|

Report

from

Europe, the UK

and

Russia

European hardwood decking market picks up

After a slow start to the spring season due to poor weather and market uncertainty, the European market for decking hardwoods has now picked up. Early signs are that consumption in this sector may be a little better than last year.

Cautious buying by European importers during 2009 in the face of market uncertainty and limited credit means that stocks of tropical hardwood decking material are very low for the time of year. This factor combined with reports of tight supplies from all the major producing regions has led to mounting concerns of potential supply problems later in the season.

Lead times for tropical hardwood decking are now extending well into the third quarter of the year so that much new material is only scheduled to arrive after the summer, too late to take advantage of the market for decking.

Forward prices for tropical hardwood decking products quoted in US dollars are generally forecast to continue to rise throughout the year. Progressive strengthening of the US dollar against European currencies this year is exaggerating this price increase for European importers.

Some importers suggest that they are having problems passing on these price increases to their European customers. The continuing gap between rising forward prices and many European consumers willingness to pay is likely to depress the European market for tropical hardwoods during 2010.

Challenging redwood market

The European market for primary tropical redwood species remains very difficult. Significant gaps are now opening up in existing European landed stocks of key African species such as sapele, iroko and sipo. But African mills are low on logs and are in no position to supply wood at short notice. African mills are generally not holding stock and are only sawing to order with the result that lead times are now stretching well into the third quarter of the year.

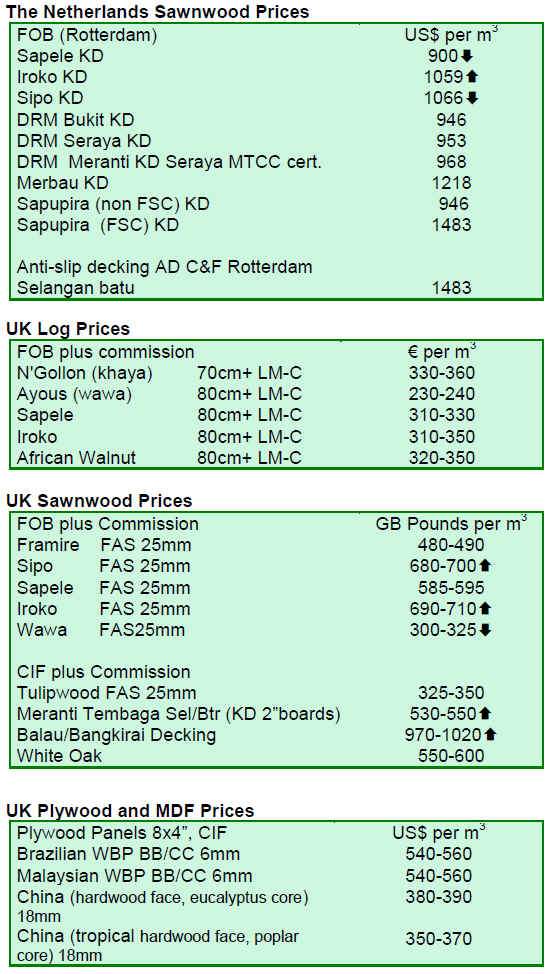

CIF prices quoted in euros to European buyers for African sapele, iroko and sipo are generally firming. However, as in other sections of the European tropical wood market, importers report that end-user consumption is still very patchy and there is little market acceptance of the need to pay higher prices.

A similar situation prevails in the market for Malaysian sawnwood. For example, the German trade journal EUWID reports that current CIF North Sea port prices for 3x6¡± meranti kiln dried sawn lumber are currently in the region of $950-1050/m3. Meanwhile, German importers corresponding onward sales prices are only in the region of EURO 800/m3 ($1060/m3) free buyers¡¯ yard, implying very tight margins within the European distribution chain.

The pace of freight rate increases, which impacted heavily on the European market for tropical hardwood in the first quarter of 2010, seems to have slowed in recent weeks. However, shipping lines are reported to be considering further freight rate increases in May.

