|

1.

CENTRAL/ WEST AFRICA

Aftermath of log export ban

Following the log export ban in Gabon coming into effect on 15th May, log exports have been completely halted. As a result, around 60,000 cu.m of logs remain in the port. Although contracts have been signed these logs cannot be exported. Most of these logs are for buyers in China.

According to reports, the Gabon Department of Forests has been very active inspecting timber companies and ensuring that the new log export ban regulations are being followed.

So far, there are no further indications of unrest amongst the timber industry labour unions. The lower output of logs has led to unemployment but there will be more employment opportunities when sawmill capacity is expanded and investment in processing industries secured.

Timber trade

Log trading is still centred in Cameroon and there is also firm demand for okume from Congo Brazzaville.

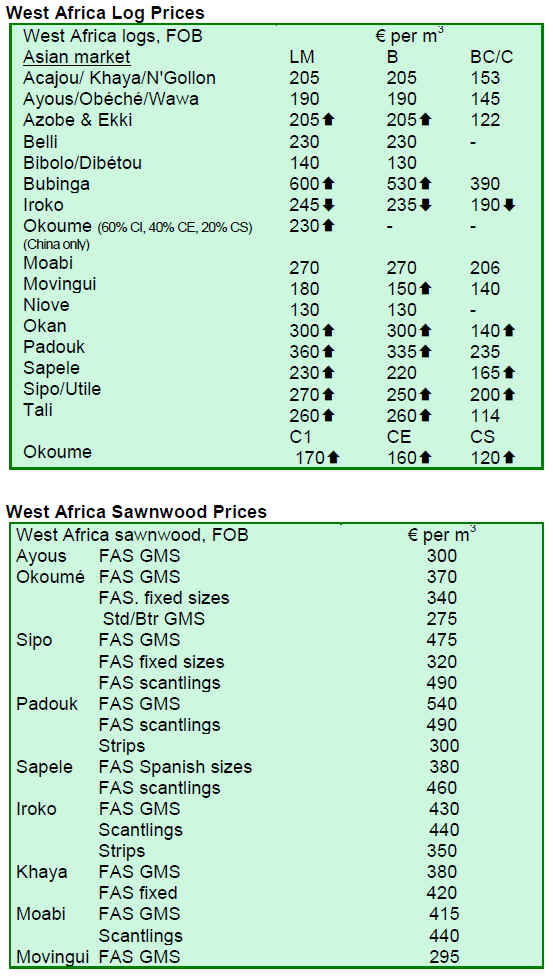

Log prices have continued a slow and steady rise over the past month, while the sawn lumber prices have been almost stable.

The current economic situation in EU and North America is such that it is difficult for producers to increase sawnwood exports or secure higher sawnwood prices. This is causing problems for sawnwood producers who have not been able to pass on the higher sawnwood production costs arising from increased log prices.

According to analysts, demand for sawn lumber may start to improve as consumption in Northern Europe picks up and if China reverts to importing more sawn and processed timber.

Trends in European market

There are some indications that North European importers are prepared to offer higher prices because of their low stocks and limited availability of sawn lumber. Traditionally, importers have relied on stocks held by African exporters with fast and regular shipping schedules.

According to reports, the delivery times to Europe are now extended up to several months for the premium species. Sawmills in West Africa have been forced to adjust production and reduce stock levels and they are producing only when orders are received.

Business prospects in South Europe remain very bleak following recent economic and financial difficulties faced by Greece, Spain and Portugal. These countries traditionally import a range of lower grade logs and sawn lumber while the north European markets demand higher grades.

