|

Report

from

Europe, the UK

and

Russia

Huge fall in imports

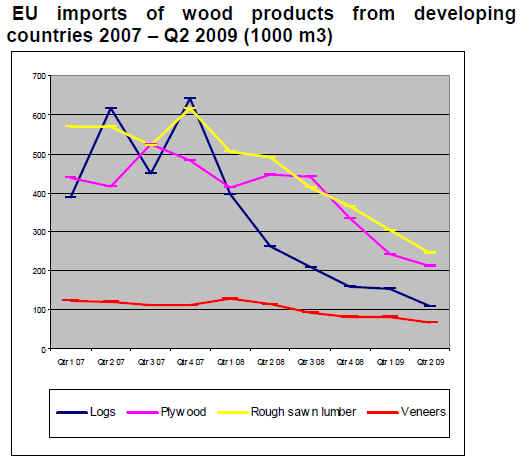

The latest European import data shows that the dramatic

fall in EU tropical hardwood imports which began at the

start of 2008, continued into the second quarter of 2009.

Between January and June this year, European imports of

tropical hardwood logs, sawn lumber, veneer and plywood

were down 41%, 45%, 39% and 46% respectively

compared to the same period in 2008. European import

volumes of these commodities in 2009 are a small fraction

of those of only two years earlier.

While it is easy to explain falling imports as a response to

the global economic downturn, such has been the depth of

the decline that serious issues are raised about the extent to

which it might drive long-term structural changes in the

European wood industry that may be generally detrimental

to future prospects for tropical hardwood.

Import downturn continues into the second quarter

The following shows that total EU-25 imports of logs,

plywood, rough sawn lumber and veneers from developing

countries suffered further falls in the April-June period of

this year. The fall in tropical hardwood log imports has

been particularly dramatic.

Total EU-25 imports of these commodity products were

only 109,000 cu.m during the three month period

compared to over 600,000 cu.m during the same period in

2007.

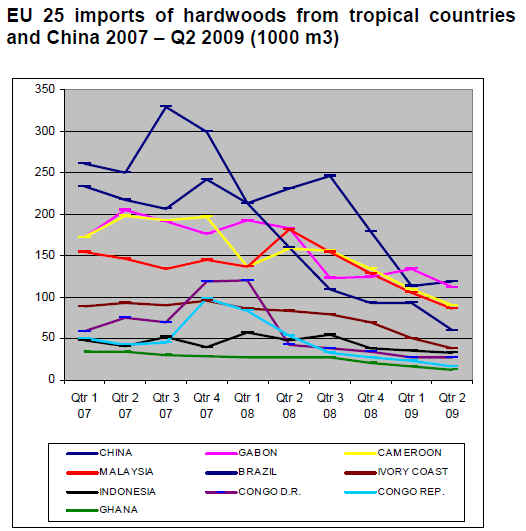

The continuing decline in tropical hardwood imports

during the second quarter of 2009 affected all the major

EU markets. While the data hints that the market decline

may be bottoming out in France, and the UK, imports into

both the Netherlands and Spain experienced further

significant downturns in the April-June period.

All the major tropical hardwood supplying countries to the

EU experienced a decline in sales to the EU during the

second quarter of 2009. Imports from China (mainly

plywood some of which is tropical) showed marginal

gains during the second quarter compared to the first

quarter, although the volumes involved remained well

below those of the previous year.

Highlights of recently released import data

• A 44% decline in imports of tropical hardwood

logs into France, the main EU market for this

commodity, with French imports from Gabon, the

largest supplier falling a massive 43%.

• A 67% decrease in Spanish imports of tropical

sawn lumber, with imports from all the major

tropical supply countries down by well over 50%.

• Of all significant European importers of tropical

hardwood, only Greece seems to have escaped

the turmoil. Greek imports of tropical veneers

were down only 3%. Greek imports of hardwood

plywood from developing countries actually

increased during the period (although most of this

came from China). Greek imports of tropical

sawn lumber (not shown on the charts) also

nearly reached 2008 levels (11,370 m3) at 11,180

m3.

• UK imports of hardwood plywood from

developing countries during January to June 2009

were only half those of the same period the

previous year.

Of all significant tropical hardwood plywood suppliers to

the EU, only Gabon managed to maintain levels close to

those of 2008 this year. Given the huge fall in French log

imports from Gabon, this is clearly indicative of a

continuing shift in manufacturing location for okoume

plywood from France to the African country.

Evidence of structural changes

Some significant structural changes in the European wood

importing industry, which began several years ago, seem

now to be deepening in response to the recession. For

example, dependence on just-in-time ordering of tropical

hardwood goods from large corporations with

concentration yards in the Benelux countries, has

increased. As a result, these companies are becoming

increasingly critical to the long term future of tropical

wood in the EU.

Uncertainty and lack of availability of credit is also

encouraging a move away from any speculative purchases,

and encouraging a shift to products and suppliers which

are regarded as lower risk, usually to the detriment of

tropical wood.

In this environment, there are some signs that the relative

power of larger better capitalised importing companies and

merchants is increasing at the expense of smaller

companies. The larger companies are more likely to

demand environmental certification and to impose other

technical requirements on their suppliers.

This in turn is also encouraging a general shift to low risk

products from an environmental point of view. This is well

illustrated by the recent announcement of a major UK

panel products importer, that it is now sourcing ¡°tropical

hardwood replacement¡± plywood manufactured from

plantation-grown eucalyptus in Uruguay. This is a

worrying sign that some importers are actively avoiding

tropical hardwood to improve their image.

Production competing materials rising

It is also worth highlighting that, while imports of tropical

hardwood have declined dramatically this year, sales and

production of some important competing materials are

actually rising ¨C again because they are perceived to be

lower risk, both in terms of environmental and technical

performance and their ready availability at reasonably

stable (although not necessarily particularly low) prices.

For example, in their latest issue, the German trade journal

EUWID reports that German wood plastic composite

(WPC) manufacturers are continuing to invest in new

capacity.

WPCs are becoming an increasingly important competitor

for tropical hardwoods, particularly in the decking sector

but also for cladding, construction mouldings, and garden

furniture.

EUWID reckons that total European WPC annual capacity

now extends to roughly 120,000 tonnes, while European

imports of WPCs from North America (with capacity now

closer to 1 million tonnes) are also increasing.

In a similar vein, the UK¡¯s TTJ recently reported that UK

sales of thermally-treated and acetylised softwood

products have been rising this year despite the recession.

These products also target tropical hardwood market

niches, such as window frames, decking, cladding,

bridges, and other external applications.

Tropical timber faces a major challenge

The combination of these changes on the demand side, and

the supply side problems emerging from widespread

shutdowns and closures in tropical countries during the

recession, suggests tropical wood suppliers may face a

major challenge to rebound from the current downturn in

the European market even as economic conditions begin to

improve.

Certainly, it will require much larger investments in

marketing, particularly to the architectural and design

profession, product development, and certification, than

has previously been applied by the tropical hardwood

industry. But financing such activities may be particularly

difficult after such a prolonged slump.

If the tropical wood industry is to turn this situation

around it has to find more effective ways of working

together to implement a coherent market access strategy.

There may be some scope to use the EU¡¯s FLEGT VPA

programme as a platform for such a strategy in Europe.

Trade data is derived from Forest Industries Intelligence Industries

analysis of Eurostat and Customs data supplied by BTS Ltd

|