|

1.

CENTRAL/ WEST AFRICA

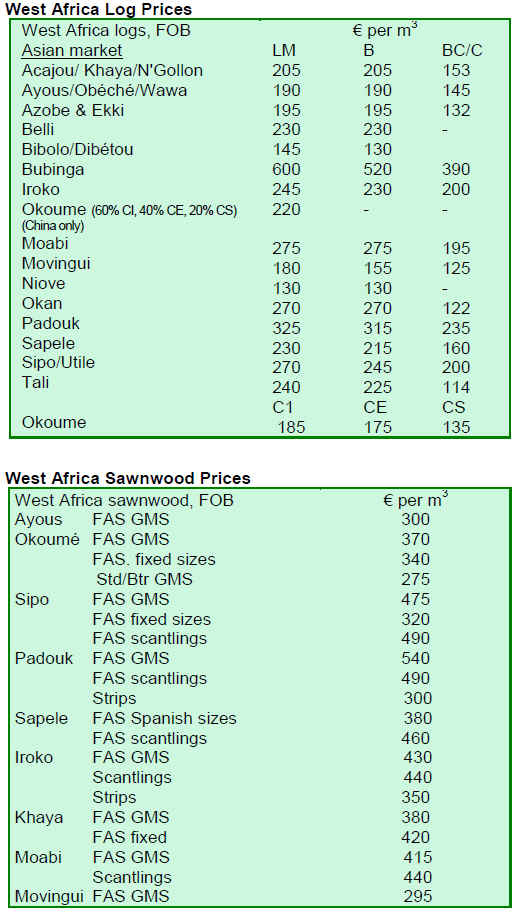

Logs the main interest

Reports from exporters in W. Africa indicate that business

with Asian and Indian buyers continues to be brisk. Logs

are the main interest in these two markets. The recent

increase in enquiries for sawnwood for the Asian markets

seen earlier in the year have not translated into firm orders.

Prices holding firm

The European interest in W. African wood products

remains very subdued. However, price increases for

specific species and sizes of both log and lumber secured

by exporters in March are now firmly established.

Analysts say it will require a sustained upward movement

in demand before prices move any higher.

Alternative log source steady market

The fear of a destabilisation of the log trade as a result of

the decision by Gabon to ban log exports has subsided,

helped by the higher volumes being made available by

Cameroon following the relaxation of restrictions on log

exports.

Exporters in Congo Brazzaville have also been hard

pressed by Asian buyers to maximise log export volumes

to make up for the shortfall from Gabon.

Gabon rushes to meet deadline

Efforts in Gabon to transport and ship all logs cut before

the January log ban announcement are running into

difficulties. It is taking longer than expected to haul and

transport the logs to the port and there are reported

difficulties in handling and loading the logs onto available

vessels. The original cut-off date to ship logs felled up to

the date of the export ban has passed.

Traders now feel that shipping all the logs might well

stretch to the end of April but there has been no official

statement on a change of deadline. The logs now being

shipped are at least 4 months old, past their best condition

by normal trade standards. Buyers prefer fresh logs hence,

the pressure is growing on Cameroon and Congo to step

up log exports.

Second quarter prospects

For the second quarter 2010 it seems likely that European

buyers will concentrate on a very small number of

sawnwood species, including sapele and sipo, padouk,

iroko, azobe and a few other premium timbers. Prices for

these timbers should remain firm, say analysts.

The economies of Asian importing countries have

strengthened. Demand for logs from West and Central

Africa is particularly strong in India and exporters feel that

prices will be stable with the prospect of some further

increases.

There are no price changes to report after the increases

recorded in March.

