|

1.

CENTRAL/ WEST AFRICA

Log trade calm after recent surge

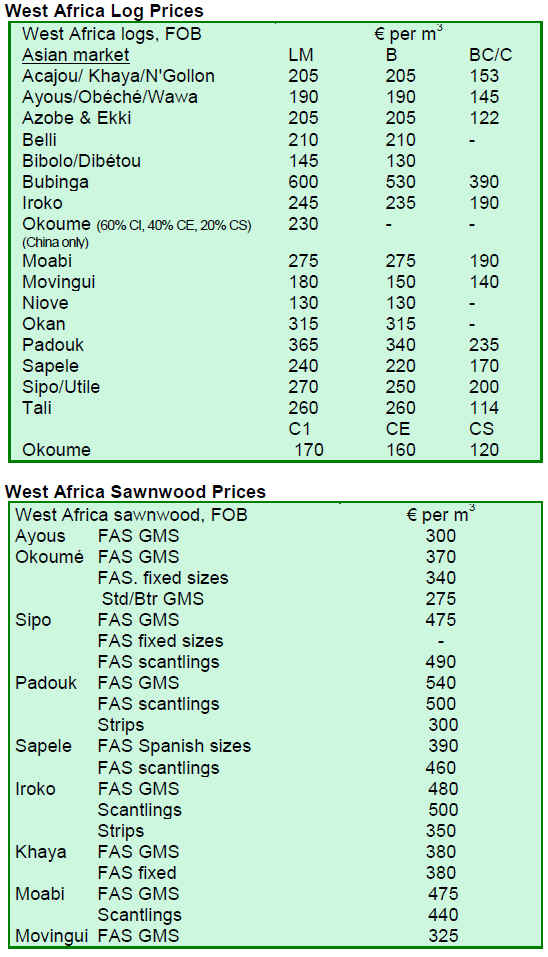

The log trade in West and Central Africa is reported as calm as importers feel that existing stocks and logs already shipped are adequate to fulfil current demand. However, log prices remain unchanged.

After a jump in log demand in June, especially from China, a quiet period was expected, says an analyst. Exporters in Cameroon and Congo Brazzaville are still confident that prices and export volumes of logs will remain stable.

Sawmills in the region continue to report on strong order books. Sawnwood export prices are firm and unchanged over the period under review.

Call for technology and market innovations

Despite the recent hopes for the relaxation of the log export ban in Gabon, the situation remains unchanged. There are still no signs that producers are about to make any substantial increases in production of sawnwood or other processed wood products. According to analysts, the previous initiatives in the region to promote downstream processing need to be reassessed to ensure the long-term profitability of production.

In addition, say analysts, the timber processing sector in the region can develop only by adopting new technologies and market innovations. It seems that the current trend is towards less production of traditional sizes which have to be processed to components in the importing country. Instead, analysts see that there is growing demand for timber components that are already processed to the final specifications. Softwood timber component exports from Scandinavian countries provide a good example of this current trend.

Market quiet in Europe during summer vacation

As usual during the summer vacation season, sawnwood exports to Europe are down. Any improvement in demand is not expected until early September when importers assess trade prospects for the winter, say analysts.

Most of the European countries have been introducing significant cuts in government spending following national budget reviews. For example, the UK announced severe cuts in new school building. However, demand in hardwood market may see some improvement as government finance flows into school renovation in the UK.