Shift to break-bulk plywood shipment

One impact of recent container freight rate increases has been to encourage a significant shift towards break-bulk imports of tropical hardwood plywood into the EU.

For example, the UK trade journal TTJ recently reported that Altripan UK has just received its largest ever shipment comprising 16,900 cubic metres of Chinese plywood carried on the maiden voyage of break bulk vessel MV Panamana. Altripan said restarting large-scale break-bulk shipment was down to a combination of rising container freight rates, improved product condition of break-bulk transport and reducing the need for feeder shipments from parent company Altripan NV in Belgium.

European tropical log market remains very slow

Economic uncertainty and continuing turmoil in Europe¡¯s hardwood veneer and plywood sectors have resulted in continuing low levels of tropical hardwood log imports. African log prices quoted in euros on offer to European importers are reasonably stable but leaning towards a firming tendency.

A decision by the Gabonese Government on a long-term log export policy will ease the strategic planning of importers and European plywood manufacturers.

Push for tougher stance on illegal imports

A group of 4 leading European retailers launched the Timber Retail Coalition (TRC) on 6 April 2010 "to support measures to curb illegally harvested timber". Kingfisher, Marks & Spencer, IKEA and Carrefour Group are the founding members. According to a TRC statement, it is "committed to tackling global deforestation linked to climate change. By providing a single platform for engaging with politicians and policymakers at national and EU levels, the TRC will significantly enhance this effort".

The TRC supports the European Commission¡¯s on-going efforts to create an EU-wide regulation requiring importers and domestic wood suppliers to implement due diligence systems designed to minimise the risk of their trading in illegal wood. The TRC sees these efforts as "a crucial step towards the widespread adoption of responsible timber sourcing practices". The TRC believes the regulation will "help to create a level playing field, which currently does not exist as the illegally logged timber products industry still has easy access to the EU marketplace".

According to a TRC spokesman interviewed by the TTJ, the coalition wants the EU regulation to go further than currently proposed by the European Commission and European Council. TRC support a specific prohibition on illegal imports with punishment for timber companies that knowingly place illegal timber on the market. But TRC also says that the burden of proof should lie with the entity that lays charges and that the principles of due diligence should not be superseded.

Next month, the European Parliament's Environment Committee is due to vote on a second more far-reaching draft of the proposed legislation tabled by Green MEP Caroline Lucas. A full plenary session of the European Parliament will then vote in June. After that further negotiations may have to be held to formulate a consensus text acceptable both to the European Parliament and to the European Council.

European bounce weaker than other major economies

In its latest forecasts released on 21st April, the IMF predicts that global output on a purchasing power basis will see healthy growth of 4.2% this year, a full percentage point more than it was foreseen only six months ago. Other forecasts are even more optimistic, predicting global growth of 4.5% in 2010 ¨C close to the average pace of the boom years prior to the recession.

Unfortunately for Europe, the healthy pace of global growth belies significant and growing differences between regions. The largest emerging economies China, India and Brazil are accelerating fastest with growth forecast by the IMF to be close to, or to exceed, double-digit rates. The IMF reckons that the US will grow by as much as 3% this year. In contrast Europe, where the downturn was particularly pronounced during 2010, is now experiencing one of the weakest recoveries. The IMF expects output growth of only 1% in the euro-zone and 1.3% in the UK this year.

The European economy received a boost this year as companies generally stopped the fierce destocking that exacerbated the recession during 2009. This is apparent in the upturn in wood imports beginning in the last quarter of 2009.

But if this recovery in Europe is to take root, it must be able to cope with a gradual withdrawal of emergency support. It will need to develop a more sustained impetus from the private sector than a short-term turnaround in the inventory cycle.

That will require new sources of demand. With overall domestic consumption in major end-using sectors like construction and furniture stagnant, for the wood sector this means serious efforts to increase and regain market share from alternative materials. It will require increased private investment and other measures to improve productivity and reduce costs in a drive to boost export demand for Europe¡¯s finished wood products.

|