|

1.

CENTRAL/ WEST AFRICA

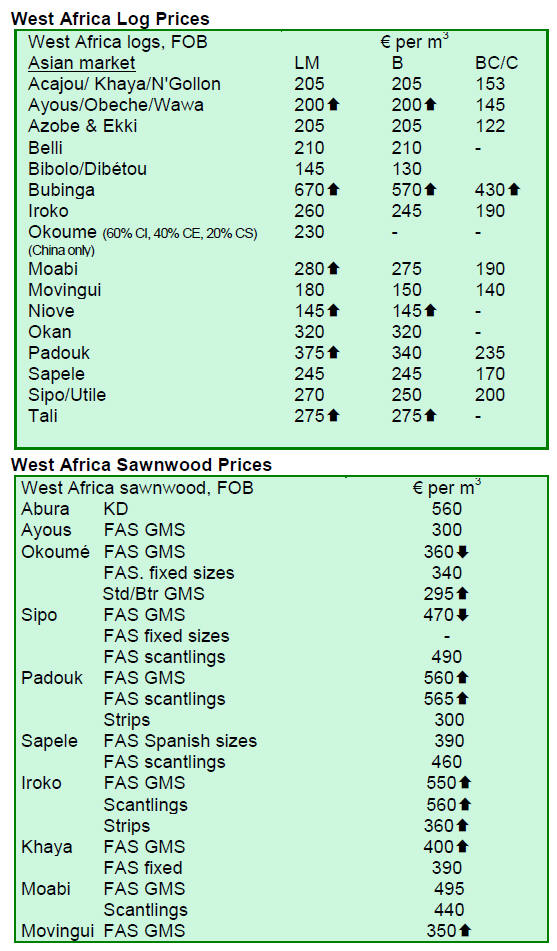

Strong demand pushes prices up

For the current quarter, West and Central African producers and exporters

report strong order books and firming prices for premier timbers. The log

export market reportedly continues to hold firm with traders confident of

market prospects till early 2011.

Meanwhile, Gabon log producers are selling their remaining logs in the

domestic market at prices much lower than were previously achieved in the

export market.

Okoum¨¦ log prices have gained further on steady demand from China, while

India and Vietnam also are buying their most favoured species, adding

stability to the market.

Sawnwood prices also experienced some substantial gains through the second

half of October, following earlier rises in August and September. Demand for

iroko is still very strong and prices for both logs and sawnwood continue an

upward trend. Sipo sawnwood is back in demand with China reportedly buying

species that were once bought almost exclusively by European importers.

Sapele log and sawnwood prices have held firm with demand steady over the

past three months. Demand for khaya logs and sawnwood has also improved in

October after a long quiet period, pushing up their prices.

Plywood and veneer prices have also strengthened and veneer manufacturers in

particular have strong order books into next year.

Inroads to US and Middle East markets

The recent interest of US buyers for khaya (African mahogany) and other red

colour species seems to have turned into firm demand. In addition, African

mahogany are at lower prices compared to South American mahogany (Swietenia

macrophylla).

West and Central African exporters have also been successfully trading

timber products to Middle Eastern countries and this business continues to

make good progress for the mix of lower grade timber products at highly

competitive prices.

