|

1.

CENTRAL/ WEST AFRICA

Log trade stays dull

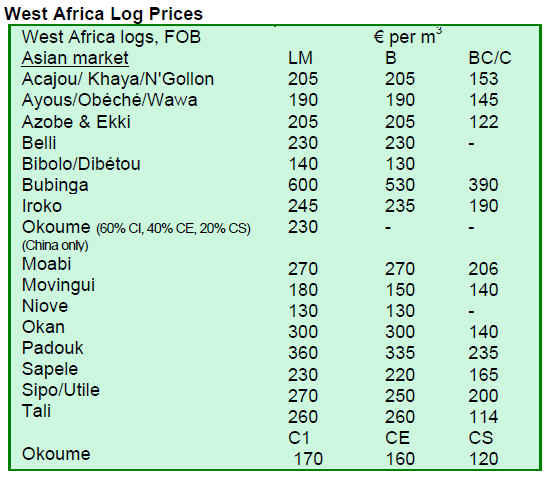

The log trade in West and Central Africa remains quiet as buyers in consumer countries review stock levels and deliberate how markets will develop under current uncertain economic conditions.

Some log prices dipped as demand eased. However, the price drop was only temporary and recently the prices have stayed close to their typical levels. According to analysts, there is unlikely to be any long-term drop in prices as log volumes in supply countries remain low.

Okoume prices improved strongly in the past two months but increasing exports from Congo Brazzaville have affected the price trend.

As a result of the log export ban in Gabon, the availability of okoume logs is expected to be substantially reduced. This market loss of over 500,000 cu.m of okoume logs will impact on plywood manufacturers in China, North Africa and elsewhere.

Strong order books for sawnwood

Demand for sawnwood has revived to some extent and producer mills in the West and Central Africa say that they have strong order books with deliveries extending into the 4th quarter.

Until now, sawnwood prices have firmed but there might be additional pressure for price increase especially for some popular premium species, says an analyst.

Sawmillers are contemplating increasing output and some are re-opening mills that were forced to close when the recession hit consumer demand hardest in 2008/2009.

