|

1.

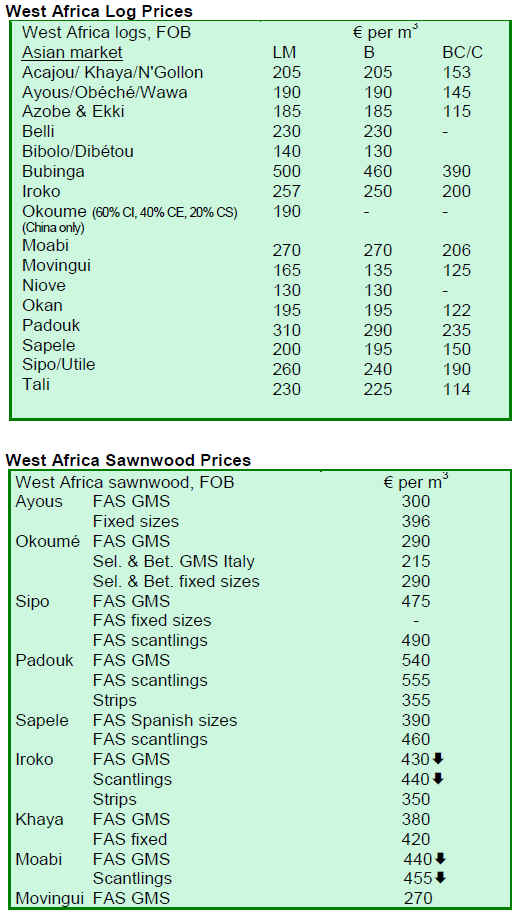

CENTRAL/ WEST AFRICA

Markets flat

Markets remain flat and prices for both logs and lumber

are unchanged this mid-month. The demand also remains

in the same pattern that has developed over the past

months. Broadly, Asian destinations are moderately busy.

Log demand in China and India is firm and prices are

steady. Demand from continental European buyers is

either very slow or in the case of southern Europe virtually

at a standstill.

Collapse in Spanish demand

Spain and Portugal are very quiet due to the building and

construction downturn in Spain in particular and suppliers

say it is unlikely to recover for possibly several years. This

collapse in demand has seriously affected those West

African log exporters that relied on Spanish purchases of

the lower and more mixed qualities.

Finding new markets has not been easy, however there are

reports of some recent success in penetrating Middle East

markets where there is some demand for logs and even

more demand for sawn lumber. This demand is said to be

attracting some business that was previously almost

wholly taken up by Asian suppliers of meranti and other

mixed light red hardwoods.

Costs rise

The rain season is affecting operations in Gabon and

leading to transport problems thus increasing the cost of

moving logs and lumber over the long distances to the

port. Exports of sawn lumber to Europe are so low that

producers report difficulty and delays in finding freight as

fewer ships are now making regular calls.

In Cameroon the seasonal rains continue but are expected

to ease at the end of November, however given the state of

the European market there will be little incentive for mills

to expand sawmill output.

Azobe over-production

Reports are emerging suggesting that the Cameroon

production of azobe lumber is well above the current

demand and stocks are climbing.

As previously reported, the relationship between lumber

output and the current demand appears to be finely

balanced and some West African producers believe that

care is needed to avoid overproduction and price

weaknesses in the more popular species. A salutary

example is sapele lumber where prices are still weak after

many months even though the excess stocks have long

been bought.

Okoume logs and lumber shipments and prices are holding

very firm on the strong demand.

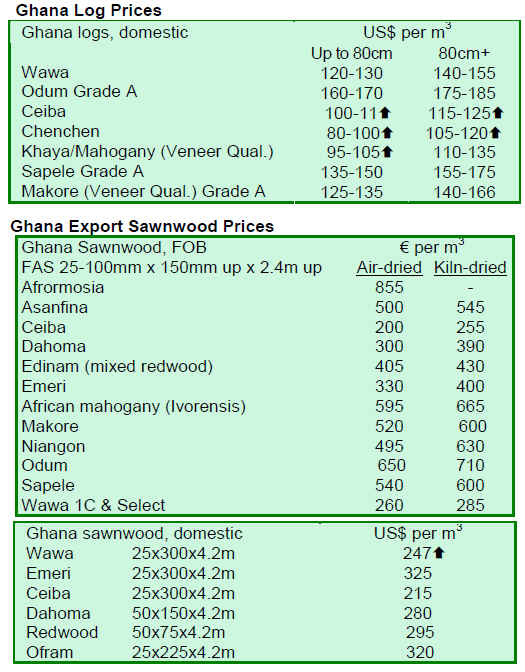

2. GHANA

Oil exports to drive 2010 growth

The Ghanaian economy remains steady but is being

impacted by deteriorating fiscal and external balances

because of the global economy. Real GDP growth was

around 6.4 per cent in 2008, slightly exceeding the 5.7 per

cent average in 2000-07.

