2.

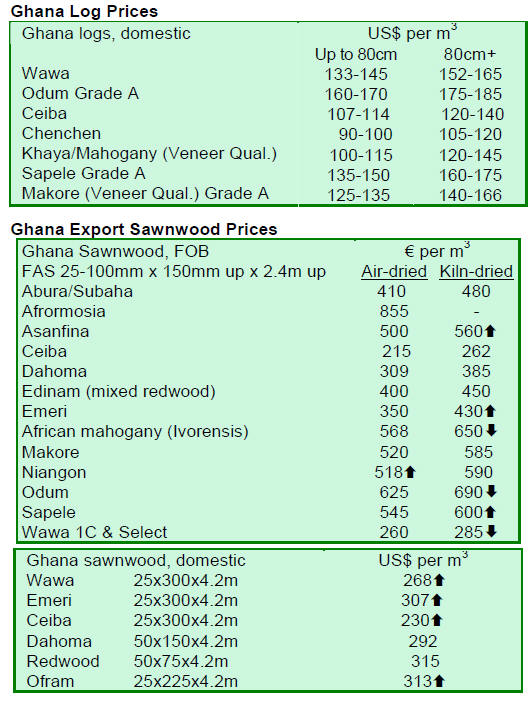

GHANA

Value of timber product exports increased despite lower export

volume

According to the report released by the Timber Industry

Development Division of Ghana, timber product exports

in December 2010 amounted to 30,200 cu.m worth Euro

10 million compared to 37,600 cu.m and Euro 9.8 million

in December 2009. Timber product exports thus fell 20%

in volume, but gained 2% in value.

The total value of timber products exported from January

to December 2010 was Euro 138 million compared to

Euro 128 million in 2009.

However, the export value of primary products including

poles and billets in 2010 was Euro 6.8 million compared to

Euro 12.6 million earned in 2009.

Exports of tertiary timber products were valued at Euro

10.2 million in 2010 increasing from Euro 8.1 million registered in 2009,

while exports of secondary timber products fetched Euro 121 million in 2010

compared to

Euro 107 million in 2009.

According to the report, exports to other African countries

were 191,000 cu.m in volume and Euro 53.5 million in

value in 2010. The ECOWAS countries including Nigeria,

Senegal, Niger, Gambia, Mali, Benin, Burkina Faso and

Togo accounted for Euro 49.1 million of the total exports

to African countries. Plywood and air-dried sawnwood

including ofram and ceiba continue to be in favour of

buyers in Nigeria and Niger.

Timber product exports to Europe in 2010 amounted to

85,000 cu.m worth Euro 40 million, with the main

destinations being Italy, France, Germany, the UK,

Belgium, Spain, Ireland and the Netherlands.

Emerging markets for Ghanaian timber products seem to

be in Asia and Far East including India, Malaysia, Taiwan

P.o.C, China, Singapore and Thailand. The value of timber

product exports to these countries was Euro 23.8 million

in 2010. India continues to be the major importer of

Ghanaian teak poles, billets and sawnwood.

The value of timber product exports to the Middle East

countries including Saudi Arabia, Lebanon, United Arab

Emirate and Israel together was Euro 10.5 million in 2010.

3.