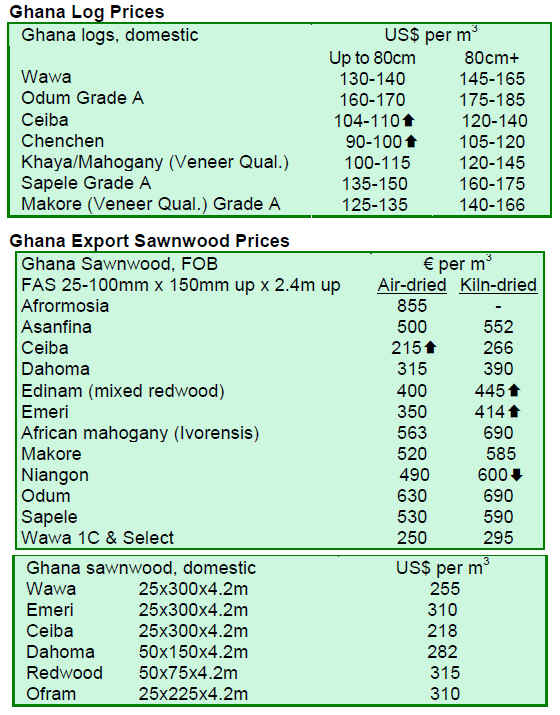

2. GHANA

Wood producers urged to embrace forest certification

Forest certification was promoted at a ¡°Media Sensitization Workshop on Forest Certification and Sustainable Forest Management¡± in Accra. Ghanaian wood producers were urged to acquire forest certification to meet the requirements of European and North American markets.

At the workshop, it was pointed out that wood and timber products from Ghana may be at risk of losing international market shares in the next few years if they do not comply with forest certification and tightened regulations. This would have serious consequences for the domestic timber industry which is said to contribute 5 to 6 % of the country¡¯s Gross Domestic Product (GDP) with over 50% of the products exported to Europe and USA.

Ghanaian timber companies can acquire forest certification through the Ghana Forest Management Certification (GFMC) scheme.

3.

MALAYSIA

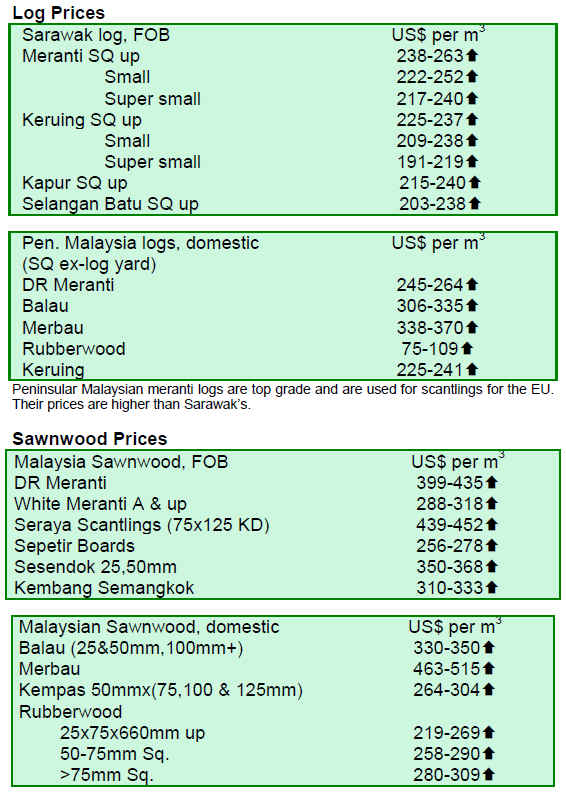

Decision on antidumping duties postponed

In July, South Korea announced that a decision had been taken to impose antidumping duties on Malaysian plywood imports. However, on 2 August 2010, the Ministry of Finance and Strategy of the Republic of Korea announced a postponement of this decision until the South Korean Trade Commission in Malaysia has finalised its investigation. The final decision and a formal ruling will be made within the next 5 months.

Sarawak posts higher exports of logs and plywood in first half of 2010

In the first half of 2010, Sarawak exported 2.04 million cu.m of logs valued at RM974 million, according to the Sarawak Timber Industry Development Corporation. In comparison, exports were 1.62 million cu.m in volume worth RM794 million during the same period in 2009. India remains Sarawak¡¯s main buyer of logs with a market share of 53% of the total volume exported, followed by China. The Sarawak State Government allows 40% of harvested logs to be exported and the balance of 60% allocated for downstream processing within Sarawak.

Sarawak¡¯s exports of plywood were 1.46 million cu.m during the first half of 2010 compared to 1.18 million cu.m in the same period last year. Japan remains the major buyer of Sarawak plywood with imports worth RM939 million in the first half of 2010.

Malaysia - New Zealand Free Trade Agreement

The Malaysia - New Zealand Free Trade Agreement came into effect on 1 August 2010 following its signing in October 2009. In the first phase, some tariff reductions will begin until total free trade is achieved by 2016 for industrial and agricultural products.