Growth is projected to dip in 2009 as export performance

weakens on account of the global economic crisis, but then

to pick up again in 2010 as Ghana begins to export crude

oil.

Forest plantation plan

To restore the dwindling forest cover of the country, the

government has announced a National Forest Plantation

Development Programme. According to the Minister of

Lands and Natural Resources, Alhaji Dauda, Cabinet has

already given its approval for the programme which could

generate about 30,000 jobs to contribute to a reduction in

rural poverty.

The immediate objective of the programme is to increase

the tree cover in the country. The programme is also

intended to improve environmental quality, reduce the

wood deficit and provide an avenue for the country to tap

the emerging benefits from climate change markets for

carbon and sequestration projects.

The Minister reportedly said the long term goal of the

plantation development initiative was to develop a

sustainable forest resource base that would satisfy future

demands for industrial timber and enhance environmental

quality, thereby reducing pressure on existing natural

forests.

3.

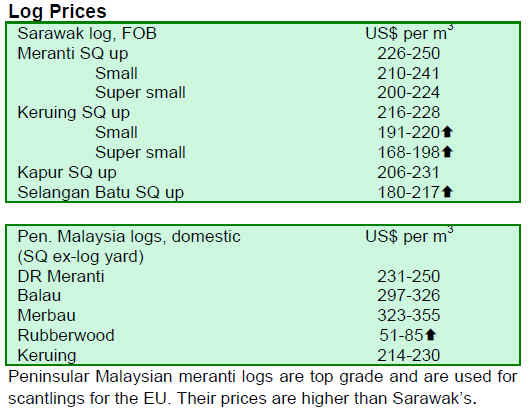

MALAYSIA

Optimism returns

The year end monsoon season failed to lift prices of timber

products higher as usually happens and this was because

millers are holding above normal stocks of sawnwood and

panel-products. However, timber traders are growing more

optimistic as the year comes to an end with positive

economic and business news emerging on the US, EU and

Japanese economies.

Former US Federal Reserve Chairman Alan Greenspan

mentioned recently that a rebound in US stocks is ¡°reliquefying¡±

the US economy and there are indications that

the decline in the house prices has bottomed out.)

MIFF 2010

Malaysian furniture manufacturers are optimistic that the

US economy has bottomed out and are expecting that US

buyers will be in the market soon. Manufacturers expect

the first signs of a turn-around to be in orders generated by

the annual Malaysia International Furniture Fair (MIFF)

2010 to be held from March 2 - 6, 2010.

MIFF 2010 will be held at three locations, the Putra World

Trade Centre, the Kuala Lumpur Convention Centre and

the MATRADE Exhibition and Convention Centre. A

separate event entitled ID Trend will be held by the

organizers of MIFF 2010 for local. The organizers are

targeting more than 20,000 visitors this year.

Japan¡¯s growth good for panels

The current-account surplus of Japan, the world¡¯s second

largest economy grew wider in September as worldwide

government stimulus spending helped to mitigate declines

in exports.

This has given Malaysian panel products manufacturers a

measure of optimism that the construction industry in

Japan will begin to pick by early spring 2010. However,

the panel products industry is wary that the price increase

of crude oil towards US$80 per barrel may unhinge

business sentiment. China has already increased fuel

prices in the wake of the increase.

The price increase of crude oil will also affect prices of

palm oil, which analysts suggest could rise above RM2,

600 per tonne by April next year if palm oil stocks remain

tight and the crude oil price remains above US$75 per

barrel. This would cause the prices of oil palm fibres, a

source of raw material for many panel-products, to

increase.

China¡¯s property market

House prices in China are rising and the latest monthly

increase of around 4% is the biggest gain in the last 14

months.

This price increase underlines the recovery in the Chinese

property market and the Chinese construction industry.

This is good news for exporters and the Malaysian timber

industry is preparing for a wave of buying of raw materials

by China. This would be important as purchases by

Middle-Eastern buyers begin to slow.