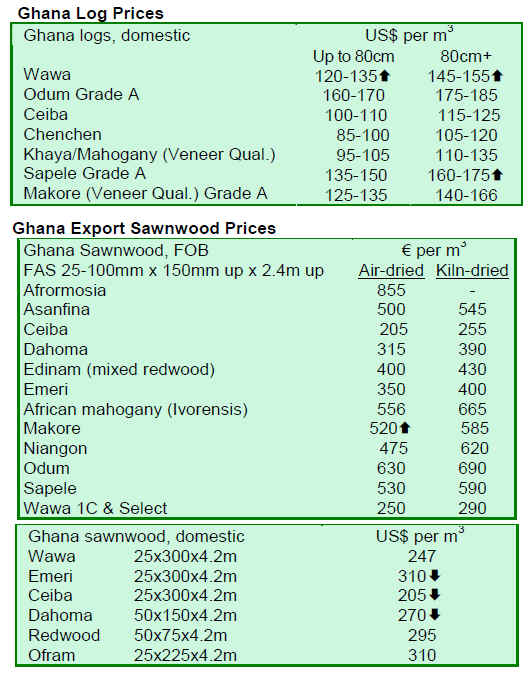

2. GHANA

Ghana¡¯s top ten sawnwood timbers

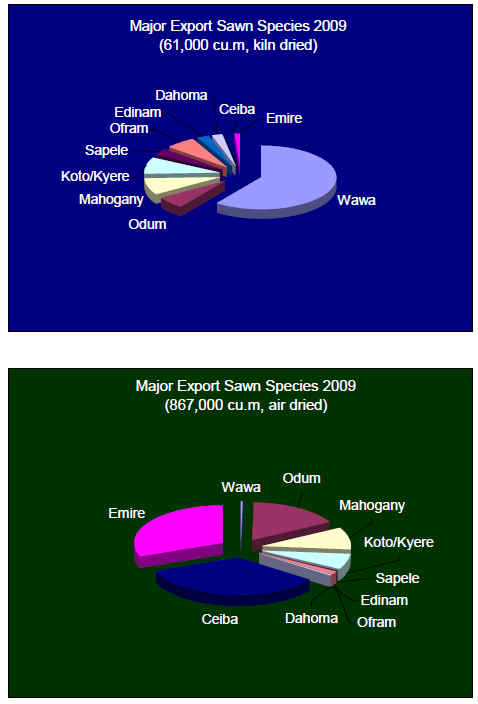

Export data for 2009 highlights the slow pace of market

growth for kiln dried sawnwood from Ghana. Of the

almost 1 mil. cubic metres of sawnwood exported, only

around 6% was kiln dried, the bulk being air dried.

As will be seen from the following graphics there is a

marked difference in the range of species exported

depending on whether the timber is kiln or air dried.

Wawa dominated exports of kiln dried sawnwood in 2009

but for air dried sawnwood Emire, Ceiba and Odum

accounted for over two thirds of totaled exports.

Exports of air dried Wawa were negligible as this timber is

highly susceptible to insect and fungal attack if not kiln

dried.

Special permit exports

During the period under review, six special export permits

were issued solely for Takoradi shipments including 67

cubic metres of Okoum¨¦ kiln dried laminated mouldings,

31 cubic metres of Odum kiln dried decking strips and 90

cubic metres of sliced veneer of various species.

These products were shipped by Machined Wood Ltd and

Africa and Auson Veneer (Ghana) Ltd to their clients in

Italy and France.

The laminated mouldings were manufactured from

Okoum¨¦ sawn timber imported from Gabon while the

sliced veneers were imported from Cameroon for reexport.

Upon application, the Ghana Timber Industry

Development Division (TIDD) grants special permits to

millers who intend to ship smaller quantities of some

selected wood products to their clients as samples for

testing.

While such items are not considered to have any

commercial value it is mandatory for the exporters to

secure these free/special permits before shipping.

Minor wood products

Export duty free permits were also issued for the

shipments of timber stumps, wood handicrafts and wood

carvings during the last quarter of 2009. These shipments

were also made through the port of Takoradi.

The shippers were John Bitar Ltd and Peewood Craft and

Art to buyers in the United Kingdom, the United States

and Spain.

Company Registration

A total of eighty company registration applications were

processed during the fourth quarter period of 2009 as

compared to ninety-one for the previous quarter,

representing a decrease of 12.09%.

Out of the total applications processed, fifty-one were

Exporters (45 Export Trading Companies and 6

Saw/Ply/Processing Mills). A further 29 non-Exporters

comprised the following; retailers (1), dealers in wood

products (14), boat manufacturers (8), dealers in wood fuel

(3) and 3 others.

Seeking Partnerships

At present, Ghana's industrial base suffers from inadequate

financial and technical resources. Working with Ghana's

Investment Promotion Centre and other institutions, the

TIDD seeks to create technical and investment

collaboration between Ghanaian timber processing

companies and their opposite numbers in overseas

markets.

Partnerships offer the potential to enhance incomes and

abilities of local companies and their workers, and at the

same time offer cost savings to foreign investors.

3.

