|

1.

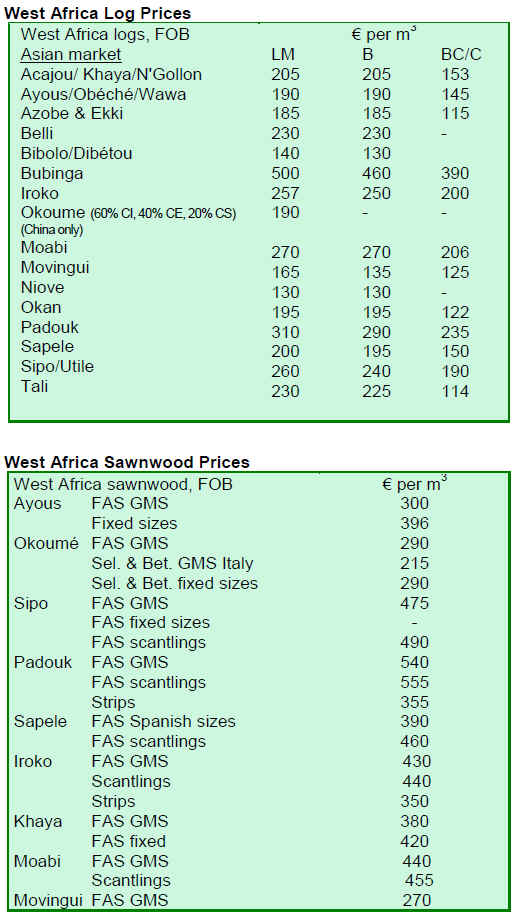

CENTRAL/ WEST AFRICA

Trade startled by Gabon announcement

Dominating the news in the West and Central African

timber trade has been the announcement that Gabon will

ban the export of round logs. The initial news was that the

ban would take effect from January 2010. This

announcement was one of several by the government team

led by the newly-elected President Ali Ben Bongo, who

became Gabon's president last month.

It seems that, so far, no formal gazetting or legislation has

followed. The proposed ban, according to the statement, is

in order to create employment in particular for young

persons and women by ensuring that further processing is

carried out within Gabon.

According to earlier goals, the Government planned to

increase the domestic wood processing rate to 75% in

2012 and only allow 25% of the log harvest to be

exported.

Industry uncertain

At the moment there are no details of any phasing out of

log exports and the industry is uncertain what to do about

the existing log stocks at the port and in transit. It is also

uncertain of what it would do in respect of contracts

already signed and for shipping and time charter

arrangements.

Although Gabon¡¯s log export volumes are much lower

than they were some years ago, there are still large

volumes sold to China, India and lately to Vietnam, as

well as some steady volumes for North Africa.

Consumer countries affected

If the ban was to come into effect in January, these

consumer countries would have just one month in which to

find alternative log supplies to keep their manufacturing

plants operating. Given that there are so few tropical log

exporting countries this will not be easy to achieve and log

prices will likely rise. At this early stage, while waiting for

more detailed information, the market has not reacted.

It is reported that some exporters in Gabon have raised

their asking prices for okoume sawn lumber, though it is

not known if any sales have been made at higher prices.

Major shift in trade pattern

Apart from this major news, there are no reports of price

movements for logs or lumber as it will take time for both

producer and consumer countries to work out strategies to

deal with, what will become, a major shift in trade

patterns. This move will result have consequences for

shipping and investments in processing in one of West and

Central Africa¡¯s major tropical hardwood producing

regions.

