|

1.

CENTRAL/ WEST AFRICA

Log markets steady amid good demand

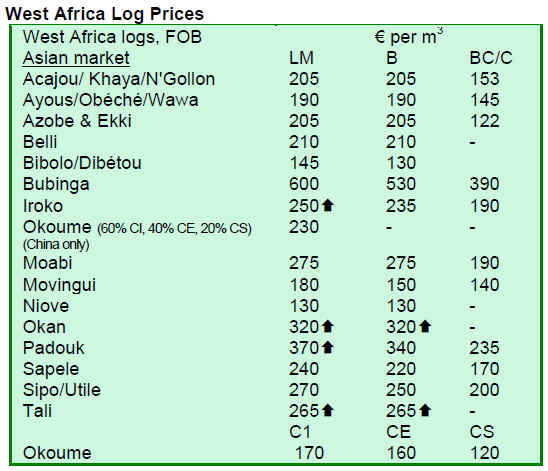

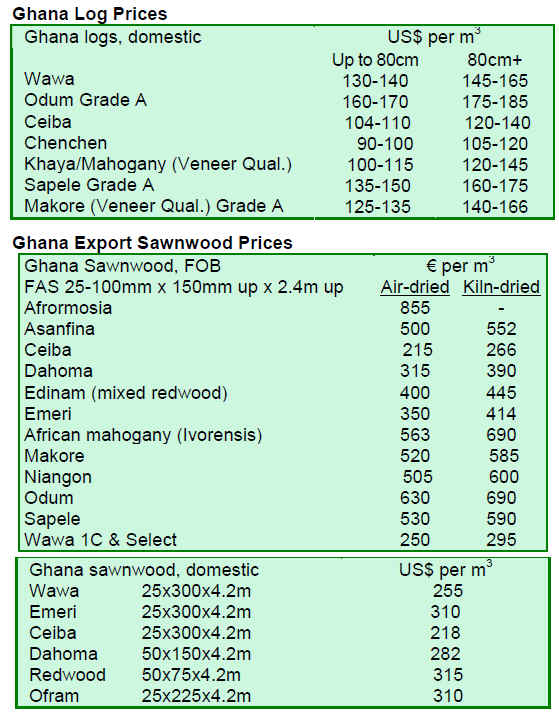

Central and West African log markets are reportedly steady with supply and demand fairly well balanced. In spite of adequate stocks, purchasing to China continues to be active. Buyers in India and Vietnam also remain as strong players in the market generating high demand for some specific species. Demand for okume is strong and is being met mainly with supplies from Congo Brazzaville and Equatorial Guinea. Demand for Azobe logs for the Netherlands has resumed and some shipments have also been made to Germany and China.

Log prices are firm with some occasional small adjustments following the upward trend in Malaysian log prices. West African shippers are now confident that the market and prices are likely to remain stable at least during the 3rd quarter.

Stable demand for sawnwood

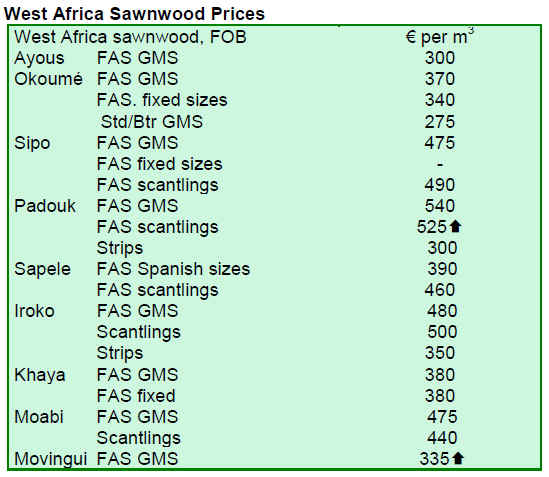

For sawnwood, market demand is also steady and sawmills are still having strong order books. Prices are firm with some small increases for few species such as padouk and bubinga. However, prices of these species tend to fluctuate according to changes in demand.