4.

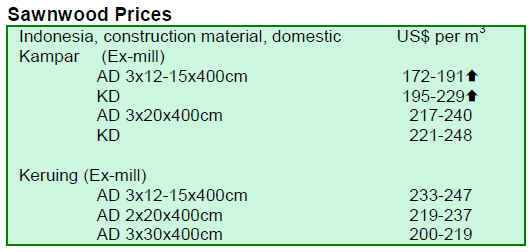

INDONESIA

Indonesia furniture fair

Indonesia will be holding its third International Furniture

and Craft Fair (IFFINA 2010) in Jakarta, March 11 - 14,

2010. It will be held at the Jakarta International Expo

(JIExpo) Kemayoran Centre. The event will be hosted by

ASMINDO and is supported by various Indonesian

government departments and trade bodies.

The organizers of IFFINA 2010 have confirmed 350

exhibitors to date and are targeting at least 10,000

international visitors and buyers.

Stimulus package delay

In a statement that could help to further stabilise prices of

Indonesian timber products and other building materials

the Indonesian finance minister said the government could

intends to spend about 60% of this year¡¯s stimulus

financing on infrastructure-related projects. Over the past

nine months only some 42% of the money available had

been spent.

The Indonesian government had allocated approximately

US$1.2 billion for infrastructure construction purposes.

This was to cover projects on seaports, airports, toll roads

and bridges and other vital infrastructure. In the absence of

rapid government spending it has been domestic spending

that has accounted for much of the growth particularly in

the retail sector.

Action on Forest fires

At the recent ASEAN environment ministers meeting held

in Singapore, Indonesia announced that it will implement

measures that are aimed at reducing the incidences of

forest fires, an annual problem that leads to serious air

pollution in the country and in the region.

The minister added that his is part of Indonesia¡¯s promise

to cut quarter of its total greenhouse-gas emissions by

2020. Although, Indonesia had not yet signed the 2002

ASEAN Agreement on Trans-boundary Haze Pollution, it

seems that this would eventually be done.

In addition, Indonesia and Australia have launched a forest

fire detecting system called Indofire - Indowatch. This will

utilise satellite images that will detect and inform

authorities about forest fires in both countries on a realtime

basis.

This support is apparently part of Australia's AU$40

million assistance programme for Indonesia in dealing

with carbon and forest issues.

5.

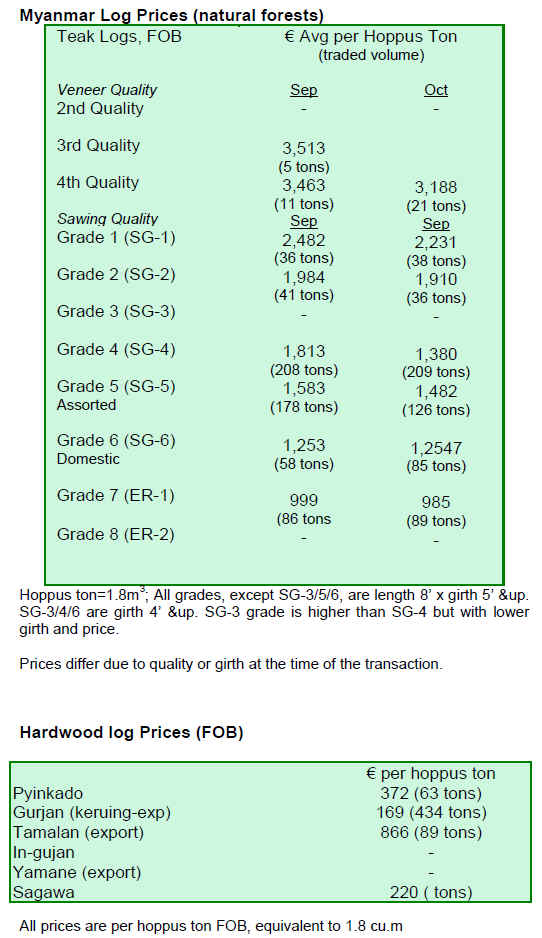

MYANMAR

Indian demand

Exporters in Myanmar report that the Indian market can

absorb a wide range of grade of teak logs, even the lower

grades for its local consumption as well as for export. At

present, say local analysts, it is only the India market that

is active for teak.

