|

1.

CENTRAL/ WEST AFRICA

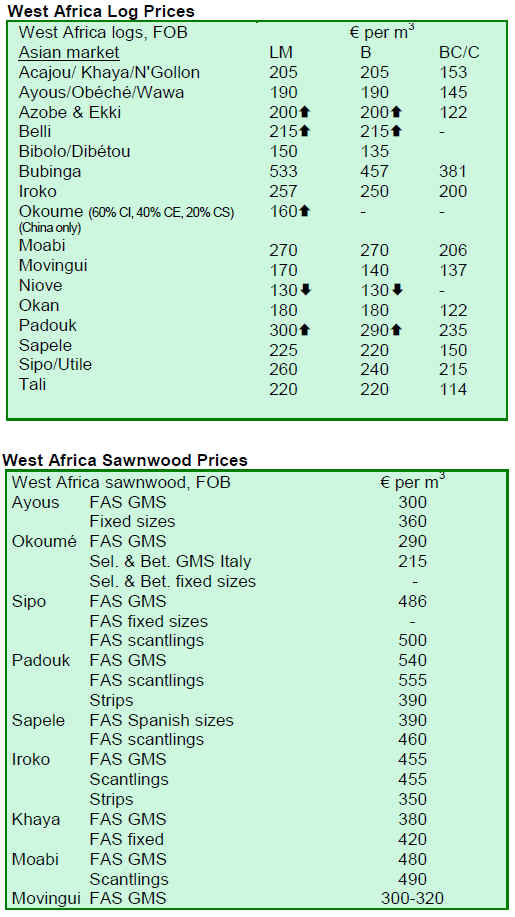

Few changes in log prices as slow business continues

There have been few changes in the market situation since

the beginning of the month as Asian demand and price

stability has been maintained. There have been increases

in log prices for some species because of competition for

the same species from India, China and Vietnam. Okan

and padouk logs showed modest price gains. Buyers from

the Netherlands boosted demand for azobe logs and the

UK strengthened its demand for azobe sawn timber.

Overall, Europe has been very quiet, with very low

demand for logs and sawn lumber of any species. Italy has

stayed in the market much more consistently in the past

two months or so than almost any other European country

and has been enquiring for sawn, kiln dried okoume as

well as sawn iroko. A few orders for sapele are in hand in

special sizes for the Benelux buyers.

Okoume logs gained two or three euros per cubic meter on

steady demand from China. Vietnam was strongly in the

market for tali in logs and lumber, although the supply of

tali is quite limited. Okan was back in some favor and log

prices for the species increased slightly. India remains a

regular force in the current market with ongoing demand

for padouk, tali, sapele and belli.

Sawn lumber prices are unchanged. The small gains in the

past month have held while the species that lost ground,

sipo in particular, have not recovered.

Gabon is preparing for the election of a new President and

a large number of candidates have stepped forward. The

timber industry has been carefully watching the election

process as it is usually the President who determines wood

processing and other industrial priorities. Cameroon will

also hold presidential elections next year.

As the level of trade has held steady over the past two to

three months, some of the previous pressures to curtail

production have been reduced thanks to the stable prices

coupled with firm demand from Asian destinations.

Exporters do not believe there will be any substantial

revival in European buying through to the end of the

quarter and the prospects for the fourth quarter do not

appear bright. Possibly the best that can be expected from

Europe will be small, regular volumes in selected species

of sawn lumber, leaving the main business, as now, for

China, India and Vietnam.