2. GHANA

Ghana chalks up gains in first quarter trade

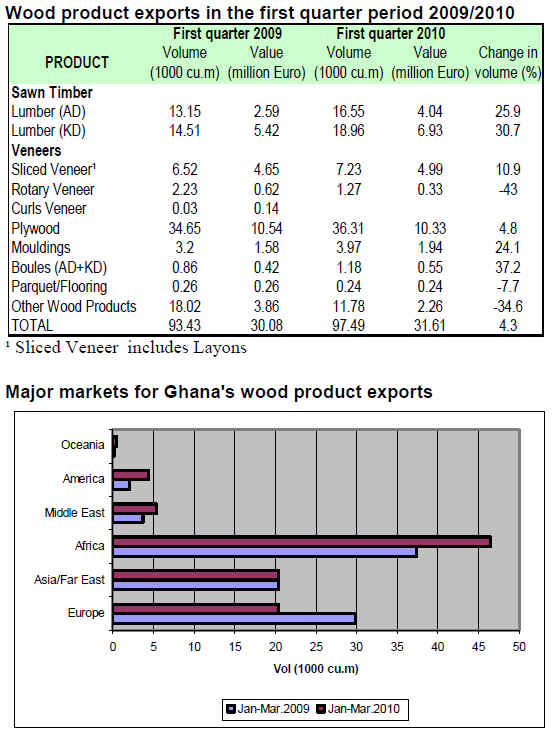

Ghana¡¯s first quarter wood products exports in 2010 amounted to 97,490 cu.m, worth EUR31 million. Compared with the same period last year, exports showed a 4.3% increase in volume. Exports to other African countries accounted for 40% of the total export value for wood products.

Primary products (poles and billets) accounted for EUR2 million, secondary products EUR27 million and tertiary products EUR2.4 million of the total export value.

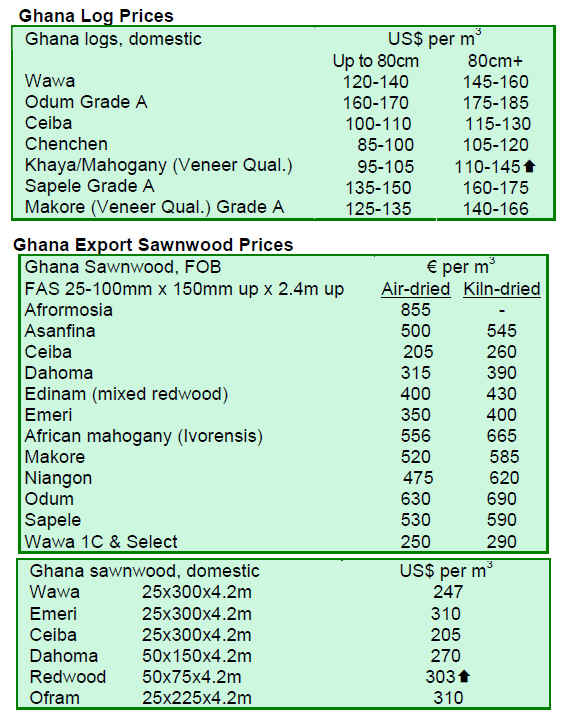

Plywood, kiln-dried and air-dried lumbers were the major export products during the first quarter of 2010 contributing 37%, 19% and 17% respectively to the total export volume. The share of veneer in the total export volume was 9%. No furniture parts were exported in the first quarter of 2010 as was the case in the same period 2009.

Plywood exports to other African countries in the period amounted to 34,800 cu.m, up 7.8% compared to 32,300 cu.m in 2009. The main importing country was Nigeria with 80% share of the total exports wood products from Ghana. Other importing countries were Burkina Faso and Togo. Ceiba, Mahogany, Chenchen and Mixed Red Wood were the principal species for plywood production.

Both air- and kiln dried lumber exports expanded. Air dried lumber exports rose from 13,150 cu.m recorded in the first quarter last year to 16,550 cu.m this year. Kiln dried exports increased from 14,510 cu.m in the first quarter 2009 to 18,960 cu.m in the same period this year. Wawa, Mahogany, Sapele, Koto/Kyere, Teak, and Ofram were the major sawnwood species exported. Germany, the USA, the UK and France were the principal importing countries.

Transportation costs undermine competitiveness of West Africa

Reducing transportation cost is considered critical to facilitate economic growth in West Africa. If export transportation costs could be reduced, exporting companies would be more competitive to expand their operations, thus creating jobs and generating revenue for the government, says a spokesman of West Africa Trade Hub.