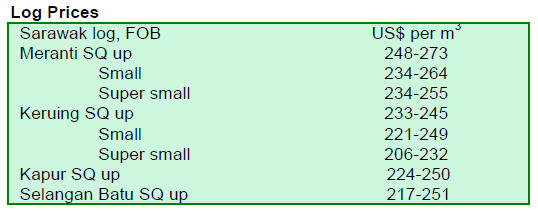

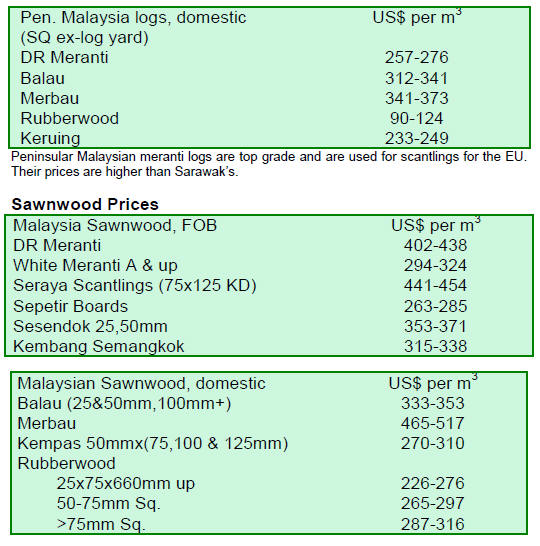

MALAYSIA

Sarawak raises royalty on timber

In November 2008, the State Government of Sarawak

announced its intention to introduce a single flat royalty

rate for all logs at RM65 per cu.m to be effective from 1

January 2009. Following an appeal by the Sarawak Timber

Association, the Government agreed to a step-by-step

increase of the royalty rate: RM50 per cu.m in 2009,

RM55 per cu.m in 2010 and RM65 per cu.m in 2011 and

onwards.

However, due to the poor market situation in 2009 and

2010, the single flat royalty rate of RM50 per cu.m was

also applied in 2010. The royalty rate has been increased to RM65 per cu.m

for all logs effective from 1 January 2011.

More foreign workforce needed to meet export target

The value of timber and timber product exports from

January to November 2010 totalled RM18.8 billion, up

6.5% over the same period in 2009. Timber product

exports are projected to reach RM20.5 billion in 2010. In

2011, exports are forecast to further increase to RM21

billion - RM22 billion.

The National Timber Industry Policy (NATIP) sets an

export target of RM53 billion by 2020 for timber and

timber products. The target requires an annual export

growth of 6.4% with 60% of exports to be derived from

value-added products. The current share of value-added

products to timber product exports is 40%.

According to the Ministry of Plantation Industries and

Commodities, the Malaysian timber industry needs 50,000

more workers in order to meet the export target. In

addition, the furniture sector is experiencing a shortfall of

23,000 workers.

The current shortage of workers is attributed to several

restrictions imposed by the federal government to promote

the employment of local population as the global

economic slowdown continues. However, the Malaysian

timber industry is dependent on foreign labour. The

booming furniture sectors in Vietnam and China compete

with the Malaysian timber industry for foreign workforce.

According to a recent study conducted by the Malaysian

Timber Industry Board (MTIB), Forest Research Institute

of Malaysia (FRIM) and Malaysian Timber Council

(MTC), the production of value-added timber products

generated RM24 billion to the Malaysian economy in

2009.

Concern over increasing costs

The Sarawak Timber Association (STA) expressed

concern over the recent increases in fuel prices, freight

charges and cargo insurance costs. In addition, the STA

hopes that the federal government would be able to

provide more incentives for forest plantation projects as

well as for the use of lesser-known-species.

The industry is taking a break for the Chinese Lunar New

Year, with many of the workers returning to their

respective hometowns for the celebration.

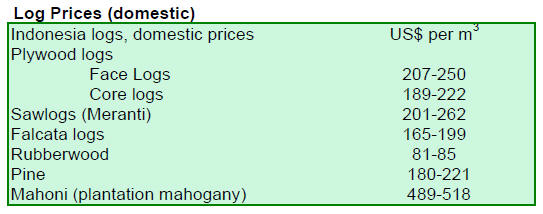

4.

INDONESIA

Germany is the largest market in Europe for

Indonesian rattan products

The largest furnishing exhibition in Germany, the imm

Cologne 2011, was held on 18 - 23 January 2011. The

Indonesian rattan industry made a comeback to the

exhibition after an absence of more than 25 years.

Altogether 12 Indonesian companies participated in the

exhibition.

At the exhibition, the Association of Furniture and

Handicraft Rattan of Indonesia (AMKRI) signed two

cooperation agreements: an exhibition cooperation

agreement with the Köln Messe and an agreement for

rattan design development programme with the German

Furniture Design and Marketing Development Institution.

Germany is the largest market in Europe for Indonesian

rattan products with Euro 18.5 billion of exports recorded

in 2008. In 2010, Indonesian rattan product exports to

Germany grew 2.7% following the economic growth of

2.5% recorded from January to October 2010 in Germany.

