Japan Wood Products

Prices

Dollar Exchange Rates of

2th Mar 2011

Japan Yen 81.89

Reports From Japan

Supply of tropical logs remains extremely tight

According to Japanese Lumber Reports (JLR), log supply

in Sabah and Sarak remains extremely tight due to heavy

rains hampering logging and transportation. Adverse

weather conditions are expected to persist through early

March. The celebration of Chinese Lunar New Year is

over and demand is back to normal. However, with tight

supply of logs, prices keep inching up. In Sarawak, export

prices for meranti regular logs breached US$300 per cu.m

FOB.

In Japan, monthly consumption of Southeast Asian logs

for both plywood and veneer production is around 40,000

cu.m. Some plywood mills have placed orders to build

their log inventories. However, orders could not be met by

importers due to unavailability of logs.

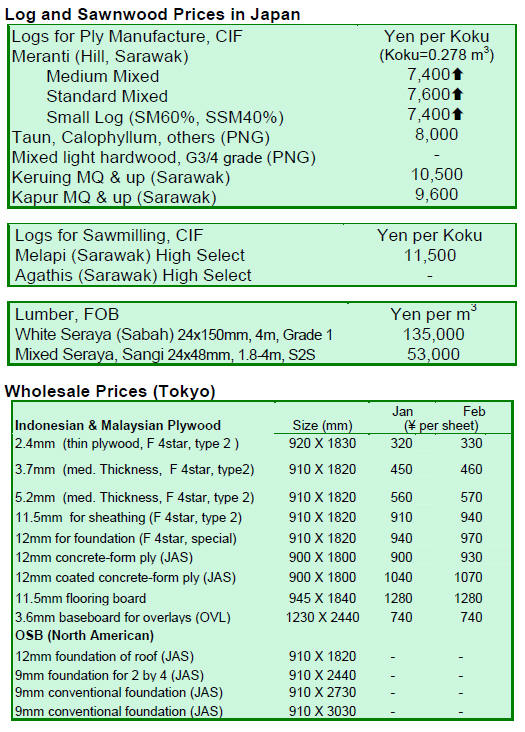

In Japan, CIF prices remained unchanged from the

previous month at Yen 7,400-7,500 per koku for Sarawak

meranti regular logs, Yen 6,600-6,700 per koku for small

meranti logs, and Yen 6,100-6,200 per koku for super

small meranti logs. Sabah kapur log prices also stood at

Yen 9,500 per koku, unchanged since November 2010.

Demand for keruin hardwood sawnwood by Japanese

crating manufacturers has strengthened, reports JLR.

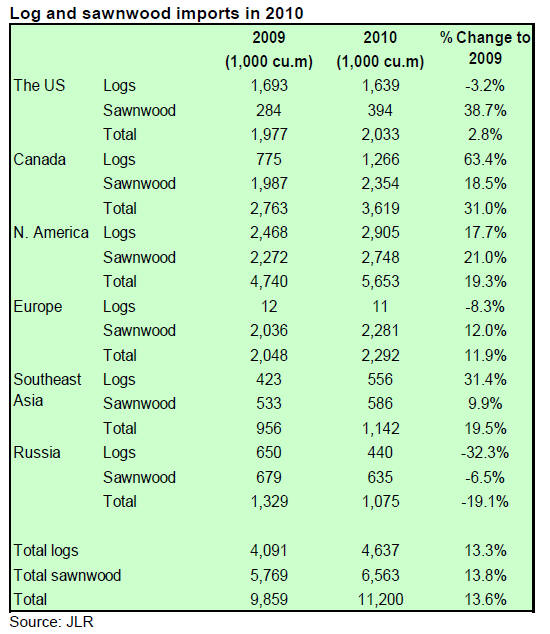

Strong rebound of timber imports in 2010

The total volume of wood and timber product imports to

Japan was 14.894 million cu.m in 2010, up 13.2%

compared to 2009. Imports in 2010 showed the first

increase after four years of decline, reports JLR.

