|

1.

CENTRAL/ WEST AFRICA

Gabon log export scheme

It is reported that the Government of Gabon will now

implement a gradual phasing out of log exports.

It appears that those logs cut up to 31st December 2009

can be exported through SNBG until end of April. This is

a month later than originally intended.

Trade sources say that in view of the large volumes of logs

already on the ground (somewhere between 500,000 cubic

metres and 700,000 cubic metres), it is unlikely that all

can be exported before the end of April and that a new cutoff

date may be set when the actual volumes to be shipped

are known.

The logistics involved in transporting, loading and

shipping such a large volume are enormous. As the trade

points out, there may not be enough trucks or rail carts to

handle such a volume quickly. It is reported that most of

the volume has been forward purchased by buyers for the

Chinese market.

After the 30th April 2010 deadline (or a revised date) a

quota scheme will be introduced.

Phased log exports up to 2012

At present, it seems that for the balance of 2010, the

maximum harvest volume will be set at 1.2 million cubic

metres of which 60% must be processed domestically. If

this is achieved, then the balance 40% could be exported

as logs.

The 2011 total harvest will be set at 1 million cubic metres

of which 75% has to be processed locally before the

balance 25% can be exported as logs.

In 2012, the plan, at present, is for a total harvest of

800,000 cubic metres of which 80% must be processed

domestically before the balance can be exported as logs.

Assessing processing capacity

Forestry authorities in Gabon are currently assessing the

processing capacity of established mills in the country.

This is to determine if they have sufficient capacity to

carry out processing of the required percentage of their

harvest volume.

The log harvest quota allocated to each mill will be based

on the assessment of the mill capacity.

2. GHANA

Privatisation of SIPL

As part of its programme to privatise state owned

enterprises, the Government of Ghana has invited

proposals and bids for the privatisation of Subri Industrial

Plantation Ltd (SIPL).

Established in 1985, SIPL established Gmelina arborea

plantations intended to feed a proposed pulp and paper

mill at Daboase in the Western Region of Ghana. The pulp

and paper mill has not been built but a sawmill and wood

processing facilities were installed to utilise the Gmelina.

The location of the processing plant is 40 kilometres from

Sekondi/Takoradi, the regional capital and the Western

seaport of Ghana.

SIPL has a nursery and 5,137 hectares of plantations with

about 13,000 hectares of underdeveloped forest land for

plantation expansion. SIPL has a sawmill and kilns and

produces value-added products as well as lumber.

Lumber dominates export trade

The TIDD vetted, processed, and approved 2,468 export

permits during the fourth quarter of 2009 covering

shipment of various timber and wood products through the

ports of Takoradi and Tema as well as for overland

exports to neighbouring ECOWAS countries.

Compared to the previous quarter, fourth quarter approvals

fell by 13%. However, when data for the quarter under

review are compared with the corresponding figure for the

same period in 2008, there was a substantial increase in

the number of approvals in the fourth quarter of 2009.

Lumber (both air dried and kiln dried) continues to

account for the highest number of export permit

applications. This is an indication that there is still a higher

demand for export lumber than for tertiary wood products

such as furniture and parts, mouldings, flooring, dowels

and profiled boards.

Inflation falling

Ghana¡¯s inflation continues to fall, dropping by 0.55

percentage points to 14% in February 2010. This is the

second decline recorded since January and the eighth since

June 2009.

The Ghana Statistical Service which announced the rate

attributed the drop to a stable Cedi and a drop in the

demand for goods and services. The Head of the

Economic Statistical Service, Ebo Duncan, announced that

inflation might continue to fall if the government

continues with its stabilisation programmes and fiscal

discipline. The current rate is the lowest in 23 months,

Central Bank figures show.

3.

MALAYSIA

One-stop buy-sell event

The Malaysian Timber Council (MTC) will host its first

international one-stop selling, buying and networking

event, ¡®MTC Global Woodmart 2010¡¯ on October 19-20,

2010 at the Kuala Lumpur Convention Centre.

This event will showcase tropical timbers as well as those

from temperate regions. The event is also to provide a

venue for buyers and sellers of timber products to meet,

network and to conduct business under one roof. This type

of event may be the first of its kind in South-East Asia and

MTC plan to host this event every two years.

