Japan Wood Products

Prices

Dollar Exchange Rates of

13th March 2010

Japan Yen 89.10

Reports From Japan

Chile quake hits industry

The devastating earthquake that struck Chile at the end of

February has seriously affected the timber industry. The

city of Concepcion, which was close to the earthquake

epicentre, is the hub of the log and lumber industry in

Chile and has suffered major damage.

The Japan Lumber Report (JLR) reports that, while the

main port suffered little damage, power supplies have been

cut and road access to the port is almost impossible. The

indications are that all shipments scheduled for March

have been cancelled and this will affect importers in Japan

and Korea, amongst others.

Reports on the damage suffered by sawmills are still being

received and from first indications it would seem that

some mills close to the ocean have been destroyed. Other

mills are reported to have suffered some damage but have

been able to continue production at a reduced rate. As

access to the ports is affected, stocks are piling up at most

mills, says the JLR.

Wood promotion in public buildings

Details of the content of the Bill on promoting wood use in

public buildings are reported in the JLR. The Ministry of

Agriculture, Forestry and Fisheries, Japan has drafted the

Bill, aimed at raising the use of wood in low rise public

buildings from the present level of 7.5% to 20-30%. This,

according to the Forestry Agency, could increase wood

consumption by between 700-800 thousand cubic metres

annually.

The package of support for manufacturers comprises legal,

financial and technical elements which are still under

discussion. The JLR reports that this initiative in the

public sector will have a knock-on effect on the private

sector leading to a greater use of wood in buildings.

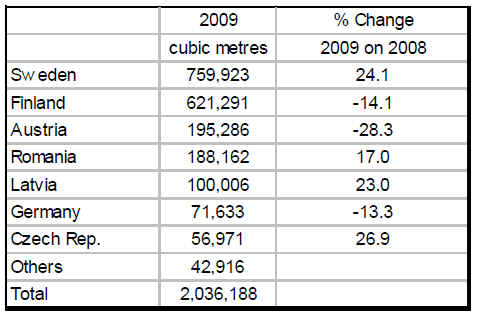

European softwood lumber imports

Total imports of European softwood lumber by Japan in

2009 were 2,036,188 cubic metres, some 1.3% more than

in 2008 according to the JLR. Finland and Austria lost

market share while Sweden became the top supplier due to

favourable exchange rates relative to the Euro.

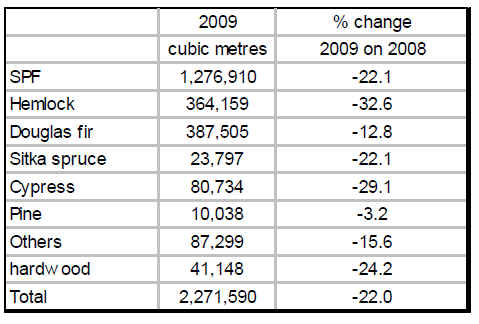

N. American lumber imports

In 2009, Japan imported 2,271,590 cubic metres of N.

American lumber, the lowest since 1975 and 22% down

on imports in 2008 says the JLR.

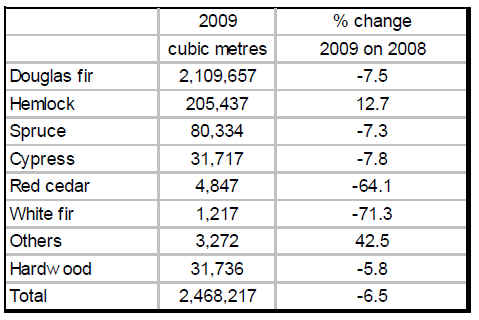

N. American log imports

Total 2009 imports of N. American logs by Japan are been

reported at 2,468,217 cubic metres by the Japan Lumber

Importers Association; this represents a decline of 6.5% on

2008 imports. The most popular timber was Douglas fir

which accounted for some 80% of 2009 imports, says the

JLR.

Firming log prices

The JLR is reporting that log stocks, built up when log

prices were lower than at present, have almost been sold.

Currently, higher priced logs are coming into the domestic

market and wholesale log prices are moving up. In

addition, higher FOB prices and the slightly weaker Yen

should add momentum to this upward trend in prices.

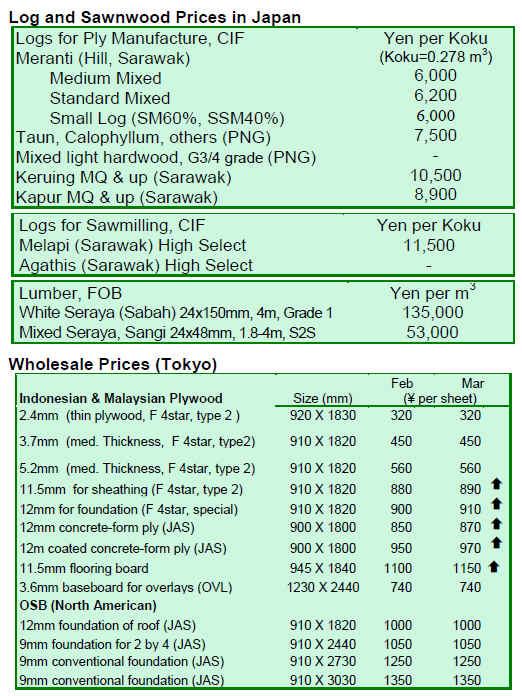

In early March Sarawak Meranti prices were up around

Yen 300 per Koku to Yen 6,200 while Meranti small logs

were at Yen 5,200 per koku. Sabah Kapur log prices

remain unchanged at Yen 8,900 per Koku.

Tropical log peeler mills in Japan are maintaining their

reduced production levels. With signs of firming prices for

imported plywood, these mills will soon have an

opportunity to raise prices and this will lead them to

increase log purchases.

According to the JLR, FOB prices have been increasing

slowly but steadily in the face of a somewhat limited

supply because of the rain season in Sarawak. The rain

season will soon end but it will take time for log stocks to

build again.

Current export prices are at US$190 per cubic metre for

Meranti regular and US$155 per cubic metre for Meranti

small. Kapur prices are reported at almost US$260 per

cubic metre in Sarawak and Sabah.

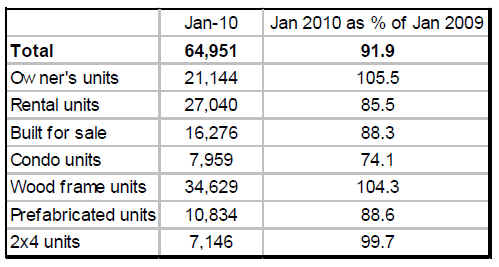

January housing starts

Housing starts in Japan have final stopped declining says

the JLR. Since November 2009, housing permits have

been increasing, indicating that construction activity

should start to pick up. In January 2010 starts were 8%

down on January 2009 which maked 14 months of

unbroken decline.

|