It is reported that currently, 5 days of road transportation of a 20 foot container in the US costs around US$650, In W. Africa travelling the same distance can take 13 to 22 days and can cost up to US$4,800.

The West Africa Trade Hub is a private initiative bringing buyers and producers together to work on improving efficiency in transportation and logistics.

3.

MALAYSIA

Ensuring continued access to the EU timber market

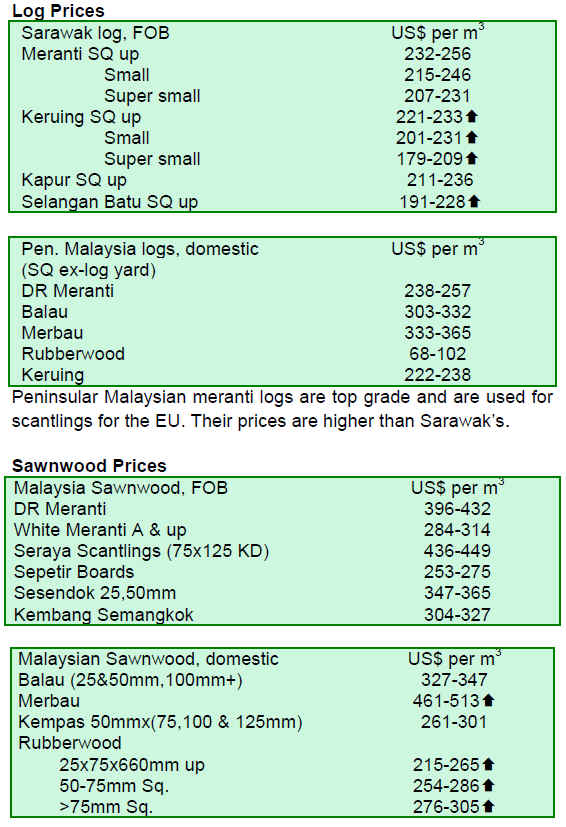

The Timber Exporters¡¯ Association of Malaysia (TEAM) has urged the federal government to sign the Voluntary Partnership Agreement (VPA) under the Forest Law Enforcement, Governance and Trade (FLEGT) Action Plan with the European Union (EU) in order that Malaysia can gain wider access to the EU timber market.

To date, Ghana, the Republic of Congo and Cameroon have signed VPAs with the EU.

Access to the EU timber market is becoming a critical issue for Malaysian timber producers. Due to the debt crisis in Europe, the Euro has weakened against the Malaysian Ringgit. This has the effect of making Malaysian exports more expensive.

Sabah furniture manufacturers seek relief from high costs

Furniture exporters from Sabah in East Malaysia complain that their market position is at risk due to high production costs, increasing ocean freight charges, unreliable power supply and tight raw material supplies.

The reason for the complaint is that the fee for a furniture export license is RM5,000 in Sabah, compared to only RM200 in West Malaysia. The EU market, which accounted for some 90% of Sabah¡¯s furniture exports has weaken and as a result, Sabah's position as the nation's leading outdoor furniture exporter is at risk.

Furniture manufacturers from Sabah are also seeking aid from the federal government to compensate for production losses caused by power blackouts.

4.

INDONESIA

Furniture industry targets brisk growth in exports

Furniture exports from Indonesia totalled US$674 million in the first quarter of 2010, 15% up from US$587 million in the same period last year.

Indonesia has set a target of US$2.59 billion for its furniture exports this year, an increase of 15% over US$2.25 billion in 2009.

Indonesian furniture companies showcased their traditional and rattan furniture at the Shanghai International Furniture Expo on 2-4 June 2010. The expo is aimed at middle and upper-middle class customers in China.

The Indonesia Furniture Industry & Handicraft Association (Asmindo) forecasts that its exports to China will hit US$20 million in 2010. This level is significant compared to US$9 million in 2009, which was 20% down from 2008. Indonesian furniture exports to China peaked in 2004 at US$14 million.

