|

1.

CENTRAL/ WEST AFRICA

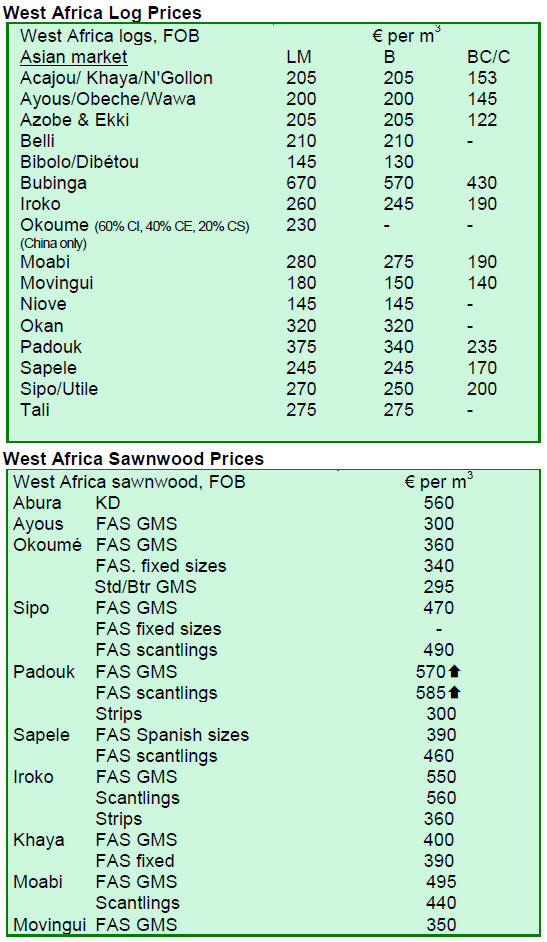

Log markets remain steady

Central and West African log markets remain steady and the recent price

increases have been well absorbed in the markets without any disturbance to

the flow of business. Prices remain unchanged during the first weeks of

November and demand from the major markets is firm.

The European demand for tropical hardwood logs is still declining and

current stock levels are reportedly adequate to fulfil projected demand for

the winter period.

Sawnwood in good demand

West and Central African sawnwood prices are firm after the gains made in

October. Saw mills in the region expect good demand through the rest of the

year into 2011.

Generally prices have not changed from October. However, demand for padouk

is strong, pushing its price up by Euro10 per cu.m for FAS GMS to Euro570

per cu.m, while scantlings were up by Euro20 per cu.m to Euro585 per cu.m.

Iroko sawnood is in good demand for the European and Asian markets. However,

according to analysts, under the current high production volume there is a

risk of overstocking and eventual decline in prices.

Uncertainty clouds demand prospects in Europe

Projections of European demand for tropical timber in 2011 remain uncertain.

Housing starts in Europe are at low levels, but refurbishment activity has

picked up. Improved refurbishment and renovation activity is good news for

hardwoods as this sector uses more hardwoods and decorative timbers in

joinery, carpentry and finishing than structural timbers.

China has introduced policies which are expected to increase imports of

sawnwood rather than logs to China. If these policies are implemented within

the short to medium term, the West and Central African mills have the

capacity and resources to meet the greater sawnwood demand from China.

Projections for the rest of the year 2010 to the end of the first quarter of

2011 suggest that demand and supply will remain in balance and prices will

continue to be stable.

Promising market prospects in Asia for Central/West African timber

The economies in Asia and Middle East are strong. Both China and India in

particular are poised to meet forecast growth in demand for in-country wood

processing industry for both the domestic and export markets.

So far, these countries are procuring much less logs and sawnwood from West

and Central Africa than from the Asia-Pacific region. However, producing

countries in the Asia-Pacific region are pushing their industries to produce

more processed products, leaving less logs for export. This could create

more opportunities for African exporters to tap these markets, as producers

in Asia and Middle East are still demanding logs and sawnwood, because of

their low labour and processing costs, say an analyst.