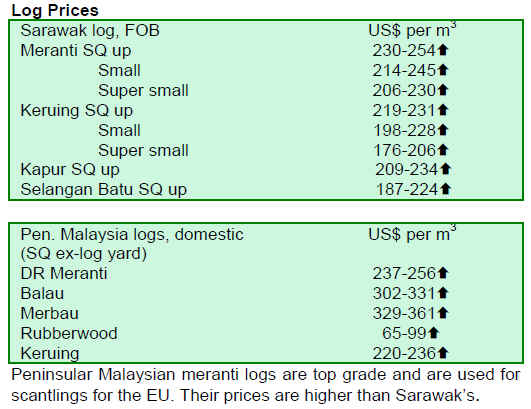

MALAYSIA

Steel price affects plywood demand

Plywood prices have been moving up over the past month

and a number of factors have contributed to this change.

The main factor driving up plywood prices is said to be the

recent jump in demand (and hence price) of iron ore in

China. This has resulted in rising steel prices in most

markets. Plywood and steel products compete in many

enduses and plywood has suddenly become more

competitive. Analysts are expecting these factors to affect

price structures in other sectors of the timber industry.

Reportedly, iron ore prices tracked through a benchmark

system used by major Japanese, Korean and European

manufacturers, almost doubled in 2009.

The benchmark price of iron ore in 2009 was US$70 per

ton (Australian powder ore), inclusive of transportation.

However, the recent spot market prices for iron ore from

India destined for China have jumped to around US$140

per ton. Similarly, in Japan, Nippon Steel has reportedly

agreed a price of US$110 per ton for April to June

deliveries.

The increase in steel prices is expected to impact the price

levels of other construction products. Plywood traders are

saying that construction plywood prices could increase by

as much as 20% over the next few months and that

eventually this will lift the prices of other wood products.

In addition, news that plywood stocks in Japan have been

run down and are now being replenished is encouraging

the plywood producers in Malaysia and Indonesia.

The STA view

The Sarawak Timber Association (STA) has indicated that

plywood stocks in Japan have been declining for the past

12 months in the face of the sharp drop in housing starts

and cuts in civil construction projects.

Most plywood mills in Malaysia and Indonesia reduced

output due to the poor demand in international markets

over the past year and a half and are likely to maintain low

production until they see improved price levels take a firm

hold.

Sarawak exports

Exports of wood products from Sarawak continued to

decline in the first two months of 2010, dropping by over a

third compared to the same period in 2009.

In addition to weak overseas demand, part of the decline

was due to log transport problems caused by a dry spell as

water levels in many rivers were too low for transporting

logs to the mills.

4.

INDONESIA

Export growth forecast

According to Indonesian Government analysts, the

country¡¯s non-oil and gas exports, which include wood

products, are likely to increase this year.

The rise in exports is said to be driven mainly by

expanding demand in China and other Asian economies,

notably South Korea.

Non-oil and gas exports in the first two months of 2010

were just over US$18 billion and estimates of March

exports are in the region of US$8-9 billion. Non-oil and

gas exports to China stood at US$2 billion for the first two

months of 2010, an increase of over 130% compared to the

same period in 2009. Similarly, exports to South Korea

more than doubled.

Mono-cable logging

The Indonesian timber industry is testing a logging system

which is not commonly used in tropical logging

operations.

The so-called ¡°mono-cable¡± system has been promoted as

an ¡°environmentally friendly¡± alternative to the traditional

crawler tractors. The mono-cable system is said to cause

less damage to the remaining standing trees and less soil

disturbance than the heavy tractors commonly used to

harvest tropical logs.

5.

MYANMAR

MTE relocates

Visitors to the Myanmar Timber Enterprise (MTE) head

office have found that the long awaited relocation of the

office is underway. MTE has occupied its current office

for 55 years and a move just before the Myanmar New

Year Holidays (10th April till 21st April) came as a

surprise to many in the trade.

The MTE office will apparently be in Gyogon, Yangon, at

the former office of the Director-General of the Forest

Department. The Forestry Department moved to the new

administrative capital, Naypyitaw, some time ago. As teak

timber is a specialised item and is of interest to just a

handful of dedicated buyers, the relocation will quickly

become common knowledge.

The old MTE riverside office with log storage ponds and

the vast log yard will remain a fond memory of many old

timers who remember State Timber Board (precursor to

the present MTE) moving its office from downtown

Yangon to the Forest Compound in Ahlone Road.