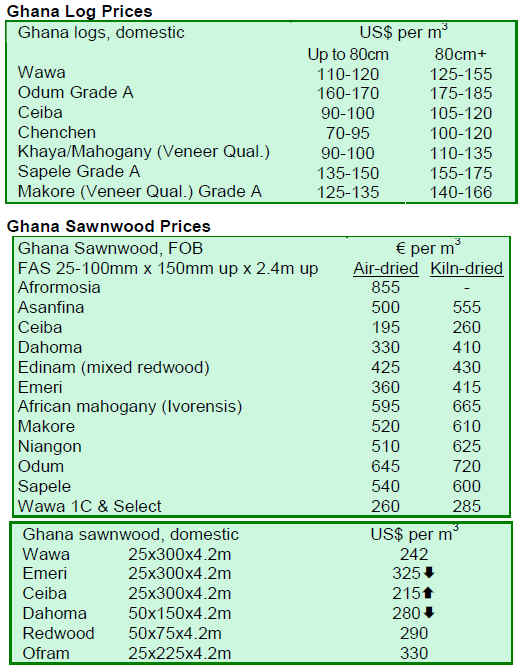

2. GHANA

Government assures businesses in midst of recession

Ghana¡¯s Vice President John Mahama announced at a

roundtable discussion organized by the Graphic

Communications Group Limited (GCGL) in Accra that the

government was determined to tackle the global economic

recession head on. He said this would be done through

prudent fiscal and financial measures, to limit its negative

impact on businesses and ensure quick recovery of the

economy. In the Vice President¡¯s speech, he said some of

the measures being adopted include cuts in public

expenditure and robust resource mobilization. He clearly

emphasized that government would be careful to ensure

that the approaches do not harm the growth prospects of

businesses and put the economy on sound footing for

growth. Mr. Mahama said a key lesson from the crisis was

the need for government through its institutions to perform

oversight responsibilities adequately, adding that the

performance of the task should not interfere with the

growth prospects of businesses.

A tax advisor at the Ministry for Finance and Economic

Planning, Dr. Joseph Amoako Tuffuor, said because the

country¡¯s economy was vulnerable to external shocks,

there was a need to develop gate keeping measures to

mitigate any possible negative impacts on the local

economy. As a solution, he suggested streamlining

domestic tax revenue mobilization measures in order to

broaden the tax base and minimize tax deductions. It

would be recalled an at ITTO conference in Ghana last

month (see TTMR 14:12), the Vice President announced

the planned removal of taxes on timber and sawnwood in

an effort to boost the timber industry.

In another development, Governor of the Bank of Ghana

(BoG) Dr. Paul Acquah, said the economy was recovering

from economic challenges of the previous year.

Meanwhile, at the end of the second quarter, the Monetary

Policy Committee (MPC) of the BoG maintained its prime

rate at 18.5%.

3.

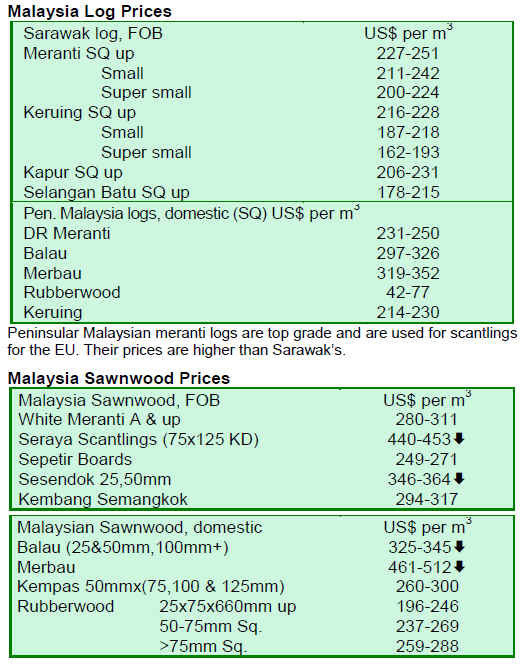

MALAYSIA

European trade representatives applaud Malaysia¡¯s timber industry

A visiting delegation of European timber trade

representatives to Sarawak called attention to the progress

made by the Malaysian timber industry to comply with EU

regulations. According to Bernama, the trip was organized

by the Sarawak Timber Industry Development

Corporation (STIDC) and the Malaysian Timber Council

(MTC).