The trade is saying that that a full recovery in the teak

market could be expected by mid-2010, but this is a very

difficult situation to assess and predict. Teak used to be the

darling export commodity for Myanmar during the past

decade, but this is no longer so.

Other than teak

Hardwood logs notably Pyinkado are still actively

purchased by buyers in Vietnam and India, but current

purchases are low compared to previous years. Gurjan logs

are also shipped out in considerably quantities. It could be

said that the trade of hardwood logs (that is other than

teak) is quite active compared to the trade levels in logs in

other exporting countries.

There is talk that MTE (Myanmar Timber Enterprise) may

scale down the extraction of teak in the coming year. It

appears that more emphasis is now given to the

reforestation, especially the establishment of plantations.

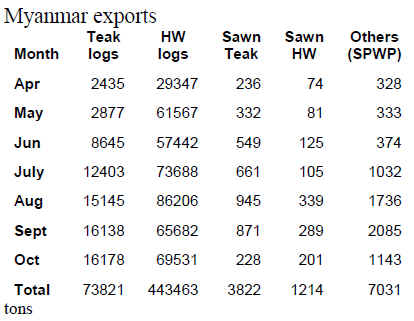

Statistical update

The following table shows the shipment data from April

2009 to October 2009. Indications are that shipments of

logs are on the rise. Other hardwood shipments peaked in

July and August and declined slightly in September and

October. The shipment of rough-sawn timber, and other

processed wood products are, by contrast, not very

promising.

Mangroves

The domestic press in Myanmar is reporting that

according to a FREDA official, a network of 17 local

NGO¡¯s has been formed to implement the replanting of

existing tidal forests in the country. FREDA (Forest

Resources & Environment Development Association) is a

local NGO formed by retired senior foresters and forestry

experts. The project will apparently extend along a 2500

km stretch of coastline starting from the Naaf River in the

Rakhine State in the west of Myanmar, to the Myeik

(Mergui) Archipelago in the south-east.

The project will begin with an initial funding of

US$500,000. Mangrove plantations will be established in

the Ayeyarwady delta that was hit by the Nargis Cyclone

in May 2008, as first priority.

6. INDIA

Markets active

Post monsoon activity in the timber market is brisk.

Government Forest Depot auctions are on and remnant of

last seasons¡¯ logs have been sold. New arrivals are

reported as substantial with over 15,000 cu.m of teak logs

coming from the Vyara and Dang Divisions of Western

India and the Betul Division of Central India. All have

been sold at good rates.

The quality of this year¡¯s cut has been generally good and

being the first auction of the new harvesting season,

buyers were quite enthusiastic. Compared to last season,

these auctions saw prices going higher by around 10-15%

over previous levels.

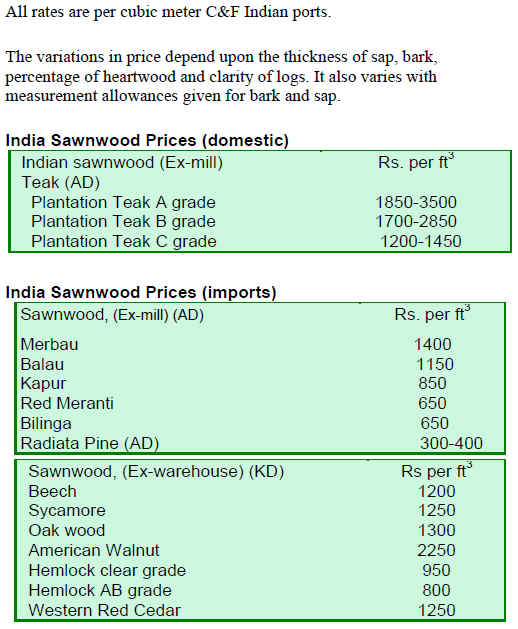

Domestic purchases

Hardwood imports are also in full swing but currently the

trade prefers to try and snap up local forest grown Teak

logs hence higher prices. Current prices per cubic foot

Hoppus are shown below

Teak A+ Shipbuilding quality

Rs.1800 to 2000

Teak B+ Shipbuilding

Rs.1700 to 1800

Teak A+ Sawing quality logs

Rs.1500 to 1600

Teak B+ Sawing quality logs

Rs.1400 to 1500

Teak long length medium girth Rs.1200 to 1300

Teak long length small girth logs Rs.1100 to 1200

Teak sawing quality C+

Rs.950 to 1100

Amongst non-teak species on offer Adina cordifolia,

(known as Kadam or Kadamba) and Terminalia tomentosa

(Indian Laurel) fetched around Rs.350 for A grade, around

Rs.250 for B grade and around Rs.150 for C grade logs per

c.ft Hoppus.

