|

Report

from

Europe, the UK

and

Russia

Rebound in EU plywood imports

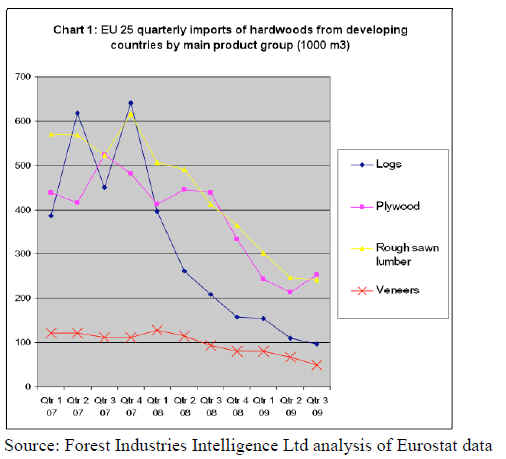

Analysis of the most recent Eurostat trade data indicates

that European imports of hardwood-faced plywood from

developing countries rebounded in the third quarter of

2009 after suffering four consecutive quarters of decline.

In the three months to end September 2009, the EU

imported 252,000 cu.m of hardwood plywood from

developing countries compared to only 211,000 cu.m in

the previous 3 month period. This aligns with anecdotal

reports of European plywood importers taking tentative

steps to rebuild depleted stocks. Nevertheless, levels of

European hardwood plywood imports during the third

quarter of 2009 were only around 50% of levels recorded

during the same period in 2008 and 2007 (Chart 1).

EU imports of other hardwoods from developing countries

continued to decline during the third quarter of 2009.

European imports of hardwood logs and sawn lumber

from these countries suffered seven straight quarters of

decline between October 2007 and September 2009.

Hardwood log imports fell from over 600,000 cu.m in the

fourth quarter of 2007, to less than 100,000 in the three

months to end September 2009.

During the same period, EU imports of sawn lumber from

developing countries declined from over 600,000 cu.m to

around 250,000 cu.m. EU imports of hardwood veneer

from developing countries fell for six consecutive quarters

between January 2008 and September 2009, from 128,000

cu.m to 50,000 cu.m (Chart 2).

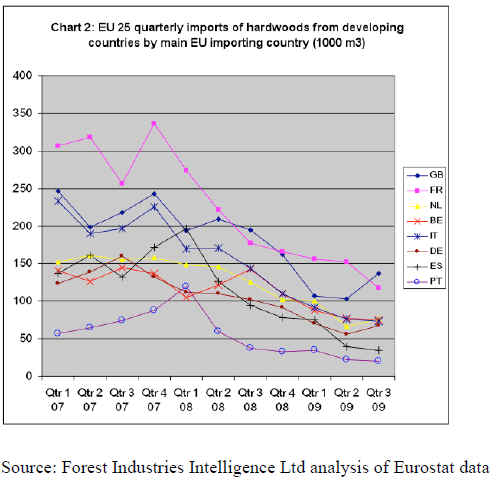

Compared to the previous quarter, the three month period

to end September 2009 saw a slight increase in total

imports by the UK, Netherlands, and Germany of

hardwood logs, lumber, veneers and plywood from

developing countries. However, total imports of these

commodities into all other major EU markets continued to

fall during the third quarter of 2009 (Chart 2).

All the main developing-world suppliers of hardwoods to

the EU with the exception of China and Malaysia

experienced a decline in European sales during the third

quarter of 2009.

EU imports of hardwood primary products from China and

Malaysia (mainly plywood) showed marginal gains during

the third quarter compared to the second quarter, although

the volumes involved remained well below those of the

previous year. During the third quarter of 2009, EU

imports of hardwoods from most major developing-world

supply countries were running at less than 50% of volumes

achieved during the same period in 2007.

Weak growth prospect for 2010

The unprecedented fall in EU hardwood imports in 2008

and 2009 reflects the dramatic economic downturn across

Europe. The sheer scale of the downturn took many

economists by surprise.

EU GDP is expected to have fallen by around 4% in 2009

according to the most recent European Commission

forecasts (in November 2009). This compares to a fall of

only 1.8% predicted at the start of the year.

Signs that the European economy may have reached

bottom began to emerge in the third quarter of 2009. The

euro-area economy crawled out of recession in the three

months to the end of September. GDP across the eurozone

rose by 0.4%, the first quarterly increase for more

than a year. While the European economy is expected to

return to growth in 2010, the indications are that the

rebound will be very weak across the continent.