Certification improvements

Sustainable forestry management and afforestation efforts in Selopuro, Wonogiri in central Java, have improved the standard of living among villagers.

The Indonesian Ecolabelling Institute (LEI) has introduced forest certification in 10 sustainable community forest management units in Java covering 21,000 hectares of forests. These measures have generated revenues for the community to build schools.

Selopuro was the first village to have its community forest certified in 2004 and since then the community has experienced many improvements. For example, in the past the area had scarce water resources but today there are 22 water sources catering the needs of villagers.

In addition to the revenue from timber, the villagers earn additional income of US$60 by breeding livestock in community forests. The villagers also practise agro-forestry.

5.

MYANMAR

Teak market

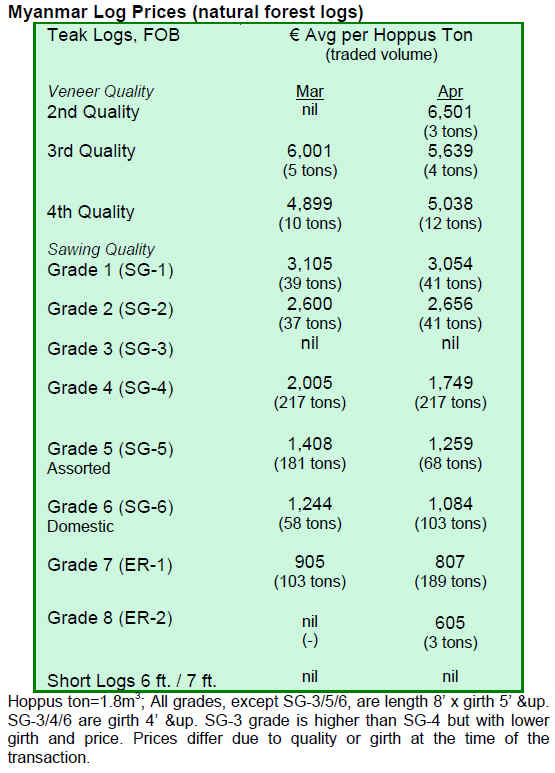

Teak log prices fluctuated with news of possible price cuts in March 2010. Instead, the Myanmar Timber Enterprise (MTE) proposed higher teak and pyinkadoe prices in May.

According to some analysts, the MTE should harvest smaller volumes of teak and other hardwoods to adjust supply and prevent excessive price fluctuations. Log traders have been requesting the MTE to provide timely information on prices and volumes in order to improve market transparency.

Non-teak hardwoods

Normally at this time of the year, fresh Gurjan logs are already available, pushing aside the old logs from the market. Instead, due to hot and dry weather conditions this year, the rivers are difficult to access, hampering log transportations by rafts and barges. As a result, fresh Gurjan logs are waiting upcountry to be transported and older Gurjan logs are still sold in the Yangon depot.

The demand for pyinkadoe logs remains strong. Some buyers report that resale prices for pyinkado are around US$900 per cu.m for the smaller girths and over US$1000 per cu.m for the larger girths.

Lessons from ASEM Conference

The recent ASEM Conference on Forest, Forest Governance and Timber Products Trade held in Cambodia generated new ideas among members of the trade on how to attract buyers particularly from the West.

The local timber industry has high stocks of teak lumber as a result of poor demand caused by the recession and economic sanctions. Some in the wood industry believe that the adoption of the EU FLEGT scheme could ease this situation.

Vietnam¡¯s annual forest product exports totalling US$3 billion could be an inspiration for Myanmar to become and important timber processor in the region. However, analysts point out that Myanmar needs to be more determined in reaching the long-term objective of exporting less logs and creating more processing capacity.

6. INDIA

Robust economic growth

In March, India¡¯s manufacturing sector maintained its growth increasing by 13.5% compared to March 2009. The sixth consecutive month of growth is creating optimism among policy makers and analysts about the future. As a result of increasing demands, production has expanded and raw material imports have surged 43%. Exports in April rose 36% compared to the level in April last year.

