|

Report

from

North America

Rebound expected in moulding and trim markets

US demand for moulding and trim is expected to rebound

and grow by an average of 10% per year to 2014,

according to a Freedonia study released in February 2011.

Moulding and trim demand suffered in 2008 and 2009

when the US housing market went down. New home

construction usually accounts for about 40% of total

demand for moulding and trim. Much of the increase in

moulding and trim demand to 2014 will be from a

recovering housing market and from non-residential

building construction such as offices and commercial

buildings.

Freedonia forecasts that demand for moulding and trim

will be US$9.6 billion in 2014, up from US$6.3 billion in

2009. Some 41% of the market will be mouldings, 30%

stairwork and 29% in other products. Interior mouldings

account for the majority of the market. Wood will remain

the leading material used in moulding and trim, followed

by metal, plastic and wood-plastic composites. Freedonia

forecasts that by 2014 plastic will be the second most

common material after wood. Plastic and wood-plastic

composites will gain market share in exterior moulding

and trim products. The price of wood materials is expected

to grow at a slightly faster rate than plastic or metal.

US tropical timber imports

Last quarter sawn hardwood imports improve

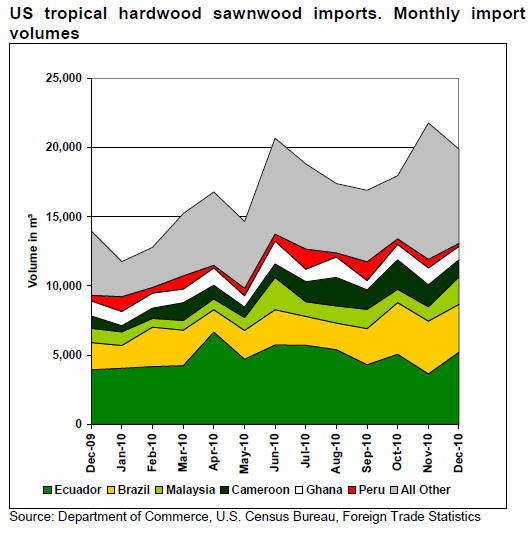

The latest quarterly import data shows that the value of

tropical sawn hardwood imports was at its highest in the

last quarter of 2010 since the end of 2008. The US

imported US$60.8 million worth of sawn tropical

hardwood in the fourth quarter of 2010, up 24% from the

previous quarter. Ipe imports soared by 169% from the

third quarter of 2010. Imports of keruing, cedro and sapelli

also increased significantly from the previous quarter.

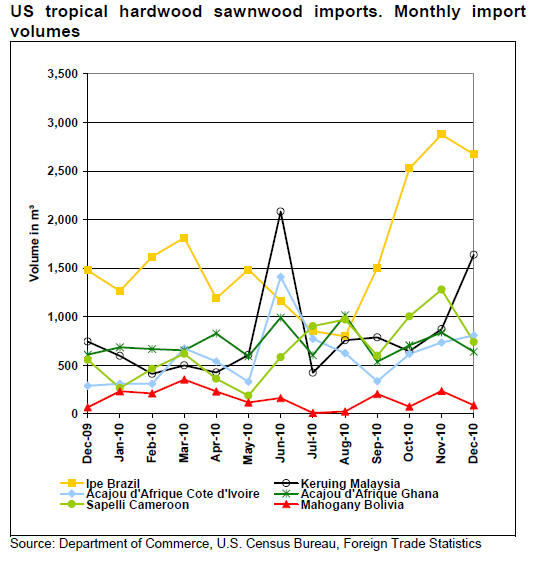

December 2010 imports of sawn tropical hardwood were

19,866 cu.m., which represents a drop of 9% from 21,765

cu.m in November 2010. Balsa was back at the top of the

imported species with 5,253 cu.m in December. Ipe

imports remained high at 2,920 cu.m, followed by acajou

d¡¯Afrique (2,054 cu.m) and sapelli (2,017 cu.m). Although

imports of most species declined from November 2010,

volumes increased for keruing, mahogany, cedro and

jatoba.