¡¡

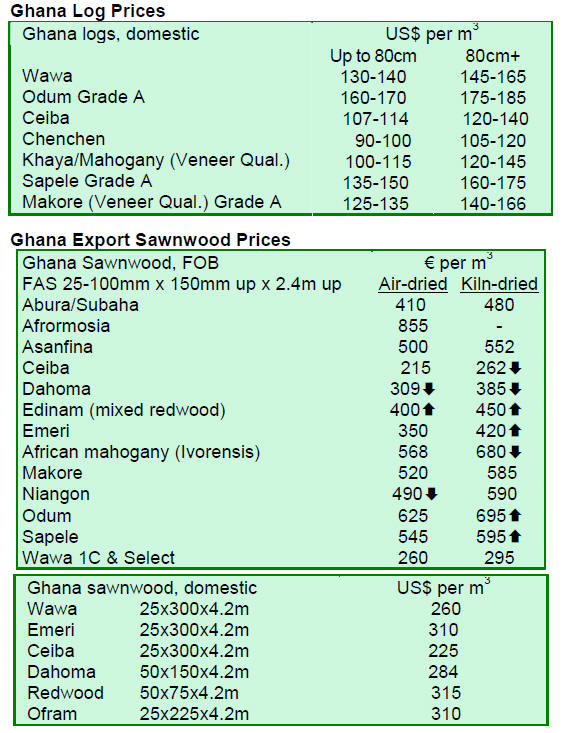

2. GHANA

Forestry Commission to promote legal timber for domestic market

The Forestry Commission of Ghana is working together with Tropenbos

International to develop policy recommendations for enhancing production and

trade in legally harvested timber for the domestic market.

The initiative is in line with the Forest Sector Development and Strategic

Plan of the Forestry Commission. The Strategic Plan places emphasis on an

efficient forest industry and value-added production among others.

The overall objective is to create an enabling environment for an efficient

forest industry, by ensuring sufficient supply of legally harvested timber

in the domestic market and discouraging illegal timber trade. Once the

recommendations are completed, these will be submitted to the Ministry of

Lands and Forestry for consideration.

¡¡

3.

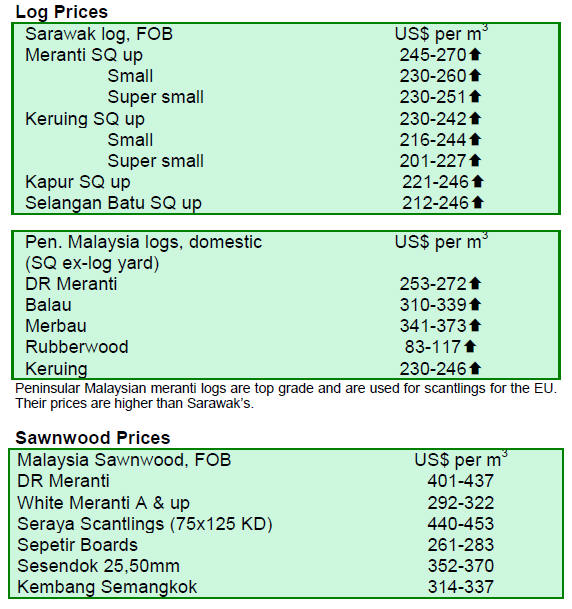

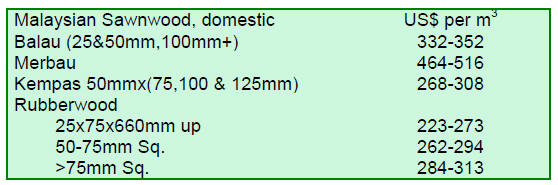

MALAYSIA

Monsoon and dam impoundment lead to drastic fall in log supply

Buyers of logs from Sarawak are facing a drastic shortfall in log supply,

which has also resulted in higher log prices. One of the main reasons for

the tight supply situation is the early monsoon season which affected log

harvests.

The other reason for the log shortage could be the impoundment of the Bakun

hydroelectric dam that might have lowered the level of the Rejang River and

its tributaries which have been used to transport logs from the major

logging areas in Sarawak. As a result, the transport of logs for processing

mills and exports has been disrupted.

The other option for logging companies is to transport logs overland by

lorries. However, this option will cost an extra US$10 to US$15 per cu.m

vis-¨¤-vis river transportation.