On display will be a wide range of new products, or socalled

¡®Innovative Products,¡¯ for example bio-composite

boards derived from oil palm trucks, kenaf and rice husk.

Trans-Pacific Partnership

The US Ambassador to Malaysia has expressed the hope

that Malaysia will join the Trans Pacific Partnership (TPP)

to take advantage of the expected increased trade volume

and improved access to US markets. The TPP is also

expected to increase trade flows and market access

between all member countries.

Currently, the TPP consists of eight countries; Brunei,

Chile, New Zealand, Singapore, Australia, Peru, Vietnam

and the US.

The ambassador added that it would be difficult for

Malaysia to join the TPP once the other eight member

countries have agreed the TPP trade pact. With this in

mind Malaysian trade officials are reportedly evaluating

the advantages and disadvantages of the TPP before

considering negotiating with the other countries.

Singapore¡¯s furniture exports dip

Many Malaysian furniture manufacturers have business

relations with companies in Singapore. Singapore¡¯s

furniture exports declined 4% in 2009 compared to 2008

exports. For 2009, exports were worth a total of S$4.7

billion while 2008¡¯s exports were worth S$4.9 billion.

Singapore¡¯s share of the world furniture market continues

to drop and currently is less than 1%.

Efforts by the Singaporean Government, through agencies

such as IE Singapore and SPRING Singapore, has helped

Singaporean furniture manufacturers and companies to

network and link up with more than 1,200 new furniture

buyers from Russia, Mexico, India and the US.

Building activity encourages industry

With the spring construction season in high gear in China,

Malaysian timber products manufacturers believe that the

recent crisis is over. Although the Chinese government is

making efforts to cool its housing market, there is still a

strong demand for Malaysian timber products for the

Chinese market.

Rent levels in China are expected to decline marginally in

most major Chinese cities as more homes come onto the

market. However, those who have invested in the buy-tolet

sector are beginning to renovate and remodel

properties in their portfolio in order to gain higher rental

income in the housing for expatriates market.

4.

INDONESIA

Ready to compete with China

The Indonesian Furniture Entrepreneurs Association

(ASMINDO) has reportedly expressed optimism that its

members are ready to compete with China for the

Indonesian domestic furniture market.

The chairman of ASMINDO claimed that the Chinese

suppliers will be seeking a US$500 million share of the

local furniture market and that some US$250 million to

US$300 million could be captured by Indonesian

furniture manufacturers. Plans are being prepared by

ASMINDO to ensure Indonesian manufacturers capture a

market share of US$600 million.

ASMINDO will be hosting a SMEESCO (Small and

Medium Enterprises and Cooperatives) exhibition in June

2010, to promote Indonesian furniture and accessories to

the Indonesian public sector as well as to local real estate

developers. In addition, Indonesian furniture

manufacturers will participate in an exhibition in Shanghai

this year over a floor space of 1,600m2.

Hint of furniture export recovery

ASMINDO has reported that Indonesian furniture

exporters have, over the past few months, experienced a

recovery in exports after the plunge experienced in 2009.

Indonesia¡¯s furniture exports stood at US$2.35 billion in

2009 compared to US$2.65 billion in 2008. In January

2010, exports rose by 16% compared to levels in January

2009.

The US and EU remain the main markets for Indonesian

furniture exports accounting for 35% and 30% of total

exports respectively.

ASMINDO is hopeful that Indonesia¡¯s furniture exports

will increase by 15% to 20% this year.

Furniture and craft fair

The 3rd International Furniture and Craft Fair is currently

being held at the Jakarta International Expo, in Central

Jakarta. ASMINDO is projecting business deals worth up

to US$250 million will be achieved, an increase over the

US$170 million transacted in 2009. A record number of

buyers (up to 2,500) are expected to attend this year

compared to 1,721 buyers registered last year.

5.

MYANMAR

Market Outlook

Demand for teak and pyinkado, as determined from

buyer¡¯s interest at the monthly auctions, remains steady.

The pre-New Year celebrations for Myanmar are always

an active time in the timber industry.

Extra quantities of freshly felled logs will be delivered to

the log depots before the onset of the rain season.

The Myanmar New Year (Thin-gyan festival) falls in

April and government offices and private companies will

cease activities for about 17 days during the month and

there is virtually no business activity during that time.