Shortage of inputs in board production

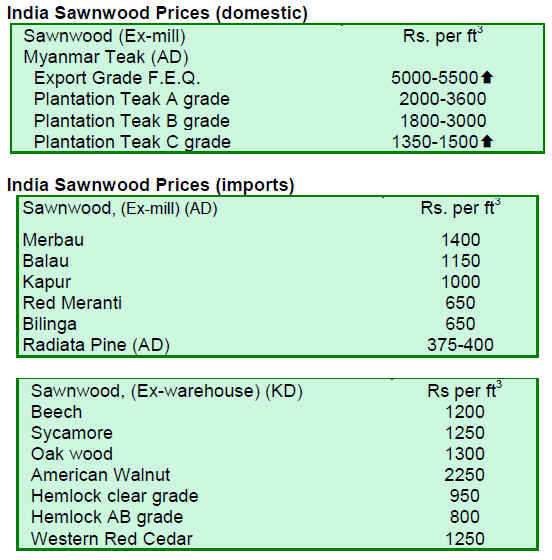

A rise of 25% in plantation log prices, low log supply and irregular power supply are causing problems for particleboard and plywood manufacturers in India.

Regional associations have recently announced prices for particleboard and plywood products. The plywood mills have seen it necessary to increase plywood prices, because there has been a sharp increase in the prices for poplar and eucalyptus logs as well as a 15% increase in resins prices. Board manufacturers in Punjab, Haryana and Uttaranchal have increased prices by 5% to 10%, whereas South Indian manufacturers have set 15% higher prices.

Low log supplies coupled with simultaneous increase in demand for processed products has led to panic in raw material sourcing. Increasing imports of high quality, large girth peeling grade logs seem to be the only immediate solution.

The industry needs additional large scale plantations of various high yielding species. China has been successful in establishing large scale plantations and India could use this as an example of how to increase the plantation production.

Manufacturers also complain of a lack of labour. One of the reasons for the shortage of labour is the National Rural Employment Guarantee Scheme which has been successful in employing workers in their own states and reducing workforce migration.

India still suffers from a lack of power plants. Many of existing units are experiencing production disruptions due to irregular fuel supplies. Plants which are planned to run in three shifts have been forced to run only one shift. As a result, the power plants have low productivity and energy supply is inadequate to satisfy demand.

Waghai and Dungarda log auction prices

The volume of auction sales in the Waghai and Dungarda depots of western India amounted to 8,000 cu.m. After more than 20 days of auctioning, the main traded species was teak and the total value of trade was RS.250 million.

Long Teak logs suitable for keels were traded between US$3100-3490 per cu.m. Shorter categories fetched US$1784-1940 per cu.m.

Premium quality, medium quality and lower quality sawmill logs were priced around US$1164-1320, US$1086 and US$466-620 per cu.m respectively.

Laurel and Haldu were the main non-teak species traded and prices were around US$698 per cu.m for first quality logs, US$388 per cu.m for medium quality logs and US$116-194 per cu.m for lower quality logs.

7. BRAZIL

Brazil sustains exports growth

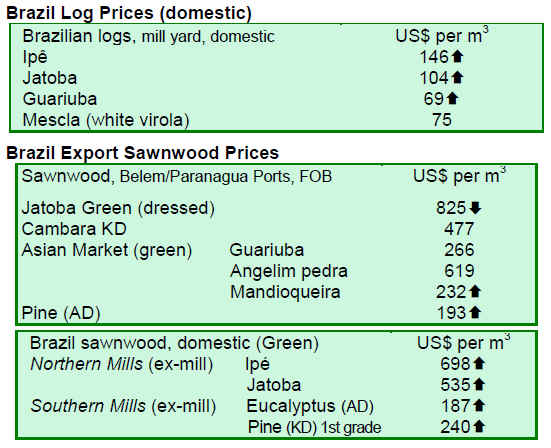

In April 2010, exports of timber products (except pulp and paper) increased by 13% from US$180 million in April 2009 to US$202 million.

