Japan Wood Products

Prices

Dollar Exchange Rates of

14th Sep 2010

Japan Yen 83.10

Reports From Japan

Strong Yen impacts log imports

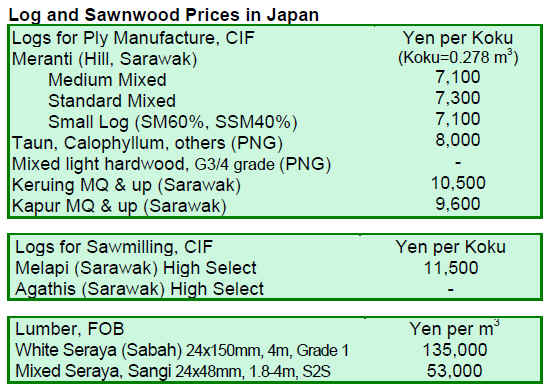

South East Asian log prices have been climbing since the beginning of the year but recently the appreciating Yen has translated into lower prices for Japanese buyers and further declines are anticipated if the Yen appreciation continues, reports the Japan Lumber Reports (JLR).

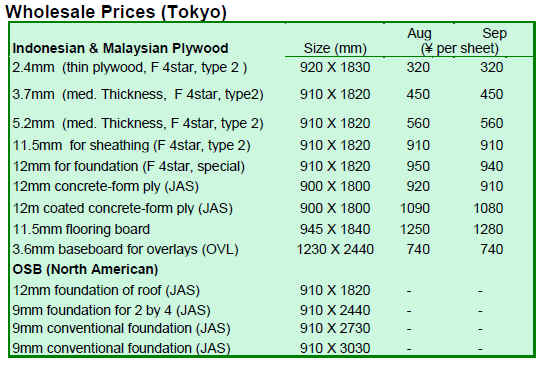

Plywood mills in Japan utilising imported tropical hardwood logs are maintaining much reduced production levels. The JLR says that, because plywood demand in Japan remains very subdued and prices are low, mill output is being kept at around 70% of full capacity and consequently log imports have fallen. In addition, the appreciation of the Yen against the main currencies has had the effect of reducing Japanese exports thus weakening demand for hardwood logs used for wooden crating. As a result of the low level of tropical log consumption for plywood production and the lower consumption of logs for crating, monthly tropical log consumption in Japan is now only around 45,000 cu.m.

Meranti log exporters in Sarawak are retaining a bullish stance on pricing as log supplies in Sarawak are tight. Sarawak meranti log prices reached US$216 per cu.m FOB for regular logs and US$185-190 per cu.m FOB for small logs. Log export prices in Sabah for kapur logs stood at US$270 per cu.m FOB.

In Japan, CIF prices remained relatively stable from August at Yen 7,400-7,600 per koku for Sarawak meranti regular logs while prices for small meranti logs levelled off to Yen 6,400-6,600 per koku, the result of the strong Yen. The JLR is reporting that, as the Yen appreciated to the level of Yen 88/89 to the dollar, there were signs that wholesalers were reducing prices by as much as Yen 200 per koku for plywood logs.

Tropical hardwood log inventories in Japan continue to be low and the JLR reports on continued delays in shipments from Malaysian Tanjung Manis port.

Japan’s timber imports from North America pick up

The Japanese Yen exchange rate has now reached Yen84/US$ and Yen105/Euro. The appreciation of Yen against US dollar and Euro benefits North American and European timber exports to Japan, reports the JLR.

However, tropical timber export prices quoted in US dollars are tending to increase as currencies in South East Asian countries appreciate. This undermines the competitiveness of South East Asian timber against the European and North American imports by Japan.

North American sawnwood imports to Japan totalled 1,333 million cu.m in the first half of 2010, up 26% from the same period last year. In the same period, log imports from North America amounted to 1,477 million cu.m, 22% more than in the first half of 2009.

In the first half of 2010, the total volume of European sawnwood imports to Japan dropped by 12% due to supply problems in the major supplying countries in northern Europe. However, imports from other European countries picked up significantly during the first half of 2010.

Law to promote wood in public buildings

A law promoting wood use in public buildings was approved in May 2010. In order to implement this law, local governments around Japan have started preparations.

The government of Kyoto prefecture introduced regulations on the utilisation of domestic wood in public buildings. Shizuoka prefecture disclosed a policy to promote the use of domestic wood in one and two storey public buildings. In Yamanashi prefecture domestic timbers have been used since 2002 in interior decoration of public buildings and the government of Yamanashi is now reformulating a new local wood procurement policy.

In general, the law applied in the prefectures seem to especially promote the use of domestically grown timber. The law will come into effect within six months from its approval in May 2010.

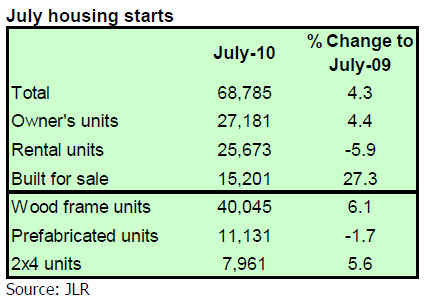

July housing starts

Total housing starts in Japan during July were 68,785, the second consecutive month of increase. However, even though housing starts grew 4.7% compared to levels in July last year, the figure for July 2010 is the second lowest ever recorded.

In July, building of publicly financed housing units surged by 70% from July last year as a result of the government’s stimulus measures. Wood frame units were up by 6.1% and these constituted about a 58% share of the total housing starts in July.

Related News:

|