Reduced log harvests

¡®The Voice¡¯, a weekly journal in Myanmar has reported

on the speeches made by U Sein Lwin, Chairman of the

Timber Merchants Association (TMA) and U Aung Lwin,

Vice Chairman of the Union of Myanmar Chamber of

Commerce and Industry (UMFCCI) at the annual meeting

of the association.

U Sein Lwin of the TMA mentioned the government plan

to reduce log production beginning in April. Whilst the

association was not informed of the level of reduction

being proposed, he said they were aware of the plan which

aims to reduce log harvests and reduce sales of timber in

log form.

U Aung Lwin of the UMFCCI reported that Myanmar

exported 600,000 tons of various timbers in the financial

year 2008-09. Most of this was exported either as logs or

semi finished products and earned only about US$ 400

million. Revenues could be much higher he said if

processed products were exported. He urged the local

entrepreneurs to produce more valued added products.

U Aung Lwin also mentioned that revenue from the

forestry and timber sectors has been falling year by year.

The decline started in 2003 as a result of the imposition of

sanctions by the US and was made worse by sanctions

imposed by the EU in 2007.

The recession in 2008 also disrupted the Myanmar timber

trade and U Aung Lwin expressed optimism in the current

global economic recovery.

Deforestation update

Although, at present, there has been no confirmation of the

plan to reduce log production from the Myanmar Timber

Enterprise, analysts say the plan to reduce log production

is a wise measure to combat deforestation.

It was reported by the Forest Department (FD) that the

annual deforestation rate between 1975 to 1989 was

0.64%; and from 1989 to 1998 it was 1.2% (the latest

estimates available).

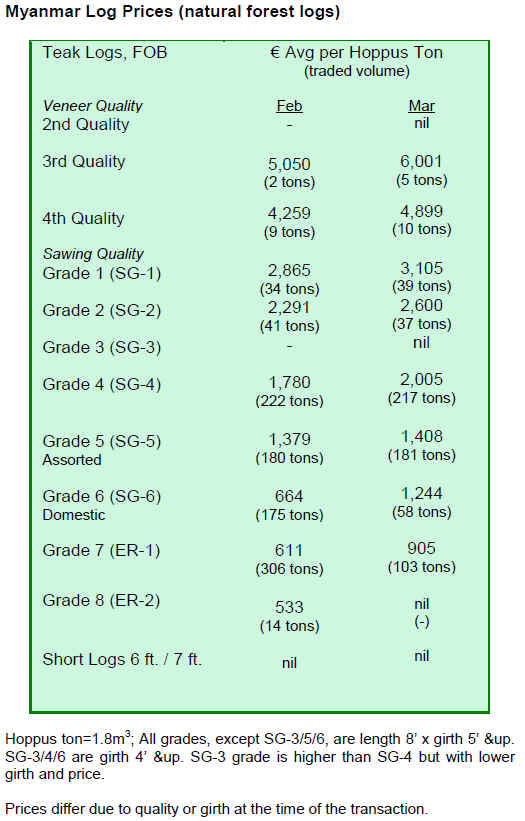

Teak auction prices have increased. Buyers for the Thai

market were active this month and Singapore based buyers

for the Indian market were also keen buyers this month.

6. INDIA

A memorable decade of growth

The Economic Advisory Council Chairman

Mr.C.Rangarajan, sees growth prospects for the Indian

economy being maintained through stable fiscal and

monetary policies. He expects GDP growth to be 8.2%

over the next fiscal year.

The 2000-2010 decade is proving a memorable decade of

progress during which, in spite of global upheavals in

2008/9, India has continued strong growth. Additionally

the publicity surrounding the Climate Summit in

Copenhagen raised environmental awareness in India and

has given fillip to official efforts on environmental issues.

India¡¯s wood working industries have also started to think

¡®green¡¯ and the country¡¯s Compensation Afforestation

Programme, under which any change of use of public

forests to non-forestry purpose is compensated for through

afforestation of degraded or non-forested land, has

received accolades from UNEP.

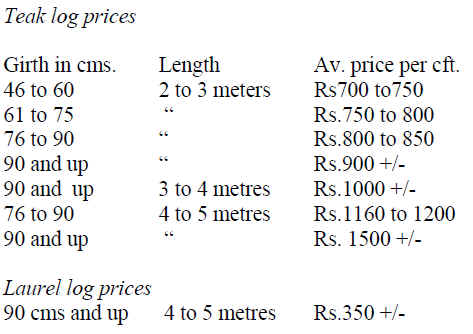

Local hardwood auctions

Auction sales in Gujarat were delayed due to public

holidays during the month. It is expected that the next

series of sales will be announced in the first week of April.

