|

1.

CENTRAL/ WEST AFRICA

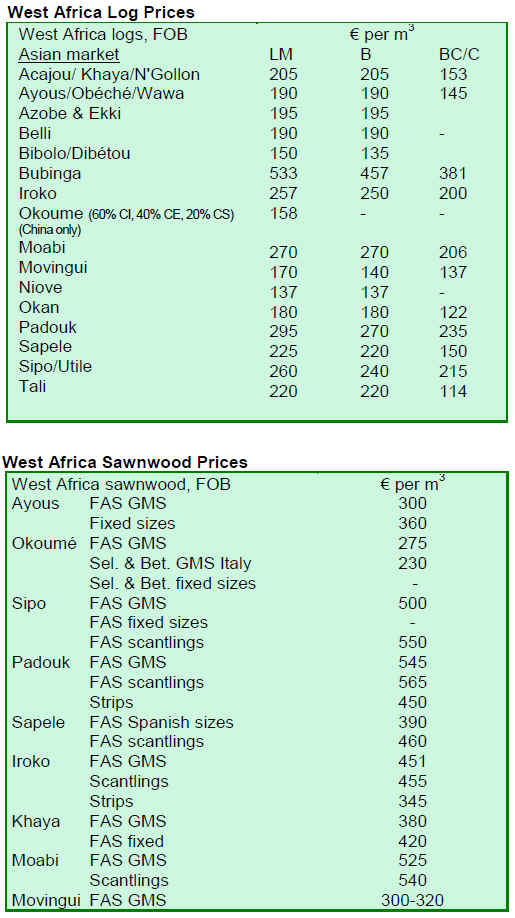

West African markets maintain stability

Market stability has been maintained in West Africa

throughout June in price and volume. Asian buyers have

continued to make regular purchases and request

shipments of a range of favored species that are rather

more limited than in 2008 and earlier. There are some

small signs of more interest from European buyers where

there have been reports of very low stocks. Ordinarily, this

would be an indicator of an imminent resurgence in new

purchases but given the present more difficult financial

conditions, there is some reluctance to commit beyond

small volumes against orders already in hand. Buyers do

seem to be well aware that any return to even moderate

volume trading levels could trigger very long lead times

for new contracts.

Producers, on the other hand, have tailored production to

maintain stability and cater for the current demand. They

are not speculating if or when European buyers will return

to the market. Some producers reported as still having

some quite large overlying stocks of certain species. One

positive trend in the market is the increasing demand for

certified timber. The Netherlands and the UK have taken

the lead in demanding certified timber and the UK

government in particular is becoming more active in

regulating the use of certified timber in central and local

government projects. Some African producers have

engaged in the certification process and are able to supply

fully certified timbers. Such producers are in the minority,

however, as most mills have not seen enough demand for

certified timber to push them to undertake certification

initiatives.

Looking at the first half of the year, many West African

producers may well feel they made the right move early

enough to survive an extremely difficult six months, with

the prospects for the second half perhaps rather better than

expected. The effects of the global economic downturn on

African timber industries may have not yet impacted fully

on the economies of those countries that depend heavily

on revenues from timber and timber products exports.

Nevertheless, mill closures and production cut backs have

been occurring over the last six months, resulting in largescale

unemployment for a number of workers in the timber

sector.

2. GHANA

Ghana announces removal of taxes on imported timber

At an ITTO-sponsored conference in Ghana, Ghana¡¯s Vice

President John Mahama announced the removal of taxes

on logs and sawn timber in an effort to boost the timber

industry. He explained that a slump in demand for the

country¡¯s timber products, particularly mahogany and

odum, had forced some of the country¡¯s lumber and

veneer prices down. These facts were supported by a study

on intra-African trade launched by ITTO at the

conference. He encouraged African countries to work

together to offset the downturn in timber markets and

encourage the free flow of trade.

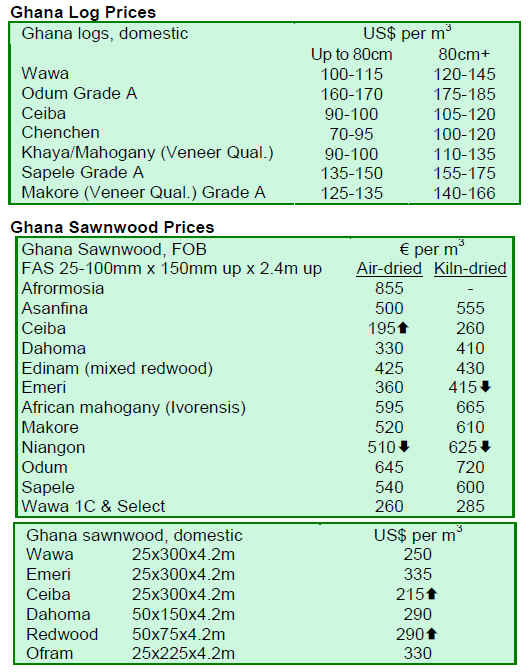

Ghana sees no significant change in market conditions

There have been no significant changes in price levels

during the second quarter of 2009, as markets have yet to

recover from the effects of the global financial crisis.