In the first phase, Malaysia will gradually eliminate import duties on 10,293 tariff lines and remove 20% and below import duties on 9,070 tariff lines by 2012. Some 1,200 tariff lines with import duties higher than 20% will be duty free by 2016.

New Zealand will reduce import duties on 7,288 tariff lines, out of which 7,237 tariff lines will be duty free by 2015. The remaining 51 tariff lines, including wooden furniture from Malaysia, will also be fully duty free by 2016.

New Zealand is well-known for its food and agricultural exports to Malaysia. In addition, other major exports to Malaysia include pulp and paper.

4.

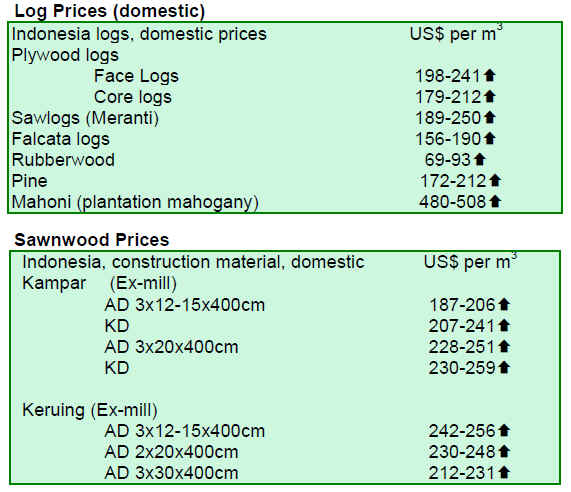

INDONESIA

Indonesia attracts foreign funded REDD pilot projects

Indonesia¡¯s renewed commitment to address deforestation and corruption is beginning to bear fruit, says an analyst, as the United Nations pledged to provide the country with US$5.6 million for a Reducing Emissions from Deforestation and Degradation (REDD) pilot project in Central Sulawesi.

The objective of the project is to enable Indonesia to develop a mechanism to calculate greenhouse gas emissions in Sulawesi province.

Presently, a number of foreign-funded REDD pilot projects are at various stages of implementation across Indonesia.

Australia is planning to invest US$64 million in carbon sequestration projects in Central Kalimantan and Jambi. Germany is planning to provide US$26 million for REDD pilot projects in Kapuas Hulu in West Kalimantan and Berau in East Kalimantan. South Korea has also pledged US$5 million to develop a REDD project for forests in West Nusa Tenggara.

Indonesian officials from the Presidential Work Unit for Development Monitoring and Control, the Indonesian Environment minister and the President¡¯s climate change expert will meet with multi-billionaire George Soros in Jakarta to discuss REDD projects in Indonesia. He is a member of the climate change advisory panel reporting to UN Secretary-General Ban Ki-moon.

Industry welcomes REDD investments

These investments in REDD pilot projects in Indonesia have been warmly greeted by both industrialists and analysts of the timber sector.

For a long time, Indonesian timber products have often been associated with illegal logging, slash and burn agricultural practices and timber smuggling. As a result, buyers, especially those in developed countries, were highly critical and had a negative perception of Indonesian timber products.

It is hoped that the flow of REDD investments will begin to rectify the negative perceptions of Indonesian timber products across the industry. Some marketing executives added that there is renewed sense of pride and optimism in the marketing of Indonesian timber products. In turn, it is hoped that this will generate greater market share and demand for Indonesian timber products.

Analysts likewise, are of the opinion that this would also attract more foreign direct investments in downstream timber industry and thus provide more jobs and much needed replacement of aging machineries. An improvement in the efficiency of downstream processing will eventually reduce wastages and improve raw material supply.

5.

