|

Report

from

North America

US tropical timber imports

Hardwood sawnwood imports down in August

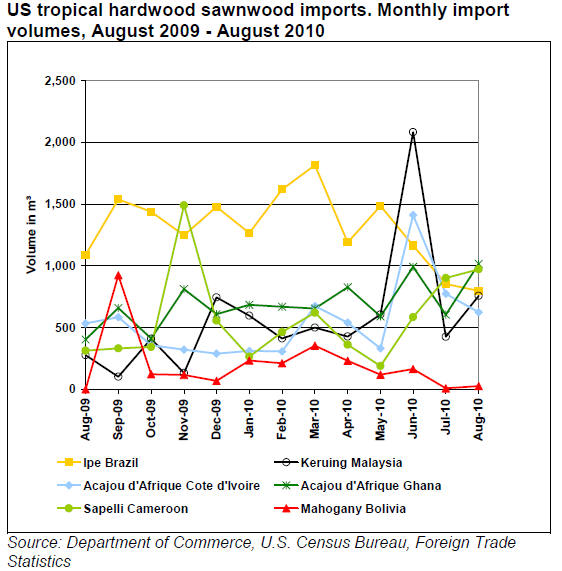

The decline in imports of sawn tropical hardwood continued this summer.

The US imported 17,382 cu.m of tropical sawnwood in August 2010, 8% less

than in July. The following species recorded increases over July: acajou

d¡¯Afrique (2,801 cu.m or +33%), keruing (786 cu.m or +74%), cedro (639

cu.m or +41%), jatoba (661 cu.m or +24%), teak (342 cu.m or +48%) and

padauk (61 cu.m or 33%). The largest declines were seen in virola (369

cu.m or -72%) and mahogany (871 cu.m or -56%).

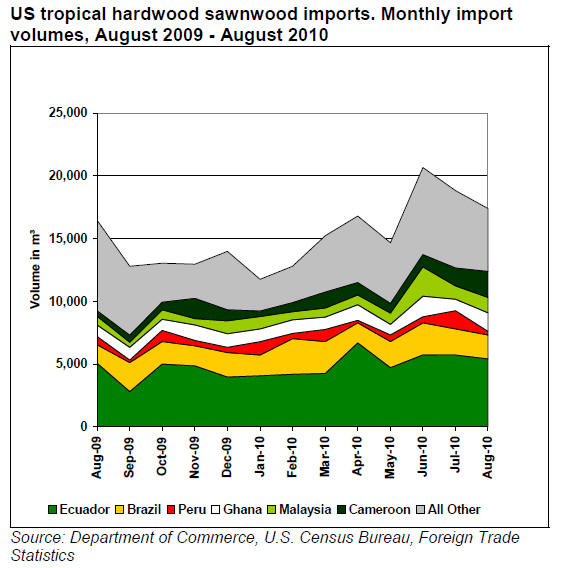

Ecuador remained the leading source of tropical sawnwood with 5,392 cu.m

imported in August, followed by Cameroon (2,063 cu.m) and Brazil (1,921

cu.m). Imports from Peru dropped by 80% to just 284 cu.m from 1,444

cubic metres in July.

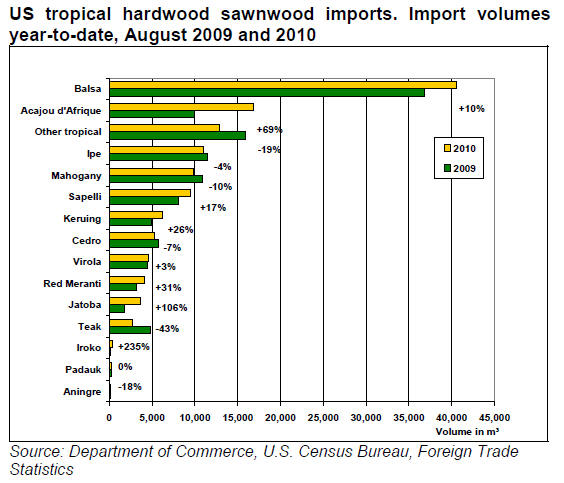

Year-to-date tropical sawnwood import volumes were 8% higher in August

than in the same period last year. Among the species with the largest

gains are acajou d¡¯Afrique (+69%), keruing (+26%), red meranti (+31%)

and jatoba (+106%). The year-to-date value of tropical sawnwood imports

was 16% higher than in July 2009.