The tight log supply has an impact especially on the Indian market, which is

the biggest for logs from Sarawak. For the first seven months of 2010,

exports to India accounted for 1.3 million cu.m of the total of 2.4 million

cu.m of log exports from Sarawak.

Increasing production of environmentally friendly plywood

The largest plywood manufacturer in Malaysia, Shing Yang plywood group, has

a monthly production capacity of 100,000 cu.m comprising four plants.

Current production volume is only around 70,000 cu.m per month, out of which

50-55% is shipped to Japan. Other destinations are Republic of Korea, the

US, Taiwan P.o.C, the Middle East and neighbouring South East Asian

countries. The reasons for the current production include a shortage of raw

material and volatile consumer markets, reports the Japanese Lumber Reports

(JLR).

According to JLR, the company is increasing production of the so-called

e-panels which are environmentally friendly plywood products made of

plantation wood. The main products are flooring base board, concrete

formboard, structural and standard panels, and LVL (Laminated Veneer

Lumber).

The company owns 650,000 hectares of land, out of which 350,000 hectares are

forest plantations. Shing Yang group has developed the first plantation area

in 2000 and it is planting 40 million trees every year to keep production

sustainable. The plantations include about 40 different species which are

tested by the company to identify appropriate end-uses.

4.

INDONESIA

President Obama addresses climate change and

deforestation during visit

On 10 November 2010, the US president Barack Obama visited Indonesia. During

his visit, he addressed the issues of climate change and deforestation in

discussions with the Indonesian government. This effort is seen as another

development to advance diplomatic relationships and trade between these two

countries.

He was expected to announce how some of the US$700 million grant allocated

to Indonesia by the Millennium Challenge Corporation (MCC), a US foreign aid

agency set up under the former Bush administration, could be used to finance

climate change and forest conservation programmes in Indonesia to create

tradable forest carbon offsets that would help the US industries to meet

future emission reduction targets.

In addition, he would unveil details of the implementation of four-year

programme on addressing deforestation, reducing loss of biodiversity and

improving the land use management. This programme involving US$35 ¨C US$40

million was announced earlier this year.

The US has also pledged US$20 million for marine conservation and promotion

of clean-energy development in Indonesia.

Indonesian furniture sector falls short of export target

The Association of Indonesian Furniture and Handicraft Industry (Asmindo)

stated that its recent marketing efforts to boost sales had fallen short of

its target. During the period from January to October 2010, only half of the

targeted growth of 30% over the previous year was achieved. Sales amounted

only to US$25 million during the period.

Asmindo calls for a more effective marketing programme for Indonesian

furniture, which would also help to generate more jobs in the country.

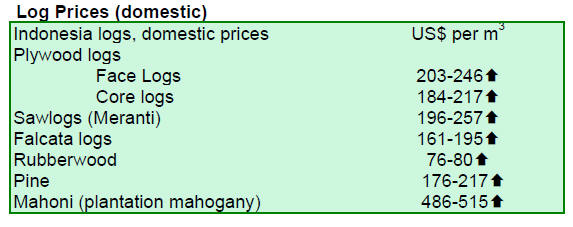

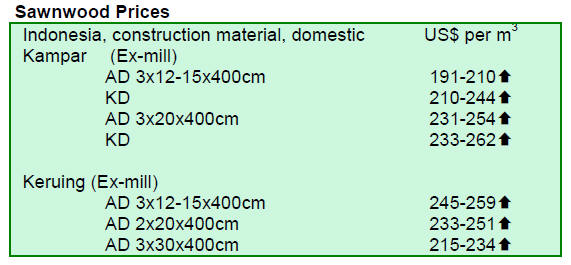

Rubberwood and construction material prices soar

The heavy monsoon and flooding in Thailand extracted a heavy toll on the

main rubber tree plantation areas in Thailand, thereby lifting rubberwood

prices across the South East Asia. Thailand is the world¡¯s largest

rubberwood and natural rubber producer.

In addition, the devastation and evacuations arising from the violent

volcanic eruptions of Mt. Merapi near Yogyakarta, has resulted in soaring

construction material prices in Indonesia. The tragic volcanic eruptions,

which have destroyed homes, farms and killed livestock, have also displaced

more than 100,000 Indonesians to date.