Demand from continental Europe has picked up slightly and this has kept sapele and sipo prices firm. Due to the lower availability and higher prices for some Brazilian species, US buyers are now showing more interest in West African redwood sawnwood e.g. khaya and sapele. Some of the larger international sawmillers in the West African region have global sales coverage and currently they seem to be active in expanding sales in the US market.

In the region, Ghana has pioneered the global sawnwood trade for many years while other producing countries are only now starting to look beyond their traditional UK and European markets. The UK market is slow and demand is unlikely to return for the time being, says an analyst. Currently, UK businesses are waiting for the government*s autumn spending review which is certain to bring some cuts in government expenditure in many sectors of the economy.

2. GHANA

Workshop on domestic timber market

The Timber Industry Development Division (TIDD) recently organised a National Consultative Workshop on Domestic Timber Market in Accra. At the opening, Mr. Samuel Afari Dartey, the Chief Executive Officer of TIDD, urged participants to find realistic solutions to the problem of domestic timber supply which has been hampering the sector development. The participants consisted of all stakeholders in the timber industry across the country.

FURNIDEC 2010 showcases local furniture

To promote local furniture, a 3-day Furniture and D谷cor Exhibition Fair (FURNIDEC 2010) was held in Accra. The fair was one of the measures taken by the local furniture producers in the country to improve the competitiveness of local furniture products in the global markets.

Progress in the implementation of NFPDP

The National Forest Plantation Development Programme (NFPDP) launched in January 2010 aims at restoring 30,000 hectares of degraded forest reserves by the end of year 2010. According to the performance review report, the implementation of the programme is progressing towards meeting the target in the various parts of the country. The programme implementation is supervised by technical officers from the Forest Service Division of Forestry Commission.

The programme also aims at creating jobs for the youth in programme areas, improving the ecosystem quality and contributing to food security.

In the Northern Ashanti region, more than 4,300 young people are employed under the programme in various plantation activities. A workshop was organised in the Volta Region to share ideas on how to address deforestation and degradation of forest reserves and promote

afforestation.

3.

MALAYSIA

Sarawak steps up imports of raw materials for domestic processing industry

Imports of wood and timber products from Australia, China, Japan, New Zealand, Papua New Guinea and the US by processing mills in Sarawak have continued to increase.

In the first half of 2010, 63,000 cu.m of raw materials worth RM63 million were imported by processing mills in Sarawak. These raw materials include logs, sawnwood, wood flitches and veneer. In comparison, around 118,000 cu.m of wood and timber products worth RM119 million were imported in 2009 and some 72,000 cu.m worth RM77.6 million in 2008.

During the first half of 2010, up to 95% of raw materials were imported from Australia comprising RM60.5 million worth of veneer which was processed into plywood. Imported sawnwood was processed into wood mouldings and wooden furniture.

As for log imports, Sarawak state limits importation to species which are not available locally. These logs are then processed into value-added products.

For the first half of 2010, Sarawak posted earnings of RM3.67 billion from wood and timber product exports, compared to RM6.59 billion for the whole year of 2009. Out of the total exports in the first half of 2010, 2.04 million cu.m were logs valued at RM974 million and some 1.46 million cu.m were plywood worth RM1.95 billion. Japan imported more than 50% of Sarawak*s total plywood exports.

New policy to promote commercial forest plantations

The Malaysian Timber Industry Board under the Malaysian Plantation Industries and Commodities Ministry announced in June a target of RM53 billion in wood and timber product exports by 2020.

In order to meet the target, the federal government is formulating a National Wood Industrialisation Policy to promote commercial forest plantation programmes.

The Forest Plantation Development Sdn. Bhd., a ministry*s programme agency, has to date granted RM1,045 million for local forestry companies to establish commercial forest plantations. The programme aims at establishing up to 375,000 hectares of forest plantations over a 15-year period at a rate of 25,000 hectares per year.