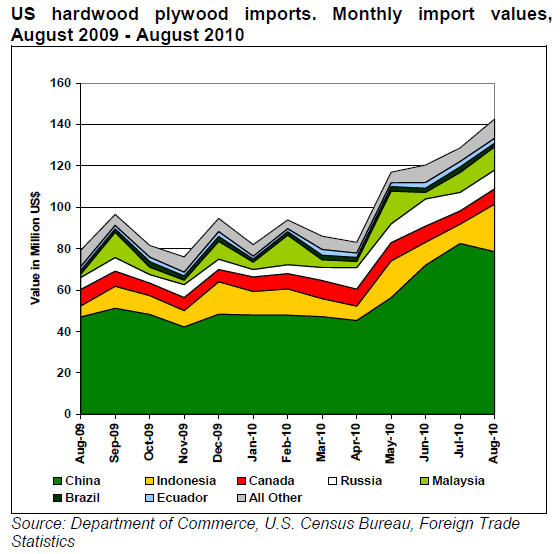

Hardwood plywood imports soar

US imports of hardwood plywood increased again in August 2010, mainly

because imports from Indonesia soared. Year-to-date imports were

US$853.3 million, up by 40% from the same period in 2009. Monthly

imports were worth US$142.5 million in August, up 11% from July. August

2010 imports from China were US$78.6 million (+34% year-to-date),

Indonesia US$22.9 million (+108% year-to-date), Malaysia US$11.2 million

(+325% year-to-date), Brazil US$1.7 million (+4% year-to-date) and

Ecuador US$2.7 million (+54% year-to-date).

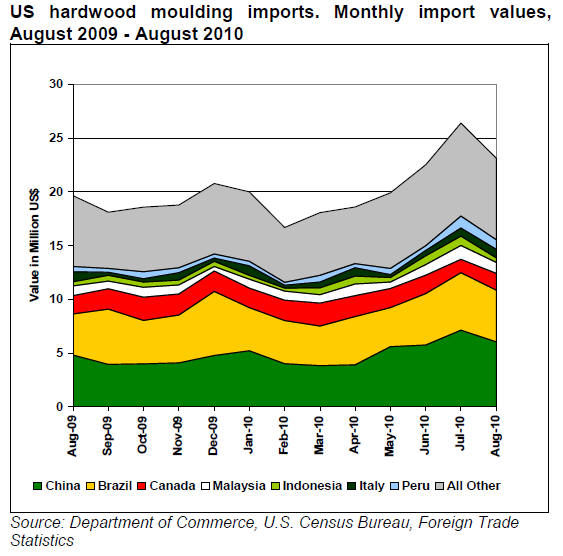

Hardwood moulding imports slip in August

US hardwood moulding imports were US$17.1 million in August, a decline

of 11% from the previous month. Year-to-date imports were US$123.9

million in August, up by 5% compared with the same period last year. The

largest year-to-date increase was in imports of cumaru mouldings (+39%),

while imports of mahogany, ipe and jatoba moulding declined compared to

the same period in 2009.

The US imported from Brazil US$2.1 million worth of jatoba moulding in

August (-11% from July), US$490,000 of ipe moulding (-9%) and US$332,000

of cumaru moulding (+4%). The value of cumaru moulding imports from Peru

continued increasing (US$539,000 or +6% from July).

China is the US¡¯ leading supplier of mouldings (US$41.5 million

year-to-date), followed by Brazil (US$34.8 million year-to-date).