Exporters, especially small to medium scale enterprises,

are finding it very difficult to secure export contracts and

buyers are taking advantage of the situation to close

contracts at much lower prices. Lumber prices have

dropped between EUR10/m³ and EUR50/m³ below the

TIDD Minimum Guiding Selling Prices (GSP) depending

on the species.

Notwithstanding the above, prices for tertiary timber

products are encouraging. Prices of dowels, parquet

flooring, lippings and mouldings in general were either at

or a little above the GSP during the quarter under review

but the volume of timber in contracts was very low. These

products altogether contributed 2.19% of the total volume

of wood products exported during the quarter.

Plywood, which is mainly exported to countries within the

West African sub-region, is the only product that has

maintained price levels since December 2008. During the

quarter under review prices were between USD5/m³ and

USD20/m³ above the TIDD Minimum GSP depending on

the thickness of the plywood.

Non-traditional exports surge despite global crisis

In spite of the global financial crisis, non-traditional

exports (NTEs) performed better in the first quarter of the

year compared to the same period in 2008. Data available

from the Ghana Export Promotion Council (GEPC)

indicated that exports during the period amounted to

USD316.6 million, a growth of 35.5% over revenue of

USD238.9 million for the same period in 2008.

Processed and semi-processed products contributed about

86% to the revenue. Cocoa paste, plastic products, cocoa

butter and canned tuna were among the 10 leading

products exported during the period. The EU and

ECOWAS were the major destinations for NTEs,

accounting for 44.6% and 35.7% of the market

respectively.

In a two-day workshop to examine the negative effects of

the global economic downturn on the export business

community, the Executive Secretary of GEPC, Mr. Collins

Boateng, said NTEs are not entirely safe from the impact

of the global economic crisis. Hence, the Council was

focused on improving market access for Ghana¡¯s NTEs in

the West Africa region and also to boost intra-African

trade particularly to South Africa, to offset reductions in

exports to the EU market.

Ghana¡¯s inflation eases marginally

Ghana¡¯s inflation slowed to 20.06% in May 2009, the first

time in three months, down from the April 2009 rate of

20.56%. The rate at which general prices of goods and

services increased in the economy thus also reduced

during that period, according to the government¡¯s Deputy

Statistician, Prof. N N Nsowah-Nuamah. The reduction

was largely due to the downward pressure exerted on

goods and services by the non-food components of the

Consumer Price Index (CPI). A reduction was expected at

this time of the year, since food production picks up

during this time and the National Petroleum Authority has

also reduced fuel prices by 10%. Mr. Nsowah-Nuamah

said although the decreasing trend of inflation could

continue for sometime, the recent 30% increment in fuel

prices leaves consumer behavior less predictable.

3.

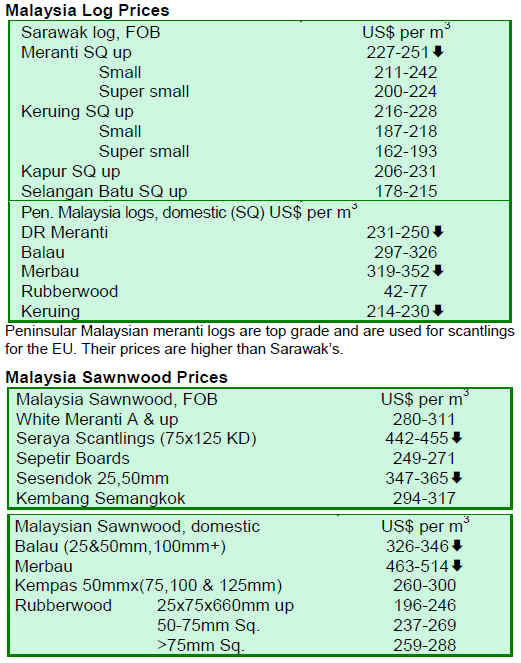

MALAYSIA

Malaysian government reins in timber smuggling

According to the Btimes, Deputy Minister of Plantation

Industries and Commodities, Mr. Hamzah Zainuddin,

reiterated the federal government¡¯s commitment to

addressing the problem of timber smuggling into and

within the country. He added that six arrests for timber

smuggling have been made to date, with timber

confiscated worth RM19 million.

Over the last two months, law enforcement officers from

the Malaysian Timber Industry Board (MTIB) intercepted

timber smuggled into the country from India via Port

Klang and the Port of Penang. A total of 11 tons of timber

were confiscated with a total face value of RM10 million.

