|

1.

CENTRAL/ WEST AFRICA

Log supply meeting demand

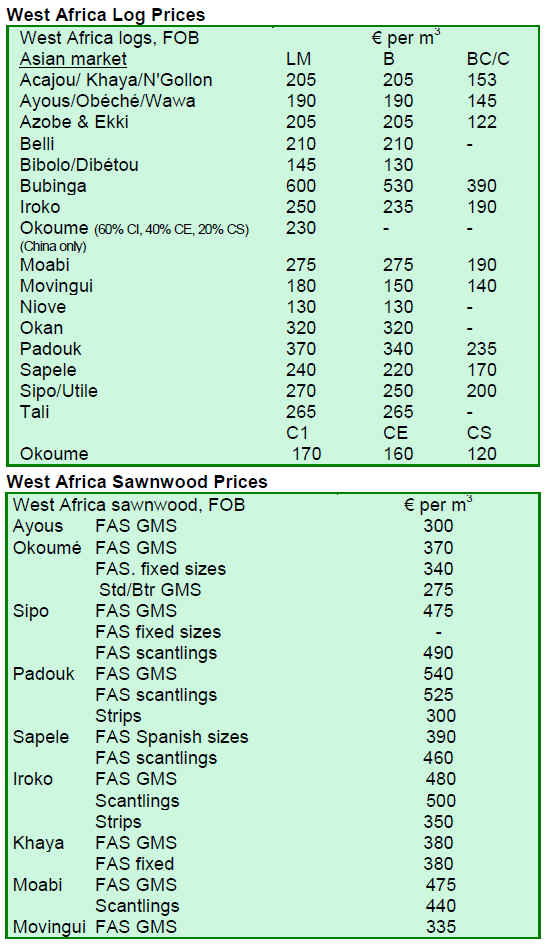

Central and West African log markets remain steady with balanced supply and demand. Log prices are firm and the recent price increases for some species seem to have been accepted by buyers. Sapele and sipo logs are in good demand for European and Asian markets.

After the frenetic log buying triggered by the Gabon log export ban in mid May, the market has entered into a more steady state and the supply of logs from Cameroon and Congo Brazzaville is now able to meet current demand.

Stable sawnwood market

Demand for sawnwood has also remained steady and prices are holding firm with some adjustments for particular specifications. Sawmills in the region continue to have strong order books with deliveries extending into the 4th quarter. Analysts say the market outlook for the final quarter and for the first months of 2011 is difficult to forecast due to mixed signals on the pace of economic recovery in consumer countries. However, analysts report that West African shippers are confident that the current market stability will be maintained into 2011.

While some European countries are showing fairly good economic growth, the building activity in Spain and Portugal remains subdued, a situation that may last up to two years, say analysts.

If a sudden improvement in market demand occurs, producers in West and Central Africa would seem to have the advantage of shorter lead times and lower freight costs to Europe compared to competitors from South East Asia. In addition, prices for South East Asian timber products have moved up fast during the past few months while West and Central African timber prices have been more stable.

Efforts to promote Gabon¡¯s processing industry

According to some sources, the government of Gabon may, some time in the future, modify the log export ban. Perhaps the framework applied in Gabon would be like the system in Cameron where the export of non-prime species is permitted.

However, so far there is no indication that the government of Gabon intends to make any changes to the log export ban. The government is said to be planning measures to secure inward investment by offering new investors tax free status for up to ten years. According to analysts, this treatment could have a positive effect stimulating the plywood and veneer sectors in the country.

Currently, some larger timber companies are reportedly exporting close to 80% of their total sawnwood and veneer production. There are also reports of higher sawnwood production and increased overseas investments in processing.