5.

MYANMAR

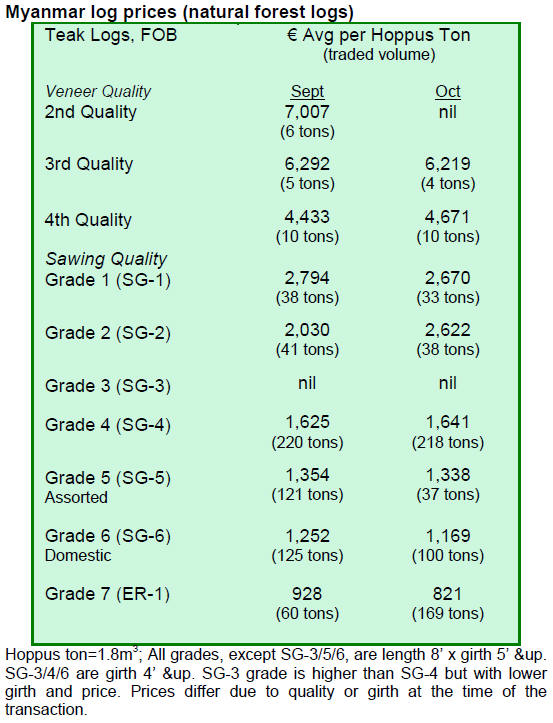

Teak market remains brisk in India

The market situation remains unchanged over the previous month. Apart from

India, other markets are quiet. It has been reported that the teak market is

good in India especially for grade 7 logs and good quality pyinkadoe logs,

while demand for Gurjan logs is sluggish.

Monthly shipments of teak and other hardwoods for the past three months

indicate the current market situation. Teak shipments were reportedly around

22,000 Hoppus tons in August, 15,000 Hoppus tons in September, and 22,000

Hoppus tons in October. The average export volume for other hardwoods was

70,000 Hoppus tons per month.

¡¡

6. INDIA

Sharp jump in exports helps trim down

trade deficit

According to the Department of Commerce India, exports in September were

US$18 billion, up 23% compared to September 2009. The result was the highest

in 24 months. September imports in India grew 26% to US$27 billion compared

to last year. As a result, the trade deficit in September decreased to

US$9.1 billion from $13 billion recorded in August.

The Indian economy is forecast to grow by 8.5% - 9.7% in the fiscal

2010-2011. The main driver for the economic growth is domestic demand,

according to the Ministry of Finance India. In addition, IMF revised the

forecast for Indian economic growth to 9.7% in 2010 and this is expected to

encourage more foreign investments in the Indian equity markets.

India¡¯s forest cover expands by 3 million hectares

India¡¯s forest cover expanded 3 million hectares over the last 10 year,

according to the Environment and Forest Ministry India. India is planning to

launch satellites in 2013 to monitor the country¡¯s forest cover.

International Panelexpo and Conference 2010 postponed

The organisers of Panelexpo 2010 have announced that due to the distracting

news circulated during the Commonwealth Games and the festival season in

India, many of the participants had called for the postponement of the fair.

The fair was planned for 1-4 December 2010 at NSIC Exhibition Ground Okhla,

New Delhi and the new dates will be announced in due course.

Furniture fair showcases alternatives to plywood

The Index International Furniture Fair 2010 held between 8 ¨C 11 October in

Mumbai showcased a number of alternatives to plywood for interior

decoration. For example, advanced digital printing techniques have brought

paper laminates to the markets. The fair also signalled that composite

flooring panels as well as printed and coated Medium / High Density

Fibreboards are gaining ground in markets with expanding production

capacities against plywood.

India delegation participates in US furniture fair

The International Woodworking Machinery & Furniture Supply Fair was held

from 25 to 28 August in Atlanta USA. The India delegation was led by CAPEXIL

(Chemical and Allied Export Promotion Council of India) and included wood

and timber product importers and exporters. The visit has resulted in new

business and trade contacts for the delegation, reports CAPEXIL.