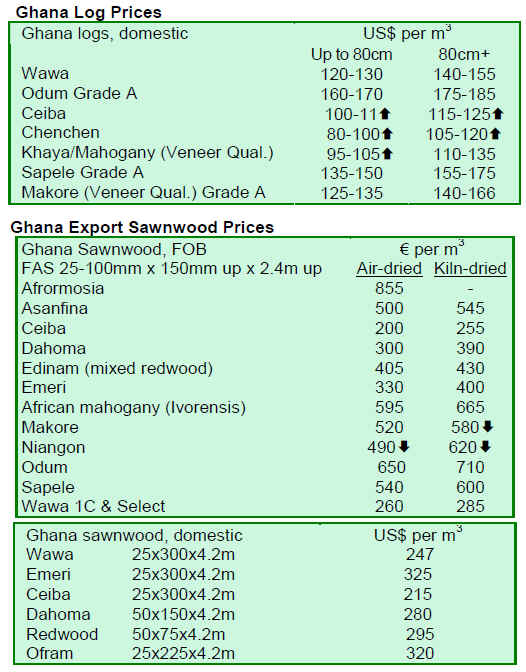

2. GHANA

Ghana¡¯s 2010 Budget

The Minister of Finance and Economic Planning, Dr.

Kwabena Duffour, has presented the 2010 Budget

Statement and Economic Policy to Parliament to usher in

the government¡¯s growth and strategic framework

towards, in his words a ¡®Better Ghana¡¯.

The budget, captioned ¡®Growth and Stability¡¯, enumerated

a set of comprehensive policies to support the

government¡¯s medium term growth strategy in a manner

that would be sustainable.

The statement included element to maintain the

macroeconomic stability and fiscal discipline achieved in

2009, positioning the country in five areas of investment

for a sustained growth through the modernisation of

agriculture, provision of key infrastructural development,

oil and gas projects, private sector development, ICT and

delivery of social programmes targeted at poverty

reduction.

The implementation of this agenda is projected to cost

government GHc10.8 billion in total payments, 23 percent

higher than the 2009 budget.

The Minister said that monetary policy would continue to

focus on stabilising price and exchange rate expectations,

saying the goal of the monetary policy was to reduce

inflation rate to less than 10 percent over the medium

term.

By a legislation instrument, the Government is to integrate

the three revenue agencies of Value Added Tax (VAT),

Customs Excise and Preventive Services (CEPS) and

Internal Revenue Service (IRS) into one agency to be

known as Ghana Revenue Authority.

Budget statement highlights

• A significant reduction in the budget deficit from

22 percent of GDP to about 10 percent,

• Improvement of import cover from 1.8months in

2008 to 2.5months in 2009,

• Job Creation through Greening Ghana,

• Provision of GHc25.0 million for the

establishment and the implementation of the

Savannah Development Authority.

Deficit cut

Ghana¡¯s budget deficit will, according to latest estimates,

narrow to 7.5 percent of gross domestic product next year

as the government looks to earn more from import duties

and mining.

Interest rates

Meanwhile, the Bank of Ghana has cut its prime interest

rate by 0.5% to 18.0 percent. The newly appointed

Governor Kwesi Amissah-Arthur, chairing his first

meeting of the bank's Monetary Policy Committee,

announced the reduction at a news conference. The

previous level of 18.5 percent represented a five-year high.

Royalties to Government

Golden Star Resources Ghana Ltd, whose mining

activities are under the jurisdiction of the Ministry of

Lands, Forestry and Mines, has paid US$8 million in

royalties to the government. This was royalties for the

third quarter and they were derived from its two mines in

Bogoso/Prestea and Wassa, Western Region. Since

Jan.2009, the company has paid US$27.9 million in

royalties to the Ghana government.

In a related development, the 2010 budget statement

indicated that royalties paid by mining companies are to be

increased from three to six percent.

3.