Prospects are dampened by a wide range of factors

including: high and rising levels of unemployment; overcapacity

in the construction sector following the bursting

of property bubbles in several countries (notably Spain,

Ireland and the UK); the strength of the euro which is

undermining European competitiveness in export markets;

and the continuing unwillingness of European banks to

provide credit, particularly to smaller businesses and

households.

To make matters worse, many European governments

have to deal with very high fiscal deficits, greatly reducing

their ability to stimulate economic activity.

Governments now face a very difficult policy dilemma.

Public debt may spiral out of control unless taxes are

raised or spending cut. But if fiscal support is withdrawn

too quickly, the economy could tip back into recession. To

address this, European Union countries have agreed in

principle to an í░ambitiousí▒ tightening of fiscal policy, but

only from 2011. By then, it is hoped, the economy will be

strong enough to withstand it.

The bright spots

There are a couple of bright spots amidst the gloom for the

hardwood industry. Activity in the European joinery

sector, particularly windows, is receiving a boost from

government stimulus measures focused on improving the

energy efficiency of buildings in some countries, notably

Germany and France. Furthermore, in those countries like

the UK where the property bubble has burst and new

residential building is in the doldrums, maintenance and

renovation work is more stable as property owners are

choosing to í░improve rather than moveí▒.

Growth prospects vary

While the economic downturn has been universally felt

across Europe, its depth and the likely strength of the

rebound varies between countries.

GDP in Germany shrank by 5% in 2009 and is expected to

rebound only weakly in 2010. Unemployment is expected

to jump this year from 3.1 million to 4.5 million, a painful

rise that will dampen consumer confidence and spending.

A wide range of government measures have been

implemented in order to stimulate growth. One beneficiary

of particular relevance to the tropical hardwood sector is

the windows sector which is currently benefiting from

government subsidies to boost energy efficiency.

Tax cuts, including a reduction in VAT scheduled for

2010 may help boost consumption this year. However

stronger economic growth will be impaired as government

support in other areas, including in the labour and car

markets, comes to an end.

Due to high dependency on the financial sector, GDP fell

particularly dramatically in the UK during 2009, by

around 5.9% from peak to trough. The UK remained in

recession in the three month period to September 2009, the

most recent quarter for which data is available.

The expectation is that the UK economy dragged itself out

of recession in the last quarter of 2009, and GDP is

forecast to grow weakly in 2010, by around 0.4%

according to The Economist. Unemployment is continuing

to rise and is expected to peak at around 9% of the

workforce in 2010. UK housing market statistics have

improved somewhat at the beginning of 2010, for example

there was a 45% rise in new house registrations in the 3

months to November 2009.

On the other hand, prospects in the UK for 2010 are

dampened by wide expectations of rising interest rates

together with higher taxes after a general election expected

sometime between March and May 2010 as the new

government tries to rein in the countryí»s burgeoning fiscal

deficit.

Recent reports in the UK Timber Trades Journal suggest

many timber traders expect the UK market to continue to

í░bump along the bottomí▒ in 2010.

GDP in France is expected to grow by 0.9% in 2010. The

French government has been spending freely in an effort

to counteract the effects of the recession, supporting

employment and bringing forward planned public

investment projects. However this is at the cost of a

burgeoning budget deficit. While the economy has

stabilised there is unlikely to be any dynamism.

Tight fiscal policies in Italy leave little room for economic

stimulus. There also appears to be little appetite for

structural reform, suggesting Italy will not be well placed

to benefit from the global upturn and its economic position

in Europe will continue to weaken. Economic growth of

only 0.4% is expected in 2010.

The strong euro will be a brake on Italian competitiveness

in key export sectors, including furniture. Manufacturing

in the Italian wood processing sectors is well down.

During late 2009, industries focused on exports, such as

furniture, were reporting that sales had fallen by nearly

50% compared to the previous year. Traditionally Italian

wood importers carried relatively high stocks, but during

the current downturn companies have followed the trend

to greatly run down stocks and minimise forward orders.

A home-grown property bubble meant Spain was hit early

and very hard by the credit crunch. The construction sector

has collapsed, feeding through into a dramatic decline in

key wood processing and manufacturing sectors.

Spainí»s large door manufacturing sector has suffered from

widespread bankruptcies and production is believed to be

down by more than 50%. Prospects for any improvement

in Spainí»s economy in the short to medium term seem

poor. GDP is expected to decline by 0.8% in 2010, with no

return to growth until at least the last quarter of the year.

Unemployment and the budget deficit are expected to soar.

|