|

1.

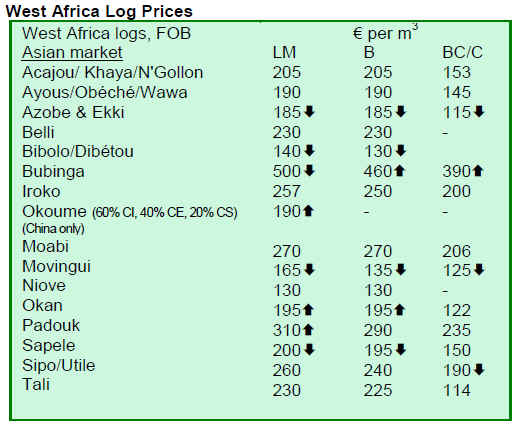

CENTRAL/ WEST AFRICA

Price adjustments

Over the past weeks there have been a few price changes

for both logs and lumber but these are minor adjustments

that have not had a significant impact on the overall

stability of the market.

Sawnwood prices do seem to be a little less firm as

demand in all major markets is still relatively sluggish and

producers believe that demand volumes will remain low

through the European winter months.

Log prices are stable with few changes. Okoume logs are

still in high demand and this is expected to continue.

Padouk logs are selling well to India and China and prices

have increased from a very firm base.

Exporter view

Exporters forecast a steady state in the log market as

demand from Asian markets is good and shows no

immediate signs of change during the remainder of the last

quarter of the year.

The outlook for sawnwood is less well defined. It does not

appear at all likely that West African sawmillers will be

re-opening sawmills or re-starting construction of mills

that are now on hold.

Prospects in Europe

Future prospects for W. African exporters hinge very

much on the European economic situation where the

recent, rather more optimistic, views of the state of the

recovery are appearing to be rather optimistic. The UK,

especially, is set for some hard times in 2010.

Building and civil engineering construction in Europe

show no signs of revival and while the D.I.Y retailing

sector has reported an increase in business, pricing

discounts are now very common and the hardwood timber

business is only a very minor part of this trade.

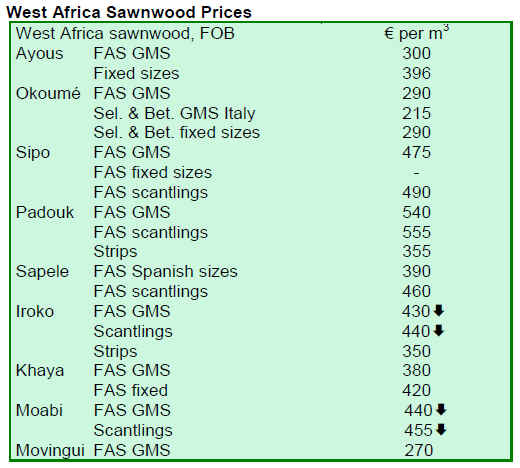

2. GHANA

Growth forecast

Initial reports from the IMF are indicating that Ghana¡¯s

economy will show a moderate growth of 4-5% this year,

in line with earlier forecasts. Stronger gold and cocoa

exports have supported the economy and good weather

conditions have helped the agricultural sector.

The IMF reports that inflation has dropped to around 18

percent in September and points out that the challenge in

2010 will be to tackle Ghana¡¯s rising public debt.

In other news, efforts are underway to strengthen Ghana¡¯s

institutions before the country becomes an oil producer in

2011. Part of this will be the establishment of a single

Ghana Revenue Authority instead of three separate tax

agencies as at present.

Inward investment

Ghana attracted significant new investment in the second

quarter, almost double that of the same period in 2008. A

report by the Ghana Investment Promotion Center showed

that about 80 new projects were registered.

China businesses registered 14 new projects valued at

US$4.98 million while Nigerian investors registered seven

out of the 118 new projects in the first half of the year.

Joint venture projects were valued at around US$75

million, about 30% of the total value of registered projects,

while 100% foreign investments registered were valued at

just over US$30 million.