Concern over raw material supply

As it was reported earlier, the 2-year moratorium planned

to be implemented on 1 January 2011 in Indonesia has

been postponed. Companies with logging permits obtained

before 2010 are allowed to continue harvesting in primary

forests. The level of harvesting is expected to be finalised

during 2011.

However, the Indonesian Ministry of Forestry has

recently

ordered some timber companies to stop log harvests in

natural forests with immediate effect. The Ministry of

Forestry stresses the need to reorganise the management of

the pulp and paper industry in order to meet the new

conditions. Timber companies violating the order will

have their permits revoked.

Concerns have been expressed whether relying solely on

plantation forests for raw material supply is going to be

enough for the Indonesian timber industry to maintain and

develop its production. It is estimated that 50% to 60% of

raw material supply for the Indonesian timber industry

comes from natural forests.

The Indonesian timber industry is estimated to be worth

US$16 billion and employing annually around 240,000

workers. In 2010, the industry contributed US$4 billion to

state revenue, accounting for 6.1% of the total.

5.

MYANMAR

Mixed market outlook

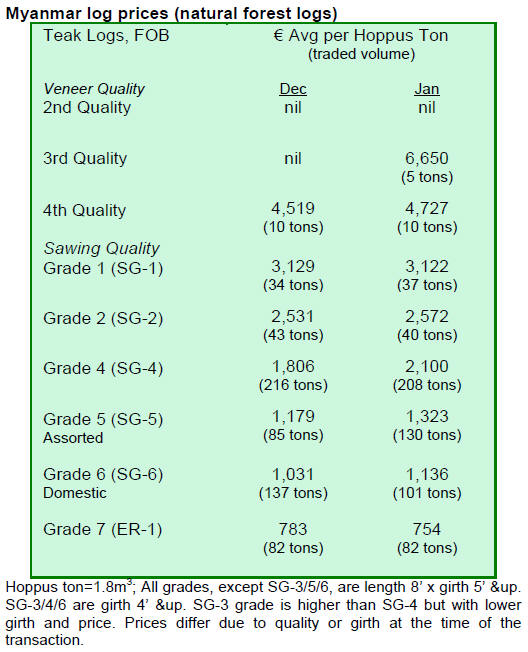

The market situation for teak is reportedly good but the

Chinese Lunar New Year holidays have eased trading

towards the end of the month. With the arrival of fresh and

good quality logs, prices at Myanmar Timber Enterprise

(MTE) tender sales were favourable in January. Buying in

MTE tender sales was aggressive especially for the Indian

market.

The market situation for pyinkado has also improved.

However, buyers say that the export market for kanyingurjan

(Dipterocarpus spp) logs is still extremely slow.

Lower grade kanyin logs are processed for construction

timber in the domestic market.

Trade in eng (Dipterocarpus tuberculatus) for the Indian

market has been active but prices are lower than for

kanyin-gurjan (Dipterocarpus spp).

The Myanmar Kyat has appreciated against the US dollar

from about Kyat 1000/US$ to Kyat 850/US$ currently. As

a result, MTE tender prices in US dollars have attracted

local saw millers. In addition, with the strong Kyat,

processed products in the domestic market fetch higher

prices compared to export prices.

In general, log trade is similar to the previous year.

However, according to an analyst, grades and girths of

logs from natural forests have declined over the years.

Purchases of Myanmar teak by country in January

Purchases of Myanmar teak logs by country during

January 2011 were as follows: India (4 buyers, 257

Hoppus tons), Singapore (3 buyers, 214 Hoppus tons), and

Hong Kong (1 buyer, 63 Hoppus tons). In the domestic

markets there were four buyers, with timber sales totalling

80 Hoppus tons in volume.

6. INDIA

Sharp jump in exports helps trim down

trade deficit

Exports from India grew 36.4% in December 2010 yearon-

year to US$22.5 billion, the highest level in 33 months.

Imports to India stood at US$25.1 billion in the same

month, resulting in the narrowing of trade deficit to

US$2.6 billion.

Increasing demand for industrial wood

India¡¯s consumption of paper and paper products of 5 kg

per person per year is among the lowest in the world. For

comparison, levels of consumption per capita of paper and

paper products in the USA, UK and China are 300 kg, 200

kg and 45 kg respectively.