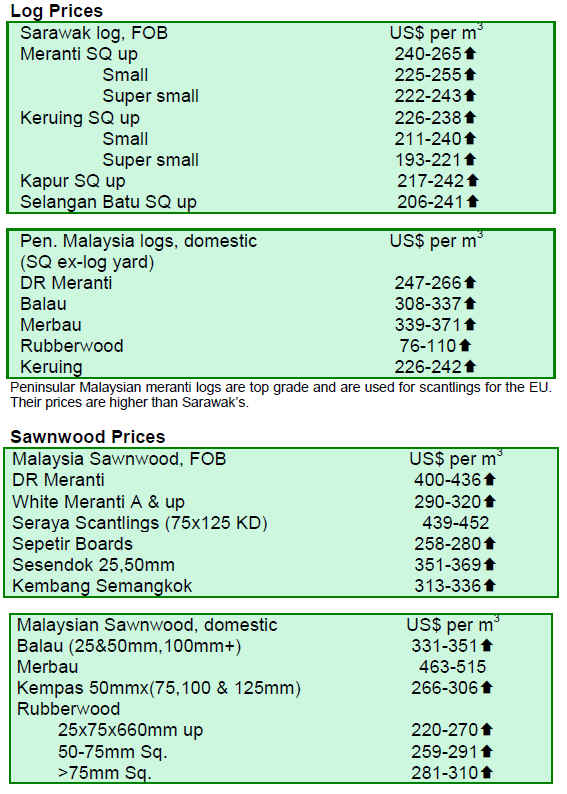

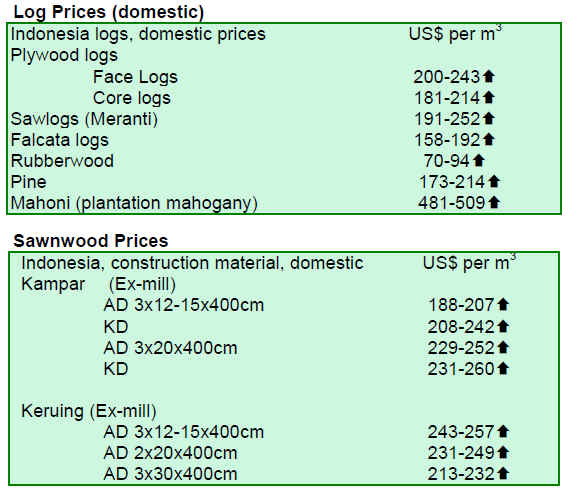

Market sentiment remains cautious

Prices of Malaysian timber products continue on an upward trend mainly due to the local currency*s appreciation against the US dollar. Sentiment among the traders, however, is cautious as the recovery of the US economy remains weak.

4.

INDONESIA

Appreciation of Rupiah hampers furniture exports

The Indonesian Handicraft and Furniture Industry Association (Asmindo) warned that the appreciation of the Indonesian currency against the US dollar is starting to have a negative impact on the industry. The Indonesian currency*s exchange rate has now reached Rp.8,900/US$.

Asmindo called on the Indonesian government to take proactive action to safeguard the furniture and handicraft industry.

Furthermore, the Euro has depreciated against the US dollar and Rupiah. As a result, Euro zone importing countries including Italy and Spain have been reluctant to buy from Indonesia. According to Asmindo, the EU is one of the major markets for Indonesian furniture.

The Indonesian furniture market grew 28% in June 2010 year-on-year, however, the continuing appreciation of the Rupiah could lead to the collapse of the local furniture industry, says the spokesman of Asmindo. In this regard, the next few months could be crucial to the industry. Some layoffs have already taken place in various regions in Indonesia including Jepara, Cirebon and Yogyakarta.

Progress in implementation of forest conservation projects

As part of the 2-year moratorium on new permits to convert natural forests and peatlands, the US$1 billion partnership agreement between Norway and Indonesia on forests conservation will protect at least 40 million hectares of a total of 100 million hectares of natural forests in Indonesia.

The Indonesian government intends to implement the moratorium and agreement gradually and in meeting the minimum measurable goals. At the same time, the position and requirements of forest concessionaires will be taken into account.

Details of the US$1 billion arrangement will be finalised by September and an initial funding of US$30 million will be released in October 2010.

The government will publish a forestry map on protected forest areas next year. The map will also outline areas under the 2-year moratorium.

5.