EPA or not

The risks to Ghana¡¯s exports from not following up on the

EPA (Economic Partnership Agreement) with the EU have

been spelt out by government. The EPAs are a new set of

trade agreements which will allow Europe to export about

80 percent of its products on a duty and quota-free basis to

Ghana, while Ghana will be able to sell products to Europe

duty and quota-free.

Projections are that 40% of Ghana¡¯s exports could be lost

if the country fails to follow through the new trade

agreement with Europe.

With the strong campaign against the EPAs, government is

calling on exporters to allay public fears. The Minister of

Trade has said that the agreement will sustain jobs in the

emerging export sectors as well as in the traditional

sectors.

3.

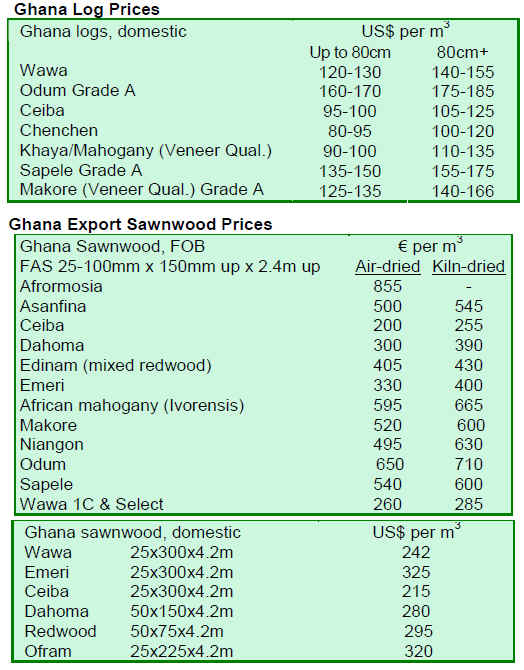

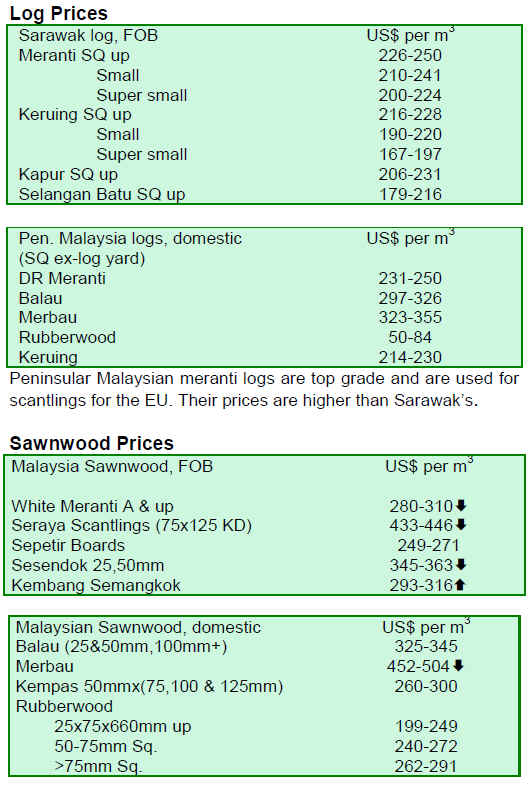

MALAYSIA

Loans for plantations

The Malaysian plantation industries and commodities

minister said that loan agreements with a value of over

RM230 million had been agreed to fund the development

of forest plantations.

Some RM1 billion has reportedly been set aside for this

purpose in the form of soft loans. The government has set

a target of 375,000 ha. of forest plantations to be planted.

SAFODA finance

The Sabah Forestry Development Authority (Safoda) in

East Malaysia became the first Sabah-based company to

obtain finance from the federal government for its forest

plantation programme.

Transparency at work

The Malaysian Auditor-General¡¯s Report for 2008

highlights the illegal activities and poor management

which were the main factors in the reduction of the forest

area in the state of Pahang in West Malaysia. This, says

the report, has contributed to air and water pollution and

the destruction of both flora and fauna habitats in the state.