Most supplier countries shipped less sawn hardwood to the

US in December 2010, with the exception of Ecuador and

Malaysia who benefited from the growth in imports of

balsa and keruing.

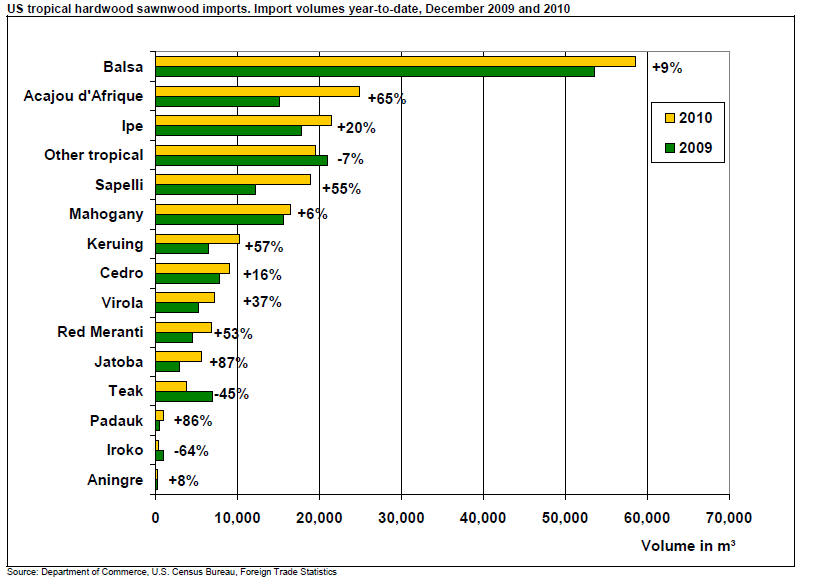

Year-to-date, import volumes of tropical sawnwood

increased by 19% compared to December 2009. Among

the species that gained significantly in the period to

December 2010 are jatoba (+87% year-to-date), acajou

d¡¯Afrique (+64% year-to-date), red meranti (+56% yearto-

date), sapelli (+52% year-to-date) and keruing (+48%

year-to-date).

Malaysia and Indonesia increased hardwood plywood

exports to US in 2010

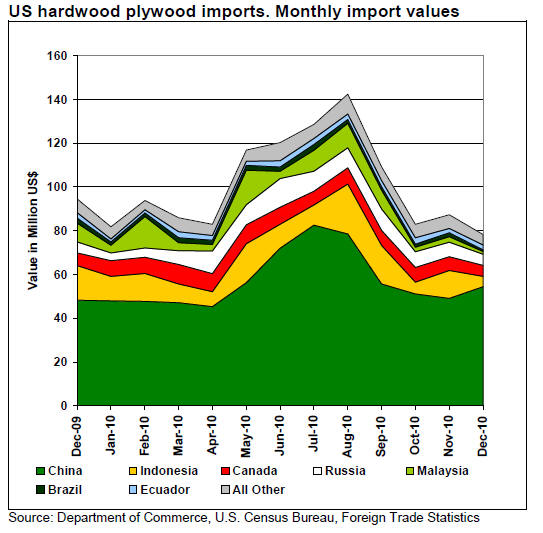

US imports of hardwood plywood declined in December

2010 to US$78.3 million, down 10% from November

2010. However, annual imports in 2010 were 26% above

2009 imports. When comparing 2010 with the previous

year, Malaysia saw the highest growth rate followed by

Indonesia, while imports from Brazil declined even further

from 2009. Imports from China accounted for 57% or

US$688 million of the total imports in 2010.

In December 2010, imports from China were US$54.5

million (+26% year-to-date) and from Indonesia US$4.7

million (+53% year-to-date). December imports from

Ecuador were US$2.3 million (+38% year-to-date), from

Malaysia US$1.3 million (+89% year-to-date), and from

Brazil US$0.7 million (-10% year-to-date).