MYANMAR

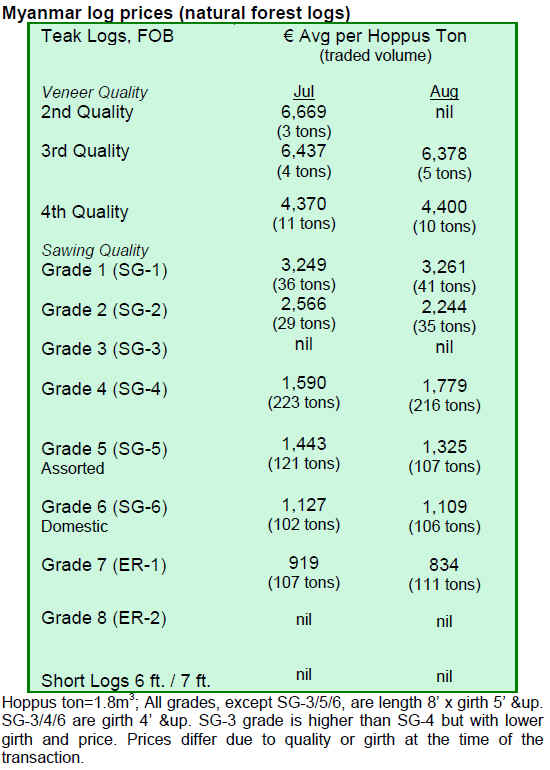

Market demand remains unchanged

The market situation for teak has remained unchanged over the past few months. Demand in the Indian teak market shows some activity while markets in China, Thailand and Vietnam are quiet.

Pyinkado and Gurjan logs are not selling well, say analysts. For the Gurjan logs, extremely dry weather conditions earlier this year lowered the river levels and thus hampered log transportations by rafts. It is reported that the Gurjan logs now available in Yangon are not fresh enough to attract buyers.

According to analysts, demand for teak in India will continue to be fairly strong in coming months, while other hardwoods may face difficult times.

6. INDIA

Indian plywood market poised for strong growth

Recently published annual reviews by plywood companies signalled growing demand for plywood and engineered panels. India*s annual plywood and panel product market is estimated at Rs.100 billion in value in fiscal 2009-10 and is expected to grow 20% per year. The plywood market in India is highly fragmented with small and medium sized companies accounting for almost 75% of the total market. The rest is supplied by large companies having the advantage of volume, quality and superior manufacturing facilities.

The sector has been suffering from increasing costs of raw materials among other challenges. As a result, importers are claiming for a revision of the current timber trade regulations. They contend that instead of a list of permitted species for import, a list of prohibited species would be more efficient as a wide range of species are now used in plywood manufacture.

Hardwood auctions

Auctions of teak in Central Indian depots continued to attract active buying. The total sales of teak logs were 8,000-10,000 cu.m with prices around Rs.50-75 per cft. higher than in the previous auctions at the end of July. Premium quality saw logs were priced at Rs.1,500 per cft., medium quality around Rs.1,000-1,200 per cft. and average quality attracted prices of Rs.800 per cft.

Higher imports of all hardwoods

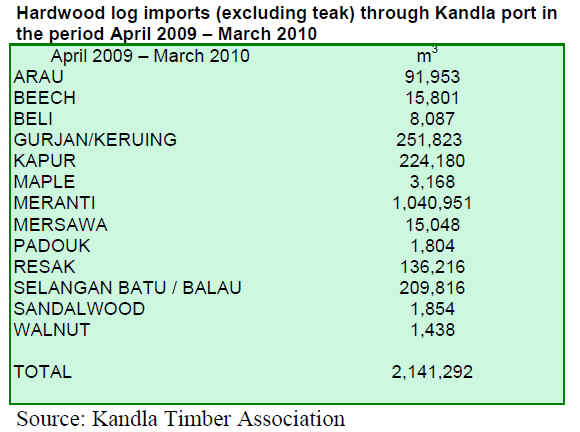

While teak market remains more or less stable, demand for other hardwood logs shows improvement. Malaysian balau, kempas, meranti, rengas and kapur are some of the species that are increasingly used to substitute teak in the local market.

In the period April 2009 每 March 2010, a total of 3,300,000 cu.m of logs were imported through Kandla port which accounted for 52% of India*s total log imports. Out of the total, around 327,000 cu.m were teak logs and 2,141,292 cu.m other hardwood logs. The following table presents hardwoods log imports through Kandla port in the period April 2009 每 March 2010.