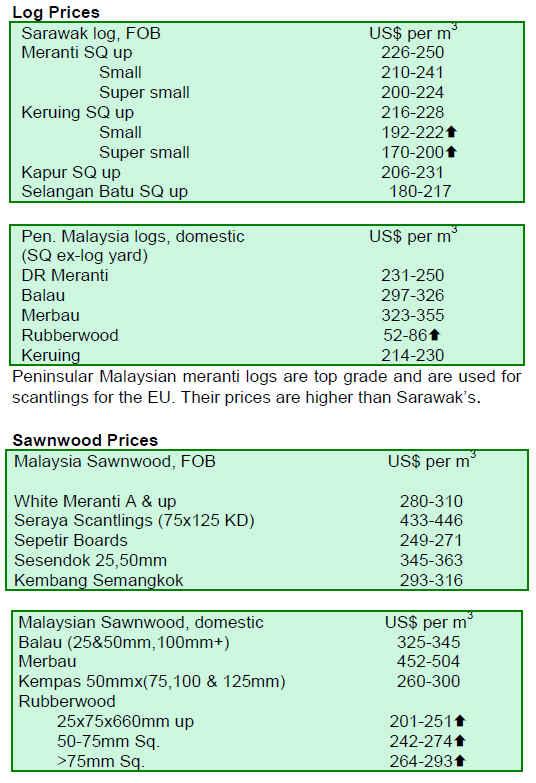

MALAYSIA

China investment plan

China, which is one of Malaysia¡¯s biggest trading partners,

will seek further trade and investment opportunities in the

country in the area of oil palm and timber. This emerged

during a press conference held jointly with the visiting

Chinese president Hu Jintao.

China is fast becoming a major buyer of Malaysian

sawnwood, plywood and logs and forecasts are for its

economy to grow by more than 9% in 2010 driven by

growing domestic consumption and exports.

Expectations are high for increased wood consumption

following the government planned low-cost housing

programme. This aims to provide 7.5 million homes to

low-income urban households from 2009 to 2011.

India major player

India¡¯s timber imports in 2008 were around US$1.4

billion, out of which, US$362.8 million (RM1.3 billion)

originated from Malaysia. This made India Malaysia¡¯s

third largest timber trading partner after the US and Japan.

Products exported to India include logs worth US$263

million (RM920 million), mainly from Sarawak and

wooden furniture worth US$44.8 million (RM156.8

million). A recent trade mission by the Malaysian Timber

Council (MTC) to Delhi, Mumbai and Chennai identified

that India is expected to remain a major importer due to its

large population and growing middle-class income group.

Gluelam plan

Plans to promote glued-laminated (glulam) timber

products are being developed by the MTC in order to

assist local manufacturers. MTC hopes to emulate the

success of its competitors in their successful promotional

efforts in Dubai, New Zealand and in Hong Kong.

To further enhance its market promotion the MTC will be

organising training programmes for overseas architects,

designers and manufacturers in the near future. The MTC

is reportedly targeting countries where Malaysian timber

products are not widely marketed.

4.

INDONESIA

Furniture selling well

In what is being heralded as growing worldwide

appreciation of Indonesian furniture products, companies

secured orders said to be worth over US$380,000 during

the Middle East International Furniture and Interior

Design Exhibition (INDEX) 2009, which was held from

November 14 to November 17, 2009, at the Dubai World

Trade Centre.

The head of the national exports development agency said

that the interest in Indonesian furniture supported the view

that Indonesian timber products are gaining acceptance in

the Middle-Eastern countries, Pakistan, East Asia and

Africa. At the fair Indonesia was represented by 21

companies including some agencies operated by

governmental institutions.

The fair had exhibits from 1,750 companies and agencies

including Malaysia, Taiwan PoC, Vietnam, and China.

Import duty cut

The Indonesian government will abolish the 5% import

duty imposed on machinery and raw material for 7 critical

industries in an effort to boost investment and to increase

the global competitiveness of Indonesian companies.

The Ministry of Finance added that the tax would be

abolished as of December 16, 2009 for a trial period of

two years when a review of its effectiveness will be

undertaken.

The industries set to benefit from the change in duty

include the transportation, telecommunications, public

health, tourism and culture, as well as, supporting

industries for the mining, construction and port and

harbour services. The move is seen as an encouragement

for domestic industries to open new plants or businesses.

At present it is not clear how this will assist investors in

the wood processing sector.

5.