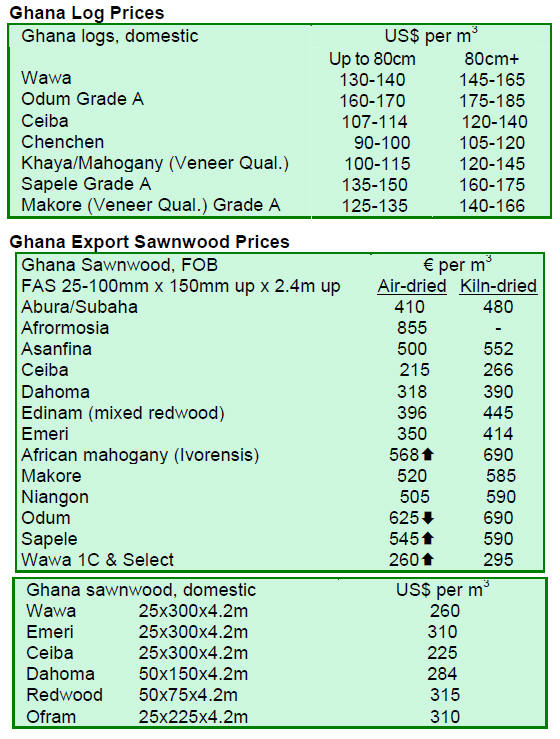

2. GHANA

More export permits for emerging markets

According to the Timber Industry Development Division (TIDD), during the

second quarter of 2010, the head office in Takoradi and its regional office

in Tema issued altogether 15 export permits for the shipment of rosewood

sawnwood (Pterocarpus erinaceus) to China. In terms of volume, the total

amount was 508 cu.m of rosewood sawnwood, worth Euro 166,468 shipped by

Nkoranza Sawmill, Geavag Company Ltd, Effedan Services Ltd, Chester Wood

Supply & Company Ltd and Trust Wood Company Ltd.

In the second quarter of 2010, altogether 57 export permits were issued for

several timber companies to ship teak billets, poles and logs to India,

totaling 4,272 cu.m. In addition, a total of 16 export permits (2,439 cu.m)

were issued in Takoradi for the shipment of Gmelina billets and poles to

India.

One export permit for 151 cu.m of rubberwood sawnwood was issued in Takoradi

for Best Glow Wood Ltd for shipment to Malaysia.

3.

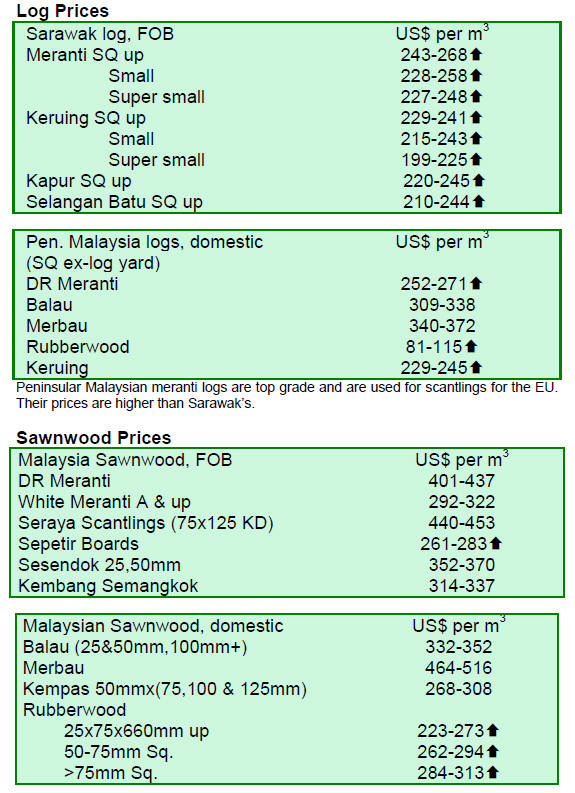

MALAYSIA

Joint effort to promote use of rubberwood

Malaysia and Thailand have agreed to promote jointly the use of rubberwood

by sharing information concerning the regional and international markets for

rubberwood products. A Memorandum of Understanding (MoU) was signed between

the Malaysian Timber Council (MTC), Malaysian Timber Industry Board (MTIB),

Malaysian Furniture Promotion Council (MFPC), Thai Parawood Association and

Wood Processing Industry Club of the Federation of Thai Industries, earlier

this year. Following the signing of the MoU, the Malaysia-Thailand Parawood

Committee (MTPC) was established with the chairmanship and secretariat to be

rotated between the various parties in these countries.

