|

1.

CENTRAL/ WEST AFRICA

Log ban comes into effect

The log export ban in Gabon takes effect as planned from midnight on 15th May. This puts an end to speculation about when the ban would come into force. Producers and traders in the region will now have to adapt to the new market conditions.

The situation is causing some unrest among the labour unions that this will inevitably lead to unemployment in the timber industry. According to reports, the port workers are already taking strike action and reports suggest that other labour unions are also considering similar action.

In the meanwhile, the industry is determining how to proceed given the current conditions in the sawn and processing markets. It is clear that current sawn lumber prices may have to rise in line with the recent surge in log prices. Exporters of further processed products have experienced even more difficult market conditions this year, as shown by the decline in exports of processed products from Ghana in particular, as well as from other West African producers.

Producers in Gabon say that much of their logging and transport equipment will be made redundant by the log export ban. For some, this would be around 50% of their total logging bulldozers and log haulers.

Local transport companies including the railways are expected to be hard hit by the removal of 1million tonnes of annual freight.

Although it is not possible for the time being to quantify any changes in log prices, some species such as okume, okan and tali have already experienced increasing prices before the ban.

The producers and traders in the region are now adapting to the new market conditions and planning their future production and market strategies. The log importing countries will also have to determine how to adapt to the reduced availability of logs from W. Africa.

Prices difficult to determine

Most of the very active log trading in the West and Central African region is centred in Cameroon and there has been frenetic bidding for all kinds of logs.

Sellers are insisting that depending on the total value of each transaction, a large proportion of the purchase price must be paid in advance and in cash. The balance is required immediately against the bills of lading.

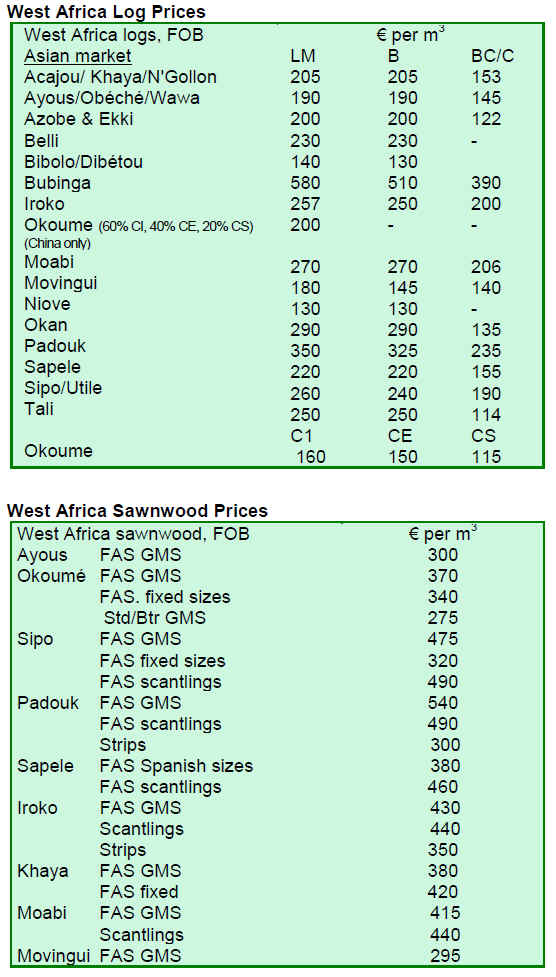

These rather ad-hoc transaction methods make the determination of the current price levels very difficult. However, it is estimated that prices of most species are up by at least EURO 5 - EURO 10 per cu.m and still rising due to strong demand from buyers mainly for China and India. Also, demand in Europe is showing some slight improvement.

2. GHANA

Difficulties in attesting origin

The Lacey Act Amendment, a law passed by the United States Congress in 2008, is significantly affecting handcraft exports from Ghana. The law requires that any product imported through the US customs is not among threatened or endangered species and complies with laws of origin.

According to the President of the Ghana Handicrafts Exporters Association, Mr. Osei Opoku- Ampomah, the Lacey Act poses a problem because many of the artisans producing for export are illiterate and thus unable to complete the necessary documentation. The association is working with the Forestry Commission in Ghana to develop a system that will assist the artisans.