In the central India log depots around 6000 cubic metres

were sold last month. Local demand was very much

apparent but many lots were not up to the usual quality

and realised lower prices than previously attained. Prices

remained firm for good quality logs. The average prices at

the latest auction are as follows:

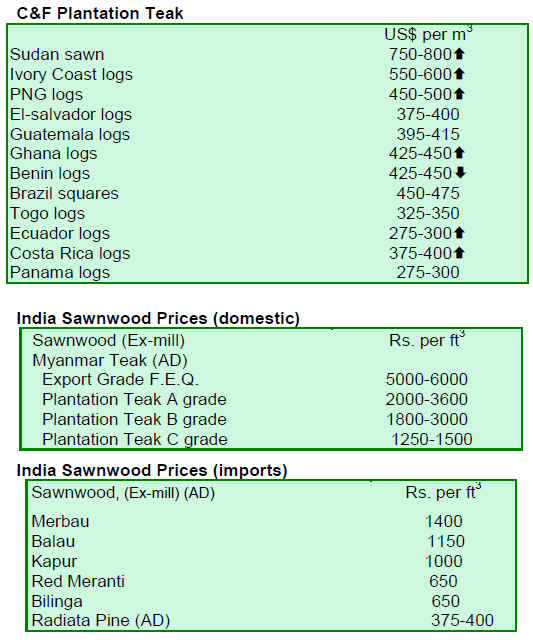

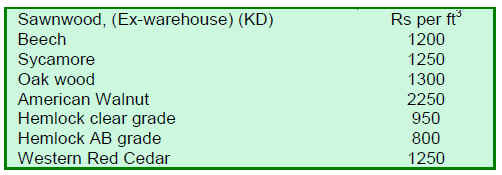

Prices for imported logs

Current C&F rates for containerised plantation teak logs

and rough squares are given below. Freight rates have

been rising and there has been some upward revisions of

prices already, but not in all cases. Market demand is

steady and flow of exports from the supply countries is

reported as satisfactory.

7. BRAZIL

Export performance

In February 2010, exports of wood products (except pulp

and paper) increased 0.5% compared with values for

February 2009, from USD 184.2 million to USD 185.1

million.

Pine sawnwood exports fell 21% in value in February

2010 compared to the same month of 2009, from USD

11.8 million to USD 9.3 million. In terms of volume,

wood product exports fell 23.5% from 59,700 cubic

metres to 45,700 cubic metres over the period.

Exports of tropical sawnwood decreased in terms of both

volume and value, from 43,600 cubic metres in February

2009 to 38,100 cubic metres in February 2010, and from

USD 20.4 million to USD 19.7 million, respectively over

the same period. These correspond to a 12.6% decline in

volume and 3.4% decline in value.

Pine plywood exports dropped 5% in value in February

2010 compared to the same period of 2009, from USD

24.7 million to USD 23.5 million. The volume exported

fell 25% during the same period, from 96,000 cubic metres

to 71,800 cubic metres.

Similarly, exports of tropical plywood were down from

11,000 cubic metres in February 2009 to 7,900 cubic

metres in February 2010, representing a 28% fall. In value

terms, a 26% reduction was recorded over the period, from

USD 6.1 million to USD 4.5 million. Wooden furniture

exports were up from US$ 41.6 million achieved in

February 2009 to USD 43.6 million in February 2010,

representing a 5% increase.

Economic overview

According to the Brazilian Institute of Geography and

Statistics (IBGE), the Consumer Price Index (IPCA) for

February 2010 increased 0.78%, slightly above the rate

0.75% recorded in January.

To-date, the accumulated inflation rate for the year is

1.54%, above the overrun of 1.03% in the same period in

2009. The IPCA of February 2009 was 0.55%.

In February 2010, the average exchange rate was BRL

1.84/USD, while the rate was BRL 2.31/USD in the same

month of 2009 illustrating the appreciation of the Brazilian

currency against the US currency over the period.