Mills at full capacity

With Diwali (festival of lights) holidays coming to an end,

workers have returned from home towns and the mills

which were suffering due to a labour shortage are once

again running at full swing.

Of late, imports of sawnwood have been increasing as the

difference in import duties for logs and sawn timber has

narrowed also exporting countries are offering sawn

timber at good prices. Sawnwood importers are happy but

saw mills which were processing imported logs are

worried at this development as they see growing

competition from sawnwood imports.

On the financial front, corporate results for the half year

ending 30th September are showing good results and this

has lifted confidence all around. Added to that, reports of

improvement in the US and Europe economies has driven

fresh activity in the wood product export sector.

India¡¯s overall exports are still under pressure showing a

decline of 14% for September, but the wood products

sector has seen no downturn and the Indian Export

Promotion Council is optimistic that last years¡¯ levels will

be maintained and probably exceeded.

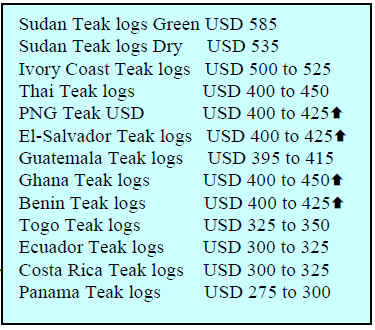

Teak prices

The flow of imported Teak and other hardwood logs is

satisfactory. Exports of wood products have been rising.

Teak supplies from Myanmar seem to be dropping and the

quality is slipping. Presently plantation shipments arriving

from Benin and Ghana are better and fill in for the

shortages from Myanmar.

The current prices for Teak imported from various sources

other than Myanmar are shown below. All rates are per

cubic meter C&F Indian ports.

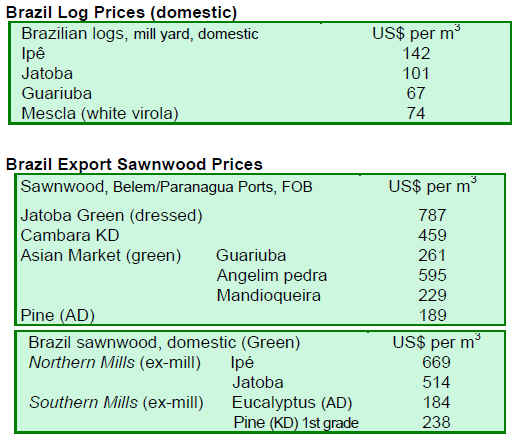

7. BRAZIL

Trade in Mato Grosso

Over the past 3 years the logging sector in Mato Grosso in

the Amazon region has generated business worth some

BRL 5.9 billion. Of this, the largest sales (BRL 3.5 billion)

have been of products destined for the domestic market in

other states. Companies in Sinop sold nearly 15% of all

volume traded in Mato Grosso. Business transactions

reached BRL 877.8 million, of which BRL 516.7 million

was sold to customers in other states; BRL 256.8 million

to the international market, and BRL 104.4 million to

customers within the state.

Aripuanã, on the other hand sold only 9% of the total state

sales (BRL 532.3 million0 locally, the largest share was to

international market

Advanced logging software

To assist companies with improvements to timber resource

management researchers from the Federal Rural

University of Amazonia and the Par¨¢ administration are

reportedly developing software for logging management.

In outline this new software allows cost saving planning,

implementation and monitoring of forest management

activity, providing lower costs to producer and less impact

to the environment. Initial training has been undertaken for

professionals working with timber companies and others.

This new system is expected to be implemented in all

Amazonian states by late 2010.

The advantage of the system say analysts is the scope of

information generated and that the digital model helps the

enforcement of forest management plans. The mapping

and field operations tracking make logging activities more

transparent and facilitate careful monitoring say the

developers

Difficult times for the trade

At the recently concluded International Timber Trade

Federation Day (Oct 2009, Geneva) Marco Tuoto of STCP

Brazil, discussed the challenges facing the Brazilian

timber sector.

This outlined Brazil¡¯s resource base, trends in production

and trade and issues of legality verification and the

implications for the Brazilian timber sector. The

presentation identified the global and domestic factors

responsible for the declining exports of which the

appreciation of the Brazilian currency against the US

dollar and falling consumption in the main markets.