Rachel Butler, head of sustainability for the UK Timber

Trade Federation, commended the Malaysian timber sector

for fast-tracking its compliance with EU requirements for

timber certification. She said current standards and

practices for sustainable production of timber in Malaysia

had placed the country a step ahead of a number of

tropical countries. Michele Eleoli, representing the Italian

Timber Federation, recommended Italian companies to

invest and set up factories in Malaysia in view of the

difficulties in finding skilled workers in Italy. Bert

Kattenbroek, representing the Dutch Association of

Joinery Companies, commented that its 250 member

companies consume about 120,000 m³ of tropical timber a

year, with 40% to 50% coming from Malaysia.

Green Furniture is key component of SIRIM¡¯s industrial research

SIRIM Bhd, a wholly government-owned company

involved in industrial research and development is gearing

up production of its ¡®green furniture¡¯ line as an alternative

to tropical timber furniture. Several prototypes of the

products had been developed under its advanced polymer

and composite programme, which utilizes a minimum of

60% of rice husk and rice straw bio-composite. Bernama

noted the target markets for SIRIM¡¯s Green Furniture will

be North America, Europe and the Far East and production

would be commercialized by 2010.

Morocco seen as attractive market for Malaysian furniture

Citing the popularity of Malaysian furniture in Morocco,

Mr. Othman Samin, Malaysian Ambassador to Morocco,

said Malaysian companies should consider participating in

the Moroccan construction and housing sectors. He called

attention to the ample opportunities for Malaysian timber

products manufacturers, reported Bernama. Total trade

between Morocco and Malaysia in 2008 was almost

RM234.2 million (USD65 million), with total Malaysian

exports reaching RM182.2 million (USD50.6 million).

Malaysian prices continue to fall

Malaysian timber prices remain depressed even as the two

economic stimulus packages announced earlier this year

have yet to make any impact on the local economy. The

spring remodelling and construction season in the northern

hemisphere has commenced, but many Malaysian timber

products manufacturers are still waiting for orders to come

in. Some manufacturers complained they have not had any

new orders for more than four months.

4.

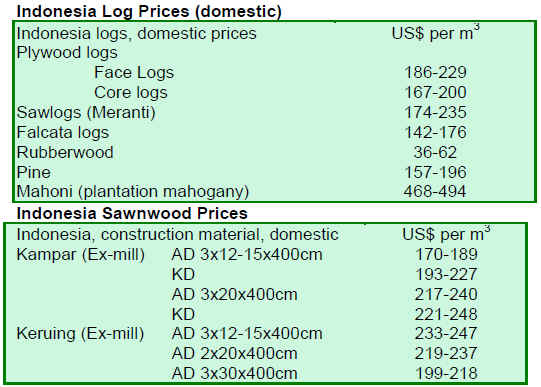

INDONESIA

Indonesia and EU to sign new bilateral agreement

The Indonesia-European Union bilateral consultation

forum in Yogyakarta, Indonesia finalized a partnership

cooperation agreement (PCA) between the two partners.

According to Antara News, the PCA is the first bilateral

agreement signed between Indonesia and the EU. Apart

from promoting trade cooperation, the agreement also

covers environmental issues such as climate change. The

PCA will be signed before the end of this year.

The objective of the broader forum was to discuss several

areas of cooperation since the two trade partners¡¯ last

meeting in Brussels in September 2008. Bilateral trade

between Indonesia and the EU stood at about EUR20

billion. In addition, Indonesia and the EU agreed to lay the

ground work for the upcoming climate change

negotiations in Copenhagen in December 2009.

Asmindo to address export decline

A 20% decline in the exports of Indonesian furniture in the

first half of 2009 has prompted the Indonesian Furniture

Entrepreneurs Association (Asmindo) to stem the decline

in exports during the fourth quarter of 2009. Exports of

wood and rattan furniture declined from USD300 million

in the first half of 2008 to USD240 million during the

same period this year, noted The Jakarta Post.

The chairman of Asmindo, Mr. Ambar Tjahyono,

expected the value of exports of wooden and rattan

furniture to be worth USD372 million in the last quarter of

this year. Asmindo plans to improve results in the fourth

quarter by promoting sales in October, November and

December, the high season for furniture sales. Revenues

for the Christmas season are expected to double or triple.