Meanwhile, Malaysia¡¯s timber exports slipped 20% in the

first quarter of 2009 compared to the first quarter of 2008,

with exports amounting to RM4.1 billion. Total exports

for 2008 stood at RM22.79 billion.

STIDC reports slump of 27% in exports

The Sarawak Timber Industry Development Corporation

(STIDC) reported that Sarawak¡¯s exports of logs and

timber products declined 27.3%, for the first four months

of 2009 compared to the same period in 2008, dropping in

value from RM2.56 billion to RM1.87 billion. As noted in

Bernama news, Sarawak exported RM940 million of

plywood; RM470 million of logs; RM230 million of sawn

timber; and RM230 million of dowels, mouldings, particle

board, medium density fibreboard (MDF), laminated

veneer lumber, veneer, woodchips and blockboard for the

period January 2009 to April 2009.

Plywood exports slid 32.19% from 1,108,305 m³ to

751,538 m³, while sawnwood exports by volume tumbled

35.45% from 385,287 m³, to 248,692 m³. Japan remains

Sarawak¡¯s main buyer of plywood at RM480 million, with

South Korea following at RM140 million. The volume of

plywood imported by the Gulf Cooperation Countries

(GCC), Taiwan and the Philippines stood at 74,859 m³,

62,494 m³ and 17,509 m³, with a value of RM100 million,

RM70 million and RM20 million respectively.

As for the exports of logs from Sarawak, India remains the

largest buyer, absorbing a total export market share of

63%, with a volume of 599,254 m³, marginally down from

a volume of 602,795 m³ in 2008. Sarawak¡¯s log exports by

volume to Taiwan fell by 40.9%, China by 59.6% and

Vietnam by 13.3%. For sawnwood, declines by volume

were registered for Thailand (40.9%); the GCC (29.1%)

and Taiwan (52.4%). The exception to this trend was

exports to the Philippines, which increased 16.4%.

The STIDC maintained that the market's future outlook at

the end of April 2009 was positive with the average unit

price of logs, sawn timber and plywood holding stable,

and the average unit price of dowels, MDF and woodchips

positive.

More than half of Malaysia¡¯s total land area covered in forests

Deputy Natural Resources and Environment Minister Mr.

Joseph Kurup said that presently Malaysia has nearly 20

million hectares of forest, covering 59.5% of its total land

area. As reported in Bernama, 5.85 million hectares of the

total amount is in peninsular Malaysia; 4.40 million

hectares is in Sabah; and 9.24 million hectares is in

Sarawak. A total of 14.31 million hectares, or 73.4% are

forest reserves, and 5.18 million hectares, or 26.6%, are

government-owned and private-owned land.

4.

INDONESIA

Economic downturn continues to stifle furniture exports

The global economic downturn continues to negatively

affect Indonesia, with the Indonesian Central Statistics

Agency reporting a decline of 28% in timber exports for

first quarter 2009 in comparison with the same quarter of

2008. The Agency reports timber products were exports

worth USD559.7 million for the first quarter of 2009.

A sharp decline of 23.2% was registered in the export

volume of wooden furniture, doors and window frames,

reported The Jakarta Globe. Similarly, the value of

exports declined by 15.8% when compared to the value of

first quarter 2008 exports (USD375.8 million).

The decline in paper and pulp exports by volume was

smaller at 3.1%, representing a volume of 32,747 MT, but

steeper by value at 17%, or USD183.9 million. Indonesia¡¯s

exports of furniture and handicrafts in 2008 were valued at

about USD2 billion. The share to the US market was 30%,

while the EU market received 40% of total exports. The

Indonesian furniture industry employs up to 11 million

workers, with 7.5 million of them located in Java.

New forestry investments climb

New investments in the Indonesian forestry industry over

the first five months of 2009 rose to Rp. 1.2 trillion

(USD116 million), due in part to new reforms in

government regulations for the forestry industry sector,

according to a forestry ministry official. As reported in

The Jakarta Post, this rise is compared to the year 2008,

when total investment for the same sector was only Rp.

861 billion and committed by a total of 11 companies.

Mr. Hadi Daryanto, a director-general of the forestry

ministry, noted that within the first five months of 2009, a

total of 14 companies successfully applied to develop new

forestry areas worth Rp 851.6 billion. An additional four

companies had secured investments worth Rp 366 billion

and would focus on developing and expanding industrial

production capacity. He added that these companies were

set to produce sawnwood, plywood, veneer, and wood

chips in Sumatra, Java, Kalimantan, Sulawesi, and Papua.

About 65,000 jobs in the forestry product sector are

expected to be created by these new investments. The

following are among the 18 new companies: PT Moranaga

in North Sumatra; PT Papua Indonesia Lestari in Papua;

PT Selemoi Timber Indonesia in West Papua; PT Elbana

Abdi Jaya in South Kalimantan; PT Elbana Abdi Jaya in

South Kalimantan; PT Wahana Lestari Makmur Indonesia

in South Sumatra; PT Cipta Wijaya Mandiri in Central

Java; and PT Sejahtera Usaha Bersama in East Java.