The Monetary Policy Committee (Copom) of the Brazilian

Central Bank (BC) has held interest rates unchanged at

8.75% per year. Interest rates in Brazil have not changed

since July 23, 2009., According to a survey carried out by

the BC, the financial markets are anticipating an interest

hike from April and that rates may climb to 11.25% by

year end.

State forests under-utilised

State owned forests in the Amazon, considered as the

cornerstone of the government¡¯s plan to promote

sustainable economic development in the Amazon, are still

under utilized.

In 2006 it was expected that concessions over some 13

mil. hectares would be offered over a 10 year period but,

to-date, concessions covering only 96,000 hectares have

been processed by the government.

The delay, according to reports was due to the fact that

¡°original plans for the concessions did not consider some

key procedural elements,¡± such as the need for public

consultations, management plans and environmental

permits.

It has been estimated that around US$1.8 bil. could be

generated annually if the planned concession bidding and

allocation was fully implemented. The add-on value to the

economy would be considerable when harvesting and

processing activities are factored in.

Media reports suggest that, in the first half of 2010, the

Brazilian Forest Service (SFB) may grant timber

concessions over a further 700,000 hectares.

Certified timber exports

The Northern Amazonian state of Acre is a model region

in terms of producing and exporting certified timber

products. As a result companies in the state have become

major wood exporters to Europe, Asia and the United

States. The global economic crisis hit the Acre industries

hard and shipments to the US and EU have dropped

dramatically and put the industry at risk.

SINDUSMAD (the Timber Industries Union of State of

Acre) has prepared a strategy for the timber industry

sector. The development of this strategy was aided by

FIEAC (Acre Industries Federation), to which the union is

affiliated. This strategy identifies two main initiatives: the

need for companies to achieve forest certification and the

implementation of studies to identify the means to achieve

efficient harvesting and forest sustainability in the

Amazon.

Brazil nut wood mill shut

An illegal sawmill dealing with Brazil nut wood was shut

down after inspection, according to the Brazilian Institute

for Environment and Renewable Natural Resources

(IBAMA). The timber company was located in the region

of Itupiranga, southeast of Par¨¢ and had been operating

without environmental permit.

A total of nearly 100 cubic metres of sawnwood and 182

cubic metres of logs were seized. The sawmill, which is

being dismantled, was established in a remote location on

a secondary road along the Trans-Amazon Highway.

IBAMA inspectors believe that the timber company has

processed thousands of Brazil nut trees based on the

amount of wood residues accumulated at the mill.

The harvesting and trade in Brazil nut trees is totally

prohibited because the species is threatened with

extinction. The conservation of this species is especially

important to the people of the region who rely on

harvesting the nut for sale.

Domestic pricing

Domestic prices in BRL, remained stable over the month

but in terms of US$ prices are down slightly due to the

moderate appreciation of the US$ against the BRL.

8.

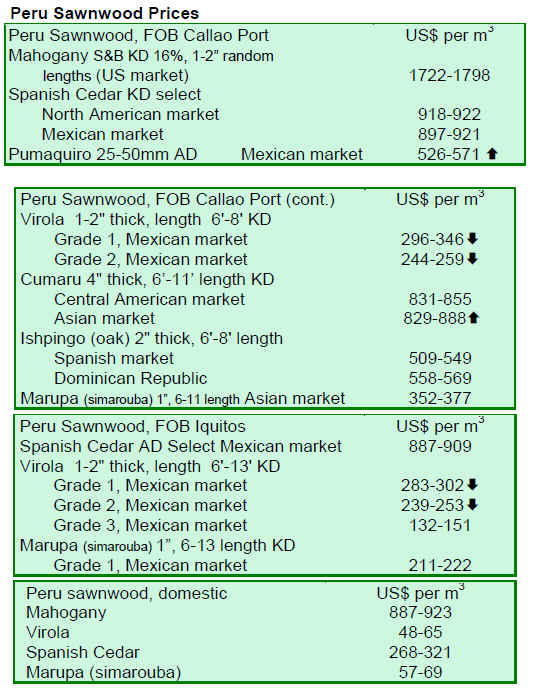

PERU

New law in April

The new Forestry and Wildlife Law that is required

to fulfill the commitments of the Free Trade

Agreement between Peru and the United States will

be sent to Congress in April, according to the Deputy

Minister of Strategic Development and Natural

Resources, Rosario G¨®mez. Ms G¨®mez also said the

ministries of Agriculture and Foreign Trade and

Tourism and the Agency for Supervision of Forest

Resources and Wildlife are working to coordinate the

development of the initiative.