Furniture sector closures

Furniture manufacturers in Santa Catarina have been

reducing their labour force as exports have plummeted

because of falling demand in export markets and because

of the appreciation of the Brazilian Real.

Many companies have been reducing the payroll and some

mills have decided to close until the markets pick up.

Reports indicate that there was around a 30% cut in the

work force in the furniture industries in the region.

Analysts point out that the raw materials and even

machinery are Brazilian-made and costs in dollar terms

have been rising sharply. In addition the industry is labour

intensive so job losses are high.

One of the greatest difficulties faced by exporters is that of

pricing forward sales when the currency is appreciating so

fast. In many cases over the past year exporters have had

to absorb the losses from exchange rate fluctuations as

contract prices could not be increased with the overseas

buyers.

Action on Argentina import rules

On November 1st Brazil¡¯s Minister of Development

Industry and Trade, reportedly confirmed that the

government is applying ¡®non automatic¡¯ license

requirements for some imports from Argentina. These

measures are similar to those measures adopted by

Argentina some twelve months ago.

This move will inevitably mean that Argentine import

documents will take longer to process and this is likely to

cause delays for goods waiting to cross into Brazil from

Argentina. Argentina imposed similar measures a year ago

and this has resulted in a slowing of trade between the two

countries.

It is not certain at the moment what range of products will

be included in the latest move by the Brazilian

government. This matter now needs mediation and

observers say it could be that either the WTO or Mercosur

will become involved.

8.

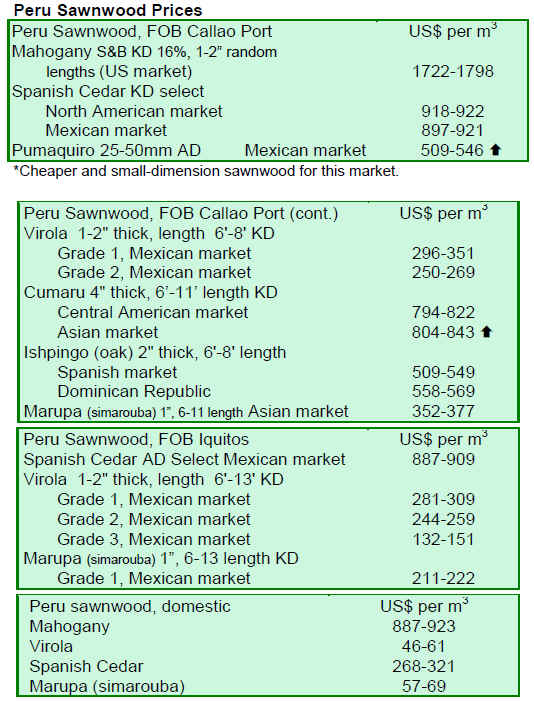

PERU

Asian markets strongest

The market situation remains very quiet with only the

Asian market showing signs of recovery. Demand from

Asian buyers while not considered strong, has been

healthy enough in recent weeks to lift prices of some

products.

Loans up

Peru's private sector banks saw a rise in consumer,

mortgage and micro-enterprise loans in September, but a

drop in their biggest segment, commercial loans.

Competitiveness support

The World Bank has approved a US$150 mil. loan for

Peru to lift its fiscal management and competitiveness.

This is part of its commitment to help Peru during the

post-financial crisis period.

This financial tool was arranged in collaboration with the

Government of Peru to help it deal with the short-term

effects of the global financial crisis.

Towards FTA

Peru's Government has apparently ratified the ¡°Agreement

signed between the Republic of Peru and Japan for the

Promotion, Protection and Liberalization of Investment¡±.

This ratification is just one more step as a prerequisite for

both countries to start negotiating a Free Trade

Agreement.

San Martin deforestation

The Regional Director of Agriculture has said a third of

San Martin forests have been degraded by shifting

agriculture. He estimated of the 5 mil hectares of forest in

San Martin some 1 mil. hectares has been lost or degraded.

Disney investment in forests

Walt Disney Co. has a forest conservation programme

which will deliver some US$7 mil. this year to forest

conservation. Some US$1 million will reportedly be

provided to the Alto Mayo Protection Forest in the

department of San Martin, northern Peru.

The Alto Mayo project covers an area of about 300,000

hectares and is managed by local communities, local

organizations, including the Peruvian Environmental Law

Society, SPDA, the Andean Ecosystems Association, the

Ministry of the Environment and the national parks service

as well as Conservation International.