It is reported that MTE will hold its April tender sales at

its previous office in Ahlone; and the May tender will be

held at the new location.

New Year holidays bring business to a halt

The month of April is the beginning of the new fiscal year

2010-11. The 1st of April usually starts with the annual

stock taking at state owned saw mills and log yards and

lasts for about a fortnight.

This year, the month of April has altogether 17 days of

holidays. These 17 days, plus the annual stocktaking

period, will bring the timber business to a halt until month

end.

The MTE is actually the hub upon which the whole timber

business in Myanmar revolves and because of the

relocation of the MTE office coupled with the New Year

holidays, business is likely to grind to a halt.

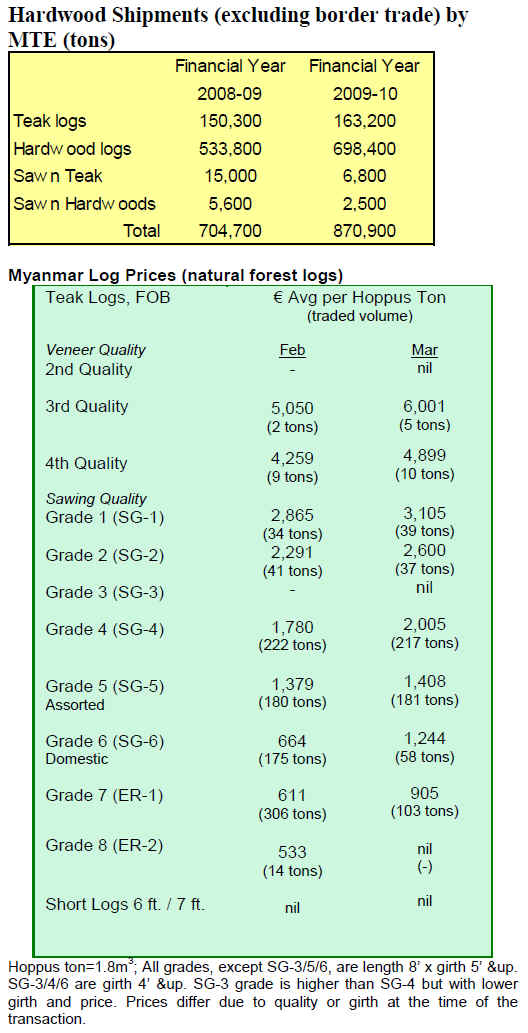

Hardwood shipments increase

The following table shows the hardwood shipments made

by the MTE in the financial years of 2008 and 2009.

It will be seen that for FY 2009 shipments (excluding the

border trade) were almost 890.000 tons, almost 200,000

tons above shipments in FY 2008.

6. INDIA

Hardwood auctions

Auctions of Teak and other hardwoods continue to attract

active buying. The volumes offered at auctions in Central

Indian and in the log depots in Gujarat are satisfactory.

Sales are swift and prices are tending to remain firm.

Further auctions will be held in late April at various log

depots in the north and south Dangs division. During the

April auctions some 7-8,000 cubic metres of hardwoods

are expected to be put up for sale, out of which Teak is

approximately 70%. The other hardwood species to be

sold include timbers such as Laurel, Haldu, Bija and other

local hardwood species.

Economic progress continues

In line with WTO forecasts of improving global trade,

exports from India rose 35 per cent in February to just

over USD16 billion, the fourth consecutive rise after 13

months of decline. Similarly, February imports also rose,

climbing 66% (US$25 billion) compared to February last

year. Industrial output also rose by about 16% year on

year.

The rapidly growing economy has attracted considerable

foreign investments and this, along with other positive

economic fundamentals, has taken Indian Rupee to a 19

month high against US dollar. At one point the exchange

rate touched Rs.44.44 to a US dollar.

Woodworking training boosts production

The Advanced Woodworking Training Center (AWTC)

has been established in India and reports indicate that the

benefits from improved training opportunities are being

already being felt in the industry.

The AWTC is a joint venture between the Indian and

Italian Governments and ACIMALL (Italian

Woodworking Machine and Tool Manufacturers

Association).

Indiawood 2010

Details of the recently concluded Indiawood 2010 held in

March this year are just emerging. Indiawood is a biannual

event organised by PDA Trade Fairs and Eumabois.