Certified wood and rattan furniture are expected to add on

another 10% to sales prices. However, buyers are asking

for similar pricing regardless of certification. Only 160

Indonesian furniture exporters have obtained certification

out of a pool of 2,400 businesses. It takes up to six months

for a company to obtain certification, plus at a cost of Rp.

60 million (USD6,000) to Rp. 100 million (USD10,000).

Indonesia prices expected to hold steady

The early July bombings of two 5-star hotels in Jakarta are

not expected to erode prices of Indonesian timber products

further. Although corporate stock prices and the

Indonesian currency had declined as a result of the

tragedy, Indonesian timber prices are expected to hold for

the time being. Most buyers are staying away from the

country presently. But with Indonesian timber prices at a

record low, Indonesian timber products are expected to

maintain a favorable position in the international market

place. With renewed commitment by the Indonesian

government to address and maintain public and national

security, buyers are expected to return to the country by

the fourth quarter of 2009.

5.

MYANMAR

Plantation initiatives begin in Myanmar

The Ministry of Forestry announced its plan to establish

12,500 acres of plantations during fiscal year 2009-2010,

with a view to protect the environment. The

announcement, as reported in the Seven Day News, said

the measures would reduce soil erosion and siltation and

would sustain the availability of water in dams and

reservoirs in the watershed areas. The Ministry of Forestry

planted 21,650 acres of trees in these areas during fiscal

year 2008-2009. The Forest Department and the Dry Zone

Greening Department, both part of the Ministry of

Forestry, are jointly carrying out the plantation, protection

and conservation initiative.

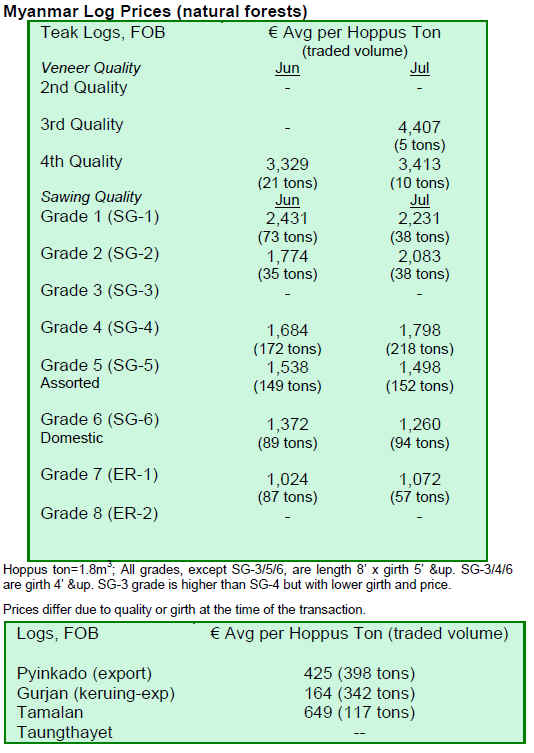

Hardwood exports improve to India

The teak market is reported to be improving in India.

Other markets areas also show some signs of recovery,

though somewhat slight. Most analysts are cautious and

say it would be premature to make optimistic projections

at this juncture.

The pyinkado market is also reported to be good in India

and Vietnam, judging by Myanmar¡¯s shipments to these

countries. In contrast, padauk and tamalan is generally

shipped to China and Japan. Availability of these species

is limited and therefore prices are usually competitive.

