|

Report

from

Europe

Latest EU data shows no pick up in tropical hardwood

imports during 2010

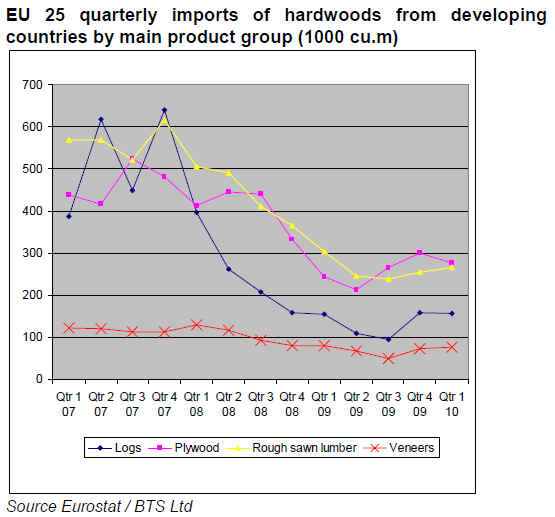

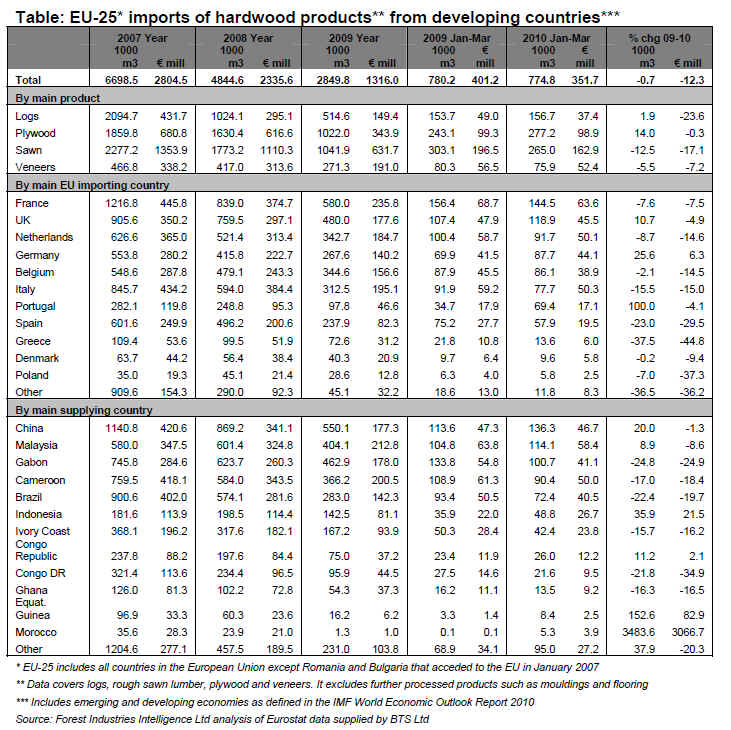

The latest EU-wide trade data indicates that imports of

hardwoods from less developed countries (LDCs)

remained at an extremely low level during the first quarter

of 2010. During this period, European imports of

hardwood logs, sawnwood, plywood and veneers from

LDCs totalled no more than 775,000 cu.m. This is almost

equivalent to the volume recorded in the first quarter of

2009, a year when total European imports of LDC

hardwood products fell by over 40%. The total value of

EU imports of these commodities during the first quarter

of 2010 was actually down 12% compared to the same

period in 2009.

The significant decline in the unit value of EU imports of

LDC hardwoods during 2009 seems surprising given clear

indications of rising prices for many tropical hardwood

products from mid-2009 onwards in response to declining

availability. To some extent, the overall unit value figures

are distorted by their inclusion of eucalyptus logs

(significant but rather inconsistent volumes of these very

low-value ¡°hardwood¡± logs are imported by Portugal and

Spain from Uruguay every year to supply the paper

sector). However, the decline in unit value in the

hardwood sawn and plywood data may also indicate that

European importers and manufacturers are switching to

lower grade and cheaper raw materials in an effort to cut

costs during the recession. The figures certainly underline

previous reports suggesting that tropical hardwood

shippers seeking to push through CIF price increases in

Europe this year have continued to come up against firm

resistance from European importers.

The continuing weak hardwood import performance in the

first quarter of 2010 is all the more disappointing as it

seems to confirm that the apparent upturn in European

buying in the last quarter of 2009 was not a response to

any real improvement in European consumption. Rather,

as many suspected, it seems to have been the result of

short-term efforts by importers to fill gaps in heavily

depleted stocks at a time when CIF prices seemed set to

rise.

According to the data, European imports of hardwood

sawnwood, logs and veneers from LDCs made very little

ground in the first quarter of 2010 compared to the last

quarter of 2009. Imports of hardwood plywood from these

countries actually showed a quarter-on-quarter decline.