In Malaysia, there are 1.02 million hectares of rubberwood plantations while

in Thailand the rubberwood plantation area is 2.6 million hectares. In 2009,

Malaysia exported wood and timber products worth RM522.8 million to

Thailand, with the major export articles being sawnwood, plywood, wooden

furniture and particleboard.

Rating scheme to improve competitiveness of SMEs

The Malaysian Timber Industry Board (MTIB) in collaboration with the Small

and Medium Sized Enterprises (SMEs) Corporation Malaysia have initiated a

rating scheme to evaluate the performance of SMEs operating in the timber

sector in Malaysia.

The new rating scheme ¡°SME Competitiveness Rating for Enhancement¡± (SCORE)

includes several parameters such as business performance, financial

management, innovation, management and technical capabilities, production

capacity and quality control systems. The purpose of this new rating system

is to enable SMEs to maintain and improve competitiveness in the

international market.

There is an urgent need for the Malaysian timber sector to improve SMEs¡¯

competitiveness as the total export value of wood and timber products fell

14% from RM22.8 billion in 2008 to RM19.5 billion in 2009. The furniture

sector remains the major contributor to total timber product exports with

RM6.28 billion, representing a 32% share of the total export value in 2009.

However, operators in the timber sector are optimistic that the sector will

improve on its 2009 performance. According to the Malaysian Timber Council,

the timber sector is forecast to lift exports by 10% to RM21 billion in

2010. For the first seven months of this year, exports were valued at RM12.3

billion, up 14% over the same period in 2009.

The certification of wood and timber products is expected to improve the

competitiveness of Malaysian timber products and create more international

markets. To date, a total of 160 certificates for chain-of-custody have been

issued under the Malaysian Timber Certification Scheme (MTCS). This is in

addition to the total of 10 forest management units holding valid

certificates under the same scheme covering a total area of 4.83 million

hectares of natural forests.

No time frame for signing of VPA

According to the Ministry of Plantation Industries and Commodities, there is

no time-frame for signing the EU Forest Law Enforcement Governance and Trade

(FLEGT) Voluntary Partnership Agreement (VPA).

However, the EU has indicated that it would like to have the VPA in place

before the EU Illegal Timber Law enters into force in 2013.

4.

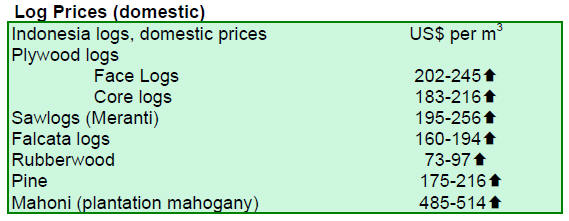

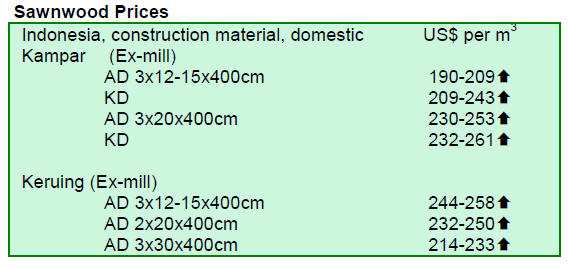

INDONESIA

Arrangement in place for moratorium

Indonesia is set to formally start the implementation of the 2-year

moratorium on new permits to convert natural forests and peatlands next

year, as a presidential decree was expected to be issued before the end of

October 2010. This will pave the way for the country to begin receiving a

grant of US$1 billion from the Norwegian government. The Ministry of

Forestry Indonesia is preparing a new set of regulations to implement the

moratorium.

The moratorium is part of the Indonesian government¡¯s effort to reduce

greenhouse gas emissions by 26% before 2020 as outlined in the National

Action Plan on Climate Change (RAN-GRK). With more support from the

international community, Indonesia hopes to reach a higher emission

reduction target of 41%.

