|

Report

from

North America

¡¡

PEFC demands that LEED include certification

systems other than FSC

The Programme for the Endorsement of Forest

Certification (PEFC) has joined US-based forest

certification systems in their call for certification systems

other than the Forest Stewardship Council (FSC) to be

included in LEED.

The green building rating and certification programme

LEED (Leadership in Energy and Environmental Design)

has grown tremendously in recent years in both the US

and Canada. The LEED Certified Wood Credit has been

undergoing a process of revision for about two years. At

the centre of this process is the USGBC forest certification

benchmark that, if the revision is approved, will be used to

judge which forest certification systems are worthy of

recognition under the LEED Certified Wood Credit.

The PEFC argues that by recognizing only FSC-certified

wood, LEED does not appreciate the wider benefits of

building with wood. More than two thirds of the world¡¯s

certified forests are PEFC-certified. National standards

organisations from Australia, Canada, Denmark, Finland,

Germany, Ireland, Italy, Malaysia, the Slovak Republic,

Spain and the UK have joined the PEFC umbrella

organisation¡¯s call.

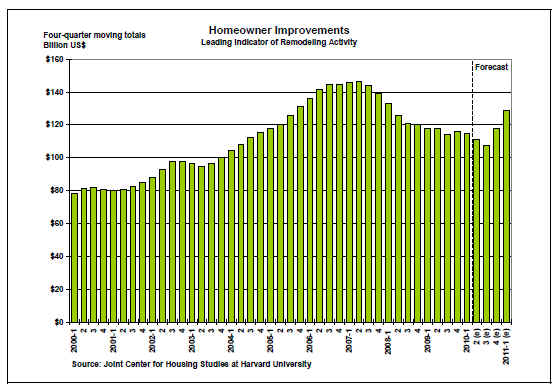

Remodelling spending to increase by the end of 2010

The Joint Centre for Housing Studies at Harvard

University released the Leading Indicator of Remodeling

Activity forecast until the first quarter of 2011. Spending

is expected to grow by 5% on an annual basis in the last

quarter of 2010 and by 12% in the first quarter of next

year.

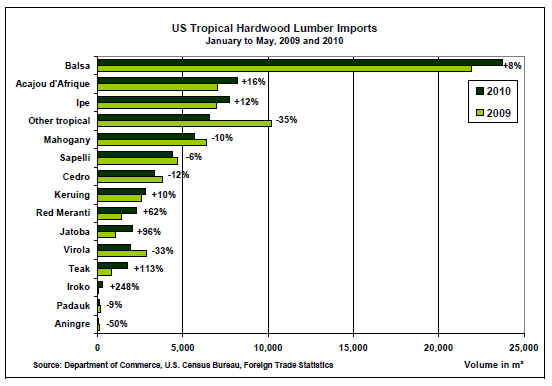

US tropical timber imports

Total US imports of tropical hardwood lumber in the

January to May period this year was nearly the same as in

2009 (+1%). There has been no significant recovery since

the downturn in imports in 2008 and 2009, except in a few

species. Red meranti, jatoba and teak all posted large gains

compared to the same time period last year. Imports of

balsa from Ecuador, acajou d¡¯Afrique and ipe were also

higher than in year-to-date May 2009.

There has also been little change in hardwood moulding

imports from 2009. The US imported US$71 million in

year-to-date May 2010, 4% less than in the same period

last year. Both jatoba and ipe moulding imports from

Brazil remained below 2009 values at US$9.5 million (-

23%) and US$2.1 million (-25%), respectively. Cumaru

moulding imports from Brazil were down at US$1.9

million, a decline of 8% from last year. Cumaru moulding

imports from Peru continued increasing, totalling US$1.2

year-to-date May 2010.

January to May 2010 imports of hardwood flooring were

60% below the same period in 2009. The largest drop has

been in imports from China, down 79%. Hardwood

flooring imports from Brazil were US$959,000 (-26%),

while imports from Malaysia were US$868,000 (-31%).

Indonesian flooring exports increased to US$226,000 by

May 2010, up 38%.

Market trends

Hardwood demand from flooring producers remains

strong. Markets are relatively robust for a range of

products: residential flooring, sport floors and truck bed

floors. For millwork and moulding manufacturers business

continues to be slow. Especially demand for high-end

architectural millwork has not recovered since the

recession.

In general, many US customers tend to replace more

pricey hardwoods with less expensive alternatives, which

is affecting demand for tropical species such as mahogany.

However, demand for tropical timber traded in Euro

makes an exception, given the depreciation of the Euro

against the US dollar.

There has been little movement in prices since June. Price

increases for ipe seem to have slowed for the time being,

but European demand for ipe remains high and supplies

are thin.

¡¡

Related News:

|