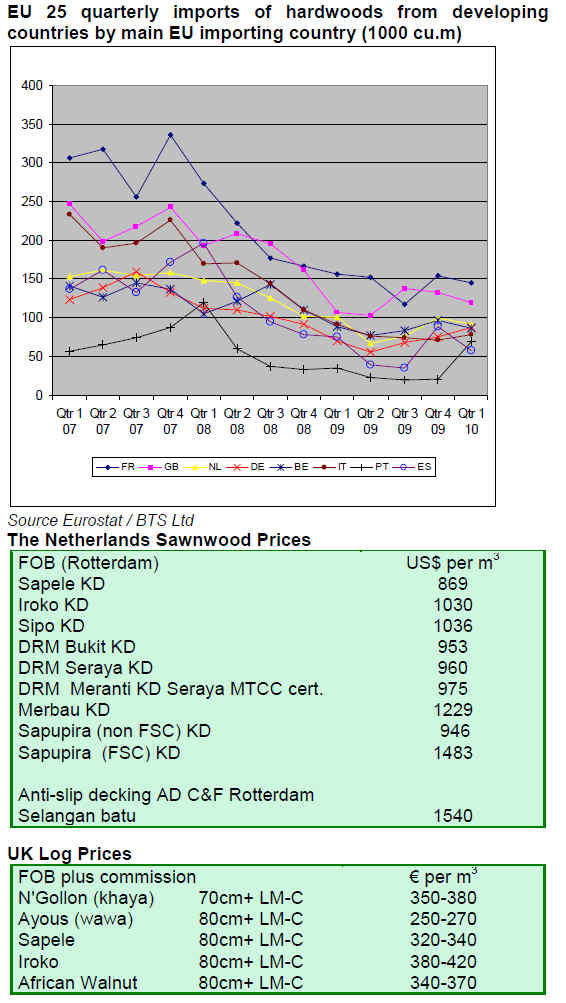

Imports by main EU importing countries

Imports of LDC hardwood products by France, the UK,

Netherlands, and Belgium were slightly weaker in the first

quarter of 2010 compared to the last quarter of 2009. The

best that can be said for Italy¡¯s imports is that they appear,

at last, to have hit bottom in the final quarter of 2009 and

showed some slight signs of upward movement in the first

quarter of 2010. Of all large European buying countries,

only Germany seems to be showing signs of a sustained

increase in imports of LDC hardwood products. This is in

line with GDP data which indicates that the economy in

Germany is bouncing back more vigorously than in other

European countries.

The rather volatile data for Spain and Portugal needs

careful interpretation because it is strongly influenced by

eucalyptus log imports from South America. Spain

experienced a spike in these imports in the last quarter of

2009 while Portugal experienced a similar spike in the first

quarter of 2010. If the eucalyptus numbers are removed,

the data suggests that Spain¡¯s imports of hardwoods from

LDCs improved slowly in the first quarter of 2010 while

Portugal¡¯s imports continued to flat-line.

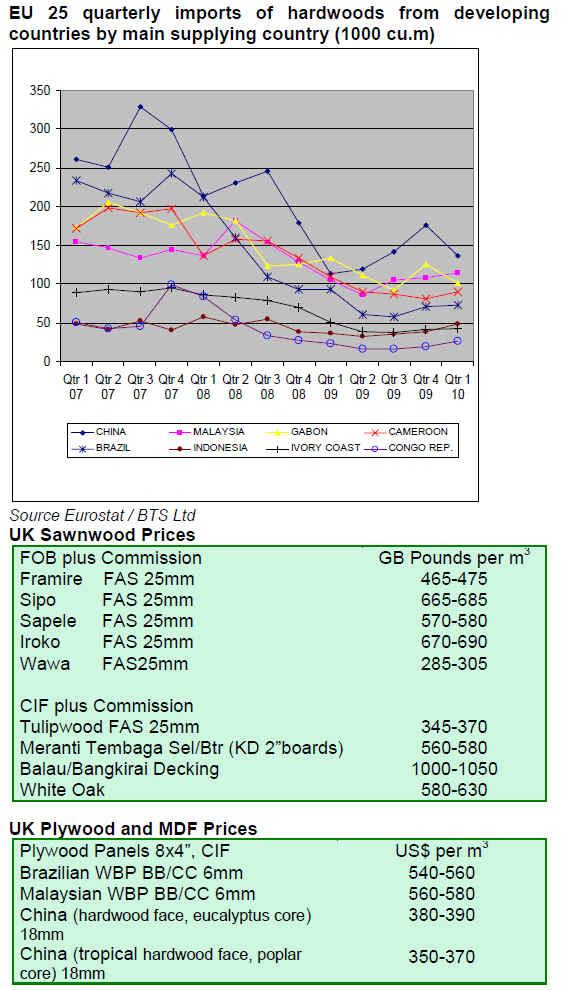

Imports by main supplying country

The first quarter of 2010 saw a significant reversal in EU

imports of hardwood products from China (mainly

plywood). Increased arrivals of Chinese plywood at the

end of 2009 met with stagnant demand in the European

construction sector so that importers greatly curtailed

imports during the opening months of 2010.

European (mainly French) imports of hardwood products

from Gabon spiked in the last quarter of 2009. This was

due to a rise in log imports in anticipation of Gabon¡¯s log

export ban from January 2010. Although implementation

of the ban was subsequently delayed until May, the

statistics suggest that most European buyers completed

their efforts to stock up on Gabon logs at the end of 2009

and that imports were already falling away again in the

first quarter of 2010.

The first quarter of 2010 saw some minor quarter-onquarter

increases in European imports of hardwood

products from Malaysia, Cameroon and Indonesia.

However imports from Brazil and Ivory Coast remained

static at low levels.

Related News:

¡¡

|