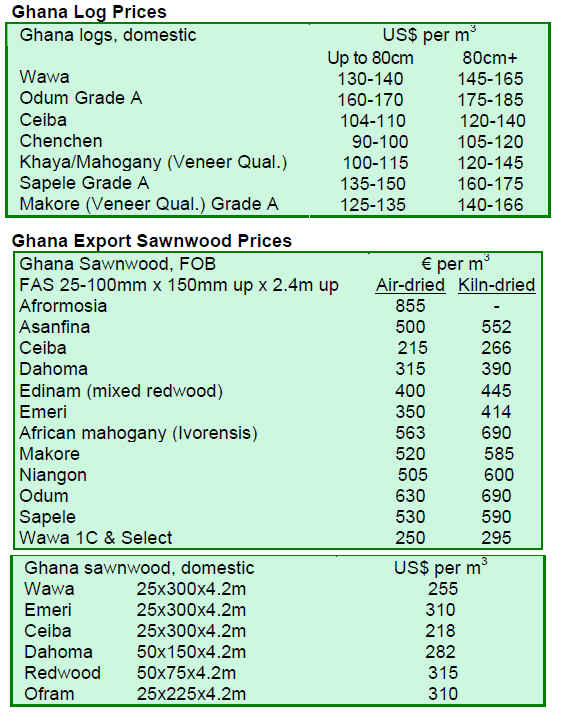

2. GHANA

Exports improve during the first half of 2010

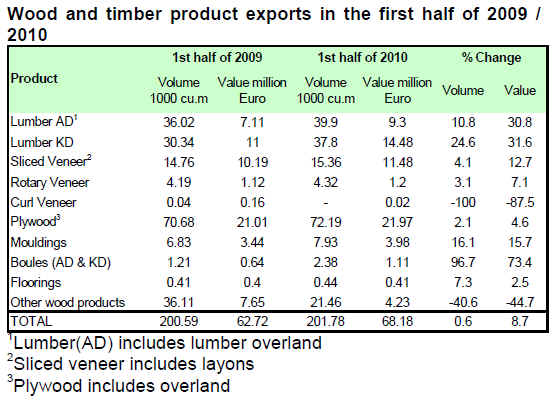

According to the Timber Industry Development Division (TIDD) of the Forestry Commission, wood and timber product exports from Ghana totalled 201,780 cu.m earning Euro 68.7 million in the first half of 2010, compared to 200,590 cu.m and Euro 62.7 million in the same period last year. The volume of exports increased by 0.6% and the value by 8.6% compare to the first half of 2009.

In the first half of 2010, all timber product exports except furniture exports showed some increases compared to the same period last year.

In the first half of 2010, the export volumes of air and kiln dried sawnwood grew 10.8% and 24.6% respectively, compared to the same period last year.

For the period under review, exports of primary products, including poles and billets, were valued at Euro 3.8 million in 2010 compared to Euro 7.2 million in 2009. The export value of secondary timber products increased from Euro 51 million in the first half of 2009 to Euro 60 million in the same period 2010.

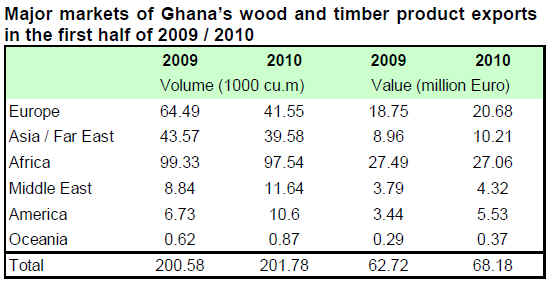

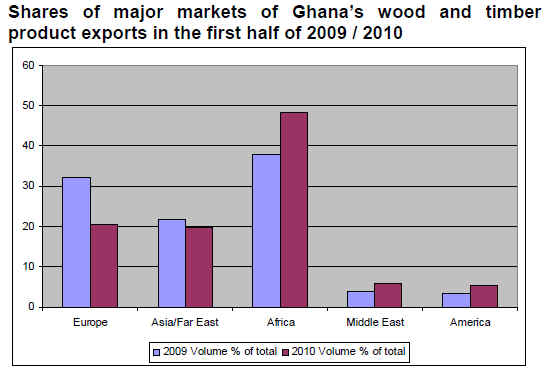

Exports of wood and timber products from Ghana to other African countries amounted to 97,538 cu.m worth Euro 27 million in the first half of 2010. The share of African exports of the total timber exports from Ghana increased significantly from 38% in the first half of 2009 to 48% in the first half of 2010.