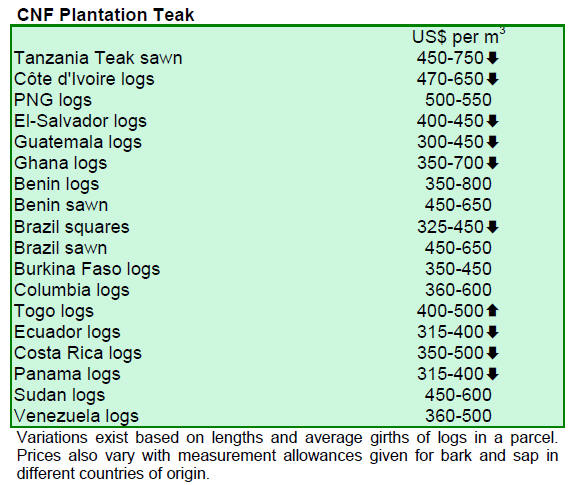

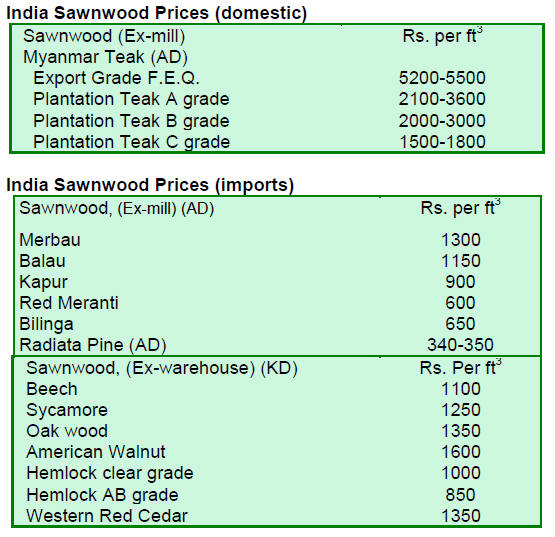

Strong demand for plantation teak

According to an analyst, there is a substantial flow of plantation teak to

India and demand from the housing sector is expected to pick up as the

monsoon season is over. Recently, some lower grades have arrived at cheaper

prices than standard grades. These are included in the price table below.

Plywood manufacturers face shortage of peeling grade logs

Shortage of peeling grade logs is plaguing the plywood manufacturers.

Eucalyptus and poplar logs are used to keep the mills running. The

manufacturers are also still suffering from shortages of labour and power.

7. BRAZIL

Forest sector is key to economy in Par¨¢

According to the report ¡°Price of standing timber, Economic Value and Timber

Market in Transition Contracts in State of Par¨¢¡±, published by the Para

Forestry Institute (IDEFLOR), the forest sector plays a kea role in the

economy of Par¨¢ state, generating jobs, income and foreign exchange.

In 2008, the forest sector¡¯s revenues reached US$4.46 billion accounting for

9.6% of the state¡¯s GDP and generating 30,481 jobs, representing 3.6% of the

total employment in Par¨¢. According to the report, although timber trade in

Par¨¢ state involves low value-added products, Par¨¢ remains a net exporter of

timber products, with a total surplus of R$1.93 billion (R$2.37 billion of

exports and R$0.44 billion of imports).

The report notes that as the forest sector generates significant income and

employment in the state, it is therefore a strategic sector in the context

of rural development in the Amazon.

Available area for concessions in Brazilian Amazon exceeds 1 million

hectares

The area available for forest concessions in the Brazilian Amazon has

exceeded 1 million hectares, according to the Brazilian Forest Service (SFB).

The total area consists of seven concessions in the states of Rondonia and

Par¨¢. The estimated timber production in the total concession area is

850,000 cu.m per year.

According to the SFB, forest concessions have been promoting the

implementation of sustainable forest management, generating jobs, improving

living conditions of forest dependent people and conserving natural forests.

For the private business, concessions offer an opportunity to have legal

access to forest resources in the long-term.

The forest concession contract value for the Jamari National Forests and the

Sarac¨¢-Taquera National Forests totalled R$6 million. The amount collected

from other concessions will be known after the bidding process is completed,

as companies may pay premium over the minimum price set by the SFB. The

minimum total value of the concessions under the bidding process is over

R$20 million a year.

