Japan Wood Products

Prices

Dollar Exchange Rates of

14th Oct 2010

Japan Yen 81.18

Reports From Japan

Strong Yen pushes CIF prices down

According to the Japan Lumber Reports (JLR), CIF log prices in Japan retreated thanks to the strong Yen. In fact, log export prices (FOB) continued to rise due to log shortages in Sabah and Sarawak. Log importers have been sourcing logs swiftly as the approaching rain season is going to affect log supply.

At Tanjung Manis port in Sarawak, meranti regular log export prices gained US$5 per cu.m from month ago to US$230 per cu.m FOB and some suppliers were even asking for US$240 per cu.m. Small meranti prices inched up to US$200 per cu.m FOB. JLR anticipates that with the arrival of these shipments in Japan in November, log CIF prices will firm again.

In Japan, Sarawak meranti regular log CIF prices levelled off by Yen 100 per koku from August to Yen 7,100 per koku. Small meranti logs were priced at Yen 6,000 per koku and super small at Yen 5,800 per koku.

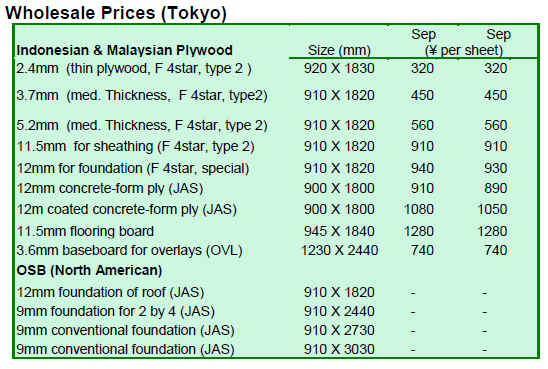

The appreciating Yen has the effect of making imported plywood cheaper in Japan dragging down all plywood prices. As a result of low plywood prices, plywood mills in Japan utilising imported tropical hardwood logs are maintaining much reduced production levels, reports JLR.

Petition on wood used in public buildings by timber importing associations

Wood and timber product import associations/groups including Japan Lumber Importers’ Association, Japan North American Lumber Conference, Japan South Sea Lumber Conference, Russian Sawmillers’ Conference of Japan and New Zealand Sawmillers’ Conference of Japan sent a petition to the Forestry Agency of Japan to address both domestic and imported wood use in public buildings, reports JLR.

The law promoting wood use in public buildings and aiming at increasing the degree of self-sufficiency in industrial wood consumption in Japan came into effect on 1 October 2010. The law states that wood to be used in public buildings shall be domestic or others. According to the groups, the law gives the impression that domestic wood is strongly recommended instead of imported wood products.

The group requested the Forestry Agency to provide more options on making decision between domestic or imported wood products. They also commented that the target of 20% wood use in public buildings will be difficult to achieve without imported wood products.

Increased use of falcate plywood in flooring

Japanese building material manufacturer, Daiken Corporation, uses structural 9mm floor base boards in floor manufacturing. Falcate plywood has increasingly been used in floor base boards to produce standard flooring and since August 2010 the company has been using only falcate plywood to produce base boards, reports JLR.

Daiken’s monthly sales of standard flooring have been around 140,000 tsubo (460,000 square metres). By switching to certified falcate plywood base boards, Daiken Corporation is said to raise the use of eco-materials in its production from 35% to 60%. The new standard flooring with 100% falcate plywood base board core will be marketed as ‘Forestia S’.

Plans to increase plantation plywood supply

Plywood manufacturer in Sarawak Malaysia, Ta Ann Plywood, produces 25,000 cu.m of plywood from both plantation and natural logs monthly. According to JLR, the company’s usage of plantation and certified wood is 50% of the total wood consumption, while the balance is hardwood logs from natural forests. The company intends to increase the use of certified wood from sustainable sources to 75% in the next three years.

The company manages 30,000 hectares of fast growing Eucalyptus, Acacia hybrid and Acacia mangium plantations and in addition slow growing kalampayan plantations for plywood face and back. Some 100,000 cu.m of wood is harvested annually from 500 hectares plantation area which was planted in 1997. In addition, the company imports 13,000 cu.m of PEFC certified eucalyptus veneer produced by Tan Ann Tasmania, a joint venture with Sumisho & Mitsuibussan Kenzai Co.,Ltd, per year. Europe and Japan are the main markets for structural plywood and floor base boards produced by Ta Ann.

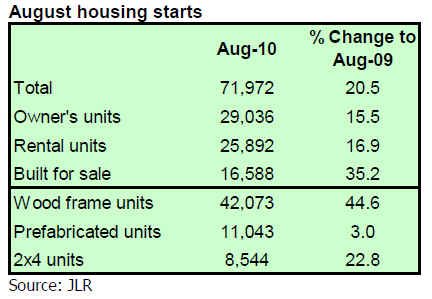

August housing starts still far lower than pre-crisis levels

Total housing starts in Japan during August were 71,972, up 21% from the lowest level recorded in August last year. The housing starts increased for the third consecutive month this year and the level of 70,000 units was exceeded for the first time in 19 months. The seasonally adjusted housing starts grew 7.4% compared to levels in July. Wood frame units were up by 21% and these constituted about 59% of the total housing starts in August. According to JLR, the overall situation is improving but still subdued, as the housing starts in August this year are the fourth lowest ever recorded.

European oak sawnwood to Japanese market

According to JLR, ENBC Ltd. (Tokyo) starts marketing European oak sawnwood in the Japanese market. Oak sawnwood is manufactured by Grupo Ureta Maderas (Burgos, Spain) in its two mills located in Poland and Ukraine with annual outputs of 25,00 cu.m and 20,000 respectively.

In addition, Grupo Ureta Maderas is building a wood drying facility in Hungary with an annual production capacity of 30,000 cu.m of kiln dried sawnwood.

Oak sawnwood supplied by Grupo Ureta Maderas is kiln dried and certified European oak with thicknesses of 27, 32, 38, 50, 65, 80 and 100 mm. Square sizes are 50, 65, 80 and 100 mm.

JLR reports that there have been no significant exports of European oak sawnwood to Japan due to the high prices. However, the appreciation of Yen against the Euro and the low manufacturing costs in Eastern Europe have lowered the prices to competitive levels.

Related News:

|