|

Report

from

Europe, the UK

and

Russia

Europe crawls out of recession

The Financial Times (FT) reports that ¡°the worst recession

to hit continental Europe since the 1930s ended formally

in the three months to September, but with less than a

bang than expected.¡±

Drawing on Eurostat data, the FT notes that GDP in the

16-country euro-zone grew 0.4% in the third quarter

compared with the previous 3 months. That was the first

positive growth reported since early 2008.

Germany returned to its role as Europe¡¯s economic

powerhouse, reporting a 0.7% expansion, boosted by

investment spending and exports. Italy also performed

strongly with GDP rising 0.6% in the third quarter.

But the overall euro-zone rebound was marred by a much

weaker than expected performance by France, which

reported a GDP rise of 0.3% - the same as the previous

quarter. Euro-zone prospects also remain blighted by

Spain, hit badly by its property market collapse.

The FT warns that the pace of recovery is likely to be

slow. Quoting Jorg Kramer, chief economist at

Commerzbank in Frankfurt, it suggests that ¡°the euro-zone

is driving ahead with the handbrake on¡±. So far, recovery

has been dependent on temporary factors ¨C less aggressive

de-stocking by industry and emergency stimulus measures.

It is too early to assume that growth will be sustained.

After a while, the recovery could run out of steam if

household spending does not pick up. Consumer spending

remains weak across the euro-zone and prospects for any

strengthening are gloomy given the current state of the

labour market. Meanwhile the strengthening euro, which is

undermining exports, and weakness in the banking sector

are other obstacles to a rapid rebound.

On the other hand, the UK economy was still in recession

at the end of the third quarter of 2009. The UK is now in

its longest recession since records began in 1955. Here

too, the latest economic data suggests that any recovery is

likely to be sluggish.

Consumer spending is currently bolstered by a reduced

value added tax (VAT) rate, which forms part of the

government¡¯s package of stimulus measures, but may well

be hit when the rate is returned to pre-recession levels in

January.

Continuing job losses are also damaging consumer

confidence. While companies are rebuilding stocks, lack

of confidence in end-user demand is feeding through into

only cautious buying.

Despite promising signs that property prices may have

stabilised in the summer months, the UK housing market

still looks very fragile. Both mortgage approvals and

private housing orders continued to fall in August, the

latest month for which this data is available. The outlook

therefore is for only very sluggish growth in the first half

of 2010.

Tentative restocking of plywood

The emergence of gaps in stockholdings and a fear of

future shortfalls in supply have encouraged some tentative

moves by UK plywood importers to restock in recent

weeks.

However, uncertainty over future demand prospects,

combined with concerns over freight rate increases and the

inconsistency of the pound-dollar exchange rate, mean that

the mood remains extremely cautious. The UK tropical

hardwood plywood market is now very much dominated

by Malaysian and Chinese material. Low price

expectations, falling availability of raw material and

environmental concerns have generally forced out

Indonesian shippers.

Brazilian shippers have also been unable to meet current

market prices, particularly as mills in Brazil have also

been hit by the strength of the real against the US dollar.

Generally slow consumption and uncertain market

prospects have meant that efforts by Malaysian shippers to

edge up their prices to better reflect rising costs and low

supply have been met with resistance by UK importers.

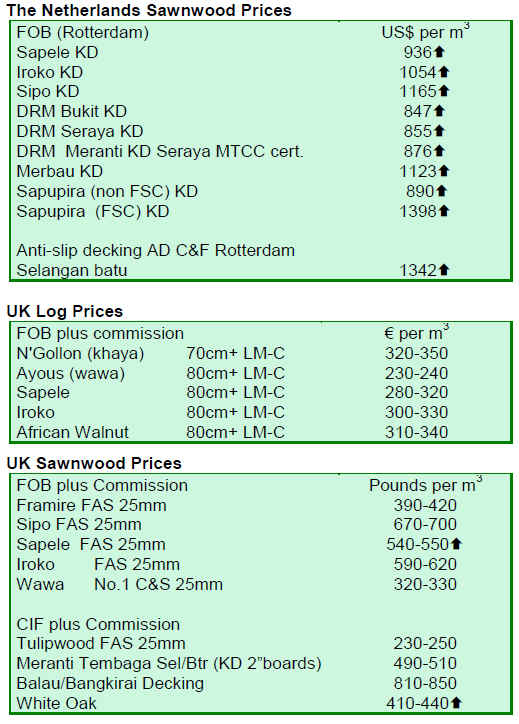

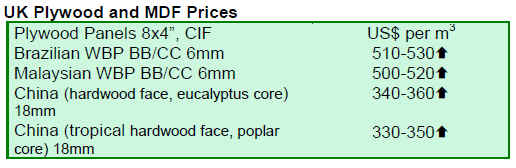

Nevertheless, expectations are that UK CIF dollar prices

for Malaysian BB/CC WBP plywood for December 2009

may be 5% higher than in September 2009. Chinese

plywood shippers are also generally looking to push up

prices due to rising costs and log supply problems.