The moratorium will be carried out primarily in Papua, Kalimantan and Aceh

where primary forests and peatlands remain largely unexploited. There are

still around 40 million hectares of natural forests and over 21 million

hectares of peatlands in Indonesia.

Norway is to provide a total of US$200 million for the first phase of the

implementation of the moratorium with the first disbursement of US$30

million to be made in 2010. In 2011 and 2012, US$70 million and US$100

million will be disbursed respectively. The balance of US$800 million will

be disbursed gradually after 2013 based on forestry sector emissions

reduction parameters.

A pilot project will be carried out in one of the proposed areas: Jambi,

Riau, East Kalimantan, Central Kalimantan and Papua. The Office of the

Coordinating Minister of Economic Affairs will select the pilot project area

based on biophysical, social, economic and cultural criteria. The pilot

project will place more emphasis on measuring, verifying and reporting

methodologies.

Indonesia ready for talks on illegal timber with Malaysia

The Ministry of Forestry Indonesia announced that it is preparing to begin

negotiations with Malaysia on allegations that Malaysia has been a

destination point for illegally harvested logs from Indonesia. A Memorandum

of Understanding (MoU) is expected to be signed between Indonesia and

Malaysia to address the issue of timber smuggling.

According to the Ministry of Forestry Indonesia, it has received reports on

smuggled Indonesian timber particularly merbau in the Chinese market,

originating from Malaysia and Singapore. Indonesia and China have already

signed an agreement to eradicate trade in illegally harvested timber and

China is discouraging illegally sourced merbau from entering the Chinese

market.

Aerial seeding for reforestation in South Sulawesi

Officials in South Sulawesi in collaboration with the Kalla Group and the

Hasanuddin University have conducted an experiment of reforestation through

aerial seeding. To date, up to 2 tons of seeds of trambesi and sengon tree

species have been sowed from the air in Moncongloe village in Manuju

district, Gowa region.

The South Sulawesi Forestry Agency noted that it needed a cost-effective

method to reforest a wide land area. The governor of South Sulawesi added

that much money had been spent in the past for reforestation but with poor

results.

The new method of aerial seeding using helicopters is expected to reach

remote areas which could not be reforested using conventional methods. The

plan is to reforest all damaged forest areas in South Sulawesi during the

next 2 years and obtain visible results in 5 years. Twenty helicopters will

be used in this programme to treat up to 100 hectares of damaged forest per

day.

5.

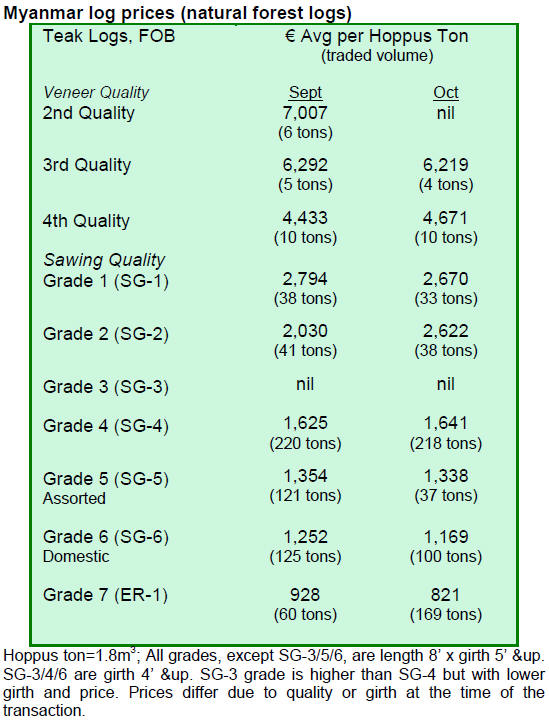

MYANMAR

Slight

improvement in market situation

Both teak and pyinkado markets have marginally improved from the previous

months. However, while traded volumes of pyinkadoe logs are up, the prices

still remain at low levels.

