Japan Wood Products

Prices

Dollar Exchange Rates of

12th July 2010

Japan Yen 88.62

Reports From Japan

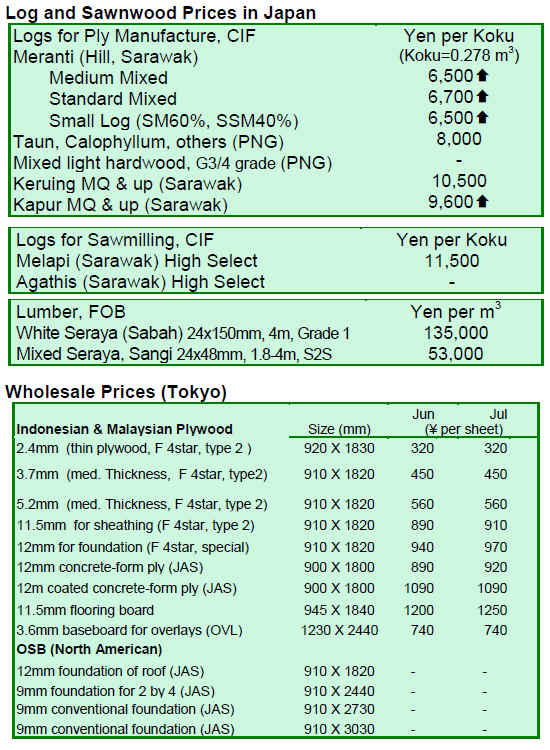

Meranti logs breach pre-crisis price level

Tropical log supply is still affected by bad weather conditions and prices have been inching up in the last few months. Local plywood mills in Sarawak reportedly have strong order books and their aggressive purchasing is lifting the prices. Japanese log importers say that the tight log supply is going to last at least until late August.

Sarawak log exporters have achieved US$210 per cu.m FOB for meranti regular logs, the same price level as in early 2008, before the global financial crisis. Also the small meranti prices are up, fetching US$185 per cu.m FOB.

Log export prices in Sabah for kapur logs leveled off to US$270 per cu.m after China shifted to purchasing keruing logs for which price also rose, reaching US$240 per cu.m FOB.

In Japan, imported log prices are firming. Sarawak meranti regular logs are priced at Yen 7,000 – 7,200 per koku CIF. Current small meranti log prices are at Yen 6,300-6,400 per koku. Sabah kapur logs are now priced at Yen 9,600 per koku.

Plywood manufacturers in Japan continue to hold back production but log inventories are still falling. Plywood manufacturers are looking to rebuild their stocks, however, constantly increasing log export prices are holding them back.

Wood demand for the second half of 2010

The Japan Lumber Journal (JLJ) reports that the Forestry Agency of Japan has released its wood demand projections for the second half of 2010. The Agency is forecasting an improvement in housing starts stemming from increasing household income and various stimulus measures introduced.

The main beneficiaries of the improved activity in the building and construction sectors will be imported sawnwood, plywood and structural laminated lumber. The demand for these products is expected to exceed last year’s levels.

South Sea log supply is projected to fall short of demand, thereby lifting the prices. Supply for sawnwood is expected to remain stable in meeting the demand. However, plywood supply will remain tight for the third quarter but should be improving towards the end of the year.

North American log demand is expected to remain firm but import volumes will likely stay at around 2.5 million cubic metres for the whole year, the same level as for 2009. Demand for North American sawnwood is increasing for the remainder of the year. European sawnwood imports to Japan are also projected to rise in the fourth quarter.

The Forestry Agency is also forecasting an increasing demand for domestic logs.

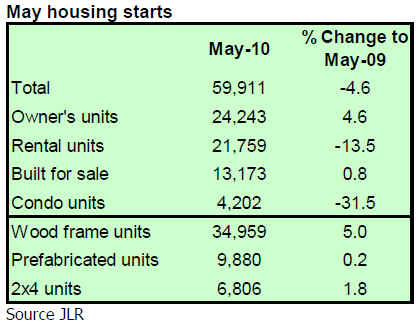

Housing starts relapsed in May

After positive figures recorded in April, housing starts relapsed in May, reports JLR. The total of 59,911 units recorded was the lowest ever for the month of May.

The main reason for the decline is the drop in condominium starts which were 31.5% down compared to May 2009. However, condominium starts were up 35.8% in April and according to the Ministry of Land, Infrastructure and Transport, the decline in condominium starts in May might only be temporary.

The number of building permits issued has been increasing for the past seven months and May permits were 8.7% up on levels in May 2009.

Declining industrial wood consumption in Japan

According to the Forestry Agency, the total industrial wood consumption was 63.2 million cu.m in fiscal 2009 representing a 19% decline compared to fiscal 2008. The depressed economy and declining housing starts have been the main reasons for the downward trend in industrial wood consumption which has declined for the third year in a row, reports JLR.

For 2009, the government’s plan was to increase the domestic wood supply, aiming at 50% self-sufficiency in industrial wood consumption. Self-sufficiency improved by 3.8% in 2009 but this was only because of the greater decline in imports than in domestic supplies, both of which fell in 2009.

Log imports fell sharply by 26% to 5.6 million cu.m while the drop in domestic log supply was 6.2% to 17.4 million cu.m.

Industrial consumption of sawnwood amounted to 23.5 million cu.m, plywood 8.2 million cu.m and pulp/wood chips 29 million cu.m, all decreasing by 13.4%, 20.5% and 23.4% respectively. Total imports of sawnwood, plywood and pulp/wood chips declined sharply by 23% while the domestic supply suffered only a 6.1% drop.

Misawa Home promotes certified products

Japanese house builder, Misawa Homes Co. Ltd, intends to increase the share of certified wood used in house building. The JLR reports that Misawa Homes is aiming at 70% share of certified wood in total wood consumption by 2014. Misawa Homes’ timber consumption has been around 470,000 cu.m. per year.

To achieve the target, Misawa Homes applies green procurement guidelines for wood introduced by WWF Japan.

Japan exports cedar logs to Indonesia

FSC certified domestically grown logs are now being exported from Japan to Indonesia. The Japanese cedar logs from Ishikawa Prefecture that are being shipped to Indonesia are from 3-4 metres in length and have a diameter from 22 to 24 cm.

The first shipment is expected to be made by Hanwa Co. Ltd in late July. The Indonesian company reportedly will use the certified logs for its manufacture of furniture for the EU market, replacing some of the cedar logs previously imported from North America.

Related News:

|