Companies are no longer required to apply for new

licenses if they move into new product development such

as wood pellet production, to facilitate licensing processes.

In addition, in line with South Korea¡¯s objective of

pursing a green economic policy, a number of South

Korean companies had expressed interest in developing

more than 700,000 hectares of industrial forests in

Indonesia, of which 200,000 hectares would be used to

meet raw material requirements for energy production in

South Korea. This would replace 5% of the 8 million MT

of coal used in South Korea with biomass.

Indonesia sets new limits to raw exports of rattan

In a response to complaints by furniture and handicraft

manufacturers concerning the shortage of raw material

supply of rattan, the Indonesian government will issue a

new export regulation to limit the export of rattan by

producers. Only two major rattan producing regions will

be exempted from this regulation, said Mr. Ardiansyah

Parman, the Secretary General of the Ministry of Trade.

According to The Jakarta Globe, under the new rattan

export regulation, rattan producers from Kalimantan and

Sulawesi will be required to direct 70% of their production

to the domestic market, while the remaining 30% may be

utilized for export purposes. However, rattan producers

outside these two regions are banned from exporting any

rattan they produce.

Moreover, rattan of a higher quality but smaller in

diameter (between 4 mm to 16 mm in width) will be

barred from being exported. This regulation will not,

however, be applied to the domestic market.

Indonesia is the world¡¯s largest rattan exporter, accounting

for up to 80% of the world¡¯s total and export products

worth a value of USD200 million.

5.

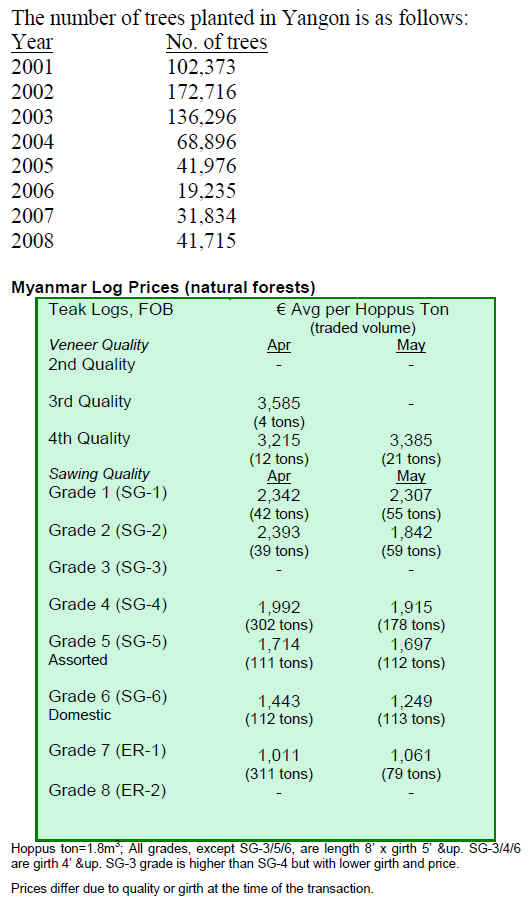

MYANMAR

Market moves slow in Myanmar

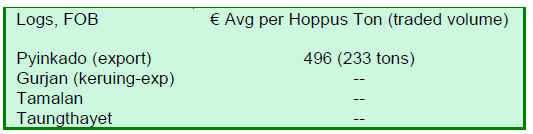

The export market is moving slowly. Some buyers for

India say the market for pyinkado logs is improving, but as

for teak, some experts believe the inflexible pricing policy

of the Myanmar Timber Enterprise (MTE) could be a

major constraint, unless the grading system is revised.

MTE announced that secondary processed wood products

from state-owned MTE sawmills and wood industries

would be shipped on FOB basis. This is a relaxation of the

recent decision that all shipments except purchases from

the tender sales would be shipped ¡®Ex-Works¡¯. Buyers

hope further relaxation of direct sale contracts will follow,

to energize the currently sluggish market.

Firewood shortages addressed by Ministry of Forestry

The Seven Days News Journal recently reported the details

of an interview with a Ministry of Forestry official

discussing the countries ¡®Dry Zone Greening Department¡¯.

The dry zone is situated in central Myanmar and

comprises 54 townships in the three divisions: Mandalay,

Sagaing and Magway in central Myanmar. The total land

area of these divisions is about 8.17 million hectares

(about 20.18 million acres). Annual precipitation is

estimated to be only about 50 days per year. The firewood

requirement per year for these divisions is 5,088 thousand

cubic tons. It is reported 200,000 acres of woodlots had

been planted in FY 2008-09 in the area and it is expected

about 1.05 million acres of woodlots will be established

within a 30-year period. The department is also

responsible for reforesting the dry green zone.