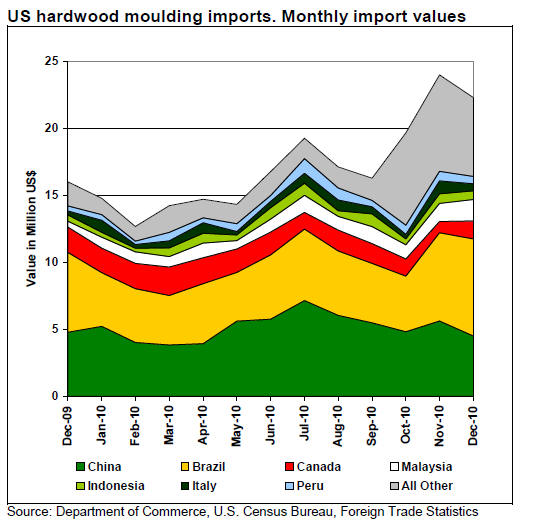

Hardwood moulding imports on the mend

In 2010, US imports of hardwood mouldings increased

slightly to US$191.2 million, up 8% from 2009. December

2010 imports were worth US$17.8 million, a decrease of

3% from November 2010. Imports from Brazil continued

increasing and December saw imports of US$7.3 million

(+4% year-to-date) from Brazil. Imports from China were

US$4.9 million (+20% year-to-date). Malaysia supplied

US$1.6 million in December (+35% year-to-date) and

Indonesia US$653,000 (+30% year-to-date).

December 2010 imports of jatoba mouldings from Brazil

were US$3.2 million (-11% year-to-date), ipe mouldings

US$797,000 (+7% year-to-date), and cumaru mouldings

US$261,000 (+1% year-to-date). Supplies of cumaru

mouldings from Peru were US$337,000 in December

(+253% year-to-date). Mahogany moulding imports from

Peru were US$119,000 in December (-24% year-to-date).

Jatoba accounts for the majority of tropical hardwood

moulding imports, although in 2010 the value of imports

year-to-date was down by 6% compared to 2009. Imports

of cumaru mouldings were up by 42%, ipe moulding was

almost steady with 2% increase, while mahogany

moulding imports declined by 26%.

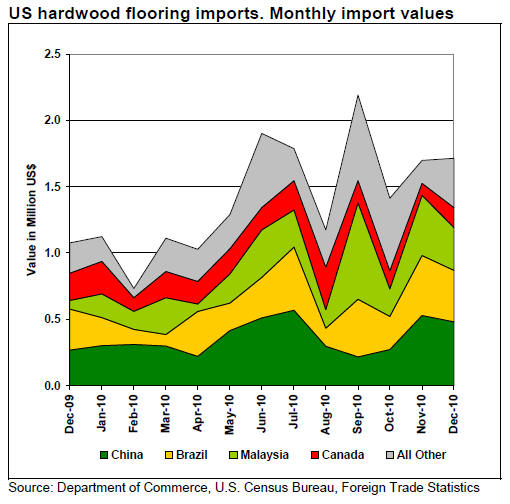

Tropical hardwood flooring imports improved

Even though hardwood flooring imports saw a slight

increase in December 2010, total imports in 2010 were

below 2009. In 2010, US hardwood flooring imports

totaled US$17.2 million, down 28% compared to the

previous year. However, flooring imports from tropical

suppliers improved during the same period.

In December, Canada was the only major supplier who

increased exports to the US from the previous month

(+63%). Hardwood flooring imports from China were

US$481,000, from Brazil US$388,000 and from Malaysia

US$325,000. On a year-to-date basis, imports from Brazil

increased by 10% from 2009, Malaysian exports increased

by 38%, Indonesian exports increased by 21%, while

Chinese exports to the US were down by 59% compared

to 2009.

Related News:

|