7. BRAZIL

Tropical sawnwood exports on the mend

In July 2010, exports of timber products (except pulp and paper) increased by 24% from US$182 million in July 2009 to US$227 million.

After a decline in June, exports of tropical sawnwood improved in terms of both volume and value, from 44,600 cu.m in July 2009 to 45,400 cu.m in July 2010 and from US$18.9 million to US$21.1 million, representing 1.8% increase in volume and 11.6% in value.

Exports of tropical plywood continued to fall; from 9,500 cu.m in July 2009 to 8,800 cu.m in July 2010, down 7.4%. In value terms, the drop was 4.1%, from US$4.9 million to US$4.7 million.

After a decline in June, pine sawnwood exports increased 20% in July 2010 compared to the July 2009, from US$14 million to US$17 million. In terms of volume, exports rose 2.8% from 70,500 cu.m to 72,500 cu.m over the period.

The value of pine plywood exports jumped 39% in July 2010 compared to the level in July 2009, from US$22 million to US$30 million. However, export volumes decreased by 4.5% during the period, from 83,800 cu.m to 80,000 cu.m.

For wooden furniture, the value of exports rose slightly by 0.2% compared to the level in June 2009 to US$49.4 million in June 2010.

Volatility of tropical timber exports from Par芍

In the state of Par芍, timber product exports rose 7% in value during the first half of 2010 compared to the same period last year while export volumes increased by 3.9%. However, there was no significant boost in exports as forecast. In particular, exports eased towards the end of the period.

Despite the positive growth in the first half of 2010, exports have fluctuated since the beginning of the year. According to analysts, this is due to the fact that export markets have not fully recovered from the global financial crises.

Impact of new EU legislation on illegal timber trade

The European Union*s decision to ban the trade of illegal timber will not have any major impact on Brazilin timber sector in the short run, say a Brazilian analyst. The reason is that most of the Brazilian timber is sold in the domestic market and little goes to the EU. Brazil*s wood product exports are forecast to grow as the global availability of tropical hardwood is diminishing while the sustainable tropical timber supply from the Amazon rainforest has the potential to be increased. In the medium to long-run, the new EU legislation may work as an incentive to strengthen due diligence systems in Brazil to verify the legality of timber from Brazilian forests.

All in all, the new EU legislation is considered to have a positive effect on the Brazilian timber sector. As the short-term impact is estimated to be slight, this decision by the EU is expected to result in new attitudes amongst Brazilian timber producers.

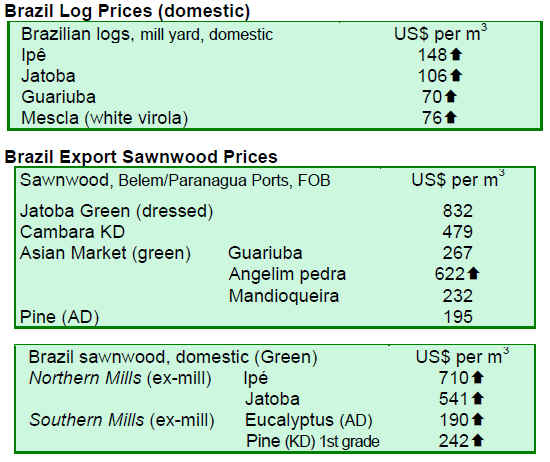

Timber prices in US$ rise

The price average of timber products in Brazil remained unchanged from the last fortnight period. However, the prices quoted in the US dollars increased by 1.70% due to the appreciation of Brazilian currency against the US dollar.

Economic growth remains steady

According to the Brazilian Institute of Geography and Statistics (IBGE), the Consumer Price Index (IPCA) of July 2010 remained steady at 0.43% increasing only slightly from June. The July*s figure is 0.24% higher than in same month last year. The accumulated IPCA for the first seven months of the year was 3.1%, posting a 4.60% increase over the past 12 months.

In July 2010, the average exchange rate was BRL1.77/US$ compared to BRL 1.93/US$ in the same month of 2009, showing further appreciation of the Brazilian Real against the US dollar over the period.