Additionally, the department will supply energy efficient

wood stoves in the area to reduce the consumption of

firewood. Briquette manufacturing is also done in the saw

mills to help relieve firewood shortages. Population boom,

socio-economic development and changes in land-use

patterns are said to be major challenges facing this area.

Tree planting initiatives continue after Cyclone Nargis

The Weekly Eleven reported that the Yangon City

Development Committee will be growing 100,403 trees

starting 1 June until end August 2009 to replenish trees

destroyed by Cyclone Nargis in 2008. The trees are from 1

to 3 years old, have been grown in various nurseries in

Yangon and will take about 3 to 5 years to provide

sufficient shade for city dwellers. The Committee has

asked for public participation to maintain the health and

vitality of the trees.

6. INDIA

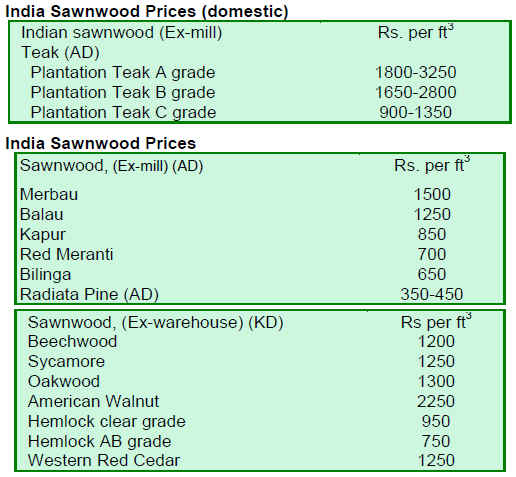

Recent trends show Indian forest products business

booming

Indian corporate results for the year ending 31 March 2009

showed excellent progress compared with the previous

year¡¯s results. The strong Indian economy and favorable

trading factors has strengthened optimism all around. The

real estate market has recently revived, which has given a

boost to all-round demand for timber and panel products.

In the present economic recession, India has held up

remarkably well, as has its wood and wood products

business.

The new government has better capacity to carry out its

policies to increase and protect flora and fauna in the

country. It is hoped that its pending plans to divide the

Ministry of Forests and Environment will materialize to

better manage both divisions and help achieve a national

target of 33% of land under forest cover. The present

Prime Minister Dr. Manmohan Singh had reduced the

import duty on timber to zero percent when he was the

Finance Minister. With him at the helm of affairs and the

determination of India¡¯s Planning Commission, many

stakeholders are more optimistic he will take measures to

increase forest cover and lessen drought conditions in the

times to come.

Until 1982, India was a net exporting country of wood and

wood products, but since India¡¯s independence, the forest

cover has dropped at an alarming rate - from 23% to 8% -

prompting the government to drastically ban felling in

Indian forests, allow imports of wood and wood products

in a phased manner and ban exports of round as well as

sawn timber. By 1985, all imports of wood and woodbased

products were permitted freely, felling in forests

was curtailed and/or banned and since then the forest

cover has improved from 8% to 24%. This policy still

continues and to date India is a net importer of timber and

panel products and the forest cover is expanding.

India regularly receives logs, sawn timber and panel

products exports from: New Zealand; Malaysia (mainly

Sabah and Sarawak); Indonesia; Myanmar; Côte d¡¯Ivoire;

Ghana; Nigeria; Cameroon; Benin; Togo; the Congo;

Brazil; Ecuador; Panama; Costa Rica; Guatemala;

Venezuela; the US; and Canada. Many of these countries

are exporting plantation materials. One of the major

exports from teak plantations is thinning poles. The teak

poles are quite a popular product with many Indians, who

find them useful for many domestic purposes. They are

primarily converted into sawn timber.

India has four climatic zones: alpine; temperate; subtropical;

and tropical. The forests of India are sub-divided

into 16 forest types producing over 600 species out of

which about 200 provide commercial timber. Coniferous

forests of pine, cedar, fir and spruce and non-coniferous

oak forests are located along the Himalayan range.

The international timber business has a wide variety of

species available to them in different regions of India.

Now that the extractions from natural forests have been

very much restricted, people are using many imported

species. Indian importers go abroad seeking substitutes for

Indian species and often introduce new species

successfully.

Among the most accepted substitutes have been New

Zealand pine (Pinus radiate) as a substitute the for

Himalayan conifer balau. Timbers from the shorea group

from Malaysia and Indonesia are often used in place of sal.

Azobe (West Africa) is used in place of irul and laurel and

similar south Indian hardwoods. Padouk and bubinga

(West Africa) may also be used to replace local padouk

and rosewood. Merbau from Indonesia has been a great

success in replacing bijasal and karimarudu (laurel). Aini

(Artocarpus hirsuta), keruing and gurjan have helped

replace local hollong and kalpen.