2. GHANA

Exports to ECOWAS countries maintained

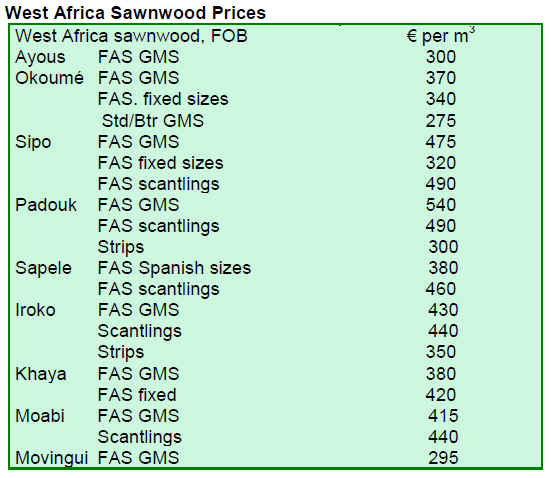

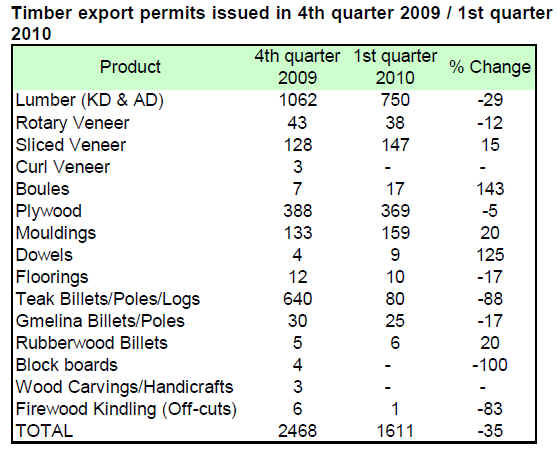

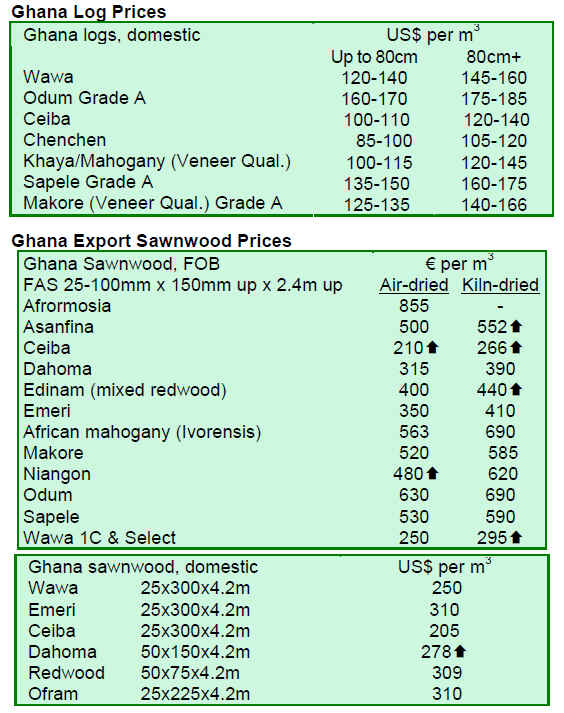

The Timber Industry Development Division (TIDD) of the Forestry Commission vetted, processed, and approved 1,611 export permits during the first quarter of 2010 covering shipment of various timber and wood products through the ports of Takoradi and Tema as well as for overland exports to neighbouring ECOWAS countries (the Economic Community Of West African States).

The regional offices in Sunyani, Kumasi and Tema and the head office in Takoradi accounted for 2.6%, 15.7%, 7.3% and 74.4% respectively of the total export permits issued during the first quarter.

For the third consecutive quarter, the Kumasi Regional Office issued more export permits than Tema. According to an analyst, this signals that the overland exports to neighbouring ECOWAS countries have not been affected by the global recession.

Compared to the last quarter in 2009, first quarter approvals fell sharply by 34.7%. Lumber export permits declined as did the number of export approvals for rotary veneer, curl veneer, plywood, flooring, gmelina billets/poles, block boards, wood carvings/handicrafts, firewood kindling¡¯s (off-cuts) and teak billets/poles/logs. However, export permits for sliced veneer, boules, mouldings and dowels increased considerably.

In the first quarter of 2010 there was a 14% increase in the number of permits approved year-on-year, indicating that the exports are recovering gradually.

Sawnwood (both air dried and kiln dried) continues to account for the largest share (47%) of the total export permit applications. This is an indication that there is still a higher demand for export lumber than for tertiary wood products such as furniture and parts, mouldings, flooring, dowels and profiled boards.

3.

MALAYSIA

Exporters hit by volatile freight costs

The Timber Exporters¡¯ Association of Malaysia (TEAM) claims that the industry has been suffering from high and volatile freight costs to Europe and the Middle-East.

According to the spokesman of TEAM, the average freight cost in 2008 was about US$1,800 per 40 foot container, dipped to US$600 in June 2009 but soared to US$3,200 in March 2010. Since then, the freight costs have hovered around US$2,800 but are expected to rise after the vacation period in Europe which runs through to August.

Timber exporters are hesitant to pass on the increasing freight costs to the consumers, fearing they will lose long-term clients.

The shippers pointed out that the freight cost increases are part of the shipping industry cycle over the last 50 years. However, timber exporters hope that freight rates could be fixed every 3 months in order to bring stability and predictability to the timber markets.