The report also noted that although over 100,000 ha. of

forest had been earmarked as forest reserve, it took more

than 10 years for the areas to be so gazetted by the state

forestry department.

Middle East construction boom over

Prices of timber products in Malaysia sank to new lows

recently as the impact of a slow down in construction

projects, especially in the Middle-East, hit demand.

Malaysian contractors operating construction projects in

the Middle East are facing considerable difficulties.

High prices for crude oil, which peaked in 2008, resulted

in a building boom in the region but now there are few

new construction projects in the pipeline and contractors

are seeing business fade away.

4.

INDONESIA

Stiff penalties

Indonesian authorities now have a framework to address

the degradation of the environment in the form of a

recently passed law. Analysts say that it will take time for

the effects of the implementation to be felt.

Under the law there are stiff penalties, including possible

imprisonment, for executives of companies which breach

the law and the conditions governing their operations.

The Indonesian government has apparently warned all

local authorities to exercise caution when arranging

agreements with carbon credit financing brokers.

Unscrupulous brokers are promising huge profits from

carbon credit trading in the forestry sector and are

reportedly targeting community leaders and municipal

officers in towns and cities.

Export financing support

Indonesia¡¯s Eximbank, a state export financing agency,

has obtained a US$100 million in soft loans from the

Japan Bank for International Cooperation (JBIC) for

exports financing. An additional loan may be provided in

the near future.

The Indonesian trade minister mentioned that the

Eximbank will assist in trade promotion activities for

Indonesian small and medium-sized industries. The

objective is to market Indonesian products in nontraditional

markets such as those in the Middle-East,

Russia and member countries of the CIS.

Eximbank has indicated that it wants to extend around

US$1.90 billion worth of loans in 2010. This would be a

60% jump over the target for 2009.

5.

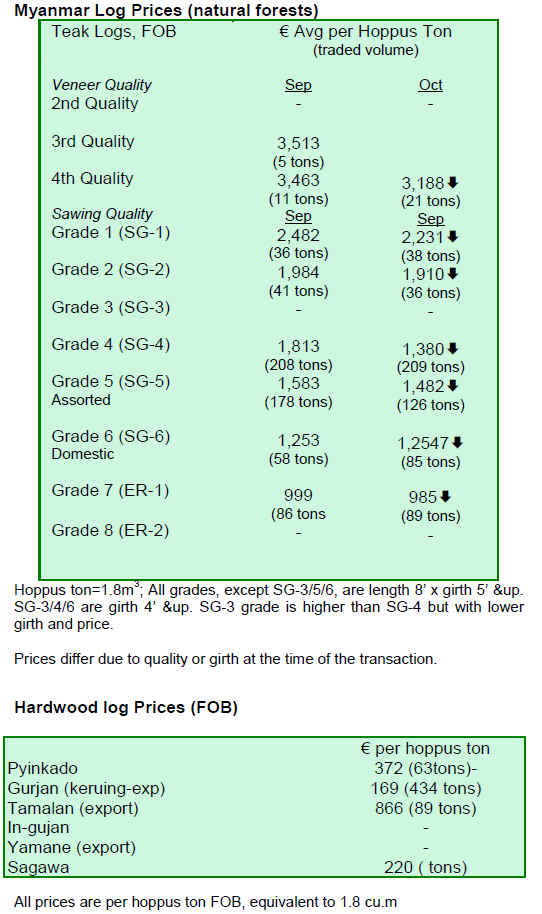

MYANMAR

Market conditions

The Indian market is still buying but there are some

reports that they are doing this to take advantage of a

stronger rupee rather than because of stronger demand.

It is also reported that Indian importers still have

considerably large inventories of material they had

purchased under a stronger dollar. It is only the Indian

market that is holding up for teak while other markets are

weak.

Pyinkado logs are still in demand from Vietnam but there

are reports that shipments have started to slow down.

Shipments of Pyinkado during July and August were over

10,000 tons each month. But they slowed down in

September to about 6,000 tons. So far this October there

has only been one shipment of around 3000 tons. Overall,

the market outlook elsewhere is not good at the moment.