In an attempt to keep inflation within the targeted range, the Copom (Economic Policy Committee) raised the prime interest rate (Selic) to 10.75% per year in July, the third increase during the current year.

Logging in Par芍 state forests

The Promadeira, a major timber sector fair was held in August in Sinop, Northern Mato Grosso. At the fair, there was a public debate on concessions and harvests of public forests which have offered an alternative for timber manufacturers to source supplementary timber for industrial processing. The topic was debated by experts considering the legal aspects, requirements and criteria for harvesting set by the federal government.

Tapajos National Forest, also known as Tapaj車s Flonam, is the major public forest area in the Sinop region that has the potential to provide quality timber for the industry. Tapaj車s Flona is a natural forest area with a rich variety of commercial timber species suitable for different processing applications. Tapaj車s Flona is located in the Western Par芍, in the counties of Belterra, Aveiro, Rur車polis and Placas, accessible by the federal road BR-163. IBAMA (Brazilian Institute of Environment and Renewable Natural Resources) of the Ministry of Environment has approved the management plan of Tapajos Flona in 2005, which also specifies the allowable timber species to be harvested. The legal timber extraction in Tapaj車s Flona has recently started.

Brazilian Forest Service funds sustainable forestry projects

The National Fund for Forestry Development (FNDF) managed by the Brazilian Forest Service (SFB) has invited applications for sustainable forest project funding. The total estimated million) in 2010 aimed at strengthening forest management.

The Brazilian Forest Service announced that the FNDF is in line with the strategy introduced in Public Forest Management Law requiring a specific fund to support the forest sector. The FNDF will be implemented in cooperation with the National Environment Fund (FNMA), Forestry Board of Ministry of Environment and Chico Mendes Institute for Biodiversity Conservation (ICMBio).

In addition to resources from the executive agencies, the FNDF harnesses financial resources from forest concessions. With the expansion of public forest concession areas scheduled for 2015, the budget of FNDF will rise to BRL20 million (about US$11.4 million) per year.

8.

PERU

Wood product exports surge in first half of 2010

The Export Association of Peru (ADEX) has reported that June 2010 exports of wood products were US$ 18.2 million, up 50% from the levels in June 2009. In the first half of 2010, wood product exports reached US$82 million, representing a 31% growth from the same period last year.

Three biggest buyers were China, United States and Mexico, together accounting for 82% of the total export volume. In June, Taiwan P.o.C and Sweden increased their imports of sawnwood, plywood and decking materials compared to last year. Venezuela and Japan reduced their wood product imports significantly from last year, by 78% and 32% respectively.

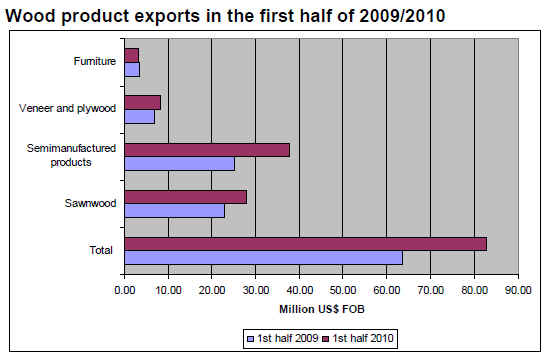

First half year exports in categories

In the first half of 2010, the main exported items were semi-manufactured products with a 46% share of the total wood product export volume. The exports totalled US$38 million representing a 51% increase over the first half of 2009.

Semi-manufactured products were exported mainly to China which accounted for 79% of the total first half year exports. Canadian and Israeli importers substantially increased their purchases of semi-manufactured products in June.

Sawnwood exports made up 34% of the total exports. In the first half of 2010, sawnwood exports totalled US$28 million, up 22% over the same period last year. The main destination was China with a 36% share of the total sawnwood exports.

Veneer and plywood exports in the first half of the year were valued at US$8.4 million, an increase of 22% over the same period last year. Veneer and plywood are exported mainly to Mexico which accounted for 95% of total exports.