Mixes trends in export markets

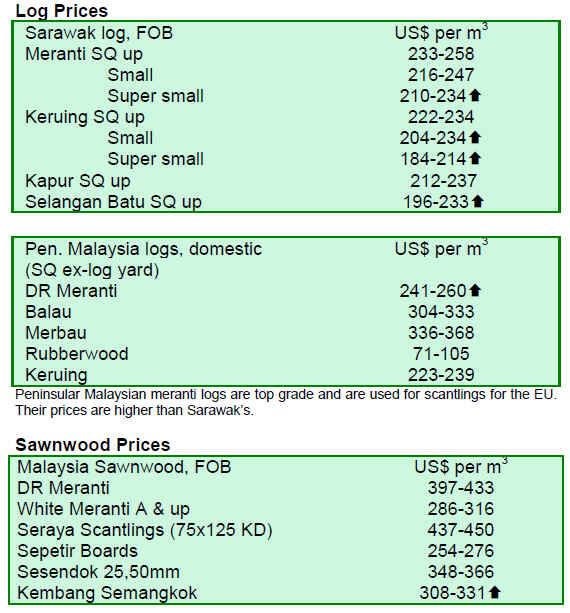

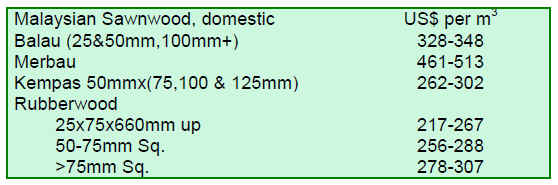

Prices for Malaysian timber products experienced some gains across the board during the period under review.

Furniture demand from the US and China has improved over the last 3 months. Furniture shipments to China are expected to peak in August 2010.

Demand from India for Malaysian sawnwood remains strong. However, Indian importers are hit hard by higher freight rates but the appreciation of Indian Rupee against the US dollar has eased the situation. Exports of mouldings and MDF to India remain stable.

Exports to the Eastern European market have slowed as the European economic crisis begins to have an impact on Eastern Europe.

With the recovery in the South Korean furniture sector and in Japan¡¯s housing starts, exporters are optimistic that prices for Malaysian timber products will be able to sustain growth in 2010. In addition, Malaysian plywood exports to Japan are expected to increase as Japanese buyers rebuild their inventories to meet the increasing demand from the construction sector.

While export prices are rising, the domestic timber product market in Malaysia is expected to slow down during the second half of the year due to low orders from the construction sector. This downturn is likely to soften prices on the domestic market.

4.

INDONESIA

TBI assists concessionaires to obtain certification

Indonesian forest concessionaires are signing up for a programme aimed at obtaining FSC certification. The programme is conducted by the Borneo Initiative (TBI) Foundation.

PT Dwima Jaya Utama, managing 127,300 hectares of forest in Kalimantan and PT Wapoga Mutiara Timber Unit II holding 196,900 hectares of forest concessions in Papua province were the two major companies signing the agreement in Jakarta.

All together eight companies, which joined the programme, manage a total of 815,670 hectares in Kalimantan, Maluku and Papua. Earlier in January, five companies with almost 600,000 hectares had signed up for the programme.

The Association of Indonesian Forest Concessionaires noted that out of 36 million hectares of managed forests in Indonesia, only 30% or around 10.8 million hectares are certified. Currently, there are five FSC certified forest concessionaires in Indonesia managing a total of 1 million hectares of forest.

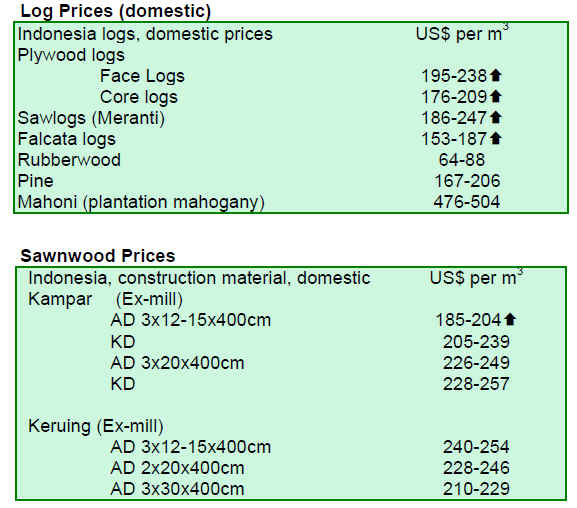

Concerns over impact of moratorium on raw material supply

Last month, Indonesia announced a 2-year moratorium on new permits to convert natural forests and peatlands. According to the Association of Indonesian Forest Concessionaires, the moratorium will severely hamper the supply of raw material to the Indonesian timber industry if natural forests within production forest areas are included in the moratorium, as some sources have been suggesting.

In Indonesia, some 63 million hectares of the total of 134 million hectares of forests are considered as production forests which are the major raw material source for the Indonesian timber industry.

Manufacturers and exporters alike are now urging the Indonesian government to address the issue of raw material supply in the moratorium regulations as at present there is confusion and misinterpretations among the stakeholders.