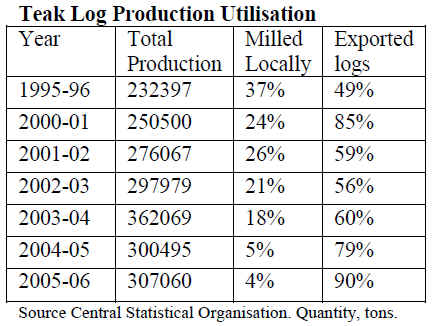

MYANMAR

Teak sawmilling a sunset industry

An article highlighting the alarming decline of the

sawmilling industry in Myanmar appeared in ¡®Living

Colour¡¯- a monthly economic news magazine- this showed

that Myanmar¡¯s timber is, today, exported mainly in log

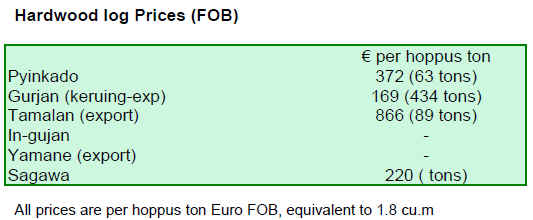

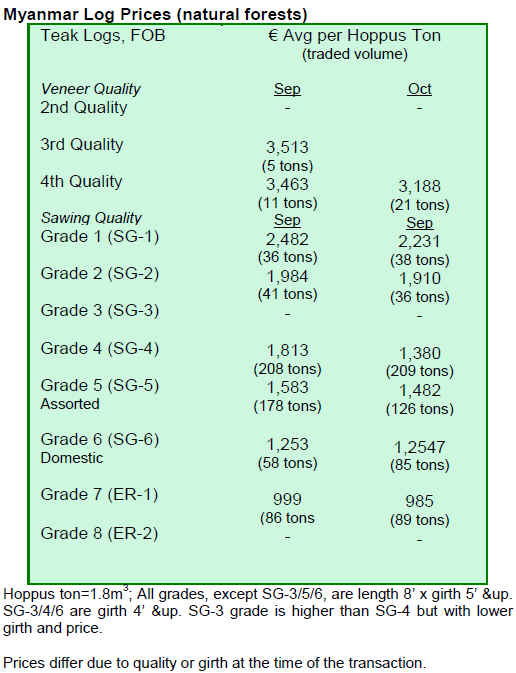

form and not as processed products. The following table

illustrates the trends in log exports and domestic

manufacturing.

The author of the article traced back into the 17th & 18th

centuries when teak was originally the favoured timber for

shipbuilding. After independence the industry was

managed by the State and the then two sawmills converted

15,725 hoppus tons of logs. The number of teak sawmills

had increased to 34 by 1968-69 and by 1983-84 teak

sawmilling had reached a peak with some 335,000 hoppus

tons being milled. Beginning in 2000, mill throughput

declined with the lowest level (10,800 hoppus tons) being

recorded in 2005.

The author advocated the need to stimulate the local

industry from slipping further and was well received

among the wood industrialists.

Sino-Myanmar border trade

A vernacular weekly in Myanmar ¡®7-Days News¡¯ carried a

story, quoting Global Witness, saying that the trade in

illicit timber declined by 70% between 2005 and 2008.

This was attributed to the efforts by the authorities in

China and Myanmar.

Analysts mentioned that the past undocumented trade in

wood into China not only adversely affected the Myanmar

wood industry, but also some major Thai sawmills. The

result was that timber buyers were sourcing their sawn

teak in China and the industry in Myanmar and Thailand

were unable to compete with the cheaper teak products.

6. INDIA

Demand strong

With the Indian Rupee at 46.22 to one US dollar there has

been a surge of 14% in the dollar from its record low of

Rs.52.20 reached in March. This jump has put exporters in

difficult spot and in October there was a drop of almost

12% in exports according to official figures.

China is one of the key competitors for Indian exporters

along with Vietnam, Bangladesh and Sri Lanka.

Nevertheless demand for hardwood products continues to

be good and the slightly lower prices seen for logs from

Myanmar and other sources has helped exporters adjust to

the dollar strengthening.