Pine sawnwood exports in April remained unchanged at US$14 million. However, in terms of volume, exports declined 10% from 69,300 cu.m in April 2009 to 62,400 cu.m in April this year.

Exports of tropical sawnwood rose in terms of both volume and value, from 40,700 cu.m in April 2009 to 46,500 cu.m in April 2010, and from US$20 million to US$23 million. This constitutes a 14% increase in terms of both volume and value.

The value of pine plywood exports jumped 34% in April 2010 compared to the level in April 2009, from US$22 million to US$30 million. Nevertheless, export volumes

dropped by 10% during the period, from 93,000 cu.m to 84,000 cu.m.

Exports of tropical plywood increased marginally from 9,500 cu.m in April 2009 to 9,600 cu.m in April 2010. In value terms, the rise was 1.9% to US$5.4 million.

For wooden furniture, the value of exports rose by 2.2% compared to the level in April 2009 to US$42 million in April 2010.

Economic trends

According to the Brazilian Institute of Geography and Statistics (IBGE), the Consumer Price Index (IPCA) for April 2010 increased 0.57%, slightly above the rate 0.52% recorded in March.

To-date, the cumulative inflation rate for the year is 2.65%. This is 5.26% above the same period in 2009.

In April 2010, the average exchange rate was BRL 1.76/US$, while the rate was BRL 2.31/US$ in the same month of 2009, reflecting the appreciation of the Brazilian currency against the US$ over the period.

In its late April meeting, the Monetary Policy Committee (Copom) of the Central Bank raised the prime interest rate to 9.5% per year. Since July 2009, the interest rate was at 8.75% per year and this is the first rise since September 2008, when it was increased from 13% to 13.75% per year.

FEMADE attracts foreign exhibitors

The International Timber Industry, Furniture and Forest Sector Fair (2010 FEMADE) was held on 24-28 May 2010, in Curitiba Southern Brazil. The event focused on business development throughout the wood processing chain and on promoting new business opportunities.

Traditionally over 40% of FEMADE 2010 exhibitors are from abroad, mostly from Germany, Argentina, Chile, China, Finland, the Netherlands, Italy, Pakistan and Taiwan. In addition, the fair attracts associations such as ACOPI (Colombian Association of Micro, Small and Medium Enterprises), FAIMA (Argentina Federation of Timber Products Industry), ProChile (Export Promotion of Chile) and WMMA (Wood Machinery Manufacturers of America).

Integrating furniture sector in the West-Central Region

The furniture sector in West-Central Brazil has undergone several changes in recent years. In the past, the region was known as a major log exporter. However, processed products such as furniture are now exported. In the state of Mato Grosso do Sul, however, logs are still the main export product according to the Intermunicipal Union of Furniture Industry of Mato Grosso do Sul (SINDMAD/MS).

In order to strengthen cooperation within the production chain, entrepreneurs and workers of the furniture industry in the state participated in a recent meeting. The meeting was also attended by representatives from the Brazilian Support Service for Micro and Small Enterprises (Sebrae/MS), SINDMAD and Mato Grosso do Sul State Industries Federation (FIEMS).

The West-Central is a major furniture producer region with distinctive design, quality and regional identity. One of the bottlenecks in production is shortage of skilled manpower. Efforts will be taken by the unions and associations to systemically educate workers, especially in production technologies.

The Central Brazil Business (PBCN) strives towards achieving this objective and it involves the West-Central states including Goias, Mato Grosso and the Federal District (Bras¡¡ìªlia). The other regional states in Brazil have already integrated their furniture sector and now its time for Mato Grosso do Sul to develop and gain more market share in furniture markets.

8.