The share of imports of processed products including

sawnwood, plywood and laminated panels has been

increasing in relation to the share of log imports. In 2001,

the share of processed products was 52% and in 2010 it

has expanded to 69% of the total wood and timber product

imports.

Imports from North America, Europe, Southeast Asia and

New Zealand have increased while imports from Russia

have dropped due to the high export tax on logs, market

expectations for possible changes in future taxation and

problems encountered by Russian sawmills.

In 2010, depressed US housing starts and the strong Yen

against the US dollar underpinned timber exports from

North America to Japan. The US began to produce and

export more sawnwood to the Japanese market. The

decline in Japanese log imports from the US and Russia

was offset by log imports from Canada.

According to JLR, timber imports from Southeast Asia

rebounded in 2010 from the sharp drop experienced in

2009. Despite the apparent upswing, JLR reports that the

market does not consider this as reflecting an

improvement in demand.

European sawnwood exports to Japan have recovered

following two years of light trade. The total sawnwood

exports from Europe to Japan jumped 12% and imports of

laminated panels soared 24% over 2009.

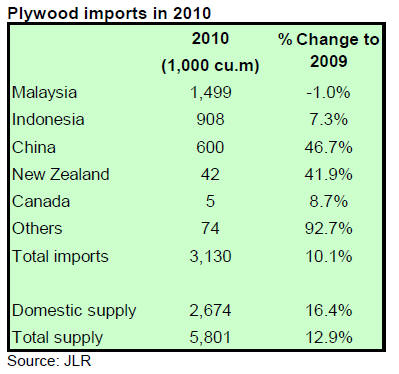

Improved plywood supply in 2010

The supply of plywood in Japan in 2010 was 5.8 million

cu.m, up 12.9% from the level recorded in 2009. The

improved plywood supply in 2010 was a rebound from

four consecutive years of decline, reports JLR. In

particular, domestic supply and imports from China and

New Zealand have recovered significantly.

Of the total supply, plywood imports accounted for 54% in

2010, down 1.3 percentage points from 2009. Both

domestic and imported thick flooring, wall and roof panels

(24 and 28 mm) were among the products with upswing

in sales in the Japanese market.

Adhesive prices moving up

Prices of naphtha and methanol have increased and this is

impacting on the costs of producing adhesives for the

plywood industry. Due to the weak demand for plywood

and board products, adhesive manufacturers were not able

to raise prices earlier to cover their increased production

costs. Previously, manufacturers were only able to raise

the prices of phenol resin adhesive by 30% since June

2010. As the plywood market has picked up and prices

improved, adhesive manufacturers presently see an

opportunity to raise adhesive prices across the board.

Oshika Corporation which manufactures adhesive for the

plywood industry has announced its intention to raise

prices of melamine resin by 15%, and phenol resin and

urea resin by 10% with effect from 1 March 2011. In

addition, two major melamine resin manufacturers, Mitsui

Chemical and Nissan Chemical, have raised prices of

melamine resin by Yen 30-35 per kg since December 2010,

reports JLR.

Plywood manufacturers are against the Trans Pacific

Partnership (TPP)

As reported earlier, the Japanese government is currently

considering joining the Trans Pacific Partnership (TPP), a

free trade agreement between Singapore, New Zealand,

Australia, Chile, Peru, Malaysia, Vietnam, Brunei and the

USA.

The Japan Federation of Plywood Manufacturers has

added its voice to other national forest product

manufacturers in objecting to the TPP. At a meeting with

government officials, the chairman of Japan Federation of

Plywood Manufactures, Mr. A. Inoue, noted that

liberalisation of the timber trade would have serious

impacts not only on the domestic plywood industry but

also the whole forestry sector and employment in Japan.

Currently, some 60% of plywood consumed in Japan is

imported plywood mainly from Malaysia, Indonesia and

China. Mr. A. Inoue added that the current level of

plywood imports has already hampered the development

of the domestic plywood industry and the forestry sector.

Related News:

|