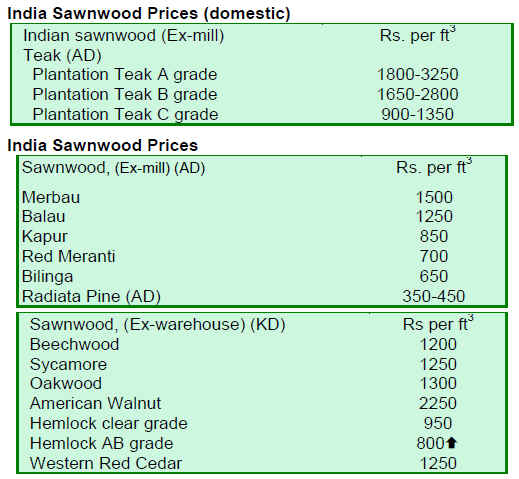

6. INDIA

MDF duties create challenges for importers

India¡¯s fiscal budget, presented on 6 July, introduced new

provisions to increase the central excise levy on plywood

from 4% to 8%, making imported plywood more

expensive. An anti-dumping duty on imported MDF (as

described below) will also remain in force. The following

duties on imported wood and wood products apply for

fiscal year 2009-10: timber logs, 9.35%; sawn timber,

14.71%; and plywood, veneer, fiberboard, softboard and

MDF, 24.42%.

The Government of India has provisionally imposed antidumping

duties on all imports of plain MDF boards of 6.0

mm and up thickness. Imports are mostly from Malaysia,

Thailand, New Zealand, Sri Lanka, and China. India has

three factories manufacturing MDF boards mostly

producing 6.0 mm and above thickness. Local production

was reported to be about 100,000 m³ of which imports

were 98,602 m³.

Investigations by government had shown that local

industry was not able to compete with imported quality

because many local factories had old technology in place.

The plant size of local factories is also much smaller

compared to the modern factories of other countries. Due

to significant increase in demand for plain MDF in the

country and with expectations of increasing profits, some

producers are also planning to establish new factories in

India.

Green Ply Limited representatives have recently said in

the June 2009 issue of Wood News that they have launched

India¡¯s largest MDF board plant with an annual capacity

of 180,000 m³ at a cost of USD53.20 million. This will be

the first continuous line and will be manufacturing plain

MDF and prelaminated MDF in thicknesses ranging from

2.5 mm to 30 mm with a range of dimensions. Currently,

MDF of 2.5 mm up to 5.5 mm is only supplied by imports.

The trial production is expected to commence by the end

of December 2009. It is expected that this unit will reduce

dependence on imports. The factory will be located at

Pant Nagar in Uttarakhand State of India.

Another development involves new wood-based industries

using plantation grown timber for their raw material

requirement. This has given a boost to the establishment of

new plantations, which in addition to increasing raw

material availability will also improve the environment.

One industrial company, ITC Limited, plans to be selfsufficient

in meeting raw material requirements in

manufacturing paper and related products. It manufactures

about 500,000 tons of paper and from 100,000 hectares of

eucalypts, su babul (Lucaena leucocephala spp.) and

casuarina. As at 30 June 2009, the company has about

95,000 hectares of plantations and is planning to expand

by 5,000 hectares. Currently, ITC imports about 130,000

tons of pulp but aims to be self-sufficient in pulp in the

next two years with raw material supplied by plantations.

The company has focused on expanding the plantations

with farmers and other communities for their mutual

benefit.

According to DNA Money, the company has been

approved by the United Nations Framework Convention

on Climate Change (UNFCCC) to receive carbon credits

under the project. The company has decided to pass on

these credits estimated at Rs.40 million to the farmers and

local communities participating in the project. This is

expected to generate an additional Rs.5000 per acre in

income for farmers.

Besides the efforts by the private sector, central

government is also encouraging the extension of forest

cover by releasing afforestation funds to States by utilizing

a compensatory afforestation fund management and

planning authority funds. The guidelines envisage a threetier

system involving central as well as state

representatives, reported the Economic Times. The

Supreme Court¡¯s order will unlock Rs.11200 in funds for

compulsory afforestation after a seven-year deadlock. It is

hoped that the differences between central and state

governments will be resolved soon and afforestation will

accelerate.

The Indian Prime Minister¡¯s visit to Malaysia and

meetings with Malaysian government officials has cleared

obstacles delaying the finalization of free trade agreements

among ASEAN countries and it was decided in principle

to proceed with a free trade pact. Effective 1 January

2010, the free trade agreements will include 4,000 items

on which tariffs will be reduced progressively over a

period of six years. The ten members of ASEAN are:

Brunei, Singapore, Cambodia, Laos, Indonesia, Malaysia,

Myanmar, Philippines, Vietnam and Thailand.