In the first half of 2010, exports of furniture and its parts were valued at US$3.2 million, representing a 9% decline compared to the same period last year. The US is the main market for furniture accounting for 55% of the total exports. In July, there was some improvement in exports to the US and Italy, however, the first half year exports were down by 59% and 38% respectively.

9. Bolivia

Sharp jump in exports in first half of 2010

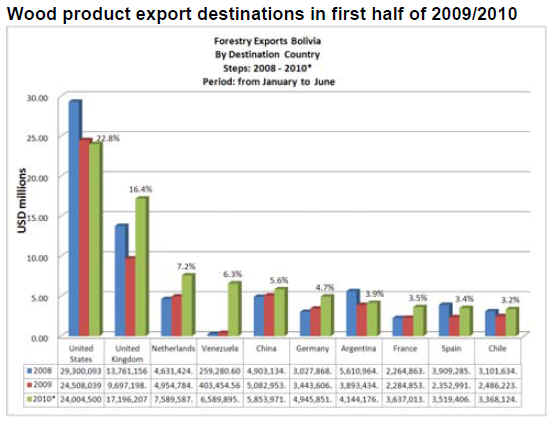

Forest product exports from Bolivia totalled US$105 million in the first half of 2010, up 33% from US$79 million in the same period last year.

Furniture, doors, panels, decking (as well as peeled chestnut and canned palm hearts) accounted for 82% of the total forest product exports, while the remaining 18% consisted of primary processed wood products, such as sawnwood and poles.

The US remains the major market for Bolivian forest products taking some US$24 million, which accounted for 23% of the total forest product exports from Bolivia. Other major export destinations were the UK (US$17 million), the Netherlands (US$7.6 million), Venezuela (US$6.6 million) and China (US$5.8 million).

10.

Guyana

Prices remain generally favourable

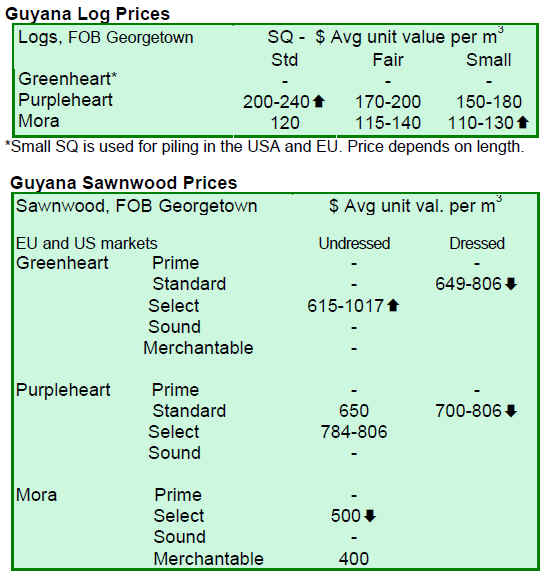

Compared to the previous fortnight period, log prices remained stable. Purpleheart and mora log export prices showed some increases while there were no greenheart log exports.

During the period under review, undressed sawnwood prices for select quality greenheart jumped to US$1017 per cu.m while mora undressed sawnwood prices were relatively stable. Prices for dressed greenheart and purpleheart sawnwood dropped in this fortnight period. Guyana*s Washiba (Ipe) is in demand fetching high prices at US$1,637 per cu.m.

The Baromalli plywood market showed some activity but only for utility category panels. However, prices were down. Splitwood, roundwood and fuelwood exports to the Caribbean and Germany also contributed to export earnings.

For the period under review, exports of value-added products were marginal with some orders for indoor furniture from the Caribbean market.

Chainsaw Milling Project launched

To enhance chainsaw milling in the country, the government of Guyana has launched a Chainsaw Milling Project with support from the EU in three pilot communities: Ituni, Orealla/Siparuta and the Annai District. Chainsaw milling is reportedly the main source of income for forest dependent communities in Guyana providing direct employment for approximately 8000 people.

Project stakeholders include federal agencies, chainsaw operators, community forestry associations, traditional sawmillers, different actors along the supply chain and persons with an interest in sustainable forest management.

According to the project management team in Guyana, progress has been made in the fields of baseline research and stakeholder engagement.

Related News:

|