Exporters added that as long as the issue is not addressed, there will be speculative buying undermining the markets.

5.

MYANMAR

Teak and pyinkado market remains sluggish

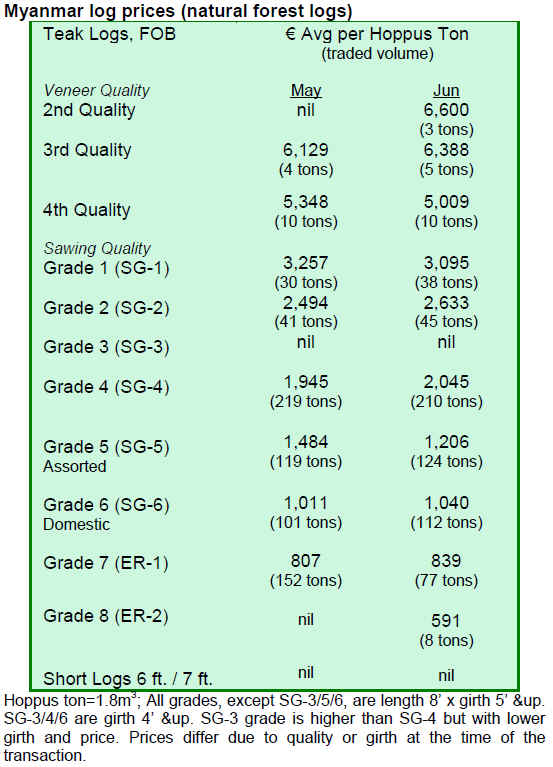

Analysts believe that over the coming months trade for both teak and other hardwoods will remain sluggish. According to dealers, Vietnam, China and India among others are placing smaller orders.

Demand for pyinkado has eased as the prices rose to over US$1000 per Hoppus ton for 7 foot girth logs.

Some big dealers say that demand for teak is low except for SG7 logs. All in all, buyers expect that July is going to be a quiet month for timber sales. The sluggish market situation for teak can be seen from the falling prices in the tender sales during 2010.

6. INDIA

Sustained growth in Indian economy

Exports from India have shown seven consecutive months of growth. As a result of increasing demand in western countries, exports from India surged 34% in May 2010 compared to May 2009. The exchange rate for the Euro slipped from Rs.67 in June to around Rs.57 in the first fortnight of July, hampering Indian timber product exports to the Euro countries.

The industrial production in India continues to be on a high level which also pushed up imports by 31% in May 2010.

Hardwood auction sales in Western India

At the auction sales in Tapti region depots in Western India, some 3,500 cu.m of timber were sold. The main traded species was teak.

Long length teak logs suitable for boat building fetched around Rs.2000-2200 per cft. Premium quality saw logs were priced at Rs.1800 per cft., medium quality at Rs.1500 per cft. and average quality attracted prices of Rs.1200 per cft.

Premium quality laurel wood (Calophyllum inophyllum) logs were traded at around Rs.700 per cft, while haldu (Adina cordifolia), kalam (Mitragyna parviflora) and medium quality laurel wood logs fetched Rs.450 per cft.

Teak billet demand for smaller components in handicraft and furniture production is increasing. In Tapti auctions, good quality Teak billets fetched Rs.19000-Rs.20000 per metric ton and medium quality Rs.12000-Rs.15000 per metric ton.

Teak auction sales in Central India

Auction sales in Madhya Pradesh region at depots of Timarni, Khirakia, Narmada Nagar were held recently.

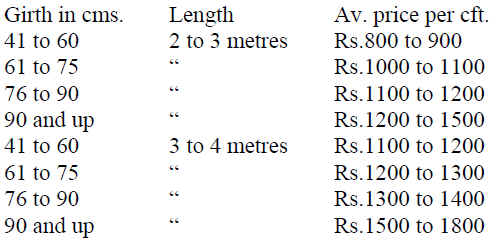

The total sales of teak logs amounted to 5000 cu.m with prices around Rs.50-75 higher than in the previous auctions. The average teak log prices at the latest auctions were as follows:

The monsoon season has started later than usual in Central India and thus one more round of auctions is expected to be held as logging can continue and the supply from the forest is still good.