7. BRAZIL

Furniture sales plummet in Northern Mato Grosso

According to S¨® Not¨ªcias, furniture companies of Northern

Mato Grosso closed the first semester with a 50% fall in

the volume of traded furniture. The decline was due to the

effects of the global economic crisis, which has affected

different sectors of the economy since the end of 2008. In

the second half of the year, it is anticipated that furniture

sales will improve. In recent years, the furniture sector has

progress in various areas including rising sales. According

to research by the Brazilian Micro and Small Enterprises

Bureau (SEBRAE), the average revenue of companies

increased about 44% between 2006 and 2007. The

SEBRAE announced that the average income of

companies jumped from BRL 5.4 million to more than

BRL 7.8 million between 2006 and 2007.

INPA study points to overexploitation of commercial species

The high value of some Amazonian timber species, such

as mahogany, cedar and ipe, are damaging the forest and

wasting its economic potential, alerts the National Institute

for Amazonian Research (INPA). According to Globo

Amazônia, which reported on the INPA study, at least 150

timber species with commercial value have already been

identified for sustainable extraction. However, as there is

only a market for 15 of these commercial species, they

have been overexploited. Many of these species are

already scarce. There are many trees with commercial

potential that are still under utilized. The existing number

of 150 exploitable trees is still small. In total, there are

about 3,000 timber species catalogued.

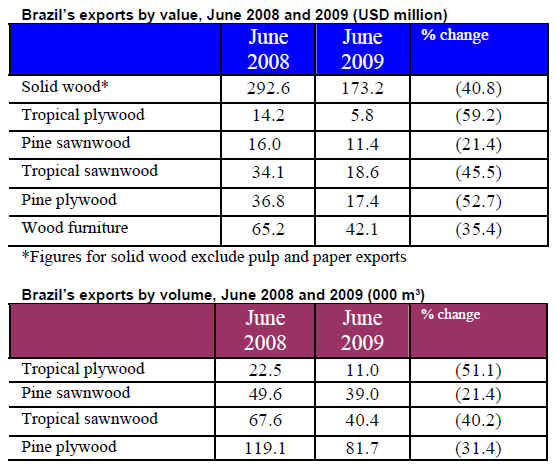

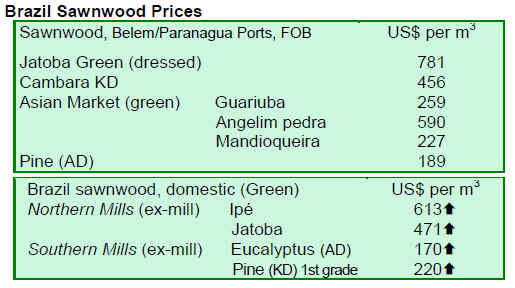

Brazil¡¯s exports show no sign of improvement

Brazil¡¯s wood products exports for June 2009 (except pulp

and paper) plunged 41% by value compared to the same

period in 2008 similar to results published in May 2009,.

The charts below show the volume and value of Brazil¡¯s

exports for June 2009 compared to the same month a year

earlier:

Alta Floresta¡¯s exports drop 48%

Exports from timber companies of Alta Floresta were 48.1

lower by product volume during the January to May 2009

period compared to the same period of last year. Timber

shipments, which in 2008 totaled USD8.4 million, were

USD4.3 million, according to the Ministry of

Development, Industry and Foreign Trade (MDIC).

Timber was the main product exported to different

countries, reported S¨® Not¨ªcias. Exports of sawnwood and

wood sheets (thickness greater than 6 mm) were

USD187,600, or 82.4% less than the January to May 2008

period. Nevertheless, this trend was reversed for exports of

doors, frames and sills, which increased 385.8%, up from

USD14,800 to USD71,900. The export of ¡®ipe¡¯ sawnwood

increased from USD43,100 to USD68,900, or a 59.8%

increase.

The largest importers of raw material from Alta Floresta

were the US (USD2.3 million), followed by Canada

(USD703,600), and Spain (USD424,200).