The objective of Indiawood is to present to the Indian

market the latest in wood processing technologies and

tools, accessories and fittings and other consumables from

around the world.

This year a special focus was on wood and bamboo in

architecture which addressed both management and

processing of bamboo in construction and for energy

generation using bamboo residues.

The event was a sourcing ground for the entire

woodworking community from India, South Asia, South-

East Asia and the Gulf region.

Indiawood 2010 attracted over 24,000 visitors to view the

more than 450 exhibitors from 24 countries. The largest

representation was from Europe with a significant

presence from German, Italian, Canadian and US suppliers

and manufacturers.

7. BRAZIL

Utilization of Paric¨¢

Research conducted at the University of Santa Catarina

has highlighted the potential of Paric¨¢ (Schizolobium

amazonicum); a lesser used timber, especially for glue

laminated products.

Paric¨¢ has been traded in small quantities as the timber is

found in the natural forest. However, timber from

plantation grown Paric¨¢ has different properties to that

from trees harvested in the natural forest.

Further studies on Paric¨¢ from plantations are needed to

determine the properties of timber from trees harvested at

various ages.

It is anticipated that Paric¨¢ from plantation forests could

be used to produce laminated products suitable for

building and construction uses.

Forest Service Timber Price Index

The Brazilian Forest Service (SFB) has recently started to

compile a tropical timber price index. The index in

January was 1.091, compared to the October 2009 baseline

(index = 1.0), the first month when prices were surveyed.

The change in the price index has come about, it is said,

mainly due to price increases for the low and mediumvalue

timber species which were actively traded in the

period reviewed.

The SFB says that business transacted in the Bel¨¦m-

Bras¨ªlia and Cujubim timber markets contributed most to

the improved price index. The reported short supply of

some timbers, due to slow harvesting in the rain season,

was also a factor for the change in the price index.

The IPMA Index calculation involves three steps. First, a

survey of processing plants in various areas is undertaken.

Some 20 to 25% of the companies in the various

production clusters in the region are surveyed (approx.

1,000 mills). The second step is to assess the harvest

volume and timber transport approvals (Forest Origin

Document and Forest Products Trade and Transportation

Documents).

The final step in compiling information for the index is a

survey of prices that sawmills, plywood, and laminated

and sliced veneer mills pay for delivered logs. The index is

published on the SFB website (www.florestal.gov.br).

Domestic trade at new highs

Wood product sales in Mato Grosso have been growing

steadily over the past years. From 2006 to 2009 the

market was worth just over R$ 6.3 billion and has

continued to expand. Over the same period wood products

valued at over R$ 4 billion were traded with other states or

within the region.

According to the State Secretary of Environment (SEMA),

exports from 2006 to 2009 were in the region of R$1.4

billion.

Of all the production forest clusters in Mato Grosso, the

Sinop cluster traded the most with a 15% share of the total

trade. Sinop was followed by Aripuanã (9%), Ju¨ªna (7%)

and Alta Floresta (5%).

According to SEMA, Sinop traded a total of R$ 933.4

million over the four year period. Of this trade over 70%

was destined for the domestic market, while the balance

(some R$ 261 million) was exported.

Aripuanã traded around R$ 569 million, over R$ 340

million for the local market and the balance for export.

Juina traded R$ 444.8 million in nearly four years. In

contrast to the trade in Sinop and Aripuanã the bulk of the

trade in Juina was to international markets (R$ 227.2

million). Slightly less than half of the trade was in

domestic markets.

Trade incentive needed in Southern Brazil

Forest sector analysts consider that the wood product

manufacturing sector in the state of Paran¨¢ is

underperforming and that certain sectors of the industry

would benefit from government trade incentives.

Trade statistics are indicating that output in the timber and

pulp and paper sectors is gradually recovering from the

effects of the global financial crisis. But, as pointed out by

the Paran¨¢ Industry Federation (FIEP), not all industry

sectors are recovering at the same pace.

As a result of the collapse in global markets, the solid

wood industries have suffered steep declines in sales

(down 11% in 2009). However, in contrast, the pulp and

paper sector in the region recorded a 5% growth of sales

last year.

The solid wood timber sector relies heavily on demand in

the North American housing market, a sector which

accounted for almost half of the export from the State.

Prior to the crisis, the timber industry exported a quarter of

its production; the paper industry exports only 16% of its

output and is less vulnerable to the ups and downs of the

international market.