Other timber product exporters from West Africa are facing the same problem. The West African Trade Hub organised a regional workshop to help exporters understand what the Lacey Act actually requires and how to comply with the requirements.

Loans for SMEs resume

Barclays Bank in Ghana has resumed offering credit facilities to small and medium sized companies, reports Business & Financial Times.

During the recent credit squeeze, the bank suspended loan facilities for SMEs because of non-performance and loan repayment problems by many borrowers. However, the bank has now resumed providing loans to SMEs on flexible terms.

3.

MALAYSIA

Challenges in expanding trade

The Timber Exporters¡¯ Association of Malaysia (TEAM) is expecting exports of timber and timber products to grow between 5% to 10% during the current year, up from RM19.5 billion registered in 2009.

The Malaysian timber industry is seeking new export opportunities in the Middle-East countries and India, in addition to its traditional markets in Japan, Europe and the US.

The timber industry is facing challenging times in finding workers and obtaining trade financing from local financial institutions. Some financers apparently perceive the timber industry as lacking environmental friendliness and as a sunset sector.

Some downstream timber companies may consider relocating their operations to countries like Vietnam or China to overcome the problem of finding workers.

The upward trend in freight charges over the last one year is also a serious challenge for the industry, especially as the weak demand makes it difficult to pass the increasing freight costs through price increases without risking a loss in sales.

Three new furniture complexes in Sarawak

The Sarawak Timber Industry Development Corporation (STIDC) is proposing new furniture complexes to be located in Bintulu, Kapit and Lawas under the Tenth Malaysia Plan, a national development plan undertaken by the Federal government.

The three complexes are in addition to another three that are already in operation in Sarawak. These furniture complexes are set up to attract local furniture vendors as well as to provide training for them.

Currently, there are 47 vendors in Sarawak¡¯s existing furniture complexes and the plan is to have up to 5 vendors for each new complex. Complexes will function as incubation centres until the vendors are capable of setting up their own furniture production facilities.

Decline in exports of logs from Sarawak

In the TTM Report Volume 15 Number 7, 1st:C15th April 2010, it was reported that exports of wood products from Sarawak declined in the first two months of 2010 compared to the same period in 2009. This is incorrect as the decline was only in respect of exports of logs.

4.

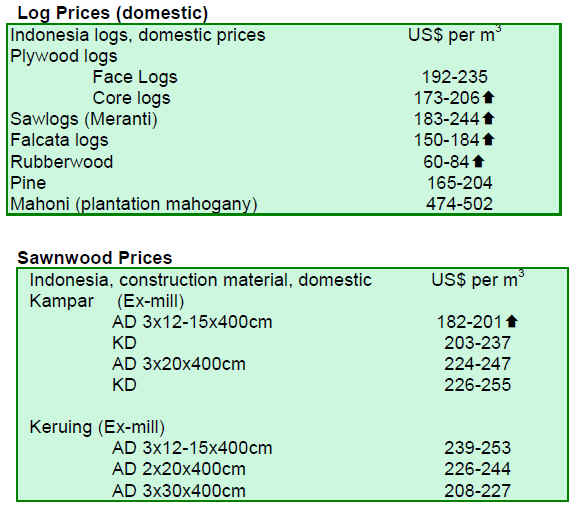

INDONESIA

Surge in revenue from processed timber exports

The state revenue from the processed timber exports increased to US$1.6 billion in the first quarter of 2010. The leap was significant compared to the same period last year valued at US$133 million.

Rupiah sustains strength

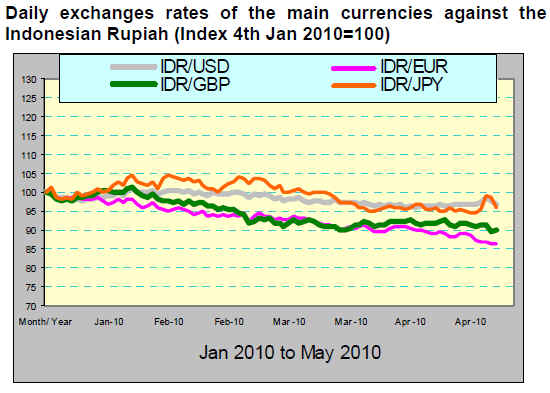

The prices of Indonesian timber products remain broadly stable. The downward trend in exchange rates of the main currencies against Indonesian Rupiah has the effect of making Indonesian exports more expensive.