Rio Grande do Sul¡¯s furniture exports show continous drop

Updating figures from TTMR 14:13, furniture export

statistics from the state of Rio Grande do Sul (the largest

furniture producing state) fell 34.2% in the first half of

2009 from the same period in 2008, reaching USD91.0

million. At the national level, the drop was 33.2%, totaling

USD314.6 million.

According to MDIC-SECEX ¨C CGI Moveleiro, Cuba was

posted one of the highest percentage increases in imports

of Brazilian furniture, although this destination

represented only 3% of total furniture exports from Brazil.

Cuba increased its imports from Brazil by 85.5% over the

period and Rio Grande do Sul was the largest exporting

state to that country.

The US was the major destination of the Brazilian

furniture, receiving 15% of Brazil¡¯s total exports. The US

imported the equivalent of USD38.2 million, reducing its

imports to from Brazil by 48% from the same period in

2008. Argentina also reduced its furniture imports from

Brazil by 45.3%.

In June 2009, Brazilian exports of timber, pulp and paper

were worth USD540.65 million, an increase of 16.8%

compared to May 2009, when exports were USD462.88

million. The total value of Brazilian exports in June 2009

was USD131 million, representing a 2% decrease

compared to May 2009.

8.

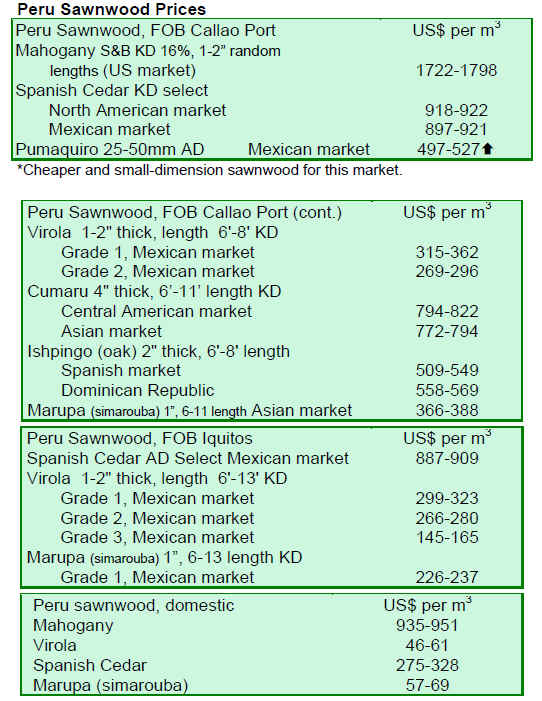

PERU

Peru to contribute USD43 million to forest

conservation

Peru¡¯s Minister of the Environment Antonio Brack

recently noted that the Council of Ministers had approved

a project that plans to compensate native communities to

conserve forests in the total amount of USD43 million.

The programme is expected to be implemented beginning

August or September of 2009. Brack noted that through

this new programme native communities will be trained in

the care and monitoring of protected areas. He also

proposed the establishment of scholarships for university

studies as part of the project.

Trujillo and Arequipa to act as hosts to furniture industry fair

The cities of Trujillo and Arequipa will act as the hosts of

the FIMAT Furniture Industry Suppliers¡¯ Fair. Part of the

fair will take place in the city of Trujillo, from 13-15

August, and the city of Arequipa, from 20-22 August. As

the cities have been considerable growth markets for wood

products, they are well-suited to host the events, the first

time a sectoral exposition will be held both in the north

and south of Peru and directed at small, medium and large

scale industries. The fair will aim to promote a variety of

products, services and technology in the timber sector,

during which a variety of organized conferences and

technical meetings will be held.

9. BOLIVIA

Business Roundtable to be held at the World Forestry

Congress in Argentina

The XIII World Forestry Congress, organized by the

Government of the Argentina under the auspices of the

Food and Agricultural Organization (FAO), will take place

from 18 - 23 October 2009 in Buenos Aires, Argentina.