October prices down

Prices at the October auction were down across the board.

There was an almost a 24% drop in SGGG; an 8% drop in

4th Quality logs; a 10% drop in SG1; and an almost 4%

drop in SG2. One regular buyer remarked that the quality

of the lots at the recent auction were very poor, resulting

in lower prices.

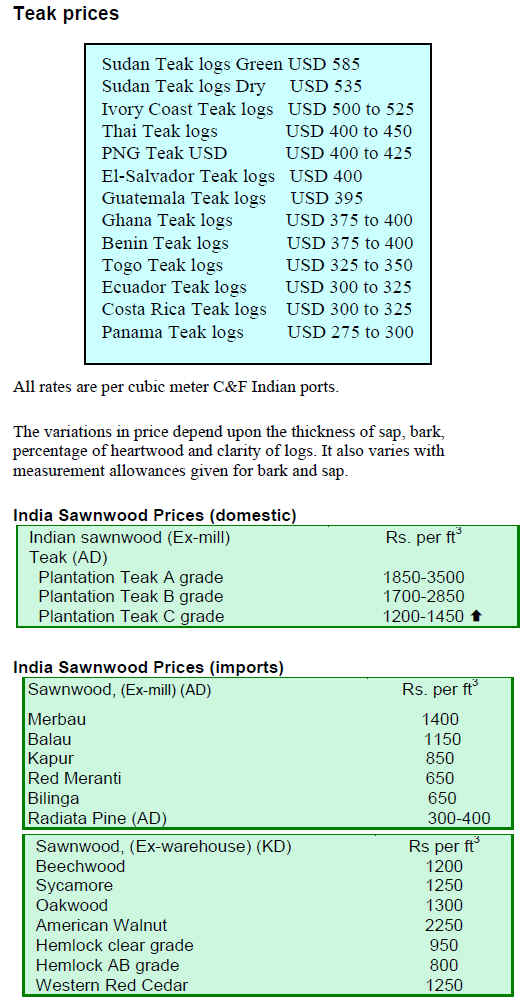

6. INDIA

Buoyant demand for logs

Once again industrial growth figures have reaffirmed that

the Indian economy is rebounding faster than was forecast.

GDP growth for August 2009 was 10.4%, the biggest

jump during the past 22 months.

This economic resurgence stems mainly from strong

domestic demand. The good overall figures are also

reflected in the timber sector.

With the end of the south west monsoon, Government

Forest Depots are busy meeting the demand that springs to

life as soon as the dry season starts.

Auction sales have been announced in Gujarat, central

India and also in southern states. Last seasons¡¯ leftover

stocks are up for sale and fresh log arrivals have also been

brisk.

Demand for sawing quality Teak and Hardwood logs is

good and auction results are expected to be better than the

last time.

Anti dumping duty on MDF.

In response to complaints by the MDF manufacturers that

they were suffering because of the volumes and prices of

MDF from China, Malaysia, Thailand, Sri Lanka and New

Zealand, the Government of India slapped an anti dumping

duty on MDF boards having thickness 6 mm and above.

Details of this are in Customs Notification No.21/2009

dated 27th February 2009.

To determine the duty, floor prices were announced at that

time. Now, with the changed global circumstances and

lower prices from the exporting countries, the floor prices

have been lowered, much to the relief of importers.

Carbon emission reduction

India has signaled that it is willing to act on carbon

emissions and put this in national legislation on reduction

of greenhouse gas emissions, conditional on funding and

technical support from developed countries.

India¡¯s action plan focuses on energy security, unlike

others who concentrate only on emissions reduction.

With abundant sunshine, wind power and biomass

availability, as well as the capacity for additional hydropower,

India has the potential to implement energy

projects with minimal increase in carbon emissions. In

addition to the energy options, improvements can also be

secured through groundwater re-charging, judicious

cropping patterns and practices, and the promotion of

organic farming.