In Europe, the major importers were Italy, France, Germany, the UK, Belgium, Spain, Ireland and Holland. Wood and timber product exports to these countries amounted to 41,500 cu.m in volume and Euro 21 million in value, accounting for 21% and 30% respectively of the total wood and timber product exports.

Exports to the US accounted for just 5% in volume and 8% in value of the total wood and timber product exports from Ghana, while the comparable numbers were 3% and 5% in the first half year period last year.

3.

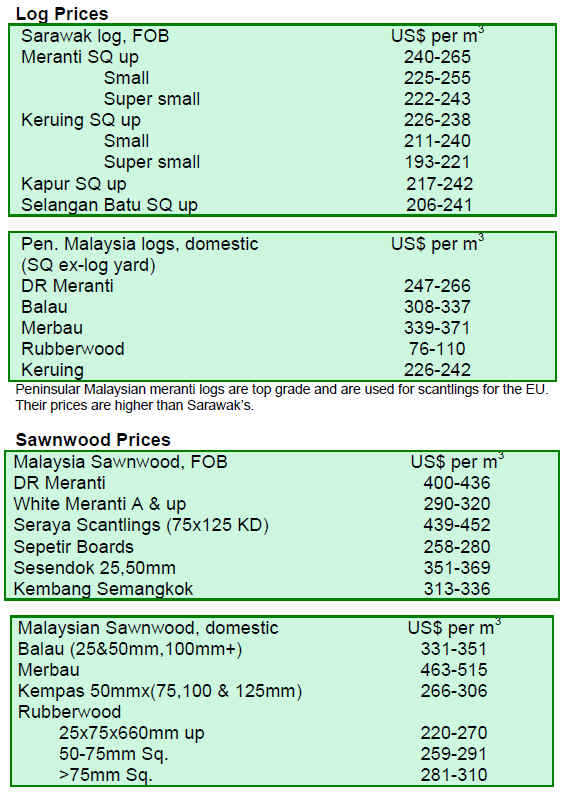

MALAYSIA

Appreciation of Ringgit upsets furniture export forecast

Due to the appreciation of the Malaysian Ringgit against the US Dollar and the Euro, exports of Malaysian timber products are expected fall below the earlier forecast level of RM9 billion for the current year. A more realistic forecast is now RM8 billion, says the Malaysian Furniture Entrepreneurs Association (MFEA).

The appreciation of the Malaysian Ringgit has increased sharply since the beginning of the year. Currently, the average exchange rate is around RM3.15/US$ compared to RM3.40/US$ in January 2010. Similarly, the Ringgit to Euro exchange rate is now around RM4.05/Euro compared to RM4.80/Euro in the beginning of the year.

The Malaysian Ringgit has also strengthened against the Chinese Yuan, from RM0.50/Yuan in January 2010 to RM0.46 currently, however, Malaysian furniture exports to China have continued to grow, posting a 26% increase in the first half of 2010 compared to the same period in 2009.

Meanwhile, the overall exports of Malaysian furniture expanded 11% to RM3.95 billion in the first half of 2010, compared to RM3.54 billion in the same period last year.

Office furniture exhibition in Saudi Arabia

Malaysian furniture companies will participate in the first office furniture exhibition to be held in Saudi Arabia at the Jeddah Center for Forums and Events on 12 - 15 December 2010.

More than 46 million square metres of office space is estimated to be completed in the global markets over the next 2 years. In the Middle East, the King Abdullah Economic City in Jeddah as well as the zero-carbon Masdar City in Abu Dhabi are examples of innovative projects offering new business opportunities for furniture manufacturers.

Saudi Arabian companies have started to appreciate the value of office decoration and furnishing as means to improve workplace wellbeing and productivity. Since 2009, consumption of interior decoration materials and furniture in Saudi Arabia has exceeded US$4 billion.