MYANMAR

Market situation remains unchanged

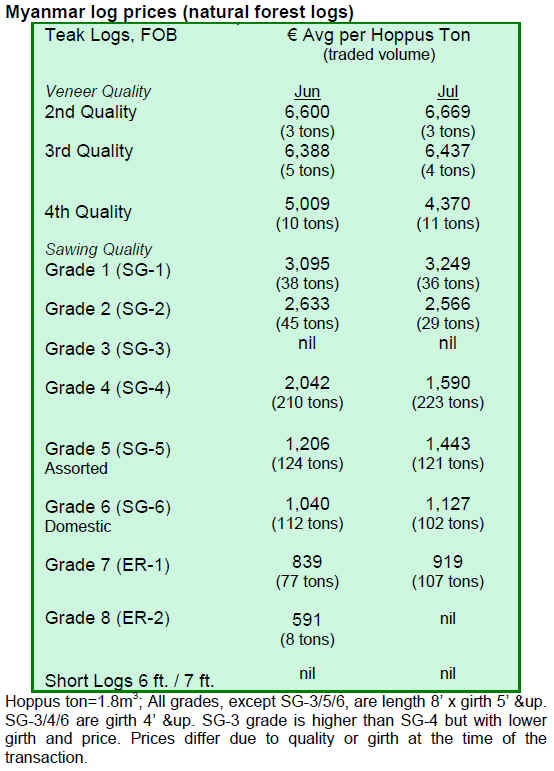

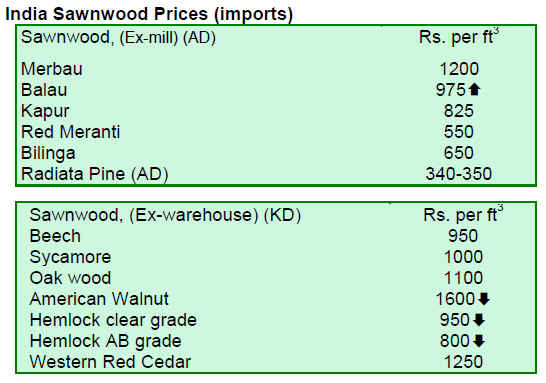

The market situation for teak and other hardwoods remains unchanged from the previous month. It is reported that in spite of substantial flow of plantation teak to India, the demand for teak from natural forests remains strong.

Although some teak dealers in India are selling the previous year's SG-7 (ER1) teak logs at very competitive prices, the market demand for fresh quality teak logs, even at higher prices, is good. However, smaller size fresh teak logs from unpopular areas are not selling well.

Indian buyers believe that the market is going to pick up in a month or two, when the Monsoon season ends. According to some analysts, demand for teak in India will remain strong as the country continues to rely on imports to meet domestic requirements.

The market for pyinkado and Gurjan logs remains weak. These species are facing strong competition from similar species from Indonesia and Malaysia.

Downward trend in shipments

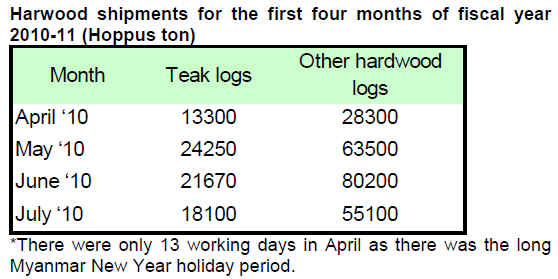

Harwood shipments in the first four months of fiscal year 2010-11 are on a downward trend. Shipments from Myanmar are not a good reflection of the market demand due to the longer lead times between sales and shipments.

6. INDIA

Factory output index reaches four month high

According to the Ministry of Commerce and Industry, the factory output index for India jumped to a four month high of 62.3 in July from 60.5 in the previous month.

Exports, another indicator of India¡¯s growth, surged 30% in June to US$17.75 billion compared to US$13.6 billion in June 2009. The cumulative export value in April-June 2010 totalled US$50.77 billion, a robust 32% growth from US$38.39 billion recorded in the same period last year.

Imports also rose to US$28.3 billion in June 2010 from US$23 billion in June last year, representing a 23% growth. The cumulative import value in April-June 2010 surged 34% from US$62 billion to US$83 billion year-on-year.

Market situation

The plywood market seems settled for the time being as prices have recently been revised. Raw material and labour shortages continue to hamper Indian plywood production.

The monsoon season has been favourable so far for the agriculture sector which depends on the rains and this is good for the overall economy. Housing demand is expected to rise after the monsoon and this is expected to push up timber sales.