The SFB estimates that forest concessions practising sustainable forest

management have the potential of increasing timber output in the future.

Timber product exports on course for growth in 2010

Analysts say that if the current economic trend continues without any

downturn, timber exports from Brazil will record a growth in 2010.

From January to September 2010, export value has gained 11% compared to the

same period in 2009. The segments that contributed the most to this growth

are veneer and mouldings, increasing 35% and 16% compared to the same period

last year respectively.

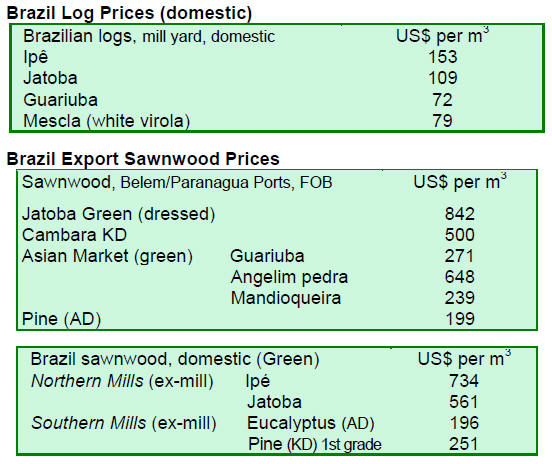

For tropical hardwood sawnwood, a 4% growth in export volume was recorded

from January to September 2010 compared to the same period in 2009, up from

380,731 cu.m to 396,145 cu.m. In value terms, the growth was 6.3%, from

US$179 million from January-September of 2009 to US$191 million in 2010. The

exports of sawnwood in September 2010 topped US$24 million, equivalent to

51,267 cu.m of hardwood sawnwood.

Furniture exports from Rio Grande do Sul show signs of recovery

Wooden furniture exports from Brazil have been declining since the economic

crisis started in 2008. However, at the end of 2009, exports started to show

some signs of recovery. According to the Association of Furniture Industry

of Rio Grande do Sul (Movergs), furniture exports from Rio Grande do Sul in

2008 amounted to US$289 million, accounting for 30% of total furniture

exports in the country.

In 2009, furniture exports from Brazil totalled US$707 million. In Rio

Grande do Sul, the leading furniture cluster in the country, exports reached

US$200 million, accounting for 28% of the national total.

Furniture exports in the country from January to September 2010 amounted to

US$573 million, up 13% compared to the same period in 2009.

8.

PERU

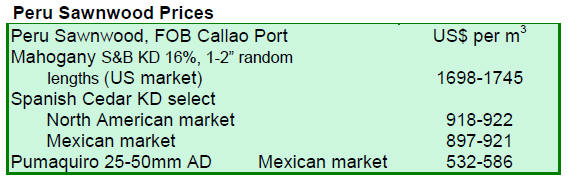

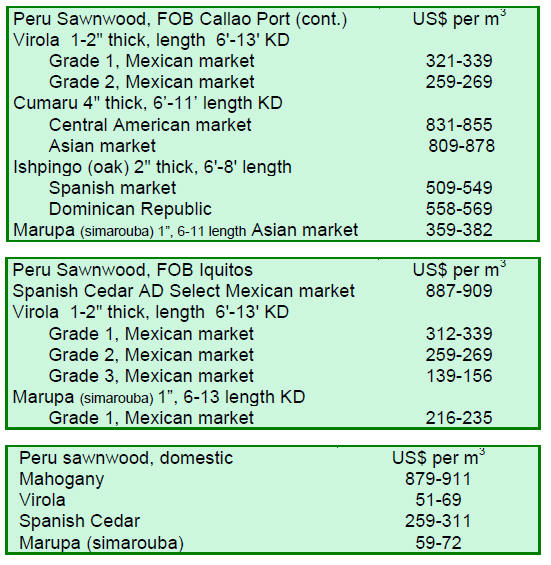

Peru timber exports poised for strong growth

Wood and timber product exports are forecast to grow by 20% - 30% in 2010

over the previous year to US$200 million, according to the National

Exporters Association (ADEX).

In 2009, wood and timber product exports from Peru were valued at US$157

million, while in 2008 exports totalled US$219 million.