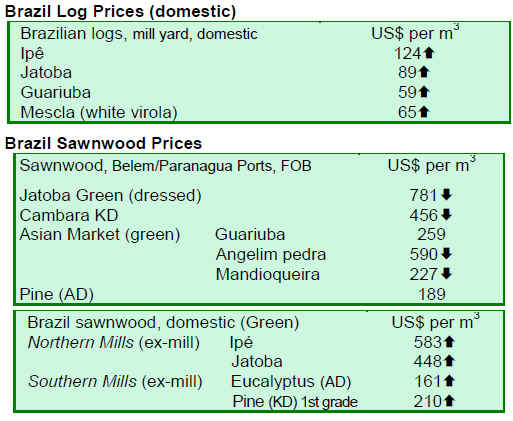

7. BRAZIL

Aça¨ª palm residue seen as new energy source

A new source of energy is being sought to replace

traditional energy sources: the seed of the aça¨ª palm tree.

According to Ag¨ºncia Sebrae de Not¨ªcias/Ecodebate, the

seed of the plant is discarded in the food production

process and has become an environmental liability because

the decomposing seeds pollute the soil and water.

According to local entrepreneurs, the use of the aça¨ª seed

as a source of energy generates jobs and income in local

communities. Moreover, this method of energy generation

is less problematic during environmental inspections and

helps protect the environment.

A growing concern for the environment has encouraged

the search for more sustainable energy production. In the

state of Amazonas, operators of the clay oven have

focused on environmentally friendly new energy sources.

The ceramic making and clay oven clusters of the

municipalities of Iranduba and Manacapuru have

developed a project encouraging the use of materials such

as wood waste and residues of the aça¨ª palm tree as fuel.

Currently, the 15 companies that compose the cluster in

both municipalities utilize 50% of the wood residues. They

come primarily from residues from sawmills and furniture

industries, tree pruning leftovers, and even the demolition

of wooden houses.

Timber theft still rampant in Amazon region

Timber theft is common in one of the most devastated

regions in the Amazon, the northeastern part of Par¨¢ state,

reports G1/Jornal Nacional. In the region, an illegal

scheme involves illegal timber transport, drivers without

licenses and timber without proper documentation.

In the municipality of Tailândia, old trucks are adapted for

timber transportation. The logs are transported without a

¡®forest form¡¯, a mandatory document that must accompany

any timber load. In Concordia of Par¨¢, sawmills¡¯

employees where illegal logs are delivered have confirmed

irregularities.

The government of Par¨¢ estimates that illegal timber

activities generate BRL4 billion a year and notes that there

are no conditions for the state government, the federal

agency, or municipal institutions to adequately control the

illegal timber trade. There are many State Road Police

checkpoints along the highway, but the police have said

there have not been much illegal timber seizures along this

route because the timber trucks loaded with illegal timber

do not use it.

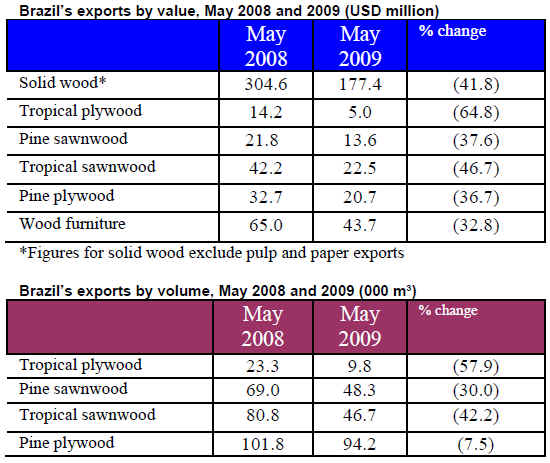

No respite for Brazil¡¯s wood products exports

Brazil¡¯s wood products exports (except pulp and paper)

plunged 41% by value compared to the same period in

2008. The charts below show the volume and value of

Brazil¡¯s exports for May 2009 compared to the same

month a year earlier:

Argentina restricts imports of Brazilian furniture

Argentina's furniture sector has imposed a 35% cutback in

imports of Brazilian furniture to Argentina, reported O

Estado de São Paulo. This percentage was based on 2008

figures and decided after hours of discussions in Buenos

Aires, during which Argentine furniture entrepreneurs

tried to restrict more than 40% of exports when compared

to last year¡¯s total.

The Argentine manufacturers state that Argentina is facing

an ¡®invasion¡¯ of Brazilian products. In the midst of the

international crisis, local businesses are calling for

protection from so called ¡®asymmetries¡¯ in relation to

Brazilian manufacturers. Argentine trade barriers, which

include a non-automatic licensing process, quotas, value

criterion, anti-dumping measures, among others, affect

14% of Brazilian exports to the country.