Teak log import statistics

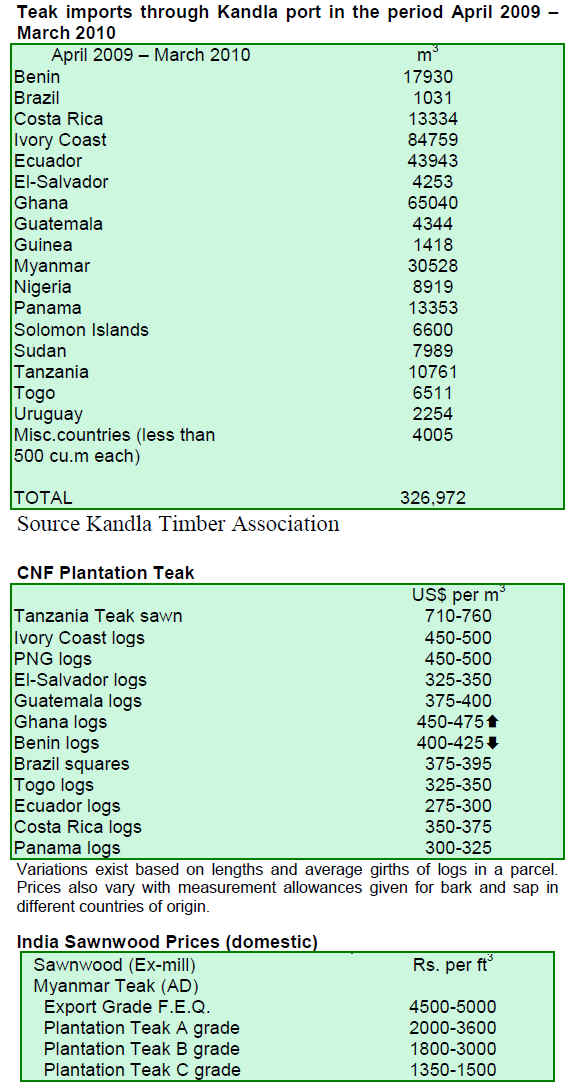

India imports approximately 6 million cu.m of logs per year. Out of these, around 500,000 cu.m are teak logs consisting some 100,000 cu.m of natural forest grown teak from Myanmar and about 400,000 cu.m from plantations.

In the period April 2009 ¨C March 2010, Kandla port imported a total of 3,300,000 cu.m of logs, accounting for 52% of India¡¯s total log imports. Out of the total, around 327,000 cu.m were teak logs. The following table presents teak log imports from different countries through Kandla port in the period April 2009 ¨C March 2010.

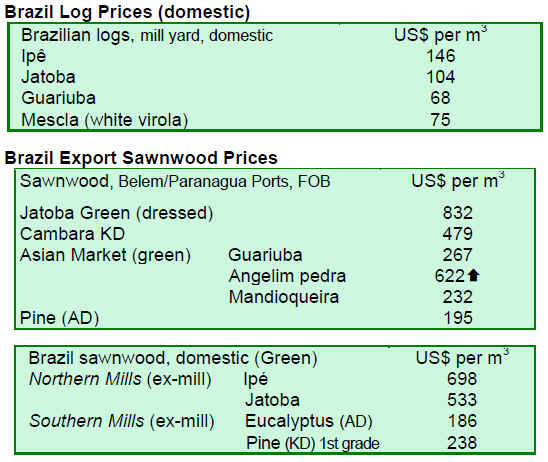

7. BRAZIL

Logging generates employment opportunities in Amazon

Commercial logging is still the main source of employment in most of the municipalities of Amazon region in Northern Mato Grosso, says the Timber Industry Association of Northern Mato Grosso (Sindusmad).

For example, in Cotriguaçu, a municipality 970 km Northwest of Cuiaba city of 14,000 people, more than 1,000 people are directly employed by the timber industry. Cotriguaçu forests are a source of many commercial timber species including Jatob¨¢, Ip¨º, Cumaru, Caxeta, Tauari and Pinho Cuiabano.

