Japan Wood Products

Prices

Dollar Exchange Rates of

14th April 2010

Japan Yen 93.25

Reports From Japan

Tropical log demand improves

Demand for tropical logs from manufacturers in Japan is

increasing according to the Japan Lumber Reports (JLR)

and FOB prices are firming on the back of this renewed

buying.

Plywood mills in Malaysia and Indonesia are maintaining

reduced production levels in the face of the weak demand

for plywood but there are indications that they have started

to rebuild log inventories. This is supporting an

improvement in domestic log prices.

Japan’s monthly consumption of tropical logs is around

45,000 cubic metres and this was maintained in January

but there are signs of slightly higher production levels in

Japanese mills so stocks must be falling.

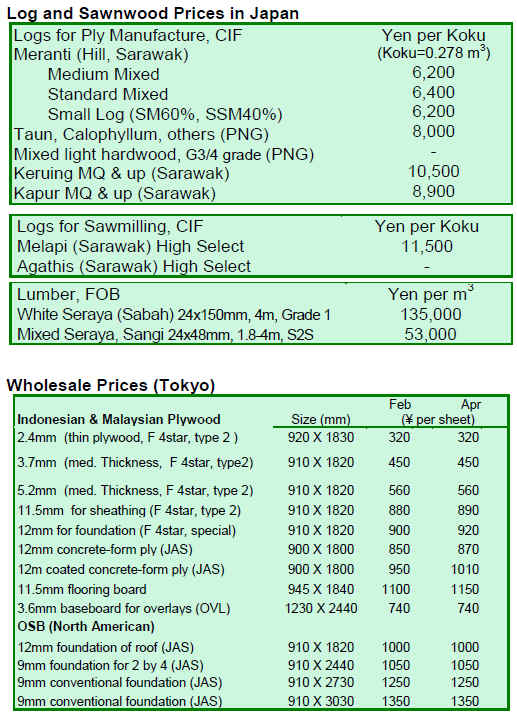

Market prices for Sarawak Meranti Regular are currently

around Yen 6,400 per koku CIF up 200 from levels in

March. Prices of Yen 5,400 for Meranti Small and Yen

4,900 for Meranti Super Small are an improvement of

levels seen in March.

Supporting the upward movement in log FOB prices has

been renewed active buying for the Chinese and Indian

markets. The JLR is saying that log shipments during

April will be affected by a diminished supply in the

producer countries with Meranti Regular logs being

particularly affected.

Current prices for Meranti Regular are around US$190 per

cubic metre but suppliers are pushing for a price of

US$200. Kapur prices in Sabah are also moving up

sharply on the back of strong demand from buyers in

China.

February plywood supply

The availability of both domestic and imported plywood

during February was 102% higher than in February 2009

and more than 100% more than in January this year.

However, plywood imports in February 2009 were the

lowest for 21 years, so this improvement is not so

startling.

Imports of plywood from all sources increased during

February. Imports from Malaysia were up 126% and

imports from Indonesia jumped 134%.

The biggest increase was seen in imports of plywood from

China which grew 250% because of the demand for low

priced Poplar crating plywood. According to the JLR

plywood inventory levels at the end of February were up

slightly from January levels.

Wood demand until Sept 2010

Japan’s Forestry Agency has released its wood demand

projections up to September 2010. The Agency is

forecasting an improvement in housing starts as a result of

the various stimulus measures introduced.

The main beneficiaries of the improved activity in the

building and construction sectors will be imported

sawnwood, plywood and structural laminated lumber. The

Agency foresees continued problems with sourcing sawn

Radiata from Chile.

North American log demand is expected to remain firm

but import volumes will likely remain at around 2.5 mil

cubic metres for the whole year, the same level as for

2009.

On the other hand, demand in Japan for N. American

sawnwood could improve over the next six months lifting

import levels above those of the same period last year.

European sawnwood imports started to increase from the

last quarter 2009 after there was a modest rebound in

purchases to replenish stock levels. However, any further

growth in demand is expected to be moderate, especially

as shippers will be looking for higher prices.

Plywood prices pushed up

The Japan Lumber Journal (JLR) is reporting that the

Seihoku Group, the largest plywood manufacturer in

Japan, has increased the wholesale price for structural

softwood plywood and will not entertain any negotiations

on price.

Apparently Seihoku accepted Yen 650 per sheet

(delivered) until the end of March but that now the price is

Yen 700 with further price increases planned. This move

by Seihoku is to reverse its loss making production.

The price of 24mm panels was previously Yen 1,300 but

has now been increased to Yen 1,400. 28mm panels are

priced at Yen 1,630 up from Yen 1,520 in late March.

In making this move to increase prices Seihoku is hoping

that other manufacturers will follow suit, a reasonable

gamble in the light of the expected increase in building

activity.

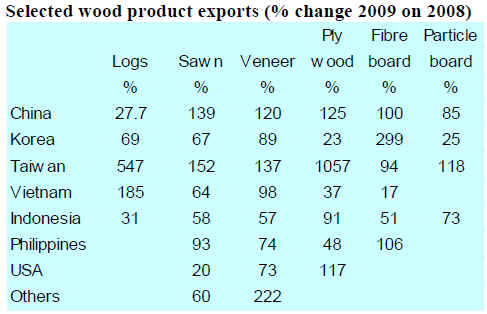

2009 wood product exports

The JLR is reporting that, according to data from the Japan

Wood Export Council, the total value of exports in 2009

fell by almost 13%, the first decline in three years. The

strong Yen and the diminished global demand for wood in

2009 are cited as the main reasons for the decline.

Japan’s log exports in terms of both volume and value

declined but higher volumes of veneer, plywood and

fibreboard were exported.

Log exports were down almost 22% because of weak

demand from China and Korea, the main markets. Taiwan

P.o.C and Vietnam are other significant buyers of logs

from Japan and for these markets export volumes

increased.

|

Abbreviations

| LM Loyale Merchant, a grade of log parcel |

Cu.m

Cubic Metre |

| QS Qualite Superieure |

Koku 0.278 Cu.m or 120BF |

| CI Choix Industriel

|

FFR

French Franc |

| CE

Choix Economique |

SQ

Sawmill Quality |

| CS Choix Supplimentaire |

SSQ

Select Sawmill Quality |

| FOB Free-on-Board |

FAS Sawnwood Grade First and |

| KD Kiln Dry |

Second |

| AD Air Dry |

WBP Water and Boil Proof |

| Boule A Log Sawn Through and Through |

MR

Moisture Resistant |

|

the boards from one log are bundled |

pc per piece |

|

together |

ea

each |

| BB/CC Plywood

grades. Letter(s) on the left indicate face veneer(s), those on the right backing

veneer(s). Veneer grade decreases in order B, BB, C, CC, etc. |

MBF 1000 Board Feet

|

|

Plywood |

MDF Medium

Density Fibreboard |

| BF Board Foot |

F.CFA

CFA Franc

|

| Sq.Ft Square

Foot |

PHND

Pin hole no defect grade |

| Hoppus ton 1.8 cubic metres |

Price has moved up or down Price has moved up or down |

|

|

|