The market for Gurjan logs is subdued and dealers are reportedly having

substantial stocks. The inventories are expected to increase as the dry

season and new harvests begin in November.

Purchases of Myanmar hardwoods by country in October

Purchases of Myanmar hardwoods by country during October 2010 were as

follows: India (3 buyers, 264 Hoppus tons), Thailand (3 buyers, 245 Hoppus

tons) and Hong Kong (1 buyer, 47 Hoppus tons). In the domestic market there

was one buyer, with 59 Hoppus tons in volume.

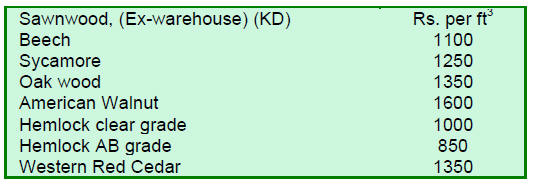

6. INDIA

Industrial output surge

In August 2010, India¡¯s Industrial Output Index jumped 26.5% over the level

recorded in August 2009. For the first five months of fiscal 2010, the

increase in industrial output was 10.6% compared to the same period last

year.

India faces rising housing shortage

According to a World Bank report, India faces a housing shortage of up to 70

million houses. High economic growth, rapid urbanization and rising middle

class have created considerable demand for housing.

The report emphasized the critical role of the private sector in providing

sustainable and affordable housing solutions for lower income groups, as

public sector housing projects alone could not meet the rising demand.

Red sandalwood seized

Nhava Sheva customs recently seized some 20 tonnes of red sandalwood (Pterocarpus

santalinus) which was set to be smuggled out of the country as aluminium

connectors.

The seizure at Nhava Sheva customs was the fifteenth this year for red

sandalwood with false transport documentation. The total seizure during the

current year amounted to 230 metric tonnes of red sandalwood worth Rs.210

million.

Red sandalwood is used in medicines and musical instruments, with Tibet and

Japan being the major markets. Besides Nhava Sheva port, red sandalwood has

been seized at Kandla port and ports on the east coast.

Shipments through land routes have been seized at northern border customs.

According to an expert, large scale commercial plantations may be the

solution to the problem of illegal harvesting of red sandalwood from natural

forests.

Clone technology for increased wood production in teak, eucalyptus and

acacia

Clonal propagation techniques for the mass production of teak, eucalypts and

acacia have been tested by the Kerala Forest Research Institute (KFRI) in

collaboration with several other institutes and industrial establishments.

The techniques involve macro- and micro- propagation of genetically superior

trees.

Forty to fifty years old plus trees of teak (Tectona grandis L. f.), were

cloned using a technique comprising two major steps: production of juvenile

epicormic shoots on branch cuttings obtained from plus trees and rooting

these shoot cuttings. Through this process it takes about 90 days to produce

100 rooted plants from 10-15 branch cuttings. With the introduction of

clonal teak plantations, a 3-4 fold increase in productivity can be

expected.

KFRI has also tested a clonal propagation method for five species of

eucalyptus and four species of acacias. Some of the best eucalyptus clones

have reached a mean annual growth of 71 cu.m per hectare, more than 10 cu.m

per hectare greater than in conventional plantations in Kerala state.

7. BRAZIL

Strong rebound in tropical sawnwood

exports

In September 2010, exports of timber products (excluding pulp and paper)

increased 8.9% to US$206 million from US$190 million in September 2009.

Exports of tropical sawnwood gained in terms of both volume and value, from

46,600 cu.m worth US$21.4 million in September 2009 to 51,300 cu.m valued at

US$23.8 million in September 2010, representing 10.1% increase in volume and

8.7% in value.

In contrast, exports of tropical plywood continued to fall by 22.6% from

6,200 cu.m in September 2009 to 4,800 cu.m in September 2010. In value

terms, the drop was 23.9%, from US$10.9 million to US$8.3 million.