The region is monitored by the Brazilian Institute for Environment and Renewable Natural Resources (IBAMA) with support from the National Security Force in the enforcement of the federal and state environmental legislations.

The largest timber company in the region produces rotary cut veneer and sliced veneer (around 1,000 cu.m and 100,000 square metres per month respectively). As for sawnwood and processed solid wood, about 800 cu.m is produced per month. However, the company is not working at full capacity as it is waiting for the approval of sustainable forest management plans by federal authorities to increase the raw material supply. While demand for timber products is picking up, there is pressure for the Federal agencies to speed up the approval of the plans.

Rio Grande do Sul passes law on legal wood

The state government of Rio Grande do Sul approved a bill to establish a public procurement procedure verifying the legality of timber and non-timber products from natural forests.

The rules and procedures apply statewide to public administration including public enterprises, joint stock companies and other companies or foundations under the state administration. The measure aims at improving control and monitoring of legal logging and trade in forest products.

The National Institute of Environment and Natural Resources (IBAMA), the State Secretariat of Environment and the General Attorney of the State (PGE) will be in charge of enforcing the law.

The law, named Madeira Legal (Legal Wood), involves procedures ranging from authorised timber transport to verification of the origin, as well as permits and approvals given by environmental agencies which are members of the National Environment System (Sisnama).

Joint monitoring operation launched in Rondonia

In August 2010, the ¡°Dinizia Operation¡± was launched jointly by a number of government agencies aimed at curbing illegal exploitation of forest products and by-products. The special target is on fictitious forest management plans and clear cutting often found in indigenous lands and conservation areas.

The joint operation involves government agencies including the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA), the Chico Mendes Institute for Biodiversity (ICMBio), Federal Police, the National Security Force (FN), the Federal Road Police (PRF) and System Amazon Protection (SIPAM). The agencies together form the Inter-ministerial Commission to Combat Crime and Environmental Violations (CICCIA).

The operation will start in Porto Velho, capital of the Northern Amazonian state of Rondonia, focusing on the city districts of Jaci-Paran¨¢, Vista Alegre do Abunã, Extreme and New California.

8.

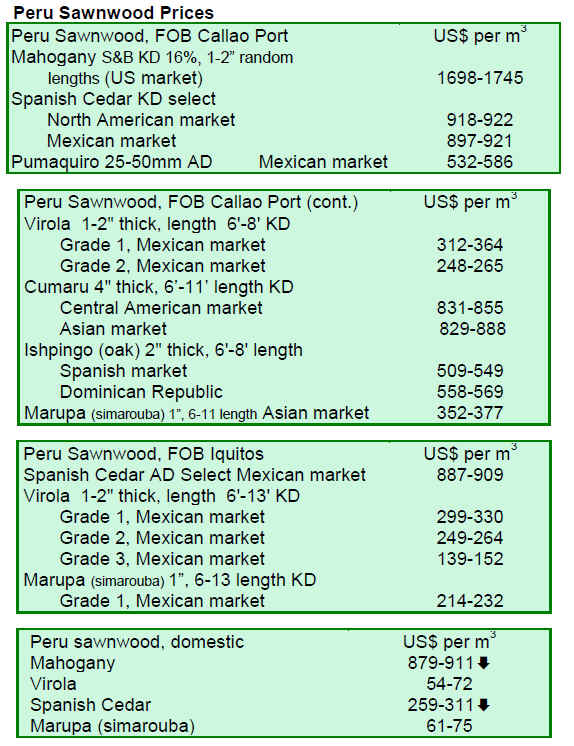

PERU

Export growth continues in May

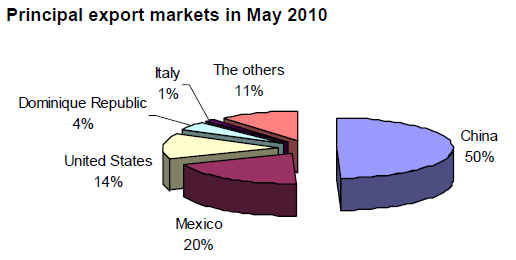

The Export Association of Peru (ADEX) has reported that May 2010 exports of wood products were US$ 13.3 million, up 9% from the levels in April 2009. The growth eased from the previous month¡¯s 36% increase year-on-year. Three biggest buyers were China, United States and Mexico which together accounted for 89% of the total export volume.