However, improved education and continuing economic

growth are expected to contribute to a rapid increase in

consumption of paper products in India. Companies are

intensifying agro-forestry activities to meet increasing

demand for pulp-wood.

In social forestry, there are efforts to plant more

fruit

bearing trees as well as neem, eucalyptus, casuarina,

poplar and rubber wood. In the district of Gujarat in

western India, rubberwood plantations are being promoted

on an experimental basis, helping in the greening of the

country and providing employment to local communities.

According to an analyst, wastelands can contribute to

alleviating the shortage of raw materials if the government

allows for the growing of industrial woods and bamboos in

these areas.

Red sandalwood seized

The smuggling of red sandalwood (Pterocarpus santalinus)

out of India appears to be continuing. However, Indian

Customs have been successful in seizing illegal shipments.

Red sandalwood is mainly shipped to China, Taiwan and

Japan for the manufacture of medicine and musical

instruments. Extracts of red sandalwood are also used as

effective coolants in nuclear reactors and this has created a

new market in China. The total seizure of red sandalwood

in 2010 amounted to 230 metric tonnes worth Rs.210

million.

Active auction sales in government depots

Timber auction sales in Central and Western Indian

Government depots continue to be active with steady

demand and prices. Sales have amounted to over 10,000

cu.m of hardwood logs.

Long length quality teak logs fetched Rs.2100-2200

per

cu.m, medium sawing quality teak logs were at Rs.1700-

1800 per cu.m, long length medium girth at Rs.1500-1600

per cu.m, and lower grades were priced at Rs.900-1000

per cu.m.

Hardwoods like adina, laurel and kinowood (Pterocarpus

marsupium) fetched Rs.800 for select qualities and Rs.400

for lower grades. Demand is good for these species, but

supplies are inadequate.

Timber market outlook

Timber and wood products are in good demand in the

Indian market and prices are firming. The shortfall of

supply of non-teak hardwoods is met through imports of

Malaysian hardwood logs.

Teak trade is active and prices trend upwards due to

continuing demand from Europe, the USA and Middle

East. Higher log prices are pushing sawnwood prices up.

Demand for plywood is also steady. Local production

costs are rising but imports of plywood and other panel

products from China make it difficult for Indian producers

to pass these costs to the consumers.

7. BRAZIL

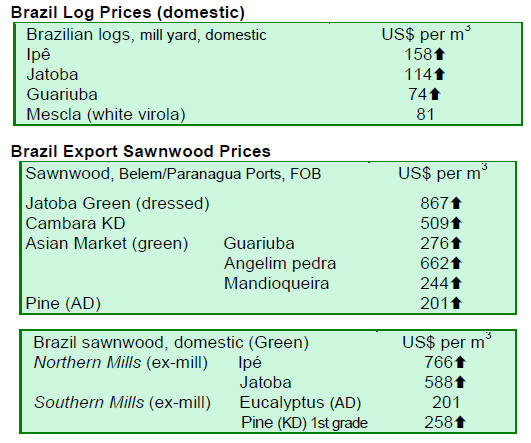

Timber product prices on an upward trend

The average price of timber products in Brazil in BRL

increased by 2.1% from the previous fortnight. Prices in

US dollars also gained 0.59% due to the slight

appreciation of the Brazilian currency against the US

dollar.

Mixed performance of wood product exports in

last

two months of 2010

In November 2010, the value of timber product exports

(excluding pulp and paper) increased 7.6% to US$204

million from US$189 million in November 2009. Exports

of timber products continued to improve in December

showing 2.5% increase compared to December 2009, from

US$219 million to US$224 million.

In November, exports of tropical sawnwood rose in

terms

of both volume and value, from 48,400 cu.m worth

US$25.7 million recorded in November previous year to

53,200 cu.m worth US$28 million. However, exports

declined in December from 49,100 cu.m worth US$25.5

million recorded in December previous year to 42,300

cu.m worth US$23.1 million.