In particular, the Euro is weakening due to the effect of the Greek crisis and the UK pound is also being dragged down.

However, increasing demand from the Asian markets is propping up timber export prices.

Lack of competitiveness of legal timber

Despite the favourable export figures, the Indonesian Forest Society (IFS) representing forestry companies in Indonesia is concerned about the vitality of Indonesian forestry companies.

Those companies which utilise illegally harvested logs which are cheaper than legally harvested, have a competitive advantage. This situation undermines the viability of companies operating within the law.

The smuggling of cheap illegal logs to overseas buyers also undercuts domestic businesses. This is dramatically weakening the profitability and vitality of the timber industry in Indonesia, says Sudradjat Djajapertjunda, the chairman of the Indonesian Forest Society.

A study by the Center for International Forestry Research (CIFOR) found that the average price for legally harvested logs was almost three fold compared to illegally harvested logs.

5.

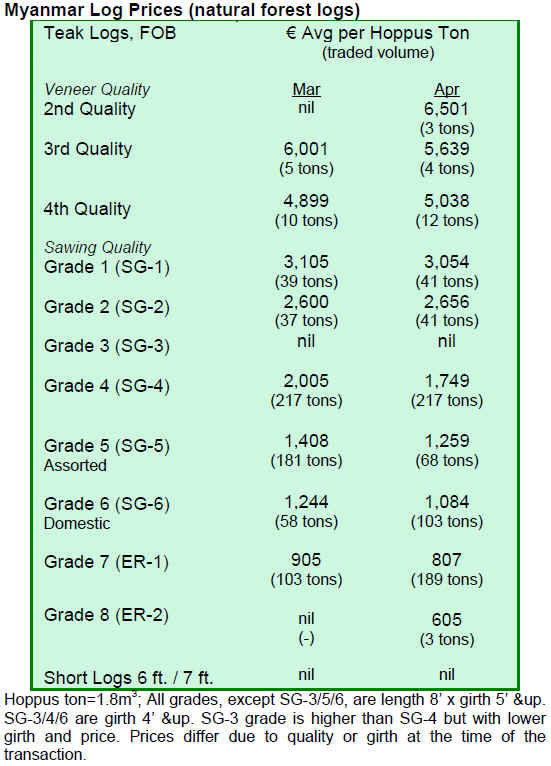

MYANMAR

LUS promoted in MHFF¡¯10

The Myanmar Hardwood Furniture Fair (MHFF¡¯10) was held jointly by two governmental agencies: Myanmar Timber Enterprise (MTE) and Myanmar Timber Entrepreneurs¡¯ Association (MTA). The fair was held at the Myanmar Convention Centre in Yangon.

The furniture fairs have been held once every two years since 2004. Previous fairs focussed exclusively on teakwood furniture and the MHFF¡¯10 was the first to have a theme on non-teak hardwood furniture.

At the fair, the Forestry Minister pointed out the need to increase utilisation of Lesser Used Species (LUS). The MHFF¡¯10 was to promote sustainable and more efficient use of forest resources, expansion of the domestic furniture production and the utilisation of modern technology in processing LUS.

Both the public and private sectors were urged to make use of the technical information and experience gained from the MHFF¡¯10, and to promote the LUS in lieu of traditional timber species like Teak and Pyinkadoe.

The fair presented various types of furniture and secondary wood products such as plywood, parquet floorings, doors, a special item called ¡®Environmentally friendly and Economical floorings¡¯ and rattan furniture. The products were mainly made from Gurjan and other

LUS.