PERU

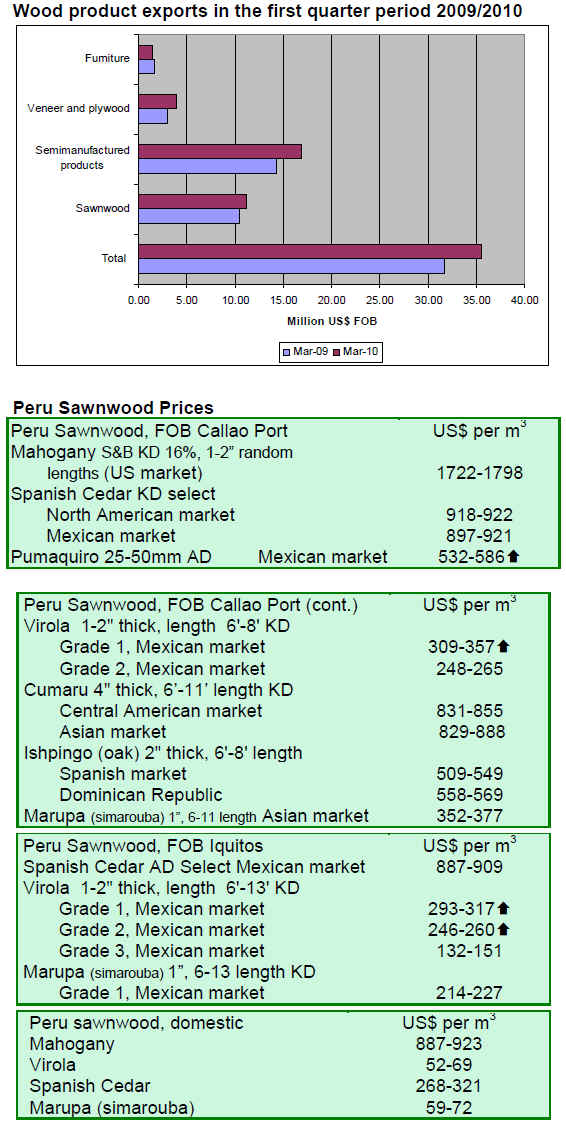

Exports growth continues in March

The Export Association of Peru (ADEX) reported that exports of wood products in March 2010 were US$13.3 million, up 9% compared to March 2009. Three main buyers were China, the USA and Mexico accounting for 82% of the total volume of exports.

Exports of parquet to Canada continued upward in March. Sweden also increased its imports of parquet. However, wood product exports to New Zealand and Hong Kong tumbled by 87% and 56% respectively.

First quarter exports in categories

The main exported products were semi-manufactured products and sawnwood representing 47% and 32% of the total volume of exports.

In the first quarter of 2010, exports reached US$16.8 million for semi-manufactured products, an 18% increase over the same period in 2009. Semi-manufactured products were exported mainly to China which accounted for 80% of the total exports.

The sawnwood exports totalled US$11.2 million, up 6.4% over the first quarter period in 2009.

Veneer and plywood were exported mainly to Mexico which accounted for over 98% of total exports.

In the first quarter of 2010, exports of furniture and parts reached US$1.4 million, a 19.5% decline compared to the same period last year. These products were exported mainly to the US which accounted for 57% of the total exports. Italy reduced its imports by 37% in this category compared to the first quarter period in 2009.

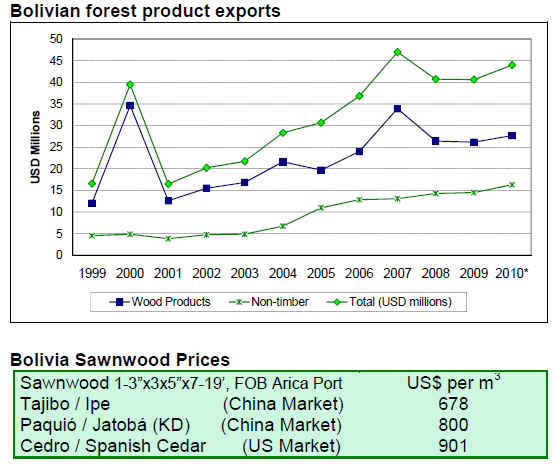

9. BOLIVIA

Forest product exports recovering

Forest product exports from Bolivia totalled US$44 million in the first quarter of 2010, up 8.2% from US$41 million in the same period last year.