Exports of tropical plywood plunged 28%

year-on-year in

November, from 9,900 cu.m to 7,100 cu.m, but increased

11% year-on-year in December, from 8,100 cu.m to 9,000

cu.m. In value terms, a 28.6% decline was recorded yearon-

year in November, from US$5.6 million to US$4.0

million, followed by a rebound of 16.3% in December,

from US$4.9 million to US$5.7 million.

Pine sawnwood exports surged 35% year-on-year in

November, from 40,900 cu.m to 55,300 cu.m, but slid

17.1% year-on-year in December, from 65,900 cu.m to

54,600 cu.m. In value terms, a 62% jump was recorded

year-on-year in November, from US$7.8 million to

US$12.6 million, followed by a 3.8% decline in December,

from US$13 million to US$12.5 million.

Pine plywood exports increased 0.8% year-on-year in

November, from 85,000 cu.m to 85,700 cu.m and

advanced further in December by 13% year-on-year, from

83,300 cu.m to 94,400 cu.m. In value terms, a 15%

increase was recorded year-on-year in November, from

US$26.4 million to US$30.3 million, and a further surge

of 23% in December, from US$27.1 million to US$33.4

million.

In contrast, the value of wooden furniture exports

slipped

0.2% in November and 3.4% in December year-on-year to

US$46.6 million and US$51.4 million respectively.

Authorities monitor inflationary trends in

economy

According to the Brazilian Institute of Geography and

Statistics (IBGE), the Consumer Price Index (IPCA) rose

0.83% in November and 0.63% in December year-on-year.

The accumulated IPCA for the year 2010 was 5.91%, 1.6

percentile points above the 2009 rate (4.31%)

In November 2010, the average exchange rate for BRL

to

the US dollar was BRL1.71/US$ compared to BRL

1.73/US$ during the same month of 2009. In December

2010, the average exchange rate stood at BRL 1.69/US$,

compared to BRL 1.75/US$ in December 2009. This

shows that BRL has further strengthened against the US

dollar over the period.

The Copom (Economic Policy Committee) has kept the

prime interest rate (Selic) at 10.75% since July 2010.

Brazilian Forest Service aims at expanding

national forests (FLONAS)

It was reported earlier that the area available for forest

concessions in the Brazilian Amazon exceeded 1 million

hectares. Recently the Brazilian Forest Service (SFB)

announced its intention to increase forest concession areas

for logging companies and forest areas for community

management. Furthermore, SFB will speed up the forest

concession approval process.

According to SFB, there are 50 million hectares of

forests

which can potentially be turned into national managed

forests (FLONAS). At least 35 million hectares of national

managed forests would be required in order to meet

current timber demand.

In addition, part of the future timber supply will

come

from community forest management projects aimed at

offering sustainable economic alternatives to illegal

logging. SFB believes that community forest management

projects are among those likely to receive international

funds in the coming years.

New export strategy for furniture manufacturers

in 2011

According to the Chamber of Furniture Industry

Development of FIESC (Federation of Industries of the

state of Santa Catarina), the furniture manufacturers of

Santa Catarina will focus on selling more furniture in the

domestic market. The strategy change is due to the

weakening of US dollar against the Brazilian Real. Santa

Catarina is the major state in Brazil exporting furniture.

In 2009, furniture sales in the domestic market

grew 5.2%

compared to 2008. In October 2010, the accumulated

furniture sales were up by 20% over the same period in

2009.

The value of furniture exports from Santa Catarina

was

US$260 million in 2009, accounting for 31% of the total

Brazilian furniture exports. In the period from January to

November 2010, furniture exports totalled US$248 million

in value. The main export destinations were the US,

France, the UK, the Netherlands, Spain and Germany.

Brazil stands out in furniture production

According to the Italian Research Institute (CSIL), Brazil

is the world¡¯s 13th largest furniture supplier and its

industry is growing. The institute predicts that the

Brazilian furniture industry will grow by 3% ¨C 4% in 2011

and 2012.

According to CSIL, besides the economic growth in

Brazil,

the expansion of the furniture industry is due to several

other factors, such as the significant expansion in civil

construction, growing middle class, and the country¡¯s

competitive position in the international market. In the

next two years, furniture consumption will be much

greater in emerging economies than in developed

economies.