Market quiet during annual festival

As usual during the annual Islamic festival Eid-ul-Fitr, the timber industry output slowed down. The festival climax was on 10 September 2010 and business is expected to resume within a week thereafter.

4.

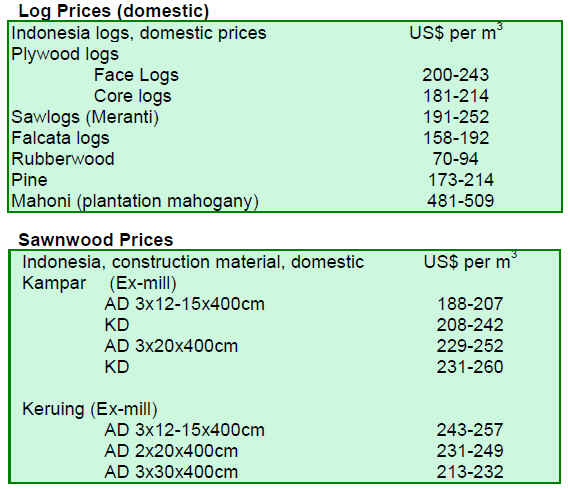

INDONESIA

Revision of regulations on illegal logging

The Indonesian government is currently revising the 2005 presidential regulations on illegal logging in order to comply with the partnership agreement between Norway and Indonesia and to attract foreign investment. The new regulations are expected to be ready for implementation by June 2011.

According to the Indonesian Ministry of Forestry, more than 2 million hectares of forests have been illegally converted to oil palm plantations. In addition, 800 mining and oil palm companies have been operating without authorisations or permits.

The ministry added that the new regulations will enable law enforcement across all sectors against illegal activities in forest areas.

Trade slowed down

Business activity in all industries slowed down in Indonesia for the annual Islamic festival Eid-ul-Fitr on 10 September 2010, business is expected to return to normal within a week thereafter.

5.

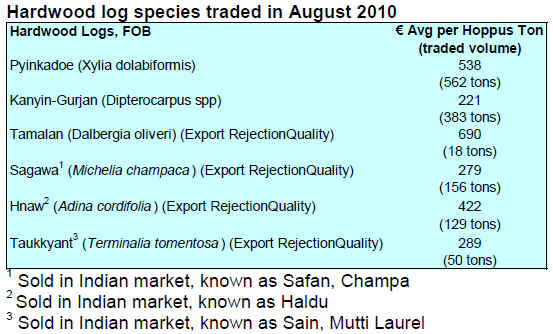

MYANMAR

First TMA furniture fair

The Yangon Lifestyle Furniture Exhibition is being hosted by the Thousand Islands Business Group under the Timber Merchant Association (TMA) between 16 and 19 September 2010 at the Tatmadaw Hall in U Wisara Road, Yangon.

Luxury furniture, household furniture, garden furniture, rattan and bamboo furniture, and traditional Chinese furniture among others will be displayed at the fair. The TMA stated that this is the first exhibition ever held by the TMA in collaboration with various private companies.