ASEM Conference

Seven participants from Myanmar attended the ASEM Conference on Forests, Forest Governance and Forest Products Trade: Scenarios and Challenges for Europe and Asia held in Cambodia from 4th to 5th May 2010.

Analysts say that many from the timber sector in Myanmar welcome the FLEGT and Timber Certification schemes as means of promoting legal trade.

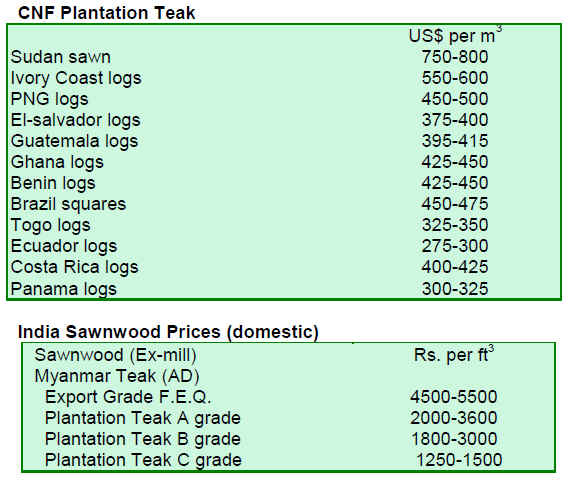

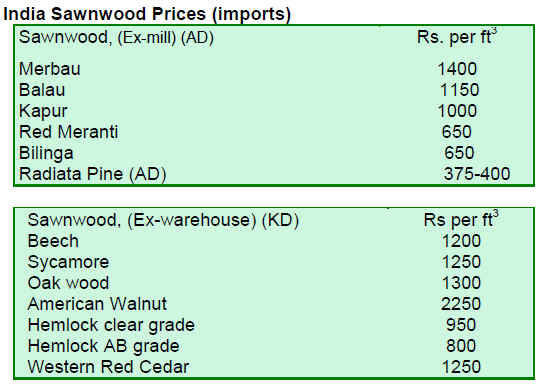

6. INDIA

Strong demand and Rupee push prices up

The market demand and flow of imports of plantation teak logs and squares are good and prices are firming. The strengthening of the Indian Rupee against the US$ is benefiting the Indian importer.

Plywood mills are facing scarcity of raw materials coupled with rising costs of logs and a shortage of labour. Consequently, some plywood mills in the north part of the country have seen it necessary to increase plywood prices.

Indian trade scene

Some issues in India concerning the EU FLEGT Action Plan were raised at the ASEM Conference in Cambodia on 4th and 5th May 2010.

The speaker from India pointed out that authenticated documentation is required on imports to prevent any illegal timber entering from producing countries. However, third-party authentication is problematic and there can be illegal timber flows through a third country that is difficult to identify.

Illegal imports are perceived to have a negative effect on local employment and state income. Smuggled products sold at low prices depress domestic timber production. Educating the domestic industry on responsible procurement and creating balanced markets for responsible wood suppliers are necessary to prevent forest law violations and smuggling.

Several measures and regulations have been set up in India to prevent domestic illegal logging. In most of the states wood processing factories are not authorised to operate within 10 km from forest the boundary. Factories are obligated to have licences to operate which are granted only if all inputs are certified. CITES-listed species and any other illegal exports are seized at the boundaries to prevent trade in these species.

Prices firm at Gujarat hardwood auctions

Auction sales in the North and South Dang¡¯s depots in Gujarat were held recently. The total volume of Teak traded amounted to 7,500 cu.m. Brisk trade kept prices at the same levels as in two preceding auctions.

Teak from Gujarat forests is favoured by domestic boat builders because the logs are of a length suitable for keels and masts. These long Teak logs were traded at between US$1,700-1,780 per cu.m and few batches with longer lengths fetched US$3,100 per cu.m.

Teak suitable for use as beams in house construction attracted average price of US$1,320 per cu.m while smaller sizes for doors and windows were priced around US$930-1,160 per cu.m. Medium quality sawing grade logs ranged from US$620 to US$780 per cu.m.

Laurel and Haldu were the main non-teak species traded and prices were around US$310 per cu.m. Prices for a few special batches reached as high as US$620 per

cu.m.