From January to August 2010, wood and timber product exports rose by 30% in

value compared to the same period in 2009. Semi-manufactured products such

as sawnwood and wooden flooring contributed to export growth during the

period. These products were mainly exported to the US and China.

The forest sector in Peru generates more than 500,000 jobs and this is

expected to increase by 80,000 by the end of the year.

Granting of new concession areas delegated to regional governments

There are seven million hectares of forest concessions in Peru which are

monitored and regulated by the State to ensure the sustainable development

of forestry and domestic investments into the forest sector.

Forest concessions used to be granted by the Ministry of Agriculture¡¯s

department of Forestry and Wildlife. Currently, the regional governments,

such as Loreto, Ucayali, San Mart¨ªn, have the power to grant concessions

after evaluation made by the department of Forestry and Wildlife. However,

since the transfer of power to the regional governments made in mid 2008, no

new forest concession areas have been approved, according to the Agency for

Supervision of Forest Resources and Wildlife (OSINFOR).

OSINFOR is the designated organisation monitoring and regulating forest

concessions in Peru. It has granted altogether 682 permits and

authorizations to operate in forest concessions during the last and this

year. Currently, there are 1,500 operators holding permits for forest

activities in concession areas and all of them are required to have annual

management plans.

¡¡

9. GUYANA

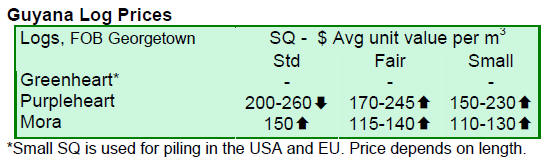

Timber exports and prices remain favourable

During the period under review, there were no exports of greenheart logs.

However, purpleheart logs were in demand attracting higher average prices in

both fair and small sawmill qualities. Similarly, mora log prices increased

for all qualities.

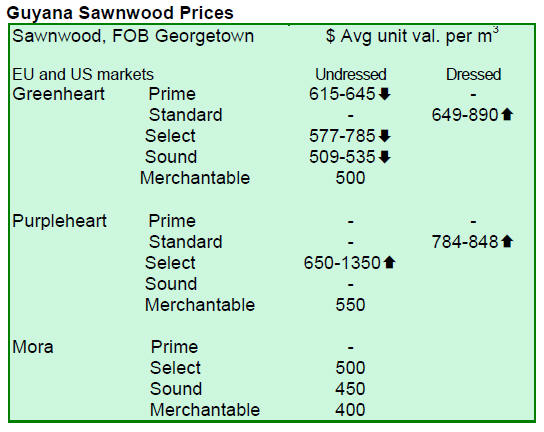

For sawnwood, prices gained in the period under review. Undressed greenheart

prices remained stable while undressed purpleheart (select) prices jumped

from US$750 per cu.m to US$1,350 per cu.m. However, the exported volumes

were small. Dressed greenheart and purpleheart prices gained while undressed

purpleheart prices remained unchanged.

Several Lesser Used Species (LUS) including burada, cow-wood, darina, fukadi,

iteballi, itikiboroballi, muniridan and Tonka bean were exported as sawnwood

during the period under review. The major markets for LUS were Asia,

Caribbean, Europe and North America. In addition, roundwood, fuelwood and

splitwood contributed to the total export earnings. Piles fetched a good

price average of US$831 per cu.m, with the major destination being the US.

For the period under review, exports of value-added products rose. The major

exported products were doors, indoor and outdoor furniture and windows.

Species used in furniture manufacturing included Crabwood (Andiroba),

Kabukalli (Cupiuba), Locust (Courbaril) and Purpleheart (Amarante). These

products were exported to the Caribbean and UK markets.

Capacity building to meet EU FLEGT requirements

On 10 November 2010, the Food and Agriculture Organization of the United

Nations (FAO) and the Forest Products Association of Guyana (FPA) signed a

Letter of agreement in support of a project entitled ¡°Building Capacity

within the Guyanese forestry sector to meet European Union¡¯s Forest Law

Enforcement Governance and Trade (FLEGT) Due Diligence requirements.¡± This

US$102,400 project will be funded by the European Union (EU) and implemented

by FAO.

¡¡

Related News:

|