Changes in ply sector

UK trade in tropical hardwood plywood is increasingly

concentrated in the hands of a limited number of larger

importers and merchants. This, combined with the fact that

during the recession a much higher proportion of new

building work in the UK is now dependent on publicsector

finance, is adding to the pressure on suppliers to

demonstrate that products are FSC or PEFC certified.

Many large importers are tightening their certification

requirements. For example B&Q, the UK¡¯s largest DIY

retailer, announced in September that it will only buy

FSC-certified tropical hardwood plywood (B&Q¡¯s tropical

hardwood throughout plywood is manufactured in Acre,

western Brazil).

Similarly, International Plywood, one of the UK¡¯s largest

importers, recently reported that over the last 5 years, their

sales of certified products went from zero to 20% of

turnover. In 2009, this figure is expected to be as high as

35% and it won¡¯t be long before all their softwood product

range is certified.

Mislabelling of Chinese plywood

Controversy surrounding quality issues and mislabelling

continue to plague imports of Chinese combi-plywood into

the UK. Most recently, a large volume of Chinese

hardwood-faced poplar plywood was impounded in the

Port of Belfast on suspicion of falsification of CE

marking.

According to the UK trade press, Belfast City Council¡¯s

environmental health department has impounded up to 80

containers of BB/CC plywood, ranging from 5.5-18mm

thickness, and ordered the remarking of product. The

department said its investigations in China and Europe led

to concerns that the CE2+ stamp on pallets had been

falsified. Product has now been remarked CE4+ and

invoices and documentation changed accordingly so that

the product can only be sold on for non-structural

applications.

In an effort to overcome quality problems associated with

Chinese plywood products, and to differentiate the good

from the bad, the UK notified body BM TRADA

Certification recently launched the Q-Mark certification

system.

This system, which goes beyond CE Marking, has been set

up as a direct response to a loss of confidence in the

quality of products from Chinese plywood manufacturers

and the appearance of CE-Marks on inferior products.

Q-Marking shows that products are fully compliant with

European Construction Products Directive (CPD)

requirements for structural applications. All boards must

be individually marked and any mills found to be noncompliant

with any of the requirements will be suspended

immediately. The plywood importer RKL is hoping to be

the first UK company to source Chinese plywood under

the scheme. The first shipment of Q-Marked products is

scheduled to arrive in the UK during November.

More competition for tropical plywood

The UK Timber Trade Journal, in its latest special feature

on the UK panel products sector, highlights some major

emerging challenges to the market position of tropical

hardwood plywood in the UK. For example:

Ireland-based Coillte Panel Products now has a joint

development agreement with Accoya modified wood

creator Titan Wood to commercialise modified MDF

panels to extend their application into shop-fitting,

exterior, facades, garden furniture and even decking.

The 4-year old JOSB Done Campaign, supported by the

Wood Panel Industries Federation, the manufacturers

Norbord and Smartply, and resin supplier Huntsman, is

having a significant effect on attitudes in the UK building

sector.

According to the JOSB campaign organisers, their

research suggests that 78% of UK builders and merchants

would ¡°opt for OSB over plywood¡± and for those who

don¡¯t choose OSB over plywood ¡°it was a question of not

knowing enough about OSB to make an informed choice¡±.

Smartply is now promoting Site Protect OSB coated prefinished

panels which are replacing tropical hardwood

plywood in the hoarding sector.

Weyerhauser is increasing its efforts to promote ¡°Tropical

Replacement Panel¡± manufactured from Uruguayan

plantation eucalyptus in the UK market. The company

claims that the top-end 100% eucalyptus appearance grade

plywood compares favourably with tropical BB/CC

tropical hardwood plywood from Malaysia and Indonesia.

While Chinese plywood has been beset with quality

problems, large UK importers like International Plywood

are now working closely with a limited number of better

quality mills in China to better ensure they get a consistent

product.

|