The world is progressing to low-carbon economies and to

manage increased applications for forest clearance the

Indian Ministry of Forests and Environments has called

for the creation of a statutory regulatory body (to be called

the National Environment Protection Authority) that

would manage forest clearance permits and also enforce

regulation.

Plans to increase India¡¯s forest cover from the current 24%

to 33% are in place. Around 9% of the forest cover

comprises degraded forests and efforts are also being

made to improve these to a medium or high density

canopy.

Reportedly, India can save 550 million tons of carbon

dioxide emissions per year by exploring all these

alternatives. Implementation of the current plan will, it is

claimed, attract substantial investments in wind power and

other sources of energy generation.

With 7000 kms of coastline and 216 potential sites

identified, the scope for wind power generation appears

bright.

7. BRAZIL

September exports

In September 2009, exports of timber products (excluding

pulp and paper) fell 30.5% compared to September 2008,

from US$ 273 million to US$ 189.6 million.

Pine sawnwood exports dropped by 15% in value in

September 2009 compared to the same month of 2008,

from US$16.3 million to US$13.9 million. By volume,

exports decreased 2.8% from 50,400 cu.m to 49,000 cu.m

over the period.

Tropical sawnwood

Exports of tropical sawnwood also dropped significantly

both in volume and in value terms, from 62,300 cu.m in

September 2008 to 46,600 cu.m in September 2009, and

from US$34.6 million to US$21.9 million, respectively

over the same period. This performance equates to an

overall 25% fall in volume and 37% in value.

Pine plywood exports fell 33% in value in September 2009

compared to the same period of 2008, from US$36.2

million to US 24.1 million. The volume exported was

down almost 20% over the period, from 119,700 cu.m to

96,200 cu.m.

Tropical plywood

A similar picture emerged for exports of tropical plywood

as they were down from 17,700 cu.m in September 2008

to just 10,900 cu.m in September 2009, a 38% fall. In

value terms the picture was even worse with a 45%

reduction recorded over the period, from US$11.3 million

to US$6.2 million.

Exports of wooden furniture fell from US$69.5 million in

September 2008 to US$48.3 million in September 2009,

representing a 30% decrease during the period.

Exporters concerned

The depreciation of the US dollar against the Brazilian

Real has raised concerns among exporters from Rio

Grande do Sul, as any further fall in the dollar would make

their situation even worse.

At the height of the global crisis, the exchange rate of

around BRL 2.40 to the US dollar gave some hope for

recovery in those companies dependent on the external

market.

However, the depreciation of the US$ since the beginning

of the year has made any recovery impossible and has

caused losses in many sectors of the economy.

According to the Industry Federation of Rio Grande do Sul

(FIERGS), exports in the first nine months of 2009

reached US$ 3.4 billion, a 28% fall over the same period

in 2008.

Real appreciates more than others

For entrepreneurs, the main cause of diminishing exports

has been the unfavorable exchange rate. Since January, the

Brazilian Real has appreciated 25% compared with the US

dollar.. This is above the levels observed in most other

countries that export competing products which are traded

in the US currency.

According to the Furniture Industry Association of Rio

Grande do Sul (MOVERGS), the companies operating in

the furniture sector registered a 33.2% fall in exports for

the first eight months of the year compared to the same

period of 2008. It is forecast that there could be a further

fall in exports in the final quarter of the year.

Furniture exports gloomy

The US, UK and France import most of Brazil¡¯s furniture

and all these countries are experiencing weak market

conditions and a consequent cutback in imports.

The only country that expanded its imports was Cuba (up

51% for the year), which accounts for about 2% of the

Brazilian furniture exports.

The US share of Brazilian exports is now about 14% of

total furniture exports, a drop of some 44%. UK imports

from Brazil have fallen by 5.5% between January and

September 2009(Jan ¨C Sept) and now represent just 10%

of the total furniture exports.

The situation in the French market is more serious with

imports from Brazil being down 31%. Currently the

French market takes some 10% of the Brazilian furniture

exports.