In 2008, Brazil exported USD155 million worth of all

furniture types to Argentina. For wooden furniture, sales

reached USD41 million. However, between January and

March 2009, Brazil exported only USD16.5 million in

furniture. The agreement on furniture trade between Brazil

and Argentina is valid for one year and ends on 31

December 2009. At the next negotiation in December,

Brazilian entrepreneurs hope Argentina will remove

barriers to trade between the two nations in 2010.

Par¨¢ state braces for reduced timber exports in June

The Association of Timber Exporters of State of Par¨¢

(AIMEX) says the sharp drop of timber exports

experienced over the past few months by the timber sector

has leveled off. According to O Liberal, exports continue

to be very low and there was no expectation of

improvement. However, the domestic market has signaled

a positive reaction to boost timber use by announcing a

federal government housing program called ¡®My House,

My Life¡¯. The sector¡¯s timber exports fell 60% before

stabilizing in recent months, a possible sign that markets

could be improving.

The timber export sector in Par¨¢ was one of the most

affected by the international crisis. As the economic

downturn hit many countries, mainly the US real estate

sector, timber producers in Par¨¢ were also affected in their

business deals with main buyers. AIMEX noted internal

problems of the state that have halted timber production,

such as the lack of institutional structure to issue

environmental licenses. If this issue is resolved, it would

be easier to resume production. Entrepreneurs have the

creativity to overcome this problem by diversifying

production and searching for new customers, although

bureaucratic barriers often interfere with the development

of the sector.

8.

PERU

Japan loans Peru USD120 million for forest

conservation

Peru has just received a 40-year loan worth USD120

million from Japan to conserve 55 million hectares of

forests in the Amazon. Environment Minister Antonio

Brack Egg said that protected areas, land belonging to

Indian communities and those lands for permanent

production would likely benefit from the loan. Brack noted

that the protection of this area would likely offset 20

billion tons of carbon dioxide.

OSINFOR welcomes new President

The Supervisory Agency for Forest Concessions

(OSIFOR), has a new president, Mr. Richard Bustamante

Morote. The incoming president said illegal harvesting in

Peru to exploit natural resources should be stopped. He

noted the importance of the government¡¯s role in

protecting and managing forests and wildlife.

Wood enterprises to invest more than USD300 million

According to the General Manager of Exports,

Transformation, Industry, Commercialization and Services

of Ilo (Ceticos Ilo), Ilo will provide benefits to the timber

industry until 31 December 2012. There are four wood

companies that will develop a wood-based business to

save costs on exports with aggregated value. To save

costs, exports will move through the Port of Ilo where the

wood will be dried. There will also be an export test to

determine the time it takes to move a product from Madre

de Dios to Ilo.

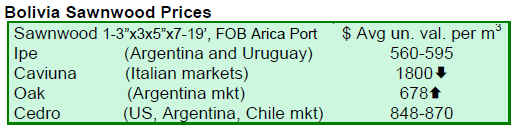

9. BOLIVIA

Decline in forest products exports in first quarter

Forest products exports in the first quarter of 2009 showed

a decline for the second consecutive year, from USD42.67

million in 2008 to USD38.26 million in 2009, a drop of

10.27%. Of these exports, the value of wood products fell

USD28.78 million in 2008 to USD26.03 million in 2009, a

corresponding decline of 9.55%. This decreasing trend has

continued since 2007, the peak year for forestry exports,

when exports reached USD45.48 million in the period of

January to March.

Wood and wood products are among Bolivia¡¯s nontraditional

exports. Soy and its derivatives represent 28%

of total non-traditional exports, followed by wood and

wood-based products at 11% and chestnuts at 5%.

Forest products have increased their share in domestic and

international markets, 3.35% and 16% respectively. This is

attributed to the sharp drop in natural gas exports, one of

its main exports, for which the value has fallen by almost

USD2 billion in the last year.

10.

Guyana

Competitive bidding process for Guyana kiln drying

project

The Guyana Forestry Commission (GFC) has received

funding from the ITTO through the execution of the

project PD 401/06 Rev.2 (I) ¡®Value Adding and Kiln

Drying of Commercial Timbers by Small Scale

Community Saw Millers in Guyana¡¯ to purchase and

install three small kiln dryers for identified communities.

The GFC now invites bids from suitable bidders for the

supply and installation of three kiln dryers.

Bidding will be conducted through the International

Competitive Bidding (ICB) procedures specified in the

ITTO Guidelines for the Selection and Employment of

Consultants and Procurement of Goods and Services,

Second Edition, November 2008. The complete technical

specification of the kilns can be found on the GFC

Website www.forestry.gov.gy or requested via an email

sent to project.coordinator@forestry.gov.gy. Further

information can also be requested by mail sent to the email

address above.