Forest product exports from Santa Cruz rose 7% over the first quarter period in 2009, from US$15.2 million to US$16.3 million.

Furniture, doors, boards, decking, peeled chestnut and canned palm hearts account for 78% of the total forest product exports, while the remaining 22% consists of primary processed wood products, such as sawnwood and poles.

The US market remained the major importer for Bolivian forest products taking some US$9.6 million, which was US$3 million lower than in the first quarter in 2009. Other major export destinations were the UK (US$6 million), China (US$2.8 million), the Netherlands (US$2.7 million) and Venezuela (US$2.5 million).

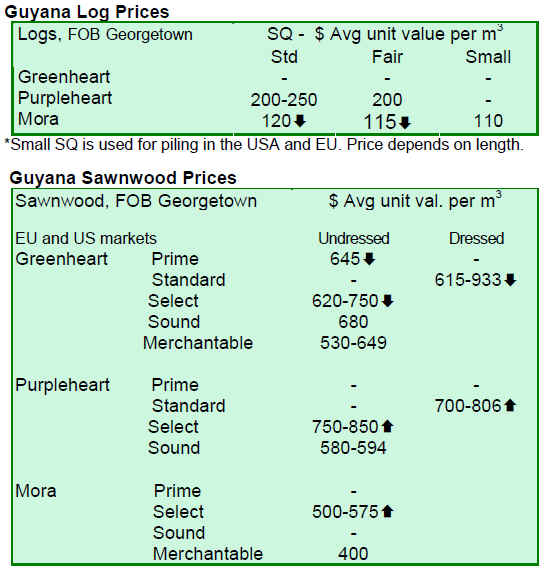

10. GUYANA

Market Trends

The traded volumes of logs declined during the fortnight period under review. However, the average prices for Purpleheart and More logs remained stable. Log stocks are ample and focus was on trade of sawn lumber which was in demand due to the local housing boom in Guyana. The Government of Guyana is supporting housing for small and middle income families by developing several new housing areas.

For the period under review, the Lesser Utilised Species exported included Burada (Parinari spp.) Darina (Hymenolobium spp.) and Itikiboraballi (Swartzia spp.). The main markets for these species were in Asia.

Sawnwood prices in select grade advanced for both Greenheart and Purpleheart (Undressed), US$750/620 and US$850/750 per cu.m respectively during this fortnight period. A price increase was also recorded for Mora in select grade.

Baromalli plywood in both BB/CC and utility category recorded higher prices compared to the levels two weeks ago.

Value added products also contributed positively to the total export earnings for this fortnight period. Some of the main products were indoor furniture, spindles and non-timber forest products.

Guyanese company wins IWPA Innovative Excellence award

The World of Wood Convention organised by the International Wood Products Association (IWPA), was recently held in Miami Beach, Florida. The conference drew nearly 300 industry leaders from 30 countries and over the years it has been very helpful in promoting Guyanese wood products worldwide and attracting buyers in the US market.

Guyana¡¯s sustainable wood sector was showcased during a special presentation. Durable Wood Products, a Guyanese company, won the IWPA Innovative Excellence award for their Turada Wallaba shingles. Cedar and other wood shingles need to be treated with chemicals to make them more resistant to fire, insects, and decay. However, the Turada Wallaba Shingles manufactured in Guyana need no chemical treatment, making them a more environmentally friendly product.

The Guyana delegation at the conference included members of the Forest Products Association of Guyana (FPA), the Guyana Manufacturers & Services Association, and representatives from the USAID/Guyana Trade and Investment Support (GTIS) project, and several timber companies, such as Toolsie Persaud Ltd., Guyana Timber Products, Guyana Shield Forest Resources Ltd., Durable Wood Products, and Ganesh Singh & Brothers

Logging/Sawmilling.

Related News:

|