Exports from Rio Grande do Sul

The Southern Brazilian state of Rio Grande do Sul has

seen a big drop in furniture exports in the first three

quarters of the year (-33.9%). The UK remains the largest

furniture importer from Rio Grande do Sul, taking around

16% of the total, followed by Argentina (9%), and

Uruguay (8%). The UK imported 13% less during the year

to September 009 compared to the previous year.

Argentina¡¯s imports fell 53% while for Uruguay a modest

increase was recorded. On the other hand Cuba imported

63% more from Rio Grande do Sul during the period

January to September 2009.

The Brazilian furniture exports to Cuba are mostly from

Rio Grande do Sul (US$8.3 million out of a total of

US$8.9 million

Domestic prices

Wood products prices in Brazilian Real (BRL) have

increased marginally (on average 0.16%) since the last

report. Prices in the local market in dollar terms rose by

1.6% due only to the appreciation of the Brazilian

currency against the US dollar.

Economic indicators

The National Consumer Price Index (IPCA) rose 0.24% in

September, following an increase of 0.15% in the month

before.

This result, however, was slightly below the 0.26%

recorded in September 2008, according to the Brazilian

Institute of Geography and Statistics (IBGE).

The Monetary Policy Committee (Copom) of the Central

Bank of Brazil maintained the prime interest rate at 8.75%

per year in a meeting held in early September 2009, and

therefore interrupted the five successive cuts started last

January. The rate is the lowest since its establishment in

1999.

World Cup and Olympics boost

The combined effect of the global crisis, lower domestic

consumption reduction and falling timber exports has

affected the timber sector across Brazil including the

timber industries in the northern region of the Amazonian

state of Mato Grosso.

However, the 2010 World Cup to be held in Brazil (with a

section to be played in Mato Grosso) and the 2016

Olympics has brought some promise that business will

improve. This optimism stems from the view that,

historically, countries that have hosted these events have

all seen an expansion of trade.

The Timber Industry Union of Northern Mato Grosso

(SINDUSMAD) has pointed out that production capacity

and the species available can meet the demands expected

as venues are developed.

Timbers such as Cambara and Amescla and others are

suitable and are abundant in the region. These timbers are

used extensively for making wooden house frames and

roofing components.

The regional timber species are considered to have quality

advantages compared to those from other (southern) states

that may provide materials for the construction work for

the World Cup in Cuiab¨¢ (state capital of Mato Grosso).

Misrepresentations in Maranhao

The state of Maranhão in the Brazilian Amazonia has

adopted IBAMA¡¯s forest origin document as part of the

electronic system for controlling forest products flow

(SISFLORA).

This decision was taken after misrepresentations were

found in documents used by many timber companies that

used the state¡¯s own forest product control system.

An audit has found misreporting of transactions involving

roundwood, sawnwood, fuelwood and other wood

products.

Reports indicate that the auditing exercise found evidence

of misrepresentation by around half of the 1,200

companies registered in the state.

IBAMA said that the approach of Maranhão State is a

good example of the adoption of federal systems for

controlling forest products and that other states such as

Rondônia, Par¨¢ and Mato Grosso should follow this

example.

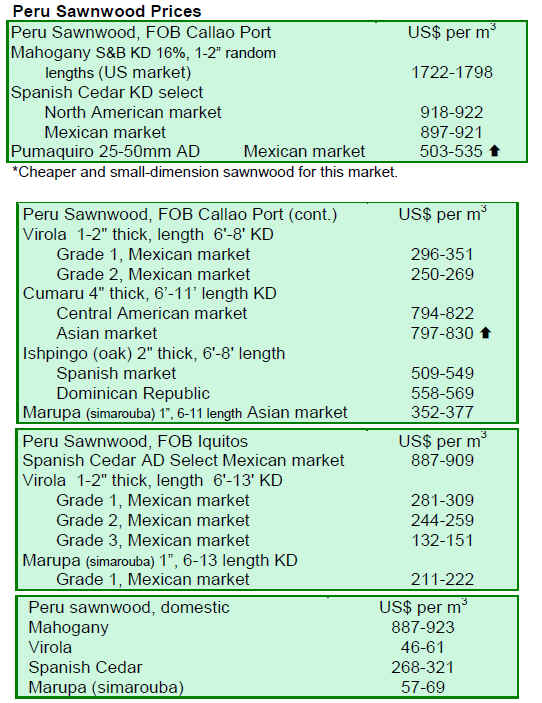

8.