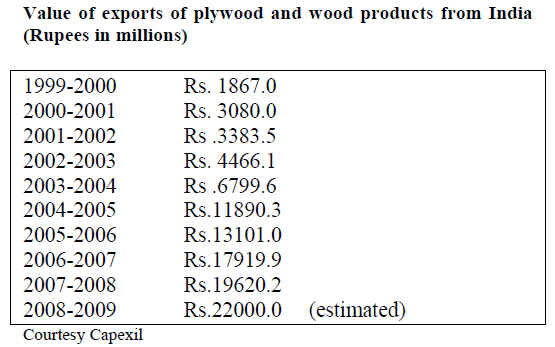

On export front the performance has been steady and

consistently improving as seen from the following

figures:

Indian consumption grows

Wood consumption in Indian is growing fast and although

the country has over 250 commercial timbers (including

some of the most highly prized tropical hardwoods like

Teak, Rosewood, Padouk, Red Sanders, Sandalwood) a

strict conservation policy limits harvesting. This means

India is a net importer of wood and wood-based panel

products. Indian industrial demand for wood jumped from

58 million cubic meters in 2000 to 85 million cu.m in

2008 and expected to cross 150 million cu.m by 2018.

India manufacturers prefer to import timber in log form to

feed the domestic industries. Imports are mostly from

Malaysia, Myanmar, Indonesia, Nigeria, Ivory Coast,

Ghana, Togo, Gabon, Brazil, Panama, Costa Rica,

Ecuador and New Zealand. The major ports used for

imports are Kandla, Mumbai, Mangalore, Tuticorin,

Chennai Vishakhapatnam and Kolkata as well as many

internal container depots.

Requirement for logs for the panel industry is met largely

from plantations, Agro-forestry sources and natural

forests. The concept of industry owned plantations of

Eucalyptus, Poplar, Casuarinas and Acacia mangium is

gaining popularity and this helps a lot in preventing illegal

fellings from state forests. Teak harvesting is handled by

the government Forestry Agencies and sales are made by

auction at forest depots. Even the private logs are brought

to the official depots for sale by auctions.

Auction prices

Auction prices for Teak logs at Government Forest depots

have continued to be firm as domestic demand exceeds the

quantity available.

Adina cordifolia has been fetching Rs.300 to 350 per

hoppus foot while Terminalia tomentosa has been selling

for Rs.350 for A grade, Rs.200 to Rs.250 for B grade and

Rs.200 to Rs.150 for C grade logs. All prices are per cubic

foot (Hoppus) ex depot.

Plantation incentives

Besides industrial plantations, Sandalwood (Santalum

album) and Red Sanders (Pterocarpus santalinus) are also

now the focus of attention due to improved and relaxed

rules and regulations for the growing and harvesting these

high price exotic species.

There is plenty of scope for raising private plantations for

these high value timbers as well as Teak. Now even

Bamboo is being promoted by the Indian government as it

is fast growing and finds many uses especially for the

paper and rayon industries. The role of Bamboo is

expected to boost the economy, the greening projects and

carbon sequestration.

Imports

Trade analysts are reporting that import prices are steady

as flow of arrivals is good. However the availability of

timbers from Myanmar seems to be getting less and less

but the expectation is for improved qualities of overseas

plantations of Teak. The recently improved quality of

plantation Teak from Ghana, Benin, Sudan and Tanzania

are helping meet the shortages from Myanmar and

supplies from Central and Latin American countries are

also expected to get better as the plantations are getting

older.

