|

Report

from

Europe, the UK

and

Russia

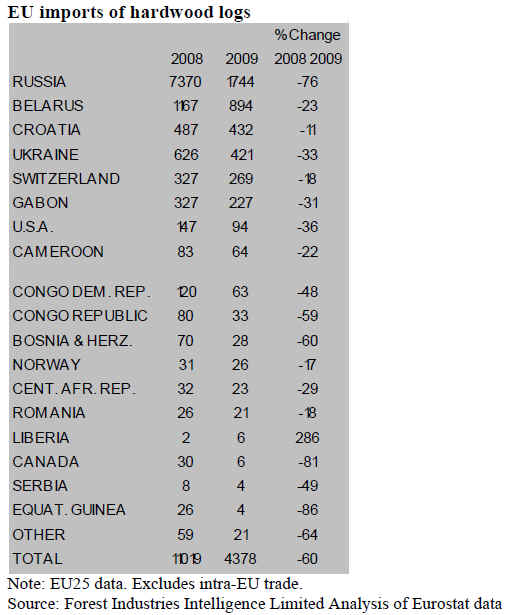

EU hardwood log imports down 60% in 2009

During 2009 EU imports of hardwood logs reached only

4.38 million cubic metres, down a massive 60% on the

previous year.

In addition to recessionary pressures and a lengthy period

of stock reductions by European importers, the figures are

strongly influenced by Russia¡¯s phased introduction of log

export taxes.

This contributed to a 76% fall in the volume of EU

imports from Russia during the year. However log imports

were also well down from key tropical hardwood

supplying countries including Gabon (-31%), Cameroon (-

22%), the Congo Dem. Rep. (-48%), and the Congo

Republic (-59%).

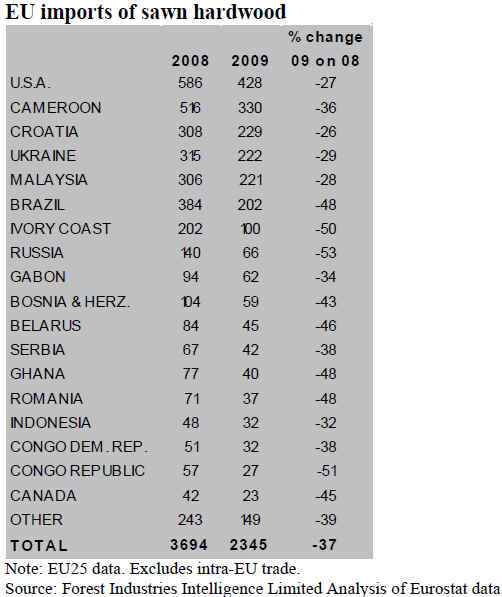

EU sawn imports down in 2009

The decline in EU imports of hardwood sawn lumber, at

around 37% in volume terms, was only slightly less

dramatic than that experienced in the log sector.

All supply countries fared badly in the European market

last year. The USA, the leading supplier, did better than

most - the 27% decline in EU imports from the USA was

relatively modest compared to the downturn in imports

from other countries. The relative weakness of the dollar

against the euro was one factor boosting U.S. hardwood

competitiveness in Europe during 2009.

During 2009, Cameroon retained its position as the leading

supplier of tropical hardwood sawnwood to the EU despite

a 36% decline in shipments compared to the previous year.

A number of factors contributed to this decline including:

very slow European consumption of the leading Cameroon

redwood species sapele and sipo; continuing efforts by

European importers to destock during the first half of

2009; and mounting supply problems in the second half of

the year.

EU imports of sawnwood from Malaysia held up

marginally better than those from Cameroon, benefiting

partly from the weaker dollar (Malaysian hardwoods

unlike African hardwoods tend to be invoiced in dollars)

and also from better availability and faster turnaround

times. This latter factor has become particularly important

in the recession as distributors throughout the European

supply chain have been much less reluctant to carry stock.

Continuing supply problems and better market prospects at

home contributed to a dramatic 48% fall in EU imports of

hardwood sawn lumber from Brazil.

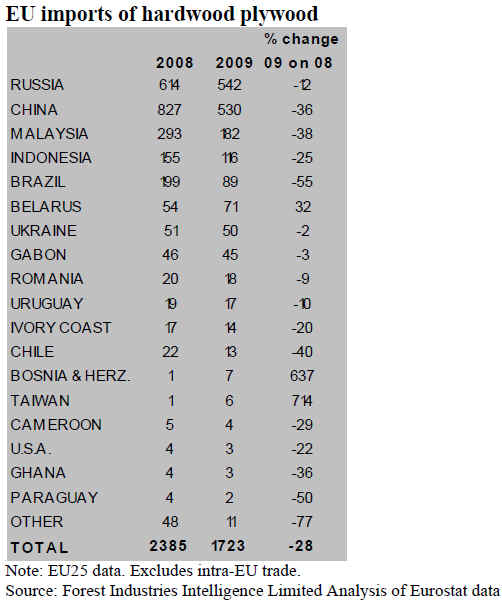

EU hardwood plywood imports down 28% in 2009

EU imports of hardwood plywood were down 28% in

volume terms during 2009. Imports from Russia, the

leading supplier of hardwood (mainly birch) plywood to

the EU, experienced only a relatively modest decline of

12%. Russian plywood producers stepped in to fill some

of the gap in Finnish supply with the phased introduction

of Russia¡¯s log export taxes. There are also reports that

more European plywood buyers are switching away from

tropical hardwood in favour of Russian birch product.

During 2009, China retained its dominant position as the

leading developing world supplier of hardwood plywood

to the EU, although at 530,000 cubic metres the volume is

only half of that attained in 2007.