PERU

Economic performance

Peru¡¯s economy has turned out to be one of the strongest

in Latin America since the global recession began, but it

has not been able to avoid a slowing in growth.

The economy contracted in the second quarter 2009 by

1.1% year on year. This was the first quarterly GDP slide

since 2001. The reason for the fall was mainly the decline

in exports particularly of minerals, as well as a steep drop

in domestic investment. However, the economy is not

expected to fall into recession this year.

Timber tracking

Companies in the sector forest, especially those serving

export markets, are trying new timber tracking technology.

Trials are underway in the El Dorado area in the region

Ucayali. This operation was supervised by the forest

authority and representatives of the company involved.

On its way to Lima the trial wood passed 11 check points

to verify the tracking system was working. The bar code

allows rapid identification.

This system of tracking does have opposition and the

president of ADEX's Forest Committee in Santiago has

reportedly questioned the utilization of the barcodes

system as being too expensive.

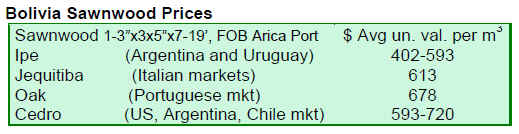

9. BOLIVIA

10. MEXICO

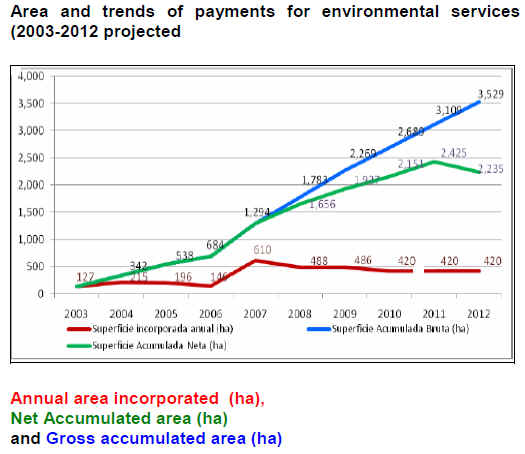

Paying for environmental services

Mexico is developing various mechanisms to stimulate

local markets, attract international funding and

strengthening the current scheme of payment for

environmental services. This is being done to protect

strategic areas for their biodiversity conservation, for

carbon sequestration or for the hydrological services they

provide.

Among the measures to combat climate change the

National Forest Agency (CONAFOR) allocated just over

one billion pesos for the payment for environmental

services. This allowed the incorporation in 2009 of a

further 488,000 hectares to the overall area of 1.9 million

hectares of forests that are currently being supported under

this heading.

Since 2003, when PES was created and up to 2009,

CONAFOR has provided funds to protect a cumulative

total gross area of 2.2 million hectares (ha).

The scheme of payment for environmental services is one

of the instruments CONAFOR developed to promote the

conservation of forests in the country.

Another important tool is the Concurrent Funds, which

seek to establish local PES schemes. In these funds, the

Commission provides up to 50 percent of the amount

required for delivery of these services through a

collaboration agreement in which a counterpart undertakes

to make a contribution at least similar to that of

CONAFOR .

Within the framework of Concurrent Funds, in 2008,

seven agreements were signed with validities ranging from

one to ten years these were worth more than 73 million

pesos and covered about 26,000 hectares.

New international mechanisms

To strengthen efforts to preserve its forest resources,

Mexico is taking steps to attract international funding to

support national needs in the ecosystem services

conservation, such as the mechanism for Reducing

Emissions from Deforestation and Degradation (REDD) ,

which is expected to increase investment for the payment

of these services.

It was against this background that CONAFOR designed

the national strategy for reducing emissions from

deforestation and forest degradation.