A large share of furniture production and sales is

concentrated in the Southern and Southeast regions of

Brazil. The furniture cluster consists of about 15,000

micro and small-sized companies. The annual panel

production capacity is expected to grow from 6 million

cu.m to 10.3 million cu.m by 2012.

Brazilian furniture sales hit a record high in

2008. In 2009,

sales went down due to the global economic crisis and stiff

competition from Asian products. However, according to

CSIL, furniture consumption increased in the Southern

and Southeast regions of Brazil in 2010.

IBAMA introduces new timber export control

The Document of Forest Origin (DOF) used since 2006 to

control the trade in forest products in the Brazilian

domestic market has been adapted to be used for the

export markets. The new module called ¡°DOF Export¡±

commenced operation on 10 January 2011 with the aim of

improving transparency of the public administration and

reducing bureaucracy.

DOF Export will be integrated to the state forest

control

system. Under the previous system, an entrepreneur had to

register a timber courtyard in every export warehouse.

With the new system, these warehouses are already preregistered

and thus duplication is avoided.

DOF can be also used as a REDD (Reducing Emissions

from Deforestation and Degradation) tool to evaluate the

legality of wood products originating from Brazil. The

new system includes also a government database

consisting information about foreign buyer companies.

With these features, a foreign buyer is guaranteed of the

legality of wood products, thereby improving and

enhancing the competitiveness of Brazilian forest products

in the international markets.

IBAMA has received delegations from several

tropical

forest countries, such as Indonesia, Ghana and Bolivia,

which have shown their interest in adopting the Brazilian

technology to control the forest products flow.

8.

PERU

Appeal for Congress to pass Forestry and Wildlife Law

The Peruvian Exporters¡¯ Association (Adex), the National

Society of Industries (SIN) and the National Forest

Chamber have appealed to the Congress to pass the

Forestry and Wildlife law in March. According to these

bodies, an adequate legal framework would help the sector

to boost exports and create jobs.

Call for integrated policies for the forestry sector

The export performance of wood and timber products in

2011 is expected to be lower than in 2010 if the next

government does not commit to support the sector, said

Eric Fischer, Chairman of the Wood Committee, Peru

Exporters Association.

According to Fischer, the regional governments are

lacking in resources and integrated State policies to

support and promote the forestry sector in Peru.

Significant losses from deforestation

An impact analysis of deforestation in Pichis-Palcaz¨² of

the Pasco region shows a loss of some US$750 - US$811

million in revenue in the next 30 years period due to

deforestation.

The analysis considered the losses in opportunities and

revenues from sustainable forest management, involving a

total area of 1,4 million hectares. According to estimates,

some 269,000 hectares were deforested in 2007, with 57%

of the deforested area turned into pastureland and the

remaining 43% into shifting cultivation.

9.

BOLIVIA

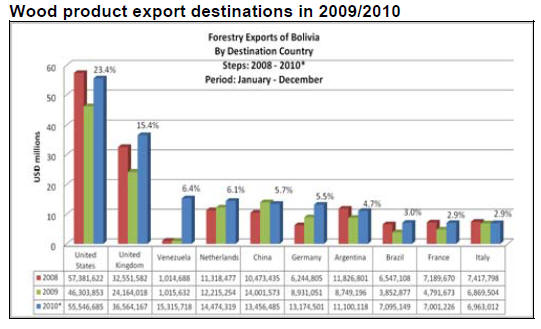

Forest product exports surged in 2010

Forest product exports from Bolivia totalled US$237

million in 2010, up 33% from US$178.8 million in 2009.

Furniture, doors, panels, decking (as well as peeled

chestnut and canned palm hearts) accounted for 82%

(US$195.4 million) of the total forest product exports,

while the remaining 18% (US$42.4 million) consisted of

primary processed wood products, such as sawnwood and

poles.

The US remains the major market for Bolivian forest

products taking some US$55.5 million, which accounted

for 23.4% of the total forest product exports from Bolivia.

Other major export destinations were the UK (US$36.6

million), Venezuela (US$15.3 million), the Netherlands

(US$14.5 million), and China (US$13.5 million).

Related News: