|

1.

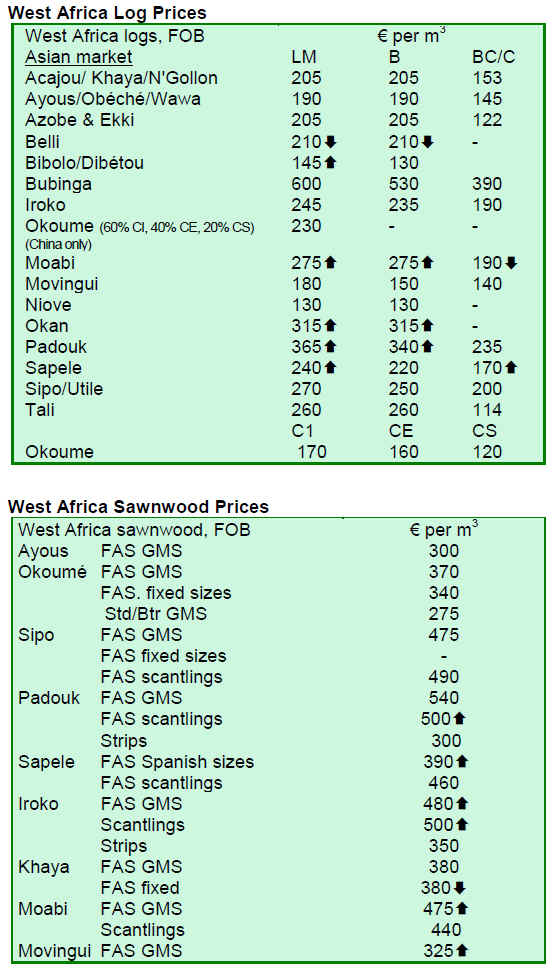

CENTRAL/ WEST AFRICA

Timber trade firming

After a short quiet trading period while importers assessed

their mid-year stock and forward position, the log market

has become active once more. China has resumed regular

purchases from Cameroon, Congo Brazzaville and smaller

volumes are also being gathered from Equatorial Guinea

and Democratic Republic of Congo.

Because of reduced exports of some heavy hardwood

sawnwood from Brazil and other South American

exporting countries, there has been a welcome increase in

demand from European importers for iroko, which has

raised both log and sawnwood prices.

Sapele is also in good demand and sawnwood output has

been increased to cope with the higher level of orders.

Prices for sapele logs and sawnwood are up and firming.

Sipo sawnwood has experienced some increase in demand

as European importers are now more comfortable to

rebuild their stocks in preparation for the expected

improved demand over the second half of the year.

Whilst housing starts in Europe have not yet recovered,

there is better demand for hardwoods from a more active

renovation and home improvement sector. As importers¡¯

stocks are low, this sector is the main reason for recently

improved demand for tropical hardwoods. In addition,

prices for West and Central African timbers are still very

reasonable in comparison with some American and

European temperate hardwoods.

Lack of investments in sawn mill business

Some exporters are still hoping that the government of

Gabon will review the log export ban. However, the

authorities in Gabon have indicated that all logs remaining

in the port must be removed.

Sawmills in the region have strong order books. However,

there has not been any news on investments to increase

production capacities for sawnwood or downstream

products. The market failures experienced over the past

two years have discouraged investors from diversifying

production.

Moreover, the continued uncertainty over the Gabon

situation is not conducive for investors to make any longterm

expansion plans. Also, uncertainty means that the

importers are unable to assess the future raw material

supplies for their in-country processing industries.

Incentive to obtain full certification

When the new EU import regulations on illegally

harvested timber imports come into force in 2012, they

will work as an incentive to African timber producers to

obtain full certification.

Consumers in EU, however, must be prepared to meet

higher prices due to costs of the certification process.

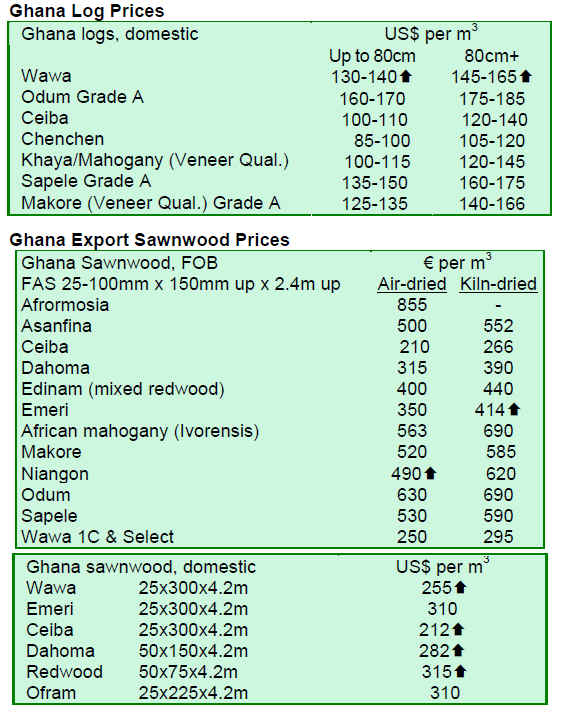

2. GHANA

Call for review of utility tariff

The Ghana timber industry has added its voice to others

who are demanding a downward review of the utility tariff

which was recently raised by the Public Utility Regulatory

Commission.

At a meeting between the Ghana Timber Millers

Organisation and the Timber Workers Union in Accra, the

millers claimed that the higher tariffs leave them no other

option but to lay off workers in order to stay in business.

The timber operator¡¯s call came at a time when the Trades

Union Congress has urged the government to reset the

previous tariff levels.

According to the timber industry, sharp increases in the

industry¡¯s major costs, especially in electricity tariffs, have resulted in some closures in timber sector over the past 5 years. In addition, the industry has suffered from

operational taxes such as the National Reconstruction

Levy and high interest rates.

The timber industry in Ghana contributes about 7% to

GDP and it is the fourth biggest industry in terms of export

revenues.

Inflation eases to single digit

According to the Ghana Statistical Service, Ghana¡¯s

inflation fell to 9.52% in June 2010, down 1.16 percentage

points from May 2010. Inflation has now declined for the

12th consecutive month.

Consequently, the Monetary Policy Committee decided to

reduce its Policy Rate to 13.5%, the fourth consecutive cut

since November 2009.

In another development, the commercial banks in the

country have followed the Policy Rate and reduced their

lending rates for businesses.

3.

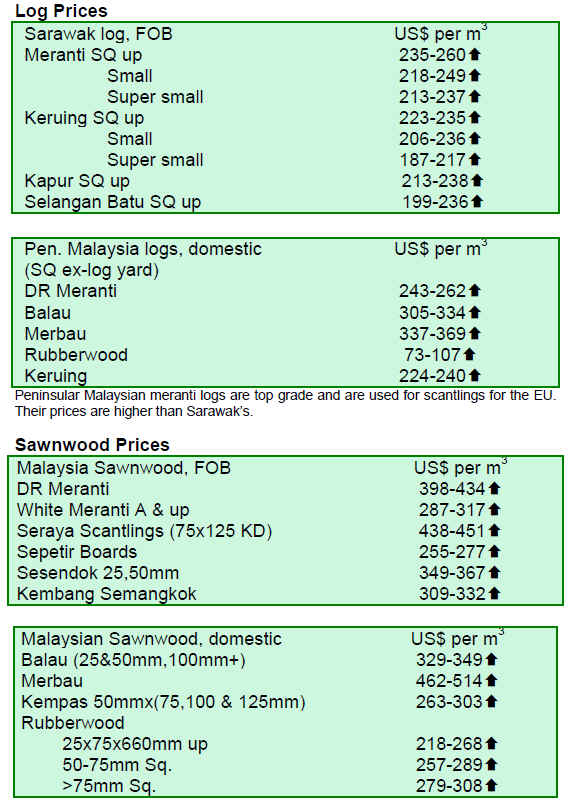

MALAYSIA

Upward trend in timber product exports

The exports of timber and timber products from Malaysia

reached RM8.5 billion in the period from January to May

2010, 17.4% higher than the RM7.3 billion recorded in the

same period last year. The Malaysian government

expressed confidence in reaching the timber product

export target of RM22 billion for the current year.

South Korea set antidumping duties on plywood

South Korea has imposed preliminary antidumping duties

on imported Malaysian plywood. The South Korean Trade

Commission (KTC) opened a dumping investigation after

receiving a petition from the Korean Wood Panel

Association that some plywood manufacturers in Malaysia

are selling their products below the production cost and so

hurting local South Korean plywood manufacturers. The

plywood market in South Korea valued at US$584 million

in 2009.

Imposed duties range from 5.11% to 33.81% on plywood

imports from Malaysia. These preliminary antidumping

duties are in effect until a formal ruling is made within the

next 5 months.

Some Malaysian plywood manufacturers expressed the

fear that the Japanese government may follow the South

Korean example and impose antidumping duties on

Malaysian plywood.

Malaysia¡¯s trade with South Korea

Plywood is one of the main exports from the East

Malaysian state of Sarawak and the plywood antidumping

duties imposed by the South Korean government are

anticipated to have a significant impact on plywood

production in the state. The Malaysian Deputy Prime

Minister visited South Korea recently addressing the issue

of bilateral trade, amongst others.

Malaysia¡¯s foreign trade with South Korea contracted

from US$15.1billion (RM49.83billion) in 2008 to

US$11.7billion (RM38.61billion) in 2009.

However, there are signs that bilateral trade between the

two countries is recovering. From the beginning of the

year trade has soared 47% over the last year¡¯s level

reaching now US$6.6 billion. South Korea is Malaysia¡¯s

sixth largest trading partner and seventh largest export

destination.

Shortage of labour clouds the furniture sector

At the recent Malaysia Furniture and Furnishing Fair 2010

(MF3), the Ministry of Plantation Industries and

Commodities announced that the current exhibition is

expected to generate RM50 million in sales compared to

RM45 million in 2009.

Furniture exports from Malaysia are projected to reach

RM7.4 billion, a 20% increase from 2009 with RM6.2

billion.

Meanwhile, the furniture industry in Malaysia is losing

millions of dollars in revenue as it struggles to overcome

the shortage of manpower, a crucial factor in the labour

intensive furniture industry which depends heavily on

foreign workers. This, in turn has forced furniture

manufacturers to operate below capacity which is causing

international buyers to turn to other countries to fulfil their purchasing requirements.

A roundtable discussion between various ministries will

take place to address the problem of foreign labour

shortage in Malaysia.

Market forecast ¨C increase in prices

Rainy weather and a recent increase in fuel prices pushed

Malaysian timber product prices up during the past few

weeks.

After a slight downturn, freight costs are expected to rise

significantly between 10% to 20%. In addition,

manufacturers are worried about how to adjust product

prices to reflect the increased costs without undermining

their marketing.

As a result of rising fuel prices, logging operators are also

expected to raise harvesting charges as the work is highly

dependent on heavy machinery.

4.

INDONESIA

Proposal to extend moratorium on conversion of

peatlands

The Indonesian government has prepared draft legislation

to extend the 2-year moratorium on conversion of

peatlands by an additional 3 years. The proposed 5-year

moratorium would affect the palm oil sector which has

been clearing and draining peatlands to expand

plantations. As the 2-year moratorium on new permits to

convert natural forests remains, there might be an

increasing risk that the Indonesian palm oil plantation

companies increase demand to clear natural forests when

the moratorium covering natural forests is lifted as the

moratorium on peatlands would still have three years to

run.

The initial 2-year moratorium on conversion of peatlands

is said to be insufficient to address sustainable peatland

management and so substantially reduce greenhouse gas

emissions. According to the draft legislation, the

government will re-examine all peatland concession

permits, including existing ones.

There are over 21 million hectares of peatlands in

Indonesia: 8 million hectares in Papua province, 7.2

million hectares in Sumatra and 5.8 million hectares in

Kalimantan. It is estimated that Indonesia¡¯s peatlands

contain 46 gigatonnes of carbon.

Rattan industry under threat

The Indonesian Rattan Foundation (YRI) claims that

inadequate rattan export policies and declining demand for

Indonesian rattan products may threaten the existence of

the rattan furniture and handicraft industry in Indonesia.

The international rattan product market was valued at

around US$100 billion in 2008 and US$104 billion in

2009. However, Indonesia was only able to generate

export revenues of US$2.6 billion and US$2.3 billion in

2008 and 2009 respectively.

YRI added that the number of rattan processing units

continues to drop. In addition, the ban on raw rattan

exports has affected the lives of 2.3 million rattan

collectors and farmers. The domestic industry processes

between 30,000 to 40,000 tonnes of rattan per year, while

the industry has a production capacity for close to 700,000

tonnes per year, says YRI.

Rattan is said to have a potential to generate revenues up

to US$4 billion per year, providing jobs for about 5

million people.

Expansion of paper and pulp industry

The Indonesian Ministry of Industry revealed that the

government is considering expansion of the paper and

pulp industry into Eastern Indonesia, including Papua.

Currently, the Indonesian paper and pulp industry is

concentrated mainly in Western Indonesia.

Indonesia is the ninth largest pulp producer and eleventh

largest paper producer in the world. A total of 14 pulp

manufacturers have a capacity to produce 7.9 million

tonnes of pulp a year, and 81 paper manufacturers¡¯

production capacity is 12.17 million tonnes of paper.

In 2009, pulp production in Indonesia reached 6.52 million

tonnes and paper production totalled 9.31 million tonnes.

5.

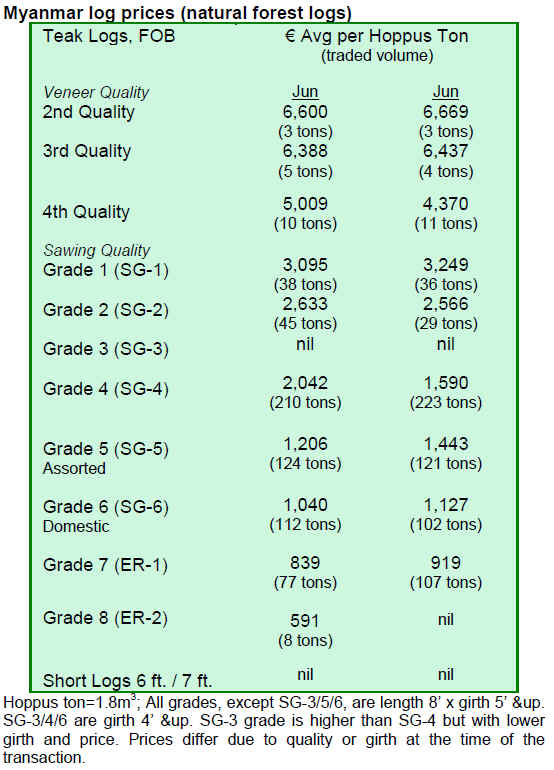

MYANMAR

Mixed market signals

During the second half of July, some traders in Myanmar

reported that the market demand for teak, pyinkado and

Gurjan logs remains sluggish as China, among others, is

placing smaller orders. Shipments in July were down

compared to last month but some increase was recorded

towards the end of the month.

Analysts suggest that there are some teak dealers in India

who are selling the previous year's SG-7 (ER1) teak logs

at very low prices while other dealers are selling fresh

stocks at higher prices. This is said to be causing some

confusion in the Indian market.

Country-wise purchases during July

Country-wise purchases of Myanmar hardwoods during

July 2010 were as follows: Singapore (2 buyer, 85 Hoppus

tons) and Thailand (3 buyers, 283 Hoppus tons). In the

domestic markets there were four buyers and the timber

sales totalled the amount of 214 Hoppus tons.

6. INDIA

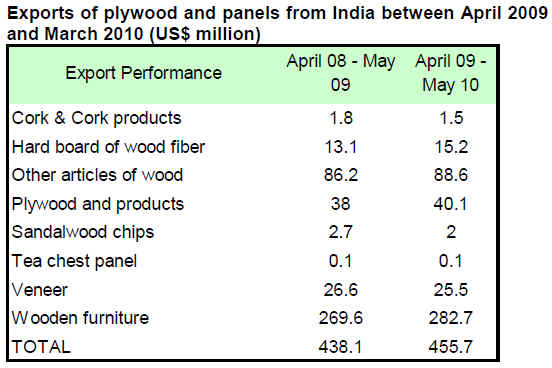

Exports of plywood and panels

While overall Indian exports are registering growths of

around 30% that is not the case with wood-products.

Continuous weak demand in North America and Europe is

said to be the reason for the poor export performance of

the wood products sector.

Nevertheless, last year¡¯s wood product export levels are

expected to be maintained. Indian exporters are

continuously making efforts to expand their markets.

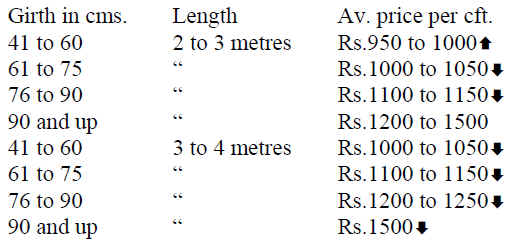

Teak auction sales in Central India

Auction sales in various depots of Madhya Pradesh

continued. The total sales of teak logs were around 4000-

5000 cu.m. The average teak log prices at the latest

auctions were as follows:

The monsoon season has still not started in Central India

and thus more log auctions are expected to be held as

logging can continue and the supply from the forest is

good.

As the monsoon season continues in Western India, the

Forest department and NGOs are implementing tree

planting programmes. This year the programme seems to

be particularly popular in terms of number of participants,

perhaps due to increased environmental awareness in

India.

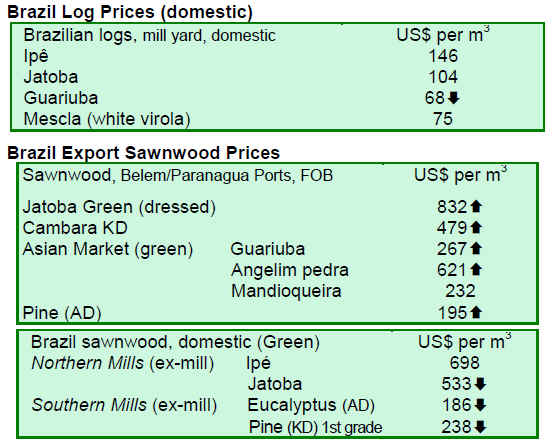

7. BRAZIL

Tropical timber exports remain dull

In June 2010, exports of timber products (except pulp and

paper) increased by 19% from US$173 million in June

2009 to US$206 million.

Exports of tropical sawnwood decreased in terms of both

volume and value, from 40,400 cu.m in June 2009 to

38,500 cu.m in June 2010 and from US$18.6 million to

US$17.9 million. This translates to a 4.7% decrease in

volume and a 3.8% decrease in value.

Exports of tropical plywood decreased from 11,000 cu.m

in June 2009 to 8,700 cu.m in June 2010, representing a

21% decline. In value terms, the drop was 16%, from

US$5.8 million to US$4.9 million.

Pine sawnwood exports dropped 12% in June 2010

compared to the June 2009, from US$ 11.4 million to US$

12.8 million. In terms of volume, exports decreased 3.5%

from 57,500 cu.m to 55,500 cu.m over the period.

The value of pine plywood exports jumped 109.8% in

June 2010 compared to the level in June 2009, from

US$17 million to US$37 million. Export volumes

increased by 36% during the period, from 71,900 cu.m to

97,600 cu.m.

For wooden furniture, the value of exports rose by 10.5%

compared to the level in June 2009 to US$47 million in

June 2010.

Furniture industry forecasts growth in 2010

The reduction of the tax on industrial products from 10%

to 5% has encouraged the furniture sector, according to the

Brazilian Furniture Industry Association (ABIMÓVEL).

The tax reduction is expected to generate a 10% growth in

the sector for this year.

In 2008, Brazilian production of wood furniture reached

R$22 billion. In 2009, sales fell 18% to about R$18 billion

due to the global economic crisis. ABIMÓVEL expects

that the furniture sector achieves the 2008 performance

this year. In December 2009, the sector already

experienced some recovery. According to ABIMÓVEL,

sales rose 13% and mills increased their production from

70% to 85% of the total production capacity.

The largest trade fair of wood-furniture industry suppliers

in Latin America, the ¡°ForM¨®bile¡¯¡¯, was held in São Paulo

between 27-30 July. The fair brought together about 750

exhibitors from around thirty countries representing

sectors such as machinery, raw materials, components,

decorative accessories and services.

Brazilian furniture exports pick up

Brazilian furniture exports in the first half of 2010 totalled

US$ 368 million. Argentina was the major importer at

US$55 million, representing a 106% increase over the

same period of last year. Second biggest importer was the

US at US$ 44 million importing 7.5% less than in the

same period last year, followed by France (US$ 38.7

million) a 16% increase in the period.

Santa Catarina, the main furniture exporting state in

Brazil, increased its exports by 11.4%, totaling US$ 126.5

million which represents 34.4% of the total Brazilian

furniture exports.

Rio Grande do Sul exported US$96 million in the first half

of 2010, accounting for 26% of the total furniture exports

from Brazil. The United Kingdom was the main importer

with US$15 million, accounting for 15% of the state¡¯s

total exports, followed by Argentina with US$11 million,

a 10% share of the total furniture exports. Exports from

Rio Grande do Sul to the US decreased by 7%, now

accounting for 6% of the state¡¯s total furniture exports.

