Japan Wood Products

Prices

Dollar Exchange Rates of

14th December 2009

Japan Yen 88.58

Reports From Japan

Deteriorating softwood plywood market

Market prices for domestically manufactured softwood

plywood continue downwards and have now dropped to

record lows says the Japan Lumber Reports (JLR).

Panic selling by wholesalers is driving down prices day

after day and there are fears that some seriously weakened

domestic manufacturers could be put out of business

As companies try and secure a larger share of the market

they are abandoning consideration of the demand levels so

there is growing confusion in the sector.

This highly irrational market for softwood plywood is

impacting the market for imported hardwood plywood.

With the continued Yen appreciation over the past weeks

importers are tempted to re-stock but are holding back

because the whole market is in turmoil.

At the moment traders do not want to carry high

inventories because the market situation is so uncertain.

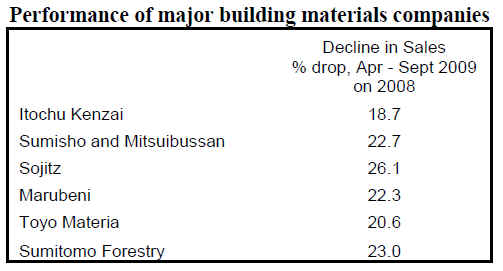

Building materials company results

The financial performance of five major building trading

firms, plus partial data from Sumitomo Forestry, over the

past half year have been reported by the JLR and are

summarized below.

Overall total sales declined by 22 % from the same period

last year and ordinary profit levels fell a massive 29%.

Profits have been driven down by low housing starts and

by weak demand for building products.

The JLR says that market condition will likely remain

unchanged during the second half of the financial year and

that full year company results will probably be in line with

those of the first half.

Plywood mills buying logs

Plywood mills in Japan are still actively buying tropical

hardwood logs as their stocks have been declining. Recent

buying activity in the SE Asian log market is because log

supply is likely to drop in February due to the Chinese

New Year holidays and the rain season, both of which

slow harvesting. Tropical hardwood log consumption in

November was 45,000 cu.m.

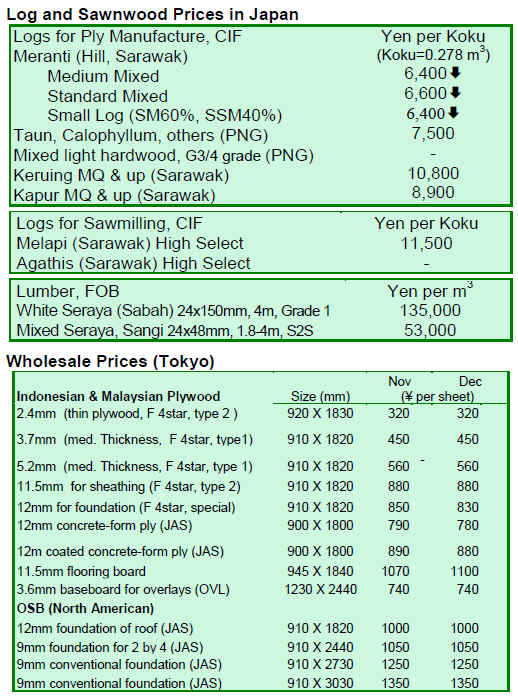

Sarawak Meranti regular log prices on the Japanese

market are reported by the JLR at 6,200-6,300 yen per

koku CIF. Small Meranti log prices are 5,200-5,300 yen

while Sabah kapur (floater) log prices are about 8,900 yen

per koku CIF.

Reports are indicating that log harvest rates and

transportation volumes in the producing countries are

dropping rapidly due to unfavorable weather conditions,

usual for this time of year. Importers say that the weather

will improve and water level in the rivers will be back to

normal in a short time so that towing of logs downstream

can resume.

The lower log availability has the effect of firming prices.

Sarawak Meranti regular log prices are US$180-185 per

cu.m FOB. Small Meranti logs are selling at US$140-145

and super small Meranti logs are reported as US$125-130

per cu.m FOB. Sabah Kapur prices are US$225-230 per

cu.m FOB. Generally, prices have not increased much but

grades which are in short supply are up US$5 per cu.m.

October housing starts

Total housing starts in Japan during October were 67,120

units, 27% less than the same month a year earlier. This is

the eleventh consecutive month of decline and a record

low for the month of October. The JLR is predicting that

total year stars would be below 900,000 units.

Because of the weak economic situation in Japan buyers

are opting for lower cost units and the average house floor

space in October was 21% down on a year ago.

Sumitomo/Toyo merger

Sumitomo Forestry announced that Sumitomo Forestry

Crest Co., Ltd. (Crest) and Toyo Plywood Co., Ltd., both

subsidiary companies of Sumitomo Forestry, would merge

from March, 2010. Crest will be the surviving company

but the Toyo plywood brand name ‘Topura’ will be still be

used after the merger.

Both companies are plywood manufacturers but, because

of the weak demand for building materials the merger will

allow for streamline of administrative functions. The

surviving entity will, according to the JLR, target some

Yen 39 billion in sales by 2012.

October plywood supply

Total plywood availability in Japan during October was

12.3% less than October last year but up 9.4% over

September levels. Volumes of imported plywood were

more than expected and on top of this, domestic

production increased by 6.4% from September.

In particular, softwood plywood production was

190,000cu.m, 7.4% more than in September, The figure

for October was the highest monthly production since

October 2007 but sales dropped to 168,000 cu.m, down

4.1% which resulted in a big jump in inventories. The end

of October inventory was 207,000 cu.m, 12% more than

for September.

Plywood imports in October were 274,788 cu.m, 19.2%

less than October last year but 11.9% more than

September. With rising production, weak demand and

increased imports inventories are seriously out of step with

demand levels.

|