Bids must be delivered to the following address on or

before 9am, 1 September 2009: The Commissioner of

Forests; Guyana Forestry Commission; Lot 1 Water Street;

Kingston, Georgetown, Guyana. Bids are to be submitted

in sealed envelopes - electronic bidding will not be

permitted. Late bids will be rejected.

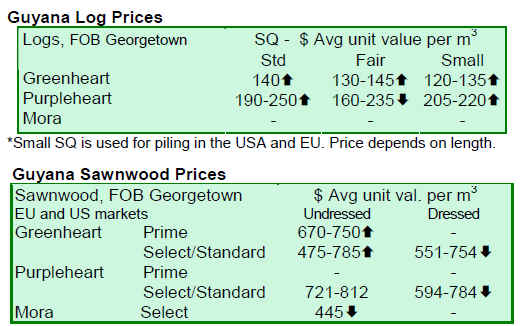

Greenheart and Purpleheart maintain strong trends

Log prices for greenheart have been favorable overall,

while purpleheart has seen strong increases up to USD250

per m³ for the period of 1-15 June 2009 compared to the

period 16-31 May 2009. This has been one of the highest

prices for this species in log form recorded over the 2009

period. Prices for undressed sawnwood (621/634) have

been fairly stable, while prices for dressed sawnwood have

decreased for the period 1-15 June 2009 compared to the

period 16-31 May 2009. Roundwood prices have

increased for the period of 2009 against the same period of

2008. Plywood prices have declined marginally from last

fortnight by approximately 10% in the BB/CC category.

Value-added products such as outdoor/garden furniture

continue to contribute to export value earnings, which

were largely maintained over this period in 2009 against

the same period in 2008. Non-timber forest products

(NTFPs) also contributed to the export value earnings and

were favorable against the same period of 2008. The

Caribbean market remains the principal destination for

these value-added product category and NTFPs.

Guyana sets pace for combatting illegal logging

Guyana is moving towards completion of a project on

¡®Improving the detection and prevention of illegal logging

and illegality in shipment and trade of wood products in

Guyana¡¯, PD 440/07 (M/I), which aims at enhancing

legality through the application of an integrated approach

to forest law enforcement.

Through the project, Guyana now has in place a baseline

of remote sensing national coverage using satellite

coverage at a medium resolution complemented by high

resolution radar data. These remote sensing analyses have

been conducted using a change detection system

developed in line with the Guyana Forestry Commission¡¯s

guidelines and standards for forest management and

monitoring, and takes into consideration various natural

resources utilization including mining and agriculture.

Regulation of forest management has been rapidly

evolving in Guyana and the Guyana Forestry Commission

(GFC) takes an active and vigilant role in monitoring and

promoting sustainable forest management practices.

Reliable information on illegal forest harvesting activities

is often difficult to obtain. Left unchecked, illegal logging

and subsequent trade of timber represent a substantial

threat to sustainable forest management in many countries.

Working with International Remote Sensing Specialist,

PŐYRY, the project seeks to improve sustainable

management of forest resources, and to identify areas

where illegal harvesting of tropical timber is taking place

by collecting accurate geographical information on

deforestation along an indicators system developed.

Remotely sensed data (satellite images spanning from

2005 to 2009) has been used to detect deforestation

activities and generate GIS layers documenting logging

activities and road networks. Such information has

assisted GFC in targeting areas of change and mobilizing

the necessary resources to undertake enforcement

measures. Some of the challenges encountered include:

the limitations of using medium resolution images to

detect change in a forest where change is usually relatively

small in nature; the cost attached to such securing satellite

images; and the issue of high cloud cover associated with

satellite data. These were addressed by selecting an

approach of ground truthing and aerial surveys, use of a

combination of radar and satellite data and integrating

hotspot monitoring, as well as selection of image providers

which produce accurate and cost effective data.

The project has been successful in conducting satellite

image analyses to detect logging, mining and road clearing

activities. Additionally, the project developed legality

indicators and applied these to a GIS environment to

assess occurrences of illegality and their impact on

deforestation. Further, an integrated geographic database

has been established for the storage and maintenance of

the acquired satellite imagery and GIS layers in order to

detect and monitor forest disturbance. The GIS is designed

to store and permit queries of temporal attributes of these

layers. Overall, the GFC is now able to integrate GIS and

remote sensing technology in resource allocation required

for forest law enforcement and provides training on

operating and maintaining the tools developed in handling

such datasets.

Over the coming two months, the Guyana Forestry

Commission will be completing all activities for this

project and is currently continuing training to enhance

capacity for continued successful implementation of this

initiative. The results have already contributed greatly to

the work that Guyana has undertaken through the World

Bank¡¯s Forest Carbon Partnership Facility and other

national climate change mitigation initiatives.

Overall, the project has lead to the enhancement of legality

and sustainable forest management in an innovative way

while ensuring future sustainability of various natural

resources in Guyana.

|