São Paulo exported 31% more in the first half 2010

compared to the same period last year, totaling US$ 65.2

million and constituting about an 18% share of the total

exports of Brazilian furniture. Paran¨¢ exports rose by 29%

in the first half of the year, accounting for 14% of the

Brazilian total furniture exports. Minas Gerais had the

highest growth in furniture exports with 121% increase in

the first half, however, Minas Gerais furniture exports

represent only 3.9% of the Brazilian total furniture

exports.

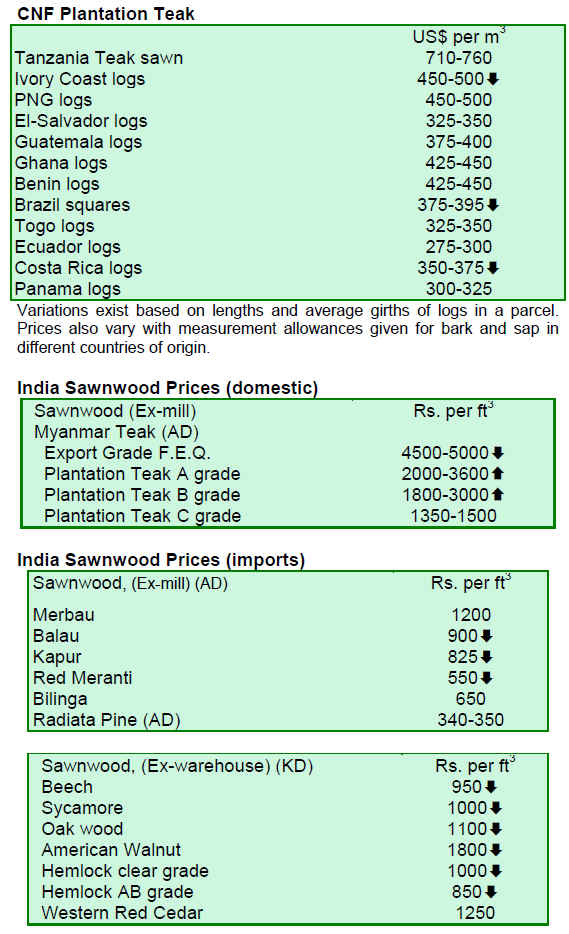

Timber product prices

The price average of timber products in Brazil increased

slightly from the last fortnight. However, the prices quoted

in the US dollars fell due to a slight depreciation of

Brazilian currency against the US dollar.

Satellite monitoring of concessions

The Brazilian Forest Service (SFB) and the National

Institute for Space Research (INPE) signed a technical

cooperation agreement to monitor logging in forest

concession areas. The implementation is planned to start in

forest concessions of the National Forest of Jamari and

Rondônia by the end of 2010.

SFB will use satellite images provided by INPE to monitor

whether companies are logging only in authorised forest

areas according to forest management plans. INPE has

also started a remote sensing training programme in digital

image processing for the Forest Service technicians.

Based on satellite monitoring and spatial information, SFB

will be able to identify timber yards and forest roads

opened for timber transportation within the forest

management unit, as well as any logging outside the

designated area.

Timber companies¡¯ concerns in Par¨¢

In the period from January to May 2010, wood product

exports from Par¨¢ increased 10% compared to the same

period last year. Timber product exports totalled 161,000

tonnes, US$161 million in value.

However, producers are not satisfied with the numbers

because exports are still 50% lower than recorded in 2008,

before the economic crisis. The timber companies believe

that as the US house construction sector recovers from the

crisis, demand for tropical timber from Par¨¢ will grow.

Besides the continued economic depression, another factor

causing weak export performance is the appreciation of

the Brazilian Real against the US dollar. To ease the

situation, Brazilian timber companies have requested the

government to address the problems of raw material

shortage and excess bureaucracy on timber operations.

Economic growth remains stable

According to the Brazilian Institute of Geography and

Statistics (IBGE), the Consumer Price Index (IPCA) of

June 2010 remained unchanged at 0.43%. The pace of

inflation has eased from the first months of the year but is

still well above 0.36% recorded in June 2009. The record

low for the IPCA was chalked up in June 2006 when there

was a 0.21% deflation.