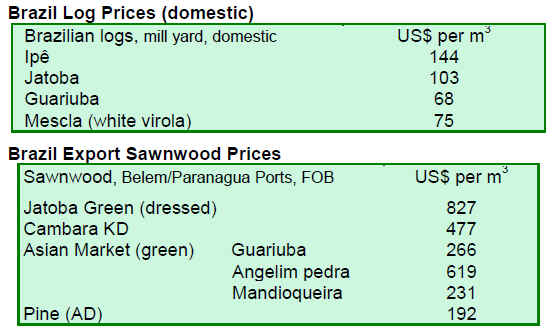

7. BRAZIL

Economic package to boost exports

Companies located in the southern state of Rio Grande do Sul expect to gain competitiveness in foreign markets since an economic package to stimulate exports was announced in the beginning of May.

According to the Ministry of Finance, 10 measures are considered essential to address the country's external balance, which recorded a deficit of US$12.14 billion in the first quarter of 2010, the highest since 1947.

Among the initiatives to boost export performance is the guaranteed return of 50% of the federal tax within 30 days, instead of the current five years. The remaining 50% of tax returns will follow the current rule.

The Ministry hopes that the measure will have an immediate and positive impact on the competitiveness of Brazilian production. According to the Industry Federation of Rio Grande do Sul (FIERGS), the sales price of manufactured goods could be reduced by at least 5% as a result of the new tax refund system. The measure, however, applies only to companies that have at least 30% of their revenues from exports over the past two years.

According to the Association of Furniture Industry of Rio Grande do Sul (MOVERGS), the furniture industry may benefit from the new tax return measure. The industry also expects an increase in export credit offered by the Export-Import Bank.

Wood furniture industry sees growth in 2010

The Brazilian Furniture Industry Association (ABIMÓVEL), forecasts a 10% growth in the sector for this year bringing output back to levels in 2008.

In 2008, Brazilian production of wood furniture reached R$22 billion. In 2009, sales fell 18% to about R$18 billion due to the global economic crisis. In the same period, exports declined by 28%. Furniture valued at R$2 billion were exported in 2008 but only R$1.3 billion was exported in 2009.

The performance of the sector from December 2009 to February this year has shown an upward trend. Sales during this period increased 13% and the mill capacity utilisation rose from 70% to 85%.

Argentina, the largest importer of Brazilian wood furniture, increased imports by 50% in 2009 compared to 2008. The second largest importer was France, despite an 11% decrease in purchases. Other major importers were the UK and the US, with 27% and 23% increase in imports respectively.

Forest Concessions at Aman:¢ National Forest, Par:¢

The Brazilian Forest Service has announced some details of the forest concessions available in the Aman:¢ National Forest in Par:¢ state. A total of 210,000 hectares will be available for legal and sustainable logging. Timber production is expected to reach 150,000 cubic metres per year and generating revenue around R$6.7 million.

Besides timber, the forest concession bid winners can utilise non-timber forest products and carry out ecotourism activities. The revenue obtained from the concession shall be distributed among all levels of government (Union, State and Municipalities) and 30% will be designated to monitoring and control of concession areas. The remaining revenue must be used to promote conservation and sustainable forest practices.

8.

