering

from periodic electricity blackouts.

Ports in Hachinohe, Sendai, Sohma, Onahama and

Hitachinaka are closed and shipments being are diverted to

Tokyo and Kawasaki. Tokyo Lumber Terminal has

secured 49,000 square metres of land as an emergency

storage area reports the Japan Lumber Report (JLR).

The Japanese Ministry of Land, Infrastructure and

Transport disclosed that some 4,702 buildings were totally

destroyed and 2,496 units half destroyed. In addition,

1,150 units are unsafe with a high risk of collapse.

Tropical plywood processing after quake

The earthquake and tsunami caused devastating damage to

Ofunato Plywood mill which processed tropical hardwood

logs from Southeast Asia. Other tropical plywood

manufacturers experienced only little damage such as

collapsed log and plywood piles. Plywood manufacturers

are now trying to boost production which may push log

prices up, reportsthe JLR.

Japan’s plywood market slowly getting back to normal

The JLR is reporting that the confusion in the plywood

market immediately after the East Japan earthquake in

March is now easing and that trade is slowly getting back

to normal.

There was a period of panic buying of plywood by

companies building house for delivery at the end of March

but this is over now. There was also a period of aggressive

purchases of imported plywood in the weeks after the

earthquake and tsunami as many plywood producers in the

quake hit area suffered damage.

This very active sourcing pushed up prices but now buyers

are cautious and are not chasing high priced plywood.

The market for imported plywood during March was

chaotic with prices soaring but by April demand had

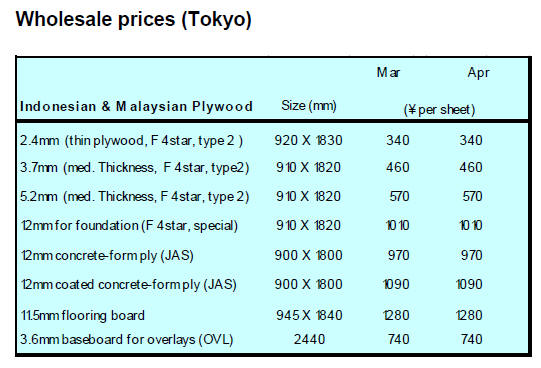

cooled down. Concrete formboard JAS 3x6 panel prices

were Yen 1,200 per sheet delivered, Yen 210-240 higher

than early March prices.

Coated concrete formboard 3x6 panel was priced at about

Yen 1,300, Yen200-230 up. Structural 12mm 3x6 panel

(F 4star) is selling at around Yen 1,300 Yen280 up and

firming. Imported thin panel of 2.4mm (type 2/F4star) is

currently at around Yen380-400, Yen40-60 up.

The supply of imported 4mm thin panel is currently

extremely tight according to the JLR.

Log supply still a problem in Sabah and Sarawak

While the rain season is over in Sabah and Sarawak

producers are saying that the weather continues to be

unsettled and that this is hampering logging.

This is at a time when export demand in India and Taiwan

P.o.C is strong. Malaysian plywood producers are

feverishly sourcing logs. The JLR reports that Indian

buyers are apparently tiring of the spiralling log prices in

Sarawak and have started looking in Papua New Guinea

for alternative species.

April FOB prices reported by the JLR indicate that

Sarawak meranti regular log prices have increased to

US$350 per cu.m and that Japanese buyers are expecting

another round of increases. Small meranti log prices are

said to be around US$330 per cu.m while super small logs

are priced at US$315 per cu.m.

In 2010 the top buyer of Sarawak logs was India which

imported some 2.2mi cu.m. China was second largest

buyer taking 588,000 cu.m followed by Taiwan P.o.C with

477,000 cu. Japan was forth largest importer of Sarawak

logs taking 370,000 cu.m.

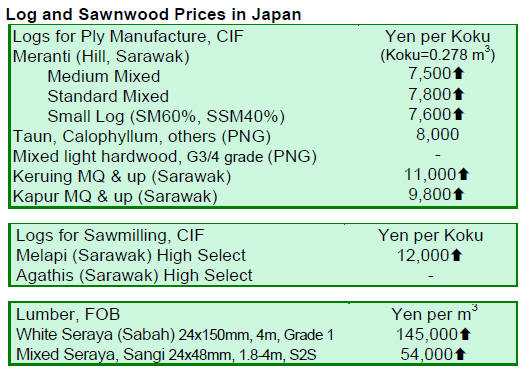

In Japan, Sarawak meranti regular log prices in April were

Yen 8,000-8,200 per koku CIF, Yen400-500 up form

January. Some plywood mills have reportedly reduced

purchases of high priced tropical logs and are increase the

production of softwood plywood.

Tsunami devastated Ishinomaki and other coastal

towns

It is now just over a month since the mega-quake in Japan

and now it is possible to get a clearer understanding of the

extent of the damage to the timber sector in the region.

On the coast of Miyagi and Iwate prefecture, there are

many major plywood mills. Around port of Ishonimaki, in

the industrial area, there are three Seihoku plywood mills

as well as particleboard and MDF plant.

These factories are the core of the Seihoku group’s wood

processing capacity. There are also other mills such as the

Ishinomaki Plywood, other sawmills and the Nippon Paper

plant in the affected areas.

The tsunami breached the high sea defences and swamped

the mills pushing plywood stocks into the factories and

manufacturing lines. Apparently logs are scattered

throughout the residential areas and recovery will be a

problem as it is difficult to determine ownership.

Even when the processing lines are restored the problem

of erratic electric power supply will remain.

Power substations have been destroyed and authorities say

it will take 2-3 months for temporary substations to be

established and even then the power available will be less

than before the crisis.

Related News:

|