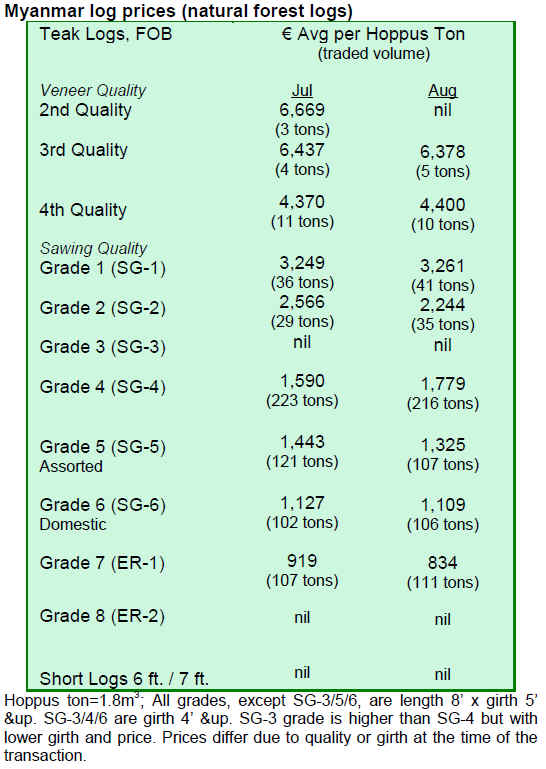

Country-wise purchases during August

Country-wise purchases of Myanmar hardwoods during August 2010 were as follows: Singapore (2 buyer, 70 Hoppus tons), Thailand (3 buyers, 305 Hoppus tons), India (1 buyer, 41 Hoppus tons) and Hong Kong (1 buyers, 61 Hoppus tons). In the domestic markets there were three buyers and the timber sales totalled the amount of 153 Hoppus tons.

Pyinkadoe logs were purchased by a Thai buyer and Tamalan logs were purchased by a Singapore buyer to Chinese market. Pyinkadoe logs fetched US$800-1,000 per Hoppus ton in Myanmar Timber Enterprise (MTE) direct sales contracts, however, only an average of US$681 per Hoppus ton in MTE tender sales.

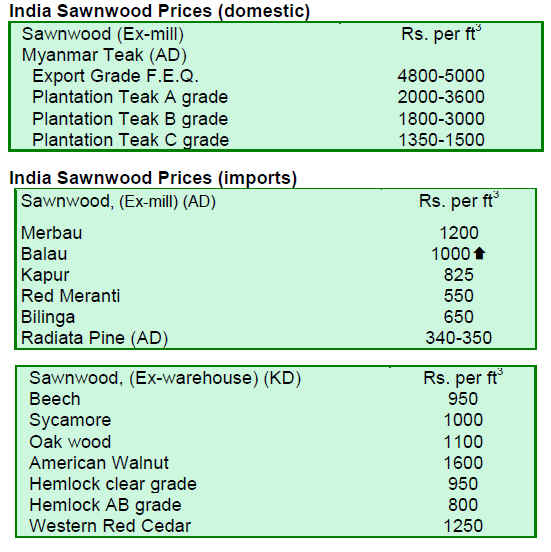

6. INDIA

Robust growth prospects for building sectors

With net annual population growth of 1.5% India gets more than 15 million new residents per year. Because incomes are rising there is a strong demand for housing and as a result, the construction sector in the country is booming, marking a 6.5 % growth for fiscal year 2009-10 against 5.95% for 2008-09.

India¡¯s real estate sector accounts for 4.5% and urban housing sector 3.1% of the country¡¯s Gross Domestic Product (GDP). Over the next five years, the housing sector¡¯s contribution to GDP is expected to grow to 6% and attract investments up to US$12 billion.

Due to rapid urbanisation, the commercial real estate sector is also estimated to increase at an annual rate of 20-22%. Construction of airports, universities, special economic zones, sports centres etc. are expected to attract investments worth US$9 billion by 2013.

Indian furniture industry expects growth

India¡¯s furniture industry output value is estimated at US$8 billion for fiscal 2009-10, with products being sold worldwide. As in many other timber processing sectors in India, the share of small and medium sized companies in the furniture sector is high accounting for around 85% of the total output, while the balance comprises large and organised manufacturers and exporters. As a result of the growing housing and tourism sectors and rising per capita incomes, furniture sector output is expected to grow by 15% per year for the next five years.

The furniture sector sources a significant share of raw materials from local agro forestry plantations. Plantation species include sissoo (Dalbergia sissoo), babul/kikar (Acacia arabica), mango (Mangifera indica) and neem (Melia azadirachta) and they are mostly used to produce antique style furniture.