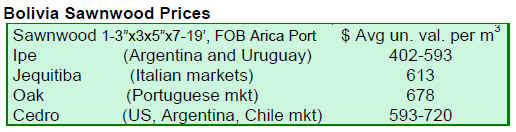

9. BOLIVIA

10. MEXICO

CONAFOR strategies

In the last Forest Expo, the National Forest Agency

(CONAFOR) announced changes in its programmes and

these included details of a new approach to ProTree, its

programme to achieve sustainable forest development in

the country.

As part of the seventh Forest Expo held in Mexico City

federal official discussed the ongoing diagnosis of the

institution and its programmes to support the forestry

sector. The first objective is to improve the allocation of

resources taking account of the needs for conservation and

production.

An effort will also be made to create incentives for further

forest conservation or restoration activities. Priority will

be given to the long-term sustainability, enhancing the

legal enforcement, maintenance and monitoring of

reforested areas. The director of CONAFOR said better

coordination between institutions will be achieved to

improve the efficiency of all forestry programs.

Energy from biomass

Mexican authorities, with partners from Canada will

undertake a study on wood waste to generate energy,

CONAFOR will coordinate the work together with the

Technological Institute of El Salto, Pueblo Nuevo, which

will be responsible for execution in the rural areas of

Victoria, Pueblo Nuevo and Durango.

This project aims to determine the amount of energy that

could be produced from biomass in the region and the

quantification of the potential for carbon credits and the

replacement of fuel fossils for power generation.

11.

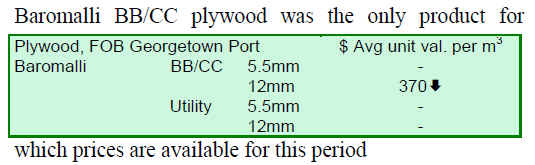

Guyana

Market Trends

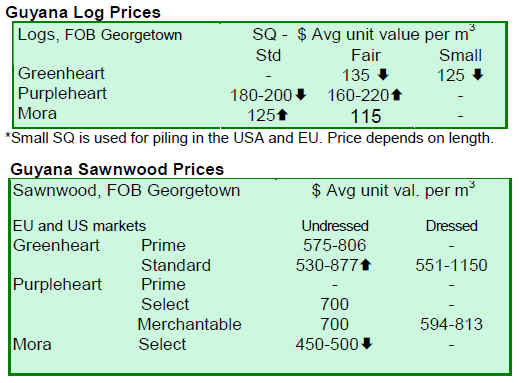

Prices for wood products from Guyana remain generally

stable. However Purpleheart standard sawmill quality logs

recorded a drop in price whilst Purpleheart fair sawmill

quality and Mora standard sawmill quality recorded price

increases of USD$5 per cu.m.

For the period under review prices for ¡®undressed¡¯ (rough

sawn) Greenheart recorded decreases in prices, while

Purpleheart sawnwood prices increased.

Dressed Greenheart also enjoyed significant prices

increases as did dressed purpleheart.

Splitwood, Roundwood (Piles, Poles and Posts) saw

positive price advances adding to the contribution to the

export earnings in this period. Prices were above average

in the period under review.

The contribution to export earnings from trade in value

added products continues to grow. Special mention should

be made on the export of doors which achieved higher

than average prices. Other products including mouldings,

outdoor and indoor furniture, spindles and windows all

contributed well to the export performance of the timber

sector.

Preserve the forest deal

Guyana has a US$250 mil. five-year forest preservation

agreement with Norway, the MOU was signed on 9

October and will begin with the Norwegian government

contributing US$30 mil. in 2010 and potentially up to

US$250 mil. by 2015.

Under the agreement, Guyana will speed its efforts to limit

forest-based greenhouse gas emissions and protect its

rainforest. Norway will provide financial support to

Guyana at a level based on this country¡¯s success in

limiting emissions. This will enable Guyana to start

implementing its Low Carbon Development Strategy

(LCDS).

As the monitoring, reporting and verification (MRV)

system for the forest is developed, and as more accurate

assessments of the carbon stock are determined more

financial support will flow.

There are a number of conditions which Guyana will have

to fulfill to ensure continued support from Norway. These

include maintaining transparent and accountable

processes. Norway has similar programmes of support

with Brazil and Indonesia.

|