Japan Wood Products

Prices

Dollar Exchange Rates of

30th April 2010

Japan Yen 94.09

Reports From Japan

Imported plywood supply remains tight

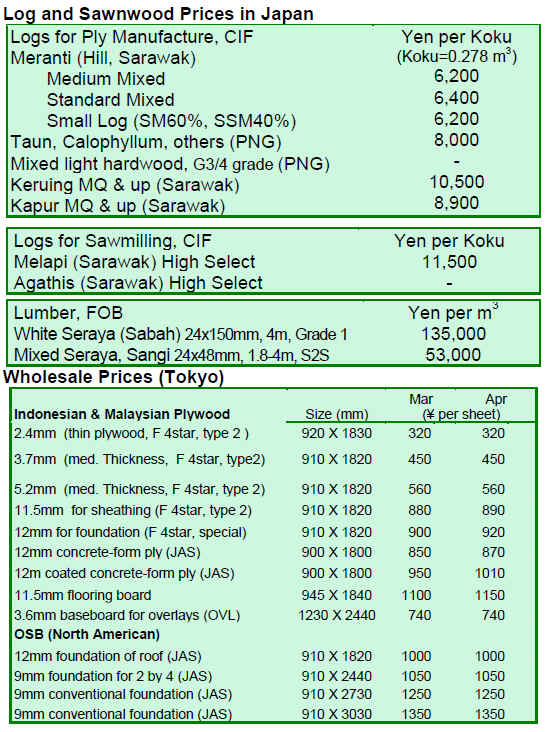

The availability of imported plywood has not improved and supplies are said to be tight. Malaysian suppliers are looking for higher prices which are aiding the strengthening of the Japanese market price. This is especially as domestic manufacturers are determined to move prices higher.

Japanese plywood manufacturers are very serious about pushing plywood prices to profitable levels. Over the past two years prices have dropped so low that most companies could not even breakeven.

For the first time, Japanese plywood manufacturers are working together, says Japan Lumber Reports (JLR). At the moment, no manufacturer is offering discounts in order to secure sales. The pricing crisis has meant that all manufacturers have a common purpose.

House builders are aware of this determined stance by the manufacturers and are slowing accepting the new prices. 12mm 3x6 structural panels are priced at ¥ 690-700 per sheet delivered. Tongue and grooved thick panels, 24mm 3x6 will be priced at ¥ 1,360-1,400 from May.

If demand in May holds, JRL is projecting that prices for 12mm panels could rise to ¥ 750 per sheet.

Shift in Canada Japan trade

Canadian softwood lumber has become more expensive for Japanese importers because of rising freight charges and aggressive sourcing by Chinese companies. Now this situation is likely to get worse for Japanese importers as a result of changes in the rate of export duty charges on softwood exports to the US by the British Columbia provincial government in Canada.

While the duty rate was high, Canadian millers had diversified their markets but with good prices available in the US market and with the reduced export duty many are shifting back to the US market at the expense of the Japanese market.

Cash for ‘heat island’ study

Japan’s summer temperatures hover around 30 degrees for 2-3 months and in the cities the high temperatures create hot spots as buildings capture and radiate heat. This results in the so-called ‘urban heat islands’.

The Forestry Agency in Japan is about to undertake a ¥ 110 mil. study of the cooling effect of wood cladding on buildings. The first part of the study will be in Osaka according to the JLR.

The idea of taking advantage of the thermal insulation properties of wood to cool urban hot spots will, says the JLR, contribute to expanding the use of wood.

Housing starts and remodelling business

The tough economic conditions in Japan have hit housing starts which have driven down demand for wood products. The poor economy has also had an impact on the house remodelling sector. According to Yano Research Institute Ltd., the house remodelling market was valued at around ¥ 5,260 billion in 2009, down 9% from the previous year.

The peak in the remodelling business was seen in 2005 when the market was reported to be worth about ¥ 6,500 billion. Since then the size of the market has been declining.

However, at a time when housing starts are down almost 30% and other industry sectors are reporting market declines from 20%-30% year-on-year, the fall in demand for remodelling of less than 10% has helped timber suppliers to this market.

On the other hand, when looking at the details of expenditure on remodelling it becomes clear that currently consumers are opting to spend on repairs to household equipment and furniture rather than on building remodelling works. This segment of the overall remodelling market has seen a decline of around 20% since the economic crisis started.

Consumer spending unlikely to improve soon

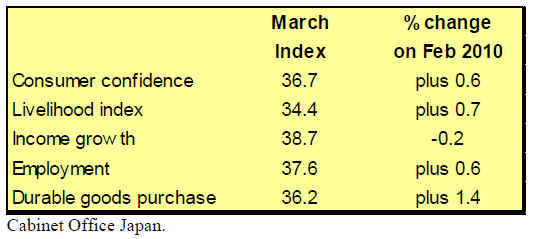

March consumer confidence levels showed a slight recovery. This comes after five months of falling numbers and a level in February which was close to a five year low. Nevertheless, from the disastrous level of just 36.1 in February, the index has only climber to 36.7.

Japan’s Consumer Confidence Index is built up of five items, each of which is considered positive when above 50, and pessimistic when below the 50 mark. The March 2010 figures are shown below with an indication of the change from the month of February.

The Cabinet Office reported that 85% of those surveyed believed prices would rise in 2010 and this confirms earlier data that consumers do not see any chance of the current price rises easing any time soon.

This data, when viewed against low wage growth expectations, does not portray a very optimistic outlook for consumer spending for the balance of the year.

|

Abbreviations

| LM Loyale Merchant, a grade of log parcel |

Cu.m

Cubic Metre |

| QS Qualite Superieure |

Koku 0.278 Cu.m or 120BF |

| CI Choix Industriel

|

FFR

French Franc |

| CE

Choix Economique |

SQ

Sawmill Quality |

| CS Choix Supplimentaire |

SSQ

Select Sawmill Quality |

| FOB Free-on-Board |

FAS Sawnwood Grade First and |

| KD Kiln Dry |

Second |

| AD Air Dry |

WBP Water and Boil Proof |

| Boule A Log Sawn Through and Through |

MR

Moisture Resistant |

|

the boards from one log are bundled |

pc per piece |

|

together |

ea

each |

| BB/CC Plywood

grades. Letter(s) on the left indicate face veneer(s), those on the right backing

veneer(s). Veneer grade decreases in order B, BB, C, CC, etc. |

MBF 1000 Board Feet

|

|

Plywood |

MDF Medium

Density Fibreboard |

| BF Board Foot |

F.CFA

CFA Franc

|

| Sq.Ft Square

Foot |

PHND

Pin hole no defect grade |

| Hoppus ton 1.8 cubic metres |

Price has moved up or down Price has moved up or down |

|

|

|