Large scale plantation areas managed by industries and farmers have been promoted by the government to increase the wood supply. The present sustainable harvest from agro-forestry plantations is around half a million cubic meters per year. As a result of improved wood availability, over 150 sawmills have been reopened which has generated business and employment in the sawmilling sector. In addition, some 58 new industrial licenses for medium and large scale wood working units are pending for Kandla region.

Rising alternative products

Another growing sector in Indian domestic and export market is paper / plastic laminates. The sector output is estimated at US$430 million in value in fiscal 2009-10 and is expected to grow 8% per year. Laminate products produced by new factories with modern technologies are considered as cheaper alternatives to plywood in interior decoration.

Similarly, the manufacture of overlaid particleboard is increasing. These boards are mostly used by the furniture industry supplementing the use of solid wood. Laminated flooring panels made from engineered wood are also in fashion replacing the solid wood flooring.

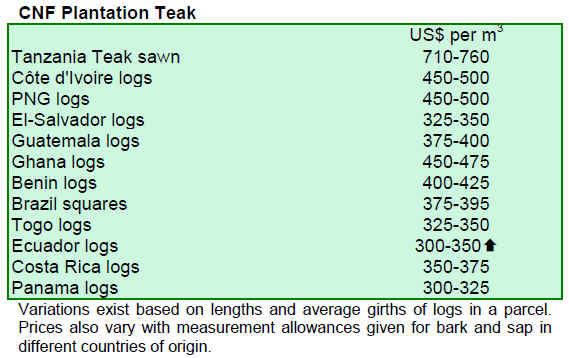

India is one of the largest consumers of all varieties of tropical wood and timber products imported mainly from Malaysia, Myanmar, Indonesia, Nigeria, Côte d'Ivoire, Ghana, Togo, and South and Central American countries. Despite the growing sector of alternative products, India is expected to continue importation of tropical wood and timber products in the future as economic prospects in the country are good.

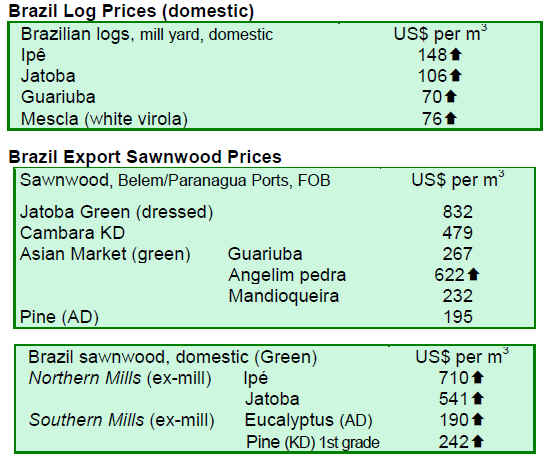

7. BRAZIL

Forest concessions in Par¨¢

The Forest Development Institute of Para (Ideflor) has released its Annual Forest Concession Plan (PAOF) for 2011. The plan identifies 1.5 million hectares available for forest concessions in six areas within the state.

However, only 800,000 hectares of the total will be auctioned in 2011. For example, the Iriri State Forest in the Xingu region with 200,000 hectares will not be auctioned before 2012. It was included in the PAOF as the establishment of the Management Council and the management plan are expected in 2011. Besides Iriri, there are three other concession areas; Mamuru/Nova Olinda II, Bacaja¨ª and Joana Peres II, where auctioning will take place after 2011.

According to the PAOF, for 2011 auctions will be held for two state forests: Faro and Paru. The concession process at Paru is almost completed and 500,000 hectares, divided into 10 plots, should be released for logging later this year. Besides these forests, the Brazilian Forest Service (SFB) will auction about 230,000 hectares for concession in the Crepori National Forest located in Tapaj¨®s region of Par¨¢ state.

Before announcing the final bidding plan, the Forest Service will have consultations with local communities, logging industry workers, the industrial sector and municipal authorities.

Timber tracking chip launched in Mato Grosso

An Electronic Forest Monitoring and Tracking System pilot project was launched in late August 2010 in the state of Mato Grosso in order to provide more information on the costs and operation of such a system. In addition, a law defining forest exploitation and transportation will be introduced to support the system.