Despite the gloomy picture, there are signs of recovery in

the manufacturing sector and more companies have moved

into the Telemaco Borba Industrial District.

According to the Jaguaria¨ªva Timber Industry Association,

the government should consider ways to assist the industry

to climb out of the difficult situation it is facing.

8.

PERU

Export recovery

Further signs of economic recovery in Peru came recently

when February export data were released by the Ministry

of Foreign Trade and Tourism.

Exports in February totalled US$2.6 billion, a 40 percent

increase over the same month in 2009. This improvement

was due mainly to increased international demand for

commodity products.

Crude oil exports were up 750 percent, agriculture product

exports were up 240 percent, zinc exports improved by

185 percent and copper oil derivatives were up around 100

percent. These products accounted for around US$2.4

billion of the total exports of US$2.6 billion.

The so-called non-traditional exports (mainly

metallurgical products, crafts, and minerals) grew by

almost 20 percent.

Exports to N. America were up by almost a third and

exports to the EU increased by about 50 percent. German

and Italian imports from Peru more than doubled in

February and this lifted the overall EU import figures.

Asia remains a major export market and there were

significant increases in exports particularly to Japan and S.

Korea.

Diversifying exports

One outcome of the slowdown in Peru¡¯s exports of wood

products, a result of the recent financial crisis, was a

diversification of markets. As companies sought to sustain

sales, new markets were sought.

In 2009, in the face of diminished demand in the

traditional markets of the US and Mexico, interest from

buyers in other countries was actively pursued with

success seen with New Zealand, where exports jumped

threefold.

Recently, there has been some interest from buyers in

Australia, particularly for certified wood products.

Historically, the trade between Australia and Latin

American countries has been small, especially when

compared to trade with Australia¡¯s Asian neighbours.

However, there are signs that markets for wood products,

especially certified products, from Peru can be developed

in Australia.

9.

Guyana

Market news

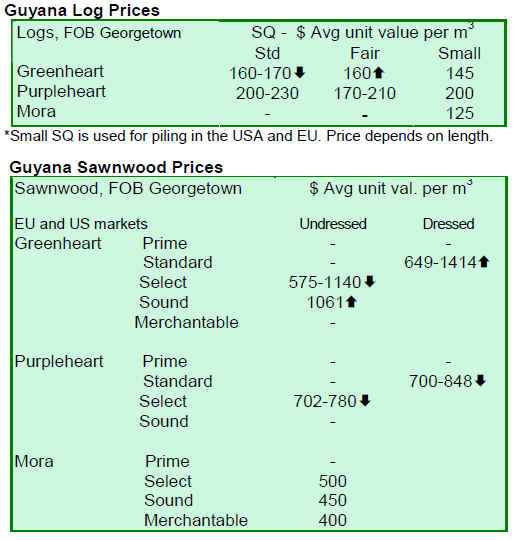

For the period under review, log prices remained stable.

Earnings were derived primarily from exports to Asia -

Pacific markets.

Prices for rough sawn (undressed) Select Greenheart were

very favourable, reaching as high as US$1,140 per cubic

metre. In contrast, prices for sawn Purpleheart (Select)

declined slightly but sawn Mora prices remained

unchanged.

Dressed Greenheart prices for this fortnight period moved

up to US$1,414, a record high thus far for the year. In line

with the prices for rough sawn timber, dressed Purpleheart

prices also dropped.

Guyana¡¯s Washiba (Ipe) continues to be in demand and is

attracting price levels of US$1,200 for rough sawn lumber

and US$1,500 for dressed lumber.

Baromalli plywood prices have now moved up slightly on

the levels seen recently. Prices for both BB/CC and Utility

qualities have increased.

Splitwood prices moved positively to attain levels of

US$1,387 per cubic metre in the period under review.

Added value exports

Outdoor garden furniture, doors, windows and non timber

forest products continue to be in demand in the Caribbean

island markets and exports of these added value products

helped improve export earnings.

Community chainsaw milling

Chainsaw milling by forest communities is common but

often carried out inefficiently. To assist a local community

in Guyana, a project involving the Guyana Forestry

Training Centre and Iwokrama, with support from

Tropenbos in the Netherlands, is being undertaken. The

objective is to educate chainsaw operators and millers on

the best practices in harvesting forest products and more

efficient log utilisation.

|