Pine sawnwood exports increased 6.5% in September 2010 compared to September

2009, from US$13.9 million to US$14.8 million. However, in terms of volume,

exports fell 10.5% from 72,300 cu.m to 64,700 cu.m over the period.

The value of pine plywood exports gained 2.9% in September 2010 compared to

the level in September 2009, from US$24.1 million to US$24.8 million.

However, export volumes plunged 20.2% during the period, from 84,600 cu.m to

67,500 cu.m.

For wooden furniture, the value of exports rose 1.9% compared to the level

in September 2009 to US$49.2 million in September 2010.

Mixed performance of wood product exports over the past 12 months

Total exports of timber products including pulp and paper totalled US$6.3

billion, a 19% increase over the past 12 months. However, in August and

September 2010, declines in wood product exports were recorded. Pulp and

paper exports were the main products contributing to improved total timber

exports.

Exports of wooden furniture, softwood and hardwood sawnwood decreased over

the past 12 months. However, exports of these products increased from August

to September 2010 by 2%, 4.6% and 21% respectively.

Softwood and hardwood plywood export volumes declined during the past 12

months, by 23% and 15% respectively.

Argentina emerges as top market for Brazilian furniture

From January to August this year, Brazilian furniture exports grew 14% from

US$441 million during the same period last year to US$502 million.

During the period, Brazilian furniture exports to Argentina jumped 93%

compared to the same period last year, from US$39.6 million to US$76.6

million. As a result, Argentina became the biggest market for Brazilian

furniture exports followed by the US, France and the UK.

Year-to-date furniture exports to the US slipped 7% from US$64.1 million

recorded in the same period last year to US$59.6 million this year.

The increases in furniture exports to Chile and Uruguay were significant

during this period, up 43% and 41% respectively. Furniture exports to these

countries totalled US$41 million in value between January and August 2010,

compared to US$29 million in the same period in 2009.

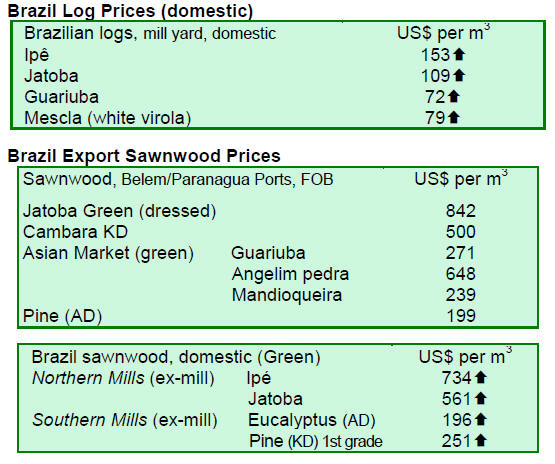

Timber product prices remain unchanged

The average price of timber products in Brazil remained unchanged from the

previous fortnight. However, prices in US dollars increased 2.9% due to the

strength of the Brazilian currency against the US dollar.

Economy is on track for growth

According to the Brazilian Institute of Geography and Statistics (IBGE), the

Consumer Price Index (IPCA) in September 2010 increased 0.45% over the level

recorded in September last year. The IPCA index for September 2010 was also

well above the August rate of 0.04%. The accumulated IPCA for the first nine

months of the year was 3.6%, a 4.7% increase over the past 12 months.

In September 2010, the average exchange rate to the US dollar was

BRL1.72/US$ compared to BRL 1.82/US$ during the same month of 2009, showing

further strengthening of the Brazilian Real against the US dollar over the

period.

The Copom (Economic Policy Committee) kept the prime interest rate (Selic)

at 10.75% per year in September. This is the second month in a row that the

prime interest rate is kept unchanged.