The project objective is to adopt e-PMFS (Electronic Sustainable Forest Management Plan) in an area of 100 hectares in the municipality of Nova Mutum. In addition to the electronic forest monitoring and tracking system, the project applies digital technology for forest inventories.

The pilot project complies with the resolution of the National Council for the Environment CONAMA (No. 406/2009) and State Decree (No. 1862/2009) requiring public-private partnerships and alternative models to develop timber origin traceability.

Timber exports grow

In July 2010, exports of timber products (except pulp and paper) totalled US$169 million, representing a 5.9% increase compared to US$160 million exported in June.

However, total exports of timber products including pulp and paper stood at just US$689 million, down 6.8% from June 2010. According to the Center for Advanced Studies on Applied Economics (Cepea), pulp and paper exports in July were US$520 million in value, recording a 9% decline over the previous month¡¯s figure of US$579 million.

Promadeira 2010 fair promotes international timber trade negotiations

The largest tropical timber fair in Brazil, Promadeira 2010, was held in August 2010 in Mato Grosso. Altogether 149 companies from all over the country including foreign companies were represented at the fair. During four days of exhibitions, timber product sales yielded BRL70 million.

At the fair, a business roundtable was organised between domestic timber companies and international buyers from Portugal, England, Germany, USA and some Asian countries.

The Promadeira 2010 was organised by the Center for Wood Producers and Exporters of Mato Grosso (Cipem) and the Industry Federation of Mato Grosso (Fiemt System), attracting more than 13,000 visitors.

8.

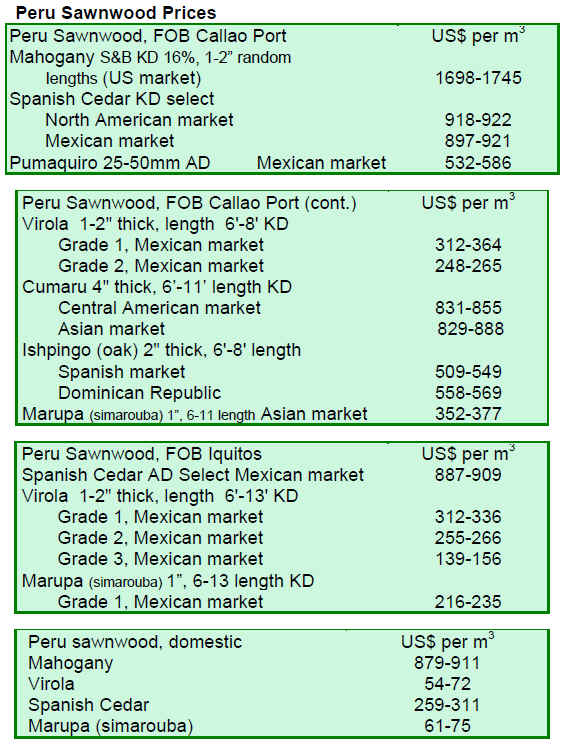

PERU

China is the main export destination for Peruvian wood products

Peru¡¯s timber exports were hard hit by the international economic crisis in 2009, but the latest statistics show a healthy recovery. In the first half of 2010, wood product exports reached US$82 million, representing a 31% growth from the same period last year.

China was the main market for wood product exports from Peru accounting for 52% of the total exports while the share was 27% in 2008. China increased its imports from Peru by 25% in the first half of 2010 compared to the same period last year.

Peru¡¯s wood product exports to NAFTA member countries increased 6% in the first half of 2010, but the share of total exports has dropped from 61% in 2008 to 35%. Mexico was the main importer in the NAFTA market accounting for 20% of the total wood product exports from Peru. Canada increased its import by hefty 116% in the first half of 2010 compared to the same period last year.

Member countries of the Andean Community of Nations (CAN), especially Colombia, increased imports of Peruvian wood products significantly by 72% compared to the first half in 2009. In addition, Chile and some Caribbean countries such as Venezuela, Puerto Rico and Dominican Republic increased their imports of wood products from Peru.