In an attempt to keep inflation within the target range, the

Copom (Economic Policy Committee) raised the prime

interest rate (Selic) by 0.5 percentage points to 10.75% per

year. The prime interest rate was already raised by 0.75

percentage points in June.

In June 2010, the average exchange rate was BRL

1.81/US$, while it reached BRL 1.96/US$ in the same

month of 2009, which shows increasing appreciation of

the Brazilian Real against the US dollar over the period.

8.

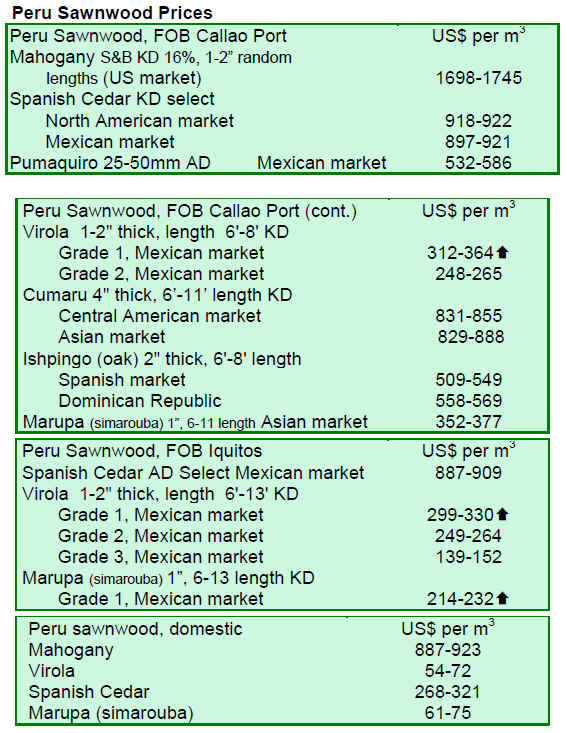

PERU

National export quota for mahogany

The Agricultural Ministry (MINAG) approved the national

export quota for mahogany (Swietenia macrophylla) for a

total of 720 trees coming from 19 forest concessions with

verified Annual Operating Plans (POAs). The quota came

into effect from 23 July and will be in effect for the next

12 months.

The approved quota is based on a report assessing the

mahogany situation in Peru. The assessment was prepared

by the National Agricultural University of La Molina

which is also the scientific authority for the Convention on

International Trade in Endangered Species of Wild Fauna

and Flora (CITES) in Peru.

The report recommends that the national sustainable

export quota for mahogany is 831 trees a year. The report

also suggests that the timber is harvested only from the

forests with approved POAs, declaring standing trees,

sustainable annual harvest, density of seed trees and

regeneration operations.

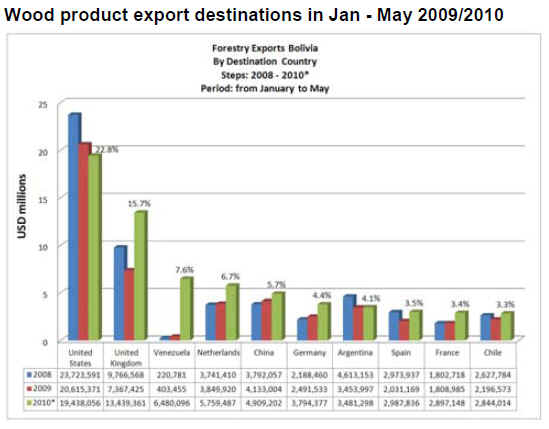

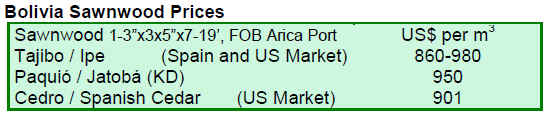

9. Bolivia

Forest product exports

Forest product exports from Bolivia totalled US$85

million in the period from January to May 2010, up 31%

from US$65 million in the same period last year.

Furniture, doors, panels, decking (as well as peeled

chestnut and canned palm hearts) account for 81% of the

total forest product exports, while the remaining 19%

consists of primary processed wood products, such as

sawnwood and poles.

The US remains the major market for Bolivian forest

products taking some US$19.4 million, which accounted

for 23% of the total forest product exports from Bolivia.

Other major export destinations were the UK (US$13.4

million), Venezuela (US$6.7 million), the Netherlands

(US$5.8 million) and China (US$4.9 million).