Within the Congress, a Business Roundtable will be held

for the benefit of the private sector, which is expected to

provide a lively venue for the improvement of trade

relations in the forestry sector. The Business Roundtable,

which will be organized by FAO and the Forestry

Chamber of Bolivia, will take place on Wednesday, 21

October 2009, at La Rural in Buenos Aires and is expected

to attract around 400 businessmen and representatives of

forestry organizations from over 30 countries.

The objective of the event is to promote trade relations to

provide greater value to wood and other manufactured

goods. The event seeks to facilitate business contacts

between private sector actors from around the world. It is

anticipated that there will be significant participation in

the event by the forest and timber industry, including

private companies, machinery and equipment suppliers,

finance institutions, forestry and business development

organizations, consultants, business chambers and small

producers and other investors. Online registration is

available on the conference website under the section

'Business Events' (www.cfm2009.org).

Until 17 August, the registration fee for the Roundtable is

USD100, and USD 150 from 18 August onwards.

Participants registered to attend the whole week of the

WFC have free entrance to the business events and should

only fill in a registration form to attend the Roundtable.

For more information, please call + 591 3 333 2699 or

skype rondadenegocios or e-mail:

rondadenegocios@cfm2009.org .

10. MEXICO

BECC to fund environmental projects in Mexico

On 22 July, the Board of Directors of the Border

Environment Cooperation Commission (BECC) and the

Development Bank of North America (NADB) announced

that the Bank is fully capitalized and can now develop a

greater number of environmental projects in Mexico. The

BECC is an international organization established by the

governments of Mexico and the US works to support the

preservation, protection and improvement of the

environment in the US/Mexico border region to increase

the welfare of the population of both countries. The

development and implementation of the projects will be

conducted through a process of transparent binational

certification in a close coordination with the NADB,

international, federal, state and local governments, the

private sector and civil society.

11.

Guyana

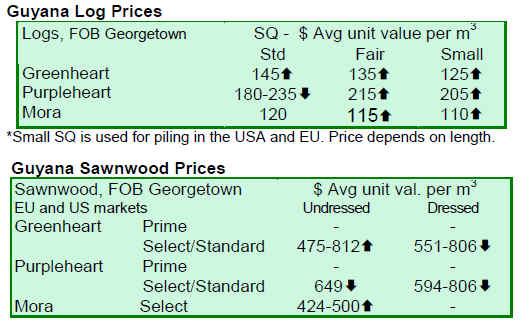

Prices increase for popular log species

Prices have increased positively for greenheart,

purpleheart and mora logs (standard, fair and small

sawmill) over the 1-15 July 2009 period on average by

USD5 as compared to the 16-30 June 2009. Average

prices for undressed sawnwood greenheart (812/ 785)

were favorable, while prices for dressed sawnwood have

declined during the same period (1¨C15 July 2009) as

compared to the previous fortnight (16-30 June 2009).

Splitwood and roundwood prices have revealed stability in

the comparative period. The contribution of value-added

products, which includes doors, furniture and

prefabricated houses revealed positive export earnings

during the 1-15 July 2009 period with prices remaining

relatively stable, but highly favorable for the category of

prefab houses.

FPDMC to implement new work plan

In response to feedback obtained during a recently

concluded stakeholder meeting, the Forest Products

Development and Marketing Council (FPDMC) has

adopted a work plan comprising several program areas

aimed to take into account the feedback received. They

include efforts to make the forest sector ¡®market ready¡¯;

establish quality and legality assurance; promote markets

utilizing market intelligence research; develop lesser used

species; conduct training activities; and support initiatives

aimed at avoiding deforestation by promoting and

monitoring environmental and ecological services.

A survey is being conducted among individual

stakeholders to determine their market and product

development capabilities. The data from the survey will be

processed and presented where possible in synch with the

deliverables identified in the Council¡¯s work plan.

Commencing next week, FPDMC officials will be visiting

operators within the industry to ensure the circulated

stakeholder questionnaires are properly completed.

The Council, a government of Guyana not-for-profit

organization, is overseen by a Board of Directors

comprising of an equal number of representatives from the

private sector, stakeholder groups and government

agencies and an independent Chairperson. An Executive

Director manages the FPDMC¡¯s operations.

|