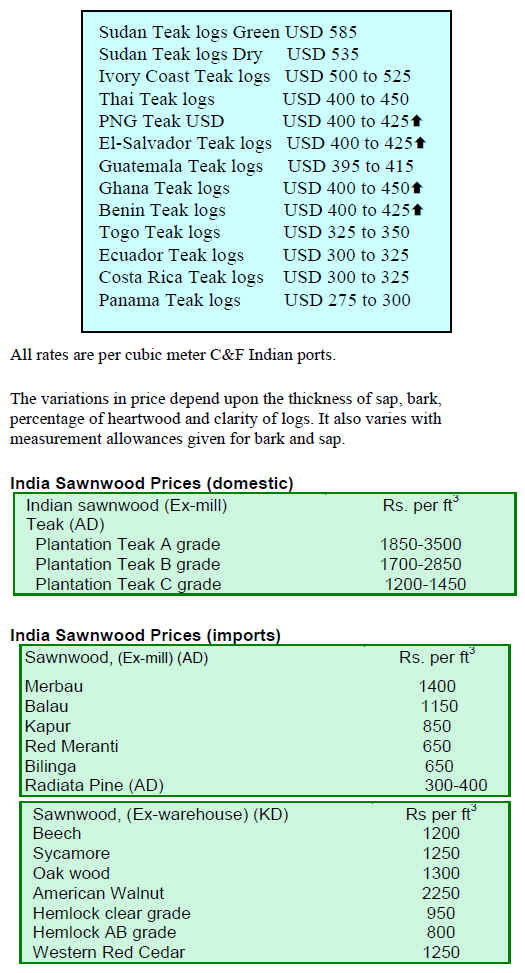

The current prices for Teak imported from various sources

other than Myanmar are shown below. All rates are per

cubic meter C&F Indian ports.

7. BRAZIL

Real appreciates further

Prices of wood products in local currency remain stable

but prices in US$ have increased about 4.9%. This is due,

primarily, to the appreciation of the Brazilian Real against

the U.S. Dollar over the period under review.

Consumer price index

The Consumer Price Index (IPCA), which measures the

official inflation rate in Brazil, closed at 0.28% in October.

This is 0.04% above the rate in September according to the

Brazilian Institute of Geography and Statistics (IBGE).

From January to October, the accumulated inflation was

3.5%, below the inflation in the same period of 2008

(5.2%).

Given the perspectives for inflation compared to the

government target, the Monetary Policy Committee

(Copom) of the Central Bank of Brazil maintained the

Selic rate at 8.75% per year. The next meeting of Copom

will be held on early December.

In October 2009, the average exchange rate was BRL

1.74/US$, compared to BRL 2.17 in the same month of

2008. The continued strengthening of the BRL against the

US dollar is of concern to exporters.

Manufacturers at full capacity

The furniture sector in the Sinop region, in the Amazon, is

celebrating positive business trends for the year end, due

mainly to the increases seen in furniture production to

supply retailers to meet demand. While sales projections

are influenced by many factors manufacturers are

optimistic and say the outlook is favorable.

The manufacturers are reportedly operating at maximum

production capacity and the furniture sector is booming in

the region. The prospects for 2010 are said to be good.

In the municipalities of Sinop, Sorriso, Lucas do Rio

Verde, Nova Mutum, Vera and Tapurah, members of the

Local Production Arrangement (APL), have proposed

increasing revenues by 30% by 2011 which would require

a jump in sales of over R$ 19 million.

In 2008 in the municipalities mentioned, the gross annual

revenues of the furniture sector reached R$ 14.8 million,

derived from sales to some 7.3 million consumers. Sales

outside of the municipalities of origin of companies

totaled more than R$ 2 million.

Exports drop

In October 2009, exports of timber products (except pulp

and paper) fell 31.4% compared to values from October

2008, from US$ 292 million to US$ 200.2 million.

Pine sawnwood exports fell 46% in value in October 2009

compared to the same month of 2008, from US$ 18.7

million to US$ 10.1 million. In volume, exports decreased

38.8% from 60,300 cu.m to 36,900 cu.m over the period.

Exports of tropical sawnwood also fell significantly in

both volume and value, from 75,200 cu.m in October 2008

to 51,600 cu.m in October 2009, and from US$ 40 million

to US$ 26 million, respectively over the same period. This

translates to a 31.4% fall in volume and 34.5% in value.

Pine plywood exports dropped by 34.4% in value in

October 2009 compared to the same period of 2008 and

from US$37.2 million to US$24.4 million. The volume

exported decreased 25% during the same period, from

125,000 cu.m to 93,700 cu.m.

Exports of tropical plywood fell once more from 17,600

cu.m in October 2008 to 11,300 cu.m in October 2009,

representing a 35.8% decline. In terms of value, a 44%

reduction was recorded over the period, from US$ 11.6

million to US$ 6.5 million.