Illegally harvested timber seized in Sierra Morena

A joint operation by the Brazilian Institute of Environment and Renewable

Natural Resources (IBAMA), the Federal Police and the National Indian

Foundation (FUNAI) resulted in the seizure of about 1,000 cu.m of illegally

harvested roundwood in the indigenous reserve of Sierra Morena.

IBAMA reported that some 50 native Brazilians with bows and arrows blocked

the access of inspectors to the area. According to the Federal Police, 22

trucks, 4 tractors, and 2 vans loaded with logs have been seized in Aripuanã

since the beginning of October.

Wood identification course for Federal Police

The Brazilian Forest Service conducted a wood identification training course

for Federal Police officials. The lack of knowledge on wood identification

hinders enforcement operations as federal police inspectors have not been

able to validate timber loads against the timber transport documentation.

The identification process is important as falsification of documentation of

timber species is common.

The wood identification software used in the course was developed by the

Forest Products Laboratory of the Brazilian Forest Service. It provides 60

different timber characteristics, such as colour, smell, growth rings and

porosity of 158 tree species in the country.

8.

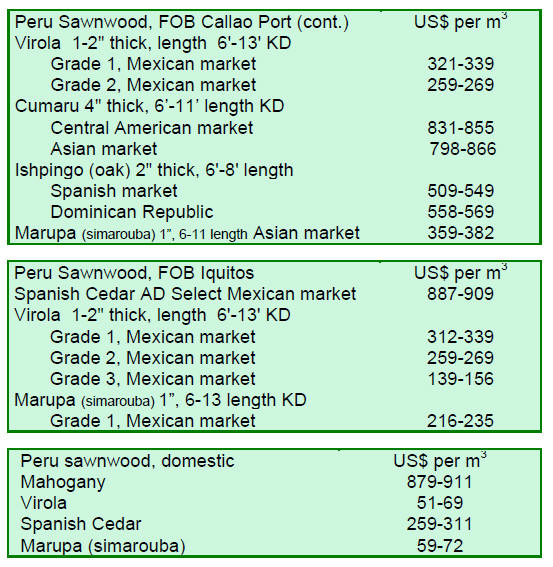

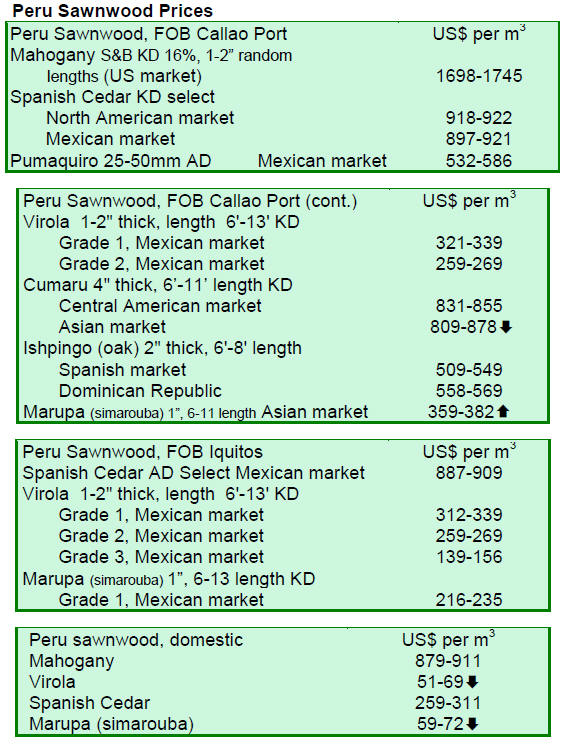

PERU

Wood and timber product exports still below pre-crisis levels

From January to August 2010, exports of wood and timber products totalled

US$114 million, up 30% compared to the same period last year, according to

the Extractive Industries Management Association of Exporters (ADEX).

Despite the significant rise, the result is still lower than the level of

US$155 million recorded in the same period of 2008. In fact, wood and timber

product exports from January to August 2010 were 26% less than the exports

made during the same period in 2008.