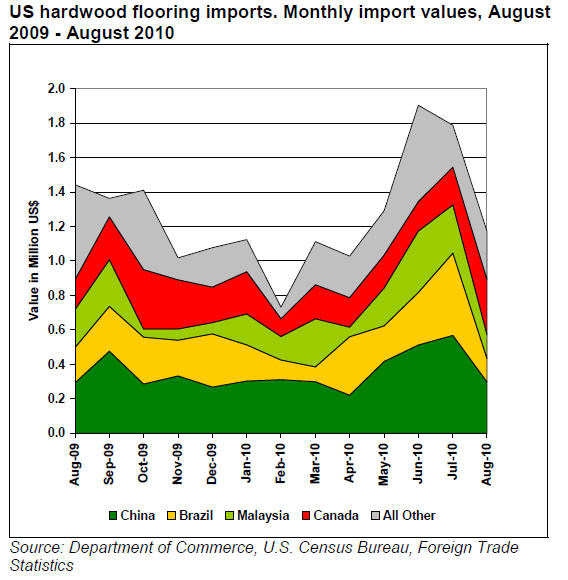

Hardwood flooring imports plunge

Hardwood flooring imports declined again in August after briefly

climbing in June and July of this year. Total August imports were valued

at just US$1.2 million, a 34% drop compared to July. Year-to-date

imports declined by 46% compared to August 2009. China is the country

most affected by this decline. August imports from China were just

US$296,000, a 69% drop compared to year-to-date August 2009. Of the top

suppliers, only Canada saw an increase in exports to the US. Of the

smaller hardwood flooring suppliers, Indonesia and Bolivia have been

able to increase exports this year (+14% and +22% year-to-date,

respectively). Hardwood flooring imports from Brazil were US$137,000 in

August (-9% year-to-date). Malaysia¡¯s exports were US$140,000 (-17%

year-to-date).

UNECE Timber Committee issues market statement and forecasts for US and

Canada

The United Nations Economic Commission for Europe (UNECE) Timber

Committee delegates met for their annual market discussions in Geneva on

11-12 October 2010. The US market review and outlook to 2011 was again

written by James Howard and David McKeever, both with the Forest

Products Laboratory in Madison, Wisconsin, while the Canadian Forest

Service prepared the market statement for Canada.

Residential construction is the single largest driver of wood products

demand in the US and Canada. Since the US housing crash in 2008 and

2009, the housing sector has not recovered and home construction is

forecast to remain weak throughout 2010. GDP growth has also been lower

than expected in 2010, and demand for wood products is unlikely to

recover before the second half of 2011.

Demand for sawn hardwoods is weak in North America, and US producers are

seeking to expand offshore markets. US sawn hardwood production

decreased by 28.6% to 16.5 million cu.m in 2009. Production is expected

to drop further to 15.5 million cu.m in 2010 and remain below 16 million

cu.m in 2011. US exports of sawn hardwood are forecast to increase from

1.7 million cu.m in 2010 to 1.9 million cu.m in 2011. Given the decrease

in US production, volatile trade figures, and a declining housing

market, apparent consumption of sawn hardwood for 2010 is forecast to

fall below the 2009 volume (15.2 million cu.m) and increase slightly in

2011.

Tropical hardwood sawnwood consumption in North America (excluding

Mexico) is forecast to increase by 17% in 2010 and 29% in 2011 compared

with 2009 volumes. The projected growth will be in Canada, while

consumption in the US is expected to remain stable at 177,000 cu.m (2009

to 2011). For Canada, consumption of sawn tropical hardwood is expected

to grow from 34,000 cu.m in 2009 to 70,000 cu.m in 2010 and to 95,000

cu.m in 2011. While the Canadian economy is closely linked to the US

economy, the Canadian housing market, non-residential construction and

the renovation market have been less affected by the recession and are

recovering more quickly.

The full country market statements for the US, Canada, Europe and Russia

are available on the UNECE Timber Committee website: timber.unece.org

Related News:

|