In respect of wooden furniture, export revenues fell from

US$ 71.1 million in October 2008 to US$ 52.1 million in

October 2009, representing a 26.7% drop.

Furniture export to Argentina fall

Despite ongoing negotiations between Brazil and

Argentina on ending trade barriers, protectionist measures

by Argentina are affecting the furniture sector of Rio

Grande do Sul, the Brazilian Southernmost state.

According to the Rio Grande do Sul State Foundation for

Economics and Statistics (FEE), furniture exports dropped

53% from January to September 2009.

Dubai Furniture Fair

A group of 23 Brazilian companies exhibited their

products at the Middle East International Furniture and

Interior Design Exhibition (INDEX) 2009 held in Dubai.

This is one of the largest furniture fairs in the region.

The fair brought together the most important companies in

furniture production, and related sectors. The participation

of the Brazilian companies was an initiative of the

Brazilian Furniture Project, developed by the Brazilian

Furniture Manufacturers Association (ABIMÓVEL) in

partnership with the Brazilian Agency for Export and

Investment Promotion (Apex).

In the first half of this year the Middle Eastern countries

imported Brazilian furniture worth around US$ 1.5. The

Middle East is a large consumer market and remains

important for Brazilian exporters despite the current

economic crisis.

8.

PERU

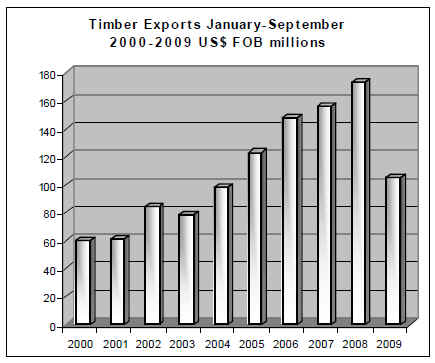

Exports down 39%

According to the Export Association of Peru (ADEX),

wood sector exports from January ¨C September 2009 were

worth US$105 million FOB while for the same period in

2008 they were US $174 million a drop of almost 40%.

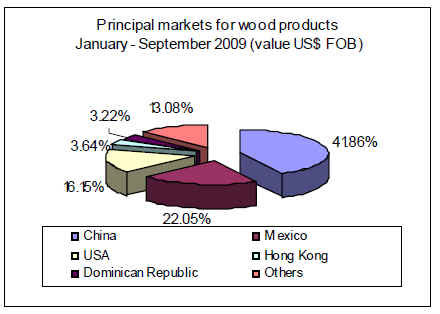

In the January ¨C March quarter, the three main wood

export markets were China, Mexico and the United States

and these three accounted for 79% of wood sector exports.

In the first three quarters of the year the Bolivia market

emerged as significant with its imports of mainly plywood

and parquet jumping more than 350% the same period in

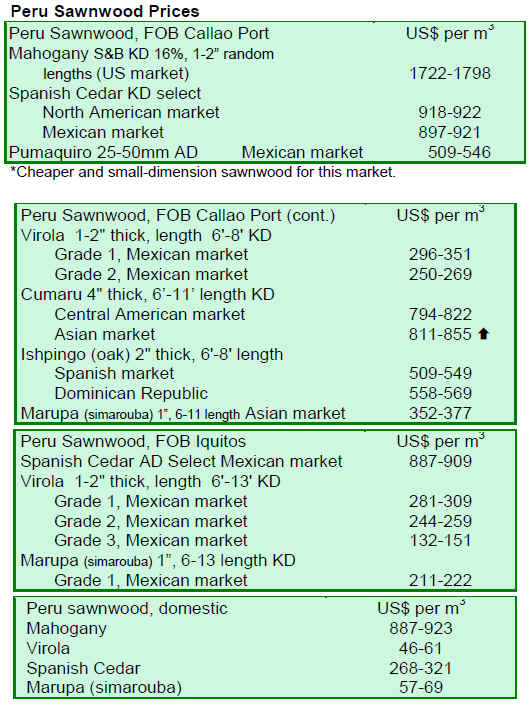

2008.