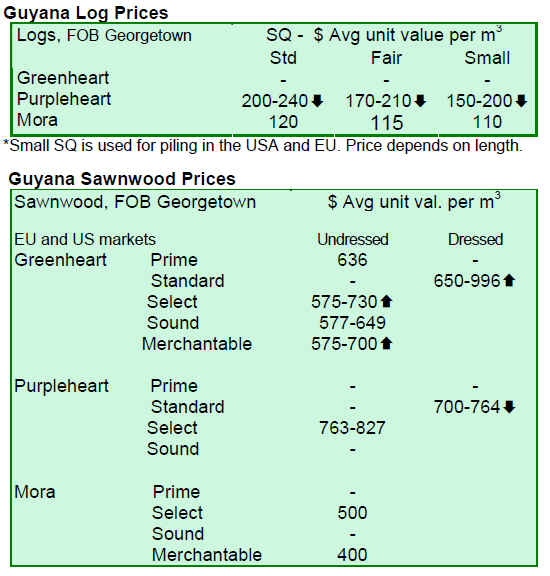

10.

Guyana

Market Trends

During the period under review, there were no exports of

greenheart logs. Prices for purpleheart logs decreased in

all grades while prices for mora logs remained firm. The

slowdown in log exports is due, say analysts, to the active

domestic housing sector which has increased local demand

for processed wood products.

Prices for both dressed and undressed sawnwood gained

during the period under review. Greenheart undressed

sawnwood prices in select and merchantable grades

experienced significant increases to US$730 and US$700

per cu.m respectively. However, mora undressed

sawnwood prices remained stable.

Dressed greenheart prices picked up during this fortnight

period reaching US$996 per cu.m and similarly dressed

sawnwood ipe (Washiba) and undressed red cedar (Cedro)

attracted high average prices of US$1,600 per cu.m and

US$1,009 per cu.m respectively.

Baromalli plywood trade was brisk and prices picked up.

Also splitwood prices were buoyant reaching as high as

US$1,225 per cu.m.

Exports of value added products have been good and this

has contributed significantly to total export earnings. The

products such as handicrafts, doors, outdoor garden

furniture and wooden utensils have been mainly exported

to the Caribbean market. Species used for value-added

products include crabwood, greenheart, kabukalli (Goupia

glabra), red sedar and simarupa (Simaruba amara).

Guyana¡¯s responds to US Lacey Act

The revised US Lacey Act (1 April 2010) includes an

expanded product coverage list covering many of the

products currently exported by Guyana to the US.

The responsibility of ensuring legality rests on the US

importer, however, the exporters are required to document

compliances at every stage of the process from harvest to

export. The test of illegality/legality is done in accordance

with compliance with each country¡¯s laws, in Guyana¡¯s

case, Guyana¡¯s forest laws.

The Guyana Forestry Commission (GFC) in collaboration

with the United States Forest Service and USAID,

facilitated the US Lacey Act expert team. The team made

a mission to Guyana on 13-15 July 2010 to engage with

stakeholders, share information and answer questions

raised over the Act. The team visited four locations across

the country and met with various stakeholders including

exporters, potential exporters, forest concession holders,

sawmillers and different wood product manufacturers.

As part of the implementation of Lacey Act, the GFC has

improved the Guyana¡¯s national log tagging and tracking

system by upgrading it with a bar coding technology. The

GFC outlines that the key concession and environmental

monitoring tools in operation include the Code of Practice

and the log tracking system. Additionally, GFC reports

that it has 25 forest monitoring stations located at strategic

control points across the country and 10 additional mobile

monitoring units. According to the GFC, Guyana has also

developed a Legality Assurance System that will be the

platform to engage with relevant partners and possible

international systems.

In order to improve detection and prevention of illegal

logging and illegality in shipments and trade of wood

products in Guyana, a ¡°Legality, Monitoring and

Extension Unit¡± has been established within the GFC, with

assistance from ITTO. In addition, ITTO has also

supported the GFC in a project aimed at identifying

specific areas for strengthening the national log tracking

system.

Additionally, the GFC has initiated several other

programmes to strengthen forest legality as well as

sustainable forest management in Guyana. The GFC has

expressed that collectively, these systems and procedures

along with others that are being implemented, will give

Guyana¡¯s forest product exporters to the US (and other

destinations with similar legal requirements like the Lacey

Act), a strong basis for continued and improved trade

relations.

Related News:

|