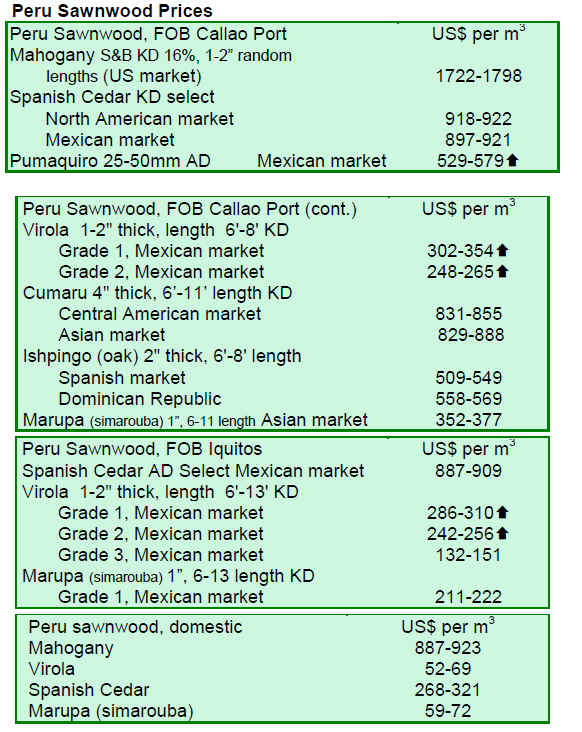

PERU

Techical support for Lorento concessionaires

Peru's Agency for Supervision of Forest Resources and Wildlife (OSINFOR) has proposed that forest concessionaires in Loreto should establish strategic alliances to strengthen forest management.

In this regard, Osinfor will provide technical assistance to forest concessionaires to enable them to prepare, implement and monitor their management and annual operational plans efficiently.

Changing operational environment for carpentry

The Peruvian woodwork sector fell 15% during the economic crises. This year, production is expected to grow but there is a need to develop the furniture sector in terms of design and technological innovations.

At present, houses tend to be smaller when different styles and designs for interior products and furniture are required. This makeover has been employing the woodwork and furniture industry.

The woodwork and furniture sector was recently promoted in the carpenters fair held in Lima.

Progress in drafting new forest law

The process of drafting the new forestry law continues. Progress has been made in the text concerning aspects of institutional strengthening and control.

The proposed text also emphasises economic and social aspects based on the premise that forest degradation is generally a product of the informal sector and illegal logging.

The new law intends to introduce interesting innovations to facilitate private investment. In addition, while it is recognised that the owner of forest is the state, rights can be assigned to others.

9.

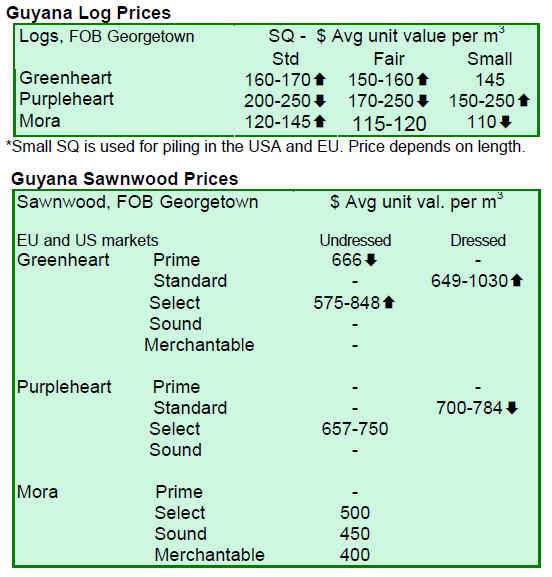

Guyana

Market news

Average prices for logs remain relatively stable. Maximum prices for Purpleheart logs held at US$ 250 per cubic metre for all three quality groups.

Prices for Mora standard sawmill quality logs increased while small sawmill quality logs recorded a decline in prices.

For the period under review, the lesser utilised species exported included Kautaballi (Licania majuscule) and one of Guyana¡¯s rare species, Dukaliballi (Brosmium spp).

Sawnwood exports contributed positively to the total export earnings for this fortnight period with Greenheart rough sawn (Undressed) select quality seeing some price increase compared to the previous period (US$ 848/742).

Rough sawn (Undressed) Purpleheart and Mora average prices remained stable for this period.

Dressed Greenheart sawnwood fetched an average price level of US$ 1030 per cu.m. Guyana¡¯s Ipe (Washiba) achieved a high average price for this fortnight period (US$ 1750 per cubic metre).

Only BB/CC Baromalli plywood was exported and price levels, as recorded during the previous two weeks, were maintained.

Splitwood also made a significant contribution to the total export earnings for this fortnight period.

Value added products such as doors, mouldings, indoor furniture, crafts, non timber forest products, windows and wooden utensils have all contributed positively to the total export value earnings for this fortnight period.

Related News:

|