During the period, the main timber products exported from Peru were

semi-manufactured products with a 46% share of the total export volume,

worth US$51.9 million.

Sawnwood and veneer/plywood exports amounted to US$39.2 million and US$10.9

million in value respectively.

Exports of furniture and its parts declined slightly by 3% compared to the

same period last year to US$ 4.4 million.

According to ADEX, the top five importers of Peruvian timber products during

the period from January to August 2010 were China, Mexico, US, Dominican

Republic and Italy.

Third FENAFOR fair held in Lima

The 3rd International Fair of Machinery, Equipment and Services for Wood and

Furniture (FENAFOR) was held from 21 to 23 October 2010 at the National

University of Agraria La Molina.

At the fair, some 120 companies producing forestry machineries showcased

their products. In addition, around 30 technical presentations were made by

several national and foreign specialists at the fair. Presentations were

made on low impact harvesting, sustainable forest management, forest

products processing and value-added forest products. The next FENAFOR will

be held in October 2012.

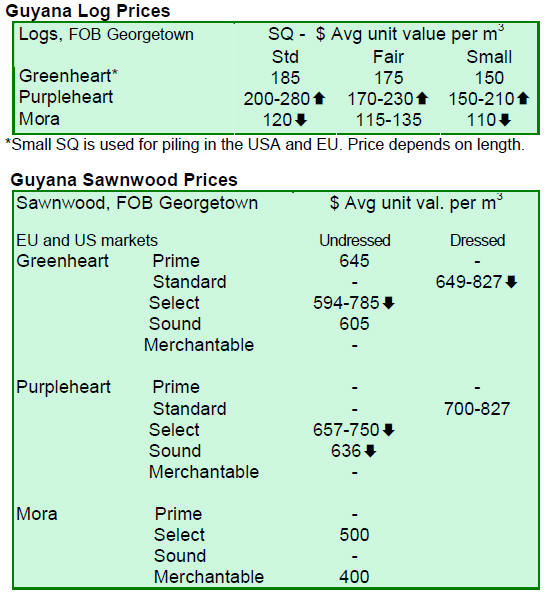

9. GUYANA

Brisk log trade

During the period under review, greenheart and purpleheart logs were on

demand attracting higher average prices for all categories. Mora log prices

retreated for standard and small sawmill quality.

For sawnwood, prices declined in the period under review. Undressed

greenheart (prime) prices remained stable while undressed purpleheart prices

fell. Average prices for undressed mora remained steady. Dressed greenheart

prices slipped while undressed purpleheart prices remained unchanged.

Baromalli plywood attracted a favourable average price for this fortnight

period. Roundwood, fuelwood, poles and piles contributed to the total export

earnings with good average prices and with the US being the major

destination. Splitwood continued to attract buyers in the Caribbean market

at high average price.

For the period under review, exports of value-added products rose. The major

exported products were doors, outdoor garden furniture, windows, spindles

and mouldings made from greenheart, purpleheart, locust (courbaril, jatoba)

and Guyana¡¯s lesser used species darina (angelim). These products were

exported to the Caribbean, European and North American markets.

Affordable core homes for low-income families

The Housing Ministry of Guyana has initiated a project that will provide 113

affordable wooden homes for low income families. The Central Housing and

Planning Authority (CH&PA) of Guyana confirmed that the project will be

implemented in Lusignan and Tabatinga. The project¡¯s financing will be drawn

from the Inter-American Development Bank¡¯s fund for the implementation of

the Second Low Income Settlement Programme, which has a total programme

financing of US$27.9 million.

According to the project plan, the core houses provided are 330 square feet

with timber and concrete structure. A house can be improved and expanded by

its owner up to 743 square feet in total residential area.

Wooden building components used in the houses are affordable and enables the

expansion work and recycling. Wood also adds to better ventilation to

houses.

Related News:

|