In May, Columbia increased its imports of Oriented Strand Board and Taiwan PoC imported more lumber and plywood compared to last year. Hong Kong and France reduced their wood product imports significantly from last year, by 84% and 71% respectively.

Range of wood product exports

The main exported items in May were semi-manufactured products with a 46% share of the total export volume. The accumulated exports from the beginning of the year totalled US$ 30 million representing a 31% increase over the same period in 2009.

Semi-manufactured products were exported mainly to China which accounted for 81% of the total accumulated exports from the beginning of the year. Canada and Israel substantially increased their imports for semi-manufactured products in May.

Sawnwood exports made up 34% of the total exports. The accumulated sawnwood exports from the beginning of the year totalled US$22 million, up 18% over the same period last year. The main destination was China with a 35% share of the total sawnwood exports.

Accumulated veneer and plywood exports from the beginning of the year were valued at US$6.6 million in May, an increase of 19% over the same period last year. Veneer and plywood are exported mainly to Mexico which accounted for 97% of total exports.

In contrast, exports of furniture and its parts declined at a steeper rate compared to the previous month. From the beginning of the year there has been a 25% drop in furniture exports, compared to the same period last year. The total value of furniture and furniture parts exports for the period was US$2.4 million. The US is the main market for furniture and its parts accounting for 53% of the total exports. The US and Italy have reduced imports by 75% and 55% respectively from the beginning of the year.

9.

Guyana

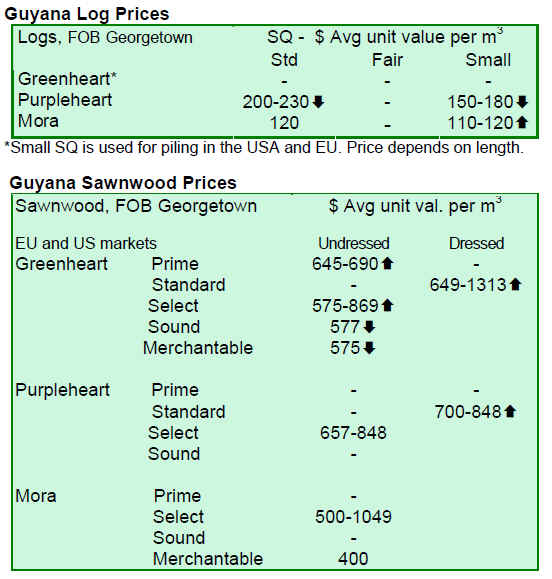

Market Trends

The period under review is the second consecutive fortnight without any greenheart log exports. Purpleheart logs showed some price decrease while mora log prices rose in the fair and small sawmill grades.

During the period under review, sawnwood prices remained relatively stable with some price increases for both prime and select undressed greenheart sawnwood and mora select sawnwood. Price for dressed greenheart jumped from US$996 per cu.m to US$1313 per cu.m in this fortnight period. Also prices for dressed purpleheart rose.

Prices of some other dressed sawnwood species including ipe (Washiba) and cupiuba (Kabukalli) eased to US$1,440 and US$1,049 respectively.

Baromalli plywood showed good market activity with rising prices. Both BB/CC and utility categories contributed significantly to the total export earnings for this fortnight period. Splitwood, roundwood and fuelwood exports to the US and Caribbean also contributed to export earnings.

Greenheart is increasingly being used in wood components and exported mainly to the Caribbean market. Other exported value-added products were doors, door components, indoor furniture and spindles made from locust, purpleheart and greenheart.

International Building Expo 2010

The Ministry of Housing hosted the International Building Expo 2010 on 6-9 August. This year¡¯s theme was ¡°Building Businesses and Communities¡± showcasing various wooden building components and construction materials.

The current housing programme in Guyana has triggered a construction boom in the country. The housing expo served as an opportunity for sawmillers and furniture manufacturers to showcase their products and seek partnerships from local and international markets.

Related News:

|