Peruvian semi-manufactured wood products including wood flooring and decking, strengthened their share as the main exported articles followed by sawnwood, veneer and plywood exports.

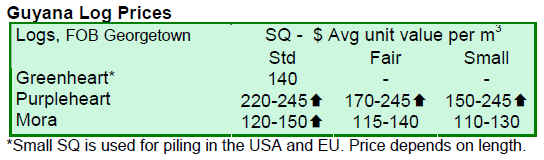

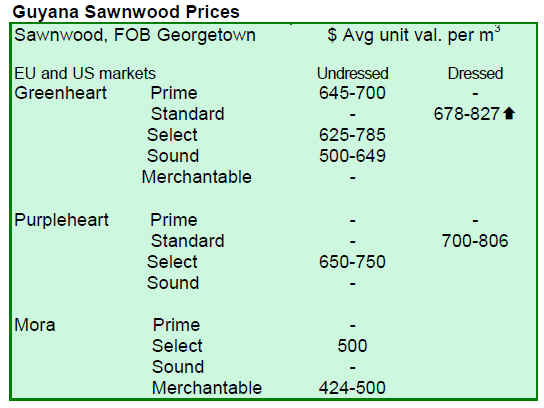

9. GUYANA

Favourable price increases

During the period under review, the market for greenheart logs showed some activity only in the standard sawmill quality. Purpleheart log prices gained in all categories. Mora log prices in standard sawmill quality rose while mora fair and small sawmill quality log prices remained unchanged.

For sawnwood, undressed greenheart earned higher average prices in all categories. Undressed purpleheart recorded increases in prices for select quality while undressed mora sawnwood prices remained relatively stable. Prices for dressed greenheart were favourable, while dressed purpleheart prices remained firm in this fortnight period compared to the previous one.

During the period under review, baromalli plywood fetched higher prices for both BB/CC and utility categories compared to the previous period.

Guyana¡¯s washiba (ipe) continues to be in demand attracting a price average of US$1,700 per cu.m. For the fortnight period under review, many of Guyana¡¯s Lesser Used Species including burada, darina, fukadi, iteballi, itikiboraballi and muniridan were exported to European and Asian markets as logs and sawnwood.

Roundwood and fuelwood (piles, poles, posts and charcoal) contributed to the total export earnings with favourable average prices. Splitwood attracted a price average of US$1,225 per cu.m, the major destination being the Caribbean market.

For the period under review, exports of value-added products gained. The major product category was doors with soaring average price of US$2,190 per cu.m, followed by windows (US$1,126 per cu.m) and indoor furniture (US$1,000 per cu.m). The main species used for added value production include crabwood (andiroba) and purpleheart (amarante).

LUS in promotion of sustainable forest management

The Forest Products Development & Marketing Council of Guyana Inc (FPDMC), the Guyana Forestry Commission (GFC) and the private sector are recognising that it is necessary to widen the utilisation of different species in order to increase value and profit from forests, without expanding the harvesting area. Fifteen Lesser Used Species (LUS) have been successfully tested and eleven additional species are identified for testing.

The key in expanding the species selection is the market demand. Guyana is pursuing this by promoting the processing of value-added wood products from LUS and introducing these products to the domestic and international markets.

The next step in this process is dissemination of wood property information that the FPDMC has already embarked upon sensitisation outreach programmes to stakeholders in the industry. In addition, a booklet ¡°Utilization of Lesser Used Wood Species in Guyana¡± is used to disseminate technical information on LUS.

Dissemination of wood property information is necessary so that the wood products manufacturers can become familiar with new wood species that may be applicable and available at affordable prices to consumers. As demand for these woods grows, so will the value of forests that are currently undervalued due to the exclusive appreciation of the main commercial species. This increase in value is important for the sustainable management of Guyana¡¯s natural forests and the future of its forest products industry.

Related News:

|