Market trends

Demand for logs remains down as the South West Monsoon season has caused a break in housing activity. The strong Rupee against the US dollar also makes imported teak log prices lower for Indian buyers.

Plywood prices continue to be stable as shortages of logs and labour continue.

7. BRAZIL

Forest concession monitoring system launched

The Brazilian Forest Service has launched a monitoring system for forest concessions in Brazil. Concessions areas will be monitored jointly by the Brazilian Institute for Environment and Renewable Natural Resources (IBAMA) and the Chico Mendes Institute for Biodiversity Conservation (ICMBio), both federal government agencies. The Forest Service has also developed a system to trace log transportation from the forest to the first log-processing site.

The forest concession monitoring is based on five pillars: Brazilian legislation on forest management; organisational and operational structures of environmental agencies; control and monitoring tools; transparency and access to administrative procedures; and participation of main stakeholders.

Timber production in the Brazilian Amazon falling

Timber production in the Brazilian Amazon fell 50% over the last decade, according to the study ¡°Logging Activities in the Brazilian Amazon¡± carried out by the Brazilian Forest Service (SFB) and the Institute of Man and Environment (Imazon). In 1998, roundwood production in the region was 28.3 million cu.m while in 2009, total production was only 14.2 million cu.m.

According to the SFB, decreased illegal timber production, substitution of tropical timber by other timber species and the recent global economic crisis have led to the decline in overall timber production. However, the timber sector is still an important source of revenue for states in the Amazon.

Currently, the timber sector in the region employs around 204,000 people, out of which 66,000 are within the sector and 137,000 are employed indirectly. In 2009, the sector's gross revenue reached R$4.94 billion. Out of the total revenue, Par¨¢ accounted for 43%, followed by Mato Grosso with 33%, and Rondônia 15%.

According to the study, illegal harvests of timber in the Amazon is decreasing. The study says that timber production in the Amazon will not return to 30 million cu.m per year as recorded a decade ago, as this level could only be achieved from harvesting on invaded land and exploiting illegal timber sources.

However, the intention is to increase timber production by adopting sustainable forest management practices in national/state forests and concession areas. States such as Par¨¢, Acre, Amazonas and Amap¨¢ are following the federal government by starting bidding processes for legal logging activities in public forests.

ABIMAD expects growth in furniture exports

The third Brazilian Contemporary Home Furnishing Association¡¯s (ABIMAD) Fair for Furniture and High-End Decoration Accessories will be held on 28 ¨C 31 July in São Paulo, Brazil. At the fair, ABIMAD will host an international business roundtable between foreign importers and ABIMAD members.

Already 30 importers from countries such as Angola, Chile, USA, UAE, Peru, Mexico, France and Panama have confirmed participation in the roundtable. The previous fair in August 2009 yielded US$3.7 million in sales and for the July¡¯s fair ABIMAD expects a 12% growth in sales.

According to ABIMAD analysts, the Brazilian furniture designs are currently being appreciated products in international markets which helps overseas promotion. To ensure ABIMAD members¡¯ compliance with international standards for furniture products and trade, ABIMAD has developed the ¡°Quality for Export¡± programme.

For the fair, ABIMAD has identified the potential trade partnerships to be established between the Brazilian producers and foreign importers. In addition, the Brazilian Trade and Investment Promotion Agency is offering support for foreign companies interested to do business with Brazilian furniture exporting-companies.

8.

PERU

New Peru forest law to be passed in August

According to the Minister of Environment, the draft legislation for Forestry and Wildlife is expected to be passed in August. The new law is required to fulfill the commitment made under the Free Trade Agreement with the USA. The commitment includes terms related to Land Use, Land-Use Change and Forestry.

However, the draft "Law of Forestry and Wildlife" is still said to be controversial in terms of classification of land, ecological zoning and standards for final decision making.

Peru sustains exports growth

Overall exports from Peru continued to increase for the eighth consecutive month. In May, exports totalled US$ 2.319 billion, up 8% over May 2009.

Despite the still weak global economy, the Central Bank projects a 23% growth for Peruvian exports in the fiscal year 2010. The Ministry of Economy and Finance (MEF) projected a more moderate growth of 17%.