Another important tool, promoted by the Federal

Government to strengthen the fight against climate change

from Mexico, is the Biodiversity Endowment Fund. This

was formed as a long-term financing scheme that will help

to preserve forest ecosystems that hold biodiversity of

global importance.

The Fund started with a capital of 130 million pesos from

the Global Environment Fund (GEF) and the Government

of Mexico through CONAFOR. The fund will be slowly

expanded to US$200 mil. in 2025.

This scheme will use only the interest generated by capital

to finance the payment for environmental services for the

conservation and protection of forest areas where there is

biodiversity of global significance.

IMF positive

Six months ago, at the height of the global financial crisis,

Mexico became the first country to secure the first

Flexible Credit Line. The FCL provides insurance against

risks beyond the control of country¡¯s authorities.

In a recent statement the IMF noted that ¡°Despite its

strong policy frameworks, the current global economic

and financial environment has hit Mexico harder than

expected. The economy is in the deepest recession since

the 1994-95 crisis, reflecting especially close links to the

U.S. economy¡±.

The IMF says recent economic indicators show signs of

recovery and overall growth is expected to pick up in the

second half of the year.

11.

Guyana

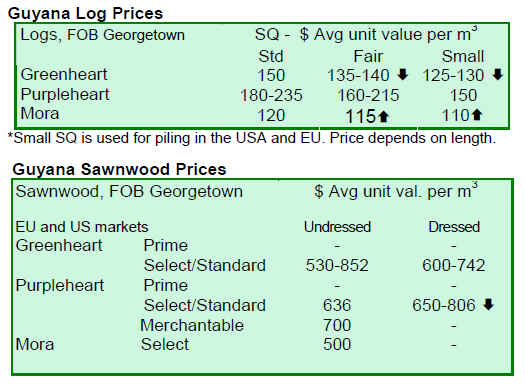

Market Trends

Prices for logs remain relatively stable, however

Purpleheart small sawmill quality log prices have

increased as they have also for Mora fair and small

sawmill quality logs

Compared to the situation as described in the last report

there was a favourable increase in prices for rough

(undressed) Greenheart sawnwood (USD 852/700), while

Purpleheart rough sawnwood also enjoyed good prices.

Rough Mora prices remain stable. Dressed Greenheart

sawnwood showed a modest price decline in the period of

review but dressed Purpleheart recorded increased prices

for this fortnight period.

Baromalli plywood demand is currently weak and prices

are down.

Value added products such as doors, indoor and outdoor

furniture, mouldings, spindles and non-timber forest

products were notable in their contributions to the export

earnings for the fortnight under review. The Caribbean

remains the primary export destination for value added

products.

FPDMC to China

An invitation to participate in the China Yiwu

(International) Forest Products Fair has been extended to

Guyana by the Vice Mayor of Yiwu City. The FPDMC

will attend.

Yiwu is a city of about 2,000,000 people in central

Zhejiang province near the central eastern coast of China.

The city is famous for its small commodity trade and

vibrant free market.

The FPDMC says this timely invitation will open unique

opportunities for Guyana to promote contacts and utilise

the existing channels for exchanges with a country that

possesses the technology and expertise suitable for

Guyana¡¯s forestry sector.

This event coincides with the recent effort by the Guyana

National Bureau of Standards (GNBS) in collaboration

with Caribbean Regional Organization for Standards and

Quality to introduce standards in the furniture industry.

¡°Promotion Competitiveness in the Furniture Sector¡± was

the theme for a recent workshop whose goal project was to

strengthen the competitiveness of the small and micro

enterprises which make up 80 percent of the total business

sector of Guyana.

The workshop highlighted specific requirements for

furniture manufacturing. These included: Quality;

Moisture Content, Workmanship and Finishing. Standards

as they relate to sanding and application of finishing coats

to furniture during manufacture and sealing of surfaces

were also discussed. Manufacturers and dealers of

furniture have access to detailed furniture standards from

the Guyana National Bureau of Standards.

|