After significantly expanding share in the European

hardwood plywood market in 2008, Malaysia lost ground

in 2009. Recent trade reports suggest that declining

availability due to tightening log supply in Malaysia is

now encouraging more European importers to look to

alternatives, including Russian birch plywood, alternative

panels and non-wood products.

The pace of the long-term decline in European imports of

Indonesian plywood slowed in 2009. However imports of

Indonesian plywood ¨C which reached only 116,000 cubic

metres in 2009 - are a shadow of levels of around 600,000

cubic metres only 7 years ago. Meanwhile the decline in

European imports of Brazilian hardwood plywood

steepened last year, falling 55% to only 89,000 cubic

metres.

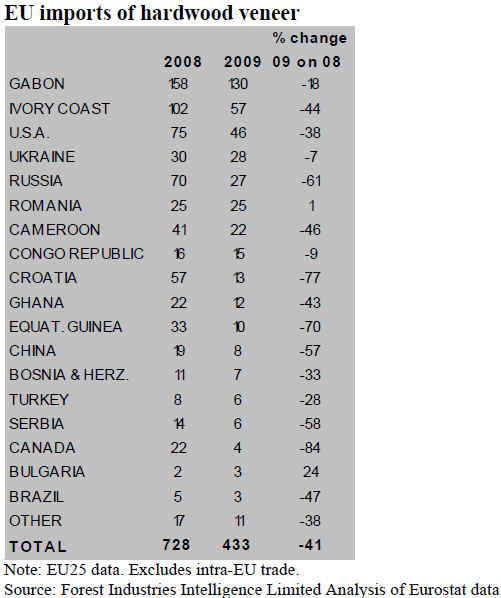

Changes underway in EU veneer sector

Europe¡¯s hardwood veneer import figures for 2009 bear

the imprint of differing trends affecting the rotary and

sliced veneer sectors. Both sectors have been profoundly

influenced by the global economic downturn.

The rotary veneer sector is being influenced both by

falling European consumption of tropical hardwood

plywood and by the continuing shift in tropical hardwood

plywood manufacturing away from Europe (notably

France). These trends are particularly apparent in the

significant decline over the last two years in European

veneer imports from Gabon, the leading supplier of rotary

veneer (mainly okoume), to the European market.

Meanwhile, the European sliced veneer sector experienced

a major crisis during 2009. There was a huge fall-off in

demand, particularly in the door sector in Spain which had

previously been one of the largest consumers of sliced

veneer in Europe. A major reduction in hardwood

harvesting in all the leading supply regions greatly

reduced access to veneer quality logs. Severe cash flow

problems also limited the ability of veneer mills to procure

those logs that were available. This all occurred at a time

when competitive pressure from the laminate and nonwood

surface materials sector ¨C also suffering from excess

capacity - was on the rise and as product manufacturers

were looking for ways to cut costs.

As a result of these trends, all the leading suppliers of

sliced veneer lost a lot of ground in the European market

during 2009. The volume of European hardwood veneer

imports from Ivory Coast, the U.S.A. and Cameroon was

down 44%, 38% and 46% respectively. For these

suppliers, some cold comfort may be found in the fact that

market conditions were just as bad for European veneer

manufacturers. The Germany-based trade journal EUWID

reports that large European veneer mills were operating at

no more than 50% to 70% of capacity throughout 2009.

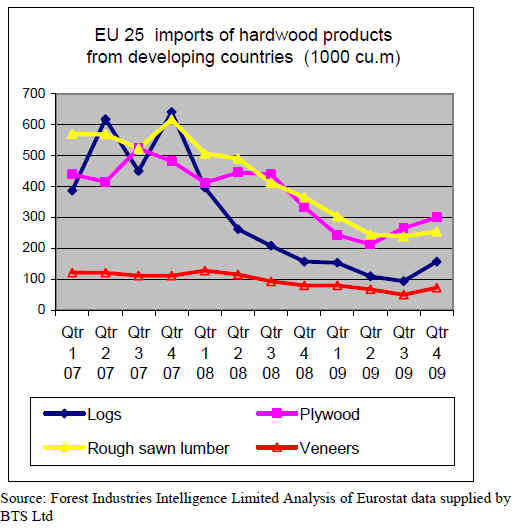

Signs of recovery in EU imports

While the 2009 annual import data makes for very gloomy

reading, closer analysis of the quarterly data provides

grounds for optimism.

The chart below indicates that EU imports of hardwood

logs, sawn and veneer from developing countries all

turned upwards in the last quarter of 2009. In the case of

logs and sawn, this was the first upward movement in

import data following seven consecutive quarters of

decline.

For veneers, the upturn followed on from six consecutive

quarters of decline. Meanwhile, the upturn in EU imports

of plywood which began in the third quarter of 2009 was

maintained into the last quarter of the year.

The signs are more promising but there is still

considerably uncertainty over the likely strength of

recovery in European tropical wood imports during 2010.

Trade reports suggest that the recent rebound in imports

has less to do with any significant change in underlying

consumption than in a move by importers to fill gaps in

stocks which have become extremely thin on the ground

after such a long period low imports.

European imports of tropical hardwood logs from Gabon

also received a significant short-term boost in the final

quarter of 2009 as European plywood manufacturers

sought to build stocks in advance of Gabon¡¯s log export

ban scheduled to be introduced from 1 January 2010.

At the end of 2009, European importers of all hardwood

products were also responding to widespread reports of

tightening availability in major supply regions which was

widely reflected in rising prices. Lack of availability

combined with patchy consumption may well put a brake

on further significant increases in European imports of

tropical hardwoods during 2010.

|