She stated that, currently, the comments and inputs

from stakeholders, especially in the Amazonian

communities, are being incorporated and that the first

draft should be available by the end of March.

No sign of demand recovery

Peru¡¯s timber exports were hard hit by the

international economic crisis in 2009 and recovery is

slow. January exports dropped 3% to US$ 9.39

billion, the second lowest in the past 48 months,

according to the Association of Exporters (ADEX).

The poorest export performance over the past four

years was in January 2006 (US$8.56 million) from

that date until late 2008, exports grew but this

changed in 2009 when the international financial

crisis affected the Peruvian timber sector.

The export figures for January 2010 do not yet

provide a glimpse of the long-awaited recovery.

In January the three main export products were short

boards for parquet manufacture, plywood and lumber.

The view of the president of the ADEX Timber

Committee, Juan Pablo Feijoo, is that this situation

may improve as the new Forestry Law will open new

market opportunities and generate thousands of new

jobs. He added that the implementation of the new

Forestry Law should result in greater timber exports.

Major markets in 2009

China remains the number one market for wood

products from Peru, accounting for around half of all

exports in 2009. The US market accounted for some

17% of total wood product exports in the same year.

Other major markets are Mexico, Dominican

Republic, Australia and Canada.

9.

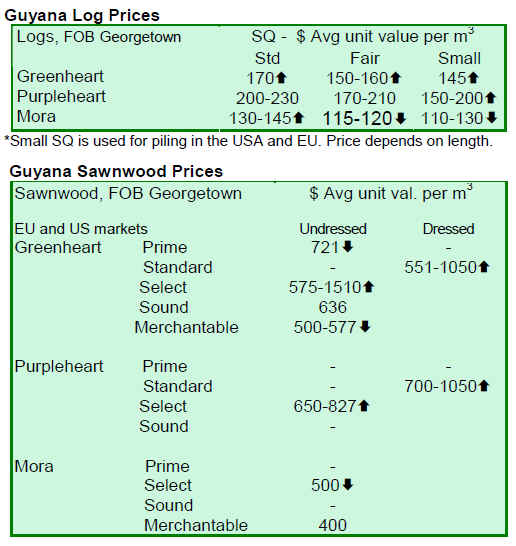

Guyana

During the period under review prices for logs remained

largely unchanged except for Purpleheart small sawmill

quality logs for which prices reached as high as US$200

per cubic metre. Also, Mora standard and small sawmill

quality logs saw price increases.

For this fortnight period, prices for rough sawn

(undressed) Greenheart sawnwood category increased for

both prime and merchantable qualities. At the same time,

Purpleheart (select quality) also recorded increased prices.

Mora sawnwood prices remain stable.

In addition, average prices for both dressed Greenheart

and dressed Purpleheart improved, reaching as high as

US$1,050. Prices for Guyana¡¯s Washiba (Ipe) rough sawn

(undressed) lumber also increased, peaking at US$ 1,600.

Baromalli plywood prices for both BB/CC and Utility

categories remain relatively stable. Splitwood has shown

improvement in average prices and a high of US$ 1,000

per cubic metre was recorded. This product is exported

mainly to the Caribbean countries.

Community Logging Associations

Since 2001 the Guyana Forestry Commission (GFC) has

been facilitating the formation of Community Logging

Associations. There are approximately forty-three active

groups operating seventy six State Forest Permits over a

total area of over 300,000 ha.

These associations have been established for the purpose

of assisting communities that rely heavily on forests as

their main source of livelihood, to gain legal access to

forest resources.

The associations effect change and development within the

community. Activities undertaken help to reduce poverty

and provide alternative sources of economic livelihoods.

The groups create jobs for residents with the aim of

reducing migration from the area and increasing

employment within the community. They also encourage

sustainable forestry practices by securing concessions and

operating according to guidelines set by the GFC.

Initiatives undertaken by the GFC for the associations

include training, granting of scholarships and job offers.

The GFC gets involved in the management and the

issuance of concessions and has raised awareness on the

key areas such as the Code of Practice for Timber

Harvesting, Forest Policies and Law and Reduced Impact

Logging.

|