According to the Association of Banks, bank financing for foreign trade increased by 4.08% in May over the last year. The Association of Banks expects further growth in foreign trade financing in the next few months.

9.

Guyana

Market Trends

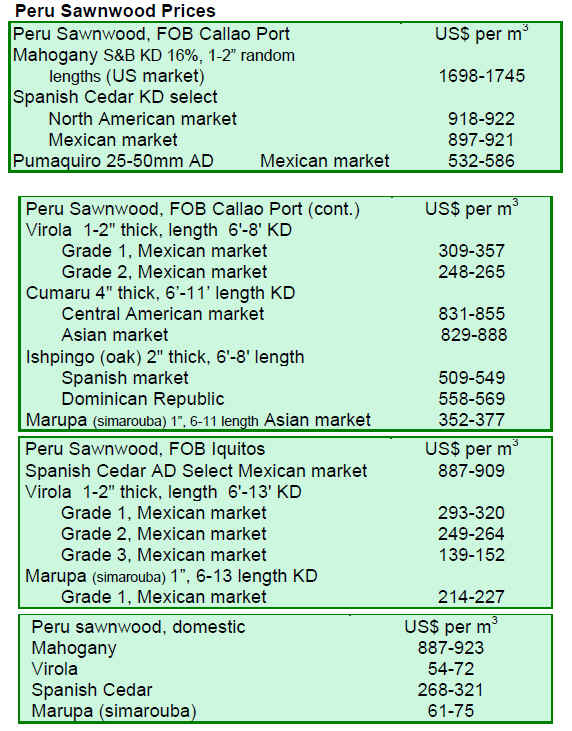

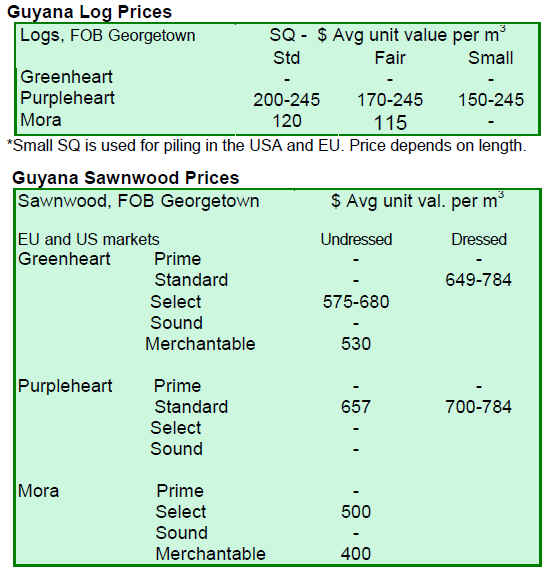

During the period under review, log export prices remained relatively stable with purpleheart priced around US$245 per cu.m. Mora experienced some price adjustments, while there were no exports of greenheart logs in the fortnight period.

Prices for both dressed and undressed greenheart sawnwood and undressed mora sawnwood decreased, while prices for dressed purpleheart were firm.

Some other dressed sawnwood species including ipe (Washiba) and cupiuba (Kabukalli) attracted average prices of US$1,750 and US$1,340 respectively. They also contributed significantly to the total export earnings for this fortnight period.

Baromalli plywood showed some market activity but only in utility category while prices remained stable. Roundwood and fuelwood exports to the Caribbean also contributed to export earnings.

Some of the exported value-added products were handicrafts, doors, door sets made from purpleheart (Amarante).

REDD Readiness Preparation Proposal for Guyana

More than 100 representatives from 40 countries and organisations attended the World Bank¡¯s Forest Carbon Partnership Facility (FCPF) Participants Committee meeting in Guyana in the end of June 2010. The sixth meeting of the Committee was meant to provide an update on the progress made under the FCPF.

Since the FCPF became operational in 2008, Guyana has completed several revisions to the REDD Readiness Preparation Proposal (RPP) through open and transparent public consultations. Accordingly, the World Bank has made four due diligence missions to Guyana. The most recent mission took place in April 2010 and the follow up is planned in September 2010.

The next major steps under the FCPF include financing and implementation of the RPP and integrating it with the country¡¯s low carbon growth model.

Related News:

|