New Zealand also represented a growing market with its

imports from Peru more than tripling on 2008. New

Zealand imported a large quantity of sleepers (railway

cross-ties HS 440690).

Weak Mexican demand

On the other hand, the Mexican market weakened with

overall wood imports from Peru dropping 64% and

imports of mouldings ceased altogether! A similar picture

emerged in Canada where imports from Peru were down

63%.

Semi manufactured exports hit

Exports of semi-manufactured products accounted for

40% of the total trade in wood products.

The main export destination for products in this sub-sector

was China (76%). On the other hand, the market in Hong

Kong grew strongly.

The Sawnwood export in the first three quarters

represented the second largest export sector at 37% of all

wood products exported and they were worth US$39

million FOB down 51% on the same period in 2008.

The main market for sawnwood was Mexico, taking 35%

of exports.

Exports of veneer and Plywood in the first three quarters

stood at US$11 million FOB down over 50% with Mexico

taking the biggest share at 82% of all veneer and plywood

exports.

The exports of furniture and parts dropped 42% in the

period January ¨C September 2009 to US$ 5.5 million FOB.

The US is the largest market for Peru¡¯s furniture and parts

exports accounting for around half of all furniture exports.

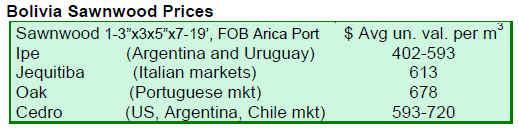

9. BOLIVIA

Small enterprises dominate

In Bolivia there are round 1300 wood processing

industries of which an estimated 73% are small

enterprises. Currently, the FSC system is being adopted by

private companies so that, through certification, they can

gain better access to international markets.

10. MEXICO

Climbing out of recession

Reports are indicating that Mexico¡¯s gross domestic

product fell by 6.2 percent in the third quarter relative to

the same period of 2008 authorities said.

Year-on-year output in the service sector fell by 6.5

percent, industrial production was down 6.6 percent and

¡®primary¡¯ activities (agriculture and livestock) were also

down.

However on a quarter-on-quarter basis a picture of a

recovery is emerging with industrial production up around

2% relative to the second quarter, while services improved

almost 4% but agricultural and livestock production

remained in negative territory.

The Mexican economy began shrinking at the end of 2008,

and GDP continued to decline in the first two quarters of

this year, falling 8.2 percent and 10.2 percent,

respectively.

The Mexican economy has been badly hit by falling

exports to the US and lower remittances from overseas

workers as well as a decline in oil production. However,

the indications are that the country has climbed out of the

worst of this recession.

CONAFOR News

The Sierra de Organos National Park, a protected natural

area of 1,125 ha. in the state of Zacatecas, is the target of

action under the CONAFOR restitution of environmental

services and land recovery project. Up to 2010 some 23

million pesos from the Mexican Forest Fund will be used

by the project.

11.

Guyana

Price movements

Greenheart log prices for only standard sawmill quality

shifted moderately, while Purpleheart log prices for

standard sawmill quality and fair sawmill quality remain

relatively stable.

Mora log prices moved up over the past two weeks

recording higher average prices for all grades (standard,

fair and small).

Sawnwood prices for undressed (rough sawn) Greenheart

(select) have not changed but prices for merchantable

grade fell. On the other hand undressed (rough sawn)

Mora select increased to the range of US$ 500/592.

Dressed Greenheart prices fell while dressed Purpleheart

prices moved up to between US$ 813/900 in comparison

to the previous period.

Baromalli BB/CC plywood prices recorded higher average

prices for the period under review.

Demand trends

Roundwood exports contributed to export earnings and

prices were steady. Splitwood exports contributed

favourably to earning with higher average prices as against

prices in the previous period.

For value added products the contribution of doors and

indoor were favorable having achieved higher average

prices as compared to prices in October.

Outdoor garden furniture is also making a significant

contribution to export earning as is trade in window

frames and non timber forest products.

|